Original author: Yilan, LD Capital

The recently launched UniswapX is currently in the opt-in beta version. It is expected that Uniswap X will play a full-chain routing function, which will have a structural impact on existing aggregators and cross-chain bridge tracks. Currently, the market believes that the most direct impact is from the aggregator market (such as 1 inch, Cowswap, etc.) in terms of trading volume, and 1 inch has experienced a significant price adjustment after the launch of UniswapX.

UniswapX is essentially a non-custodial trading protocol based on Dutch auction. The protocol allows third-party Fillers to execute transactions (as takers), and Fillers can be liquidity providers on-chain and off-chain, such as market makers, MEV searchers, DEX, etc. The competition between Fillers is achieved through Dutch auctions, which is a way to parameterize the starting price of a Dutch order. The starting price of the Dutch auction is determined by RFQ, an off-chain inquiry system, which allows some Fillers to vote (incentivizing market makers to use private transaction relays in order to route orders to on-chain liquidity pools). At the same time, in order to incentivize the Filler network to offer the most favorable prices, UniswapX allows orders to specify a Filler, giving them exclusive rights to fill the order for a short period of time, after which the Dutch auction begins and any Filler can execute the order. The RFQ+Dutch auction model used by Cowswap for Coincident of Wants has been implemented for a long time, and 1 inch Fusion also implemented the integration of professional market makers for off-chain order matching last year. By choosing to integrate professional market makers and combining with later V4 composability, UniswapX offers more diversified choices in the market.

Optimization and problem-solving for UniswapX

(1) MEV revenue internalization, a portion subsidizes swapper (in the form of lower transaction price), a portion goes to Filler, returning profits to users;

(2) Off-chain transaction signing, user-friendly for retail traders. Filler calculates a combination of optimizing gas fees and optimizing actual exchanges to generate the best results. For trading across multiple pools, fewer gas fees are required, and trading can be done without native gas tokens; no gas is needed for failed transactions;

(3) Meeting the needs of cross-chain transactions.

Some criticisms:

(1) Some single-path tokens may already have the optimal price in normal mode, using UniswapX may be subject to repeated charges and does not necessarily save money;

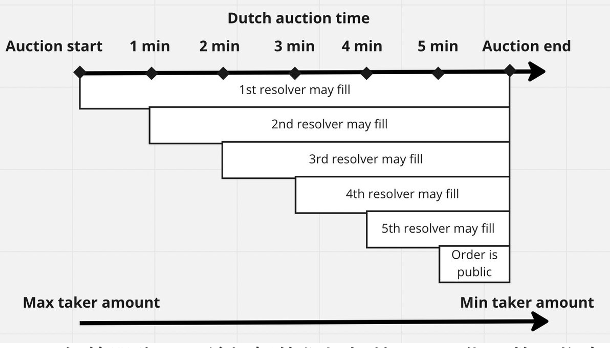

( 2) The Dutch auction has a certain delay in internal trading speed (see the figure below), which can lead to losses caused by market price fluctuations, or Filler waits for the price to drop before conducting transactions (UniswapX adopts a reputation system to solve this problem);

( 3) The RFQ mode of Filler is relatively less decentralized.

Dutch Auction Flowchart

1. How to help users save gas and get better prices

UniswapX and 1 inch Fusion have the same principles in optimizing user transaction costs, but UniswapX is more permissionless and does not have the whitelist system of 1 inch.

For users, the 1 inch Fusion mode looks like a normal swap exchange, but technically, Fusion is actually implemented through the mode of limit order, which is reflected in the price exchange rate being filled by a third party called "Solver" (similar to "Filler" in UniswapX). The exchange rate of the order will gradually decrease from the initial exchange rate to a smaller amount (Dutch auction method) until the Solver is profitable enough to fill the order. Multiple Solvers compete for the order to ensure it is filled before the exchange rate reaches the minimum return amount. Here are some opportunities for Solver to make profit:

Dutch auction continuously reduces the order exchange rate;

Save gas fees when filling matching orders;

Save gas fees due to batch filling.

