Tonight, global payment giant PayPal (NASDAQ: PYPL) announced the official launch of its USD stablecoin, PayPal USD (PYUSD). This is also the first time that a large financial company has issued its own stablecoin.

PayPal USD is based on Ethereum (ERC 20) and is issued by Paxos Trust Company. It is backed by 100% support from US dollars, short-term US Treasury bonds, and similar cash equivalents, and can be exchanged for USD at a 1:1 ratio.

Starting from September 2023, Paxos will release monthly reserve reports for PYUSD, outlining the specific composition of its reserves. Paxos will also provide third-party verification of the value of PYUSD reserve assets. The verification will be conducted by independent third-party accounting firms in accordance with the auditing standards established by the American Institute of Certified Public Accountants (AICPA).

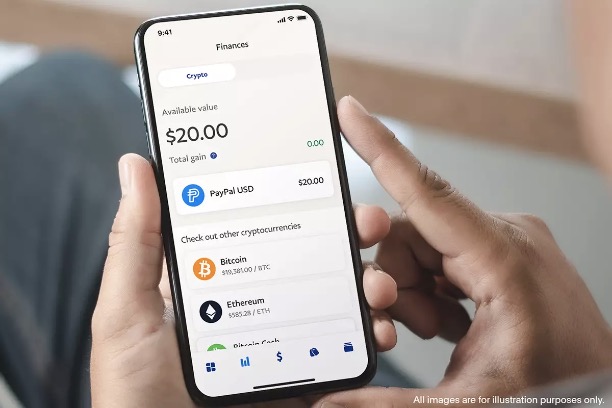

PYUSD will be available to PayPal US customers (excluding Hawaii) in the coming weeks. Holders can enjoy the following services: (1) make peer-to-peer payments using PYUSD; (2) choose PYUSD as the settlement option at checkout - PayPal's crypto checkout feature allows customers to convert cryptocurrencies into fiat currency at checkout for transaction settlement; (3) exchange PYUSD with supported cryptocurrencies by PayPal (considered as an off-exchange transaction); (4) transfer PYUSD between PayPal and compatible external wallets.

PayPal President and CEO Dan Schulman said, "The transition to digital currency requires a stable tool that is both native digital and easy to connect with legal tender such as the US dollar. Our commitment to innovation and compliance, as well as our past achievements in providing new experiences for customers, provide the necessary foundation for driving the growth of digital payments through PayPal USD."

The press release states, "Fully supported and regulated stablecoins have the potential to change the way payments are made in the web 3 and digital native environments." PayPal USD aims to reduce friction in inexperienced payments in virtual environments, facilitate the rapid transfer of value, enable direct flow for developers and creators, and promote the continued expansion of digital assets for the world's largest brands. Most stablecoins are currently used in web 3-specific environments, but PayPal USD will be compatible with this ecosystem from day one and will soon be available on Venmo. (Odaily note: Venmo is a mobile payment service owned by PayPal.)

In fact, this is not PayPal's first foray into the cryptocurrency field. As early as June 2022, PayPal began allowing users to send BTC, ETH, BCH, and LTC to external wallets, and also supported the purchase of cryptocurrencies through MetaMask and Coinbase. Data shows that as of the end of the first quarter of this year, PayPal's balance sheet had $943 million worth of cryptocurrencies, including BTC, ETH, BCH, and LTC, a 56% increase from the $604 million disclosed by the company in the previous quarter.

In the press release, PayPal states its focus on the education, understanding, and adoption of cryptocurrencies. "In addition to creating products and services that increase the utility of cryptocurrencies, PayPal is also committed to enhancing consumer and merchant understanding of cryptocurrencies, stablecoins, and central bank digital currencies (CBDCs). In addition to offering PayPal USD to US account holders, PayPal currently provides customers with the ability to buy, hold, sell, and transfer cryptocurrencies, and offers educational content to help account holders understand the risks and possibilities of this technology."

With the release of PYUSD, there is another noteworthy development, namely that Paxos appears to be recovering from SEC's crackdown. complex. In February this year, the US SEC sent a Wells Notice to Paxos, stating that the issuance and listing of BUSD by Paxos is an unregistered security. It plans to sue Paxos for violating investor protection laws and may take enforcement actions. Subsequently, the New York State Department of Financial Services ordered Paxos to stop issuing BUSD tokens. Under regulatory pressure, Paxos ended its partnership with Binance and initiated BUSD redemption (with a one-year window period until February 2024). The market value of BUSD has also decreased from over $10 billion to the current $3.5 billion in the past few months. For Paxos, even a giant like Binance cannot withstand regulatory pressure. It is not easy to find a new partner in Web 3.0. Its focus is now shifting to Web 2.0 internet companies, especially some payment platforms that naturally align with stablecoins. In June this year, Paxos partnered with Mercado Libre, the Latin American e-commerce giant with 40 million active users, to launch regulated Pax Dollar (USDP) in Mexico and make it available to all customers in the country on the Mercado Pago payment platform. This collaboration with PayPal is also a rebirth for Paxos. Perhaps in the future, as the market share of PYUSD expands, we will also see the appearance of the &&/PYUSD trading pair on CEX platforms.