original:What is the reason for buying a large amount of rice on the market, Matsushita Matsushita?》

Author: AKIRA.H, CoinPost

Compiled by: Aya, Odaily

Listed companies holding the most Bitcoins

As a pioneer in the business intelligence (BI) industry, MicroStrategy has delivered innovative products to thousands of companies. What has driven its stock price even higher in recent years has been a seemingly improbable investment strategy.

The company’s co-founder, Michael Saylor, purchased $250 million worth of Bitcoin in August 2020 as part of a capital allocation strategy. The bold strategy is based on expectations of Bitcoins potentially high returns and appeal as a hedge against inflation. As a result, MicroStrategys stock price has roughly tripled compared to the start of 2020.

Trust in the company’s Bitcoin investments continues to grow, with its holdings exceeding 150,000 BTC as of July 2023, making it the largest holder among publicly traded companies. Now, MicroStrategy stock (MSTR) has become a proxy investment vehicle for Bitcoin, attracting the attention of large institutional investors like BlackRock, Vanguard Group, Morgan Stanley, Fidelity and others.

This article takes a closer look at MicroStrategy’s Bitcoin investment strategy, financials, and Michael Saylor’s vision, compiled by Odaily Aya.

Table of contents

MicroStrategy overview

MicroStrategy BTC holdings changes

BTC purchase funds and their financial status

Michael Saylors Vision

Major MicroStrategy shareholders

MicroStrategy overview

Headquartered in Virginia, USA, MicroStrategy was founded in 1989 by MIT graduates Michael Thaler and Sanju Bansal.

After providing enterprises with a platform to efficiently analyze and visualize business data, the company achieved steady growth and was listed on Nasdaq in 1998 (symbol: MSTR).

As a pioneer in business intelligence (BI), MicroStrategy provides enterprise-grade analytics solutions and mobile software. These innovative products empower thousands of organizations around the world to gain data-driven insights for decision-making.

In the BI space, MicroStrategys main competitors include SAP AG Business Objects, IBM Cognos, and Oracle Corporations BI platform.

In a trend worth watching, in June 2023, MicroStrategy partnered with Microsoft to expand its offerings and enhance AI capabilities on Microsoft Azure. Through this collaboration, customers can achieve comprehensive solutions for managing and analyzing data in the cloud, enabling faster and more accurate decision-making.

MicroStrategys revenue mainly comes from license fees and subscription fees for cloud services. Sales in the first quarter of 2023 (January-March) were approximately 16.8 billion yen ($121.9 million), a year-on-year increase of 2.2%. Sales and operating profits have remained stable over the past few years.

But when it comes to stock prices, the story is different. MicroStrategys stock price has increased approximately 3x since the start of 2020, largely due to the companys purchase of Bitcoin in August 2022 as part of a capital allocation strategy.

Since then, the company has continued to increase its Bitcoin holdings, and as of July 2023, its holdings exceeded 150,000 Bitcoins, making it the largest holder among listed companies. MicroStrategys share price (MSTR) closely correlates with Bitcoin price movements.

When Bitcoin prices fell by 60% in 2022, MSTR stock price also fell by about 35%. However, entering 2023, things have changed, with the stock price rising from about 19,000 yen (about $145) at the beginning of the year to about 56,000 yen (about $400) as of July 11.

MSTR stock price (yellow), BTC price (candlestick), Nasdaq 100 index (blue) Source; Trading View

When MicroStrategy first purchased Bitcoin, the price was around $11,700 and MSTR stock was trading around $144. However, as of July 2023, the price of Bitcoin has increased nearly 3 times to approximately $30, 300, while MSTR’s stock price has also increased 2.7 times.

Over the past 5 years, MicroStrategy (MSTR) has significantly outperformed the SP 500, while also outperforming Meta and Amazon.

