After the recent Curve incident, the DeFi sector is facing a major crisis of confidence. Lending platforms associated with Curve founder Michael Egorov's personal debt have been on edge these past few days.

Egorov has reduced the risk of liquidation through a series of operations, such as the launch of the crvUSD/fFRAX pool on Curve, which affects the debt position interest rate on the CRV/FRAX pool on Fraxlend, and has sold a large amount of locked CRV for repayment through OTC. According to blockchain analyst Yu Jin, as of August 2nd, 22:00, Egorov has sold a total of 59.5 million CRV and exchanged it for $23.8 million in funds.

The Curve incident seems to have turned around (at least for DeFi). However, the four core lending platforms involved in the water, Aave, Fraxlend, Abracadabra, and Inverse, are busy taking precautions and proposing changes to the Curve pool in order to reduce the risk of future bad debts and chain liquidation.

Odaily has conducted an investigation into the latest actions of these four platforms and shares their improvement directions and progress as follows.

Aave

Aave, as the largest debt position holder, is the most worth paying attention to regarding its subsequent actions. How to avoid the impact of large positions on the normal operation of the platform?

In fact, there has already been a liquidation risk at the end of May to mid-June this year. Egorov first purchased a luxury house, and then was sued by three VCs. Later, he borrowed a total of $71 million in stablecoins from Aave (Lookonchain Statistics, triggering market panic.

