1. Overview

The proposal for Aave to launch its decentralized stablecoin GHO on the Ethereum mainnet has been executed on-chain. Aave officially confirmed the successful launch of GHO on the Ethereum mainnet. According to previous reports, Aave DAO has voted to approve the AIP proposal to launch GHO on the Ethereum mainnet. The proposal aims to introduce GHO to the Ethereum mainnet through Aave V3 Facilitator and FlashMinter Facilitator. Aave V3 users on Ethereum will be able to use collateral to mint GHO.

As part of the Polygon 2.0 roadmap, Polygon, Ethereum's scaling solution, has proposed a technical upgrade for its native token, MATIC. While awaiting community approval, MATIC will be converted to Polygon (POL). The POL token is designed to operate across all Polygon protocols, including Proof of Stake (PoS), zkEVM, and the SuperWeb. The overall goal of the upgrade is to ensure scalability of the ecosystem without compromising security. The upgrade plan from MATIC to POL is straightforward. Token holders need to send their MATIC tokens to a specific smart contract, which will then return an equivalent amount of POL tokens. Polygon proposes a grace period of at least four years for token holders to complete the upgrade process.

2. Secondary Market: In the short term, the price of ETH may continue to consolidate, with support at $1900 and resistance at $1950.

2. Secondary Market

1. Spot Market

OKX Price data shows that last Thursday, ETH price soared as a result of the Ripple case ruling, rising above $2000 and reaching a high of $2030 USDT before falling to $1897. It closed the week at $1937, a 3.8% increase compared to the previous week.

ETH daily chart, from OKX

The daily chart shows that the price is currently consolidating below $1950, with support at $1900. If it drops below that level, it may further decline to $1850. The resistance level above is $1950.

2. Network Performance

Etherscan data shows that the Ethereum network had a total of 49701 blocks mined in the past week, a 0.2% decrease compared to the previous period. The number of weekly active addresses increased by 15.6% to 2851673. Block rewards totaled 4410 ETH, a 1.3% decrease compared to the previous period. The weekly ETH burn reached 16471, a decrease of 24.3% compared to the previous period.

3. Significant Movements

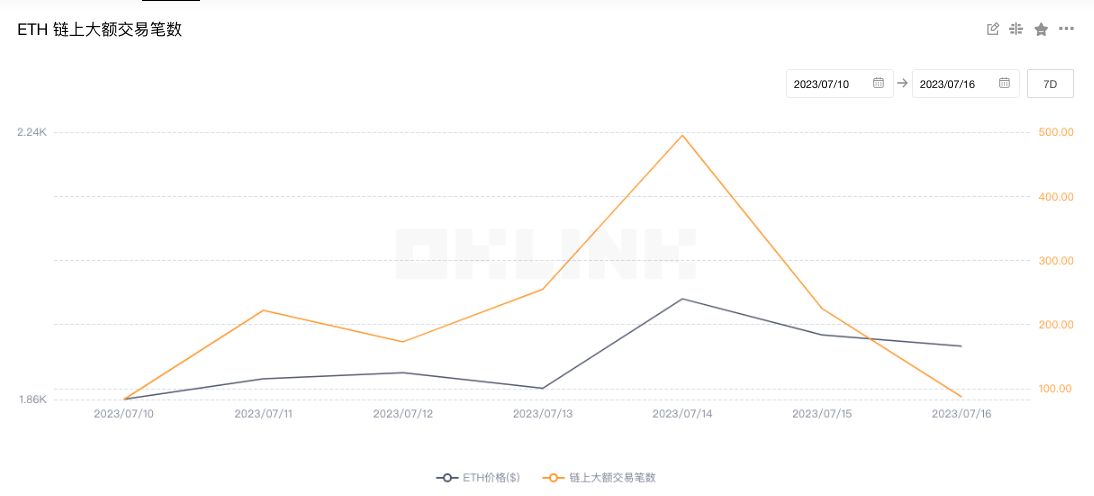

OKLink data shows that the number of high-value transactions on the Ethereum blockchain reached 1540 last week, a 34.6% increase compared to the previous week, indicating a notable increase in whale trading activity.

