The wait is finally over, Sam Kazemian recently announced frxETH v2. Through innovative means such as market interest rates, Frax Finance is pushing frxETH to a new peak in the LSD field.

In the next article, I will deeply analyze the exquisite design of frxETH v2.

Some background information first.

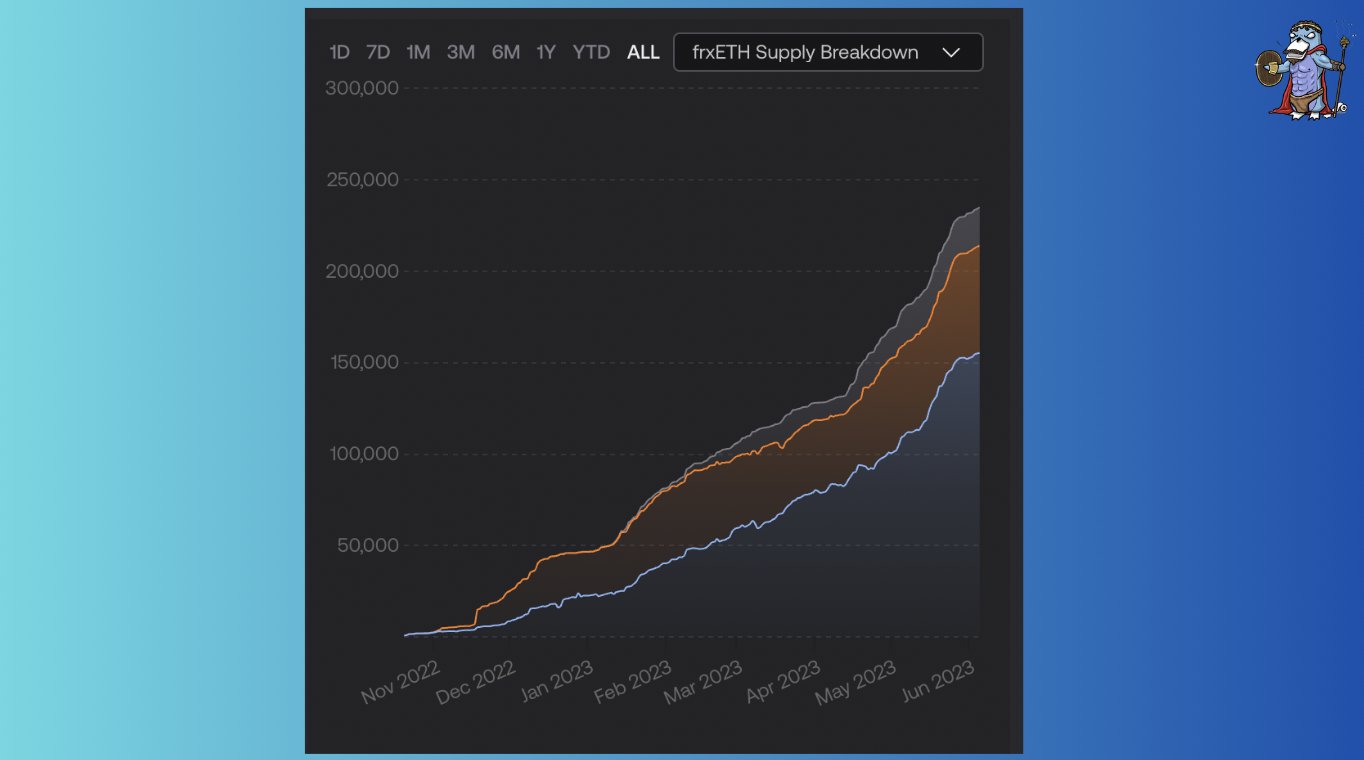

frxETH is one of the fastest growing LSDs, having amassed over 233.4 K ETH in over a year. This exponential growth is mainly due to the synergy between sfrxETH and the frxETH-ETH pool on Curve.

While it is important to ensure the quality of early validators, Frax relies on internal validators in version 1. To solve this problem, frxETH version 2 introduces new mechanisms to further decentralize frxETH and improve the efficiency of the lending market.

