1. Overall overview

1. Overall overview

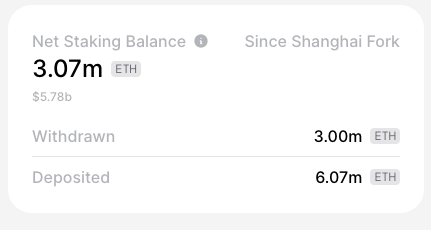

On-chain data analyst Tom Wan revealed data on social media that the encrypted lending platform Celsius pledged a total of 396,000 ETHs on June 1 and June 2 (accounting for 92.5% of its total stETH withdrawals). , currently there are only 32,000 ETH left in its stETH withdrawal wallet. Due to the pledge of Celsius, the single-day deposit volume of the Ethereum beacon chain hit a record high on June 1. A total of 409,000 ETHs were deposited on June 1, 71% of which came from Celsius. The online deposit amount is 231,000 ETH, of which 44% comes from Celsius.

The Ethereum pledge agreement Swell Network announced the launch of the Voyage airdrop plan, which will distribute 50 million SWELLs (5% of the supply) to users. Users can now collect pearls by staking swETH and providing liquidity, which can then be exchanged for SWELL during the TGE later this year.

Second, the secondary market

Second, the secondary market

1. Spot market

image description

ETH daily chart via OKX

The daily chart shows that the price is currently consolidating around $1,900, and the lower support level is $1,850; if the support is valid, it may continue to test $1,900 and $1,950 in the short term.

