July 2023 is a period witnessing many updates of projects related to MEV, not only on Ethereum but also in other ecosystems. In today's article, let's take a look at the approaches of these projects and see how they will address the MEV problem!

MEV Overview

Regarding MEV, we already have an article about MEV that introduces the attack methods of MEV bots for profit extraction. If this concept is new to you, you can learn more in the link below!

DApp Layer Solutions

I will group the projects based on their proximity to users, as I perceive it hierarchical. The "Protocol" layer will be closer to the infrastructure and further from the users. In contrast, the "Dapp (Interface)" layer will be considered closer to the general users. In the DApp layer, we will discuss 3 names: UniswapX, CowSwap, and 1inch Fusion.

UniswapX

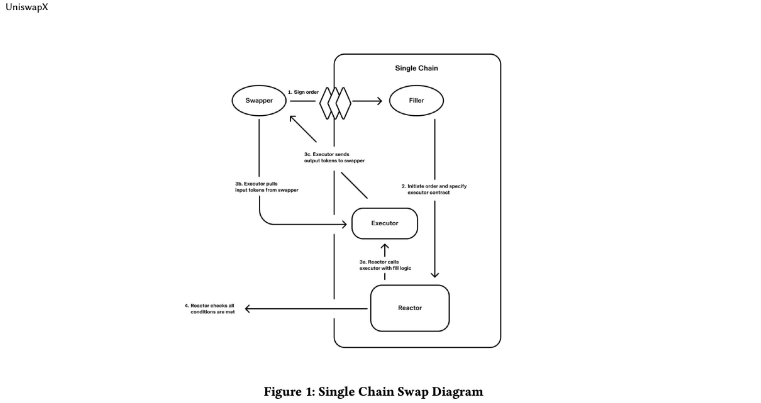

Let's start with a recent and controversial project called UniswapX. According to the information shared in the UniswapX whitepaper, the team will "internalize" MEV, meaning they will incorporate MEV into the product and redistribute the advantages to users through a more favorable price index (here, the token being exchanged). It seems that Fillers will replace the role of MEV searchers in the traditional model. By interacting with the Reactor contract, these Fillers will be able to reallocate MEV rewards to users.

Here are a few comparisons between UniswapX and the "leading" solutions that the project has been accused of stealing.

(Please note that I appreciate the efforts of all projects in addressing problems and do not intend to "defend" UniswapX after the recent accusations. The following are some comparisons that I have attempted to make, extracted from information provided by the project.)

CowSwap

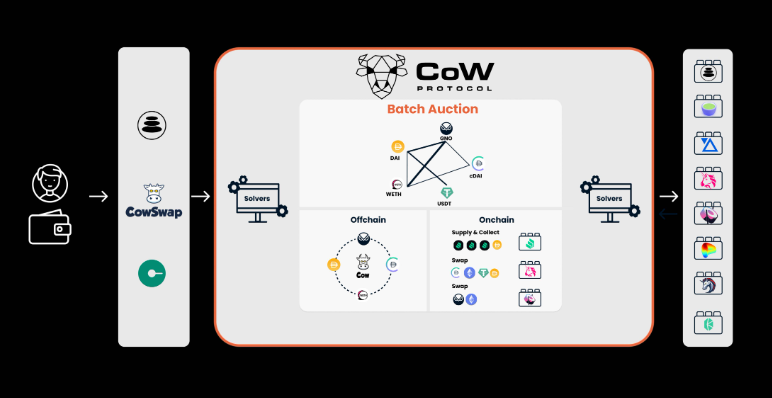

Over the past month, UniswapX has become the subject of ridicule, especially as many people believe this new solution is a copy of CowSwap - an exchange that also aims to reduce users' MEV. Readers can learn more about CowSwap's product model in the article below.

If we take a look at how CowSwap works, we acknowledge that we see some similarities between the "Solver" and "Filler" roles. Additionally, allowing users to sign transactions off-chain to save on gas fees is another similarity between these two projects.

However, there are still some differences between the two projects.

The transaction fees in Uniswap will be paid by the Filler, and there is currently no information on whether users need to pay the fees to the Filler. Essentially, UniswapX indicates that these are gasless transactions. In CowSwap, the Solver will first pay the gas fees, and the third parties will later charge fees for token swaps.

The next difference is that CowSwap will have a certain level of an "Order Book" and allow users to place limit orders. However, I will not go into detail on this aspect because Uniswap V4 is specifically designed for creating limit orders, not UniswapX (a liquidity aggregator - DEX aggregator).

The final difference is that Uniswap has significant liquidity pool advantages from V2, V3, and possibly even V4, while CowSwap is still purely a aggregator solution that relies on external liquidity. This can be seen as a competitive advantage that concerns many projects in the market, as Uniswap is taking every step very firmly and systematically, potentially creating a platform that is "too big to fail." This may be a concern for the entire market.

1 inch Fusion

Another solution, compared to UniswapX, is 1 inch Fusion.

Another similarity between UniswapX and 1 Inch Fusion, besides details like third-party liquidity routing and off-chain transaction signing support, is the Dutch auction mechanism.

The third parties responsible for connecting liquidity have different names for these two products: "Filler" for UniswapX and "Resolver" for 1 inch Fusion.

inch Fusion.

However, one difference to note is that ^1 inch Resolver^ needs to whitelist and stake the project token to increase its credit score (referred to as "Unicorn Power"). Only the top 10 Resolvers with the highest credit scores can participate in transaction bundling and broadcasting.

As mentioned above, ^1 inch^ is purely an aggregator solution and cannot compete by establishing liquidity pools internally within the product. Recently, the project also announced the suspension of internal liquidity pools.

Overall, DApp layer products will deploy third parties to connect liquidity and incorporate MEV profits into their products, redistributing value to users.

As mentioned above, I believe UniswapX has "borrowed" some patterns from previous competitors. However, UniswapX has a significant competitive advantage with a large liquidity ecosystem, making it difficult for competitors to catch up.

Solutions at the Protocol Layer

MEV Blocker

In addition to traditional aggregator products, CowSwap has also collaborated with Gnosis to develop an independent relayer category called MEV Blocker. This relayer category can be compared to the MEV-Share of Flashbots (which I will explain as part of that solution later). The MEV Blocker solution has just reached 4 million transactions.

Flashbots

Flashbots is an influential organization with many different product branches:

Mev-Boost: This is software that provides an operation flashbots filtering mechanism for validators. It can be seen as an upgraded version of Mev-Geth, when Ethereum was still using proof-of-work mechanism.

MEV-Share: This is a protocol that involves searchers, builders, validators, and other parties participating in the transaction creation process and optimizing MEV profits for users. CowSwap's MEV-Share and MEV Blocker can be seen as two products in the same array.

SUAVE: This can be seen as an extension and more decentralized version of the MEV-Share protocol.

In addition, there are branches for research, data, and RPC connection port support for users.

In the future, Flashbots' plan is to deploy a private network called SUAVE. This network will include running nodes to share MEV profits in a decentralized manner. SUAVE will also address other issues including:

Cross-chain MEV: Imbalance of MEV opportunities across different chains.

Accumulative effects: Unfair competitive advantage of certain validators in the initial stages, leading to accumulation and attracting users to their side. This is always a potential issue for decentralization in every network.

Conclusion

Therefore, we have delved into the technical aspects of some projects that offer solutions for MEV. We hope that the above article can provide you with a detailed understanding of the approaches used in these projects, making product evaluation more accurate for each individual.