In the current bear market of cryptocurrencies, giants such as Celsuis and FTX have gone bankrupt. Although creditors may eventually get some compensation, complex bankruptcy procedures and financial problems may keep the lawsuit going on for several years.

first level title

Plan to support 10 company debt transactions, rvUSD and CELSIUS have 0 recent transactions

As a platform featuring debt transactions, OPNX plans to support claims transactions of multiple bankrupt companies, including Celsius, FTX, Genesis, BlockFi, etc.

The first debt token launched by OPNX is the debt based on CoinFLEX. According to the restructuring terms approved by the Supreme Court of Seychelles, CoinFLEX distributed 83.65 million rvUSD (Recovery Value USD Tokens) to creditors. The CoinFLEX exchange stopped trading in April this year because OPNX acquired CoinFLEX. The co-founder of CoinFLEX is also the co-founder of OPNX. The KYC information and account balance of CoinFLEX users can be seamlessly migrated to OPNX, which also brings OPNX the first batch of users.

Since going live in April, the price of rvUSD has fallen from a high of over $0.6 to its current $0.1875, with zero trading volume in recent days and less liquidity around market prices as of June 7.

On June 1st, OPNX opened the claims and transactions of Celsius, and the token name is CELSIUS. Considering Celsius's 600,000 creditors, and 85% of them are composed of retail investors who owe less than $5,000, it is difficult for these people to complete transactions through OTC and other channels. At the beginning of its establishment, OPNX also needs to acquire user groups, but currently OPNX also has no trading volume.

Although both rvUSD and CELSIUS are credit tokens, OPNX believes that the first claim transaction opened on the platform is CLESIUS. It may be that considering the association between CoinFLEX and OPNX, rvUSD was issued by a special purpose company, and the claim process did not take place on OPNX. The debt tokens of CLESIUS and subsequent FTX are collected directly in the OPNX exchange. According to the rules of OPNX, the following four steps are required to complete the CELSIUS debt transaction.

Registration: Create an OPNX account and complete KYC;

Application: Provide creditor's rights details and submit a creditor's rights assignment application;

Sign: sign the creditor's rights assignment agreement;