4. Rich List address

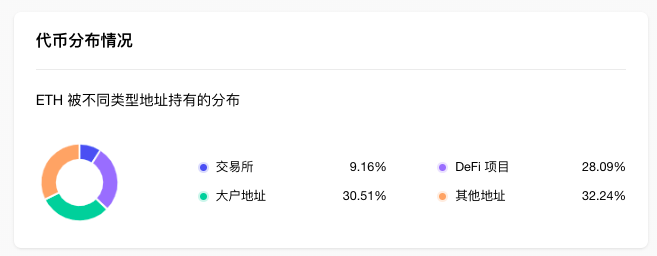

OKLink data shows that, from the distribution of ETH holding addresses, exchanges account for 9.16%, a decrease of 0.15% compared to the previous period; DeFi projects account for 28.09%, an increase of 0.29% compared to the previous period; large holder addresses (excluding exchanges and DeFi projects) account for 30.51%, an increase of 0.01% compared to the previous period; other addresses account for 32.24%, a decrease of 0.15% compared to the previous period.

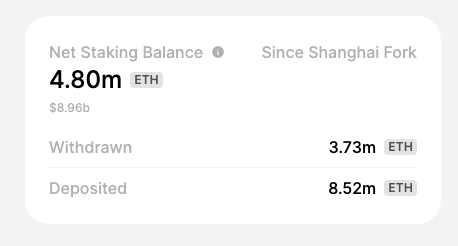

token.unlocks shows that the total amount of ETH staked on the entire ETH network is 21.47 million ETH, with a staking rate of 17.62%; since the upgrade in Shanghai, the cumulative deposit amount is 8.52 million ETH, last week's data was 8.06 million, with an increase of 460,000 in the past week; the cumulative withdrawal is 3.73 million, last week's data was 3.61 million; the total net staked amount increased by 4.8 million, compared to the previous week's data of 4.45 million, with an increase of 350,000 in the past week.

5. Lock-up data

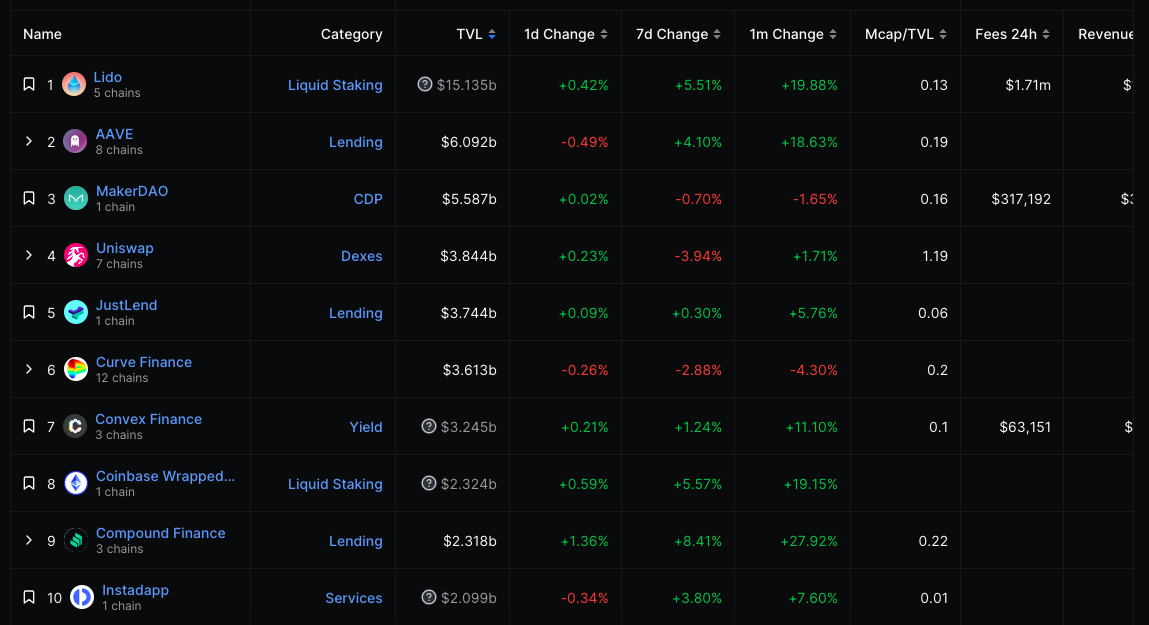

DeFiLlama data shows that the value of on-chain locked collateral increased from $26.01 billion to $26.47 billion last week, a 1.7% increase compared to the previous period. Looking at individual projects, the top three in terms of locked value are: Lido at $15.13 billion; Aave at $6.09 billion; and MakerDAO at $5.58 billion.

III. Ecology and Technology

1. Technical Progress

"Ethereum ACDC Meeting #113: Next CL Upgrade after Deneb to be Named with 'E'"

Vice President of Galaxy Research, Christine Kim, summarized the 113th Ethereum Core Developers Consensus Meeting (ACDC), where developers discussed the possibility of reducing the restrictions on validator churn rate, i.e., the rate at which validators enter and exit the beacon chain, to mitigate the growth of validator set size and prepare for the upcoming Deneb/Kankun (Dencun) upgrade.

