Swift Cooperative accesses multiple blockchains in a secure and scalable manner to transfer tokenized assets globally.

Swift provides financial institutions with a unified interface to transfer tokenized assets while preserving existing infrastructure.

Through this series of pilots, Swift aims to integrate the fragmented financial ecosystem in a robust and secure manner.

On August 31, 2023, Swift released a report on the results of a series of new pilots. The report demonstrates how the Swift infrastructure seamlessly transfers tokenized assets between multiple public and private chains. These pilot results are expected to eliminate key barriers hindering the development of tokenized assets, drive market maturity, and promote the adoption of tokenized assets worldwide.

Although tokenized assets are still in the early stages of development, 97% of institutional investors believe that they will disrupt asset management models and have a positive impact on the entire industry[^1]. The main reason for this belief is that tokenized assets have the potential to improve efficiency, reduce costs, and enable ownership fragmentation to cater to a larger number of investors.

However, one challenge faced by investors and institutions is that tokenized assets are scattered across multiple different blockchains, each with different functionalities and liquidity. Therefore, it is crucial to bridge these blockchains; otherwise, financial institutions would have to connect to each blockchain separately, resulting in increased operational difficulty and cost.

Swift is currently collaborating with numerous large financial institutions and market infrastructures. Additionally, Swift has partnered with the leading Web3 service platform Chainlink. Through these collaborations, Swift has successfully demonstrated its ability to act as a unified interface, leveraging existing secure infrastructure to access multiple networks and significantly reducing the difficulty and cost of tokenized asset development.

These pilots are part of Swift's overall strategy to achieve secure, global interoperability in new technological areas and platforms. Building on the work of the past few years, Swift's infrastructure has shown its ability to support the financial industry in integrating central bank digital currencies (CBDCs) and other digital assets into various new and existing payment systems.

Tom Zschach, Chief Innovation Officer of Swift, said: "In today's increasingly fragmented world, Swift's core goal is to achieve interoperability in order to seamlessly transfer value worldwide. To fully leverage the potential of tokenized assets, financial institutions must be able to seamlessly access the entire financial ecosystem. Our series of pilots clearly demonstrate that we can use Swift's existing secure and trusted infrastructure as a unified interface. This can eliminate key barriers in the development of tokenized assets and fully unleash their potential."

