1. Overall overview

1. Overall overview

UBS announced that Bank of China International (BOCI) successfully issued RMB 200 million fully digital structured notes for the first time, becoming the first Chinese-funded financial institution to issue blockchain digital securities in Hong Kong. The product is initiated by UBS and sold to its clients in the Asia-Pacific region. When the two parties issued this blockchain digital bill, they made new attempts in terms of applicable laws and blockchain types. This issuance is the first in the Asia-Pacific region to be established in accordance with the laws of Hong Kong, China and Switzerland. It is the first time to digitize the blockchain on the Ethereum public chain and successfully introduce regulated securities into the public chain. It is reported that BOCI is a wholly-owned subsidiary investment bank of Bank of China.

Second, the secondary market

Second, the secondary market

1. Spot market

image description

ETH daily chart via OKX

The daily chart shows that the price is currently consolidating around $1,750, and the lower support level is $1,700; if the support is valid, it may continue to test $1,800 in the short term; if it falls below, it may fall further to $1,600.

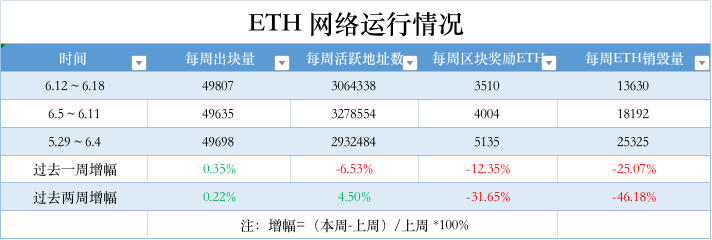

2. Network operation

Etherscan 3. Large transaction

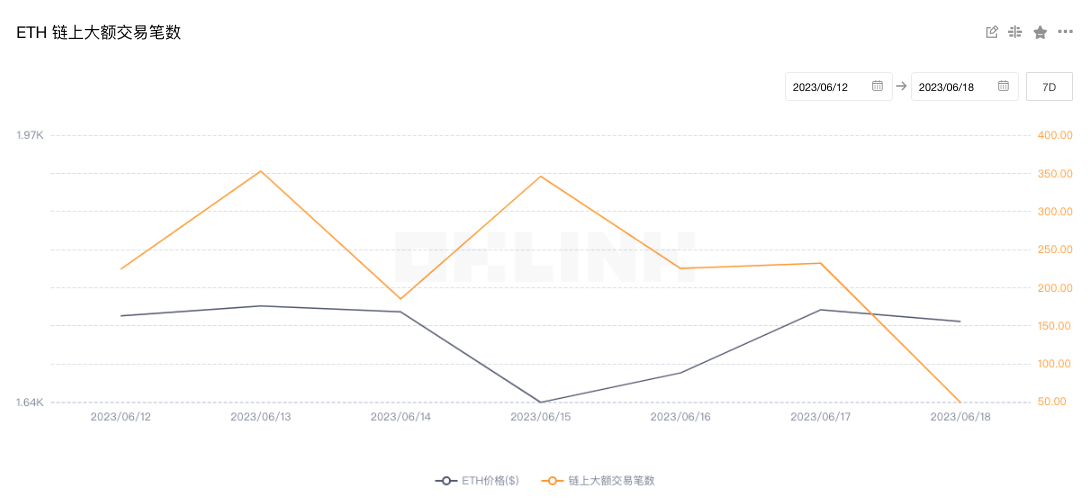

3. Large transaction

OKlink data4. Rich list address

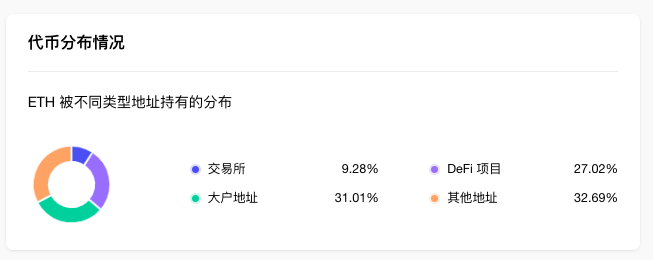

4. Rich list address

OKLink dataOKLink data

token.unlocksIt shows that from the perspective of the distribution of ETH holding addresses, exchanges accounted for 9.28%, an increase of 0.11% month-on-month; DeFi projects accounted for 27.02%, an increase of 1.4% month-on-month; large addresses (top 1000 addresses excluding exchanges and DeFi projects) Accounted for 31.01%, down 1.03% month-on-month; other addresses accounted for 32.69%, down 0.48% month-on-month.

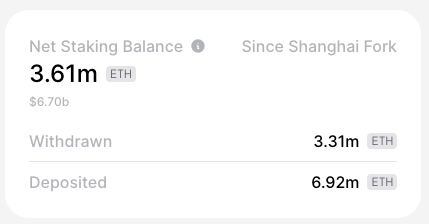

It shows that the total amount of ETH pledged in the entire ETH network is 19.85 million ETH, and the pledge rate is 16.28%. The figure last week was 3.18 million; the total net pledge volume increased by 3.61 million, compared with the previous week's data of 3.4 million, an increase of 210,000 over the previous week.

