Everything originates from Ethereum's transition from POW to POS

After transitioning to POS, Ethereum actually generates an interest rate of over 5% annually because it needs to distribute income to validators. It is these interests that bring new opportunities to the DeFi market and make entrepreneurs eager to try.

First, protocols like Lido solve the liquidity problem of staking and issue corresponding tokens called LST, allowing the financial power inherent in staked Ethereum to return to the market. Then, another batch of protocols, based on LSD, issue higher-level financial derivatives including stablecoins, creating a whole new track called LSDFi.

We have always viewed DeFi as Lego, and LSDFi has actually created a whole new Lego module. In the view of our guests, LSDFi will be an important driving force for the next bull market because it has created a new currency multiplier tool in the industry, greatly improving the efficiency of currency usage. Of course, this also brings a new narrative—the most important thing in the Web 3 market, which is that derivative assets will replace native assets like ETH and become the new underlying asset. 1. Four ways of Ethereum staking and LSD becoming the simplest channel

LSD, which stands for Liquid Staking Directive, is a liquidity staking derivative. The birth of LSD is to solve the liquidity problem of staking: the staking mechanism requires validators to lock tokens in smart contracts to participate in mining, undoubtedly causing staked assets to lose liquidity. Therefore, LSD protocols, including Lido, provide staking certificates to users, allowing them to enjoy staking interest while still having liquidity, thus not losing the opportunity to participate in other market activities.

The token of the LSD protocol, abbreviated as LST, is actually a staking certificate. For example, Lido's token is stETH, and Rocket Pool's staking certificate is rETH. These staking certificates have a ratio close to "1:1" compared to Ethereum as the underlying asset, but due to differences in interest payment methods, the exchange rate will be around "1 "Fluctuation up and down.

In fact, the concept of LSD began in 2020. In 2019, Ethereum proposed the concept of transitioning from POW to POS, known as "Eth 2.0". In 2020, the Ethereum mainnet launched the staking contract. In the second half of that year, although Ethereum did not fully switch from POW to POS, users were able to start staking Ethereum, and Lido Finance was founded at that time.

There are four forms, including LSD, that can participate in Ethereum staking:

LSD: Nodes participating in Ethereum mainnet staking must hold 32 Ethereum or multiples of 32. However, using protocols like Lido and LSD, staking can be done with any amount of Ethereum, significantly reducing the staking threshold. Currently, over one-third of Ethereum staking is done through LSD;

Staking through centralized exchanges: For example, participating in staking through centralized exchanges like Binance and Coinbase, entering their fund pools. Exchanges charge a certain fee, which is relatively high. However, the advantage is that it is extremely convenient to operate and does not require any on-chain operations. It is the lowest threshold form in terms of operability;

Solo Staking: Running a node directly and participating in mainnet staking. This is the most decentralized form of staking and is highly recommended by the community. The downside is that the operational threshold is higher, requiring running a server or renting a public cloud to form a node. Additionally, Ethereum has a slashing mechanism, so improper operations leading to node downtime may result in slashing;

Non-custodial Staking: A solution between Solo Staking and LSD, where participants do not need to surrender their private keys. The work of running the node, including server maintenance, is entrusted to a third party, avoiding the risk of slashing. The third party typically charges a lower fee.

Interestingly, Ethereum staking has undergone a dramatic reversal in recent months.

The staking and unstaking mechanisms of Ethereum are different from other POS chains. Unlike fixed periods of 21 or 14 days in other chains, Ethereum's unstaking period is dynamic. Unstaking involves two stages: the exit queue and the withdrawal period, with the exit queue determined by several variables:

The total number of validators

The minimum churn limit, set to 4

Churn Limit Quotient, set to 2^16 (65,536)

The exit pledge cycle has a complex calculation formula, but it can be simply understood that whether it is pledging or exiting the pledge, Ethereum needs to ensure that the number of running nodes remains within a stable range, so it requires queuing for seats.