Specific Contents of the Pilots

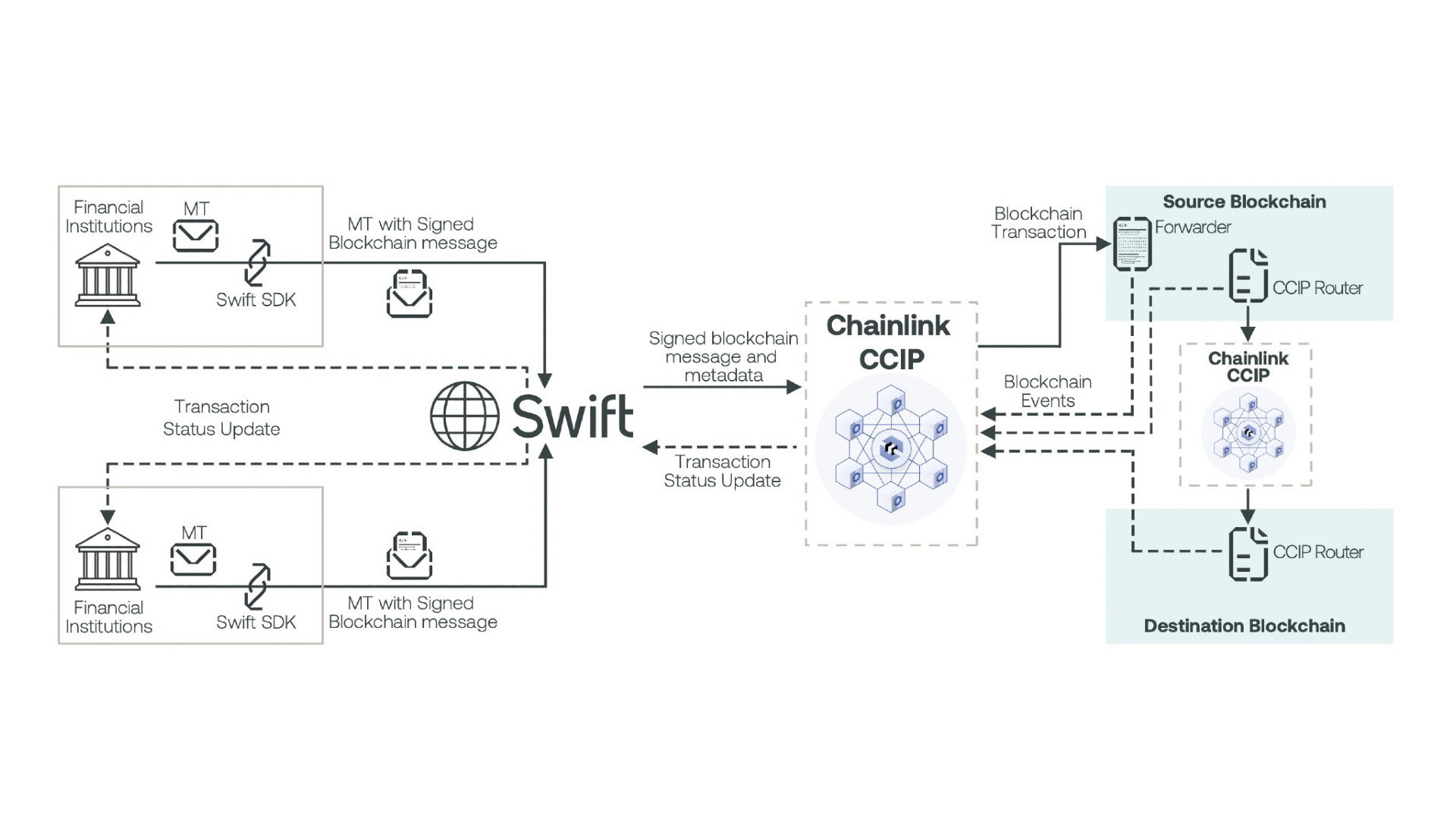

Swift has launched a series of pilots with several large financial institutions, including ANZ, BNP Paribas, The Bank of New York Mellon, Citibank, Mizuho Bank, European Central Counterparty Limited, Lloyd's Banking Group, SIX Digital Exchange (SDX), and the Deposit Trust and Clearing Corporation. Chainlink is responsible for providing an abstraction layer that securely connects Swift's network to the Ethereum Sepolia network. In addition, Chainlink's Cross-Chain Interoperability Protocol (CCIP) is responsible for fully achieving cross-chain interoperability between source and target chains.

These pilots not only demonstrate that the existing Swift infrastructure can enable financial institutions to access various types of blockchains securely and scalable, but also help us further understand the technical and business requirements when interacting with enterprise systems and public chains. These pilots also explore how to securely transmit data between traditional systems and any number of blockchains using blockchain interoperability protocols.

In these pilots, we explore the design ideas and technical development plans of the solutions, and consider various dimensions such as data privacy, data governance, operational risks, and legal responsibilities. We simulate the transfer of tokenized assets in three scenarios: between two wallets in the same public distributed ledger technology network, between two wallets on two different public chains, and between two wallets on one public chain and one private chain.

Swift will continue to collaborate with the financial industry, conduct in-depth research on the most specific use cases of tokenized assets, and plan our work focus based on this. The immediate focus is expected to be on secondary trading of unlisted assets and private markets.

Please click the link to download the complete report.

