The original intention of Web3 is to try to replace it with a decentralized systemIneffective traditional trust model. Afterwards, attention shifted to achieving product-market fit and growing the number of users. In the process, Web3 evolved into a far-reaching technological revolution.As Web3 continues to evolve, the door to innovation has been opened, and Web3 has become an unstoppable force.

At present, there is still huge room for development in the Web3 industry, and the next step is to establish a sustainable economic model to ensure that the underlying infrastructure can not only operate safely, but also reach billions of new users. The next wave of apps is coming,Traditional capital markets’ interest in Web3 infrastructure continues to surge, these companies hope to use Web3 technology to reduce costs, find new sources of revenue, and satisfy customer demands.Token assetsgrowing demand.

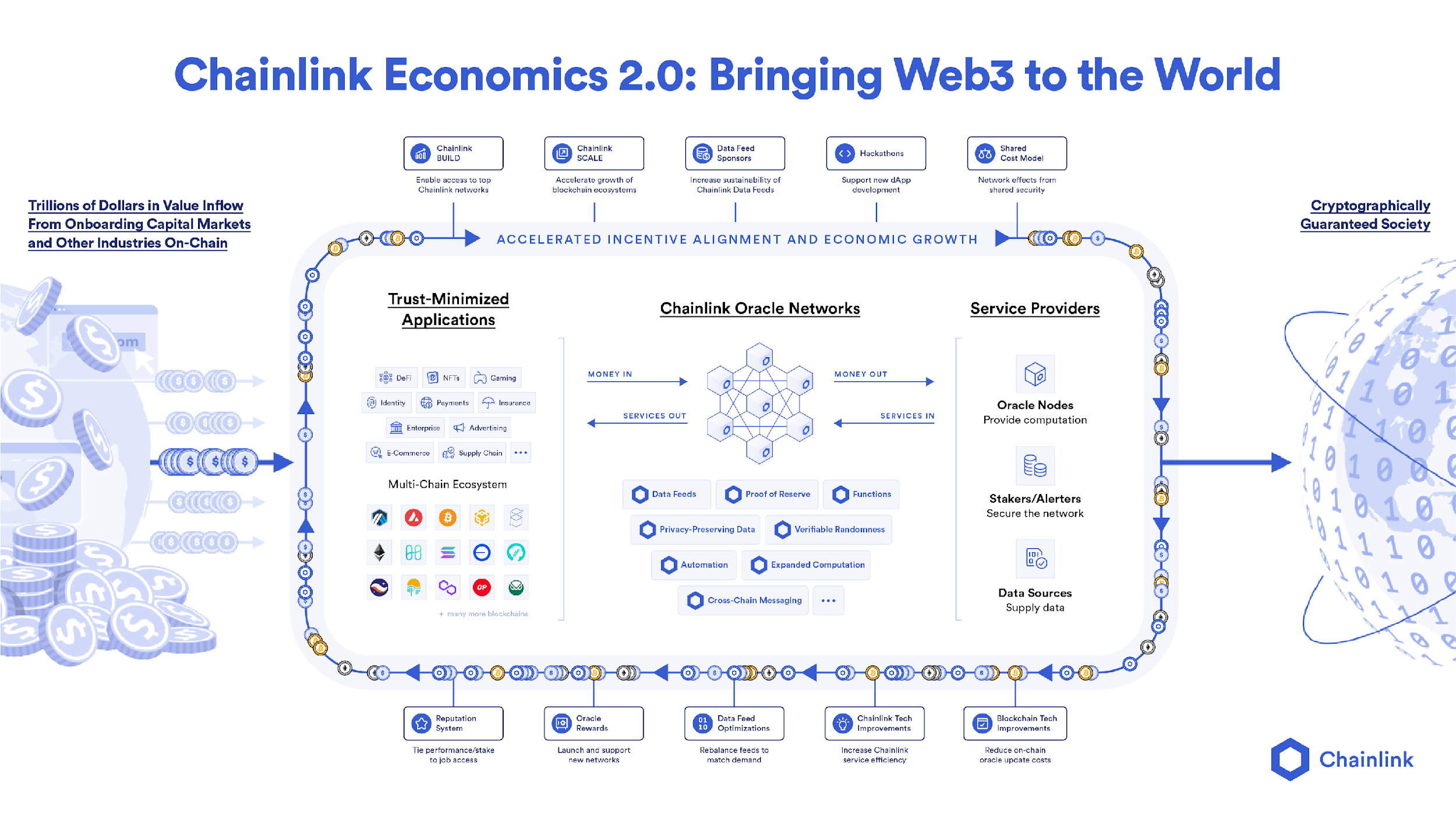

Even if only part of the assets in traditional financeput on chain, which also means that trillions of dollars of value will flow into the Web3 economy. Therefore, if we want to ensure that the security and reliability of the Web3 ecosystem are sufficient to support the needs of these new users, new asset types, and liquidity, then we must establish a complete Web3 economic model to ensure that each layer of the Web3 technology stack can be Run continuously.

This article will delve into the elements of the Web3 economy, especially how value is transferred between technology stacks, and why it is necessary to ensure the sustainability of value flows. The second half of the article will discuss the importance of a sustainable oracle economic model, andChainlinkHow to lead the creation of a sustainable oracle economic model and benefit the entire Web3 industry.