Source: https://wenmerge.com/

In April 2023, the completion of the Ethereum Shanghai upgrade made the pledged ETH redeemable. At that time, many people were eager to withdraw their tokens, but they had to wait for a long time. Now, the withdrawal is immediate, while joining the pledge usually requires queuing for about 38 days.

Behind this is the increasing confidence of users in Ethereum 2.0 and the attractiveness of over 5% annualized return in the bear market environment. Therefore, LSD is a more convenient way to participate in the pledge, despite the commission that LSD platform will extract. However, it can still obtain the pledge rewards in the fastest way.

2. LSD Profit Source and the Three Major Participants

To understand the interest of Ethereum, that is, the profit source of LSD, it is necessary to first understand the structure of Ethereum - the Ethereum mainnet and the beacon chain.

Under the POW mechanism, Ethereum originally had a mainnet. After transitioning to POS, a beacon chain was added. The roles of the mainnet and the beacon chain can be understood using an internal management structure of a company: the original Ethereum mainnet can be compared to the company's execution layer, that is, the company's regular employees,

General handling of transactions and smart contracts; The beacon chain is essentially the consensus layer of Ethereum, which can be understood as the management layer of the company, that is, the group of people who do approvals in the company. Its function is to manage nodes and shard chains, and coordinate the entire Ethereum network.These two layers have their own sources of profit:

-

Consensus Layer: Mining refers to the portion of Ethereum that is newly generated and distributed to the nodes on the Ethereum Beacon Chain, with an annualized return of 3.5% or even higher;

-

Execution Layer: This portion of income mainly consists of Ethereum gas fees, with an annualized return of 2% or even higher.

These two parts together make up the source of Ethereum LSD profits, which amounts to an annualized return of 5%.

In the LSD track, there are many participants, and in terms of TVL, the top three players in the LSD field are Lido, Frax, and Rocket Pool:

Lido:

-

Operation Method: Users deposit money in Lido to obtain stETH, which is equivalent to participating in Ethereum staking. Lido, as a platform, has recruited 29 white-label node operators globally through public tender, entrusting users' funds to these operators. Recently, they have expanded by adding 5 to 10 new operators worldwide. This model has some centralization drawbacks, but Lido is still striving for decentralization, for example, by considering geographical dispersion for suppliers. The Lido model is similar to a bank - when users deposit ETH, it is like depositing money in a bank, and the bank must use the deposit to generate interest, such as by lending to other businesses to seek higher returns. In this case, the node operators are the lenders, and the difference in interest rates between the two parties is the profit for Lido.

-

LST Interest Payment Model: Of course, users are entitled to the interest from participating in Ethereum staking. Lido's interest payment model is to pay users more stETH, which means that if you hold one stETH today, you will receive more stETH as interest tomorrow.

Rocket Pool:

Operating Mode: Emphasizes the decentralization of operating bottom-level nodes. In the Rocket Pool ecosystem, there are two different roles: depositors and node operators. Therefore, Rocket Pool acts more like a matching platform, matching depositors' funds with node operators. To ensure the security of the depositors' funds, Rocket Pool has certain requirements for node operators. They require applicants to have at least 16 Ether to apply as a node operator. Rocket Pool will match them with 16 Ether in the staking pool to form a node. Recently, they have lowered the threshold to 8 Ether. Therefore, Rocket Pool's network can also be seen as a permissionless network.

LST Interest Payment Mode: Its interest payment mode can be seen as an exchange rate mode. It does not pay users more LST, but adds the interest to the total pool, making individual LST holdings more valuable. Therefore, the exchange rate of RETH to ETH has been climbing above 1.

Frax:

Operating Mode: Frax also follows a banking model similar to Lido. Compared to Lido, which delegates operations to third parties, Frax leans towards running its own nodes.

LST Interest Payment Mode: Same as Rocket Pool, it follows an exchange rate mode.

