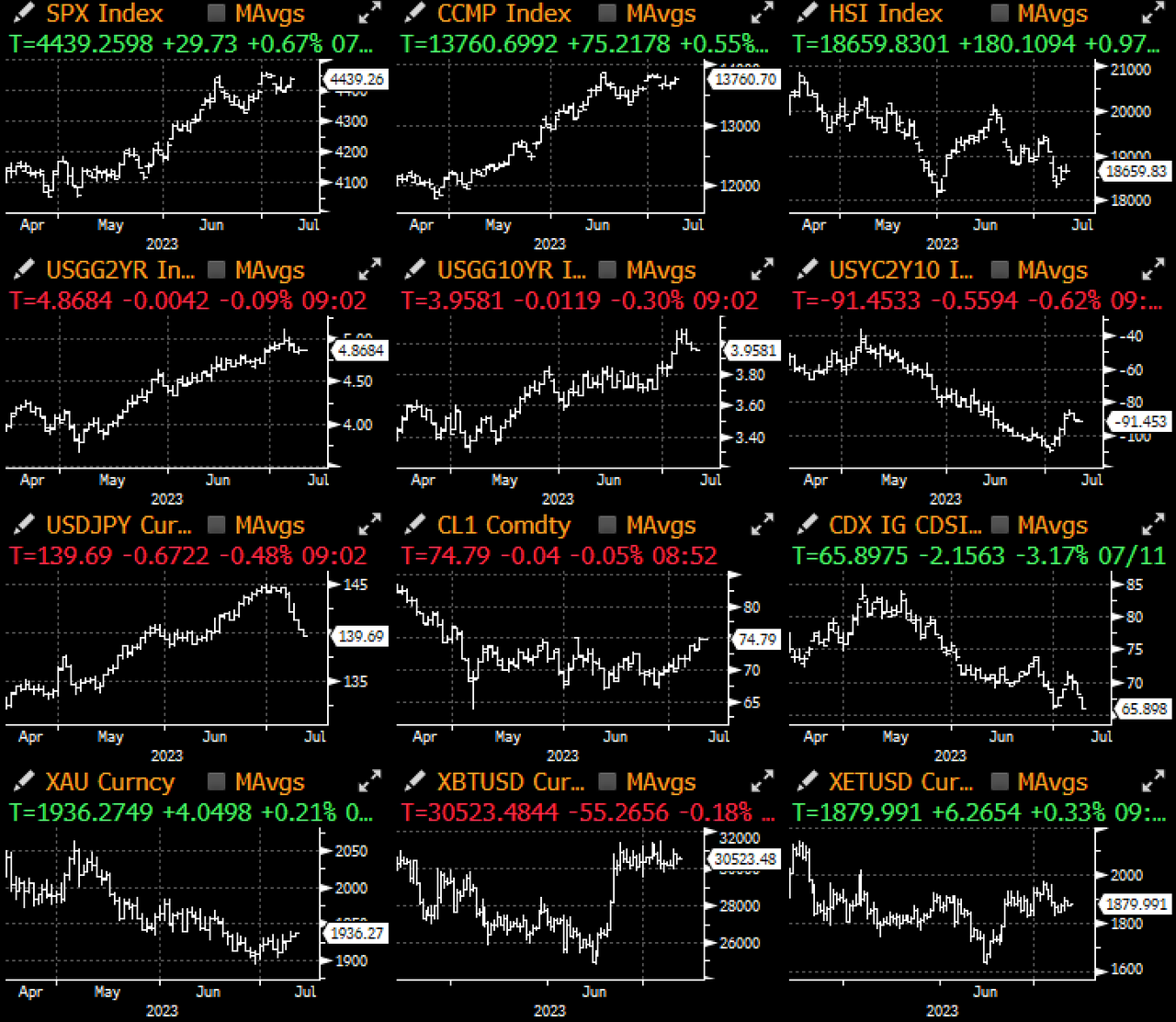

Tuesday before CPI release, the market was extremely quiet, after experiencing stop-loss triggered by yield last week, current risk positions of traders are clearly lower, the 2-year yield continues to try to break the psychological level of 5%, and due to the market's crowded flat positions, it seems that the yield curve faces the risk of rising rapidly; the data side is also light, the NFIB small business optimism index reached the highest level since last November, while the proportion of companies raising prices fell to 29%, the lowest point in two and a half years.