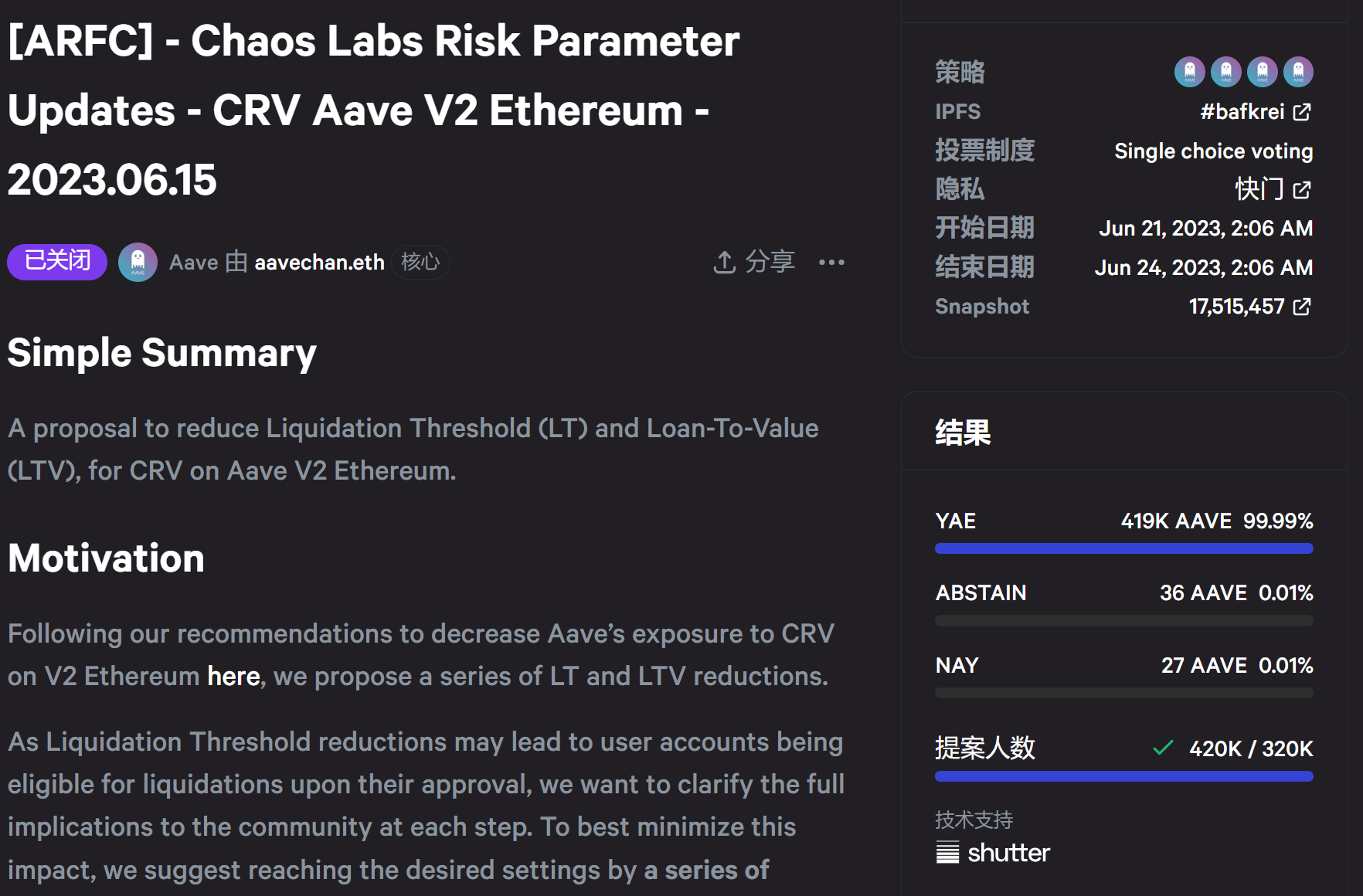

In mid-June, ChaosLabs launched a proposal on Aave to slow down overheating behavior by reducing the 3% CRV LT. The proposal was approved, but the effect was not significant. (On June 15th, CRV fell to a monthly low of 0.558 USDT.)