The composition of the Web3 economy

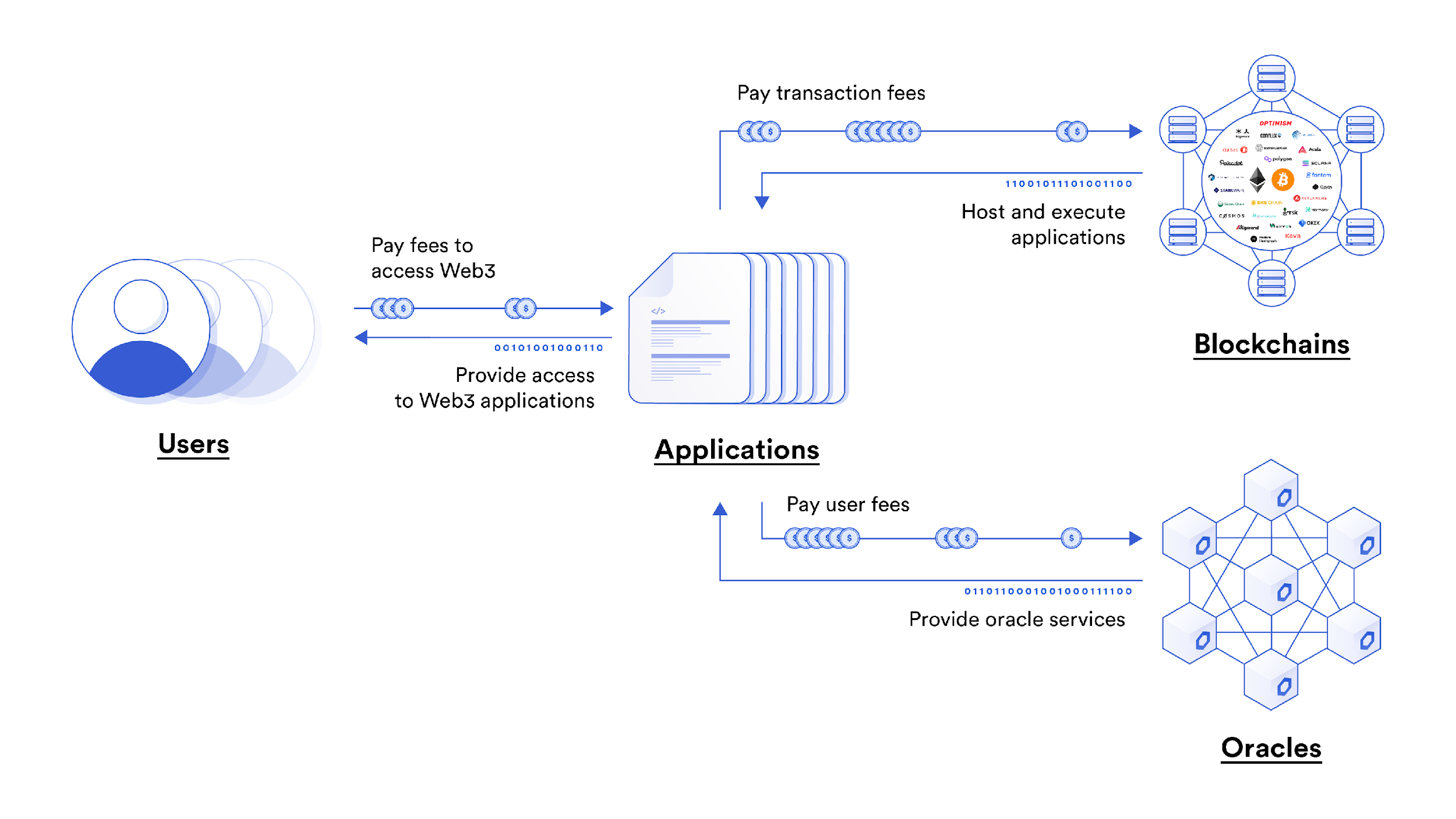

To understand the oracle economic model, we must first analyze the components of the Web3 economy. Web3 mainly consists of three technology stacks, namely:blockchain,applicationandOracle. If the Web3 economy is to be sustainable, each layer of the technology stack must be able to be financially self-sufficient, earning revenue from users or other technology stacks, and using this revenue to keep running.

blockchain

Blockchain is the underlying ledger in the economic model, responsible for storing and updating the owners of assets and data, and at the same time storing and executing the underlying smart contract code of blockchain applications.

Blockchain users need to create transactions on their ledgers, which generate network transaction fees andMEV, and these fees go to miners or validators, rewarding them for their efforts to keep the blockchain running. Transaction fees are paid in a peer-to-peer manner using the blockchains native token, but most of the transaction fees and MEV rewards for smart contract blockchains come from users of on-chain applications. In addition, blockchains dedicated to settlement will earn transaction fees from the L2 network (ie: rollup), and these blockchains need to provide settlement services for L2.