The head of the Banking Services Portfolio at ANZ Bank, Nigel Dobson, said: "ANZ Bank actively learns and explores the application scenarios of decentralized networks and tokenized assets, especially focusing on markets that are not fully serviced by financial institutions, such as nature-based assets. Accessing multiple blockchains through existing financial market infrastructure is crucial for market development. We are pleased to participate in the pilot project with the Swift community."

The head of Client Delivery at BNP Paribas Securities Services, Alain Pochet, said: "As the number of blockchains continues to grow, it will be an increasingly big challenge to connect traditional technology platforms to various blockchains and achieve interoperability. We must overcome this challenge. This round proves that Swift has the ability to access a wide range of platforms and has the potential to bring significant value."

Thilo Derenbach, Head of Business Development and Commercialization at Clearstream's Digital Securities Services, said: "Clearstream, as a provider of financial market infrastructure, can play a critical role in the digital transformation of the financial industry. Using cutting-edge technology to drive digital transformation and asset tokenization is one of Clearstream's key strategies. Such collaborations and pilots can drive industry innovation and provide interoperable solutions for existing and future ecosystems."

Jennifer Peve, Global Head of Strategy and Innovation at DTCC, said: "As a provider of financial market infrastructure, DTCC is committed to collaborating and developing solutions with various parties, connecting market participants, eliminating barriers to innovative solutions, and maximizing the value of these technological solutions. We are pleased to collaborate with Swift on this important pilot project and take key steps to explore the value of cross-network interoperability in the future."

Stephanie Lheureux, Head of Euroclear's Digital Asset Center of Excellence, said: "We are pleased to participate in this important pilot project and collaborate with other financial market infrastructures and financial institutions to conduct a series of interoperability pilots to explore the value of distributed ledger technology. As a financial market infrastructure, we have been committed to developing solutions in collaboration with our ecosystem, with the goal of continuously improving efficiency and reducing costs and risks."

Alexandre Kech, Head of Digital Securities at SIX Digital Exchange (SDX), said: "Exploration in interoperability allows us to gain a good understanding of how banks and financial market infrastructure can use blockchain technology for institutional businesses, that is, to create a round-the-clock infrastructure for asset issuers and investors that allows multiple parties to participate, comply with regulations, and trade, settle and service any digital asset globally."

Chainlink co-founder Sergey Nazarov said: "We can clearly see that the world's top banks and financial market infrastructures believe that the entire banking industry will adopt digital assets more widely. These digital assets will be logged on multiple blockchains at the same time." More than a dozen major financial institutions including Chainlink participated in this Swift cooperation, demonstrating that cross-chain interoperability is a key factor in driving the application of digital assets to the next stage. Large banks and market infrastructures will combine Swift with CCIP to achieve cross-chain interoperability at minimal cost."

About Swift

Swift is a cooperative composed of global members and is a leading provider of financial messaging services worldwide. We provide the community with a messaging and communication standards platform, as well as products and services that enable access, integration, identity authentication, analysis, and policy supervision.

Our messaging platform, products, and services are accessed by over 11,500 banks, securities institutions, market infrastructures, and corporate customers, covering more than 200 countries and regions. Swift does not hold funds or manage accounts for users, but provides secure communication services to the global user community, transmitting standardized financial messages in a reliable manner, supporting global and local financial processes, and facilitating trade and business activities worldwide.

As a trusted service provider, Swift strives for operational excellence. We help the community address cybersecurity issues, continuously seek ways to reduce costs, risks, and improve operational efficiency. Our products and services provide community members with access and integration, business intelligence, reference data, and financial crime compliance. Swift also integrates the financial industry at global, regional, and local levels, establishes market norms, sets standards, and explores topics of mutual concern.

Swift is headquartered in Belgium and strengthens its neutrality and global reach through international governance and regulatory mechanisms. Swift has established a network of global offices to ensure activity in all major financial centers.

[1]New York Mellon Bank, institutional investment 2.0: accelerating migration to digital assets, bnymellon.com/content/dam/bnymellon/documents/pdf/insights/migration-digital-assets-survey.pdf