I will discuss the following:

Basic Concepts of Liquidity Source Discovery (LSD)

What makes frxETH v2 innovative

market-based interest rate

Programmable lending market

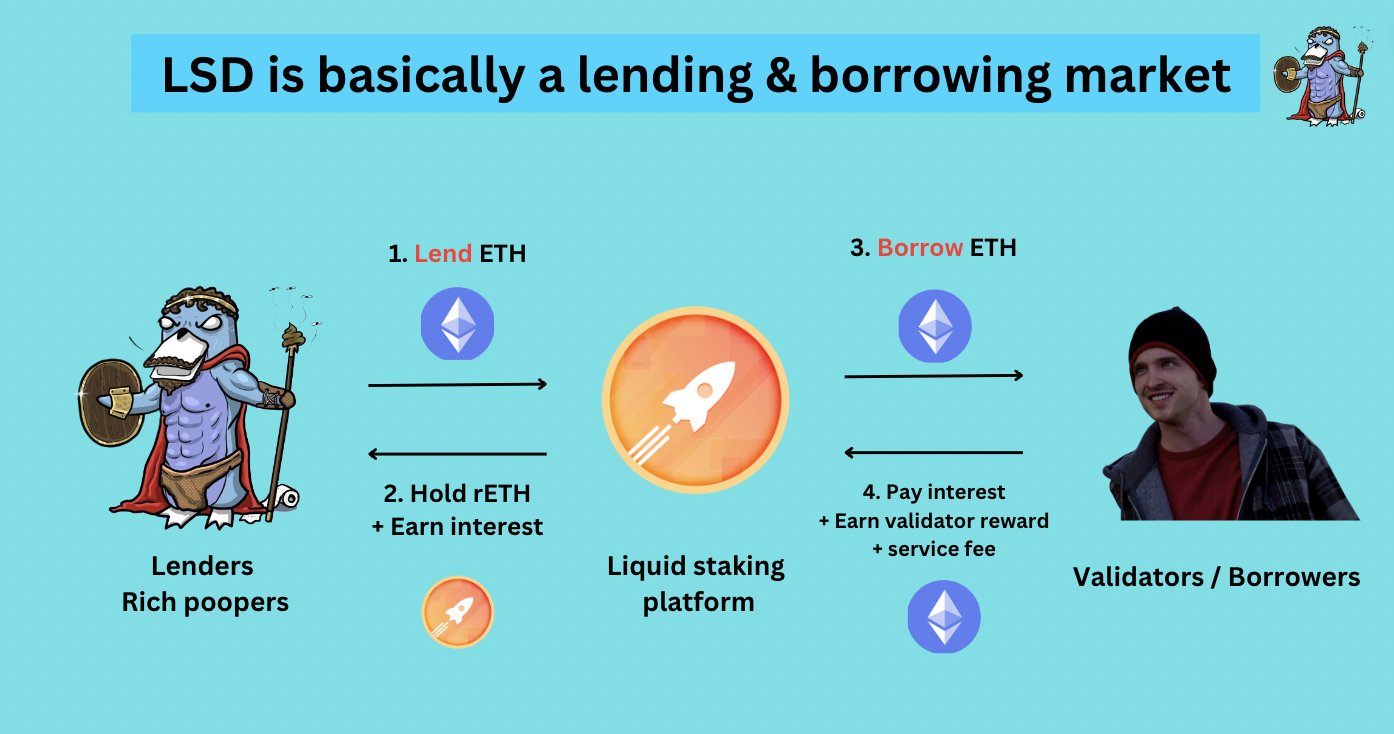

The basic idea of LSD

The core idea of LSD is very simple, which is to create a lending market based on Ethereum. Users can lend Ethereum collateral and obtain tokens representing rights and interests as certificates. Borrowers can use this collateral to run validator nodes and pay interest to creditors.

What is certain is that P2P staking pools are the most efficient and decentralized model. At the same time, LSD like stETH and rETH are essentially profitable stablecoins anchored to ETH.

