1. Overview

Credit Suisse has partnered with the Swiss Football Association to launch an Ethereum-based NFT series to support Swiss women's football. According to the information on Credit Suisse's website, this NFT series includes 756 digital art portraits of players from the Swiss women's national football team. It will be exclusively available for sale through Credit Suisse's CSX application from July 11th to August 31st. This marks Credit Suisse's entry into the NFT field.

According to DeBank data, an address starting with 0x225d and marked as 1inch: Investment Fund removed two transactions of Uniswap V3 LP, receiving approximately 11,000 ETH. Subsequently, the ETH was converted to WETH and exchanged for DAI through several transactions. All the exchanged DAI was then converted into CHAI, the interest-bearing token launched by MakerDAO. Currently, it holds approximately 26.78 million CHAI tokens.

In the secondary market, the price of ETH may continue to consolidate in the short term, with support at $1850 and resistance at $1900.

2. Secondary Market

1. Spot Market

According to OKX market data, the price of ETH dropped to $1825 last week and closed at $1866 for the week, a decrease of 2.7% compared to the previous week.

ETH daily chart, from OKX

The daily chart shows that the price is currently consolidating around $1860, with support at $1850. If it falls below, it may further decline to $1800; the resistance above is $1900.

2. Network Status

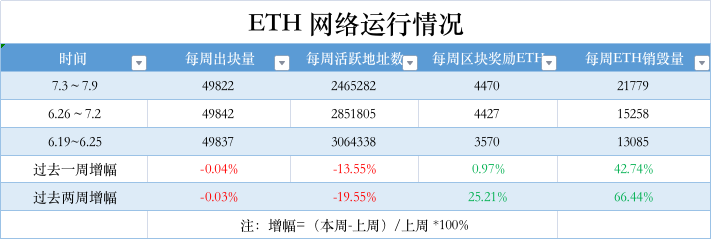

Etherscan data shows that the number of blocks generated by the Ethereum network in the past week was 49822, which is basically the same as the previous week; the number of active addresses per week is 2465282, a decrease of 13.55% compared to the previous week; the block reward income is 4470 ETH, a 1% increase compared to the previous week; the number of ETH burned per week reached 21779, a 42.7% increase compared to the previous week.

3. Significant Changes

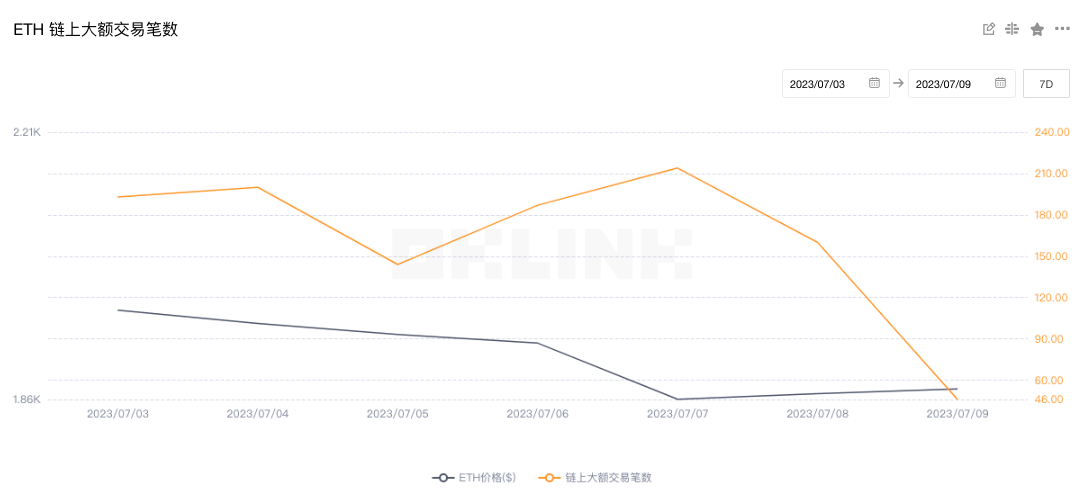

OKlink data shows that the number of on-chain large transactions reached 1144 last week, a 33.2% decrease compared to the previous week (1713), indicating a significant decrease in whale trading activity.

4. Top Wealthy Addresses

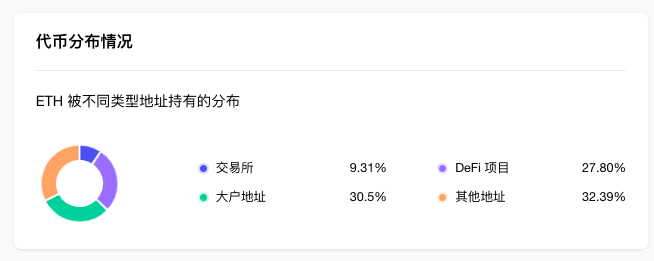

OKLink Data shows that from the distribution of ETH holding addresses, exchanges account for 9.31%, a 0.19% increase compared to the previous period; DeFi projects account for 27.8%, a 0.14% increase; large addresses (excluding exchanges and DeFi projects) account for 30.5%, a 0.26% decrease; other addresses account for 32.39%, a 0.13% decrease.