UniswapX's Filler also profits from the above methods. In addition, Filler not only competes with Uniswap v 1, v 2, v 3, and v 4 after launch, but the competition between Fillers can provide users with better prices.

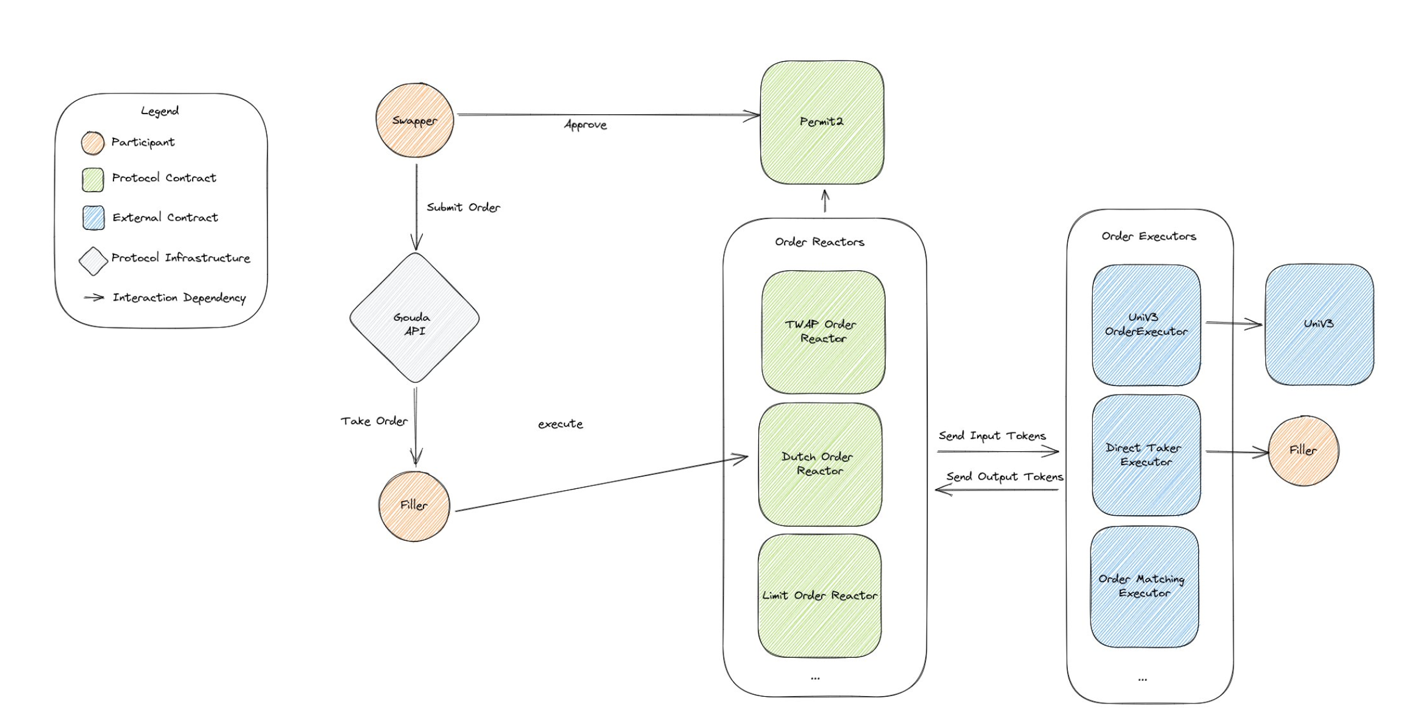

UniswapX Trading Process Diagram

In this process, the transaction is submitted to the Reactor Contract with the gas paid by Filler. If the transaction fails, gas loss will be borne by Filler. Although gas will eventually be reflected in the user's transaction price, users no longer need a large amount of gas token, only a small amount of gas is required to complete the initial authorization. Price competition, reducing MEV loss, reducing gas, all of these will ultimately result in users having better prices when trading.