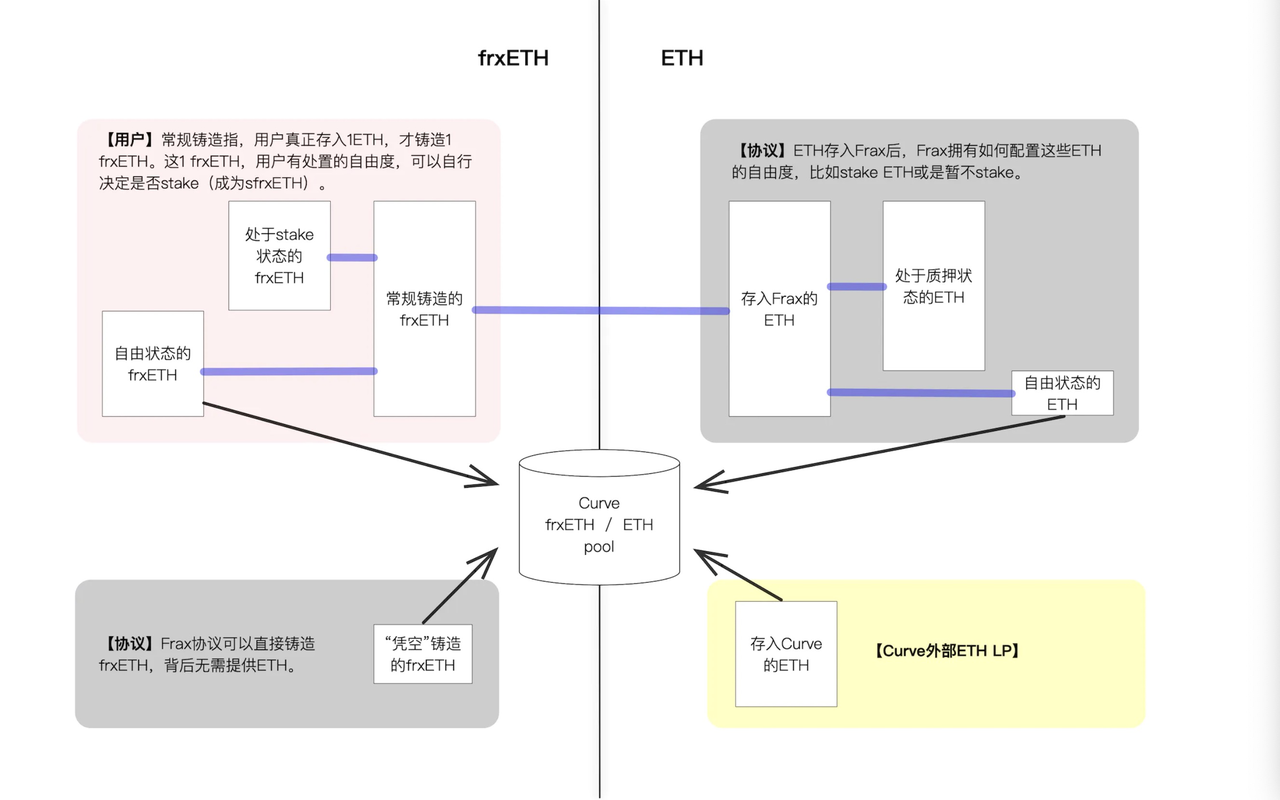

LST Yield: Currently, users can mint frxETH at a 1:1 ratio with ETH on the Frx Protocol official website, but this is a one-way process and Frax cannot be redeemed back to ETH. After obtaining frxETH, users have two options: one is to participate in staking and become sfrxETH holders to enjoy Ethereum staking rewards, and the other is to deposit frxETH into the Curve frxETH/ETH pool to provide liquidity and earn CurveLP rewards. However, users who provide liquidity to Curve no longer enjoy Ethereum staking rewards, as these rewards are transferred to sfrxETH holders. In simple terms, Frax redirects users who participate in dividends, allowing individual users to receive more dividends.

