key points

Original compilation: Luffy, Foresight News

key points

The collapse of FTX and the loss of customer funds has severely affected the trust of crypto users in centralized exchanges (CEX). Users are now demanding more transparency and protection from exchanges.

Many exchanges have begun to provide proof of asset reserves. Exchanges such as Binance and Bitget have added protection funds. Note that these do not guarantee the solvency of the exchange without a breakdown of liabilities.

Binance has maintained its dominance in the market, but it is not the only beneficiary of FTX's exit. After FTX, Bitget's derivatives trading volume has grown significantly, while Binance and OKX continue to maintain a favorable position in the derivatives business.

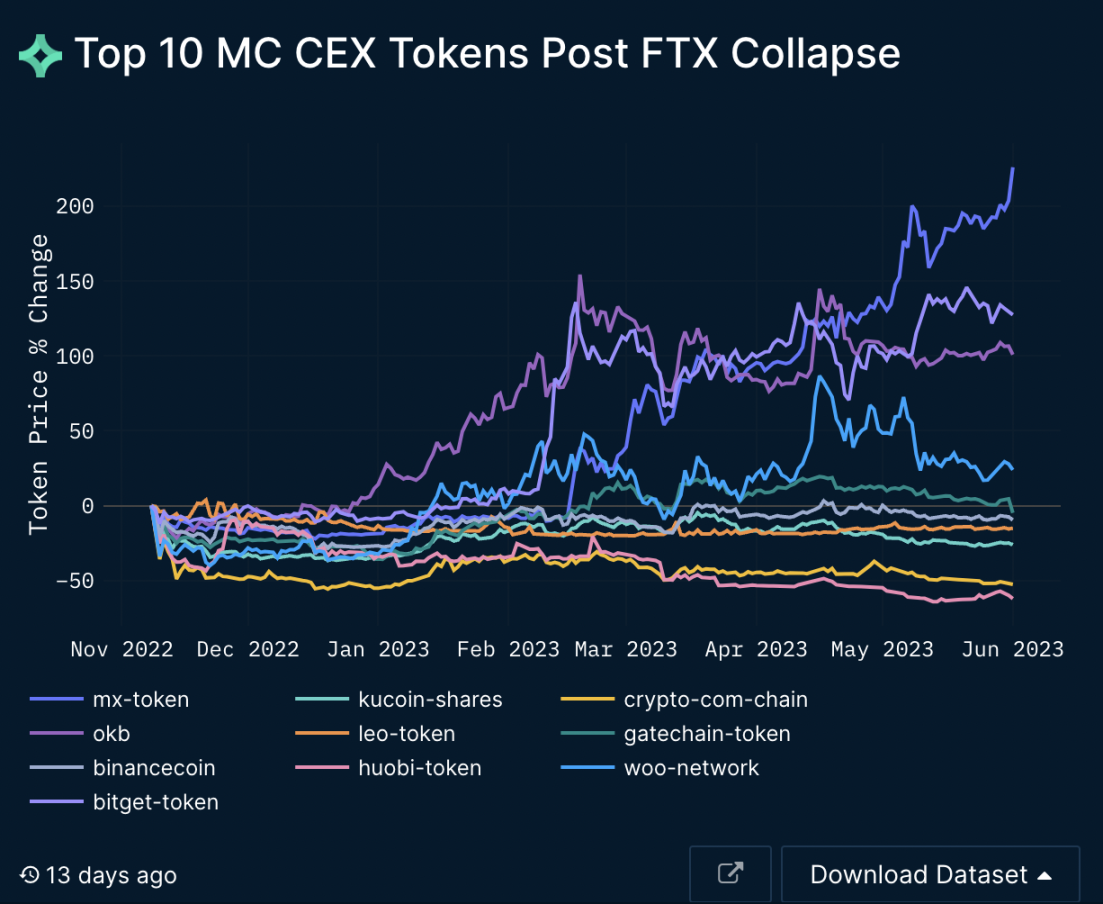

After the FTX crash, exchange tokens MX, BGB, and OKB performed strongly.

In a competitive environment, successful exchanges will prioritize security, transparency, user trust, and ecosystem building. At the same time, it is also important to meet the needs of users, provide a powerful feature set, and a great user experience.