II. How to implement MEV protection

Introduce the unpermissioned Filler network, where Filler selects various Reactors for settlement and completes transactions through auctioning a batch. Through methods such as mempool confidentiality, it achieves MEV protection to a certain extent and users become sharers of MEV profits.

First, a brief introduction to how MEV occurs. MEV (Maximal Extractable Value) refers to the value that can be extracted by miners orOther traders extract the maximum extractable value by prioritizing transactions, reordering transaction sequences, or selectively including or excluding transactions. MEV is a phenomenon caused by the transaction sequence nature and consensus mechanism of the blockchain. Take CoW Swap as an example. CoWSwap uses several protocols to match orders and avoid sandwich attacks. Here are some MEV protection data for CoW Swap in 2022: In 2022, there were approximately 1.9K sandwich attacks targeting CoW Swap transactions. Compared to 239K transactions, sandwich attacks only account for about 0.8% of the total transaction volume on CoWSwap. Sandwich attacks extracted approximately $1.3 million from CoW Swap solvers. Compared to the total fee revenue of $8.55 million on CoW Swap, sandwich attacks only account for about 1.5%. The percentage of attacked transactions through CoWSwap is an order of magnitude lower than that in Uniswap or Curve. Additionally, compared to other decentralized exchanges, the batch value of attacked transactions on CoW Swap only accounts for 0.7% of the total transaction volume, which is also lower by an order of magnitude. Currently, the most severely attacked contracts are Uniswap V3 and Uniswap V2. UniswapX is a protocol used to address this issue. If there are better pricing methods and resources, people will certainly prefer to choose them, and over time, more trading volume will shift from the original versions of Uniswap to UniswapX.In UniswapX, traders first sign an authorization to Permits to provide the right to transfer tokens. This process requires paying a certain amount of gas tokens. Next, traders need to sign specific transaction parameters, including the input and output token types and quantities, and authorize the Reactor Contract (the relevant contract for settlement) to spend tokens. Fillers compete with each other for transaction orders, and the winning Filler submits the batch transaction to the Reactor Contract. The Reactor Contract calls the Executor Contract to execute the transaction. The Executor Contract receives the output tokens from the Filler and sends them to the trader. The Reactor Contract checks if the execution result of the transaction matches the submitted transaction parameters and settles the transaction. In this process, traders directly interact with Fillers, leaving attackers with no opportunity for MEV arbitrage. Even in case of an MEV attack (where Filler may also be an MEV searcher), the profits are shared to some extent with the traders. In the scenario of UniswapX, through auctions, the price decays over time. As long as someone finds the transaction profitable, they will submit it for auction, and the order is already profitable before the tolerance threshold is reached. This prevents arbitrageurs from front-running trades as they used to. This system ensures that someone completes the order when the first profitable opportunity arises, which itself is an MEV protection mechanism. For example, if there are multiple transactions off-chain simultaneously, a submitter can discover them at the same time and...

Some trades, and complete all trades at the same time - this means that they will submit orders early in the cycle. In a price auction, the earlier you auction, the higher the price, and the less value leakage.

III. How to support cross-chain transactions

The UniswapX protocol can extend support for cross-chain transactions, where traders can trade their assets held on the source chain to obtain the desired assets on the target chain. Off-chain signed orders not only solve the complexity problem of the pool, but also solve the complexity problem of bridging. The complexity is solved by the same service provider and the same submitter.

UniswapX achieves the following functions for cross-chain:

(1) Fast exchange - as long as there is a message passing bridge between two blockchains, UniswapX can provide fast asset exchanges between any two chains;

(2) Simplified operation - exchange and bridging are merged into a single operation, eliminating the need for users to interact directly with the bridge, maintain gas tokens on various chains, or wait for settlement delays;

(3) Quick Exit-UniswapX can achieve almost instant exit from Layer 2 to its parent chain;

Optimistic cross-chain protocol can solve the problem of slow or expensive settlement oracles. In the Optimistic cross-chain protocol, Filler completes orders on the target chain, and if no one challenges the filling of the order within the challenge deadline, Filler receives the funds of the trader and Filler's collateral on the source chain. Anyone can challenge the filling using the reactor contract on the source chain before the challenge deadline expires. If Filler can provide valid filling proof before the proving deadline, they will receive the challenger's collateral. If Filler fails to provide valid evidence, Filler's collateral will be distributed to the challenger and the trader, and the trader's funds will be refunded to them on the source chain.

