Original | Odaily

Author | Nanzhi

Since the beginning of the year, the popularity of on-chain Meme has gradually increased with the decline and consolidation of BTC. In addition to the old trading Bot Maestro, a large number of professional trading Bots have emerged. Among them, Unibot has emerged as a leader, with a token market value once exceeding 200 million US dollars. However, its revenue growth has recently started to stagnate, and a strong group of competitors has also emerged in the market. The price of UNIBOT has been rapidly declining since September, with a closing price of 88 USDT on September 3.

In this article, Odaily will compare the functional differences and profitability of various trading Bots to provide an overview of the current development and trends in the trading Bot race.

Overview of Trading Bot Functions

The following table shows the functions of some mainstream trading Bots. From the table, it can be seen that the most widely covered functions are "Anti-MEV" and "New Coin Sniper", followed by limit orders, copy trading, and Anti-Rug and FrontRun functions. The lowest coverage is for Anti-Rug and FrontRun functions, which may be because such functions are not purely smart contract transactions and involve aspects such as Mempool.

From the differences of each trading Bot, we can deduce their differentiated development directions, including:

Link connection to provide the most comprehensive full-process services, starting with information broadcasting and sniper targeting of new coins at the forefront, followed by popular upward trends and new coin recommendations, and finally fast-selling services for FrontRun. MEVFree even "considers" the tax payment issue at the end and introduces the contract holding token function.

Professional upgrade, Bot kills "manual" users, while some Bots aim to occupy Bot market share by providing professional features such as 0 block grab, FrontRun, etc.

Combining with AI, in addition to the existing MEVFree, which has launched AI trading advice function, top AI project PAAL also announced the development of Bot business.

The following is a partial overview of trading Bots, including:

Token situation: The proportion of top coins is moderate, and the overall market has multiple coin issuance protocols, all of which set transaction taxes as a source of income.

Threshold for use: Usually charges a fee for use, and some protocols offer advanced features by holding coins.

Protocol income: Usually relies on usage fees as the main source of income, some of which also include transaction taxes.

User income: Most users do not participate in profit sharing, only Unibot and MEVFree are mentioned in this article.

Market Analysis

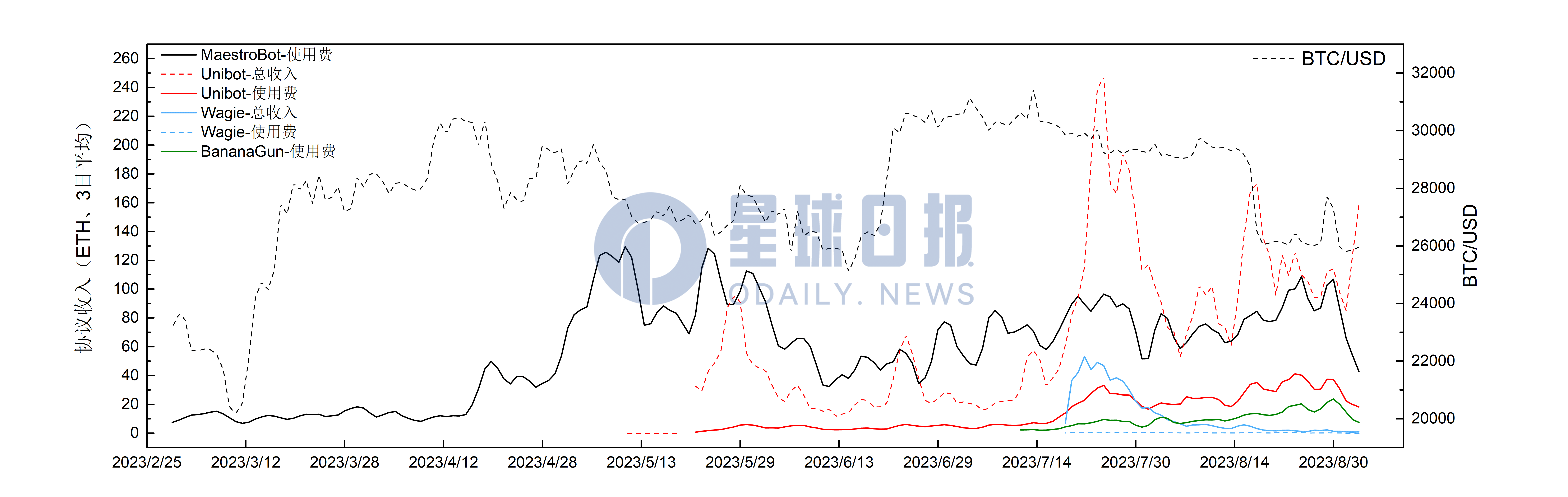

The following chart shows the usage fees of major trading Bots starting from February 28th (taking a three-day average due to large fluctuations), and the total protocol income after deducting token transaction taxes (Unibot and WagieBot). Odaily has summarized three stages of development:

A monopoly: From November to December in the 22nd year, MaestroBot had an average daily income of about 4-5 ETH. From January to February in the 23rd year, the income fluctuated between 6-10 ETH. After BTC started to decline from its peak of 31,000 US dollars in April, the income surged, reaching a record single-day income of 155.61 ETH on May 23rd.

