1. Overall Overview

The Polygon team has announced plans to create a new governance framework aimed at further decentralizing the ecosystem. The team states that Polygon's new governance model will form "three pillars of governance," focusing on governance of its core protocol, smart contracts, and community treasury management. Other key features include the expansion of the Polygon Improvement Proposal (PIP) framework, the introduction of an "ecosystem council" for governance of system smart contract upgrades, and a two-phase community treasury governance to provide funding for promising ecosystem projects.

The Manta Network development team, p0x labs, has completed a Series A financing with a valuation of $500 million and $25 million raised, led by Polychain Capital and Sequoia Capital China. The team states that this funding will be used to expand Manta Pacific and Manta Atlantic. Manta Network founder Victor Ji unveiled a new vision earlier this month. In the roadmap, Manta joins the OpStack and Celestia ecosystems as the first Ethereum L2 platform to integrate with OpStack and Celestia DA.

In terms of the secondary market, the price of ETH may continue to consolidate in the short term, with support at $1850 and resistance at $1900.

2. Secondary Market

1. Spot Market

According to data from OKX, ETH fell to $1846 at one point last week and closed the week at $1873, a decrease of 3.3% compared to the previous week.

ETH daily chart, from OKX

On the daily chart, the price is currently consolidating below $1900, with support at $1850. If it breaks below, it may further drop to $1800. The resistance above is at $1900.

2. Network Status

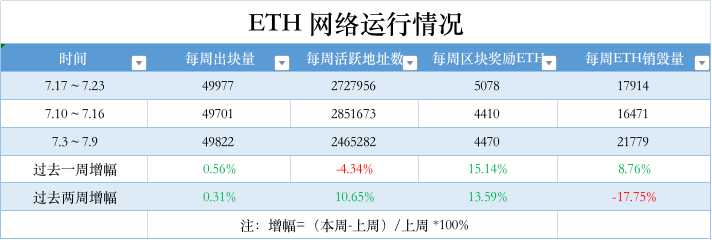

Etherscan data shows that in the past week, Ethereum network had 49,977 blocks, a 0.56% increase compared to the previous period. The number of weekly active addresses was 2,727,956, a 4.3% decrease. Block reward income was 5,078 ETH, a 15.1% increase. The weekly ETH burn reached 17,914, an 8.7% increase.

3. Significant Changes

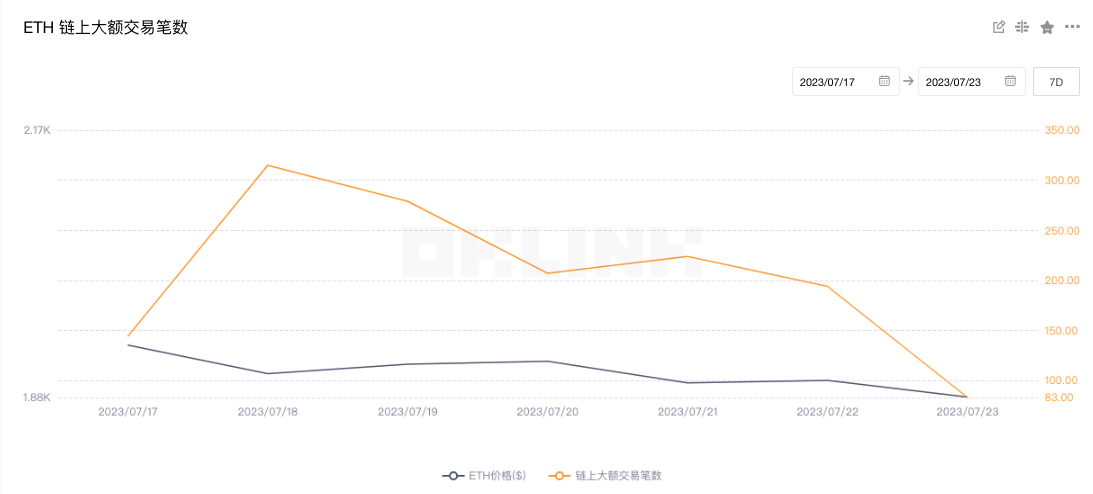

OKLink data shows that the number of on-chain large transactions reached 1,446 last week, a 6% decrease compared to the previous week (1,540), indicating a slight decrease in whale trading activity.