Hayden Adams believes that in the future, most assets will exist on their native chain, or on the most secure chain, or on the most typical asset chain, rather than bridging. That is, if a submitter conducts a cross-chain swap, they will receive the tokens on the native chain of the tokens. In this way, the use of bridging seems to be reduced to a minimum, and rather than saying that a cross-chain bridge is a bridge for assets, it is more accurate to say that in this model, the cross-chain bridge is only used to transmit the final information. Even that packet is not needed unless the submitter is lying. This can be called minimal viable bridging, where users only bear bridging risk when trading across bridges. Once the swapper gets the output tokens and the submitter gets the input tokens, neither party will have bridging risk anymore.

Therefore, UniswapX minimizes the degree to which people need to bridge while also abstracting it, for example, this system can support any possible bridging. It can be imagined as a bridge aggregator, where a submitter can use any bridge, but each transaction has a specific cross-chain bridge, which is the "settlement oracle". It can be any bridging mechanism or any other system, and can also use multi-signature systems, governance systems, or unilateral systems, or trust the submitter.

Four. The difference between UniswapX and 1inch Fusion

UniswapX's trading orders allow Fillers to accept and submit without permission, which is more open compared to 1inch's whitelist system.

1inch Fusion's Solver receives order flow based on the amount of 1inch tokens they have staked. This means that in the first minute of the order, only one Solver can match the trade. Even after that, the competition is very limited. In other words, to fill an order, the Solver must be whitelisted and have enough balance to pay for the order fee. The process of being whitelisted is as follows:

(1) Obtain enough Unicorn Power to be listed in the top ten registered Solvers. There are two ways to increase Solver's Unicorn Power:

· Mortgage more 1inch tokens or extend the mortgage period.

Lock for 1.5 years, each locked 1 inch token will give the staker 0.47 "Unicorn Energy".

Lock for 1 year, each locked 1 inch token will give the staker 0.22 "Unicorn Energy".

Lock for 0.5 year, each locked 1 inch token will give the staker 0.1 "Unicorn Energy".

Expired lock, each locked 1 inch token will only give the staker 0.05 "Unicorn Energy".

UniswapX adopts permissionless

The admission system uses the reputation system to reduce the possibility of wrongdoing by Fillers and gives priority to the best bidders and the reputation system (to prevent Fillers from waiting for prices to drop before executing the transaction). The inquiry system may benefit from the use of accompanying reputation or penalty systems to restrict Fillers from abusing the monopoly power provided by the choice and ensure that the user experience of traders is not affected. Other aspects are similar. Chapter 5: Income Growth Forecast. UniswapX charges a transaction fee of 0.05%. Based on the current data of 1 inch (35 million) and CoWSwap (22 million) per day, even if Uniswap gains half of the trading volume of these two platforms, the increase in income per day is calculated using the current market share: 25 million * 0.05% ($12.5k). This is equivalent to a 1.25% growth compared to Uniswap's current income of nearly 1 million per day, which is not significant. Conclusion: In terms of marginal changes in income growth, UniswapX's impact on Uniswap's income in the short term will not be significant.Rooting is not a fundamental change, but rather has a greater impact on other protocols in this track. The development of Uniswap's layout in wallets, NFT markets, aggregator markets, etc., which have been squeezed by other protocols in the stock market, has not been widely accepted by the market. UniswapX is just one of the protocols that we can see the potential empowerment of V4. With the emergence of Uniswap V4, by embracing its core mission of building a better ecosystem, Uniswap is expected to overcome the criticism of not focusing on its core business and become an important infrastructure that supports various applications. Its diversified layout in different fields will gradually develop into a market with a huge experimental base that cannot be ignored.