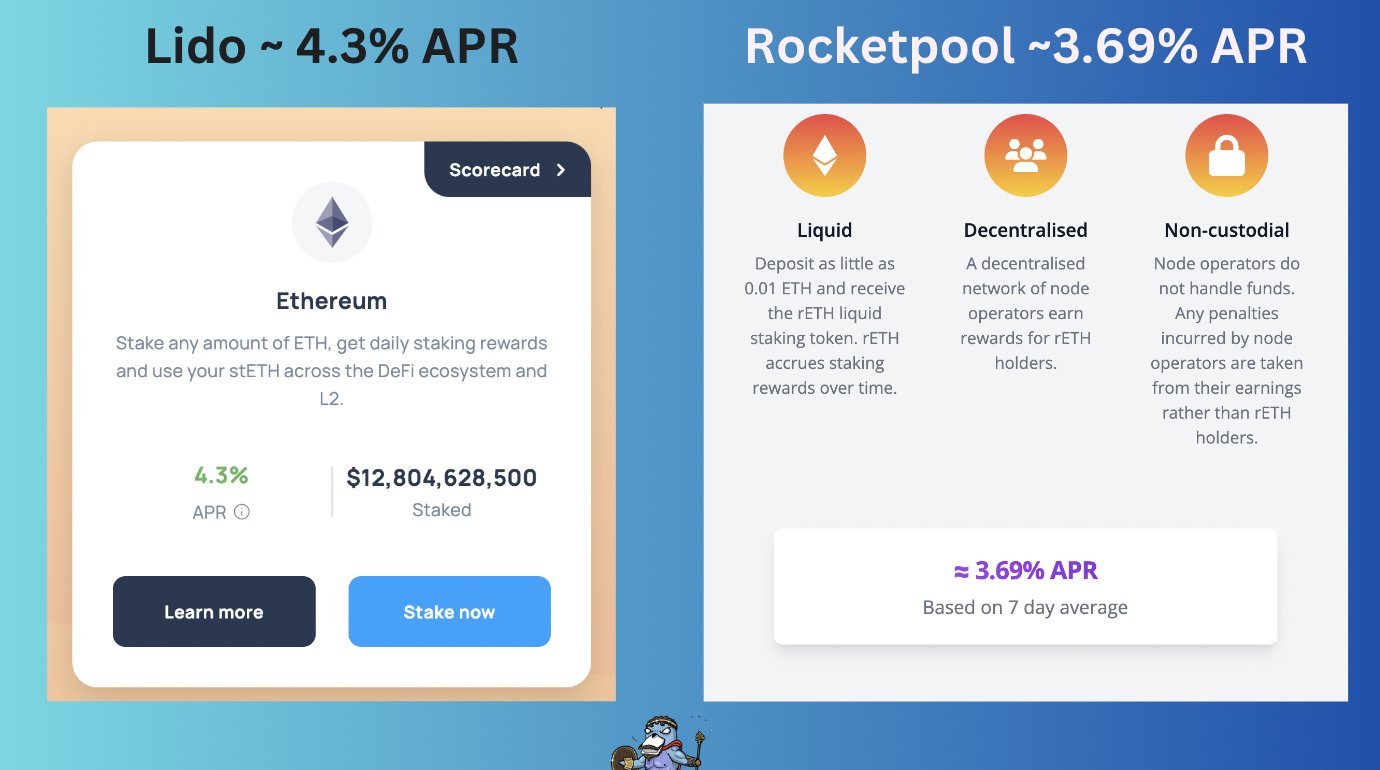

However, the annualized rate of return on LSD is limited by the cost of collateral. Rocket Pool has an annualized rate of return of 3.69% and Lido Finance has an annualized rate of return of 4.3%. This is because rewards must be distributed from a larger pool of funds before rewards are distributed to LSD holders.

Innovation highlights of frxETH v2

So, what are the innovations of frxETH v2?

In order to create a truly decentralized LSD project, frxETH v2 introduces some innovative mechanisms, the most important of which include:

Variable rate based on market and utilization rates

Programmable lending market

Let's quickly review frxETH v1:

In Frax v1, users deposit ETH and get frxETH. Users can stake frxETH to get sfrxETH to earn rewards, or pair it with ETH-frxETH pair to earn CRV on Curve Finance.