As in the past period, survey data still show divergences and overly pessimistic economic prospects, while actual economic activity data continues to improve, further postponing concerns about economic recession.

Due to recent better-than-expected economic activity data and widespread expectation that today's CPI data will be soft, driven by the rebound in overall risk, the S&P 500 index rose 0.7% and closed above 4,400 points, with the index led by the energy sector as oil prices broke through the 100-day moving average. China's data also saw the rare occurrence of better-than-expected situations, with new RMB loans in June (CNY 3.2 trillion vs expected CNY 2.25 trillion), incremental social financing scale (CNY 4.22 trillion vs expected CNY 3.0 trillion), and M2 data (YoY growth of 11.3% vs expected 10%) all far exceeding expectations.

However, with the revaluation of bond yields, the SPX has reached its lowest level relative to the yield of 3-month Treasury bonds since the internet era, and even if the economy successfully achieves comprehensive softening, valuation may still be a sustained resistance to the stock market.

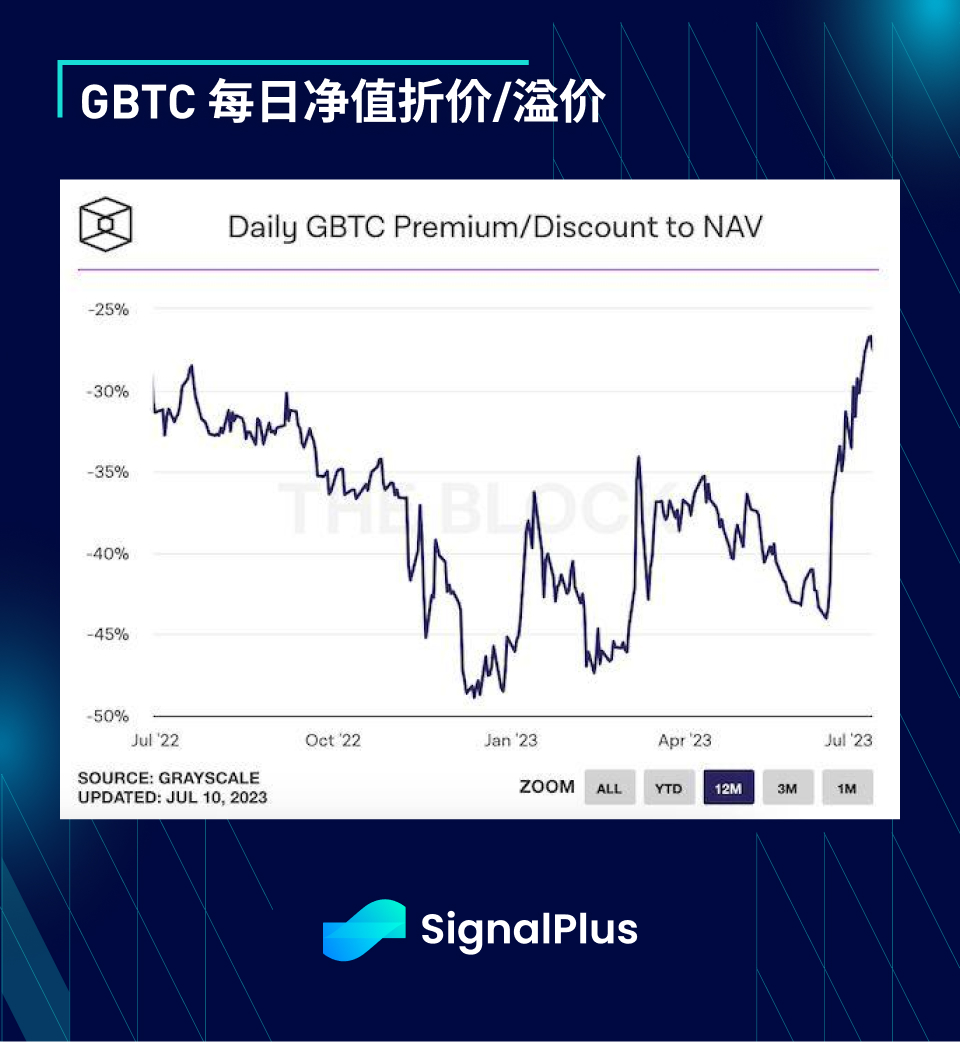

Cryptocurrency prices have also remained calm; interestingly, despite DCG still being embroiled in litigation disputes with various counterparties, due to various spot ETF applications, Grayscale Trust's long-standing net asset value discount has been significantly corrected in the past month, and the current discount level has returned to the level seen before the 3 AC/Celsius and FTX era.

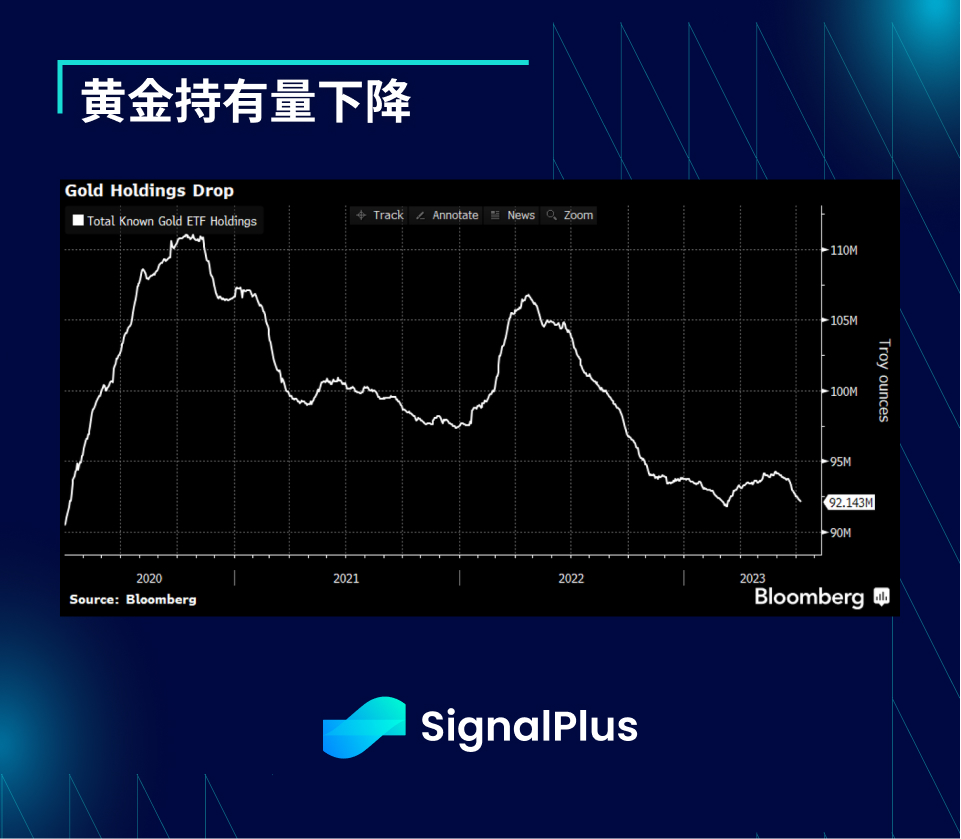

On the other hand, regarding the argument that BTC = digital gold, the public holdings of gold ETFs have been steadily declining since 2020 in the context of rising interest rates, and as long as central banks maintain a hawkish attitude, this trend is likely to continue; current interest rates are still rising, which could have some impact on the long-term trend of cryptocurrency prices.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time cryptocurrency information. If you want to receive our updates instantly, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: chillywzq), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com/