Original author: Cookie

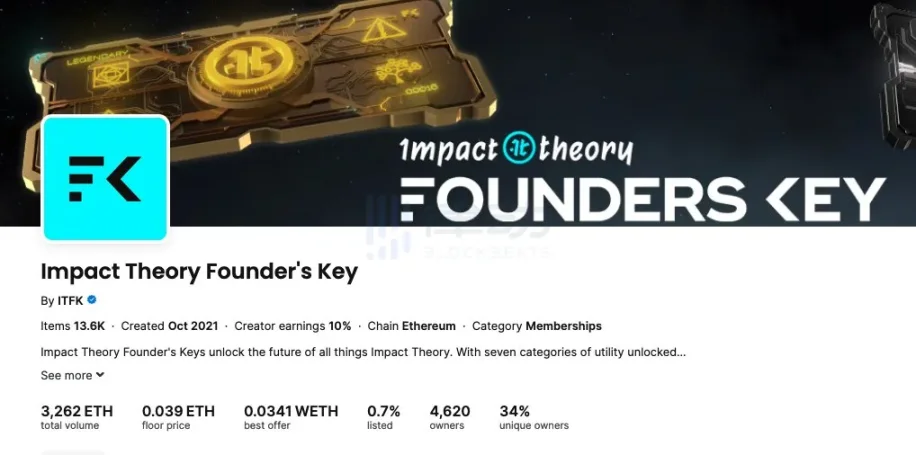

Impact Theorys Founders Keys, which is the first NFT project in history to be accused of unregistered securities by the SEC.

On August 28, the SEC (US Securities and Exchange Commission) accused Los Angeles-based media and entertainment company Impact Theory, LLC of conducting unregistered crypto asset securities offerings in the form of NFT.

Confronted with the SECs allegations, Impact Theory, LLC received an injunction without admitting or denying the SECs findings. The restraining order found it in violation of the registration provisions of the Securities Act of 1933 and ordered it to pay a total of more than $6.1 million in disgorgement, pre-judgment interest and civil penalties. Losing investors. In addition, Impact Theory agreed to destroy all Founders Keys NFTs in their possession, post an announcement about the injunction on its official website and social media, and waive any royalties that may be obtained from future secondary market transactions involving Founders Keys income.

Why was Founders Keys accused of unregistered securities?

The SEC determined that Founders Keys NFTs were offered and sold as investment contracts and securities based on the following facts and circumstances:

From October 13, 2021 to December 6, 2021, Impact Theory raised approximately $29.9 million from hundreds of investors, including investors across the United States, through the issuance of the NFT series Founders Keys.

When the series was released, it was divided into three levels of rights: Legendary, Heroic and Relentless and sold at different prices

Ahead of the release of Founders Keys, Impact Theory held several live-streams on Discord, uploaded recordings of these live-streams on its own Discord channel, and shared them on its official website and social media, which are open to the public. recorded information. Impact Theory also posted recordings of other speaking engagements on YouTube, and participated in public interviews in news outlets and social media about promoting Founders Keys.

Through the above publicity, Impact Theory attracted potential investors to view the purchase of Founders Keys NFT as an investment in its business, and stated that if Impact Theorys efforts are successful, investors will get more money from the purchase of Founders Keys NFT. profit. In particular, Impact Theory emphasized that the company is working hard to build the next Disney, which, if successful, would bring tremendous value to buyers of the Founders Keys NFT, with a future value well above its purchase price. Impact Theory has illustrated this in several ways:

“If you pay 1.5 (ETH), you’ll earn more. So nobody’s going to just take one look at the project and say, ‘Sorry dude, I don’t think this stuff is worth it’. I’m very Bullish about it, and I’ll try to Do everything you can to make sure what I say is true.

The project is called Impact Theory Founders Keys and we like to say it unlocks the future of everything were doing as a company right now... When I took a serious look at NFTs, I realized that what it allows you to do is reward your community. For someone like me trying to build the next Disney, what you need is a thriving community. So we think its a huge way for our community to get a lot of value out of what were building.

“Now, when we’re building this IP, imagine, when Disney made Steamboat Willie, you could have had the opportunity to be a part of Disney, that’s how we think about Legendary. Quite frankly, this is how we feel about our first NFT collection as well.