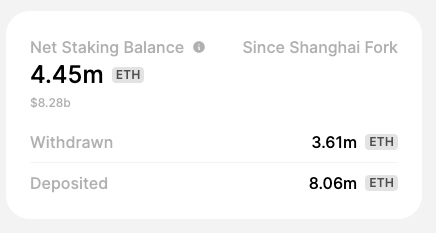

token.unlocks shows that the total staked amount of ETH in the entire network is 21.01 million ETH, with a staking rate of 17.14%; since the upgrade in Shanghai, the cumulative deposit amount is 8.06 million ETH, last week's data was 7.80 million, with an increase of 260,000 in the past week; the cumulative withdrawal is 3.61 million, last week's data was 3.55 million; the net staking amount has increased by 4.45 million, the previous week's data was 4.25 million, with an increase of 200,000 in the past week.

5. Lock-up Data

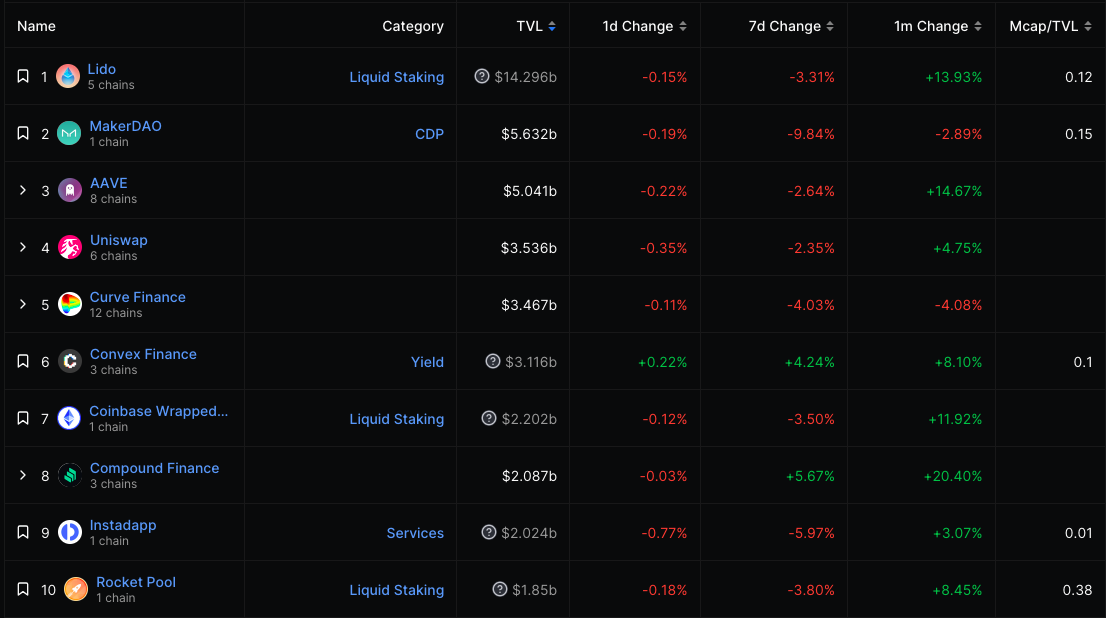

DeFiLlama data shows that the value of on-chain locked collateral decreased from $26.98 billion to $26.01 billion last week, a decrease of 3.5%. In terms of individual projects, the top three in locked value are: Lido with $14.29 billion, MakerDAO with $5.63 billion, and Aave with $5.04 billion.

III. Ecosystem and Technology

1. Technological Progress

Christine Kim, Vice President of Galaxy Research, summarized the 165th Ethereum All Core Developers Execution (ACDE) Call.

First, let's analyze the impact of EIP-6466 and 6406. EIP-6466 and 6406 are code changes that update the encoding of the two block header fields transactions_root and receipts_root from RLP to SSZ. Blockchain security and audit company Dedaub analyzed that the SSZ update will affect three major projects: LayerZero, a blockchain interoperability protocol, zkBridge, a cross-chain bridge, and Telepathy, an oracle. Despite the impact on these applications, Dedaub Director Neville Grech stated that all three can be upgraded to accommodate the code changes implemented through EIP-6466 and 6406. Danny Ryan stated that no decision needs to be made during this call regarding the implementation or timing of transitioning from RLP to SSZ and that the information shared by the Dedaub team should be considered in future discussions.

