Thala is a decentralized finance protocol supported by the Move language. It enables seamless decentralized lending and over-collateralization of stablecoins with Move Dollar and provides capital-efficient liquidity supply through a rebalancing AMM on the Aptos blockchain.

Since its launch in early April this year, Thala has continuously developed and evolved as a protocol, becoming the largest native protocol on Aptos with a peak TVL of $30 million and a trading volume of $50 million. Since then, Thala has released many features and updates, strengthening the existing product suite and introducing new protocol collaborations. And now, the release of Thala V2 is imminent. Given the scope of protocol changes and upgrades, the launch of V2 will be conducted in three phases next month.

Phase 1

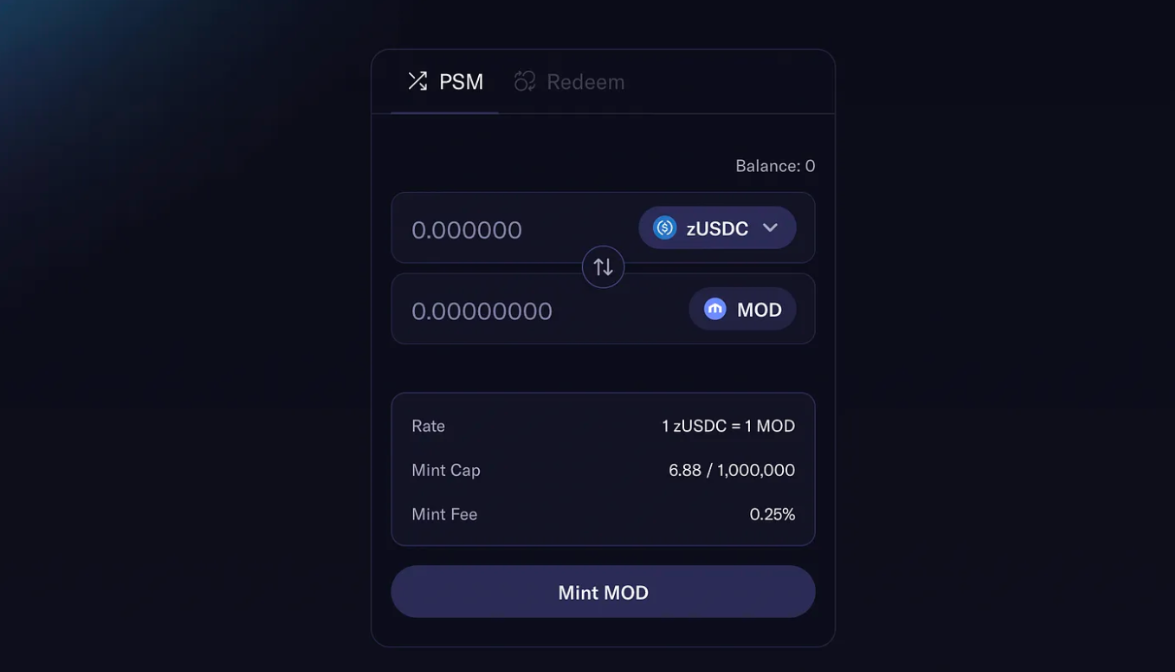

MOD Stability Module

To facilitate recursive strategies and further strengthen the stability of Move Dollar, Thala introduces the Stability Module (PSM), which is essentially an interest-free treasury that allows users to exchange MOD for whitelisted stablecoins on a 1-to-1 basis with low fees. Initially, Thala's PSM will support the bridging of USDC through Wormhole and LayerZero.

The launch of PSM will not only solidify the peg of Move Dollar (MOD) to $1, but also create a new source of revenue for the project treasury. In the future, PSM assets can also be deployed into real-world assets (RWA) that are low-risk, highly liquid, and interest-bearing through governance.

CDP Incentives

Since its launch, Thala continues to differentiate itself from other CDP protocols by offering Vaults with special collateral types. Thala is the only protocol on Aptos where users can borrow and lend with LST, similar to tAPT, and the first to provide on-chain leverage for retail RWAs.

With the release of PSM and more unique Vault products in the future, CDPs can be used to acquire even more exotic collateral types, providing unique value propositions for their holders. Protocols with income-generating assets such as liquid staking tokens, LPT, RWAs, and deposit receipts can allocate a portion of fees to incentivize borrowing against their assets.

By supporting Vault mining, Thala can better incentivize and shape its future collateral support, and users can earn additional rewards from more unique collateral types through Vault incentives.