Impact Theory also emphasized that the companys efforts will achieve these values they claim, and that Impact Theory will use the proceeds of the sale of the release for growth, bringing more talents to the team and creating more projects, as well as:

But of course, Im going to make sure that we do something that by any reasonable standard people are getting staggering value.

The key message I want you to get is that theres a lot of cool stuff going to happen in the next 18 to 24 months, and thats ultimately just a fraction of whats going to happen in the next five years. The reason were only in the future 18 to 24 month hype because I want you guys to be able to capture 90% of the economic value of all the big things were going to be doing in the longer next few years. The only way to do that is, only based on what were doing in the short term Sell and price what youre doing, and thats going to get you a huge markup.

We will use this money to grow, bring more talent to the team and create more projects to ensure we deliver amazing value. Until people are giggling and thinking they cant believe theyve spent — you know — whatever level of NFT they hold theyre going to get all this value — until theres this feeling — weve been going into NFTs Inject value.

Additionally, Impact Theory has openly shared the view that Founders Keys NFT purchasers, Impact Theory, and the fortunes of Impact Theorys founders are all tied together:

“Our goal is to make sure that as Impact Theory gets richer, as the Impact Theory founders get richer, our members at Impact Theory get richer, and you, the NFT buyers, get richer. That’s Why are we so actively supporting NFTs.”

“NFTs are a mechanism by which communities will be able to derive economic value from the growth of the companies they support.”

The above remarks made many Founders Keys NFT buyers express in their Discord that they believe that purchasing Founders Keys NFT is an investment in Impact Theory. Founders Keys” NFT brings added value:

“It’s like being invited to invest in a booming company that’s just getting their Series A round.”

“It’s like investing $10,000 with a $300,000 upside and taking a little risk.”

Everyone here is a crab eater! Buying a Founders Keys NFT is like investing in Disney, Call of Duty, and YouTube at the same time.

“There hasn’t been an investment with such an incredible risk-reward ratio. You’re not investing in some ‘Founder’s Keys’ NFT or PNG image, you’re investing in the Impact Theory team, and this unprecedented opportunity is like handing over $20 in your dorm room. Same for Mark Zuckerberg.

Old NFT players who read the above content should have no choice but to smile bitterly—Promise to use the sales revenue from the issuance of NFT to build a brand, NFT is a way for the community to benefit from the teams efforts, We are building the next Disney, Buy NFT Like investing in startups / budding brands...not thinking of how many NFT projects have said these words, but thinking of how many NFT projects have not said these words...

Will NFTs suffer huge downsides?