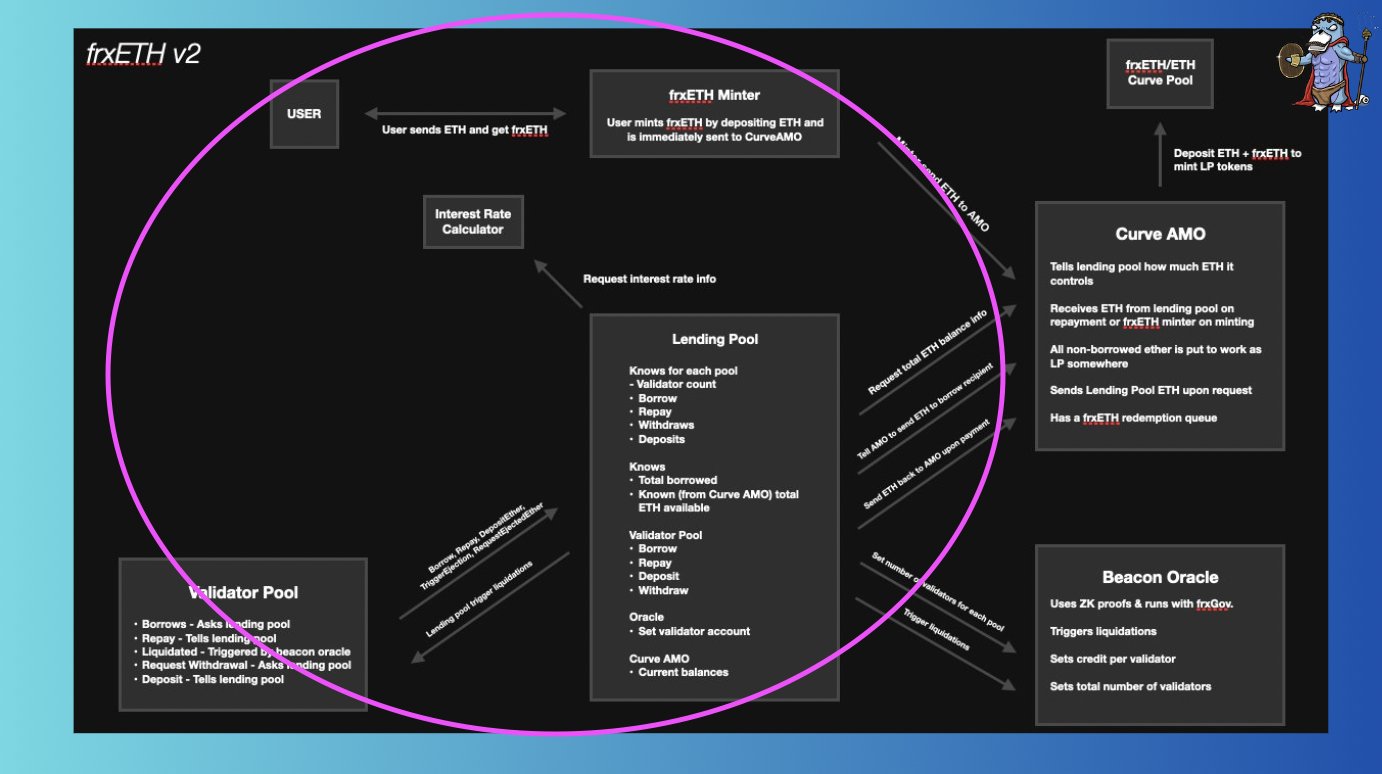

In frxETH V2, users can "borrow" validators based on loan-to-value (LTV). To "borrow" a validator, a user must first stake a certain amount of ETH (possibly more than 8 ETH), which gives them the right to borrow and run a validator on Frax Finance. At the same time, borrowing interest is deducted directly from the user's ETH and validator rewards.

The diagram below gives an overview of the architecture of frxETH V2, for simplicity I will only focus on the circled area:

Market-based floating rates are an innovation

Unlike other protocols,

Utilization

Utilization

market supply and demand

Borrowers can view and transact at floating rates in real time, which provides node operators with more profitable options.

Let's illustrate with an example:

If the borrowing rate is low (with a large number of lenders or ETH pledgers), users can"borrow"A validator, who performs verification operations and pays interest to lenders (that is, sfrxETH holders). At the same time, the verifier can keep all the rewards, such as MEV, priority pen, etc.

On the other hand, if interest rates increase (demand is higher than supply), then running validators may not be profitable. At this point, the user may choose to:

• repay loan

• Abandon validators

• Wait for more profitable opportunities

With floating interest rates, experienced node operators can formulate strategies based on market interest rates and obtain more profitable options.

Penalty Mechanism:

Penalty mechanisms kick in when a validator fails to do some work. As the total value of validators decreases, the loan-to-value ratio (LTV) of borrowers will increase. If the LTV reaches an unhealthy level, validators will be retired in order to maintain the stability of the protocol.

Programmable lending market

veFXS holders propose new collateral types (e.g. new chains or tokens)

Design new borrowing terms through governance, including minimum bid amount, interest rate, etc.

in conclusion

in conclusion

Overall, programmability endows frxETH v2 with a flexible and extensible framework. This will help develop more application scenarios and create a new lending market.

For more exciting content, please follow Twitter:poopmandefi