Original author: Jiang Haibo, PANews

Velodrome, modeled after Solidlys ve(3, 3), has been a liquidity center on Optimism since its launch in June 2022. Velodrome V2 was officially launched in June this year, adding new functions such as custom liquidity pool fees, centralized liquidity pools (this feature has not yet been launched), and automated voting management. In addition, some ecological projects built on Optimism and Base have also been launched one after another.

Custom liquidity pool fees promote rising transaction fees

Velodrome enables token swaps by attracting liquidity. Liquidity providers pledge liquidity to obtain VELO token rewards; VELO token pledgers (veVELO holders) vote to determine the placement of VELO tokens among liquidity pools based on transaction fees, bribery funds, or for their own interests. Emissions; traders trade on Velodrome with extremely low transaction fees to increase transaction volume and income for VELO stakers.

Architecturally, Velodrome V2 has made major adjustments compared to V1, allowing the addition of new liquidity pools, such as centralized liquidity pools, multi-token pools, and custom pools. The reward contract of the liquidity pool is also set to be updateable for long-term maintenance and timely adjustment in the event of a security incident. The launch of V2 is mainly to achieve the following main functions:

Support centralized liquidity;

Support dynamic fees;

Dynamic emission of VELO;

Multi-token pool;

new dApps;

New VELO token.

As a DEX, the transaction fee of Velodrome V1 is only 0.02% ~ 0.05%, and there are a lot of volatile assets such as OP, SNX, and VELO on Optimism. The proportion of such assets in other DEXs is usually 0.3%, low transaction fee means a subsidy for traders. Ideally, low transaction fees could also lead to higher transaction volumes, increasing the income of VELO stakers, but this would require transaction volumes to grow severalfold. For example, for the VELO-USDC trading pair, will the transaction volume be 6 times that of 0.3% under the 0.05% handling fee? I am afraid it will be difficult to achieve.

Aside from unrealized functions such as centralized liquidity pools and multi-token pools, the relatively large update of Velodrome V2 is to allow custom handling fees. For example, for the above-mentioned VELO-USDC trading pair, the transaction fee in V1 was 0.05%, but it is currently 1% in V2, which contributes more fee income to VELO pledgers. This part of the income is also the real income of VELO. Only the VELO/USDC trading pair has brought a weekly income of more than 50,000 US dollars in the past few weeks.

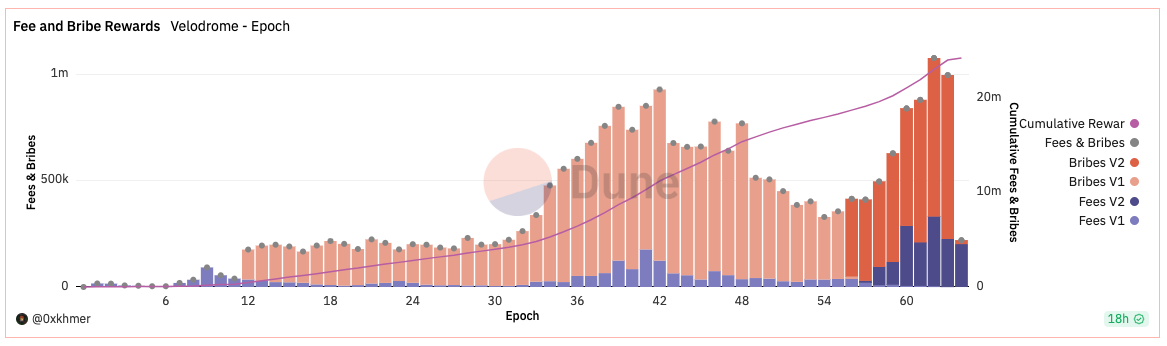

according to@0x KhmerAccording to the dashboard, in the last five Epochs, Velodromes transaction fee income has exceeded the historical high before the launch of V2. The transaction fee income of the most recent Epoch 63 (August 10th to August 16th) was US$210,745, of which $208,077 comes from V2 and $2,668 comes from V1.