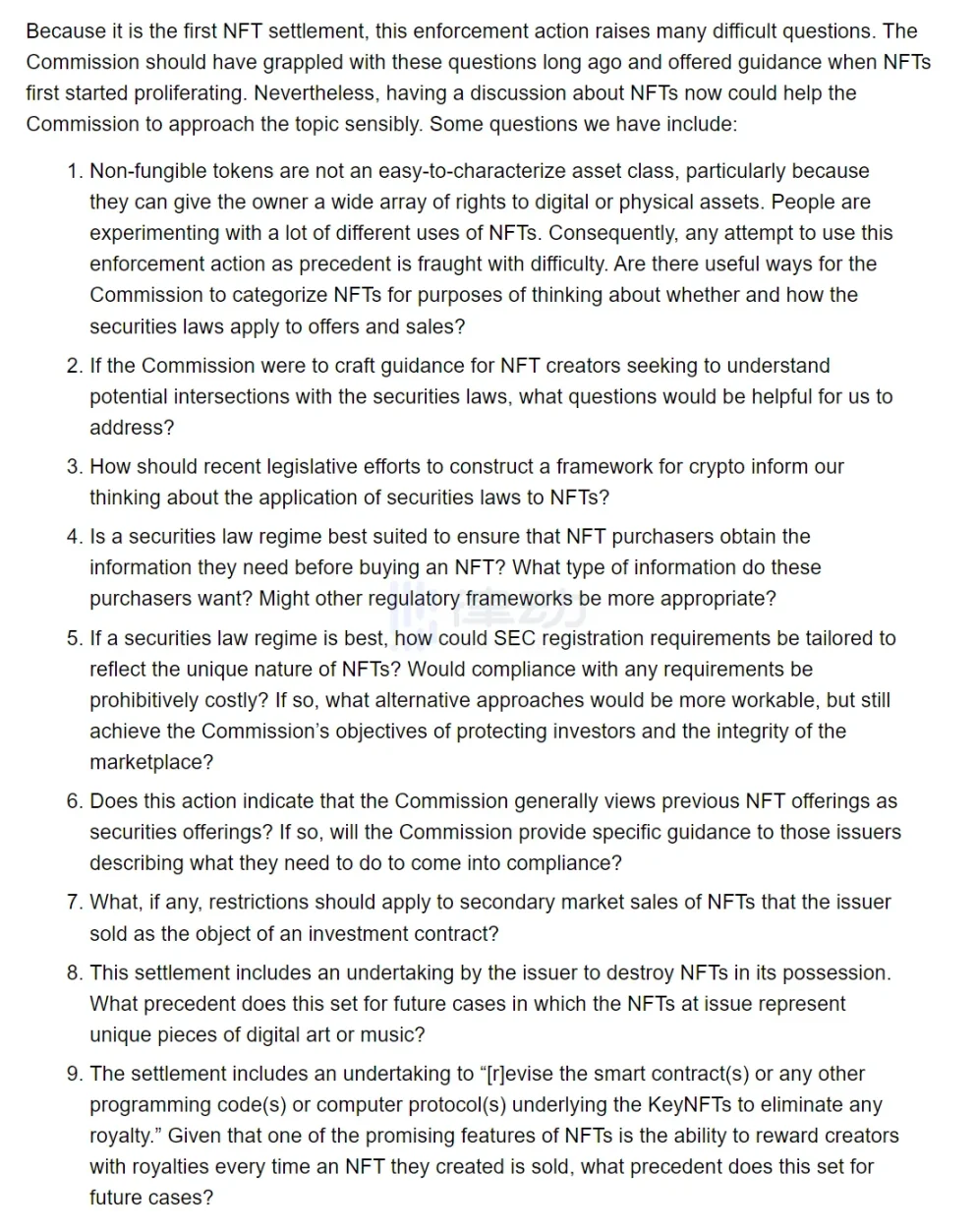

Two SEC commissioners, Hester M. Peirce and Mark T. Uyeda, raised objections to the SECs first-ever enforcement action against NFTs, partly because they disagreed with the application of Howeys analysis. The two commissioners emphasized that NFTs are not company shares and do not generate dividends of any kind for purchasers. In addition, Impact Theory has formulated a repurchase plan in December 2021 and August 2022. The company proposed to repurchase the Founders Keys NFT purchased on the issuance or secondary market. A total of 2,936 NFTs were repurchased to investors. Approximately $7.7 million worth of ETH was returned. Even if the NFT sales here are fully in line with Howeys analysis, it must be a feasible path for the project party to continue to buy back the buyers NFT in this way. Is it really worth carrying out such an enforcement action?

@Orlando_btc believes there is a reason why the SEC let Impact Theory settle without admitting or denying the allegations. Compared to FT, NFT is more like collectibles such as Pokemon cards, sneakers, or watches, so it may have stronger membership benefits Credentials, consumability, and utility debates will still bring up many complex issues related to securities law .

Impact Theory is a Crypto-based company. They have a mainstream brand that is completely separate from Crypto/NFT, so may be happy to pay a hefty fine, not admit they did anything wrong, and walk away. This is where the SEC is very smart - it chose a defendant who has no strong motivation to fight, avoids chewing hard bones like Yuga Labs, and can easily say that it has won a victory in the regulation of NFT. But it can also be said that the SEC has finally started to deal with NFT, and Yuga Labs may gradually encounter trouble like Coinbase.

For most NFT teams, please stop selling projects like equity. Although many lawyers should have made such suggestions to NFT project gates, such suggestions may still be news to many NFT project founders.

Although this may be the biggest NFT news of the year, the market has not reacted so far... There is no panic in the short term, nor is it so optimistic in the long term. Two commissioners, Hester M. Peirce and Mark T. Uyeda, proposed in the objection statement With 9 questions about NFT, the road to NFT regulatory compliance has just begun.

Conclusion

Impact Theory founder @TomBilyeu has tweeted to announce that the company has reached a settlement with the SEC, saying that he is happy to end the investigation from the SEC so that he can focus on the future of the business and the community, and even hit his own NFT project Kyzen wave ads. Tom looks a bit similar to Su Zhu, both are eternal optimists.

The SECs shotgun is finally aimed at NFTs, @garyvee, @frankdegods and other big names are probably going to be sneezing non-stop today...