first level title

Almost all trading volume comes from perpetual contracts

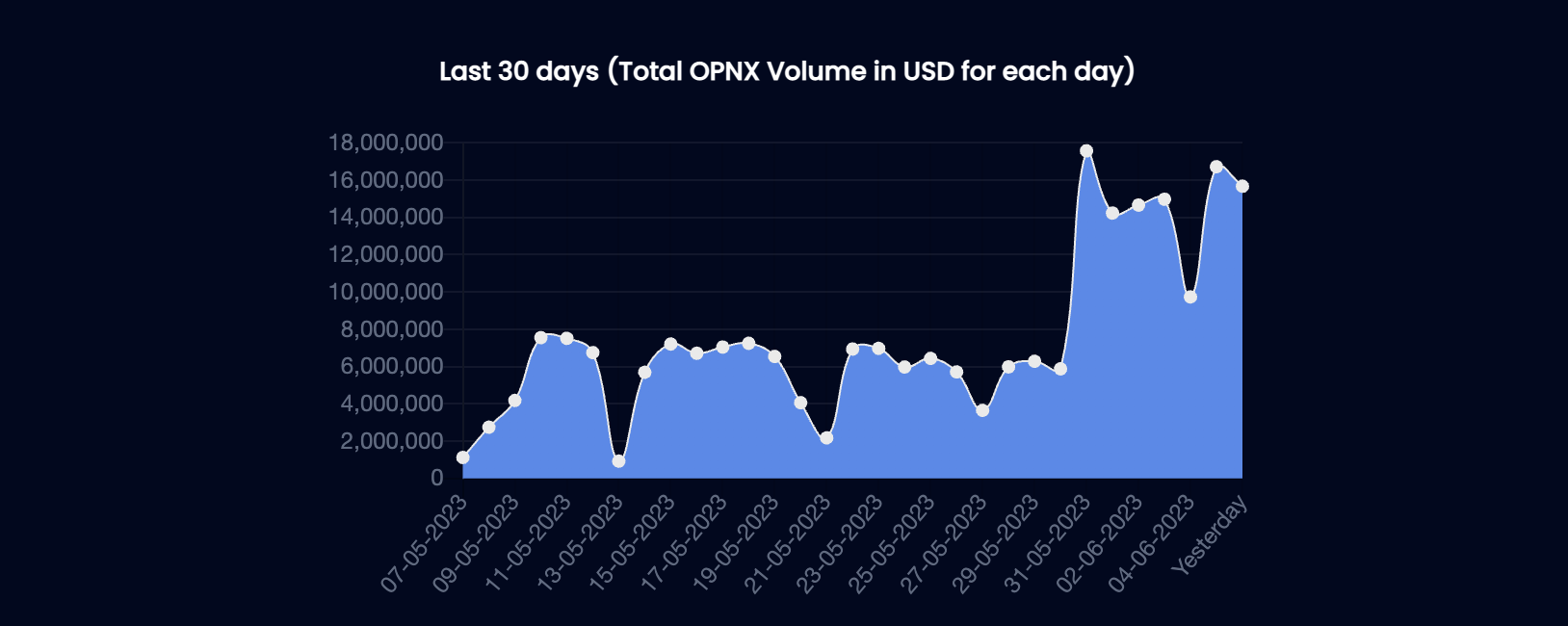

While supporting tokenized debt transactions, OPNX also enables spot and futures transactions of mainstream cryptocurrencies such as BTC and ETH. Unlike debt tokens, where almost no one is trading, the trading volume of OPNX’s perpetual contracts is on the rise. According to the official website data, the total daily transaction volume of OPNX is about 15 million US dollars recently.

As of June 7, the total trading volume in the past 24 hours was 8.508 million US dollars, of which the spot trading volume was 148,000 US dollars, the perpetual contract trading volume was 8.36 million US dollars, and the perpetual contract trading volume accounted for 98%. The trading volume of debt tokens is included in spot transactions, and the spot trading volumes all come from the transactions of popular currencies such as BTC and FLEX. The trading volumes of debt tokens rvUSD and CELSIUS are both zero.

first level title

FLEX and OX tokens

Since the co-founder of CoinFLEX is also the co-founder of OPNX, user profiles and account balances of CoinFLEX can be directly migrated to OPNX. OPNX also decided to directly use CoinFLEX's native token $FLEX as the platform currency of the new exchange at the beginning, which made $FLEX jump from the platform currency of the bankrupt exchange to the platform currency of Su Zhu's new exchange, with a price of 3 It has increased more than 50 times in a month.

It can be seen from the OPNX official website that $FLEX is indeed the native token of the OPNX exchange. But on May 31, OPNX re-issued a governance token $OX and launched the staking platform The Herd (cattle herd). OX is taken from the two capital letters of Open eXchange. It looks auspicious in Chinese. Although $FLEX will be gradually deprecated, the interests of holders have not been sacrificed.

According to the white paper of the OX token, the maximum supply of $OX is 9.86 billion, which is derived from the maximum issuance of $FLEX of 100 million minus the burned 1.4 million and multiplying by 100. $FLEX can be converted into circulating $OX at a ratio of 1:100. If you choose to exchange $FLEX for pledged $OX, you can exchange it at a ratio of 1:125, and the additional part will be paid by OPNX Treasury.

Compared with other exchange platform coins, $OX is special in that it can obtain the same proportion of free transactions (returned in the form of rebate) in OPNX according to the pledge ratio, and only 50% of the handling fee is required for the excess. If a user’s pledged $OX accounts for 2% of the total pledged volume, and the transaction volume accounts for 4% of the total OPNX transaction volume, then 2% of the transaction volume can be exempted from handling fees, and the excess 2% of the transaction volume can only be 50 % handling fee.

At this stage, in order to attract staking, OPNX has an additional staking multiplier, which is currently 12 and will decrease year by year thereafter. This means that as long as the pledged $OX accounts for 1% of the total pledged amount, transactions within 12% of the total transaction volume will be free of handling fees.

In addition, $OX is also a governance token, which can vote to change the basic functions of the exchange, including fees, destruction mechanism, listing and so on. In addition, stakers can also benefit from OPNX's Real World Assets (RWA) business, which reduces handling fees when generating tokenized real assets.

summary

summary

Although OPNX is characterized by a creditor's rights trading platform, Celsius's creditor's rights trading has been launched, but the current trading volume of OPNX mainly comes from the perpetual contract transactions of mainstream currencies, and the trading volume of creditor's rights tokens in the past 24 hours is zero. While its transaction volume is on the rise, the total transaction volume of $15 million per day is still low.

OPNX initially used CoinFLEX’s platform currency $FLEX as its native token. Although it recently re-issued $OX as a governance token, the rights and interests of $FLEX have not been diluted and can still be exchanged for the same proportion of $OX. Due to the free $OX staking fee and now the additional staking multiplier, the cost of implementing free transactions in OPNX is not high.