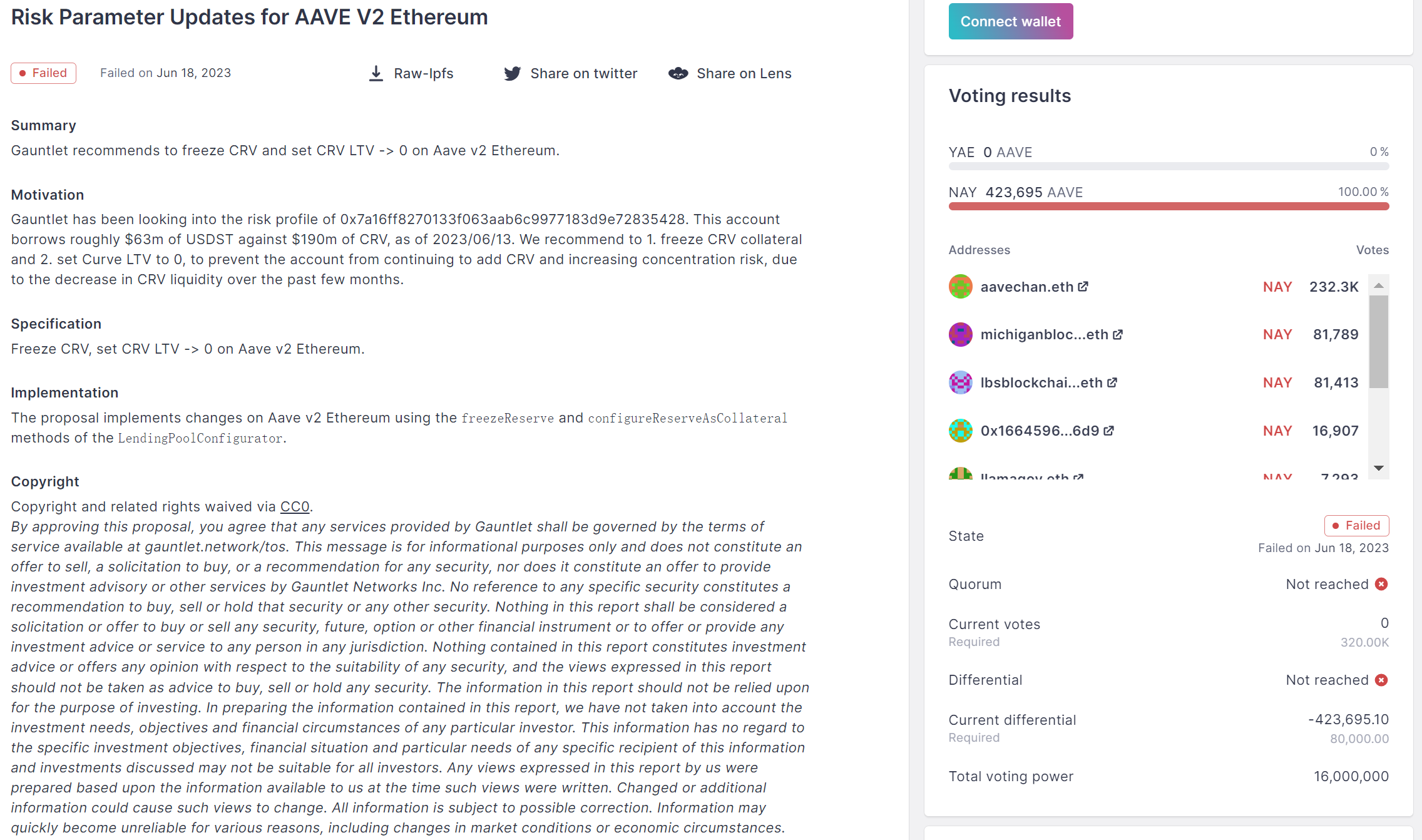

Gauntlet subsequently proposed to freeze CRV on the Aave governance forum and set the CRV LTV to 0 on Aave v2. Specifically as follows:

Unfortunately, this proposal did not pass due to insufficient votes and widespread opposition. At the time, some voices on the Aave governance forum believed that this action was not decentralized enough and should not selectively restrict the other party just because Egorov's borrowing scale is relatively large.