4. Rich List Addresses

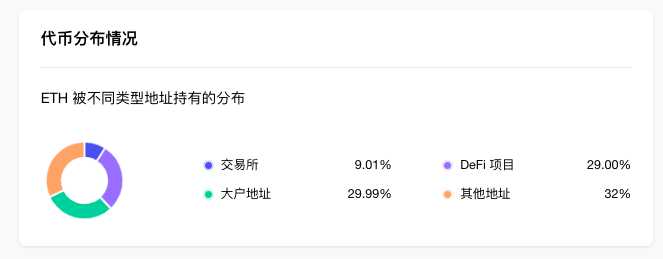

OKLink data shows that the proportion of exchange addresses in ETH holdings is 9.01%, a decrease of 0.15% compared to the previous period; the proportion of DeFi projects is 29%, an increase of 0.91% compared to the previous period; the proportion of large addresses (top 1000 addresses excluding exchanges and DeFi projects) is 29.991%, a decrease of 0.52% compared to the previous period; the proportion of other addresses is 32%, a decrease of 0.24% compared to the previous period.

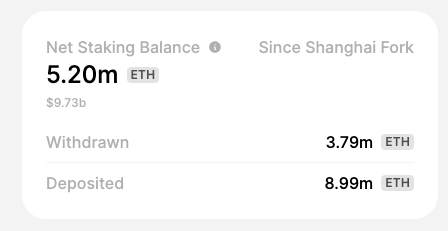

token.unlocks shows that the total amount of ETH staked in the whole network is 21.92 million ETH, with a stake ratio of 17.99%; since the upgrade in Shanghai, the cumulative deposit amount is 8.99 million ETH, and the data for last week is 8.52 million, with an increase of 470,000 in the past week; the cumulative withdrawal amount is 3.79 million, and the data for last week is 3.73 million; the total net staking amount has increased by 520,000, with the data for the previous week being 480,000, an increase of 400,000 in the past week.

5. Lock-up Data

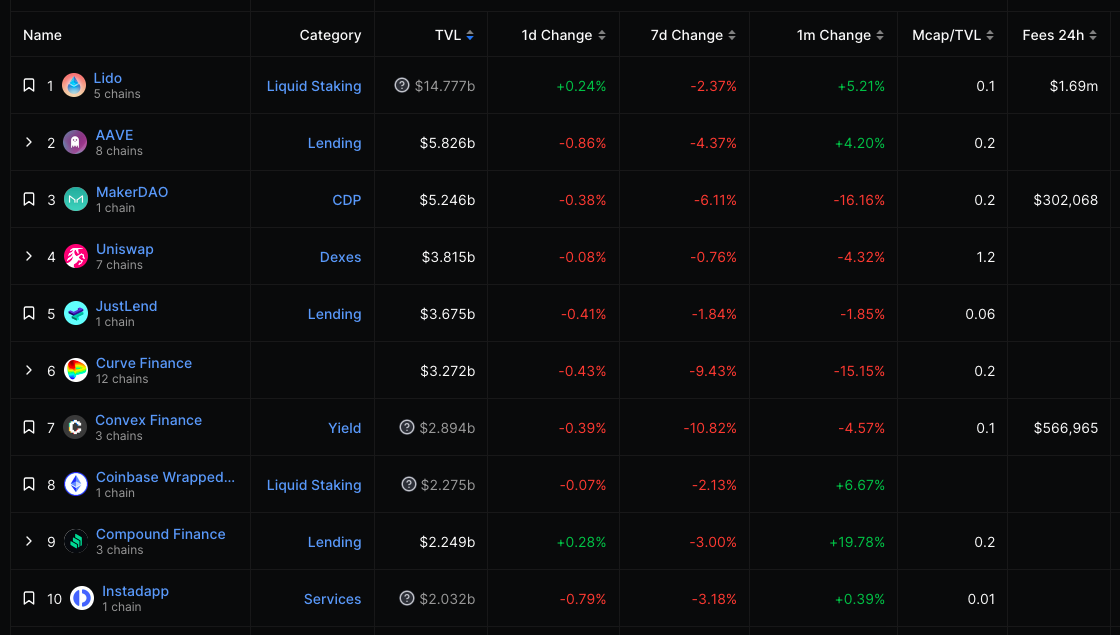

DeFiLlama data shows that the value of on-chain locked collateral decreased from 26.47 billion US dollars to 25.35 billion US dollars last week, a decrease of 4% compared to the previous period. Looking at individual projects, the top three in terms of locked collateral value are: Lido, 14.77 billion US dollars; Aave, 5.82 billion US dollars; MakerDAO, 5.24 billion US dollars.