DeFiLlama1. Technological progress

3. Ecology and technology

1. Technological progress

111th Ethereum ACDC Meeting: Three proposals planned to be included in the Deneb specification in the next few weeks including EIP-7044

- EIP-7045: Proposed code changes to strengthen network security, extending proof slot inclusion from a rolling window of one epoch to two epochs. The EIP, proposed by Danny Ryan, a researcher at the Ethereum Foundation, is undergoing more discussion and final review.

- EIP-7044: Proposed code changes to improve staker experience, ensuring signed validator exits are permanently valid.

- EIP-7045: Proposed code changes to strengthen network security, extending proof slot inclusion from a rolling window of one epoch to two epochs. The EIP, proposed by Danny Ryan, a researcher at the Ethereum Foundation, is undergoing more discussion and final review.

- EIP-4788: Proposing code changes to improve staker experience, this EIP will expose the root of the beacon chain block, which contains EVM internal chain state information, for trust-minimized access by DApp developers. This EIP was proposed by Ethereum Foundation researcher Alex Stokes and was incorporated into Cancun and Deneb during ACDE #163.

- EIP-4788: Proposing code changes to improve staker experience, this EIP will expose the root of the beacon chain block, which contains EVM internal chain state information, for trust-minimized access by DApp developers. This EIP was proposed by Ethereum Foundation researcher Alex Stokes and was incorporated into Cancun and Deneb during ACDE #163.

Stokes stated that it is planned to incorporate the three aforementioned EIPs into the Deneb specification in the coming weeks, and encouraged the CL client team to review them as soon as possible. Meanwhile, the CL client team has agreed to test the increased number of blobs on Devnet 6, the next EIP-4844 testnet, and will make a final decision on the matter within two weeks.

Additionally, Ethereum core developers had their first coordination call regarding the launch of the Holesky testnet, which is expected to replace the existing Goerli testnet by the end of the year. In terms of active validators, it is expected to be twice the size of the Ethereum mainnet.

2. Voice of the Community

JPMorgan strategists say Congress will either simply classify ethereum in the same commodity category as bitcoin, or place it in a new "other category" with less regulatory burden than securities. JPMorgan strategists led by Nikolaos Panigirtzoglou wrote in a note on Thursday that "a new 'other category' may be introduced specifically for ethereum and other cryptocurrencies that are sufficiently decentralized to Designation as a security could be avoided. This 'other category' would involve more restrictions and investor protections than are currently envisaged for commodities, but less onerous than that required for securities." (The Block)

3. Project trends

(1) Aave has implemented the "BUSD Delisting Plan Part II" proposal to incentivize inactive borrowers to exit

(2) ENS contributors publish new proposals aimed at updating the ENS name canonicalization standard

(3) Decentralized hosting protocol Safe integrates P2P.org's Ethereum pledge service

(4) EigenLayer deploys the Restaking protocol on the Ethereum mainnet

(5) Web3 infrastructure project Rated launches UMA-based Rated Oracle

(6) The Lido community initiated a new proposal to promote the sustainable growth of stETH according to the hierarchical reward sharing plan

The Lido community launched the proposal "Layered Reward Sharing Program: A Sustainable Approach to Growth of stETH", proposing to provide 5% of the DAO's staking reward share to participants who use Lido to stake ETH in order to strengthen the Ethereum network by increasing the use of the Lido protocol security.

The plan is divided into three stages: application and evaluation (Onboarding), reward sharing (Rewards-Share) and exit (Offboarding). Participants must demonstrate the ability to drive a minimum of 2,500 ETH pledged to Lido within 12 to 24 months. For each ETH staked by participants, the DAO will share the reward within 12 months from the date of staked ETH. Reward sharing shares will be issued based on different ETH pledged amounts.

The program will be governed by a Reward Share Committee, which will control a multisig wallet responsible for vetting and filtering participants, abuse analysis/disqualification, reward calculation, and reward distribution. The committee will start with an initial reward pool of 3000 stETH. When the funds are depleted, the DAO will vote on whether to replenish them.

(7) The Graph is in the final stages of migrating to Arbitrum

Decentralized indexing protocol The Graph has entered the final stages of migrating to Arbitrum. This migration aims to reduce gas fees, speed up transactions, and increase the accessibility of the protocol. Previous network participants voted on improvement proposals and approved the transition to Arbitrum. The process begins in 2022 with initial deployment as Phase 1 and Phase 2 enabling Layer 2 protocol rewards. Today marks the start of the third phase of the integration, representing a full migration to the Arbitrum network.

(8) The Ethereum Foundation announced the list of donations for the first quarter of 2023, and ETH Beijing was selected

(9) Frax Finance released the Ethereum Layer 2 network Fraxchain, which may be launched by the end of this year

Stablecoin protocol Frax Finance released the Ethereum Layer 2 network Fraxchain, which is committed to creating a smart contract platform that emphasizes decentralized finance. The network may be launched before the end of this year. According to reports, Fraxchain will be a hybrid rollup, EVM compatible L2 network. Hybrid rollups combine an optimistic rollup architecture with zero-knowledge proofs, thereby providing developers with an easy-to-code environment and giving users the finality, security, and decentralization that ZK rollups provide.

Fraxchain will be managed by Frax Shares (FXS) token holders. The network will use Frax, a stablecoin, and FraxEther, a liquid collateralized derivative, to pay transaction fees. Users will need to redeem their native assets on-chain or via the frxETH bridge to execute the transaction.

(10) BOCI issued 200 million yuan of digital structured notes on the Ethereum chain