(Note: Regarding the frxETH system architecture, the icons created by @@observerdq can provide a better understanding)

For the differences among the major participants, we summarize as follows:

Operating models: Lido and Frax are more similar and can be called banking models,

Interest payment models: Frax and Rocket Pool are similar, both are exchange rate models, Lido is an interest payment model.

LST yield: currently, frxETH has the highest yield because it redirects frxETH holders to provide liquidity on Curve.

3. LSD becomes the new underlying layer and builds a brand new LEGO module. After a period of development in LSD, the pattern is set—Lido occupies nearly 33% of the entire Ethereum network nodes. For new entrepreneurs to seize new opportunities, a better approach is to build on top of LSF and develop a new track, LSDFi. Therefore, a group of entrepreneurs create derivative protocols on LSD to build financial utility tokens.

LSDFi can be understood as LST being the equivalent of Ethereum's collateral certificate. Its function is to allow users to redeem Ethereum in the future, but in reality, users can also use this certificate as collateral for engaging in higher-level financial activities, such as minting stable coins. Currently, there are roughly two or three main sub-tracks for the formation of LSDFi:

Lending: Currently, most mainstream lending platforms already support LST as collateral. In other words, instead of requiring collateral in Ethereum, they only require collateral in the form of LST, this track includes Raft, Gravita, etc.