Overview of the recent CEX pattern

FTX is a typical representative of CeFi, has been recognized by many famous people, and even sponsored stadiums. Behind the scenes, however, the exchange has beenMixing client funds with its market maker Alameda, resulting in a loss of $4 billion in customer deposits, and eventually filed for bankruptcy. The FTX incident caused shock waves across the industry, and people's confidence in centralized exchanges plummeted. This report aims to examine the CEX landscape after FTX and the general trends we see.

renewed focus on credibility

The FTX incident seriously damaged users' trust in CEX. Since then, users have demanded more transparency from exchanges, with a focus on proof-of-reserve and protection funds.

proof of reserve

Many exchanges started offering Proof of Reserve (PoR) in response to the crisis of trust. Proof of reserve refers to the act of CEX publicly declaring its reserve assets. This is usually done through an independent audit, the purpose of which is to provide transparent and verifiable evidence that the exchange has sufficient asset reserves to cover customer deposits.

While this is a step in the right direction, PoR does not guarantee the solvency of an exchange without a corresponding breakdown of its liabilities. A Proof of Liabilities would be a more convincing approach, but it is off-chain and requires independent auditing. And the audit itself has proven to be questionable, as did FTX before it crashed.

image description

source:Nansen

CheckCheck。

protection fund

The purpose of the protection fund is to provide margin coverage when client assets are lost. By establishing a protection fund, exchanges aim to reassure their customers that in the event of a hack, the exchange will have funds to cover deposits (as long as the size of the funds exceeds the size of the hack). This scheme can be viewed as an over-collateralization of customer deposits.

Outside of protecting funds, implementing risk management best practices, such as storing funds dispersedly across multiple addresses, is also critical to effectively mitigate the impact of various hacks. After the FTX crash, Binance increased the dollar value of its fund from $735 million to $1 billion. Likewise, Bitget increased its protection fund from $200 million to $300 million.

The table below lists the largest exchange protection funds in the industry. It’s worth noting that at the time of writing, Binance and Bitget are the only two centralized exchanges that have disclosed the address of the protection fund’s wallet:

Proof of Reserves should be the minimum standard for the exchange industry, however, as mentioned above, these are positive indicators for an exchange not enough to guarantee its solvency.