(Note: Exotic collateral refers to assets such as deposit receipt tokens, real-world assets, LP tokens, etc.)

Flash Loans

Flash loans are an important financial primitive that Thala has incorporated into the one-click leverage design for RWAs. Other applications of flash loans allow users to swap collateral in Vaults; liquidators can also access significant funds through flash loans, providing a seamless user experience on Thala.

A comprehensive overview of how to execute flash loans can now be found in the protocol documentation;

The protocol charges a fixed fee of 1 basis point for all Lightning loans, which accumulates to the protocol fee address.

As of the time of publication, all Phase 1 features have been deployed on the mainnet, and Ottersec has completed a comprehensive security review of the Phase 1 V2 contract. The audit report can be found in the protocol documentation.

Phase 2

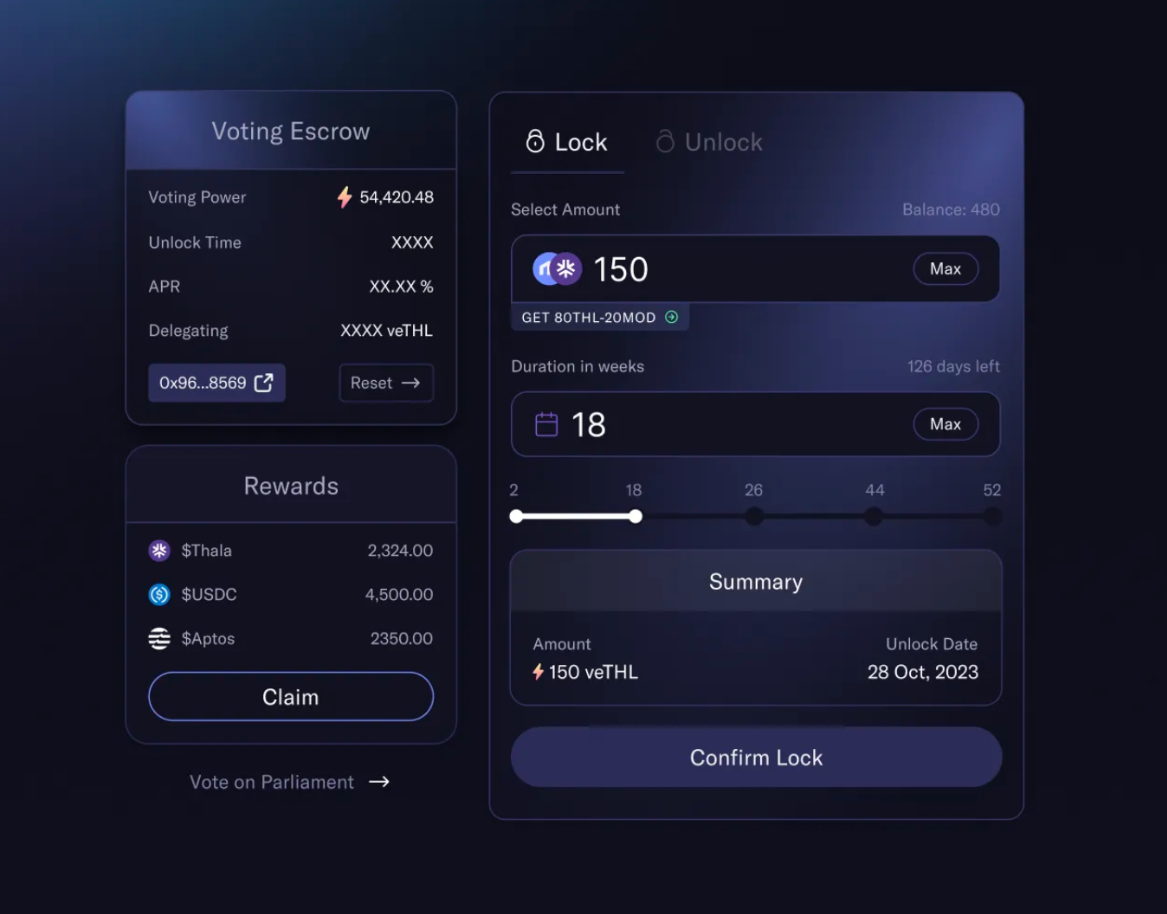

veTHL

Thala's voting escrow model has undergone additional changes during development. The initial implementation of veTHL only supported locked LPT (80 THL-20 MOD), forcing users to provide liquidity without other options. To incentivize all users to participate in Thala's governance, our updated voting escrow tokenomics now support single-sided THL and 80 THL-20 MOD liquidity pool tokens.

veTHL can be obtained through one of the following methods:

Locking THL unilaterally for 2-52 weeks;

Locking 80-20 THL-MOD ThalaSwap LPT for 2-52 weeks.

