Original author: Yuuki, LD Capital

The current staking rate of ETH has exceeded 20%, while still maintaining good growth. We have detailed the fundamentals of the LSD track and different targets in previous reports. This article aims to analyze the token selling pressure and demand brought by the non-secondary market trading of the top two LSD targets, Lido and RocketPool, from a capital perspective, and provide references for selecting targets for different investment horizons. (FXS, due to its diversified positioning, cannot be simply categorized as an LSD track. It has deviations from the fundamentals of LDO and RPL, so it is temporarily not included in the discussion scope)

1. LDO Token Distribution and Selling Pressure Sources

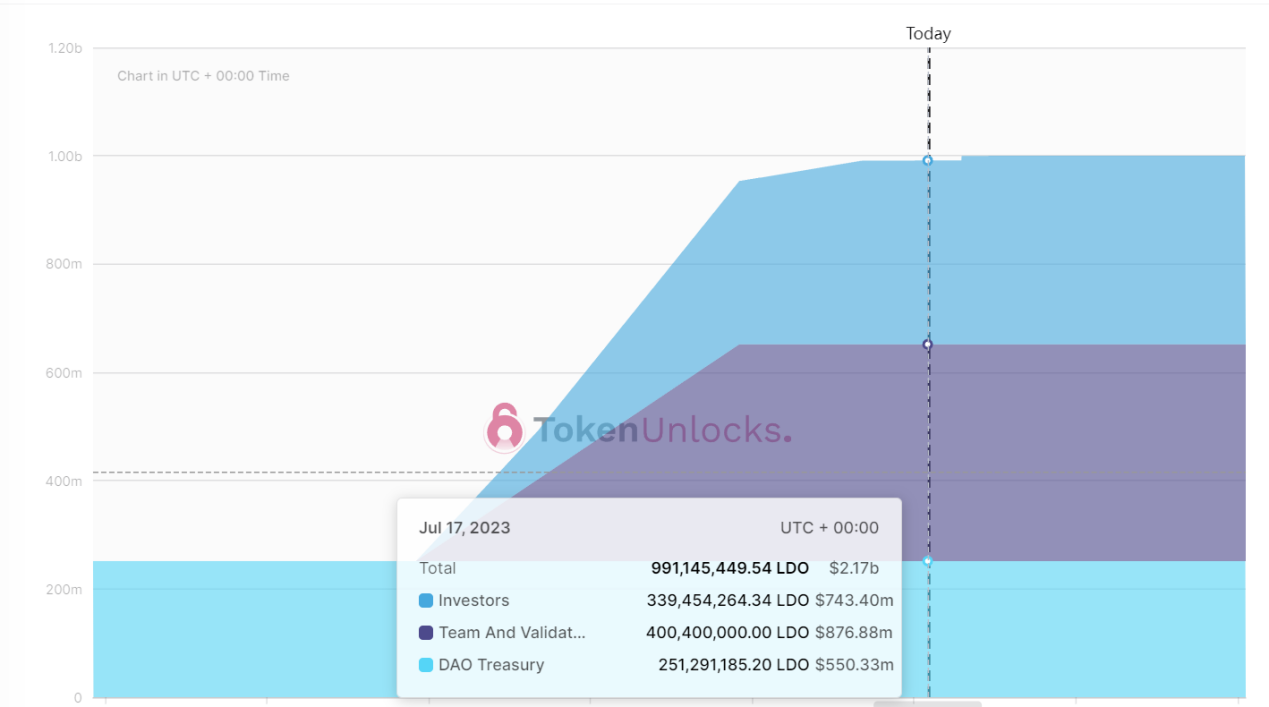

LDO has a total issuance of 1 billion, with a current circulation of 879 million. In terms of token distribution, 40.2% is owned by the team and validators, 34.6% is owned by investors, and 25.2% is owned by the treasury (current data statistics from Tokenunlocks, not initial token distribution). The next significant token unlock of LDO will occur on August 26, 2023, with an unlock amount of 8.5 million LDO, owned by Dragonfly, and a token cost of $2.43.