The Changing Landscape of CEX

total transaction volume

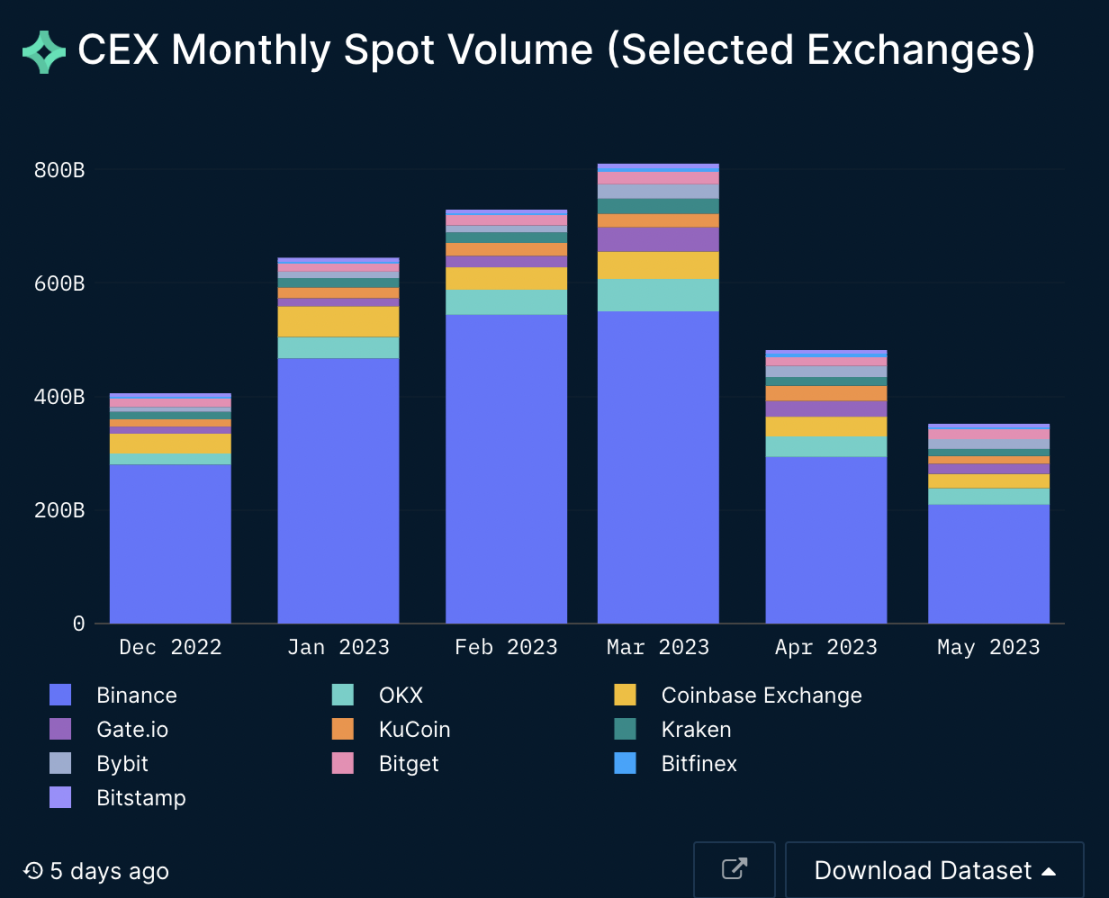

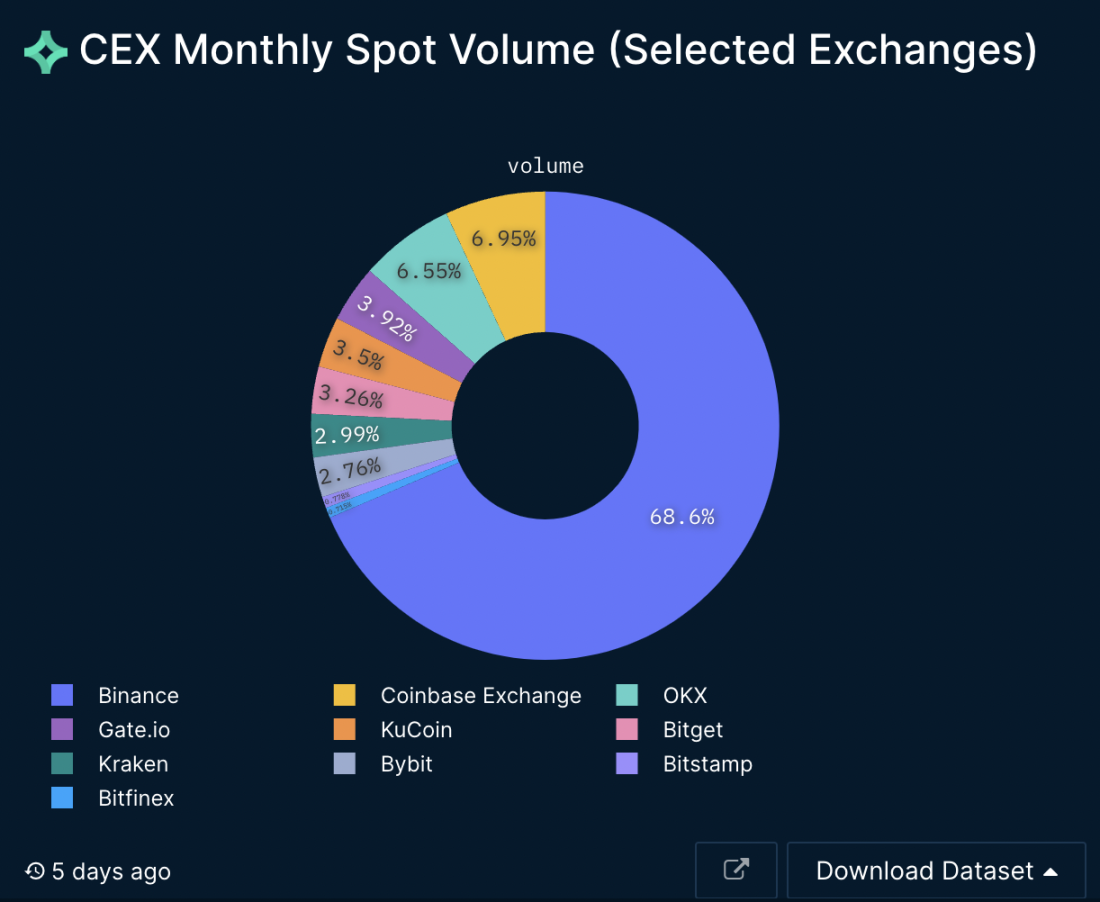

Binance has maintained a relatively stable trading volume. Taking the FTX storm as the dividing point, the average monthly trading volume in the first 6 months was 470 billion US dollars, and the average monthly trading volume in the following 5 months was 428.4 billion US dollars. This means that Binance trading volumes have fallen by about 10%, remaining relatively stable. Note that trading volume can be an important indicator of an