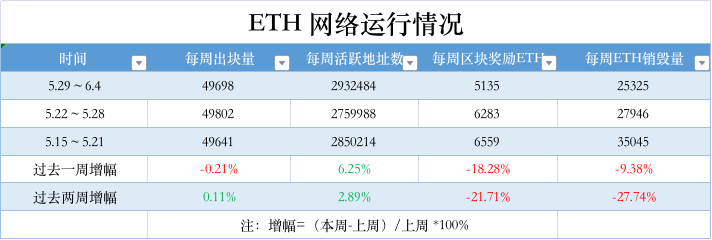

2. Network operation

Etherscan 3. Large transaction

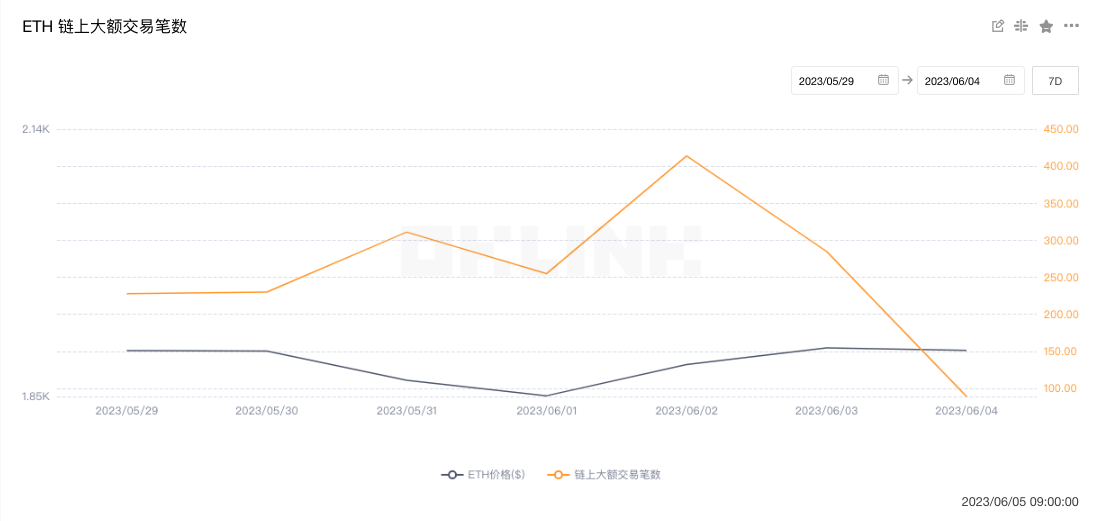

3. Large transaction

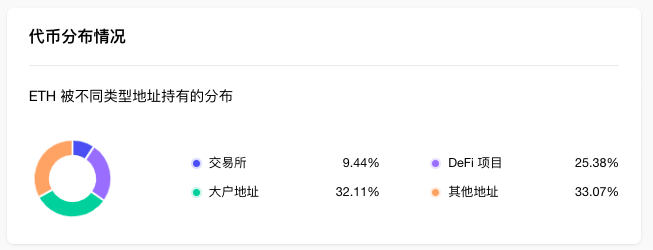

OKlink data4. Rich list address

4. Rich list address

OKLink dataOKLink data

token.unlocks3. Ecology and technology

3. Ecology and technology

1. Technological progress

(1) The 110th Ethereum Core Developers Meeting: The CL client team is considering incorporating EIP 4788 into the Deneb upgrade

Christine Kim, Vice President of Galaxy Research, concluded in a post that Ethereum core developers held the 110th All-Core Developer Consensus (ACDC) conference call on June 1, hosted by Danny Ryan, a researcher at the Ethereum Foundation. Developers discuss and coordinate changes to the Ethereum Consensus Layer (CL) at the meeting. This week, Ethereum Foundation researcher Dankrad Feist presented the results of a data experiment on the ability of Ethereum mainnet nodes to disseminate large amounts of data. Based on his findings, he proposes to increase the EIP 4844 specification from a maximum of 4 blobs to 6 per block.

Additionally, the CL client team is considering incorporating EIP 4788 into the Deneb upgrade. It is reported that EIP 4788 introduces a trust-minimized way for smart contracts and Dapps to access information such as CL and validator balances, activities, and rewards.

(2) The Ethereum meeting decided to implement an update for EIP-4844 and test it before the launch of Devnet 6

Ethereum community developer terence.eth tweeted a summary of the 22nd EIP-4844 implementers call. The sessions covered three main topics: Deneb Engine API versioning; adding "data_gas_used" to execution headers; and Devnet 6 scope and testing updates.

Also, the meeting decided to update "data_gas_used" for Devnet 6 to cover. Before "data_gas_used" moves to Devnet 6, use another testnet slaved to EIP 4844 for testing.

2. Voice of the Community

The Decrypt analysis article stated that the NFT project Bitcoin Miladys provides derivatives of the Ethereum-based Milady Maker PFP project. Bitcoin Miladys has partnered with marketplace Ordinals Market and Xverse Bitcoin Wallet to launch a bridge. The BRC-721 E-token standard enables the bridge to migrate artwork and data onto the Bitcoin chain via Ordinals. When using the BRC-721 E standard, you need to pay attention to a problem. Migrating NFT to Ordinals in this way is a one-way irreversible process, that is, it is impossible to recover the original assets on the original chain by destroying the NFT version on Ordinals. Migrants need to be aware of potential risks.

3. Project trends

(1) Ethereum programming language Vyper released version v0.3.9

(2) The ETH burning volume of the ENS registration contract has exceeded 25,000 pieces

(3) Ledger's encrypted wallet application Ledger Live has integrated ENS

(4) Curve: Tricrypto-NG has been deployed and 3 votes have been conducted to optimize gas fees and oracles

(5) Ethereum side chain SKALE announced the launch of the cross-chain bridge Metaport Bridge

(6) Swell Network launches the Voyage airdrop plan, which will distribute 50 million SWELL

The Ethereum pledge agreement Swell Network announced the launch of the Voyage airdrop plan, which will distribute 50 million SWELLs (5% of the supply) to users. Users can now collect pearls by staking swETH and providing liquidity, which can then be exchanged for SWELL during the TGE later this year.

