This article comes from: Fortune

Original author: Anna Tutova

Compiled by: Odaily Azuma

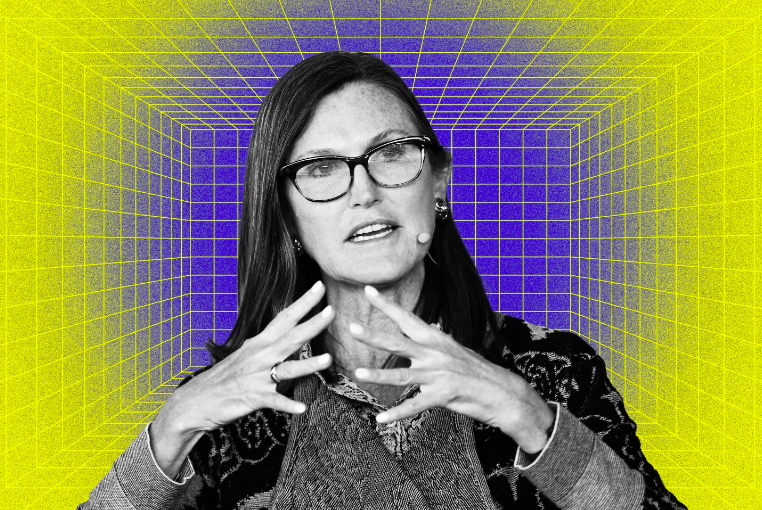

On July 6, Fortune magazine published an article on ARK Invest CEO Cathie Wood, which focused on the Bitcoin spot ETF, which is currently attracting a lot of attention. In the exclusive interview, Sister Mu reviewed the past history of ARK Invest’s application submissions and emphasized that she did not believe that BlackRock had an advantage over ARK Invest in terms of applications.

The following is the entire content of the interview, compiled by Odaily.

Last week, I met Cathie Wood at the ImPower Fund Forum summit in Monaco, and had the opportunity to sit down and chat with her. ARK Invest, which she directs, focuses on disruptive innovation industries and is known for her research on Crypto and Web3. Known for bold investments.

ARK Invest has made headlines recently for resubmitting a Bitcoin spot ETF application to the U.S. Securities and Exchange Commission (SEC). Cathie Wood said that this application was submitted after the SEC repeatedly rejected applications from ARK Invest and other similar companies. This may give ARK Invest the opportunity to launch the first Bitcoin spot ETF in the United States and seize the market. Take the initiative.

In our conversation, Cathie Wood shares her thoughts on Bitcoin’s potential, the challenges of the regulatory environment, and her vision for the future of digital assets. The interview questions and answers below have been edited to keep the text concise and clear.

Q1: Can you describe how your idea of ARK Invest first came about?

Cathie Wood:Prior to founding ARK Invest, and particularly in the wake of the tech and telecom meltdowns and the economic crisis of 2008-09, I saw the traditional asset management world moving away from innovation in favor of passive and benchmark-sensitive strategies. I said, No, we have to focus on innovation because there are five major technologies that are evolving right now. That includes DNA sequencing, robotics, energy storage, artificial intelligence and blockchain technology, all of which are developing at the same time.

These innovations will lead to explosive growth—what we call super-exponential growth—and we don’t think people understand that yet. They will disrupt the traditional world order, so we want to focus on change and educate more people to realize this. We have an open research ecosystem and also provide our research results for free. We love to see people commenting on our research, especially from front-line innovation fields, which can give us more feedback and test our hypotheses.

Q2: What about your involvement in cryptocurrency and blockchain? I learned that you started personally investing in Bitcoin in 2015. Can you tell us your initial impressions of Bitcoin and this technology?

Cathie Wood:We have been curious about Bitcoin since 2011. Our chief futurist, Brett Winton, is really fascinated by this, so we talk about it frequently. When ARK Invest was created, we began to devote resources to research, and now ARK Invest has three cryptocurrency analysts.

In 2015, our analysts wrote a paper. I asked my mentor, the famous economist Art Laffer, to read it and critique it. When he found out what Bitcoin was, he said, “This is what I’ve been waiting for since the dollar went off the gold standard!” My reaction was, “Well, that sounds great!

That was in 2015, when the price of Bitcoin was $250, and we opened our first Bitcoin position through GBTC.

Q3: BlackRock has also recently submitted an application for a Bitcoin spot ETF, and ARK Invest jointly submitted an application with 21 Shares in April last year (but was rejected). Do you think this attempt will be successful?

Cathie Wood:Well, a lot of people think BlackRock knows something about the SEC, and we dont think thats true. We believe that this situation (should refer to the SECs repeated rejection of applications) has been going on for a long time, but the Grayscale v. SEC case (questioning why the SEC rejected its Bitcoin spot ETF application) will be concluded in the near future - — Possibly in August — If the SEC loses this case, the chances of a Bitcoin spot ETF passing review increase.

We have submitted the application, and the SEC will review it before mid-January next year, and BlackRock will review it before March next year. The SEC has now approved a number of Bitcoin futures ETFs and most recently approved a leveraged Bitcoin futures ETF. Futures involve swaps, while spot ETFs (at least the grayscale version) are completely supported by Bitcoin stored in cold wallets as reserves, so we believe that spot trading is safer than futures. In our opinion, SEC approval The situation (pass futures ETFs, reject spot ETFs) is contradictory.

Odaily Note: Grayscale filed a lawsuit against the SEC in June 2022. Grayscale’s previous application to convert GBTC into a Bitcoin spot ETF was rejected by the SEC. The SEC said that there was fraud and manipulation in the spot Bitcoin market. Grayscale stated that any fraud that occurred in the Bitcoin spot market would inevitably affect Bitcoin. The price of futures, but the SEC has approved some applications for Bitcoin futures ETFs, this logic does not hold up.

Q4: If the SEC finally approves a Bitcoin spot ETF, to what extent do you think this will change the development of the crypto industry?

Cathie Wood:We have always been worried that the SEC will drive innovation out of the United States. Innovation has always been in Americas DNA, which is why were pleased that both the judicial and legislative branches are getting involved.

So this (Bitcoin spot ETF approval) may mean that once we have the rules fully put in place, we will stop driving out innovation and bring more innovation back. This is also going to be a global phenomenon and were very excited because there are a lot of other innovation hubs that are trying to do this and we want to do it too because this is a global movement.

Q5: Do you think the SEC will favor BlackRock? That is, approve their application but reject yours.

Cathie Wood: We dont think so. We know that their applications have an oversight sharing provision and ours does not, but as far as I know it wont take us much time to revise the applications and all agencies applications are moving in that direction.

Odaily note: This interview with Fortune was completed last week, but was published for the first time today. Shortly after the interview was completed, ARK Invest had amended its filing to add a BlackRock-like oversight sharing agreement.

Q6: There are some other cryptocurrency news that are getting a lot of attention at the moment, such as the recent launch of EDX Markets, and other large institutions such as Citadel Securities and Fidelity are getting involved in cryptocurrencies. What do you think of this?

Cathie Wood: Yeah, I think some of the events in the last year to date have disrupted the rhythm of institutional development, like FTX and all the turmoil, and then some of the lawsuits, especially the SEC lawsuit against Coinbase. But I think weve seen the worst of it, and the interesting results are that were finding that institutions want to know more, and theyre becoming more sophisticated. So, you can see they want to be ready for new asset classes.