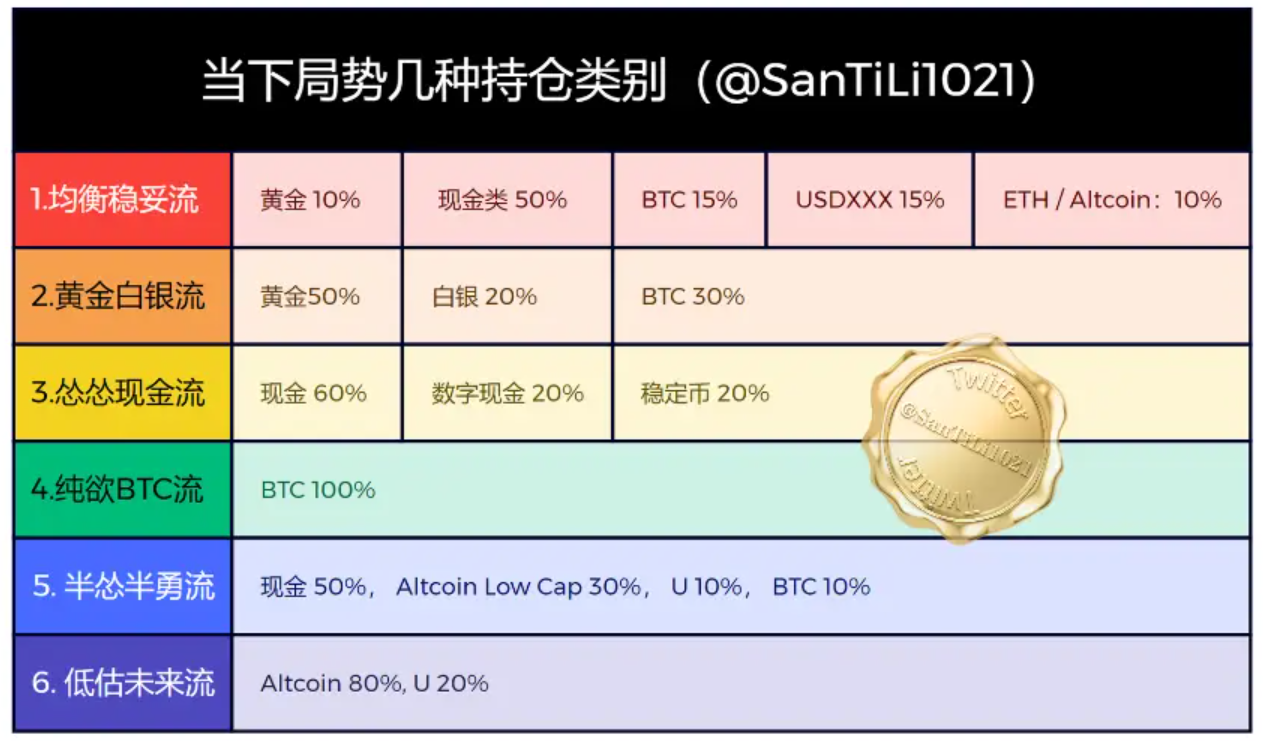

Original Authors: SanTi Li, Feng Yu, Naxida

In the current global financial environment, both the emerging blockchain Web 3 industry and the traditional financial industry are experiencing a perplexing situation with opportunities and hidden currents simultaneously present. With the rise of digital currencies and the widespread application of blockchain technology, the investment landscape is quietly undergoing changes, and the investment styles of traditional institutional investors are gradually becoming more diverse. The choice of asset allocation strategy is becoming increasingly important.

To cope with this challenge, investors need to understand the characteristics and risks of various possible investment strategies, analyze the advantages and disadvantages of various allocation styles in the current financial environment, and help us make decisions that are relatively suitable for our own styles in the current financial environment. This article provides a relatively brief introduction to six different asset allocation models, discusses the pros and cons of various allocation styles in the current financial environment, and their corresponding risk-return characteristics.