About Cancun/Deneb testing, Parithosh Jayanthi, a DevOps engineer at the Ethereum Foundation, stated that the Devnet #7 upgrade for Cancun/Deneb was launched on June 30th. The test network is progressing smoothly and has identified some issues in client implementation. Once the client issues are resolved, attempts will be made to send Blob transactions to the network over a longer period of time to understand how the network handles the load of 3 target blobs/blocks. Jayanthi emphasized that among these issues, one problem affected the staking ETH deposits, which should be further investigated by the Teku and Prysm consensus layer client teams. Representatives from the Geth and Nethermind execution layer teams also shared the issues they are actively addressing in preparation for the next stage of testing for Devnet #7.

About the Builder Override Flag, Mikhail Kalinin, a Teku (CL) developer, asked the EL client team if they are willing to accept the changes to the engine API in the Cancun upgrade. This change aims to create a Boolean flag in the "get_payload" API command that returns true if the EL client of an Ethereum validator node detects audit behavior.

In addition, EIP-4788 introduces a new precompile that is a cost-effective smart contract operation that exposes information about CL on EL to prevent excessive use of storage space through code changes. This feature will unlock many use cases for decentralized applications such as staking pools and re-staking protocols, which benefit from minimized trust access to the CL state. Alex Stokes, a researcher at the Ethereum Foundation, stated that this modification will be merged into the final EIP-4788 specification for implementation in Cancun as soon as possible.

Ethereum client Lighthouse releases version 4.3.0, supporting the Gnosis Capella upgrade

The Lighthouse development team, Sigma Prime, has announced the release of Lighthouse v4.3.0. This version supports the Gnosis Capella upgrade, and Gnosis users must upgrade to v4.3.0 before August 1st.

2. Community Voice

Ethereum developers Diyahir and Meir Bank, a community member of Fluid Protocol, jointly propose the creation of the ERC-7265 standard. This standard aims to introduce a "Circuit Breaker" smart contract interface to the DeFi ecosystem to solve the problem of delayed response in the face of hacker attacks in DeFi.

The effective logic of ERC-7265 is that the "Circuit Breaker" will real-time monitor the flow rate of each asset in the DeFi system. When this rate exceeds the predefined parameter threshold, the smart contract will be triggered, immediately pausing the token outflow of the protocol.

The proponents of this standard believe that with ERC-7265, hackers will no longer be able to deplete the funds within the entire contract within a few seconds after executing an attack, thus ensuring the security of most of the funds within the DeFi protocol.

The team member of Lido, the liquidity staking protocol, accused competitor Rocket Pool of being too centralized in a social media post on July 4th. Dmitry Gusakov, the Staking Lead of the Lido community, stated in the post that the Rocket Pool contract is controlled by the Rocket Pool team, allowing them to change any parameters and invoke any methods. This means that Rocket Pool developers can increase the inflation rate to any percentage or raise fees up to 100%.

Gusakov claimed that this vulnerability does not exist in the Lido contract because in Lido, these actions are "fully controlled by the decentralized autonomous organization LidoDAO".

It is reported that the RocketStorage contract (ethereum address starting with 0x1d8f) contains a parameter named "guardian", and many functions in the Rocket Pool contract are also marked as "onlyGuardian", meaning they can only be called by the accounts listed in this parameter, which is currently set to the Rocket Pool deployer's account.

Waq, a member of the Rocket Pool funding management committee, responded to these accusations, stating that the team is aware of this vulnerability and will address it in the future. Waq accused the Lido team of trying to take credit for discovering a known issue. (Cointelegraph)

3. Project Trends

(1) EigenLayer: Expected to increase the upper limit of liquidity re-staking tokens next week

EigenLayer officially announced that the maximum limit for the re-collateralization of liquidity for stETH, rETH, and cbETH projects will be increased to 15,000 tokens, with no individual deposit restrictions. The protocol parameter changes require approval from the multi-signature governance system and are expected to be completed at some point next week. Previously, the maximum limit for the re-collateralization of liquidity for stETH, rETH, and cbETH projects was set at 3,200 tokens on June 16th.

(2) Proposal to "Freeze TUSD Reserves on Aave V2 Ethereum Pool" has been executed

The governance page shows that the AIP proposal submitted by the Aave community to "Freeze TUSD reserves on the V2 Ethereum Pool" has been executed. Previously, on July 2nd, the Aave community conducted an on-chain vote to support the AIP proposal, with a approval rate of 83.76%. The proposal will be executed on-chain within one day. According to the proposal, following the recent TUSD incident, it is proposed to freeze the TUSD reserves on the Aave V2 Ethereum Pool, which will prevent users from depositing or borrowing TUSD on the Aave V2 Ethereum Pool. This will not affect current positions, and users can still repay and withdraw TUSD from the Aave V2 Ethereum pool. This AIP aims to take a conservative approach to the TUSD situation, allowing the community to step back and evaluate the situation before making any further decisions.

