This article comes fromTwitter, the original author: encryption KOL @BCBacker

Odaily Translator |

Odaily Translator |

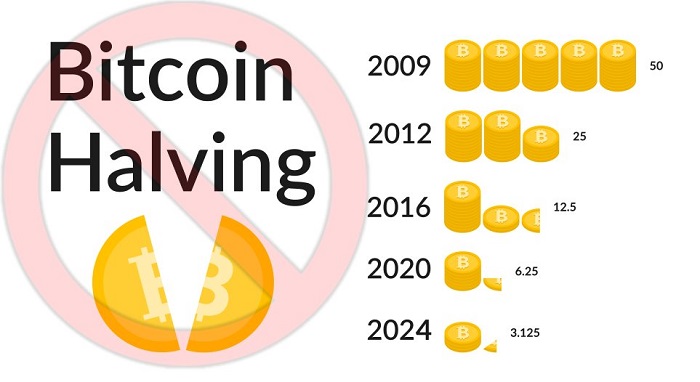

As Bitcoin’s block reward nears its fourth halving, investors are trying to “snap up” the historically bullish event, but are Bitcoin’s price gains really tied to the magic “4-year cycle”? ? If you really believe in this so-called cycle, then please be prepared that this concept will be subverted, because this article will prove that the Bitcoin halving bull market cycle is actually just a "legend".

People who believe that "Bitcoin's block reward halving every 4 years is the main reason for the bull market" may consider the inflationary pressure on the price of Bitcoin to gradually decrease - which makes sense conceptually, because the miners are provided The less Bitcoin rewards, the less selling pressure they will have. However, if you analyze it through the chart, you may find a hint of "different".

The most recent Bitcoin block reward halvings took place at:

May 11, 2020

July 9, 2016

November 12, 2012

And here are the number of days it will take for Bitcoin to “touch” its post-halving all-time high:

2012: 92 days

2016: 180 days

2020: 204 daysThe first observation that can be drawn from the above data set is that the number of days after the Bitcoin block halving to reach new highs is increasing, 92 days, 180 days, and then 204 days. But in fact, based on years of data analysis,

2020: 204 daysThe first observation that can be drawn from the above data set is that the number of days after the Bitcoin block halving to reach new highs is increasing, 92 days, 180 days, and then 204 days. But in fact, based on years of data analysis,

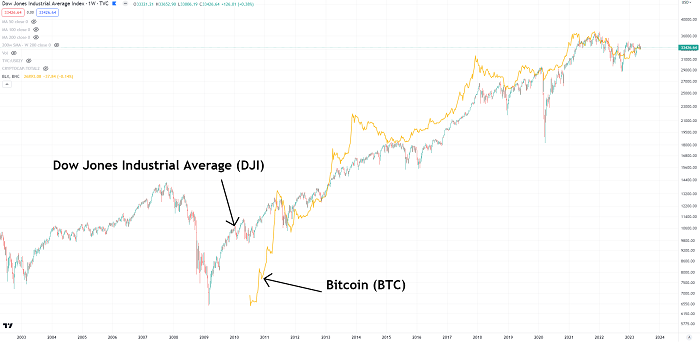

The timing of Bitcoin's price cycle is not convincing, but its price trend is relatively consistent with the Dow Jones Index (DJI).

Let's start from 2012, after the bitcoin block reward was halved, the price hit a record high at that time 92 days later, this price increase was sent after the US subprime mortgage financial crisis, when the bitcoin price hit a Fifteen days after the new high, the Dow also hit a new all-time high. The bear market at the time lasted as long as 618 days, and the record high in Bitcoin prices coincided with the period when the Dow Jones index broke through the peak of the financial crisis.

Many people still remember the bull market in 2013, but then Bitcoin entered a long bear market in 2014-2016. During this period, the Dow Jones index also fluctuated in the range between 15,400 and 18,300, and there were three relatively large declines (see the red box range in the figure below).