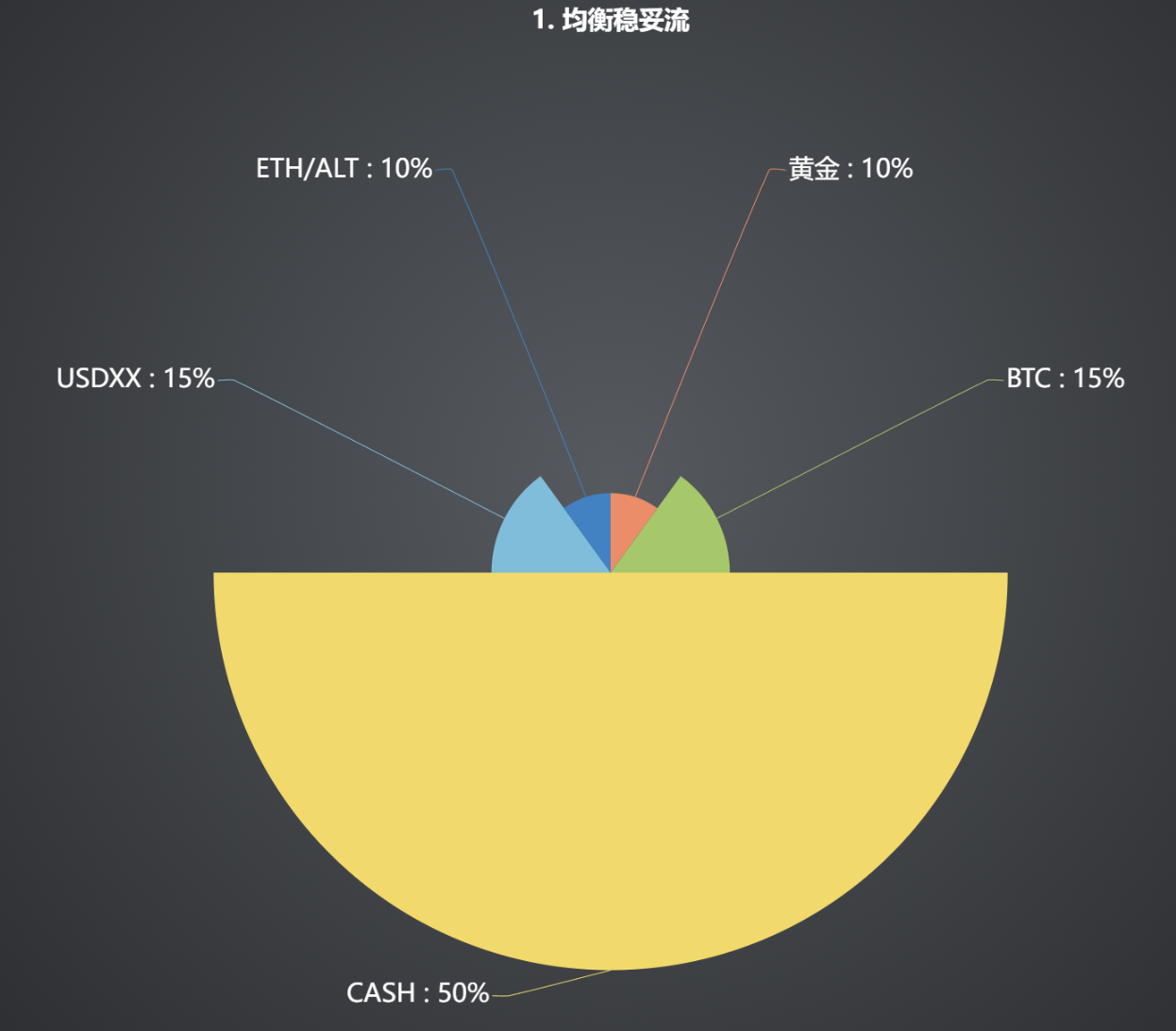

1. Balanced Flow Allocation

Gold 10%, Cash 50%, BTC 15%, USDXXX 15%, ETH/Altcoin 10%

This combination strategy is suitable for risk-sensitive investors seeking relatively stable returns, and it is relatively balanced in terms of risk diversification and value preservation and appreciation. The addition of gold provides a traditional relatively secure means of hedging, while cash assets ensure liquidity. The portion of BTC is the relatively stable target in the blockchain field (although it also has large fluctuations), and USDT/C stablecoins provide increased flexibility in entering and exiting, with relatively low volatility but risks tied to government bonds. And the 10% allocation of ETH/Altcoin adds potential appreciation space to the investment portfolio (although it also carries higher risks of fluctuation).