Users can lock either of them to obtain veTHL, which represents their voting weight. This can be calculated based on the nominal amount of veTHL and the total duration of the lock. To reward and compensate liquidity providers for potential impermanent loss and higher capital costs, LPT lockers will receive a multiplier on voting weight.

User's veTHL balance represents their voting weight relative to the total veTHL minted in DAO governance. veTHL marks the beginning of Thala's transition to DAO governance protocol, empowering stakeholders to manage various aspects of the protocol, such as treasury, collateral whitelist, treasury swapping, THL emissions, etc.

veTHL marks the beginning of Thala's transition to DAO. This means that members of ThalaDAO will be able to vote on important protocol matters, including financial management, collateral whitelist, protocol integrations, emissions, etc.

Token Economics Transformation and Custody THL

High THL inflation allows Thala to bring in new users and TVL to the Aptos ecosystem, successfully guiding over $30 million TVL on both the Treasury and ThalaSwap during peak periods. However, Thala strongly needs to adopt a more sustainable and user-consistent model. To address this issue, Thala has made significant changes to its emission model. All $THL emissions, including Stable Pool providers and Liquidity Providers, will receive escrowed $THL ($esTHL), which is a non-transferable version of accrued $THL rewards.

To convert $esTHL into transferable $THL, users must vest their $esTHL for 30 days. However, users can exit their vesting period early, but at the cost of a dynamic penalty on their accrued rewards. A portion of the penalty will be reallocated to reward veTHL holders for their long-term commitment, while the remaining penalty will be returned to the Treasury. The calculation of dynamic exit penalties and other details will be announced close to the launch of the second phase.