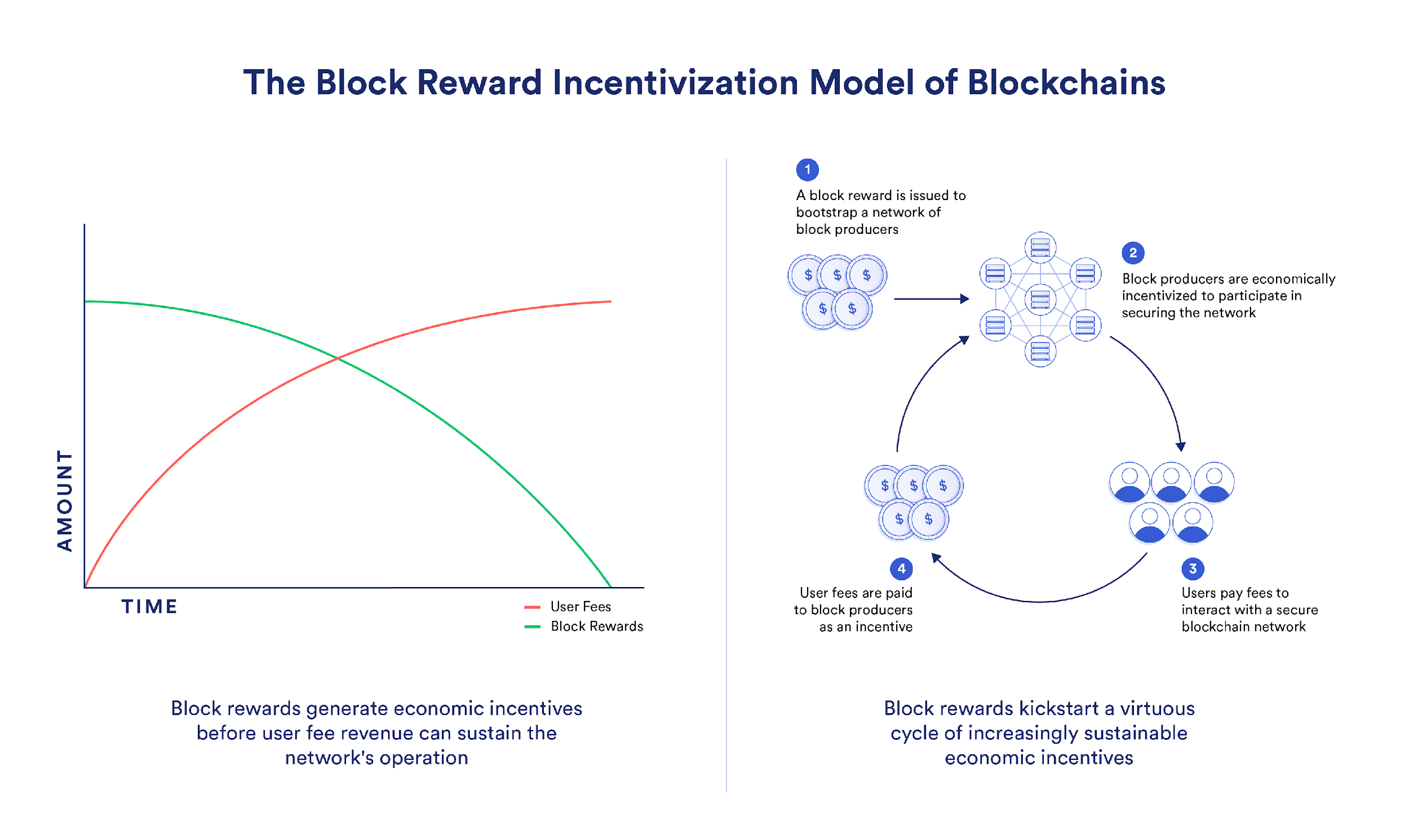

Generally speaking, the more people use a blockchain application or rollup ecosystem, the more transaction fees will flow into the blockchain network, thus creating greater economic incentives to ensure system security. All in all, transaction fees are a sustainable security budget for a blockchain, especially as block rewards decrease over time.

application

Applications refer to specific products and services that provide value to Web3 users. For example, users can borrow stablecoins in the lending market and buy stablecoins on the trading platformNFT, or inDecentralized insurancePurchase insurance on the platform.

Apps provide users with products and services and charge corresponding fees to maintain subsequent operations. The application itself needs to carry out various tasks, such as developing protocols, controlling risks, and maintaining the native token economic mechanism. Even governance tokens specifically for protocol upgrades need to consider the token economic model and value capture mechanism (such as controlling the protocol treasury); otherwise, the cost of governance attacks will be reduced, which will threaten the security of the entire protocol . Some completely immutable public good applications do not need to capture any value, but such applications are still a minority after all. Most applications have operating costs and need to update the protocol in a distributed manner, for example, in order to maintain competitiveness. And implement the upgrade.

The application layer includes not only Web3 native applications (i.e.: dApp), but also traditional enterprises and institutions that develop hybrid solutions (i.e.: Web2), such as using smart contracts to improve existing back-end business processes and issuing passes on the chain. certificate assets, or connect customers to Web3 assets and services.