The following is the distribution and unlocking situation of LDO:

Source: Token Unlocks, LD Capital

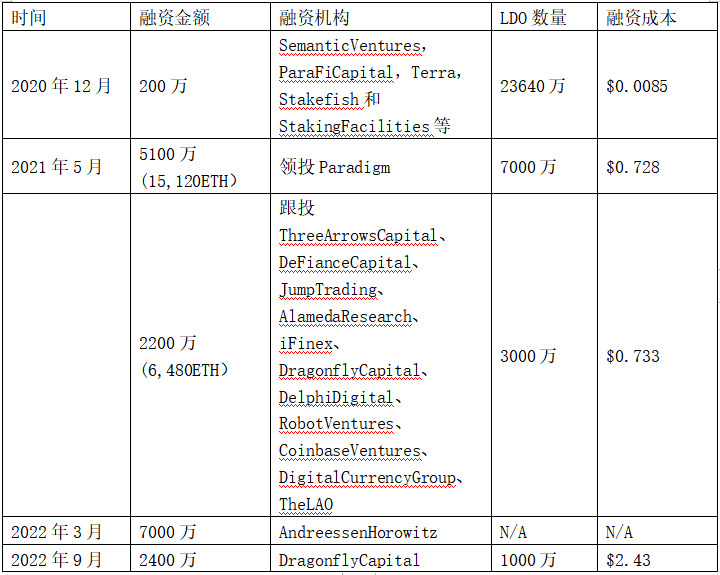

Lido has had a total of 5 rounds of financing, with the first round of financing taking place before the issuance of tokens at a very low cost (0.0085 USD/LDO). Here are the specific details:

Source: LD Capital

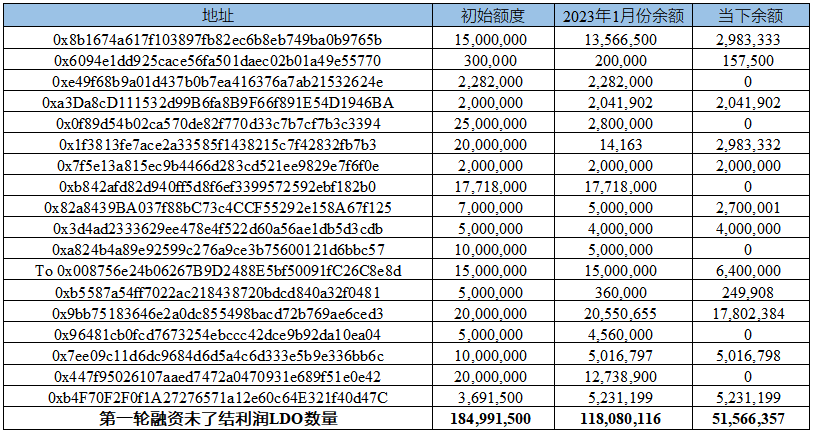

Currently, the main issue affecting the secondary market price of LDO is that the majority of primary market investors' shares have been unlocked, leading to continuous profit selling pressure in the secondary market. Due to the very low cost of the first round of financing, with an average cost of about 0.0085 USD, there has been over 200 times increase in price, which needs to be closely monitored. The table below shows the addresses of first round investors and their current token balances:

Source: LD Capital

The above table shows the addresses of over 90% of the first round investors, and from the aggregated data, it can be seen that these low-cost investors are continuously selling tokens. The tokens held by the first round investors began linear unlocking in December 2021 and will be fully unlocked by December 2022. Due to their very low cost, they are relatively insensitive to the current secondary market prices. Based on the initial amount, the balance in January 2023, and the current balance statistics, it can be seen that the first round investors are selling approximately 7.41 million LDO tokens linearly each month. Currently, the total unsold tokens from the first round of financing are 51.57 million. According to the aforementioned selling pace, the selling will continue for another 7 months.

