With the fermentation of Curve's founder Michael Egorov's personal debt risk, there is also an increasing discussion about the interest rate issue surrounding Fraxlend.

The reason for this is that Fraxlend uses a relatively unique interest rate adjustment mechanism, resulting in the loan interest rate in the CRV/FRAX market of Fraxlend rapidly rising from yesterday to today, "forcing" Egorov to repay $7.13 million of debt on the platform this afternoon.

So, how is the interest rate of Fraxlend calculated? Why is this number rising so quickly? Combining the official documentation of Frax Finance and the tweet explanation from its developer Drake Evans, we have briefly summarized this algorithm.

Firstly, according to the documentation of Frax Finance, Fraxlend adopts three different interest rate adjustment algorithms for different markets:

Linear interest rate: Simply put, it is a basic algorithm where the interest rate grows linearly with the market utilization rate.

Time-weighted variable interest rate: An algorithm that determines interest rate increase or decrease based on market utilization rate and adjusts the interest rate at fixed time intervals.

Variable interest rate V2: A compound algorithm that combines the previous two, using a linear interest rate function to determine the current interest rate and adjusting the maximum interest rate using the formula of time-weighted variable interest rate.

Well, you might find this explanation even more confusing, but don't worry, let's continue.

According to Drake's explanation, the CRV/FRAX market in Fraxlend adopts the second algorithm (i.e., time-weighted variable interest rate). The operation mechanism of this algorithm is as follows:

Firstly, Fraxlend sets a target utilization rate range for a specific market, and when the market utilization rate is within this range, the interest rate does not need to change.

When the market utilization rate is below the target range, the interest rate will gradually decrease by a certain multiplier at regular intervals until reaching the minimum rate.

When the market utilization rate is above the target range, the interest rate will gradually increase by a certain multiplier at regular intervals until reaching the maximum rate.

This specific duration is called the "half-life" in Fraxlend's design, which refers to the time it takes for the interest rate to halve when the market utilization rate is 0, and also the time it takes for the interest rate to double when the market utilization rate is 0.

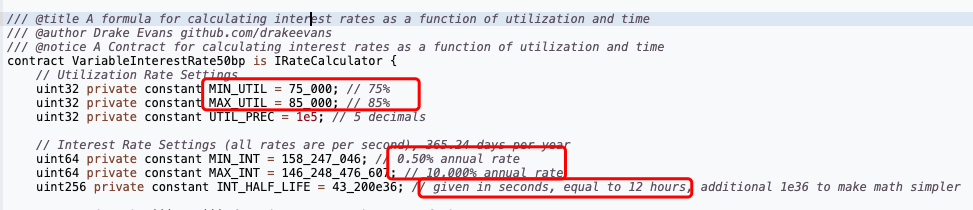

According to the CRV/FRAX market contract, the target utilization rate range is 75% - 85%, the minimum interest rate is 0.5%, the maximum interest rate is 10000%, and the half-life is 12 hours.

This means that for the CRV/FRAX market:

When the market utilization rate is within the range of 75% - 85%, the interest rate does not need to change.

When the market utilization rate is below 75%, the interest rate will gradually decrease by a certain "multiplier" every 12 hours until reaching 0.5%.

When the market utilization rate is above 85%, the interest rate will gradually increase by a certain "multiplier" every 12 hours until reaching 10000%.

Therefore, for a significant period from yesterday to today, due to the consistently high overall utilization rate of the CRV/FRAX market in Fraxlend, even close to 100%, the borrowing interest rate in that pool has been continuously rising.