Oracle

The oracle implements varioustrust minimization service, provides the services required for the normal operation of the application, and these services cannot be obtained from the native blockchain or centralized infrastructure. These oracle services can be divided into three categories, namely: enabling two-way communication between the blockchain and external data/systems,Conduct trust-minimized off-chain computing, and cross-chainEnable interoperability of data and assets。

The oracle service needs to be paid by the application, and the user fees obtained by the oracle will flow to the network service providers. The responsibility of these service providers is to provide services and ensure the security of the oracle service. becauseBlockchain itself has limitations, the value of the oracle machine is to provide various trust-minimized services for applications, such asserverless computing environment、verifiable random number、Smart contract automation,、Cross-chain message transmission、Reserve Certificateas well asTransaction sortingwait.

Typically, oracles serve as a connector, seamlessly connecting Web2 infrastructure to the Web3 economy. The fees paid by applications and users to the oracle network will become the security budget, which is essentially to ensure the security, reliability and accuracy of the oracle network through economic incentives.

How Value Flows Between Blockchains, Applications, and Oracles in the Web3 Economy

Activate the oracle economy

To establish a two-sided market, the classic chicken or egg problem must first be solved. Without paying users, there are no economic incentives for service providers; and without service providers, there are naturally no services to sell to users.

Previously, a common practice in Web3 protocols was to use token subsidies to incentivize service providers to join the network (i.e., the supply side) and to incentivize users to use the platform (i.e., the demand side), thereby activating bilateral market demand. Subsidies serve as an early method of growth, allowing protocols to provide high-quality services even if they fail to break even from users. The goal is to achieve sustainability. As fee income continues to grow and can fully meet the service providers charging standards or an economic model can be established to offset subsidies, then the intensity of subsidies can naturally be gradually weakened.

How blockchain uses block reward subsidies to activate the network economy

Subsidies are nothing new in the Web3 industry. For example, blockchain will use block rewards to motivate verification nodes or miners to ensure the security of the blockchain to meet the ever-expanding needs of the on-chain application ecosystem; or blockchain applications will use tokens to incentivize early users to incentivize early users. . Likewise, the oracle protocol also usesOracle rewardsTo incentivize the creation and continuous operation of the node network, while ensuring security and reliability. When the running costs of the Decentralized Oracle Network (DON) are subsidized, applications can enjoy oracle services at far lower than normal prices, or even use oracle services directly for free, so they can spend more time implementing them. Revenue growth.

This oracle subsidy model is indispensable for the development of the blockchain application ecosystem, and may also play a certain role in various smart contract tracks in the future. However, this is not a sustainable model in the long run. As oracle protocols become more mainstream, a sustainable economic model will be established, and all revenue of service providers will come directly from blockchain applications or users that access oracle services.

Oracle network operating costs

To ensure the economic sustainability of the oracle network, we must first understand the operating costs of the oracle network. In general, the operating costs of the oracle network can be divided into four major categories, namely: on-chain node costs, off-chain node costs, encryption economic security costs, and coordination costs.

On-chain node cost

For the oracle network to send oracle reports directly to the chain, a gas fee must be paid to the blockchain miners or validators in order for the transaction to be confirmed on the chain. The gas cost of an oracle node depends on several variables, including the gas cost of the blockchain itself (note: this depends on the supply and demand balance of block space), and the frequency with which oracle reports are published on the chain (note: different applications Scenarios are published at different frequencies).Chainlink Data FeedsThe publishing frequency is based on a deviation threshold (i.e.: the percentage change from the last asset price update), or based on the heartbeat value (i.e.: the time since the last update)

in addition,Pull oracle networkStoring cryptographically signed oracle reports off-chain shifts the responsibility for paying gas fees onto applications and users. Applications or users can publish oracle reports directly to the chain, or through oracle automation solutions. Ultimately, different users may have different requirements for how data is published to the chain and who publishes the data, which will also lead to different on-chain operating costs for each oracle network.

Off-chain node cost

The operating costs of the oracle network also include off-chain costs, including but not limited to:

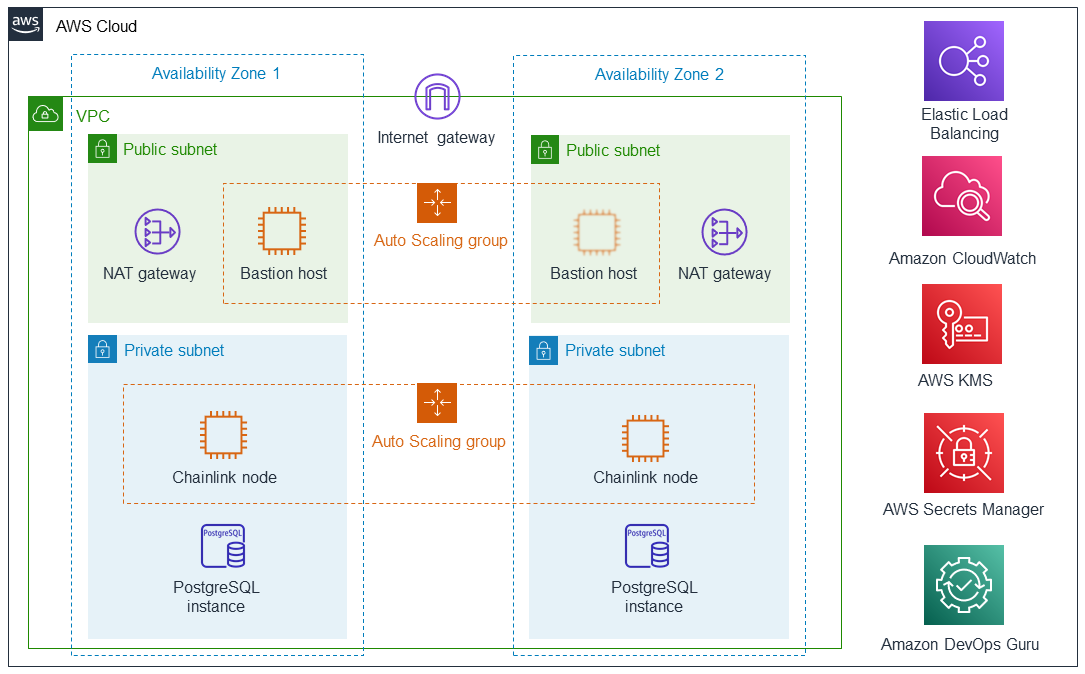

Node infrastructure cost: To participate in the blockchain network, miners or validators need to run and manage node software. Likewise, oracle node operators need to run and manage oracle node software in order to participate in the oracle network. The oracle node software will be responsible for obtaining user requests, connecting to external resources, performing various types of calculations, aggregating the results and publishing the final report on-chain or storing it off-chain. Node operators can run software on cloud infrastructure or on-premises servers, or a combination of both. Whichever option you choose, there are operational costs, including hosting fees and usage costs. In a high-quality oracle network, node operators may also run several oracle nodes in parallel, or be able to create more nodes at any time to improve security. In general, the more tasks a single oracle node performs, or the more oracle nodes are created, the greater the cost to the node operator.

AWS CloudAn example of an oracle infrastructure running on , featuring both primary and backup oracle nodes deployed, thus increasing security

Blockchain full node/RPC: Node operators need access to a full node that is fully synchronized with the blockchain ledger in order for the oracle node to read and write on the blockchain. Node operators can choose to manage the blockchain full nodes themselves (note: they can use cloud services or local servers, or a combination of the two), or they can access RPC providers to access externally managed blockchain full nodes. A reliable oracle network may require node operators to connect multiple full nodes to each blockchain to improve operational stability. Generally speaking, the more mainstream the blockchain that a node operator serves, the more blockchain full nodes it needs to operate. Blockchains with relatively high throughput may require node operators to expend more resources to keep the ledger fully synchronized.

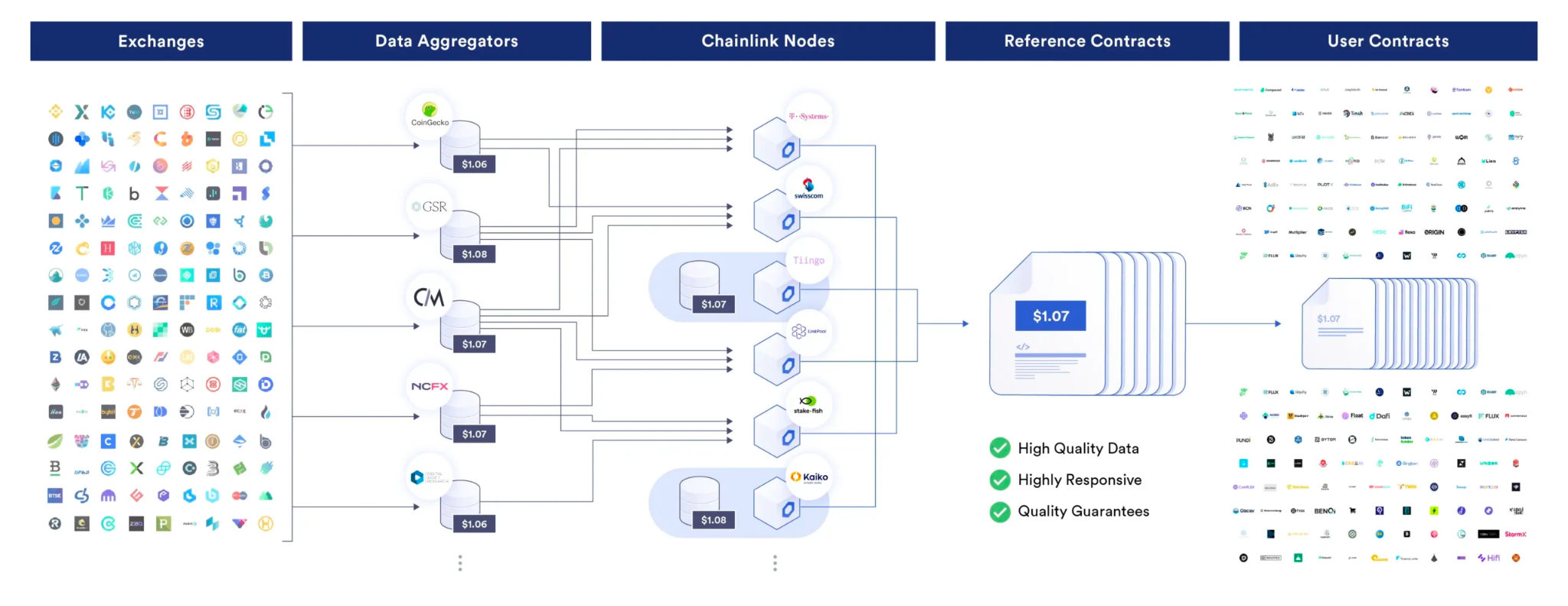

Data provider subscription: Node operators that provide oracle services obtain data from external data providers. Such node operators usually need to subscribe to APIs to obtain permission to access the data. Premium data sources often charge a fee, either on an annual basis or on a pay-per-use basis. Each node operator in a high-quality oracle network can subscribe to the API services of multiple data providers for a certain data point to improve the decentralization level of the network.