Rapid growth: In July, during the second upward trend, BTC remained in a high-level consolidation, and bots led by Unibot gradually gained a certain market share. However, because the total income of Unibot is the sum of usage fees and transaction tax dividends, the transaction tax is significantly higher than the usage fees, temporarily making the income structure of the protocol resemble a Ponzi scheme, causing concerns about its sustainability.

Fragmented market: Currently, multiple bots are starting to make efforts. For example, BananaGun's usage has surged due to its new coin sniping feature. However, the overall market share of the meme market has not shown a significant increase. The situation has become a fragmented state where major bots compete for the existing market share.

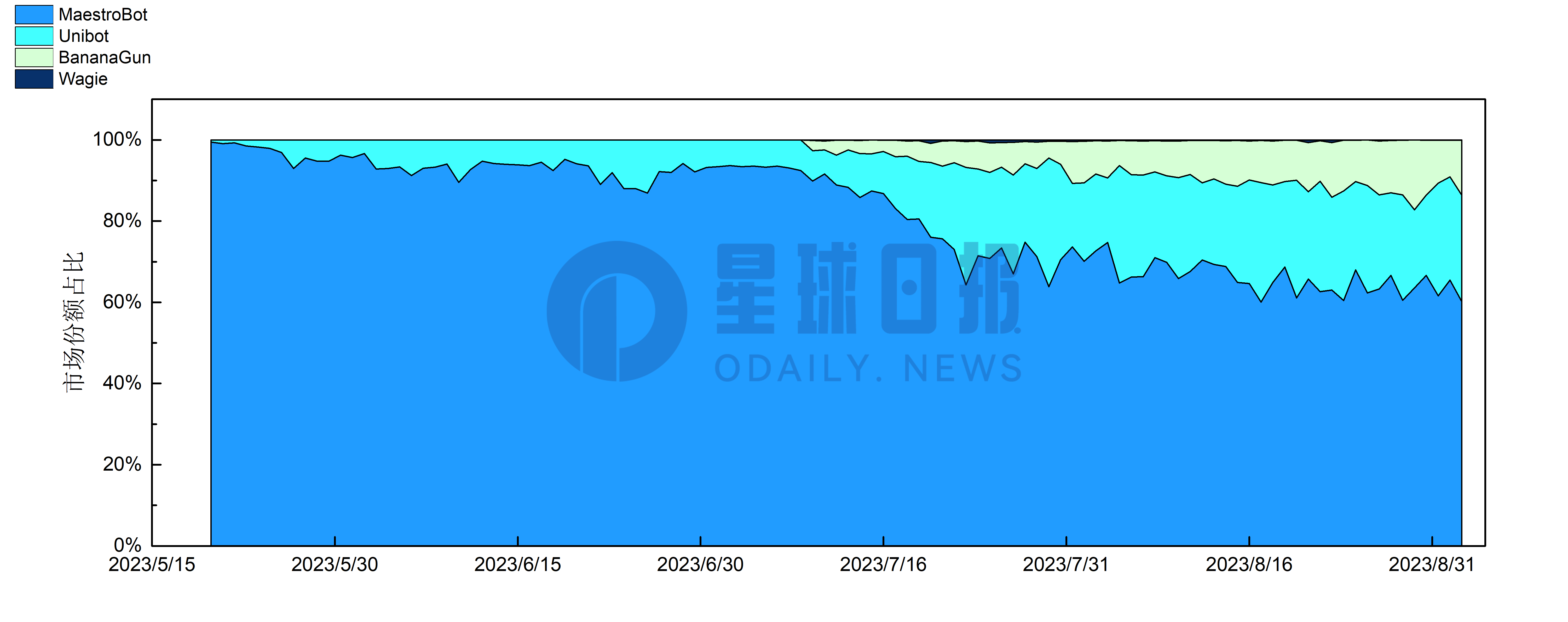

The following figure compares the usage fee income of the four trading bot projects. Since late July, Unibot's share has fluctuated between 20% and 25%, while BananaGun has been continuously rising and MaestroBot has been declining accordingly.

From the previous earnings chart, it can be seen that although WagieBot's total income skyrocketed at one point, the actual income came from transaction taxes, and the usage fee share of the bot can be ignored both in the income structure of the protocol itself and in the overall market.