exchange's performance, but this metric can also be manipulated through things like knock-offs.

image description

image descriptionNansen

source:Nansen

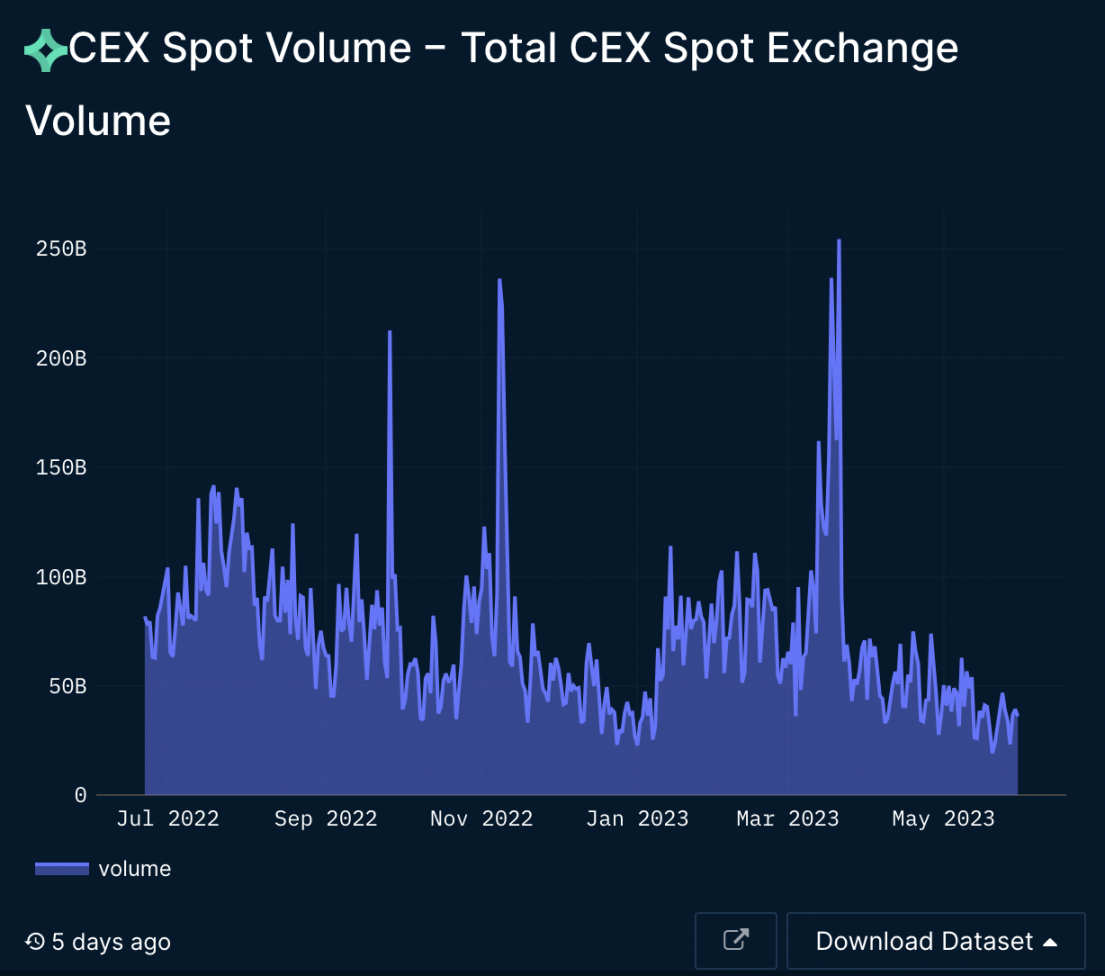

image description

source:Nansen

The data shows that in the 6 months following the FTX crash, spot trading volumes have declined slightly. The massive spike in late March can be attributed to the Arbitrum airdrop frenzy. Spot trading volumes have taken a hit on most exchanges, with the exception of Bybit and Kraken, which took steps to manage to increase their trading volumes.