MicroStrategy Bitcoin Holding Changes

Source: Ecoinometrics

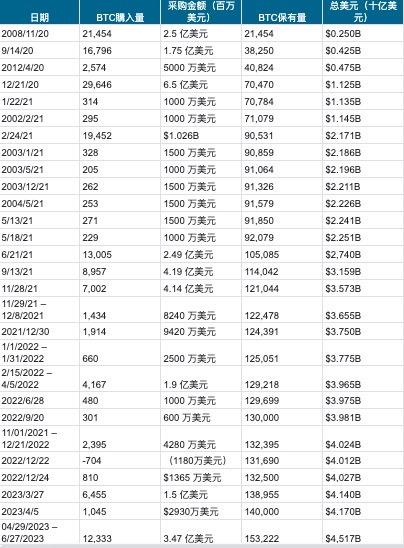

MicroStrategy has been an active Bitcoin buyer since August 2020 and has purchased Bitcoin more than 25 times in the past three years.

This buying pace continued into 2023, with an additional purchase of 1, 045 Bitcoins on April 5 of the same year. Then, on June 28, they made a massive purchase, purchasing 12,333 Bitcoins equivalent to 50 billion yen ($347 million).

Through these transactions, MicroStrategy’s Bitcoin holdings total 152,333 BTC (approximately $4.6 billion), with a total investment of approximately 650 billion yen ($4,516.98 million). The company has purchased Bitcoin at an average price of $29,668 so far.

Considering that the current market price of Bitcoin is approximately $30,000 per coin, MicroStrategys unrealized gains and losses on its Bitcoin investments to date have turned slightly positive. This is a significant improvement compared to the approximately 27.1 billion yen ($197.6 million) impairment loss recorded in the fourth quarter of 2022.

Microstrategy BTC Purchase History

BTC purchase funds and their financial status

MicroStrategy, through its wholly owned subsidiary MacroStrategy, purchases and holds Bitcoin directly and indirectly. Bitcoin purchases are funded by working capital, borrowings, issuance of corporate bonds, and new funds raised on the stock market, known as"public offering"。

Data source: Buy Bitcoin Worldwide

During the first quarter of 2023, MicroStrategy worked to improve its financial structure, including fully repaying the Bitcoin-backed loan. MicroStrategys long-term debt fell to Rs 217.5 crore from Rs 237.8 crore.

Currently, MicroStrategys principal long-term liabilities are as follows:

Source: MicroStrategy

・Convertible bonds due 2025, interest rate: 0.75%: $650 million (October 2020) ・Convertible bonds due 2027, interest rate: 0%: $1.05 billion (February 2021)

A convertible corporate bond is a bond with the right to convert it into stock under certain conditions (conversion option). By issuing convertible corporate bonds, MicroStrategy can obtain capital without dilution and use the proceeds to purchase Bitcoin.

MicroStrategy holds liabilities with convertible bonds that carry lower interest rates of 0% to 0.75% and are not at risk of requiring early repayment in full as long as they are not delisted by Nasdaq or the New York Stock Exchange. Take the risk out of the equation.

・ 6.125% secured junk bonds (high yield bonds) due 2028: $500 million (June 2021)

As part of the guarantee for this loan, MicroStrategy had 14,890 Bitcoins on deposit at the end of September 2022, with a liquidation line of approximately 500,000 yen ($3,561) in Bitcoin prices. There is room for this liquidation line, and MicroStrategy has no direct exposure to the Bitcoin market.

However, loan interest accrues twice a year, which could put pressure on MicroStrategys results. As of September 2022, MicroStrategy has paid approximately 3 billion yen ($22 million) in Bitcoin-related interest. with the company"Cash and cash equivalents"Thats not a small amount compared to its balance ($94.3 million as of March 31, 2023).

Additionally, the secured loan that will be fully repaid in the first quarter of 2023 is a secured loan agreed with Silvergate Bank in March 2022 that matures in 2025. At the time, MicroStrategy borrowed $820 million backed by 19, 466 Bitcoins. MicroStrategy paid approximately $161 million in advance, fully repaying this secured long-term borrowing.

Additionally, in the first quarter of 2023, MicroStrategy sold its own shares on the open market, generating net proceeds of approximately $339 million. About $179.39 million of that amount was spent on Bitcoin purchases.