Each Chainlink node operator of Chainlink Price Feeds will access multiple high-quality data aggregators and take the median

Monitoring and management: Running an oracle node is not a set-it-and-forget-it initial setup, but requires subsequent active management and rapid response, because the off-chain world to which oracles are connected is inherently unpredictable and non-deterministic. . Therefore, node operators in high-quality oracle networks usually need to have monitoring-related tools and infrastructure to analyze and track node current and historical performance data, including running time, latency, accuracy, and resource utilization. This infrastructure includes real-time alerts, monitoring dashboards, and automation tools. In addition, dedicated personnel are assigned to resolve potential performance or reliability issues in real time.

Cryptoeconomic security costs

In order to ensure that nodes in the oracle network have sufficient economic incentives to operate honestly and reliably, appropriate mechanisms need to be established to increase the opportunity cost of attackers. One economic incentive model is to allow node operators to gain benefits. This creates a future-fee opportunity that will be lost in the future if node operators cannot meet performance requirements. Blockchain actually uses the same incentive mechanism. If blockchain miners and validators want to continue to earn income in the blockchain network in the future, they must ensure that the network can continue to operate.

In addition, you can also passEquity pledgeTo enhance economic incentives and establish a reward and punishment mechanism for the performance of the oracle machine, thereby ensuring the security of the encrypted economy. Stakeholders improve the economic security of the oracle service and will therefore receive corresponding rewards.

coordination costs

There is a type of participant in the oracle network whose responsibility is to help coordinate the development, release, maintenance and technical support of oracle services. These services broaden the breadth, practicality and security of oracle services, and at the same time reduce the integration threshold and subsequent management costs for users.

Oracle release: Deploying a new oracle network requires screening and recruiting node operators, finding high-quality data providers, and configuring network parameters to meet the needs of specific application scenarios. Although users can choose to perform these key tasks themselves, the coordinator can simplify these processes and allow developers to focus on the development of core business logic.

Oracle maintenance: Oracle networks require ongoing monitoring and maintenance to maintain a certain level of security, guarantee service levels, and meet the changing needs of customers. While node operators handle many maintenance tasks themselves, coordinators can help them identify and resolve problems with the operation and dependencies of the oracle network.

Research and development of oracle machine services: The users demand for oracle machines is constantly changing, so it is necessary to continuously improve existing oracle machine services and create new oracle machine services. The coordinator can help develop the oracle services required by users and improve the security, speed and flexibility of the underlying core protocol of the oracle.

Technical support: As new developers and projects continue to emerge in Web3, it is necessary to provide them with technical guidance to help them understand how to use oracles in their applications. Coordinators will combine their own expertise and experience to help projects in the ecosystem successfully create oracle networks or integrate oracles into applications.

The coordinator can help smart contract developers to quickly start and develop the oracle machine ecosystem, and at the same time allocate the developers oracle machine needs to an external professional team. These teams have specialized experience meeting developers’ specific oracle needs. These coordination tasks will incur various labor costs and operating costs.

What risks will arise if problems with the oracle economic model arise?

Before talking about how Chainlink can create a healthy oracle economic model, let’s briefly explore the risks if oracles don’t have a sustainable economic model.

Economic Incentives Decline

The original economic model of the oracle protocol is only based on a subsidy mechanism to reward service providers. In the short term, users can benefit from these subsidized services. But in the long term, the oracle network does not have a stable economic model. The oracle may be attacked, and the ultimate victim is the user. If the long-term incentives for service providers are reduced, this will weaken the security of the entire network because the opportunity cost of launching a malicious attack will become lower and lower.

Switching costs and trust assumptions

Another problematic economic model is to hope that new oracle protocols will continue to emerge, and then use the subsidies of these agreements. This line of thinking is very dangerous. First, an oracle protocol cannot subsidize users forever, which is not economically sustainable. Therefore, someone will always be looking for new, free oracle solutions, and this assumption is unpredictable. In addition, all new oracle protocols have not been tested by the market and therefore pose significant risks to applications. If there is a problem with an oracle update, it may permanently destroy users trust in the application. This kind of thing has indeed happened in the Web3 industry. Another model is oracle rotation, which incurs switching costs, meaning that applications must spend valuable development time and resources switching to a new oracle solution.

conflict of interest

If the oracle machine is free, or users can optionally pay, and there is no clear and sustainable economic model, then the long-term viability and value capture ability of the oracle machine service will be marked with a big question mark. No infrastructure or service is free. You either pay for the product or you are the product. This is true in the Web2 industry, and Web3 may suffer from the same problem. The free oracles are either of very poor quality and follow-up maintenance, or they are designed to attract users for free, and then cut leeks, such as taking advantage of information asymmetry and sacrificing users interests to satisfy their own interests.