III. Ecology and Technology

1. Technological Progress

Ethereum developer Tim Beiko tweeted a summary of the highlights of the 166th Ethereum ACDE meeting. This includes the status of Dencun devnets: devnet-7 is still running, work is being done on tooling support, particularly including a blob browser that contains all blobs since genesis. It is now transitioning to devnet-8, which will include some non-4844 features. Some EIPs are under review, while 4844, 1153, 5656, and 4788 are currently being implemented. Additionally, Tim provided a detailed explanation of the self-destruct removal proposal 6780.

Developers also discussed API interface changes, EL and CL clients, among other issues. They proposed the names for the next Ethereum upgrades, with EL using Prague and CL using Electra.

2. Community Voice

(1) Vitalik Buterin: Account Abstraction Upgrade can attract billions of people to use Ethereum

Ethereum co-founder Vitalik Buterin recently detailed how the account abstraction upgrade "paymasters" can allow users to pay gas fees with tokens for transactions, thus attracting billions of people to use Ethereum, in a speech at the Ethereum Community Conference (EthCC).

Account abstraction allows users to switch from externally owned wallets (EOA) to contract-based wallets. If this upgrade is successful, wallet management will be more efficient and seamless than now. Vitalik Buterin and the community believe that this can lead to widespread adoption of cryptocurrencies.

Moreover, the cryptocurrency field is filled with users who have lost their mnemonic words or had their mnemonic words stolen. Through account abstraction, users can create non-custodial wallets that act as programmable smart contracts. Wallet recovery is just one of the many features brought about by this recent upgrade. (Coinedition)

(2) A photograph of Vitalik Buterin taken in 2014 is being minted as an NFT and auctioned

Canadian photographer Andrew Miller announced the exclusive auction of the first professional and never-before-sold portrait of Ethereum founder Vitalik Buterin. The portrait, taken in 2014, has been minted as an NFT titled "ETHEREUM GENESIS - VITALIK BUTERIN". The auction coincides with the 10th anniversary of the Ethereum concept. The auction will take place on Manifold.xyz from July 1st to July 30th, with a starting price of 333 ETH. (Cryptoslate)

3. Project Trends

(1) Mantle Network launches its mainnet alpha version

Ethereum Layer 2 solution Mantle Network officially launched its mainnet alpha version at the Ethereum Community Conference (EthCC) in Paris. According to a statement, the network has undergone six months of development and testing, during which it processed over 14 million on-chain transactions. Mantle stated, "The testnet phase has concluded after multiple security audits, which helped eliminate potential risks and vulnerabilities." (The Block)

Furthermore, the Manta Network development team, p0x labs, raised $25 million in Series A funding at a valuation of $500 million, with Polychain Capital and Qiming Venture Partners as joint lead investors. The team stated that this funding will be used to expand Manta Pacific and Manta Atlantic. Manta Network founder, Victor Ji, released a new vision this month. In the roadmap, Manta will join the OpStack and Celestia ecosystems, becoming the first Ethereum L2 to integrate with OpStack and Celestia DA.

Tally page shows that the AIP-2 proposal for "Activation of Account Abstraction Endpoints on Arbitrum One and Nova" has been approved by the community through voting, with a support rate of 99.95%, and is currently awaiting execution. The proposal suggests the introduction of a new RPC endpoint, eth_sendRawTransactionConditional, as part of the development of a broader account abstraction standard and tooling, to accommodate the specific needs of the ERC-4337 bundlers in the L2 sequencer. Offchain Labs has supported the Arbitrum sequencer endpoint in Nitro v.2.0.14 through development, testing, and integration, and this version is now live on the Arbitrum testnet. This AIP proposes the activation of support for this endpoint on the Arbitrum One and Nova mainnets by the Arbitrum DAO.

(3) Compound's outstanding debt on Ethereum exceeds $1 billion, reaching a one-year high

The Block data shows that Compound's total outstanding debt on Ethereum exceeds $1 billion, reaching the highest level in a year. Among them, USDC ranks first with over $630 million.

Gnosis Chain launched the decentralized payment network Gnosis Pay and self-custodial debit card Gnosis Card during the EthCC conference in Paris. Gnosis Pay, based on Gnosis Chain, allows Web 3 developers to integrate various traditional payment methods, including Visa. Users can use encrypted assets directly from their wallet to make purchases anywhere that accepts Visa. Gnosis Card is a self-custodial consumer debit card certified by Visa, requiring KYC authentication. It is built on the Gnosis Pay decentralized payment network and directly linked to on-chain wallets, supporting various offline and online card payments, with each transaction processed through smart contracts. In addition, Gnosis Pay supports users to bind ENS to the card, allowing it to be used with any wallet. Each community or wallet can issue its own branded Visa card.