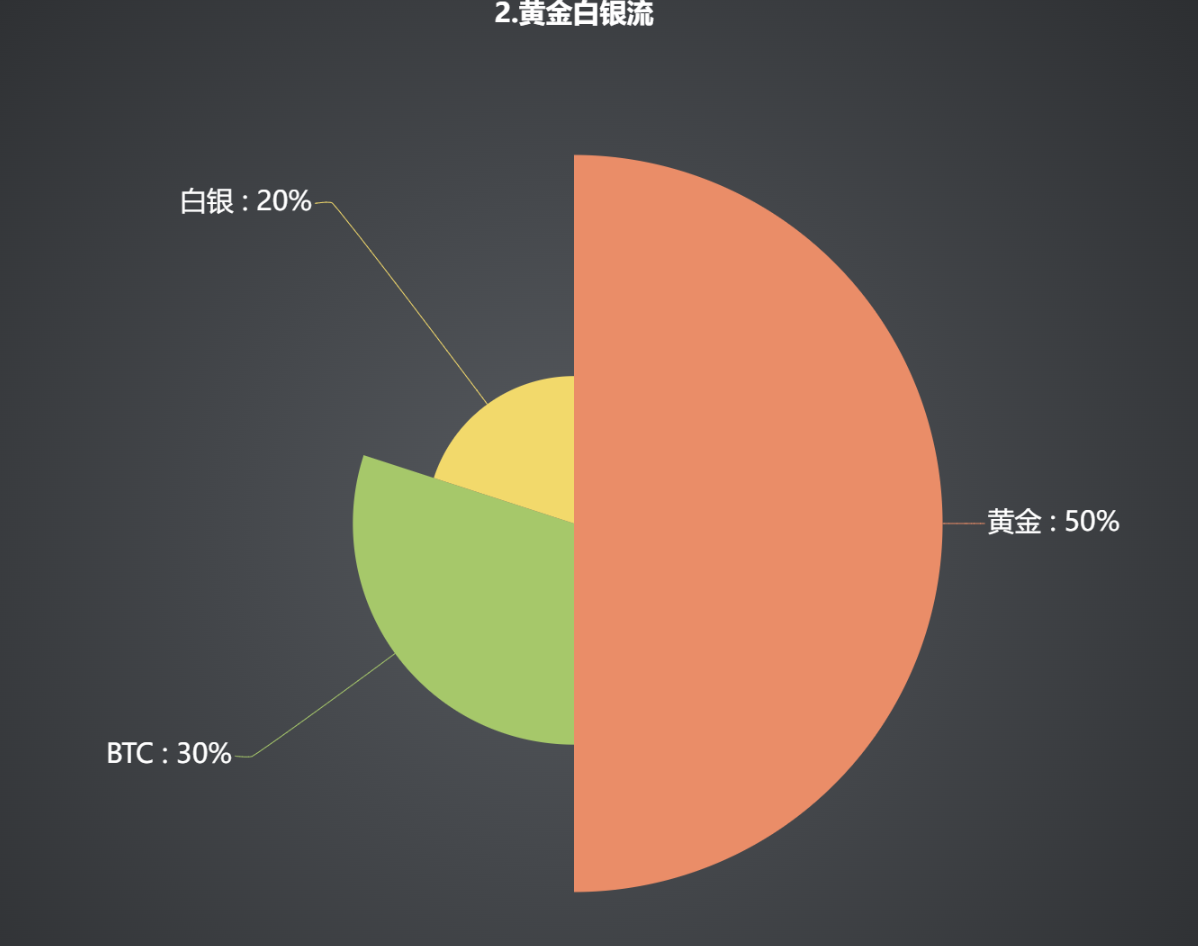

2. Hard Currency Allocation

Gold 50%, BTC 30%, Silver 20%

This strategy aims to hedge against potential inflation risks. Gold and silver, as traditional hard currency assets, provide relatively stable value preservation effects during economic instability. BTC has gradually been regarded as "digital gold" with potential long-term appreciation but also with higher short-term volatility risks. This strategy can provide relative stability during market turbulence while retaining a portion of Bitcoin for potential growth.