MicroStrategys total assets, on the other hand, reached $3,026.4 million in Q1 2023, up from $2,410.27 million in the previous quarter. This increase was primarily due to a significant increase in digital assets (from $1,840.02 million to $2,039.2 million) and a significant increase in deferred tax assets (from $188.15 million to $651.51 million).

Michael Thalers Vision

MicroStrategy co-founder Michael Saylor is considered a leader in Bitcoin investment strategies. In August 2020, Saylor judged Bitcoin to be superior to other investments as an investment to fight inflation and potentially deliver higher returns. As a result, he purchased approximately $250 million in Bitcoin as part of a capital allocation strategy.

Saylor said at the time: “Investing in Bitcoin is part of a new capital allocation strategy aimed at maximizing long-term shareholder value; Bitcoin is an attractive investment asset and a reliable store of value with the potential for long-term appreciation. .

Even if the Bitcoin market enters a bear market beyond 2022, MicroStrategy remains committed to its strategy of expanding its Bitcoin holdings and their commitment has not wavered. Despite the criticism, Saylor made it clear: “We will continue to increase our Bitcoin holdings and have no plans to sell.”

Additionally, on August 8, 2022, Saylor resigned as CEO of MicroStrategy and became executive chairman. He said the decision will allow MicroStrategy to focus more on its Bitcoin-related work.

Now, Saylor has expressed his bullish view, saying: “With regulatory clarity, it will become easier for institutional investors to participate. If we rebuild the business around Bitcoin, its advantages will be further enhanced.”

The U.S. Securities and Exchange Commission (SEC) considers most cryptocurrencies (tokens) to be unregistered securities, but in the case of Bitcoin, it relatively clearly treats it as a commodity. According to data from CoinMarketCap, Bitcoin’s market share has increased from 43% at the end of February 2023 to approximately 49.9% now.

BTC market cap market share source: CoinMarketCap

MicroStrategy has been actively working on Bitcoin adoption in recent years, including developing new products related to Bitcoin’s second-layer scaling solution, the so-called “Lightning Network.” The following are its main trends:

2021/5/25 Why is the community afraid of the “Bitcoin Mining Committee” established by North American mining companies (related articles)

2022/4/27 MicroStrategy will provide employees with Bitcoin investment defined contribution pensions (related articles)

2022/12/30 MicroStrategy will provide enterprise solutions for the Bitcoin Lightning Network (related articles)

2023/4/1 MicroStrategy allows sending Bitcoin via company email (related articles)

Major MicroStrategy shareholders

The Bitcoin investment strategy adopted by MicroStrategy enables it to act as a bridge between mainstream investment institutions and Bitcoin.

As the industrys leading business intelligence (BI) company, MicroStrategys major shareholders include well-known institutional investors such as BlackRock, the worlds largest asset management company, and Vanguard Group, the worlds second-largest asset management company.

In January 2020, financial giant Morgan Stanley reportedly acquired an 11.9% stake in MicroStrategy. In addition, related companies of Fidelity, which has more than $4.5 trillion in assets under management, significantly increased their holdings in MicroStrategy, according to reports in the first quarter of 2023. This makes the two companies among MicroStrategys top ten shareholders.

BlackRock owns about 6% of MicroStrategy, equivalent to more than $2.2 billion, according to quarterly 13 F filings with the SEC. Separately, Fidelity increased its stake in MicroStrategy by 650,000 shares in the first quarter of 2023, bringing its ownership ratio to 6.79%.

MicroStrategys top ten shareholders Source: CNNMoney

This trend isn’t just limited to the United States, but is happening around the world. National Bank of Canada, Canadas sixth-largest bank, bought more than $500,000 worth of MicroStrategy stock in the first quarter of 2023, increasing its holdings by 8.8%.

Buying MicroStrategy stock (MSTR stock) is a very easy way for investors to gain exposure to Bitcoin. As a result, some believe MSTR stock actually plays the role of a Bitcoin ETF.