Original Author: Jiang Haibo, PANews

Synthetix founder Kain Warwick recently mentioned in an interview at Ethcc that they plan to launch Perps V3 and a new trading front-end called Infinex in the fourth quarter of this year. Last Friday, Synthetix publicly announced their plan to create a new trading front-end called Infinex to compete with centralized exchanges. Founder Kain published an article on Mirror titled "Synthetix, what comes next, part four", as a continuation of the series of articles on Synthetix's future plans. PANews has also translated the first article "part zero" of this series.

According to Kain, when naming the first front-end for Synthetix, he initially chose the word "Infinex", but it was met with opposition from others, so in the end, they settled on "Kwenta" instead ("source"). Now, in order to compete with centralized exchanges, Synthetix plans to launch a new front-end named Infinex. The features of this new front-end can be summarized as follows:

It offers referral registration links and commission for trading fees.

It generates a public-private key pair for each user and stores it in the browser, automatically signing transactions.

It may have social or governance recovery features.

It continues to use SNX tokens for governance.

It captures value through incremental trading fees, integration costs, and SNX LP fees on Synthetix.

Similar User Experience to Centralized Exchanges

Synthetix already has a frontend project called Kwenta, which, combined with Synthetix, forms one of the main solutions for on-chain perpetual contracts. However, on-chain trading requires certain learning costs, such as the need to keep private keys and mnemonic phrases and sign every operation. These characteristics limit the development of on-chain derivatives trading.

The aim of Infinex is to design a product that can theoretically remain decentralized without centralized custody risks and minimize proprietary components to circumvent regulations, while still providing a user experience similar to centralized exchanges.

Starting from registration, Infinex uses commonly used referral links in centralized exchanges to enhance Infinex's promotion and increase the income of KOLs and other groups. Users who click on the link will be directed to a referral page, and the promoter can receive a portion of the fees generated by the referred user.

In order to enhance user experience, Infinex generates a public-private key pair for each user and stores it in the browser. This key pair is only used for signing transactions on Optimism. In practice, when users click on "Trade," the order will be automatically signed in the browser and routed to Optimism, eliminating the need for additional user signatures.

Infinex also generates a unique deposit address for each user, where users can deposit USDT, USDC, or sUSD. The funds are pooled in a margin pool controlled by governance. The entire process can be viewed on the blockchain at any time, ensuring transparency of funds.

Continued Governance with SNX Token

Infinex plans to continue governance with the SNX token and will not introduce additional tokens. After deploying the Infinex governance contract, SNX stakers (liquidity providers, LPs) vote to decide Infinex board seats and elect board members.