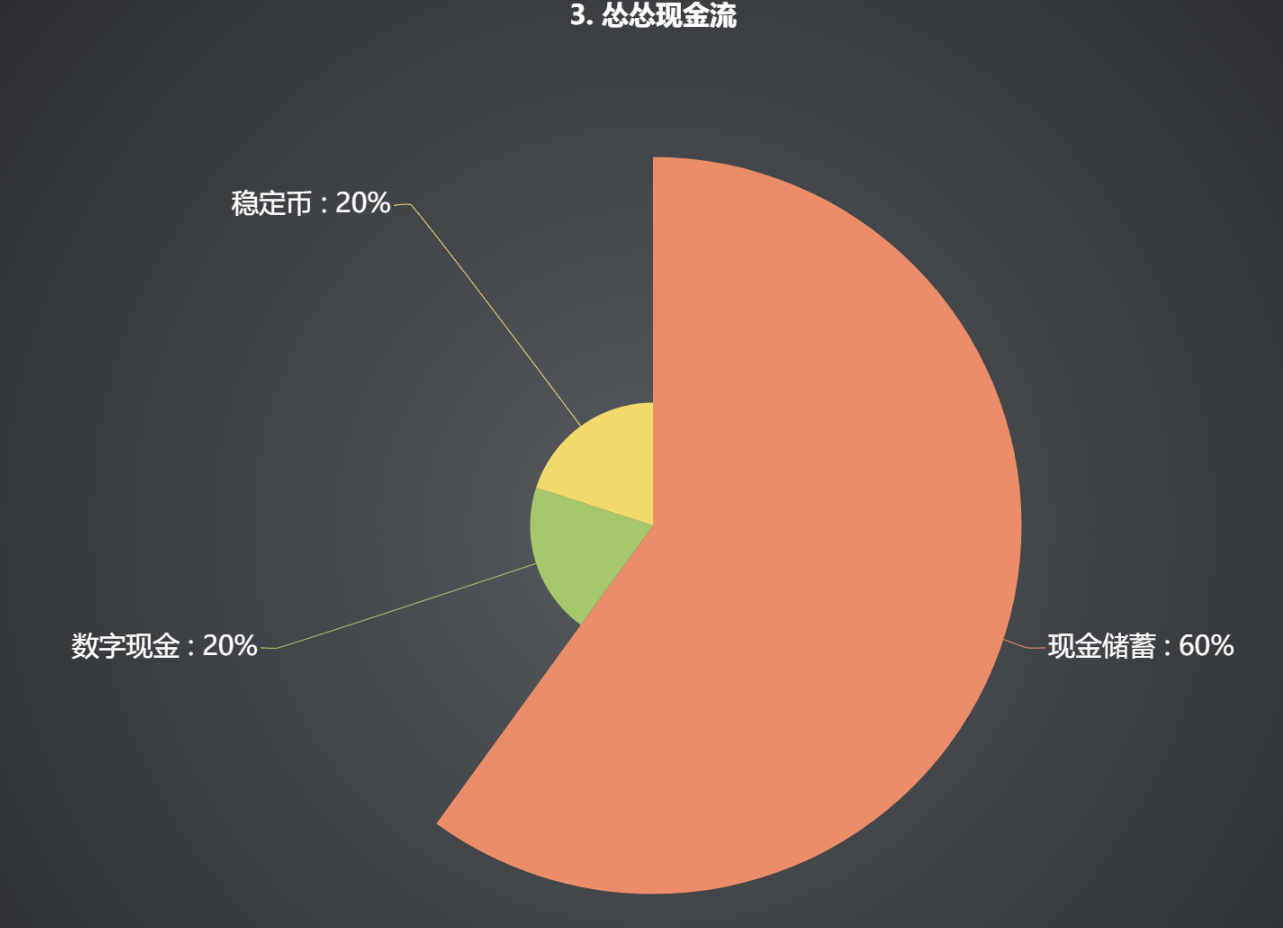

3. Cash Flow

100% (Cash + Stored Cash 60%, Digital Cash 20%, Stablecoin 20%)

This allocation style is a conservative defensive strategy for foreseeing market instability or anticipating significant downturns, emphasizing liquidity and risk control. It is suitable for investors who are pessimistic about market expectations or wish to control risks. Unlike gold, cash has higher liquidity and flexibility. Additionally, electronic cash (such as digital RMB) and stablecoins bring universality and convenience in the digital world.

The allocation that relies entirely on cash assets is typically applied by investors who have pessimistic market expectations or desire to control risk. It can help avoid major losses in a market downturn, but this allocation also carries the risk of a black swan event, such as the bankruptcy of storage banks in different countries, in the current financial environment. For example, Signature Bank, which is favored by many projects in the blockchain industry, went bankrupt this year.