image description

Data as of May 31, 2023

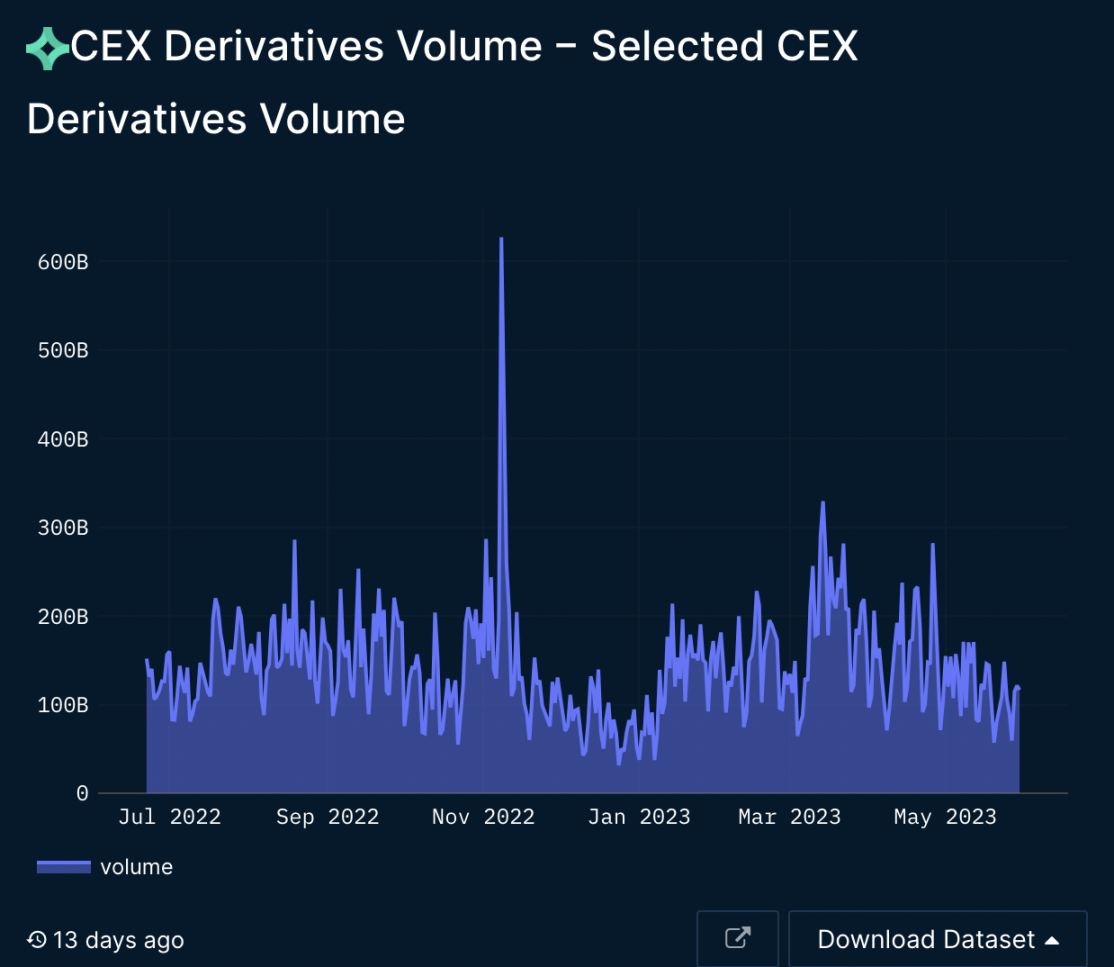

Derivatives trading volume

source:

source:Nansen

image description

Data as of May 31, 2023

FTX was originally known for its leading derivatives business. Derivatives volumes have declined among the top CEXs, with the exception of Bitget, which saw their derivatives volumes grow in the 6 months following FTX.

Binance

Bitget

Bybit

Binance

Overall, Bitget has done a great job of managing to capture more trading volume. Bybit and Binance saw small declines but generally retained most of their trading volume (and expanded their market share), while other exchanges saw a bit more decline. This could also be due to the general decline in trading activity during crypto bear markets.

