Compilation of the original text: Deep Tide TechFlow

Compilation of the original text: Deep Tide TechFlow

Mechanism Capital co-founder Andrew Kang thinks Radiant Capital could be a top contender for Aave and Compound, and outlines why he thinks so in this article.

Note: This article is the author's personal opinion and does not constitute investment advice, DYOR.

Aave and Compound are currently the largest money markets in cryptocurrency, with TVLs of $5 billion and $2 billion, respectively. Through innovation, Radiant Capital is a top competitor challenging for the throne, with the potential to become the new money market king in the cryptocurrency market.

Radiant in brief:

$260 million TVL on Arbitrum and BSC;

The first functional cross-chain MM (lending on the X chain, borrowing on the Y chain);

Coming soon on ETH and zkSync;

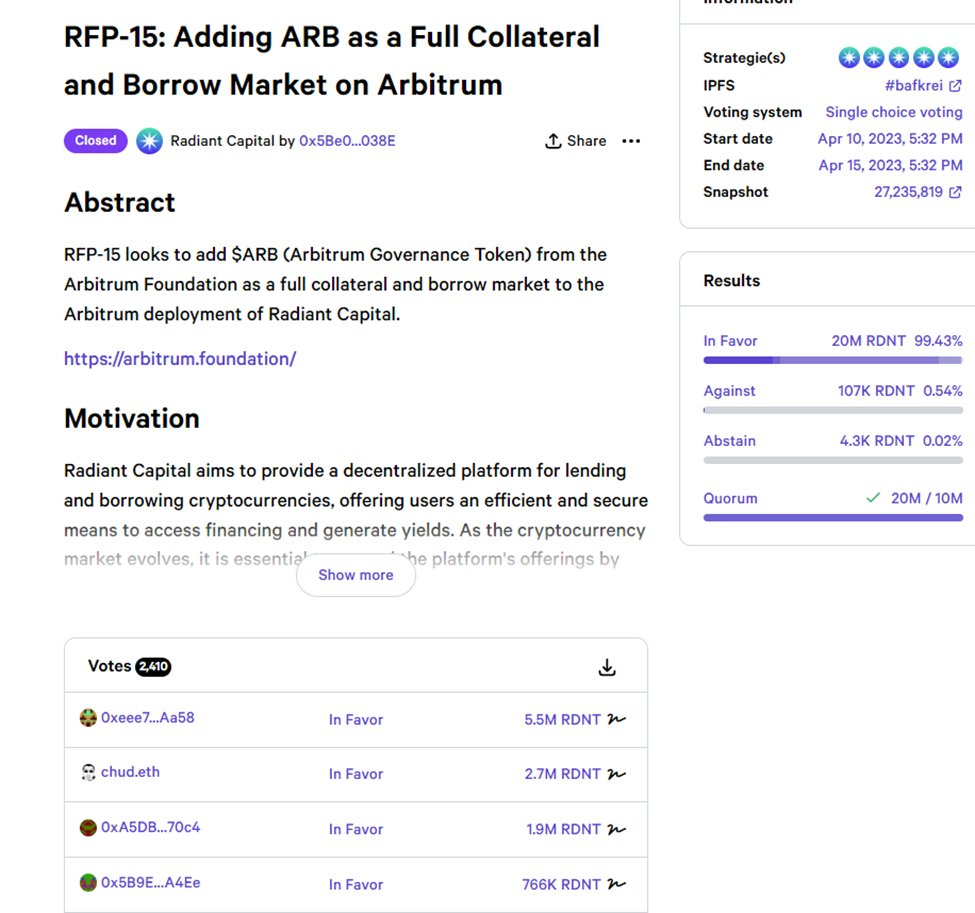

Add more safe collateral like $ARB (other currency markets are slow);

Token design optimizes demand and protocol growth.

Aave and Compound only offer 1-2% yields on stablecoins, less than treasury. With stablecoin market capitalization exceeding $100 billion and over $10 billion of stablecoins once in market makers now sitting idle, this untapped liquidity is a huge opportunity. The 10-40% stablecoin yield offered by this audited one-year protocol will become more widely known and TVL expected to grow.

first level title

flywheel

Radiant is one of the biggest beneficiaries of ARB. Apart from Radiant, there is no other currency market that has listed ARB. Therefore, we expect that there will be continuous capital inflows, allowing the $2 billion ARB to find a place in the unilateral income.

An important driver of RDNT's growth is the V2 Tokenomics flywheel upgrade, which increases the value of its incentive reserve while directing more sustainable issuance to long-term agreement-related users.

User deposits are $1 million and satisfy 5% of the "locked LP" emissions.

RDNT price drops → users are now below the 5% threshold.

Users are incentivized to buy RDNT and re-lock more LPs to stay above 5%.

With the rise of LayerZero and the zkSync narrative, Radiant will hopefully be a huge beneficiary, with people using the platform to mine for possible airdrops.

income

income

first level title

Valuation

first level title

community involvement

The community is very active. DAO governance proposals received an average of over 2,000 votes, with a third of token holders registered on Snapshot.

Over the past few weeks, over $10 million in dLP has been unlocked. When comparing the total dLP tokens (locked and unlocked) on May 31st to the total tokens on May 10th, the total dollar value of dLP increased by about $5.2 million. This means that while unlocked, Radiant is still attracting new staking users.

Within two weeks after the implementation of RFP-17 and RFP-18, 71% of users who locked their positions chose to lock their positions for 6 months or 1 year, compared to only 40% of users who chose this period last month.