friend.tech is one of the most watched projects on the current base chain. In the long-ago Ancient Internet era, the Friends Buying and Selling mini-game was once active on major SNS sites. And Friend.tech is a Web3 product similar to the buying and selling with friends model.

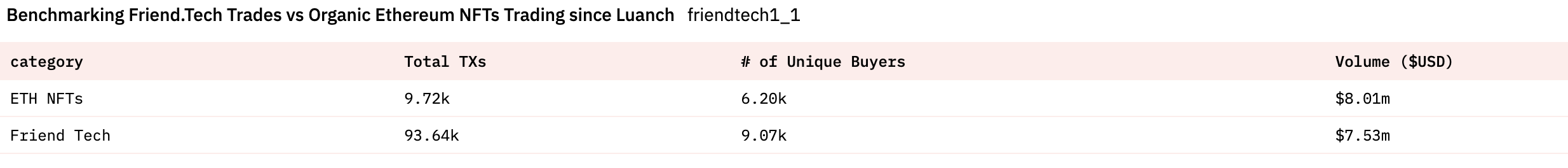

The product sparked community discussion within one day of its launch, and Dune data shows that it has generated more than $8 million in transactions.

What are the highlights of this popular express product, and how is it different from the previous SocialFi?

Web3 Population Trading Platform

friend.tech is built on the L2 network base launched by coinbase. This product is forcibly bound to Twitter to obtain the users Web2 social identity. If it is not bound to Twitter, this product cannot be used.

This product is too mysterious. If you visit its official website directly, you cannot get any product information. Currently, there is no product introduction, official documentation, etc.

To learn more about the product, users can access and use friend.tech via mobile only. For specific operations, please refer to what Odaily has previously published.tutorial。

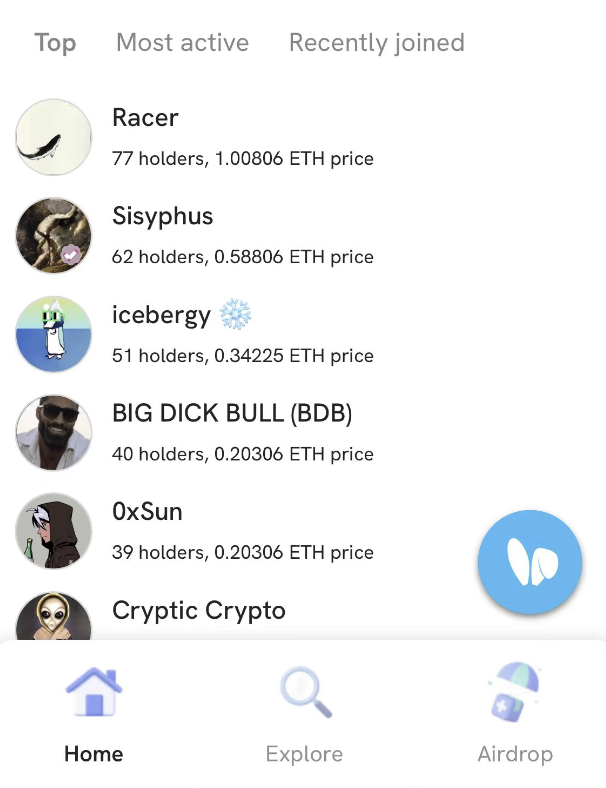

In friend.tech, every user is tokenized. User influence can be directly priced by the market.

Specifically, the user is abstracted as a cryptoasset. A user can purchase shares of other users.

Why are some people willing to pay real money to buy other peoples equity? For those with strong social influence (such as popular analysts, project founders, etc.), many of their followers want to have a private conversation with them, or directly initiate a consultation.

On traditional social platforms such as Twitter, the private message function has been abused because of its unrestricted nature. KOL will receive a large number of private message requests and cannot process all private messages. Not so at friend.tech. By default, users cannot have private chat conversations. For buyers, only after owning a persons shares can they have the permission to initiate a private chat with him. The price of shares will also fluctuate with changes in market supply and demand. Users can also resell their shares to earn profits.

And for those social influencers whose shares are bought, every time his stock is bought and sold, he can earn a subject fee.

How are real-life stocks priced?

Roughly speaking, the more popular a person is and the more his stock is traded, the more his share price will be.