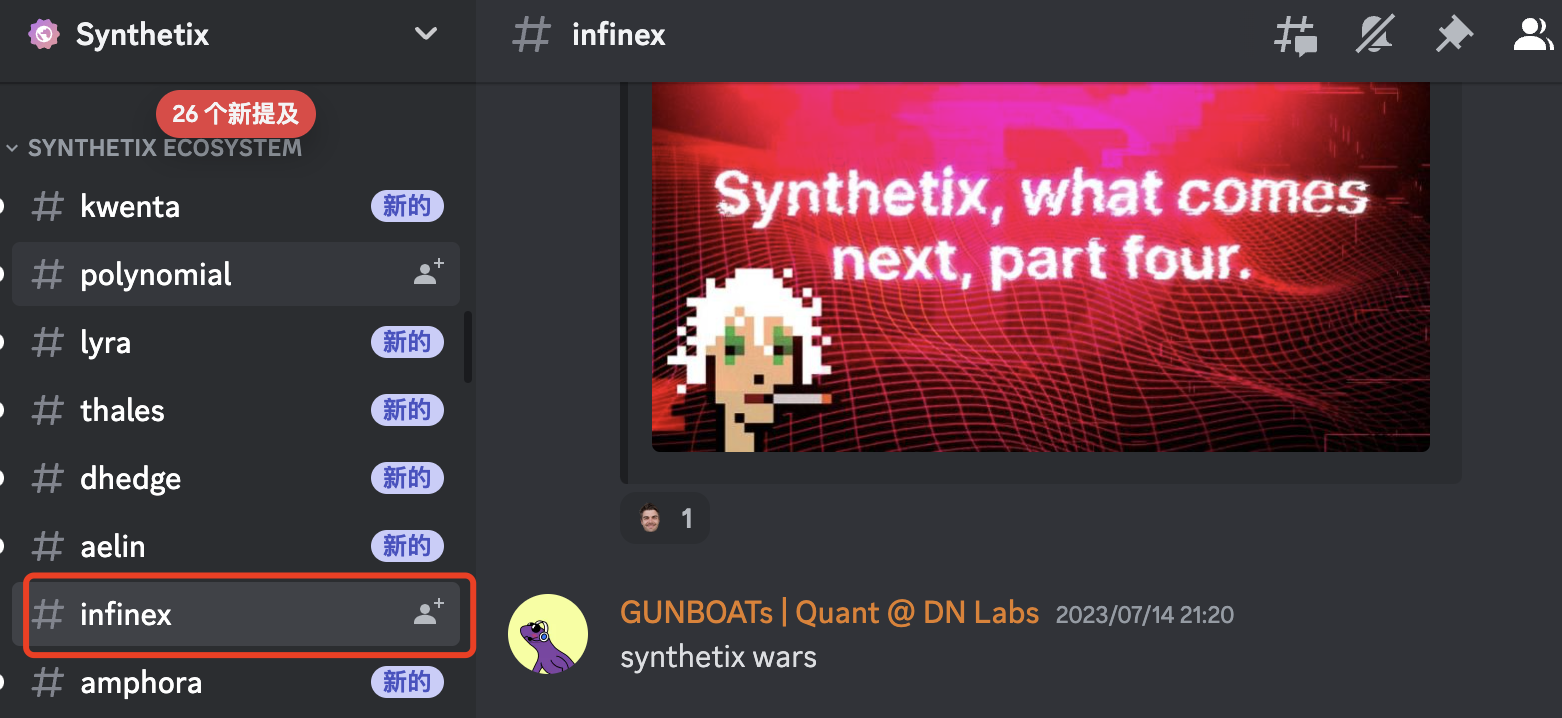

Discussions about Infinex are also centered on the Synthetix Discord, and Infinex will not create its own Discord until it is officially launched.

On July 14th, the Infinex channel has been created under the Synthetix ecosystem in the Synthetix Discord, alongside projects like Kwenta, Lyra, and Aelin.

The plan for Infinex's new front-end, which still uses SNX for governance, caused the token price of SNX to rise over 50% in a short period on July 14th, but it later pulled back. However, considering projects like Kwenta, Lyra, and Aelin have issued their own governance tokens, there may be some doubt whether Infinex will never issue governance tokens. Even if tokens are issued, they will be airdropped to SNX stakers.

Generating Revenue through 3 Ways

Similar to Kwenta, Infinex is also just a front-end for Synthetix. Since the back-end SNX LP provides liquidity as the counterparty for traders and bears the risk, it shares all or most of the fees. Front-end projects usually have difficulty capturing the value generated by exchanges. Kwenta also struggled to capture the value brought by contract exchanges in the early stages.

Infinex will generate revenue through the following 3 ways:

Charge additional fees on top of the Synthetix trading fees

Obtain integration fees from the Synthetix Integrators program

SNX LP fees

The accumulated fees from the agreement will be converted to SNX and used for staking. As the trading volume increases, more SNX LP positions will be accumulated, allowing the generation of transaction fee income.

Summary

From the publicly available information, Infinex is a product launched to compete with centralized exchanges. It offers a user experience similar to centralized exchanges, with features such as referral links and signature-free trading. However, Infinex itself is just a front-end for Synthetix, and the governance is still handled by SNX LP. The project also has a revenue generating mechanism.

The official website of Infinex is now open and it is expected to launch in the fourth quarter of this year along with Perps V3. You can join the waiting list on the official website here. After the official launch, a certain number of traders will be invited to participate in testing on a first-come, first-served basis.