On-chain manipulation

Developers may feel that time-weighted average price (TWAP) or other access to data from on-chain decentralized exchanges (DEX) is a free oracle solution. Although the data is placed on the chain, the oracles of DEX are not free. These trading platforms need high liquidity and upkeep solutions to provide funds to maintain the latest market prices. In addition, DEX oracles are also very insecure because they cover a limited market range and cannot combine tamper resistance and low latency at the same time.

Another problem is that the DEX oracle can only transmit the price feed of on-chain tokens, and it can only be priced based on other on-chain tokens. Lastly, getting price data from one of the liquidity pools in a DEX itself presents serious risks to the blockchain as there is no guarantee that liquidity will not be transferred to other platforms. Of course, it is also possible to calculate on-chain aggregate prices across all on-chain liquidity pools, but doing so is very complex and costly, and liquidity transfers and new sources of liquidity must be actively managed and monitored.

Even if liquidity remains abundant, multi-block attacks and other innovative attack vectors can exacerbate the risks of DEX oracles. The fact is that the biggest economic incentive of DEX is to provide market liquidity, rather than to provide reliable and accurate price oracles.

Chainlink 2.0 Economics: A Sustainable Oracle Economic Model

Chainlink has launched Chainlink 2.0 Economics and a series of related plans to create an oracle economic model. These plans can be divided into three categories, namely: increasing user fees, reducing operating costs, and establishing sound cryptoeconomic security.

There are three types of service providers in the Chainlink network, and a sustainable economic model needs to be established to support them. The first category is node operators, who are responsible for providing oracle services; the second category is coordinators, who are responsible for assisting users in the development, release, maintenance and technical support of oracle services; the third category is pledgers, who are responsible for providing Encrypted economic security ensures the performance of oracle services.

Chainlink 2.0 Economics is a multi-disciplinary initiative designed to enable a positive cycle around security, value capture, and adoption of the Chainlink network

Increase fee income from the Chainlink network

Earning fees from applications and users is an important part of achieving economic sustainability for oracle services. Chainlink 2.0 Economics has launched and tried various monetization models, focusing on increasing user fees and optimizing the payment experience of applications and users. One factor that is particularly taken into consideration is that different applications are at different stages of the billing cycle. User fees earned by the Chainlink network are paid to various service providers in return for their services.

We have launched or are trying to launch the following initiatives to increase user fee income for service providers in the Chainlink network.

Usage-based payment: In this model, users pay for oracle services based on usage. For example, Chainlink VRF, Automation, and Functions solutions all require applications to deposit a fee into the on-chain subscription contract, from which the service provider will deduct the fee. There is also a model where users pay directly from the wallet when performing transactions that include oracle services. A usage-based payment model allows applications to self-manage the cost of oracle infrastructure in a simple, scalable way; or applications can shift oracle costs directly to end users.

User fee sharing: Applications share a portion of fee revenue with Chainlink service providers to pay for oracle services. This user fee sharing model can take into account the customized needs of mature protocols, and can also be used as a supplement when the first payment model is not applicable. The first recently passedChainlink and GMX fee sharing proposalIt is proposed that 1.2% of the revenue from GMX V2 and later versions will be used to pay Chainlink service providers to obtain low-latency oracle services and related technical support. As the Chainlink equity pledge continues to iterate and support more and more oracle services, part of the user fees mentioned in the proposal will be directly distributed to the pledgers to reward them for improving the cryptoeconomic security of Chainlink services for GMX. This will make the relationship between Chainlink service providers and applications closer, and the expansion of application scale will also bring greater economic incentives to oracle machine services, which will in turn improve the security of oracle machines for applications.

BUILD: The Chainlink BUILD program is designed to accelerate the growth of early-stage projects, which often have not yet begun to generate revenue. Projects that join BUILD can have priority access to Chainlink’s services and technical support. In exchange, the project party needs to commit to paying a certain proportion of the native token (usually 3-7%) to Chainlink service providers, including stakers. In this way, applications in the early stages of development and adoption can also receive oracle services and additional resources, and eventually grow into mature applications with sustainable revenue streams.

Reduce operating costs for Chainlink service providers

We have taken a series of measures to reduce the operating costs and service prices of service providers, in order to establish a sustainable oracle service economic model and lower the payment threshold. In addition, we are also launching new plans to share the cost of oracle service among various ecological participants, especially at a stage when user fees are insufficient to support long-term operating costs.

Some of the following initiatives are already starting to reduce the operating costs of the Chainlink network:

OCR 2.0 : Chainlink Off-Chain Reporting (OCR) 2.0 is Chainlink’s latest off-chain consensus protocol. DON can efficiently reach consensus on a certain data point or calculation through OCR 2.0. OCR 2.0 provides a shared platform for multiple Chainlink services by creating a reporting plug-in interface. This interface simplifies the complex process of running different product logic and increases the efficiency and scope of use of OCR.

Low Latency Oracle: Chainlink low-latency oracle is a pull-type oracle solution, and oracle reports are regularly generated off-chain. Users, applications, or oracle automation solutions can obtain and submit data on-chain to verify user transactions. In pull oracle mode, oracle reports are only sent to the chain when needed, rather than automatically uploaded to the chain based on predefined conditions. This model shifts the responsibility for paying on-chain gas fees from the oracle node operator to the application or user.