Phase 3

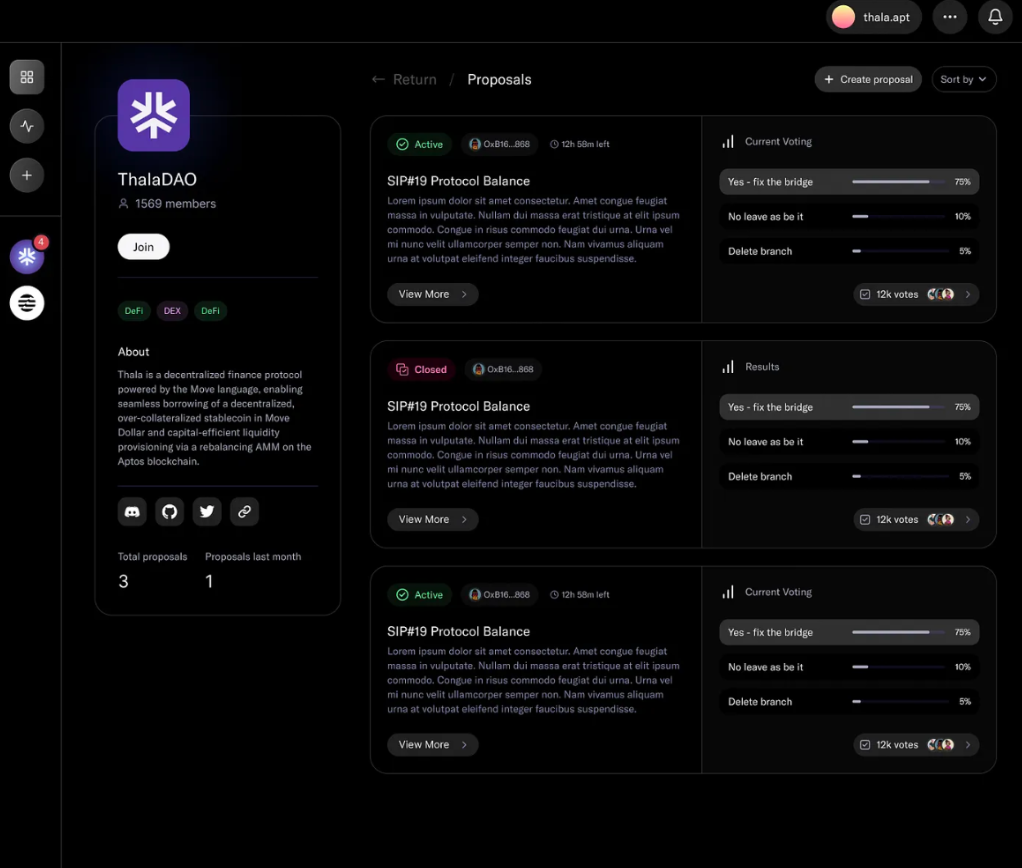

Parliament

As the largest native protocol on Aptos, what the Thala ecosystem lacks is the release of new tokens (excluding $THL). Thala currently has ThalaLaunch to facilitate the mechanics, but there is no governance platform that supports token voting for new protocols, including Thala.

Thala has already provided new functionalities for Aptos Explorer, Surf, and numerous open-source development tools, but Parliament is Thala's biggest initiative to date.

Parliament is a DAO governance platform built and supported for Aptos, allowing the protocol and NFT communities to participate in token governance. Soon, the protocol will be able to create its own highly customizable community space seamlessly and permissionlessly.

When launched, Thala will integrate the parliament for DAO governance, allowing veTHL holders to vote on protocol matters. Thala will be the first country to use the parliament for DAO governance, and other native Aptos protocols will be able to emulate it.

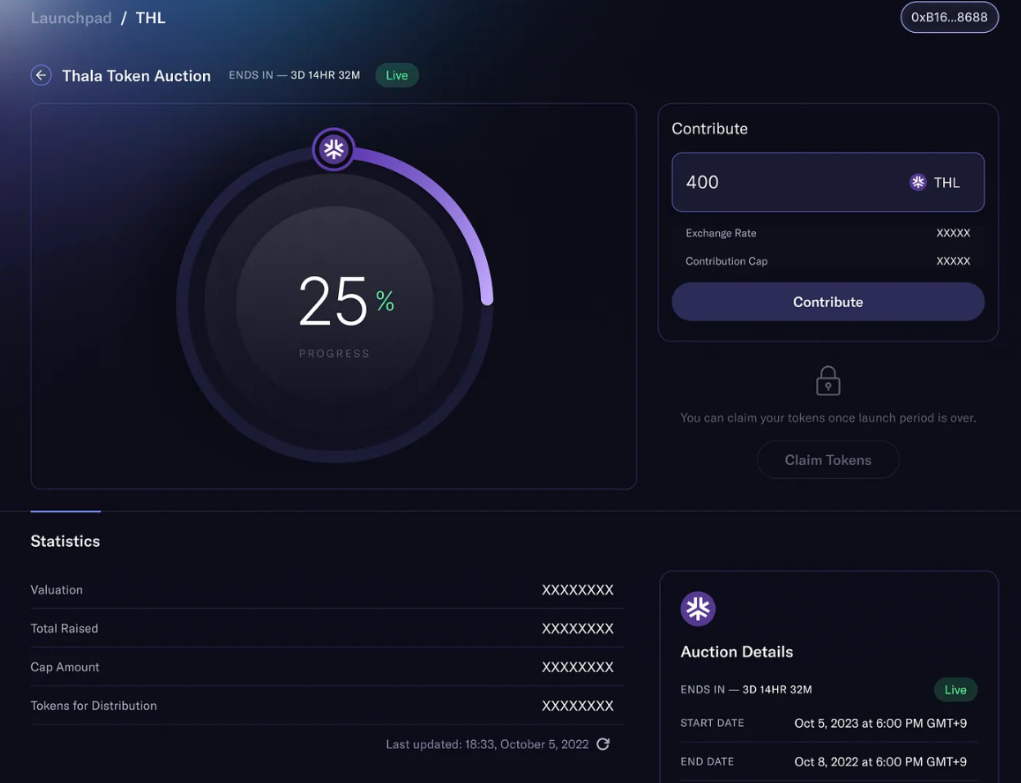

Batch Auctions

Based on feedback from Thala's own token generation activities, Thala recognizes the need for more flexible token distribution for projects. For Thala V2, the launchpad product of the protocol will support batch auctions and liquidity bootstrapping pools (LBP).

In batch auctions, there is a fixed deadline in which users can contribute funds to participate at a predetermined valuation. Once the deadline is over, all commitments will be batched and executed at a single clearing price. If there is oversubscription that exceeds the limit, all participants will receive their tokens and auction refunds proportionally. The batch auction model is very similar to the LBP model, with its own advantages and disadvantages. With this new product, the protocol can better evaluate its token issuance strategy by adding batch auction options to Thala Launch.