(7) Optimism is preparing for the Bedrock upgrade and will introduce a two-step withdrawal process to ensure security

The Bedrock upgrade of the Optimism mainnet is coming, and this latest upgrade will lay the foundation for it to eventually become a super chain. In short, a hyperchain is a group of chains that share a software stack and share the same security properties, enabling them to communicate and work together. Bedrock's implementation will significantly reduce transaction fees and reduce deposit times to less than a minute. Optimism CEO and co-founder Karl Floersch said a two-step withdrawal process will also be introduced to ensure maximum security. It is reported that Bedrock is a new generation of decentralized Rollup infrastructure developed by OP Labs, which aims to provide modularity, simplicity and Ethereum equivalent to Layer 2 networks.

(8) Circle will launch native USDC on Arbitrum on June 8

(9) Rocket Pool, the Ethereum liquidity staking protocol, has been deployed to zkSync Era

(10) The Aave community initiated a temperature check proposal to "integrate MakerDAO's DSR into the Aave V3 Ethereum pool"

Aave community member MarcZeller initiated a temperature check proposal to "Integrate MakerDAO's DSR into the Aave V3 Ethereum pool". This temperature check proposes to integrate MakerDAO’s Dai Savings Rate (DSR) into the Aave V3 ETH pool. This will be achieved by integrating sDAI, an ERC-4626 Vault token containing DSR rewards, into the Aave protocol. Integrating DSR into Aave via sDAI allows Aave liquidity providers to benefit from DSR interest rates without paying additional fees to Aave DAI borrowers.

The DSR is a variable interest rate set by MakerDAO governance that allows DAI holders to earn savings by locking their DAI in the DSR contract. Recently, the MakerDAO governance plan proposed increasing the DSR rate to 3.3%. But the latest update to MakerDAO governance reveals that the DSR will now be set at 3.49% instead of 3.3%. It just finished the voting period and will enter the executive voting period soon.

4. Borrowing

DeFiLlamaThe data shows that the value of locked collateral on the chain fell from $28.06 billion to $27.16 billion last week, a month-on-month decrease of 3.2%. From the perspective of individual projects, the top three lock-up values are: Lido $13.4 billion; MakerDAO $6.3 billion; Aave $4.62 billion.

4. News

(1) Deutsche Telekom subsidiary establishes Polygon verification node

(2) The Ethereum Foundation officially opened the fourth batch of EPF applications, and the window will last until June 16

(3) Data: Celsius has pledged nearly 400,000 ETH

(4) Data: Bitcoin, Ethereum futures and options trading volumes all fell in May

Open interest in bitcoin futures increased by 2.9% in May, while ethereum futures increased by 5.7%, according to data from The Block Pro. Monthly trading volume for bitcoin futures fell 15.3 percent to $778.5 billion. Open interest in CME bitcoin futures fell 8.4 percent to $1.85 billion, while average daily turnover fell 30.1 percent to $1.22 billion. Monthly trading volume of Ethereum futures fell 24.3% to $408 billion.

In terms of cryptocurrency options, Bitcoin options open interest decreased by 10.6% in May, while Ethereum options open interest increased by 5.6%. Both bitcoin and ethereum options monthly volumes fell, with bitcoin options down 12% to $16.8 billion and ethereum options down 8.5% to $10.7 billion.

In addition, The Block Pro data shows that the adjusted total transaction volume on the Bitcoin and Ethereum chain decreased by 5.3% to $196 billion in May, of which the transaction volume on the Bitcoin chain decreased by 13.3%, and the transaction volume on the Ethereum chain increased by 3.2%. % .

Adjusted stablecoin on-chain transaction volume fell 4.2% to $464.6 billion; issued supply decreased 1.4% to $122.4 billion, with USDT’s market share increasing to 68.2% and USDC’s market share falling to 22.2%.

BTC miner revenue increased by 13.7% to $916.6 million, while ETH staker revenue decreased by 34.5% to $157.2 million.

In May of this year, a total of 204,576 ETH was burned, or about $380.1 million. ETH has been in a deflationary state since January 2023. Since the implementation of EIP-1559 in early August 2021, a total of 3.36 million ETH, or approximately $9.76 billion, have been destroyed.