Data Feed Deprecation: Chainlink continues to evaluate the use and economic viability of Data Feeds across all networks. Data Feeds with no public users or sustainable development paths may be deprecated. The aim is to eliminate unnecessary costs for network and node operators. However, deprecated Data Feeds may also be republished on other blockchains or L2s if requested by users.

Additionally, we have plans to provide buffer space for applications until enough user fees are collected to pay for the oracle service:

SCALE: L1 and L2 blockchains participating in the SCALE program (the full name is Sustainable Chainlink Access for Layer 1 and 2 Enablement) will be exempted from the node operating costs of Chainlink services for a period of time, with the purpose of activating the application ecology on the blockchain. SCALE can facilitate cooperation between Chainlink and various blockchains to jointly provide the oracle infrastructure needed for applications. Applications will have more time to create sustainable revenue streams and eventually be able to pay for the blockchain and oracle infrastructure.

Building Cryptoeconomic Security with LINK Tokens

The LINK token is indispensable to the Chainlink ecosystem, and its biggest role is to improve the cryptoeconomic security of oracle services. We are currently trying to enhance the crypto-economic security of the Chainlink network through LINK tokens in three aspects.

Payment: The first option is to optimize the payment process of the oracle service. Once paid with LINK, the fee revenue the service provider receives is tied to the overall security and health of the Chainlink network. This creates additional financial incentives for service providers to improve security and reliability. In order to optimize the payment experience to the greatest extent, in addition to LINK, payments can also be made with other assets, including native assets, in some cases. However, when paying with other assets, the rate is higher than the rate when paying with LINK. When paying with other assets, the payment will be converted into LINK and circulated on the Chainlink network.

Guaranteeing service security based on equity pledge: The second option is to ensure security based on equity pledge. In this mode, LINK will be stored in the staking smart contract. This money is deducted as a penalty if the oracle service does not meet the predefined requirements. The pledger can share a part of the service fee paid by the user and the application, because the pledger guarantees the security of the oracle service by staking LINK. The security model based on stake pledge may be further expanded to introduce loss protection. Loss protection means that a portion of confiscated LINK tokens can be used to compensate applications that suffer losses due to oracle services. Both node operator pledgers and community pledgers can guarantee service security through equity pledge. Staking v 0.1 will be launched in 2022, and later versions will gradually add more functions and security guarantees.

Establishing node reputation based on equity pledge: The third option is to establish an oracle node reputation mechanism based on equity pledge. To put it simply, assuming that other performance indicators are the same, the more LINK a node pledges, the more jobs it can get and the more user fees it can earn. That is to say, the income opportunity of a node is directly proportional to the number of LINK tokens it is willing to stake. The amount of LINK pledged represents their commitment to ensuring the normal operation of the oracle network, and it also means that these nodes provide additional security for the oracle service.

Although the initial crypto-economic security model will basically revolve around LINK payments, it will gradually focus on pledging LINK tokens to ensure the security of Chainlink services. In order to reward nodes for staking LINK tokens to further ensure the security of the crypto economy, the Chainlink network will then distribute a portion of user fees to stakers.

Under the influence of Chainlinks powerful network effect, many dApps from various blockchain and smart contract tracks can issue tokens to stakers to reward their contributions to the security of Chainlink services.

Increasing sustainability and predictability

Chainlink protocols and services need to establish a sustainable economic model to maintain extremely high security and reliability and enrich the types of oracle services. However, fully achieving economic sustainability will take some time and is fraught with uncertainty, not to mention that the Chainlink network’s fee revenue depends on the growth and adoption of Web3 as a whole. We believe that in addition to the multiple Chainlink 2.0 economics plans currently launched, a predictable long-term development roadmap is also needed, which is in the best interest of the Chainlink ecosystem and can consolidate Chainlink’s position as the Web3 industry standard in the long term.

Establishing a sustainable oracle economic model is a prerequisite for the success of Web3

Oracles activate a wide range of application scenarios for the blockchain, and these application scenarios must access external data, carry out trust-minimized off-chain calculations, and adopt cross-chain interoperability solutions before they can be truly implemented. To provide developers with these oracle services, a sustainable economic mechanism must be established between the blockchain, applications, and oracles to ensure the security of the three while maintaining the economic foundation required for innovation. Without a sustainable oracle economic model, Web3 innovation will seriously lack endogenous power. And more importantly, Web3 will face security risks across the entire ecosystem.

Chainlink has led the innovation and adoption of decentralized oracle services. Today, our focus is on establishing a sustainable oracle economic model so that current and future developers can create secure and mainstream Web3 applications. We firmly believe that this will be the key to unlocking billions of new users in the future.

——

Disclaimer: The content of this article is for reference only and involves future development plans, such as product features, development work, and feature release time nodes. These are forecasts only and reflect current expectations and views. These expectations are based on assumptions and are subject to risks and uncertainties, which may change at any time. Although the content in this article is based on rational assumptions, we cannot guarantee that the final results will be consistent with the ideas in the article. All content in this article is valid only on the date of first publication. Since actual user feedback and future events cannot be predicted, the content in this article may deviate from subsequent actual situations, and we may not make corresponding changes in this article.