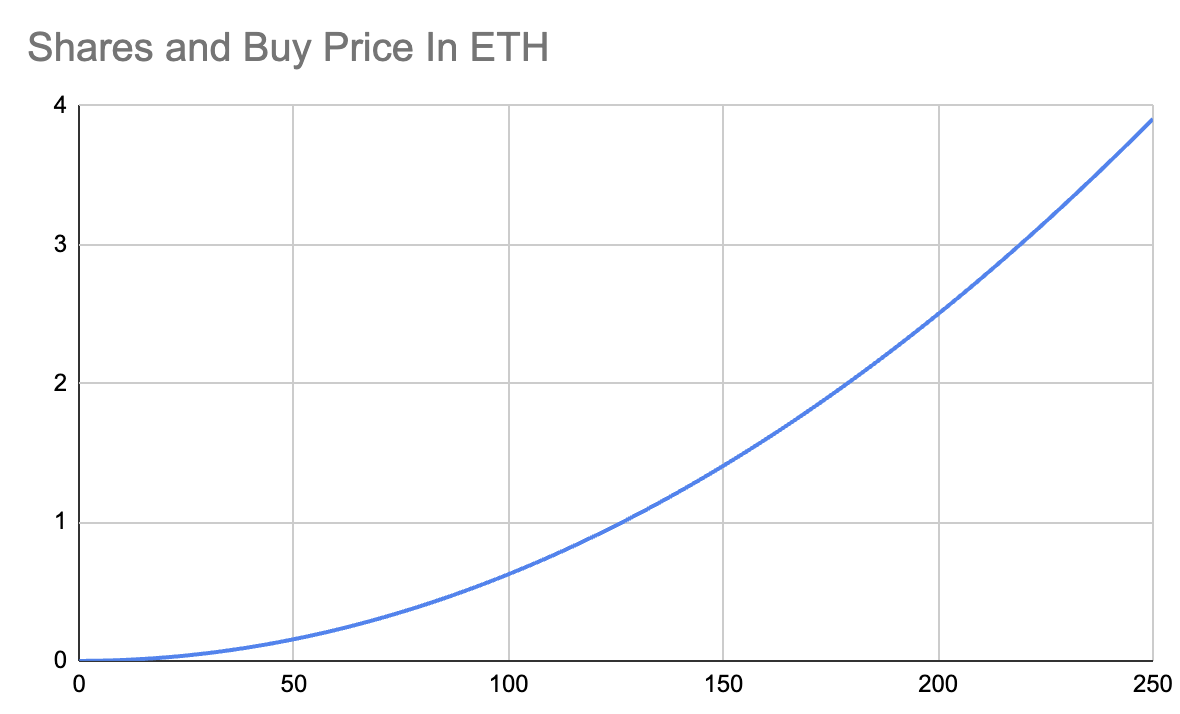

So specifically, how is the stock price determined? Twitter user @functi0nZer0 put together a pricing model for the product.

As shares are sold, prices rise significantly. The more people buy someones stock, the more valuable that persons stock becomes.

And 5% of each sale is earned by the original issuer (that is, the person the stock is named for). This also leads to extremely strong network effects. The more trading and speculation on someone, the more money that person can make.

Although this product is not a fan token issuance platform for KOLs, its product design cannot help but remind people of traditional fan tokens.

Previously, the category of “fan tokens” has always had a greater influence on the SocialFi track. It is generally believed that allowing people with social influence to issue fan tokens and empower fan tokens is a way to combine social and crypto.

However, as fan token products take shape, it is not difficult to find various problems with such products. On the one hand, it is difficult for fan tokens to be deeply associated (or bound) with influencers. Often, fan tokens have little more to do with the influencers they represent than just their names.

The problem this brings is that it is difficult for fan tokens to have liquidity in the market. These items are difficult to trade and in most cases have no investment or speculative value.

The change that friend.tech brings to social tokens lies in the fact that through the setting of the price curve, the transaction value is given to the stock of the influencer in terms of mechanism. Just like DEX abandoned the order book that requires higher immediacy and chose the AMM mechanism. Changes in a persons stock price do not require constant trading. Even if there is only a small amount of buying and selling activity, individual stocks will still generate sufficient fluctuations according to the price curve set in advance.

The invitation code farce reappears, is the social track reaching the same goal through different paths?

friend.tech is currently in beta and can only be used by users with an invitation code.

In addition, the user can also earn points when the invitation code is used. Due to the expectation of receiving airdrops for points, this has further attracted peoples enthusiasm for its CX.

But when we look back at past history, it is not difficult to find that such social products that become popular overnight and are hard to find appear in every cycle.

In 2021, the social product Monaco became popular overnight. Since this product also uses an invitation mechanism, you can only register using an invitation code. This also caused the invitation code of the platform to reach hundreds of dollars at one time.

At the beginning of this year, Nostr, promoted by Twitter founder Jack Dorsey, became popular in the crypto world and was even repeatedly discussed as to whether it could replace Twitter.

Social networking is one of the most core and pillar application scenarios of the Internet, and it can reach the most common and extensive C-end users. This also makes it a hot entrepreneurial field in the encryption industry.

But as concepts like SocialFi, DeSocial, etc. rise and fall. Looking back on the past, users can’t help but find that encrypted social products all seem to have the same fate—quickly becoming popular and then falling silent. Of course, the same is true for Web2. I believe everyone still remembers the popularity of Clubhouse.

In the initial stage of the product, the large-scale influx of ordinary users is restricted by using the access mechanism. It is a common practice for social products to artificially raise the threshold for users and create scarcity to attract attention. But without the real needs and the precipitation of the relationship network, the initial freshness cannot determine the retention and conversion of users.

In the Web3 world, although new social protocols and applications have sprung up under the support of popular concepts such as DID and SBT, none of them has really accumulated a large number of active users after woolly expectations. The popularity of friend.tech can also How many days?