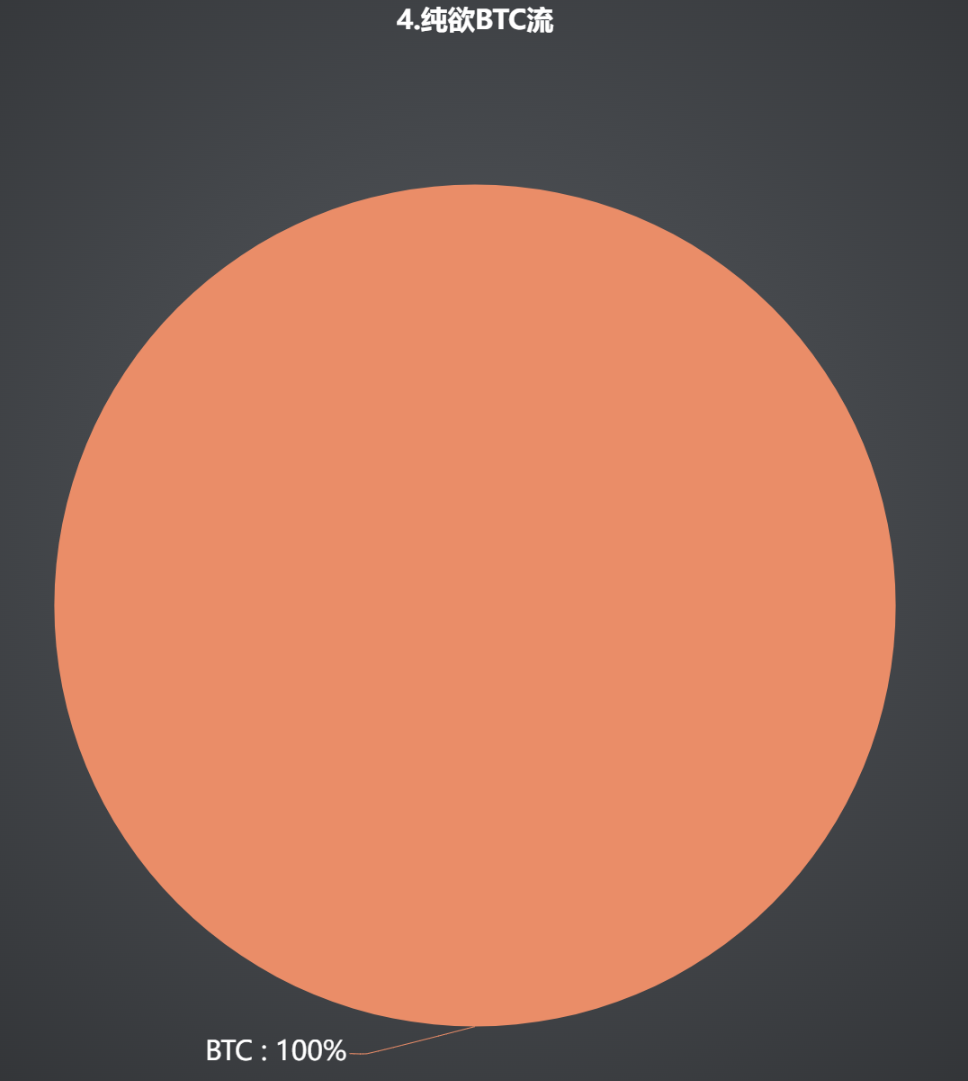

4. Pure Lay Flat Flow

BTC 100%

This strategy is suitable for investors who have extreme confidence in holding Bitcoin. Although it may achieve higher long-term returns in the future, it also comes with high market volatility risk in the current world. This strategy requires investors to have a profound understanding of the history, development, and the level of Bitcoin's development, and to comprehend and accept the possibility of significant value fluctuations of BTC in the short term.

This is an investment strategy that is extremely bullish on the future value of Bitcoin, suitable for investors who are willing to lay flat and bet on the potential appreciation of BTC in the future, and do not mind how much it may temporarily decline, and are willing to bear significant risks of volatility, even to zero.

