Dear friends, welcome to the SignalPlus macro research report. SignalPlus macro research reports update macro market information for you every day, and share our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

Dear friends, welcome to the SignalPlus macro research report. SignalPlus macro research reports update macro market information for you every day, and share our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

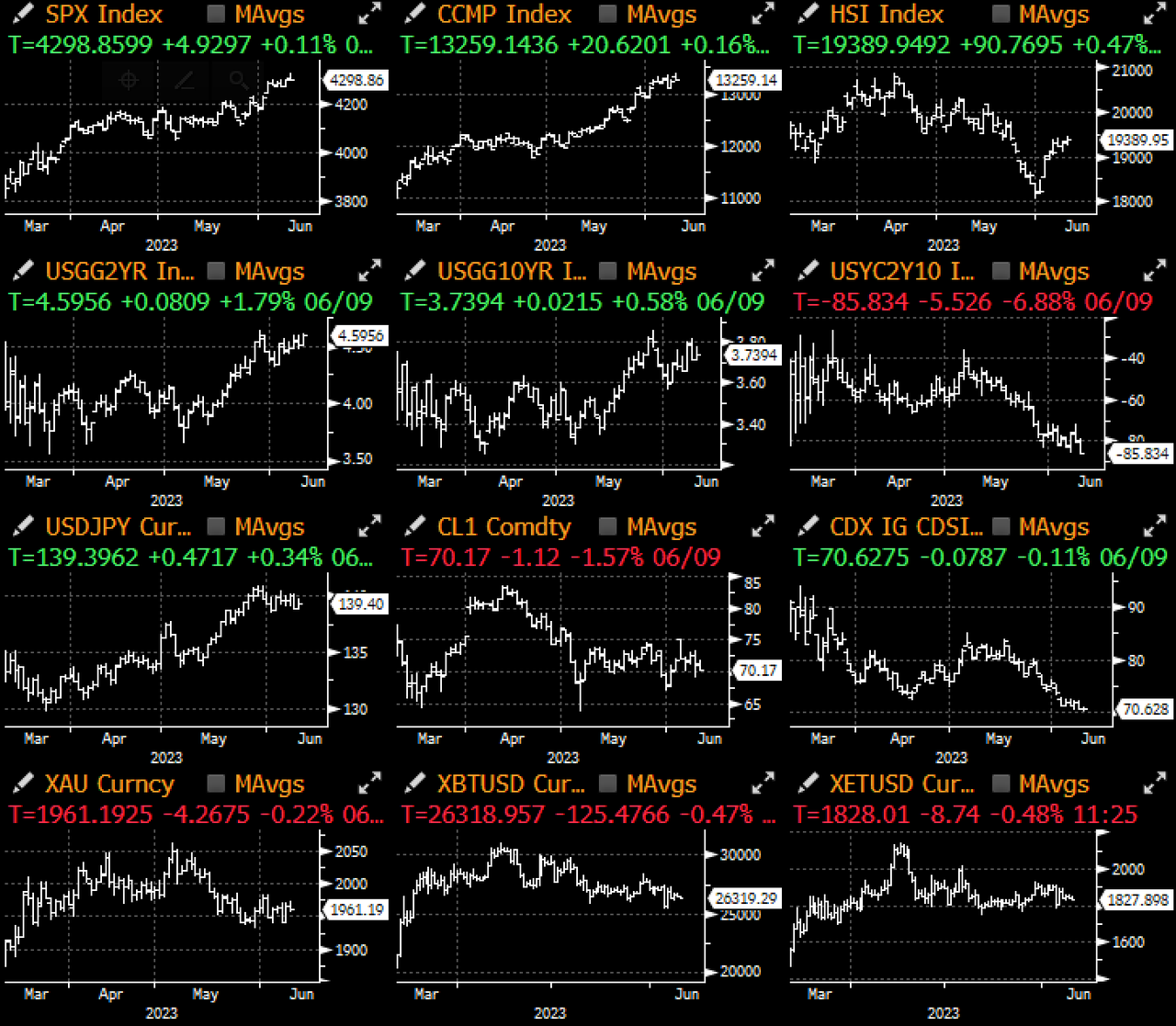

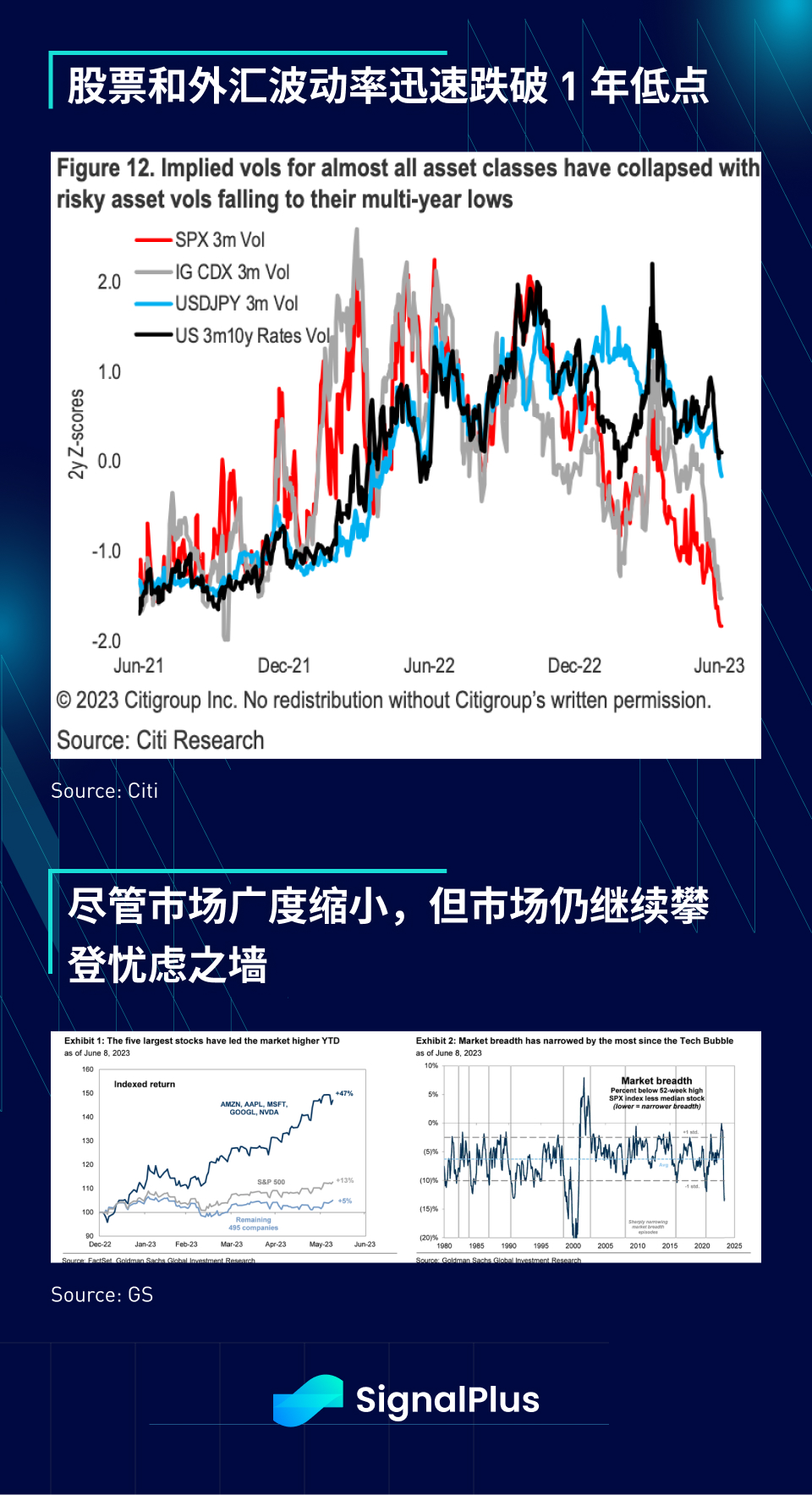

Unlike the woes of cryptocurrencies, TradFi assets had another quiet day at the end of last week. Although the summer vacation has not yet started, the trading range of short-term U.S. bond yields has fallen to the narrowest since March (about 18 bps). basis points), the stock VIX fell to around 14, the pre-epidemic low, and global foreign exchange volatility has also fallen to a 12-month low; Investors expressed concern about poor market breadth, but still see little reason to abandon their long equity strategies.