From this perspective, under the condition that there are no major changes in Lido's fundamentals and the market lacks incremental funds, the secondary price of LDO will continue to be suppressed until the first round of investor shares are cleared. (Recently, due to the favorable outcome of the XRP vs SEC lawsuit, the market has lowered its expectation regarding SEC regulation on Ethereum staking. The price of LDO has risen significantly along with "securities concept" tokens such as XRP, SOL, ADA. The primary market investor Certus One sold 4 million LDO at a high price, and currently the LDO price has dropped by 16.3% compared to the previous high point.)

2. Distribution and Supply-Demand Relationship of RPL Tokens

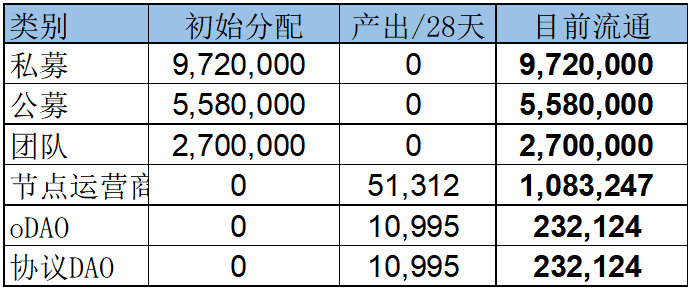

Currently, RPL tokens are fully circulated with a total supply of 19.55 million. The initial supply of RPL was 18 million, with 9.72 million raised through private placement, accounting for 54% of the total, at a price of $0.21 per token. There were 5.58 million tokens sold publicly, accounting for 31% of the total, at a price of $0.98 per token. The team holds 2.7 million tokens, accounting for 15% of the total. The public sale of RPL tokens was completed in January 2018. Due to the long period of time and market fluctuations, the primary market shares have been fully traded. From the on-chain holder addresses, there is currently no selling pressure from primary market investors for RPL tokens. The focus should be on the inflation brought by additional issuance.