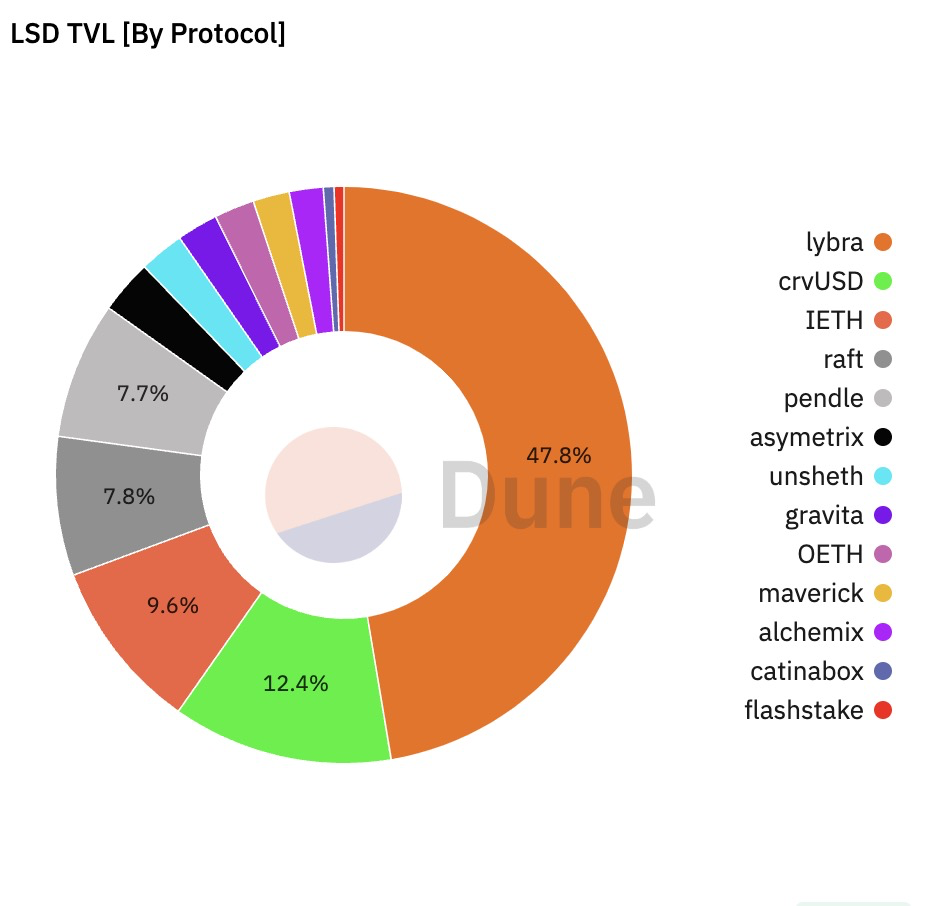

Stablecoin: LST is used as collateral to mint new stablecoins on the platform, such as Lybra Finance and the newly incubated project Prisma by Curve. From market data, stablecoins are the largest category in terms of TVL proportion.

Yield strategy: For example, Pendle is essentially a traditional discount market. For instance, if someone has 100 ETH with an annual yield of about 5%, it would be a total of 15% over three years. However, Pendle offers a strategy that separates the user's interest rights from the principal. After the split, the user can still enjoy a 15% yield over three years, with 5% interest per year, but the principal is discounted slightly, granting immediate access to the principal. In addition, Pendle also offers a structured product that allows users to purchase Ethereum at a discount, but with a waiting period - effectively subsidizing the discount with pledged interest for users.

Recently LSDFi has been booming, attracting them mainly for higher yields:

Pendle's stETH LP, 30-day APR 11.74%;

PancakeSwap V 3's RETH-WETH, 30-day APR of 26.13%;

fConvexFinance's frxETH-CVX, 30-day APR of 27.75%;

0 x Acid provides the highest yield, with a staked APR of about 90% distributed in wETH;