Recently, the Aave governance forum has reopened discussions on the Curve incident, hoping to mitigate risks on the Aave platform through previous proposals. This measure can to some extent limit the use of the CRV pool on Aave.

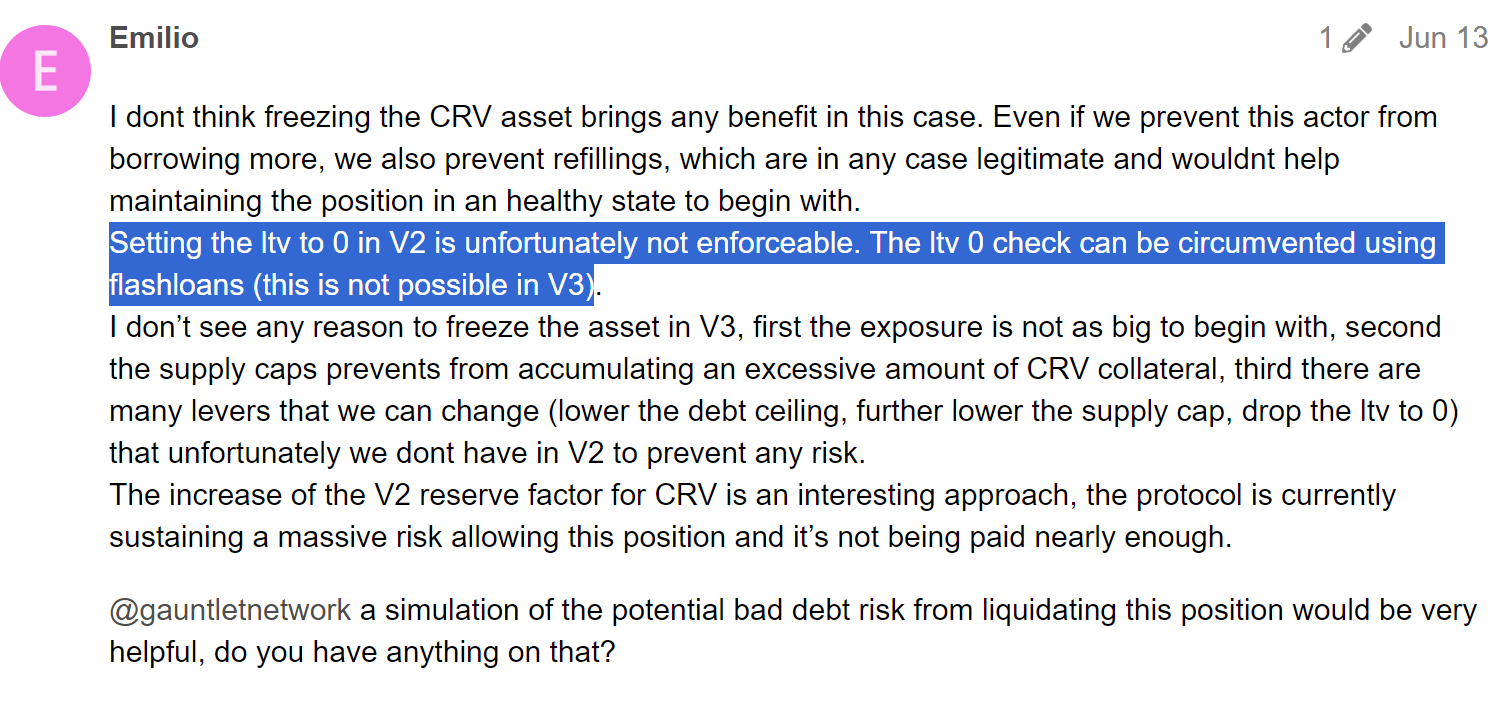

However, Emilio from the governance forum believes that even if the LTV is set to 0, it can still be bypassed through flash loans.