Ecological projects focusing on OP and Base

Aerodrome

Aerodrome calls itself the Base liquidity layer jointly developed by the Velodrome and Base teams and partners. In Layer 2, which has recently launched the main network, Base has received more support and attracted more funds than Linea, which has the same strong background. Base not only has the background of Coinbase, but also has the support of many projects on Optimism. For example, Synthetix V3 has also decided to deploy on Base through a proposal.

The current ecological development of Base is similar to that of Arbitrum in the early days. Various DEXs have been launched in turn to attract funds, such as the current leading BaseSwap and Alien Base. However, due to the competition incentives on the DEX track, most projects lack a moat, and some DEXs have security incidents, such as LeetSwap and RocketSwap.

Aerodrome, which was developed by Velodrome, is relatively safer and has reached partnerships with about 20 projects before going online. 40% of the initial circulation of AERO will also be allocated to VELO stakers in the form of veAERO.

Extra Finance

Extra Finance is a leveraged liquidity mining project built on Optimism, which can provide up to 7x leverage. Since the liquidity on Optimism is mainly on Velodrome, almost all of Extras leveraged mining strategies are built on Velodrome.

Users with low risk appetite can lend stablecoins, ETH, OP, VELO and other assets on Extra to obtain interest and EXTRA token rewards; users who need to increase leverage can also pay interest to borrow assets for leverage mining.

Bike

Bike, a meme token on Optimism, launched in July of this year. 10 million BIKE tokens were initially minted, 50% of which were airdropped to VELO stakers, and the remaining 50% were used for weekly bribes to attract more liquidity.

The contradiction between the new high income and the income is still not as good as the value of token issuance

Due to the fee increase brought by Velodrome V2 and the bribery funds are still at a high level, in the last two weeks (Epoch 62 and Epoch 63), Velodrome’s bribe + fee income was US$1.076 million and US$996,000, respectively, both of which exceeded the history before the V2 upgrade highest value. Bribe funds and fees are also among the real rewards distributed to VELO stakers.

This also makes Velodromes revenue in the past 7 days ranked fifth in DeFiLlamas statistics (after excluding the public chain), as shown in the figure below.

But amid rising revenue, the price of VELO tokens keeps falling. One of the reasons is that the Velodrome V2 upgrade also increased the emission of VELO tokens. As shown in the figure below, Epoch 62 and Epoch 63 issued 14.337 million and 14.181 million VELO respectively, worth 1.566 million and 1.25 million US dollars respectively. The additional tokens issued are worth more than the profits captured.

This may also be the predicament that projects such as Curve that rely on token economics to attract liquidity are prone to fall into. Although projects can attract high liquidity and may also have good income, this is based on the issuance of more tokens on a basic basis. When the market conditions are not good, the selling pressure brought by the newly issued tokens causes downward pressure on prices.

In addition, some people have questioned that there are a group of worthless projects on Optimism that are bribing Velodrome. Since a large number of tokens of these projects are controlled by the team, the team can attract people to buy their tokens through high APR through bribery, and can also obtain VELO income by providing liquidity. If this is the case, it should be considered an attack on Velodrome.

summary

After the upgrade of Velodrome V2, it is allowed to customize the transaction fee, which also increases the transaction fee in disguise. For example, the VELO/USDC transaction pair used to have a transaction fee ratio of 0.05%, and now it is 1%. Currently, this transaction pair can contribute more than 5% per week. Thousands of dollars in fees. Some ecological projects that have been launched one after another may enhance Velodrome’s expectations, especially Aerodrome on Base. All of the above improves Velodromes fundamentals.

However, the V2 upgrade also speeds up the issuance of VELO, which is currently attenuating at a rate of 1% per week, and the value of VELO issued every week still exceeds the fee + bribe income. There is also the question of whether Velodrome was bribed by a worthless project.