4. A New Type of Stablecoin with Natural Interest

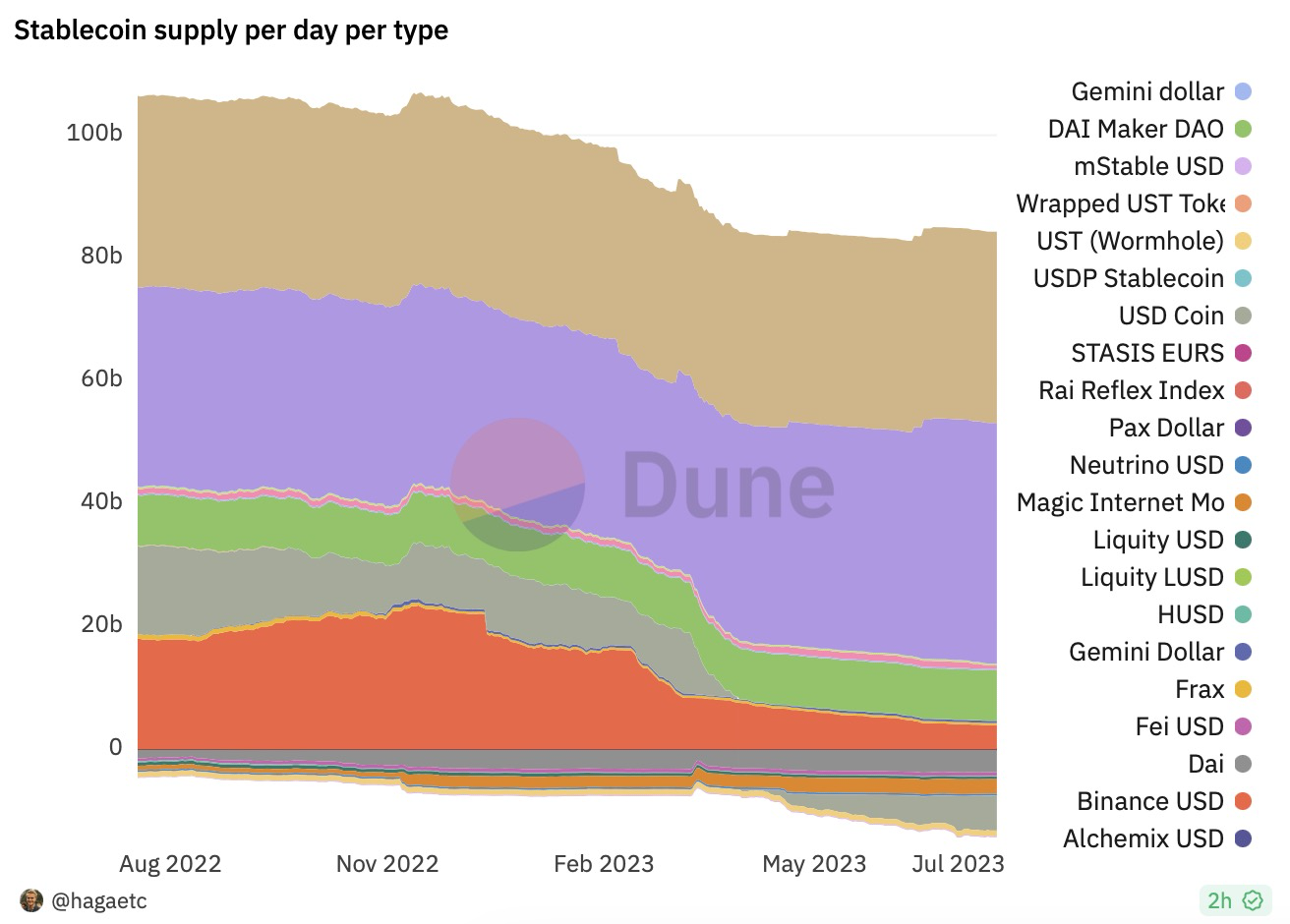

To some extent, the scale and quantity of stablecoins are indicators of industry prosperity. Since 2022, the issuance scale of several mainstream stablecoins has been shrinking, which is also considered an indicator of industry "bear market". After LSD became the new underlying asset, it has inspired a group of entrepreneurs to create new stablecoins. Currently, Lybra Finance, ranked first in TVL in the LSDFi platform, is a stablecoin project. Prisma, a stablecoin project fostered by Curve, is also being pursued by capital.

Stablecoins have always been a battleground in the crypto industry.

First of all, stablecoins are a low-entry but high-yield track. Many people want to occupy the top position in the industry's "food chain". For traditional funds entering the crypto field, stablecoins are definitely the first stop. Therefore, entrepreneurs know that if they can create a relatively top-tier stablecoin, they will be able to cooperate with various defi protocols, ensuring a lack of use case scenarios and occupying the top position in the industry's "food chain". At the same time, MakerDao has developed a mature stablecoin model, and most of the stablecoins currently on the LSDFi are based on this model.

Secondly, there seems to be competition space in the narrative of decentralized stablecoins. MakerDao's stablecoin, Dai, has always claimed to be a decentralized stablecoin. However, starting from last year, it started accepting centralized stablecoins like USDC as underlying assets, which led the outside world to believe that it has abandoned its "decentralized stablecoin" label. This also makes some entrepreneurs believe that this narrative can still make a difference.

More importantly, LSD provides a brand new underlying asset and narrative.

From the perspective of users, if a stablecoin is built on LSD, it can allow those who do not want to bear the volatility risk of Ethereum to enjoy the interest of Ethereum staking, and even earn interest rates higher than the staking yield. From the perspective of underlying assets, based on LSD as a stablecoin at the underlying level has natural interest, which has never been seen in the crypto industry. In comparison, USDC and USDT belong to classical stablecoins, with government bonds and commercial bills as their underlying assets, and the interest generated is taken by the issuers. In the opinion of our guests, stablecoins based on LSD with natural interest support are a dimensional blow to stablecoins like USDC and USDT, which are considered 1.0 stablecoins. The following are several LSD stablecoins: - Lybra Finance ($LBR / $eUSD):

Minting: Mint $eUSD using $ETH or $stETH collateral with a collateral ratio greater than 150%. Lybra automatically converts any $ETH collateral to $stETH.