Types of Tokens Listed

Different exchanges employ different listing strategies. For example, Binance only lists projects that have shown considerable market interest and trading volume elsewhere. In contrast, Gate.io has taken a more relaxed approach and listed a large number of tokens of unlisted projects for initial exchange offerings (IEO).

Since the FTX crash, some exchanges have become more responsive to user needs and market trends. Let's take the example of BRC-20, which grew to a $1 billion market cap within 3 months of launch.

The first four exchanges to list BRC-20 are Gate, Bitmart, Digfinex and Bitget.

Gate.io: Launch ORDI on May 8th

Bitmart: Launch ORDI on May 8

Digfinex: Launch ORDI on May 9

Bitget: ORDI will be launched on May 10

Quickly listing new tokens is key to meeting the changing needs of users, and many traders can benefit from new tokens. However, exchanges must balance listing coins while protecting users from scams. This is important for maintaining the reputation of the exchange, which is why the largest exchanges such as Coinbase, Binance, and Kraken have taken a more conservative approach to listings. However, slow listing of tokens can have adverse effects on exchanges, such as missing out on the volume of popular tokens and the recent memecoin wave, etc.

Compliance

Upcoming regulations targeting DeFi and cryptocurrencies could present some major challenges for exchanges. SEC Chairman Gary Gensler believes that almost all tokens are securities, which may prevent many exchanges from operating in the United States. If the US takes this official stance, it could create serious problems for CEXs globally.

source:Twitter

platform currency

source:

source:Nansen

MX

MX provides additional utility and benefits to users of the exchange. In addition, MEXC spends 40% of its profits on repurchasing and burning MX every quarter to keep the circulating supply of tokens at 100 million.

BGB

The utility of BGB involves improving the user experience of Bitget by reducing fees, obtaining exclusive products, etc. Bitget is expected to launch a buyback and burn plan for BGB in the near future. Read more here.

OKB

OKB is also an access credential to numerous products and benefits on the platform. It conducts buybacks and burns every quarter based on “seasonal market and operating performance.” In the last report, they bought back and burned the equivalent of $177 million in OKB in 3 months.

The impact of buybacks and burns on token prices is debated, with some arguing that it creates no value. However, with steady cash flow, the buying power of buybacks may contribute to stronger token performance.

BNB

image description

Data as of May 31, 2023

The above table shows the market performance of the CEX platform currency from December last year to May 31 this year. MX, WOO and BGB all performed very well, while HT saw the most significant decline.

track record

An exchange's track record is important to its legitimacy. In fact, most CEXs have been hacked in the past, and some of them never recovered. Since 2012, hacking attacks have cost more than $2.85 billion. Not a single top exchange has been directly hacked since the FTX debacle. However, hacking incidents still occur frequently, including:

GDAC was hacked in April 2023 and lost $13 million.

Bittrue was hacked in April 2023 and lost $23 million.

CEXs remain vulnerable to hacks, making strong risk management and protection funds more important than ever to ensure clients do not suffer losses in unforeseen circumstances.

The latest trends in CEX

Copy trading

Copy trading

Another popular feature of CEX is copy trading. It allows users to copy the strategies of top traders on the platform.

An important difference from on-chain copy trading is that traders need to explicitly authorize the exchange to allow others to copy their trades. In contrast, copying transactions on-chain is permissionless, allowing anyone to copy trading strategies from any address.

Some of the exchanges that offer copy trading are:

Bitget

ByBit

OKX

Gate.io

The above-mentioned exchanges provide documentary trading services for spot and futures transactions.