Web 3 Social Protocol, Lens Protocol, was officially released during the EthCC conference in Paris on Ethereum. Version V 2 is open, composable, and focused on sharing interests, trust, and security. Users can now directly execute external smart contract operations in Lens publications and interact with smart contracts on social media within Lens V 2.

Newly added third-party contract operation permissions include whitelist functionality, minting NFTs on Sound.xyz (Ethereum mainnet), and minting NFTs on Opensea (Polygon).

Added asset management functionality includes delegating operations to any wallet, allowing users to use multiple wallets instead of just a single one. Personal profiles can be stored directly on hardware wallets and can be used on another wallet. The new version also supports storing DAOs or community profiles on multi-signature wallets and allows them to be used from one or multiple addresses. This ensures the security and access control of personal profiles and allows for association with multiple addresses.

Additionally, V 2 provides support between configuration files and ERC-6551. LIP-4 introduces a Profile Guardian to enhance the security of personal profiles.

The Polygon team has announced plans to create a new governance framework to further decentralize the ecosystem. This development is in response to Polygon 2.0's new roadmap. The team states that Polygon's new governance model will consist of three pillars of governance, focusing on the governance of core protocols, smart contracts, and community treasuries. Polygon points out in a blog post that they drew inspiration from Ethereum's governance model and intend to absorb Ethereum's spirit and community-building technology.

Other key features include the expansion of the Polygon Improvement Proposals (PIP) framework, the introduction of an "ecosystem council" for system smart contract upgrades, and a two-stage community treasury governance to provide funding for promising ecosystem projects.

Polygon team said it is inviting stakeholders including validators, dApp developers, and users to participate in its governance. The team stated, "To achieve this goal, we propose a forward-looking framework for decentralized ownership and decision-making for all Polygon protocols and ecosystems." (The Block)

Previously, on June 13th, Polygon announced the launch of Polygon 2.0 as a set of upgrade solutions aiming to become a unified network of L2 chains supported by ZK technology, establishing the "value layer" of the internet that allows users to "create, exchange, and program value." The upgrades involve protocol architecture, token economics, and governance to provide scalability and unified liquidity through ZK technology.

(7) Cymbal launches "human-readable" Ethereum blockchain explorer Beta version

Cymbal announced the launch of the "human-readable" Ethereum blockchain explorer Beta version. Cymbal's Ethereum block explorer uses public chain data of the same type as standard explorers and transforms it into a data source that is not only visual, clear, and easy to understand, but also social. Cymbal runs this data through AI tools to generate conversation summaries of transactions and trends, making it easier for ordinary users to understand. Eric Feng, CEO and co-founder of Cymbal, stated that Cymbal is running this tool using OpenAI's GPT language model. (Decrypt)

Radiant Capital, a cross-chain DeFi lending protocol, has secured a $10 million investment from Binance Labs. This funding round will support further product development, including expanding oracle support, increasing collateral options, and deploying on the Ethereum mainnet.

Previously, Radiant Capital released DEV UPDATES #001, which includes a series of completed milestones, current major tasks, and future plans. On the backend, the audit-related updates from Open Zeppelin have been completed, with rigorous testing and merging finished (awaiting deployment). Current major tasks include UI/UX enhancements by the FE team to strengthen the game and research on application performance. Additionally, Radiant Capital is preparing for a smooth transition as they are about to launch on the Ethereum mainnet, with the development team reviewing the Radiant code repository and UI/UX for Ethereum integration. (The Block)

Mina development team, O(1) Labs, tweeted that their RFP (Foundation Task) about implementing zero-knowledge proofs (ZKP) for OP-series blockchains has been accepted by the Optimism Foundation. In the future, O(1) Labs will introduce the proof system Kimichi, currently used in Mina, into the Optimism ecosystem to safeguard OP Mainnet and the transaction security of other blockchains built on the OP-stack, possibly opening the door for interoperability between Ethereum and Mina.

(10) Report: Ethereum network revenue down 33.3% in Q2

Bankless' Ethereum Q2 2023 report shows that as of June 30th, Ethereum network revenue decreased by 33.3%, from $1.027 billion to $847 million; the USD value of ETH destroyed decreased by 35% from $1.009 billion to $713 million; the average ETH inflation rate decreased by 213%, from 0.71% to -0.8%; and the average daily active addresses decreased by 6%, from 471,447 to 444,419. Note: Network revenue measures the total value of transaction fees paid by users to Ethereum validators, as well as the portion of fees that are destroyed (i.e., removed from the circulating supply of ETH through EIP-1559).