Real World Assets (RWA)

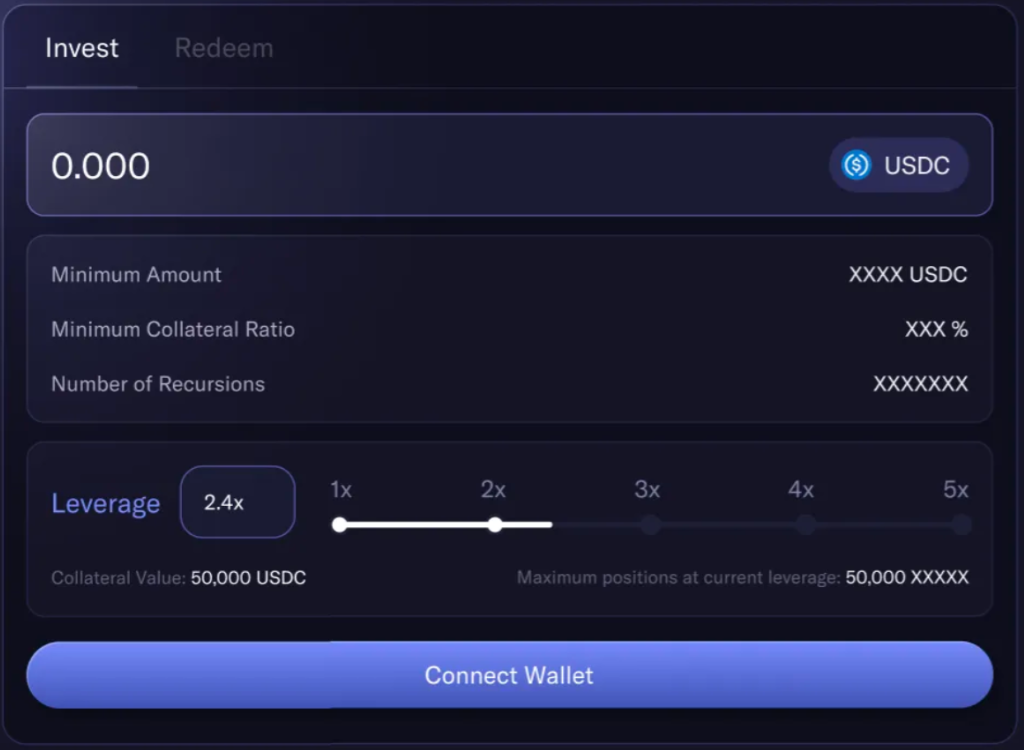

We have been preparing to release a new vault product that is far more scalable than our existing wTBT and MOD vault features. Based on feedback and existing integrations, we recognize that a seamless user experience is crucial for expanding the RWA product.

Thala announces plans to launch the product at the end of July. Enhanced RWA product aims to make RWA DeFi applications more user-friendly. This improved product has several key features:

Sleek user interface for easy navigation.

Yield expressed in USDC, providing a unified and accessible metric.

One-click recursive circulation through MOD-USDC LP and PSM.

Secure cross-chain messaging for seamless, automated user processes and settlements without the need for manual bridging of assets by users.

RWA redemption distributed back to users in the form of USDC on Aptos.

Pre-defined and easy-to-understand yield display, including expected leverage loop yield, to assist users in making informed decisions.

The primary goal here is to provide a simple yet powerful interface that enables users to easily leverage DeFi for RWA. Due to DeFi's high liquidity and efficient markets, users' debt costs are significantly reduced compared to traditional alternatives like banks. We firmly believe that this innovative product will set new standards in the DeFi and RWA space, highlighting the practical application of DeFi in real-world solutions.

Thala's next RWA integrated deposit module

Future Plans

In addition to these core features, Thala V2 will also introduce multiple quality of life updates, including UI/UX upgrades, gas optimization, and more. Furthermore, all the above frontend previews are ongoing work, and Thala is open to community feedback and discussions before release.

Since its launch, Thala has continuously updated and improved its existing suite of products, with V2 introducing several new components and features utilizing CDP, AMM, and launchpad. Given Thala's success in the following verticals within the Aptos ecosystem, the protocol will soon expand to another undeveloped DeFi primitive. With the unlocking of $APT in October, the protocol will seek to expand its product suite and launch its liquidity staking token $thAPT later this year.