We are currently working with the Swift global community to allow financial institutions to seamlessly interact with major global blockchain networks through Swift.

Today, more and more institutional investors are considering investing in token assets to open up new channels of value. However, these institutions are faced with complex challenges. Their investments are often scattered in multiple different blockchain networks. These networks cannot interact with each other, and each network has unique functions and asset combinations. And transactions bring extremely high costs and challenges.

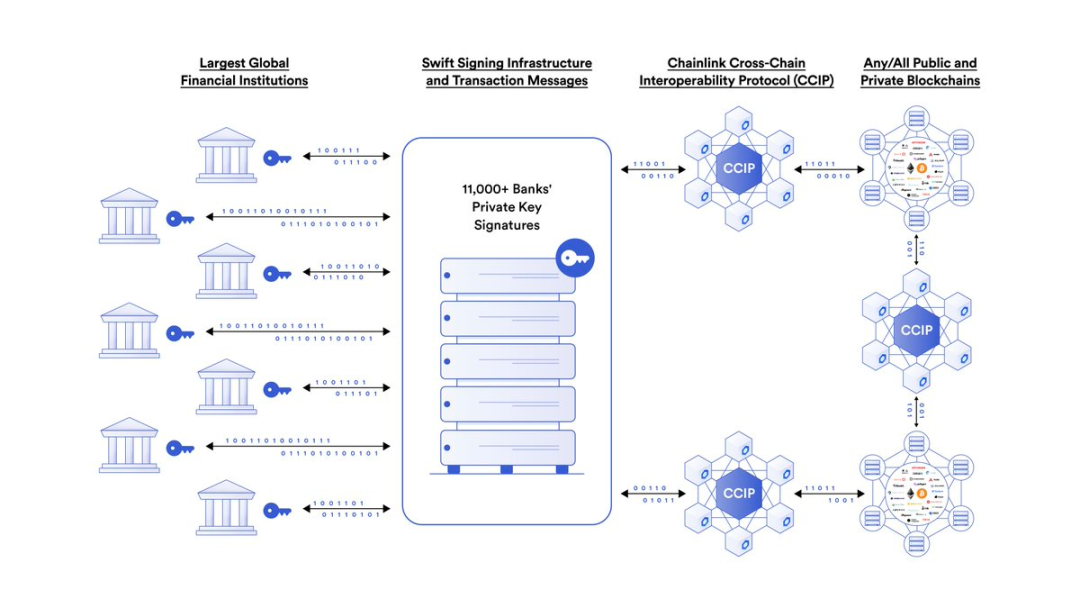

If we want to expand the market size in the long run, we must solve this problem, and this is also in line with our purpose of continuously optimizing cross-border transaction services. Therefore, we are currently working with the community to explore potential technical solutions. In a series of pilots in the future, we will cooperate with more than a dozen mainstream financial institutions and financial market infrastructures (FMI), including ANZ, BNP Paribas, BNY Mellon Mellon, Citibank, Clearstream, Euroclear, Lloyds Banking Group, SIX Digital Exchange, and The Depository Trust & Clearing Corporation for the purpose of Explore how these institutions can leverage existing Swift infrastructure to efficiently transfer tokenized assets between public and private blockchains. The top Web3 service platform Chainlink will provide us with connection services to seamlessly connect various blockchain networks.

We will succeed as early as 2022launched a series of pilotfirst level title

Blockchain challenges for investors and intermediaries

There is an increasingly mainstream view in the capital market that blockchain technology has the potential to improve efficiency, reduce costs, and bring new opportunities in certain areas. For example, the private equity market has always been based on traditional systems and processes, so it faces problems of high costs and investment thresholds. Blockchain can optimize operations and settlement processes, thus attracting more investors to the private placement market and ultimately enhancing market liquidity.

However, due to regulatory policies in this field, token asset trading is still a niche market. If the market size is to be expanded, financial institutions must easily access multiple blockchain networks in a secure and trusted manner, so that the transaction process can be as smooth as traditional assets.

first level title

Leverage existing infrastructure to drive change

first level title

Meeting the Challenge: How Swift Enables Blockchain Interoperability

Swift is a global collaborative community focused on enabling fast, efficient, and interoperable transactions. Therefore, Swift is uniquely positioned to help the financial industry overcome the aforementioned challenges. In 2022, we successfully leveraged existing infrastructure as a single point of access to multiple token platforms deployed by financial institutions on private chains. Our community has expressed great interest in this and hopes that we will continue to carry out pilots and broaden interoperability between platforms, using public chains as the underlying settlement layer.

Jonathan Ehrenfeld, Head of Securities Strategy at Swift, said: "More and more institutions are beginning to explore how to serve customers on consortium chains and public chains like Ethereum. This raises new questions for us, such as What are the key application scenarios and how to support these business needs in a safe and compliant manner.”

first level title

Pilot Specific Details

The next series of pilots we will be rolling out are designed to demonstrate how Swift infrastructure can be used to achieve interoperability, based on existing connectivity, standards and messaging layers, to transfer tokens between traditional off-chain systems, public chains and private chains .

The first use case will be to transfer token assets between two wallets on the same public chain network (ie: Ethereum Sepolia test network). The second use case will transfer token assets between a public chain (ie: Ethereum) and a consortium chain. A third use case will attempt to transfer tokenized assets between Ethereum and another public chain. Chainlink will provide us with an enterprise abstraction layer to securely connect the Swift network to the Ethereum Sepolia network. Additionally, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) will fully enable cross-chain interoperability.

Sergey Nazarov, co-founder of Chainlink, said: "We are very happy to be able to cooperate with Swift. As banks begin to try to connect to many blockchains, we must build a unified cross-chain connection layer to assist banks to carry out financial business on the chain. .”

In addition, we will also try a series of non-technical solutions for regulated financial institutions to help them interact with the public chain network and carry out cross-chain transactions in a compliant manner. There are a series of challenges in terms of operation, compliance and supervision, especially when it comes to confidentiality and data privacy, responsibility and recourse when trading on public chains.

We will announce the results of the pilot later this year.