Parithosh Jayanthi, DevOps Engineer at the Ethereum Foundation, shared the latest progress on Dencun testing work. The dedicated test network Devnet #7 for EIP 4844 has been active for two weeks. So far, almost all EL and CL client combinations have been tested, except for the Erigon (EL) client. Jayanthi encouraged client teams to look into the Dencun issue tracker to identify prominent bugs and fixes made to their software versions. Additionally, the blockchain explorer for Devnet #7, used to track blob data, has been updated.

About Devnet #8, it will include testing of the complete Dencun EIP feature suite, not just EIP 4844. Jayanthi said the client team should ensure that their version passes the relevant Hive tests. Once the client version passes the Hive tests, developers will launch a local test network before starting Devnet #8. While testing Dencun, developers are also introducing blob transactions to further explore different optimizations for the Ethereum peer-to-peer layer. Stokes emphasized that these optimizations are not obstacles to the Dencun upgrade, but help ensure healthy performance of nodes on the network after EIP 4844. Some specification changes regarding the network have already been included in Dencun, including PR #3346 and #3338.

The next EL upgrade after Cancun will be named Prague. The naming convention for CL upgrades is to use names of stars. Considering that the CL upgrade after Deneb will be the fifth hard fork upgrade for the beacon chain, developers are considering different star names starting with the letter "E." Some proposed names include: Ebla, Edasich, Electra, Elgafar, Elkurud, and Elnath. So far, the most popular among developers seems to be Electra. Stokes encourages participants in this week's developer meeting to share their opinions on the naming of the CL upgrade on the forum.

2. Project Trends

(1) Stader Ethereum Staking Product ETHx Goes Live on Mainnet

Stader Ethereum tweeted that the Ethereum staking product ETHx is live on the mainnet. There will be a 1.5x staking reward bonus for the first 30 days, and $800,000 in liquidity incentives will be provided.

NFT lending protocol Gondi announced its launch on Tuesday and completed a $5.35 million seed round, with Hack.vc and Foundation Capital leading the investment. Other participants include Dragonfly Capital, Pantera Capital, and 6th Man Ventures. Gondi allows lenders and borrowers to leverage the value of blue-chip NFTs on the Ethereum blockchain. Lenders can offer their NFTs on the platform at fixed interest rates, while borrowers can use NFTs as collateral or for NFT-based financial applications. Gondi states that borrowers on its platform only pay interest based on the remaining loan term. Additionally, borrowers can benefit from instant refinancing, ensuring they always have the best loan terms available. (CoinDesk)

(3)Marex Unveils Bitcoin and Ether-Linked Volatility Adjusted Strategy with Dollar Index as Hedge

London financial services platform Marex has launched a volatility adjustment strategy that is linked to Bitcoin, Ethereum, and the Dollar Index (DXY) futures, targeting investors who are cautious about high price volatility in the cryptocurrency market. Marex stated that this strategy has been promoted to its clients. Bitcoin and Ethereum have equal weightings in this strategy, with DXY futures serving as a hedge. The strategy continuously rebalances between BTC, ETH, and DXY futures to achieve a target annualized volatility of 8%. When volatility increases, the strategy reduces exposure to risk assets (Bitcoin, Ethereum) and increases exposure to the dollar. When volatility decreases, the strategy rebalances towards BTC and ETH. (CoinDesk)

(4) Manta Network releases Manta Pacific, an EVM execution layer for building zk applications

Manta Network founder Victor Ji announces a new vision. In the roadmap, Manta joins the OpStack and Celestia ecosystems to become the first Ethereum L2 integrated with OpStack and Celestia DA. The announcement states that the future Manta ecosystem will consist of two parts: Manta Atlantic, based on Substrate, is the fastest zk L1 solution that focuses on web3 programmable privacy and identity. Manta Pacific is an EVM execution layer built for a large number of zk applications. It provides a powerful scalability and extremely low gas fees, allowing for the direct development of new zk applications using Solidity.

Linea officially announced that the nine-week Voyage event has ended. During the event, Linea Testnet attracted a total of 5.2 million unique addresses and processed over 30 million transactions. Linea also mentioned that all participants in Voyage are eligible to mint a commemorative "Contribution Proof" NFT based on their ranking (expected to be announced on July 18th). Currently, Linea is integrating with partners who intend to access its mainnet Alpha phase. Once the integration is complete, Linea will first distribute NFT rewards to top-ranking participants and then open limited edition NFT minting to all remaining participants. As previously reported, ConsenSys plans to launch its Layer 2 network, Linea, on the Ethereum mainnet this week. Application developers will be able to deploy their projects to the Linea Alpha network on Friday.