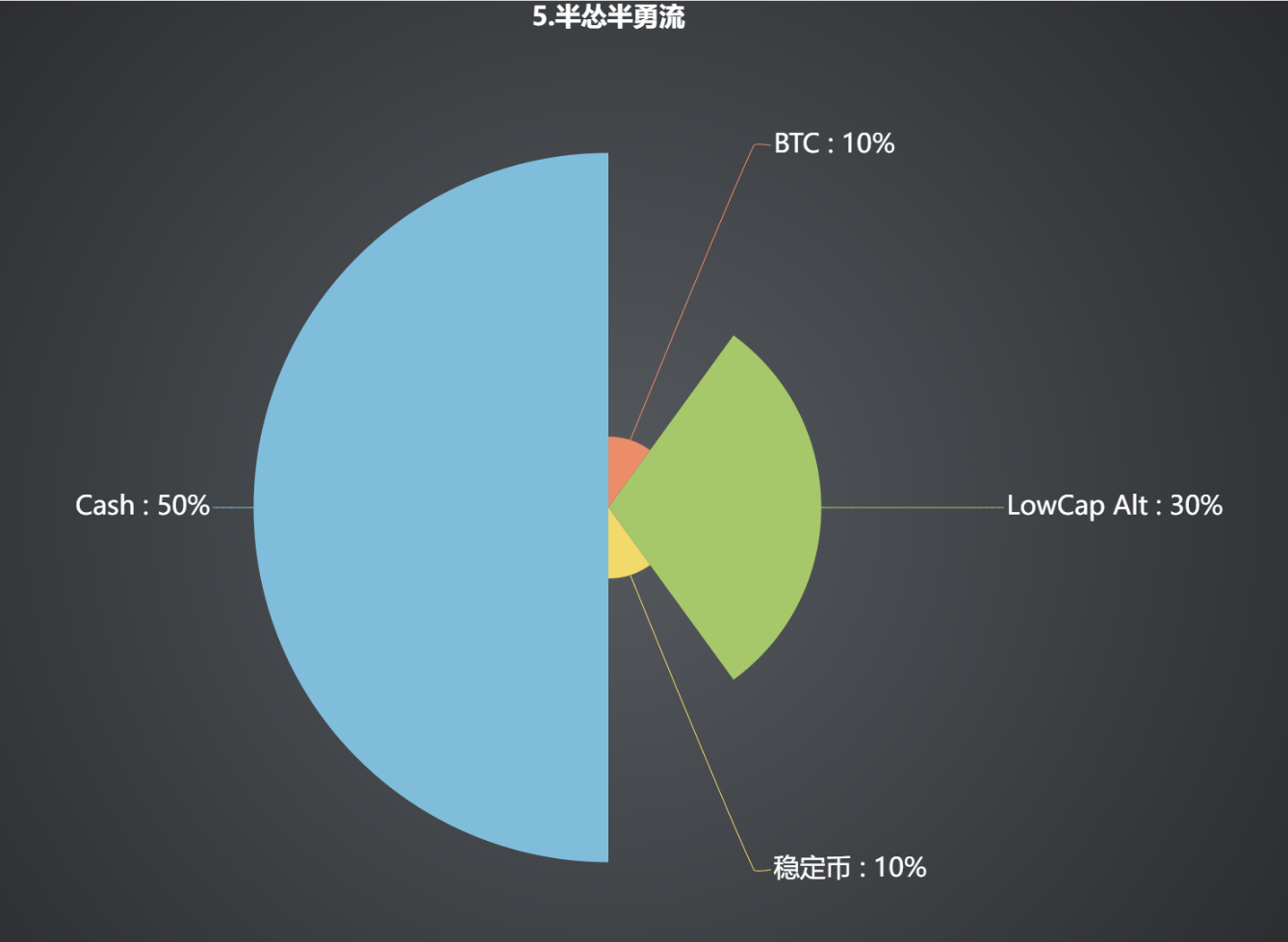

5. Half Stream

Cash 50% , Altcoin Low Cap 30% , U 10% , BTC 10%

This investment allocation method differs from the first one in that it is more optimistic about low market value Altcoin categories, with a higher proportion of cash as a backing and mainstream digital currencies. Investors who choose this allocation tend to be willing to accept higher volatility risks in pursuit of higher returns. Investors using this allocation method are advised to have a deep understanding and stay updated on the background, development progress, and economic model of Altcoin, and be willing to bear the risk of zero returns.

This allocation strategy emphasizes investment in diversified digital currencies, especially with a low market value Altcoin.