Revenue Source: Lybra explains the revenue source in the whitepaper, primarily from the interest generated by LSD collateral.

Let's understand the revenue source and dividends of Lybra with an example:

Alice deposits $135,000,000 ETH and mints 80,000,000 eUSD

Bob deposits $15,000,000 ETH and mints 7,500,000 eUSD

Current circulating supply of eUSD = 80,000,000 + 7,500,000 = 87,500,000

Current collateral = $135,000,000 + $15,000,000 = $150,000,000 stETH

After one year:

LSD revenue = $150,000,000 * 5% = ~$7,500,000 stETH

Bob redeemed the newly issued stETH with his held 7,500,000 eUSD (equivalent to destroying his held eUSD).

Service fee = eUSD circulation (i.e. 87,500,000) * 1.5% = 1,312,500 eUSD

Dividends = 7,500,000 eUSD - 1,312,500 eUSD = 6,187,500 eUSD distributed to all eUSD holders (only Alice remains)

Now:

Alice's collateral = $135,000,000 ETH, debt (worth 80,000,000 eUSD) = holding 80,000,000 + 6,187,500 = 86,187,500 eUSD

eUSD APY = 6,187,500 / 80,000,000 = ~7.734%

Bob's collateral = $15,000,000 ETH, debt (worth 7,500,000 eUSD) = but he holds 0 eUSD, and holding $7,500,000 ETH

Current eUSD circulation remains = 87,500,000

Existing collateral = $135,000,000 + $15,000,000 = $150,000,000 ETH

Price stability: Lybra stated in the whitepaper that by simply holding $eUSD, the annual yield can reach approximately 8%. The redemption mechanism forms the "price floor," while a minimum collateral ratio of 150% forms the "price ceiling."

Raft(n.a. / $R):

Minting: Mint with $stETH or $rETH with a collateral ratio greater than 120%.

Price Stability: The redemption mechanism forms a "price floor", while the minimum 120% collateral ratio forms a "price ceiling".

Ethena - Testnet:

Minting: Mint with any Ethereum LSD, with a collateral ratio of 1:1.

Income Source: Hold the collateral in the form of Ethereum LSD, generating approximately 6% collateral yield per year. Shorting 1x $ETH perpetual contract on centralized exchanges will also earn income in the form of funding rate.

Price Stability: Ensure stability by holding Ethereum LSD spot and shorting $ETH perpetual contract.

Prisma Finance:

Minting: Overcollateralize minting with any of the 5 Ethereum LSD tokens whitelisted: $stETH, $cbETH, $rETH, $frxETH, $bETH.

Price stability: The redemption mechanism sets the "price floor," while the minimum collateral rate for each asset sets the "price ceiling."

In short, the profits of these stablecoins come from the interest of LSD exceeding 5% per year, which means that LSD is becoming the new underlying asset.

5. The engine of the next bull market

Our guests believe that a prerequisite for the arrival of a bull market is to have a leverage mechanism that can accommodate a large volume of funds, which is the money multiplier mechanism, and LSDFi happens to meet this requirement.

That was the case in the bull market of 2020. LP refers to a certificate that provides liquidity to market makers, such as uni on Uniswap or SLP on Sushiswap. These certificates are actually market tokens issued by DEX decentralized trading systems to market makers. At that time, using these certificates for "mining" was equivalent to repeatedly using 100 dollars as 500 or even 700 dollars. Under certain strategies, the annualized returns could reach 300%.

And LSD Fi is exactly such a money multiplier tool. Previously, the underlying asset was Ethereum, but now an additional layer has been added on top of Ethereum, or you can say that a new module has been added to the DeFi Lego, which amplifies the efficiency of capital utilization. At the same time, the yield of 5% to 6% is very stable and risk-free.

Another important condition for a bull market is narrative, and LSD becoming the new underlying asset prepares a new narrative for the next bull market.