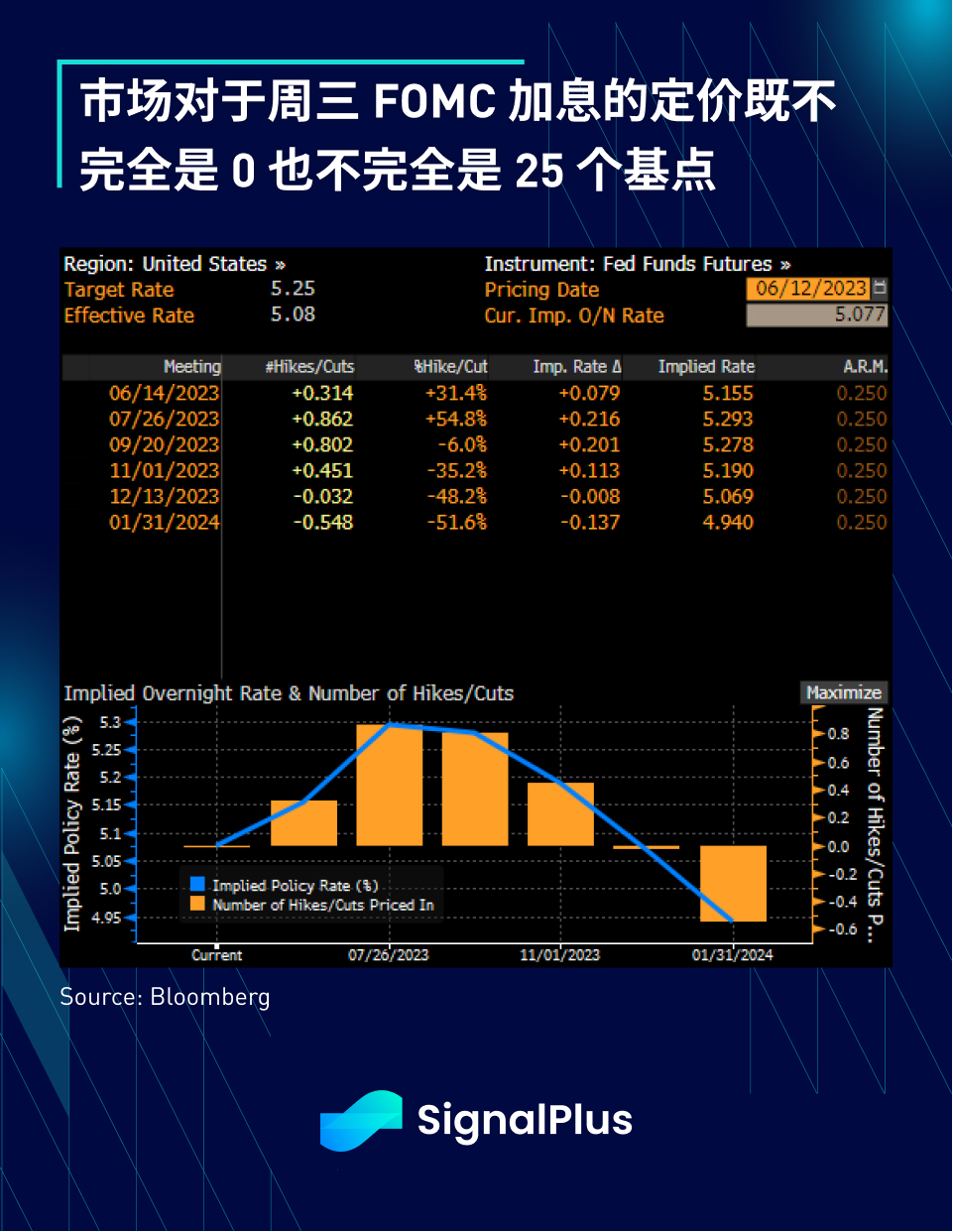

A series of economic data and central bank meetings this week are expected to bring some stimulus and activity to the market before the official start of the summer vacation. On Tuesday, the UK unemployment rate and US CPI will be announced. The FOMC meeting will debut on Wednesday. It will end the week on Thursday, followed by the Bank of Japan's rate decision on Friday. The FOMC decision will be the toughest, with current market forecasts for a rate hike in June at about 30%, so whether it's 0 or 25 basis points of interest rate change should cause some market volatility, especially depending on the announcement, press conference information from the Federal Reserve.

The stock market has seen further rebalancing, with technology stocks leading the gains again, thanks to Tesla's rebound rather than AI, and GM is adapting its electric vehicles to Tesla's charging stations to help standardize charging in the electric vehicle industry. Additionally, Wall Street investment banks have been aggressively raising their year-end target prices for the S&P 500, with Goldman Sachs recently raising its year-end target price from 4,000 to 4,500 thanks to multiple expansions in valuation multiples (EPS forecast unchanged at $224 ).

Finally, in a perhaps somewhat surprising finding, narrow market breadth does not necessarily lead to underperformance in the medium term based on prior history, so perhaps there is nothing wrong with the current complacency in stocks.

When it comes to cryptocurrencies, market sentiment shifts day and night, with tokens like Solana, Matic, Cardano and Avalanche plummeting by more than 30% over the weekend amid ongoing U.S. SEC enforcement actions to treat most tokens as securities. In addition, Robinhood Announced that it will remove Solana, Cardano, and Polygon from its platform from June 27, and will force liquidation of related positions at the end of the month. Plus, a fake news article/picture of a so-called cryptocurrency hedge fund being in liquidation added to the FUD sentiment in the market, with BTC dropping below $26,000 and ETH nearing $1,750.

Registration link: https://t.signalplus.com/competition-okx?locale=zh-CN

The "Contest for the King of Options" jointly organized by OKX and SignalPlus has started! Sign up now and don't miss your chance to win up to 115,000 USDT!

Registration link: https://t.signalplus.com/competition-okx?locale=zh-CN

If you want to receive our updates immediately, welcome to follow our Twitter account @SignalPlus_Web 3 , or join our WeChat group (add a small assistant WeChat: chillywzq), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com/