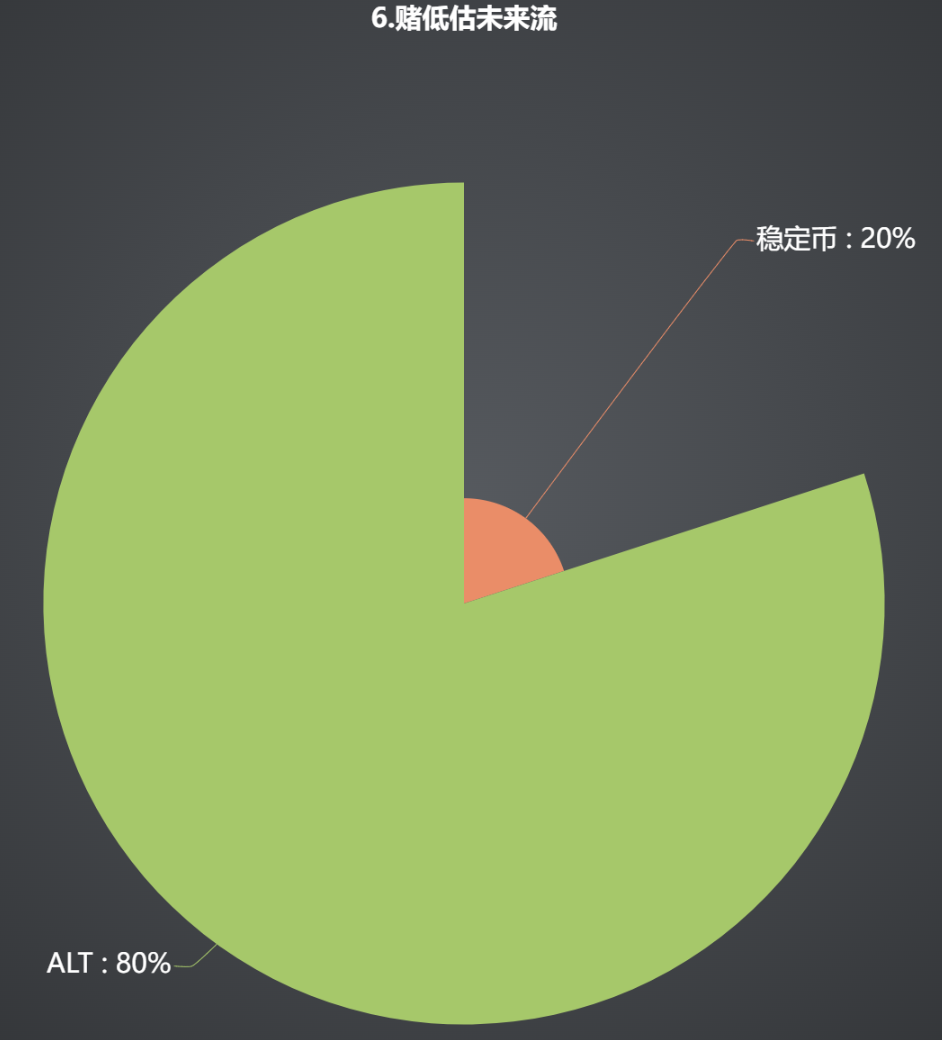

6. Underestimate Future Flow

Altcoin 80% , U 20%

This strategy demonstrates extreme trust in the investor's own chosen Altcoin, and it requires the investor to have a deep understanding of the market and a high tolerance for risk. It requires strong prediction and response capabilities for market changes, especially with regards to buying points and trends. If chosen correctly, the returns may be extraordinary (such as GMT, CFX, etc., which have experienced 20 times high trading volume gains even in bear markets), but there is also the risk of losing everything or suffering massive losses (such as buying at short-term high points or experiencing situations like the bottomless pit of LUNA in 2022).

This is a high-risk investment strategy that may bring high returns. Investing a large amount in Altcoin means that the investor is willing to bear the possibility of significant losses.

Summary:

This article introduces six different holding models, and their proportions are not fixed but flexible. Although the cryptocurrency market has tremendous growth potential, its price volatility is also very high. Therefore, investors must remain rational, avoid over-investment, and be prepared to deal with possible market fluctuations. Any investment strategy comes with risks, and when choosing the appropriate holding style, investors need to consider their own financial situation, market changes, risk tolerance, investment goals, and life situation comprehensively. Especially, one needs to understand what kind of person they are, understand their weaknesses. High-risk investments may bring high returns, but the possibility of losses is also higher.

Investments need to be made in a relatively calm state, and one should never invest under the expectation of making a profit to solve temporary financial difficulties or repay debts. This mindset often leads to the probability of losing all funds.

Disclaimer: This article is only for educational and informational purposes on different types of investment styles and sharing, and does not constitute specific investment advice. Investors should make their own judgments based on their own characteristics.