(3) Loopring L3 launches Taiko alpha-3 zkEVM testnet

Loopring announced the launch of Loopring L3, an Ethereum Layer 2 network based on zkRollup, with the alpha-3 zkEVM testnet of Taiko to achieve greater scalability and highly optimized experience. The L3 smart contract wallet release will support exchange and transfer functions and has been launched on the iOS and Android versions.

(4)Decentralized Ethereum Staking Infrastructure SSV.Network Announces Mainnet Launch Schedule

Decentralized Ethereum Staking Infrastructure SSV.Network has announced the launch schedule for its mainnet, which will be rolled out in four phases: pre-launch, limited launch, launch, and permissionless launch. The team plans to kick off the first phase of the mainnet launch in early Q2 2023 and prepare for the permissionless launch by Q4 2023. SSV.Network is a decentralized validator infrastructure based on DVT technology.

(5)Ethereum ZK Coprocessor Axiom Releases alpha Version on Mainnet

Ethereum ZK coprocessor Axiom has released the alpha version on the mainnet. Axiom aims to provide smart contracts with trustless access to all on-chain data, allowing developers to access historical on-chain data and perform verified computations by querying Axiom, thus enhancing blockchain consensus with zero-knowledge proofs.

(6)L2 Network PGN Launched Based on OP Stack, with Governance Consortium Members including Gitcoin

Gitcoin introduces the Public Goods Network (PGN) based on OP Stack, a Layer 2 network. It is reported that PGN is a highly composable EVM-compatible Rollup, and most of the sequencer net revenue is planned to support the Ethereum ecosystem and other public goods. Currently, the deployment and infrastructure of PGN are ready for testing, including cross-chain bridges, transaction views, block explorers, and core infrastructure. After 6 months of mainnet launch, the accumulated impact data will be evaluated to determine the allocation of fees and join the network alliance. PGN promises to conduct experiments for at least two years, allowing partners to run Dapps on PGN to support public goods funding. PGN governance alliance members include Protocol Guild, Public Nouns, Clr.fund, Giveth, Hypercerts, Protocol Labs, Octant, Eco, Hedgey, Gitcoin, etc., and they will oversee the allocation of sequencer fees to ensure the growth and sustainability of public goods funding.

(7) dYdX: Milestone 4 achieved ahead of schedule, dYdX v4 testnet officially launched

Decentralized derivative protocol, dYdX, announced on Twitter that dYdX v4 testnet has officially launched. Previously, the dYdX Chain public testnet was scheduled to go live on July 6th at 1:00. With the achievement of Milestone 4 ahead of schedule, the necessary features for the launch of the public testnet, including more validators (over 40) running their software, have been completed. The public testnet will support Bitcoin and Ethereum markets, and with network upgrades, it will include approximately 30+ markets. dYdX founder Antonio Juliano has stated that dYdX v4 will be fully open-source and does not include any commercial copyright licenses, allowing anyone to freely use the code.

According to DeBank data, the address starting with 0x225d and marked as 1inch: Investment Fund removed two Uniswap V3 LP transactions, receiving approximately 11,000 ETH. The ETH was then converted to WETH and exchanged for several transactions of DAI. All the exchanged DAI was then converted to CHAI, the interest-bearing token launched by MakerDAO, currently holding approximately 26.78 million CHAI. CHAI (chai.money) is an ERC-20 token that allows users to earn interest based on Dai without locking it in the Dai Savings Rate. It can be freely transferred and can continuously exchange for more Dai. The address for CHAI on the Ethereum mainnet is 0x06AF07097C9Eeb7fD685c692751D5C66dB49c215.

According to CCData, the trading volume of CME Bitcoin futures in June increased by 28.6% to $37.9 billion, reaching a new historical high. Micro Bitcoin futures (MBT) also achieved double-digit growth with a trading volume of $702 million, a 21.1% increase. These contracts have smaller sizes and are usually worth only one-tenth of a standard contract. In CME Bitcoin futures, this ratio is 1/50. In June, a total of 264,323 Bitcoin contracts were traded on CME, an increase of 22.7% compared to the previous month; as well as over 97,000 ETH futures contracts, an increase of 10.8% compared to the previous month. Overall, the trading volume of these contracts increased by 24.6% compared to the previous month, reaching $46.8 billion, the highest level since May 2022. (Decrypt)

Credit Suisse is partnering with the Swiss Football Association to launch an Ethereum-based NFT series to support Swiss women's football. According to information on the Credit Suisse website, the NFT series includes 756 digital art portraits of Swiss women's national team players and will be exclusively sold through Credit Suisse's CSX application from July 11th to August 31st. This move signifies Credit Suisse's entry into the NFT space. (The Block)