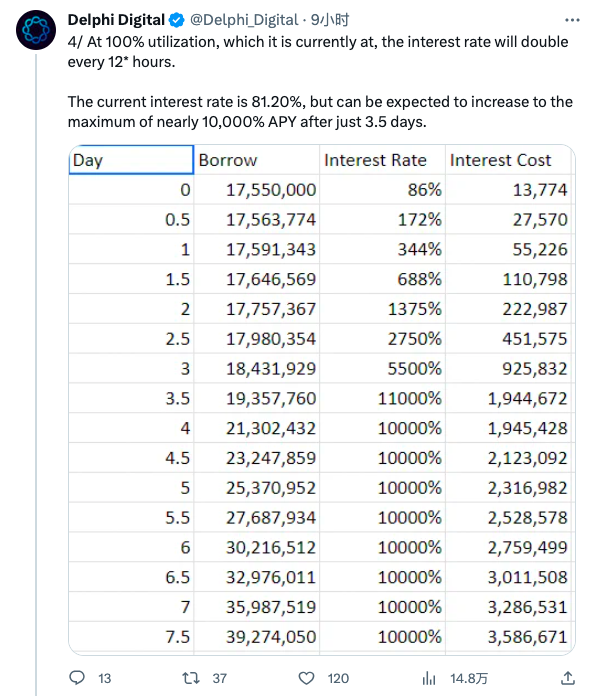

However, this does not necessarily mean that the interest rate in that market will double every 12 hours, or soar to 10000% in three and a half days, as some rumors suggest (this claim originated from Delphi Digital, but Delphi Digital only listed the case of 100% utilization rate, without stating it as a common situation after surpassing 85%). In reality, the utilization rate of that market has not continuously remained at 100% (which is also impossible), so the mentioned "multiplier" is not always doubling.

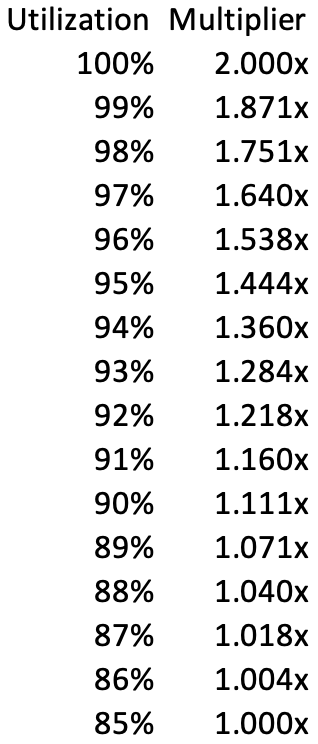

According to Drake's supplement, when the utilization rate of the CRV/FRAX market exceeds 85%, the multiplier for interest rate growth varies for different levels of utilization rate.

As shown in the above figure, when the market utilization rate is 85%, the "multiplier" is 1, which means that the interest rate will remain unchanged; but as the utilization rate increases, the "multiplier" will gradually increase; until the utilization rate reaches 100%, the "multiplier" will become 2, which means the start of the so-called exponential growth as mentioned by Delphi Digital.

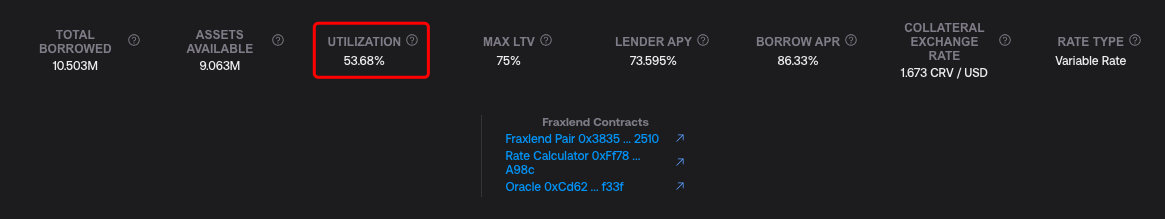

Currently, with Egorov's repayment, the utilization rate of the CRV/FRAX market has dropped to 53.68%, which means that if this situation is maintained, the interest rate will further decrease after 12 hours. As a result, Egorov's pressure will be greatly reduced.

So it's not difficult to understand why Egorov needs to repay part of the debt from Fraxlend in advance. At least, the utilization rate needs to be suppressed first, otherwise it would be really unbearable with the interest rate continuously increasing.