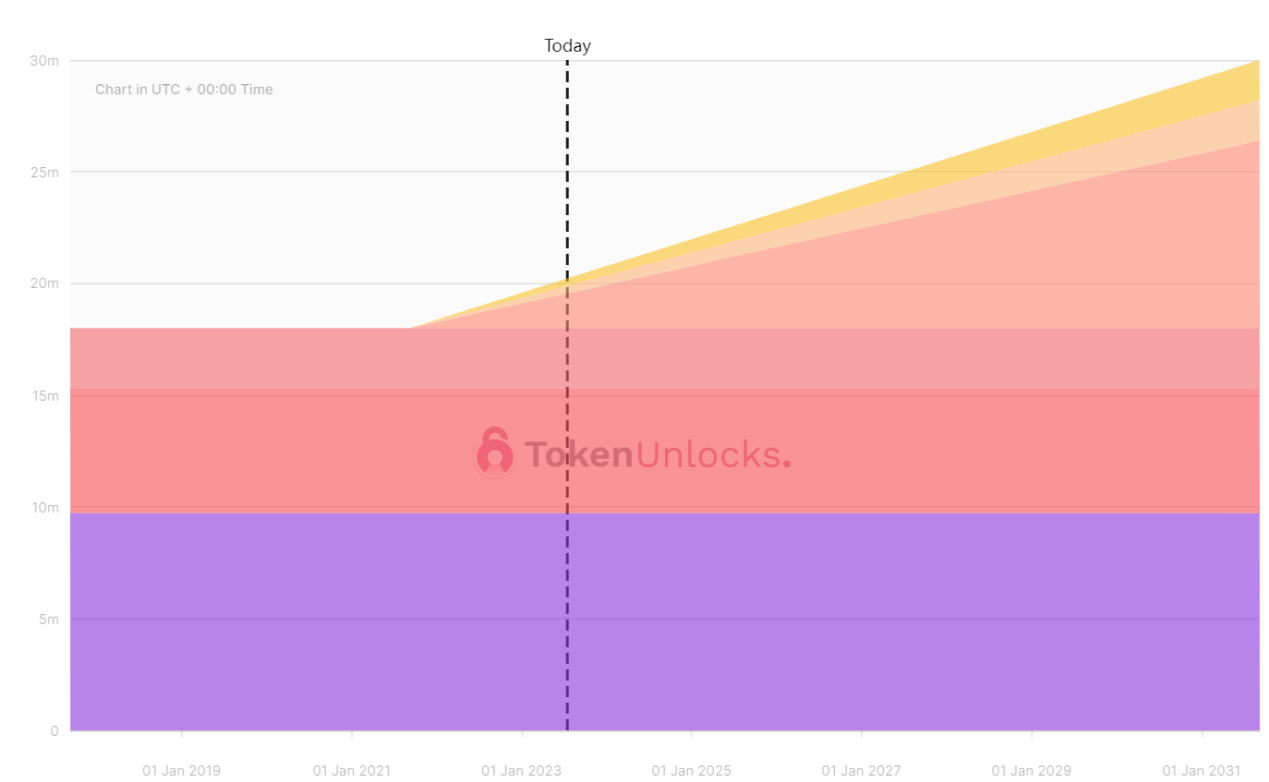

The following diagram shows the distribution and inflation of RPL tokens:

Source: Token Unlocks, LD Capital

In October 2021, RPL started linear inflation at a rate of 73302 tokens every 28 days, lasting for 10 years, with an annual inflation rate of 5%. The total supply of RPL will eventually reach 30 million tokens. 15% of the inflationary rewards will be distributed to oDAO (Oracle node DAO), 15% will be allocated to the protocol DAO, and the remaining 70% will be distributed to node operators, as follows:

Source: LD Capital, Rocket Pool

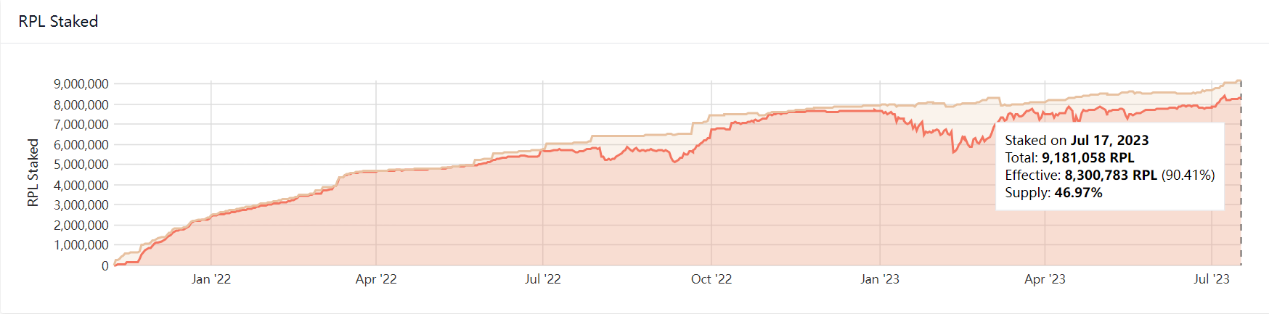

In the emission of RPL, node operators account for 70% of the RPL token inflation ratio. To obtain RPL emissions, operators need to stake RPL, with a stake ratio ranging from 10% to 150% of the value of the user-called ETH. The more RPL staked, the more RPL emissions obtained. Most large node operators stake at full capacity. Currently, the staking rate of RPL is 46.97% and continues to rise. From this perspective, staking RPL is somewhat similar to leveraging the value of ETH staked on a platform. With the increase in platform ETH staking or the rise in ETH price, the price of RPL will be strongly supported by the platform's staking mechanism. The following chart shows the increase in RPL staking rate:

Source: Rocket Pool, LD Capital

From a data perspective, there is no selling pressure from primary market investors for RPL. Since October 2021, RPL has inflated by 1.55 million tokens, but it has generated 9.18 million tokens staked, resulting in a decrease of 7.63 million tokens in circulation. It is predicted that, without observing a decline in RPL business, buying driven by the protocol will continue to exceed token inflation. (For updates on the growth of the Rocket Pool protocol, please refer to the LD Track Weekly Report)