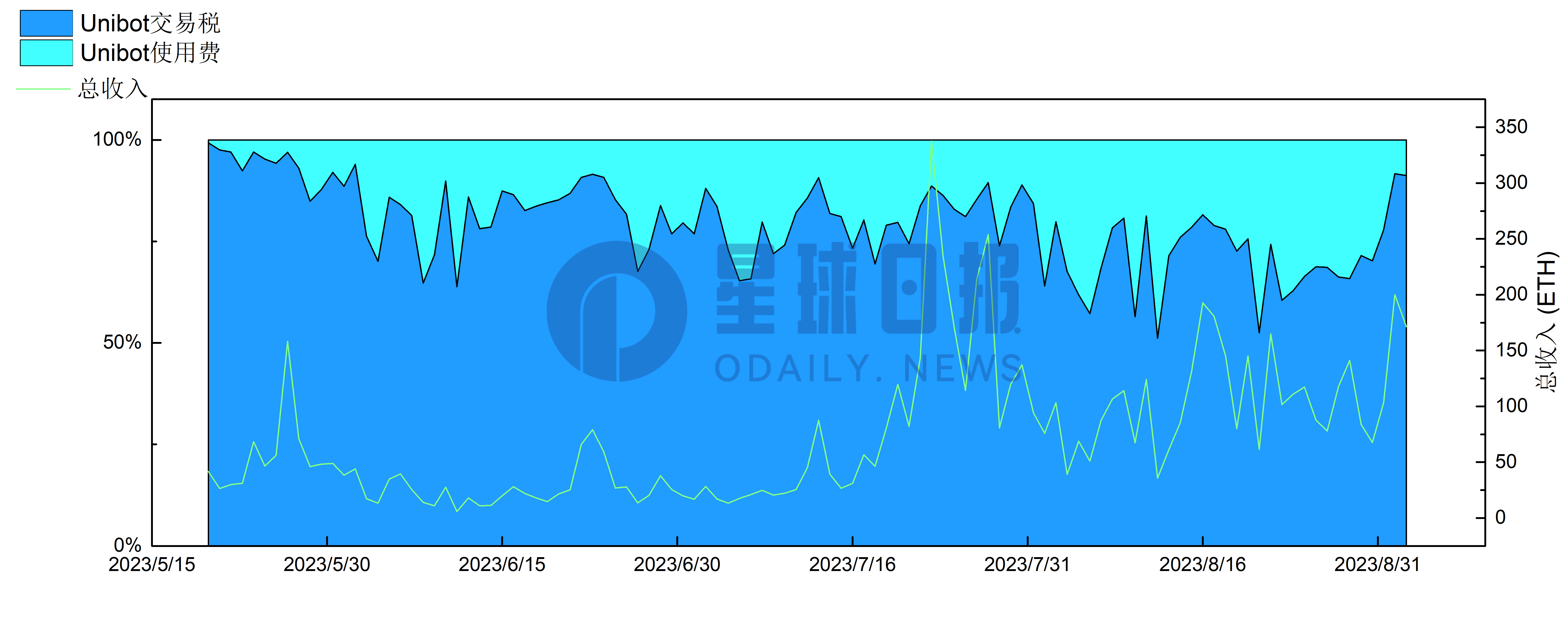

The following figure shows the income structure changes of Unibot, with a rising trend in the usage fee ratio despite large daily fluctuations.

On the other hand, it can be seen that the total revenue of Unibot is synchronized with the increase or decrease in transaction taxes. The extreme point of total revenue is often the extreme point of the proportion of transaction taxes, indicating that transaction taxes are still the main source of revenue for the protocol. Especially since the September crash, while the usage fee has been declining, the proportion of transaction taxes has increased significantly, reaching a maximum of 95%.

Conclusion

In the era of competing trading bots, there are still many emerging trading bot categories, such as SnakeBot, which specializes in tracking whales, and Newsly, which is based on trading based on breaking news. However, these functional thresholds are not high and are easily copied by various leading projects.

Therefore, the potential development paths of major projects can be divided into two categories:

Becoming the "king" of bots: By replicating the most prominent features of competitors, they become all-in-one tools. For example, Unibot has launched a unified trading terminal, Unibot X, and stated that they will "focus on separating Telegram and web applications". From their revealed roadmap, it appears that they will also add more horizontal feature expansions.

Becoming "One Punch Man": Since the meme market often has a limited single currency scale, no one is willing to become a lift bearer. Therefore, by achieving excellence in a certain feature, it can make all users of that segment have to use it. For example, the current market meme automated trading project, AimBot, has also announced the integration of BananaGun to target new coins.

Although Unibot has already captured a certain market share, the characteristics of the stock market combined with the lack of network effects mean that its moat is not unbreakable, and whether it can build its brand barrier remains to be seen.