In response to this, dForce founder Mindao explained to Odaily: "LTV checks require an account equity check. Flash loans involve borrowing, trading, and repayment within a single transaction, which does not affect account equity. Therefore, it is possible to continue borrowing through flash loans (which may have been overlooked in the V2 mechanism). However, this only allows bypassing of flash loans and can still restrict new non-flash loan borrowings. It seems that this person is using it as a convenient excuse to oppose any adjustments."

Fraxlend

As the party with the highest risk to Egorov in the liquidation dispute, Fraxlend forced Egorov to repay his debt on the platform first due to its risk isolation and special interest rate adjustment mechanisms. Fraxlend's superior mechanism placed it in a priority position for repayment in this liquidation dispute.

For detailed rules and advantages of Fraxlend's interest rate adjustment mechanism, please refer to Odaily's article "How is Fraxlend's interest rate calculated, surging to 10,000% in just three and a half days?", which will not be repeated here.

Abracadabra

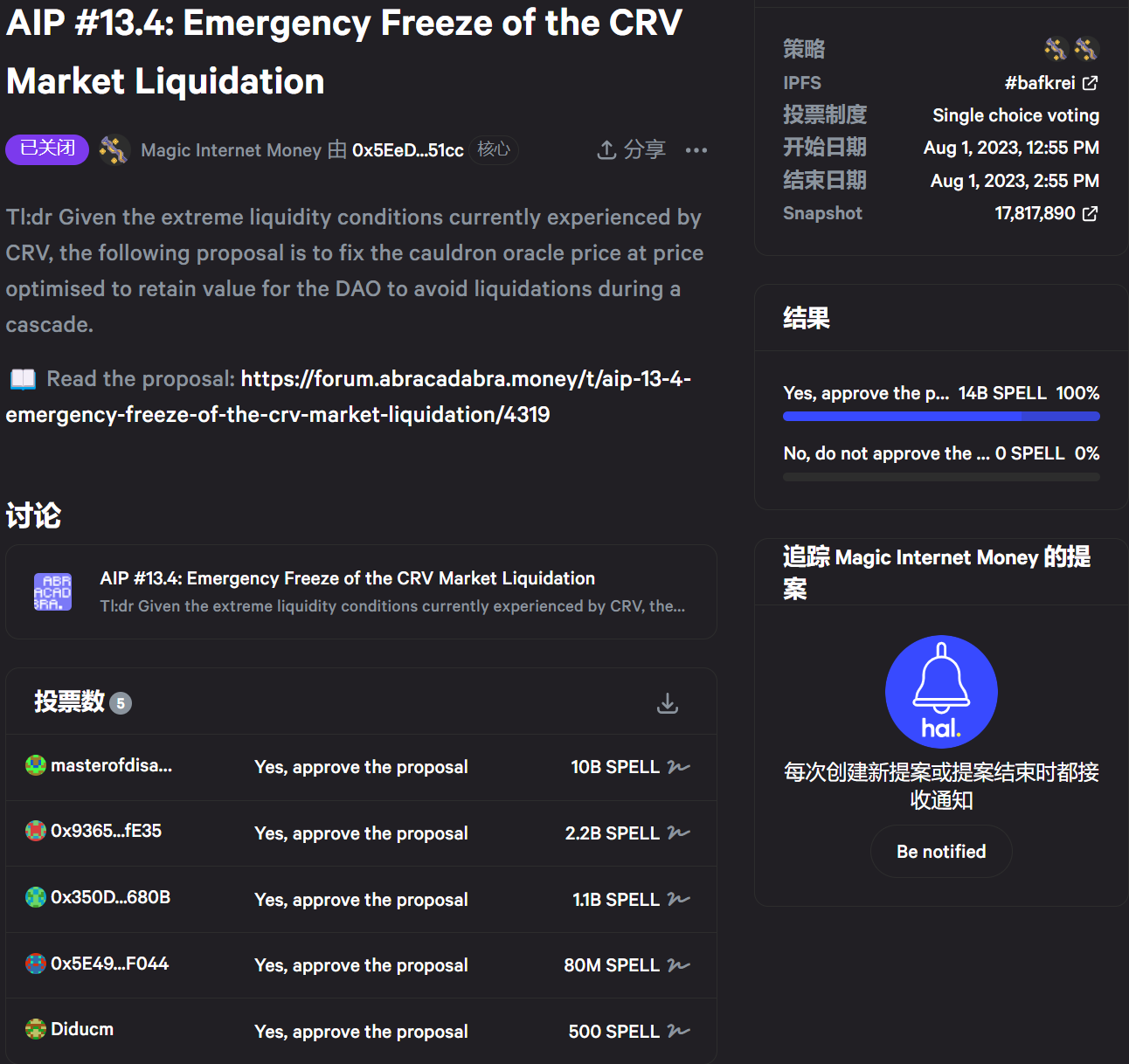

In this incident, Abracadabra also acted swiftly and has already initiated an emergency freeze of the CRV market through AIP #13.4.

That's a good proposal, although there are only 5 voters, at this point, the insufficient decentralization actually reflects the advantages in decision-making efficiency.

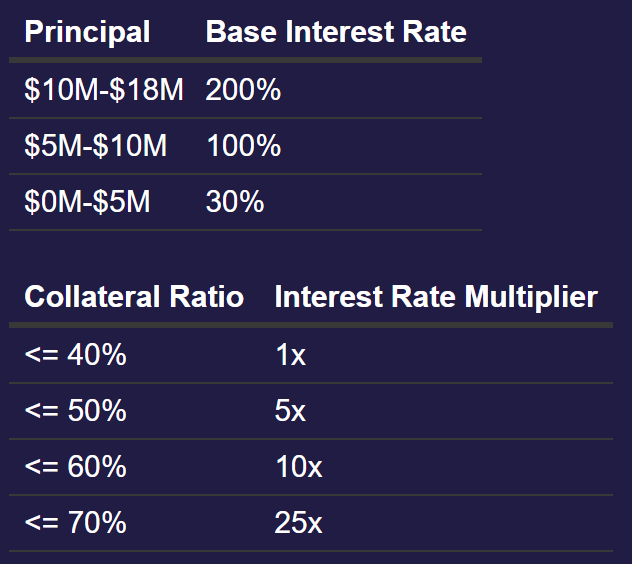

Abracadabra subsequently launched the proposal AIP #13.5: Adjustment of CRV LP Interest Rates, which redefines the way interest is earned by calculating the amount of interest deducted based on the corresponding interest rate and collateral ratio. The specific interest rates are shown in the following figure:

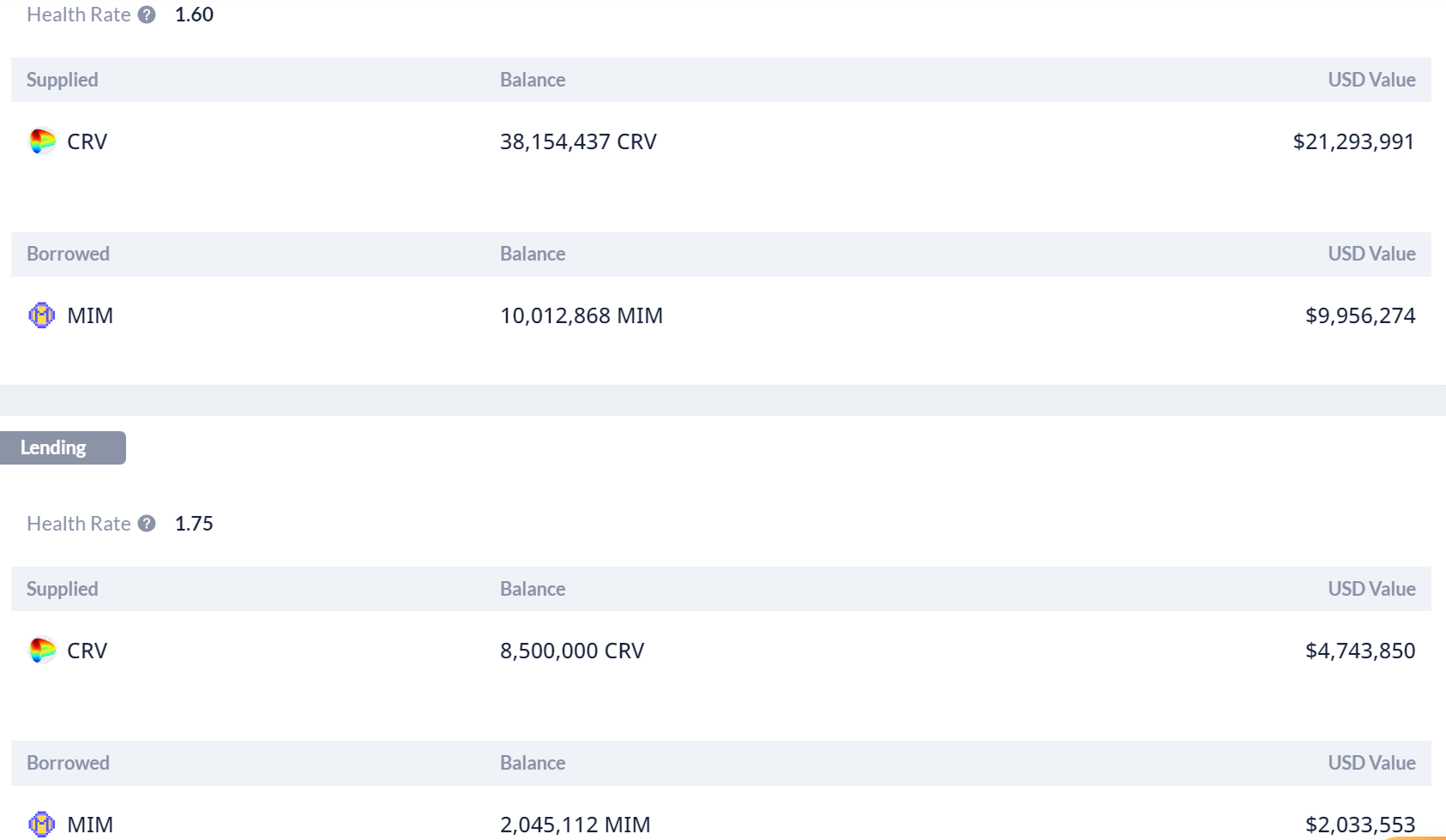

Currently, DeBank data shows that Egorov still needs to repay approximately $12 million MIM.

Under the new proposal of Abracadabra, there are only a few hours left for Egorov, and the situation is not optimistic. Although this move is domineering, it is effective and aims to quickly reduce their own bad debt risks. Egorov will most likely continue to repay MIM debt through off-exchange OTC trading.

Inverse

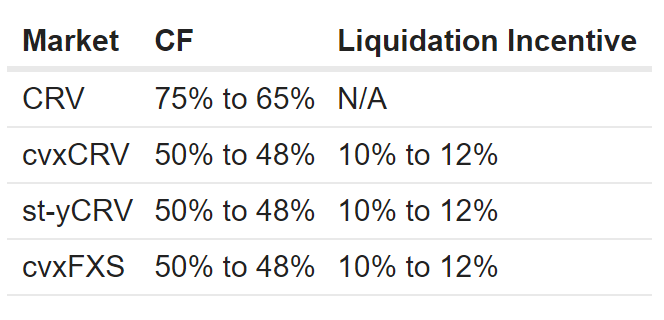

On the evening of August 2nd, community member edo proposed in response to the Curve incident. Compared to the previous three, Inverse has relatively low debt position, and the proposal is relatively mild—lowering the collateralization ratio of CRV, cvxCRV, st-yCRV, cvxFXS, and increasing the liquidation incentives for cvxCRV, st-yCRV, cvxFXS. The specifics are as follows:

Inverse This action does not seem to have a strong performance, and the community has not voted on the proposal.

Overall,

1. Aave is the most decentralized, but less efficient. The latest proposal mentioned earlier will enter the on-chain governance process today.

2. Fraxlend has inherent advantages and strong risk resistance.

3. Abracadabra reacts quickly, with a strong new proposal, but lacks decentralization in governance.

4. Inverse currently, based on proposals from community members, it seems to have less intensity and has not been voted on.