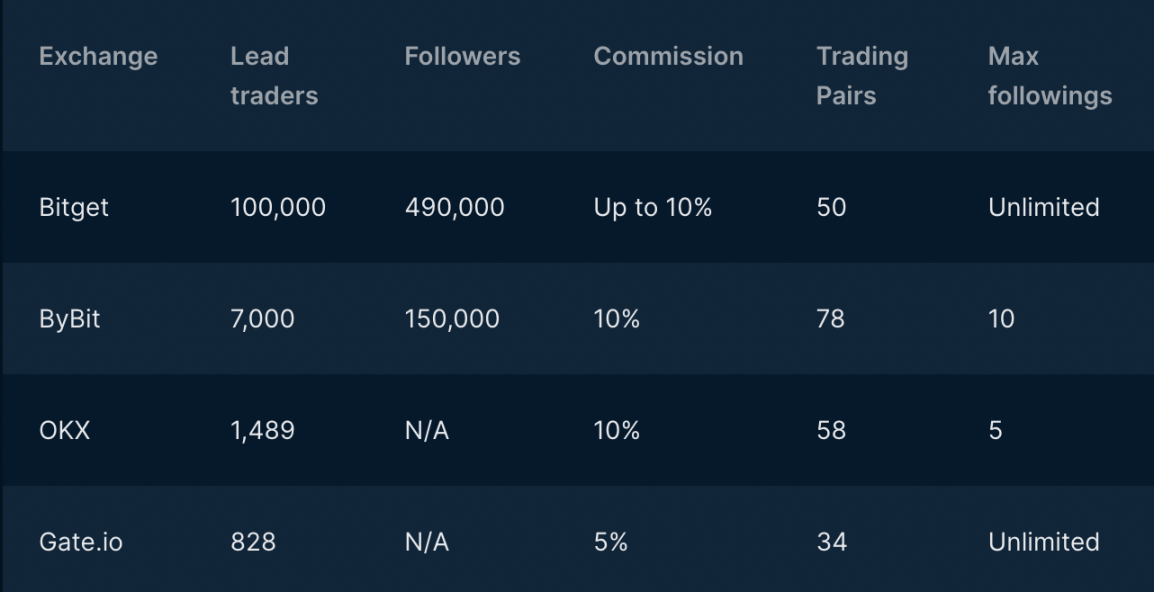

According to official data, Bitget has more than 100,000 order traders and 490,000 copy traders. Order traders can earn up to 8% commission for sharing their strategies and have specific requirements and application process.

Bybit says 150,000 copy traders have used their copy trading feature, allowing them to copy strategies from over 7,000 traders. Order traders can be sorted by 7-day win rate, 3-week win rate and 7-day PnL and are entitled to 10% of the profits generated by the copy trader. Various parameters can be customized, including capital size, leverage, stop loss and other related factors.

There are 58 tokens available for copy trading on OKX, and 1,489 order traders to choose from. Fees are the same as regular trading fees, and traders with orders get a 10% profit share. Users can copy up to five different traders. This feature provides spread protection and can set a maximum investment amount. Traders with orders can make up to 50 transactions per day, and can only close positions with market orders.

Gate.io currently has 828 book traders, and they charge 5% of the profits generated by copy traders.

Things to consider when copy trading include track record, performance metrics, trading strategy, risk adjustment, and community engagement (number of followers). It is also considered good practice to spread out the traders you choose to copy to reduce overall portfolio risk.

Exchange Ecological Business

Many users increasingly expect CEX to participate and contribute to the broader crypto ecosystem.

Coinbase

Binance

Binance

After the FTX crash, Binance deployed a $1 billion “recovery fund” to fund projects that struggled due to market turmoil but otherwise performed well. As of March, 18 organizations had joined the fund, totaling $1.1 billion. This demonstrates the exchange's commitment and responsibility to the wider industry.

Bitget

In April, Bitget announced a $100 million venture capital fund focused on Asia. It has begun expanding into the crypto ecosystem and acquired Bitkeep in March 2023. The exchange is also partnering with fetch.ai and CORE DAO to develop its ecosystem.

Who will be the winner?

in conclusion

in conclusion

The FTX crash was a catastrophic event for the entire industry, but especially for CEX. This poses greater challenges to CEX transparency and depositor protection. Proof of Reserves have essentially become the industry standard since the FTX incident. But some exchanges are taking further steps, such as protection funds, which Binance and Bitget increased after the collapse of FTX.

Binance has maintained its lead, however, it has not cornered the market left by FTX. Compared with DEX spot transactions, we observed a relative decline in CEX spot transactions. Most derivatives trading platforms have seen a drop in volume, with the exception of Bitget, which saw a slight increase in volume in the months following FTX.

While exchanges strive to become more transparent, they must still adhere to higher standards. Proof-of-reserve and protection funds are improvements, but no guarantees of security. A successful exchange needs to consistently provide users with the best features while building trust through increased transparency, protection of funds, and participation in the ecosystem.

This report was written by Nansen in collaboration with Bitget.