(6) EigenLayer has raised the re-staking limit for stETH, rETH, and cbETH to 15,000 tokens

EigenLayer, the Ethereum re-staking protocol, announced that the liquidity re-staking limits for stETH, rETH, and cbETH have all been increased to 15,000 tokens. Currently, the re-staking pools for stETH and rETH have reached their TVL limits, while cbETH still has approximately 2,000 tokens of available space.

(7) Polygon proposes upgrading the MATIC token to POL

As part of the Polygon 2.0 roadmap, the Ethereum scaling solution Polygon has proposed a technical upgrade to its native MATIC token. While awaiting community approval, MATIC will be converted to Polygon (POL). The POL token is intended to operate across all Polygon protocols, including Proof of Stake (PoS), zkEVM, and the SuperNet. The overall goal of the upgrade is to ensure scalability of the ecosystem without compromising security. The upgrade plan from MATIC to POL is straightforward. Token holders need to send their MATIC tokens to a specific smart contract, which will then return an equivalent amount of POL tokens. Polygon proposes to provide token holders with a grace period of at least four years to complete the upgrade process. (The Block)

(8) Ajna launches uncollateralized and permissionless DeFi lending protocol on Ethereum

Ajna has introduced an uncollateralized and permissionless decentralized lending system on Ethereum that does not rely on price oracles and governance mechanisms. The protocol allows users to borrow and lend a range of collateral tokens and lend out any fungible tokens. Ajna claims the protocol has undergone six security audits by Sherlock, Trail of Bits, Quantstamp, Prototech Labs, and Code4arena. The Ajna protocol is now live on the Ethereum mainnet and plans to expand to support layer-two solutions in the coming months. (The Block)

(9) Ondo Finance expands tokenized US treasuries to Polygon

RWA platform Ondo is expanding from the Ethereum mainnet to the Polygon network. Ondo's OUSG token is one of the largest on-chain tokenized sovereign debt products, with an asset size of 134 million US dollars on Ethereum. Ondo has issued OUSG on the Polygon network, which is a tokenized version of the BlackRock Short-Term U.S. Government Bond Exchange-Traded Fund. The company also plans to introduce its upcoming income-generating stablecoin alternative (tokenized money market fund OMMF) and the decentralized lending market Flux Finance developed by Ondo (pending governance approval) to Polygon. (CoinDesk)

(10) Figment and Nexus Mutual to Collaborate on ETH Slashing Cover

Staking infrastructure platform Figment and crypto insurance provider Nexus Mutual are teaming up to launch "ETH Slashing Cover" to provide additional insurance for Figment clients against validator slashing risks. Nexus Mutual states that the product aims to offer comprehensive coverage against double-sign slashing risks faced by Ethereum validators. These risks refer to potential penalties that Ethereum validators may face for engaging in malicious behavior. Slashing can result in partial or total loss of assets staked by validators and impact their reputation on the network. (The Block)

(11) MetisDAO Launches Incubated Project ZKM to Upgrade Optimistic Rollup to Hybrid Rollup

Ethereum scaling solution MetisDAO has launched its incubated open-source infrastructure project ZKM. ZKM is scheduled to start operating on the Ethereum testnet in January next year.

The roadmap of ZKM is based on three stages. In the first stage, ZKM plans to upgrade the existing Optimistic Rollup to Hybrid Rollup, enabling instant withdrawals (previously had a withdrawal period of 7 days) while ensuring security. The second stage aims to transform Ethereum into the global settlement layer. The third stage involves deploying MIPS-based technology to replace processors for many Web3 applications, including IoT devices, machine learning, and cloud computing.

ZKM adopts the MIPS instruction set to achieve zero-knowledge proof (ZKP) security for all virtual machines (VMs) and applications at the CPU level, and supports multiple blockchain smart contract engines. Additionally, the plug-and-play feature of ZKM allows developers to apply ZKP without changing the codebase, reducing adoption costs. With the large decentralized security infrastructure of Ethereum, ZKM can verify all blockchain and non-blockchain transactions. (CoinDesk)

(12) Aave Native Stablecoin GHO launches on Ethereum Mainnet

The proposal for Aave to launch its decentralized stablecoin, GHO, on the Ethereum Mainnet has been executed on-chain. Aave has confirmed the successful launch of GHO on the Ethereum Mainnet. As previously reported, the Aave DAO has voted in favor of the AIP proposal to introduce GHO on the Ethereum Mainnet through Aave V3 Facilitator and FlashMinter Facilitator. Aave V3 users on Ethereum will be able to use collateral to mint GHO.