Next, let's look at the situation in 2016, when Bitcoin's block reward was halved, and it took 180 days for its price to hit a new high at the time. It is worth mentioning that the Dow Jones index also got rid of the downturn at that time and also hit a record high. The time for Bitcoin to break through the historical high this time was set within 57 days after the Dow Jones index left the 3-year bear market period.

A year later, in 2017, the parabolic trend of Bitcoin price and the Dow Jones Industrial Average became more and more similar, although this synchronous trend only lasted for about 42 days at the time.

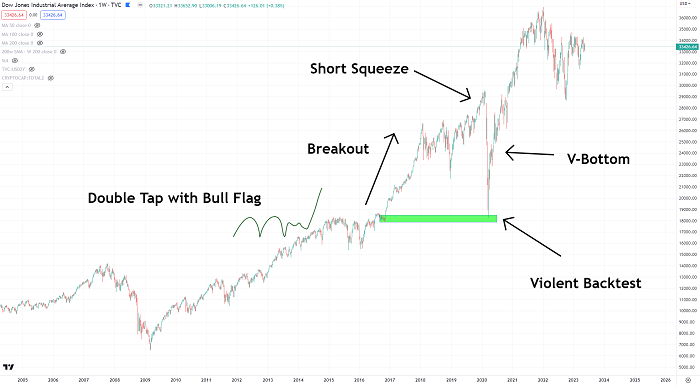

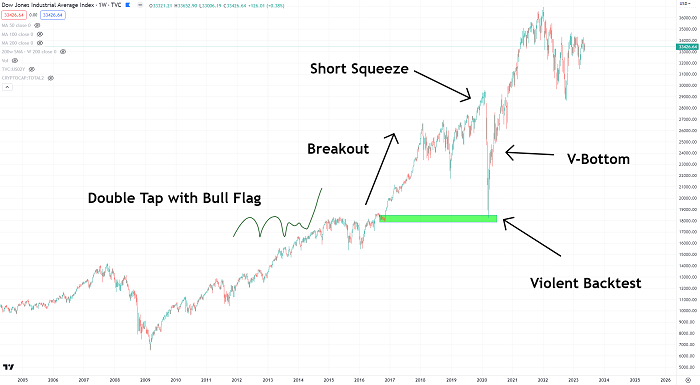

A more complex pattern emerged following the 2017 bull market, which many see as a correction "range" or market correction, and a widening wedge formed (note: a wedge is a common The price correction structure, the rising wedge refers to a strong technical rebound after the price has fallen sharply. Points form a trend of one wave lower than one wave, and the rebound high point gradually moves down.) Interestingly, at that time, this market situation seemed more like a "double-click bull market flag breakout short squeeze backtest V-shaped bottom".

Most people who believe in Bitcoin’s 4-year cycle would probably argue that it’s price action, “March 2020 would never have happened without Covid.”

But the problem is that the crypto market crash in March 2020 is an established fact, especially when we compare the data from 2013 and 2017-2021 (as shown in the figure below), even those who believe that the Bitcoin block Whoever rewarded the 4-year bull cycle will admit this too.

The following picture reflects the trend of Bitcoin price from 2017 to 2020, which will be disassembled and analyzed later.

The figure below shows the trend of Bitcoin in 2013. It can be seen that the price of Bitcoin at that time experienced four stages: plummeting, slight rebound, re-accumulation, and price rise.During 2017-2020, when the market sell-off caused by Covid began to appear, some investors in the market also began to "capitulative reaccumulation (Capitulative Reaccumulation)"

(Note: Captive re-accumulation is a term coined by the author and can be seen as a situation of market capitulation.)

Next let's briefly review what has changed in the Dow during the Covid period, in fact, some of the changes are common in bubbles, in other words, the Covid-induced market sell-off in March 2020 was actually normal.

As an example, if we look back at the price action of Ethereum in 2017, we can see a similar parabolic trend situation and the crypto market during Covid is also very similar.

On the other hand, during the same period, the Dow Jones Index is also undergoing a normal correction structure. For some "novice" who do not understand economic concepts, they may think that the market shock caused by Covid, but if you look back at the past historical trends It is not difficult to see that this is not the case. And this is why some people sold in panic during the period from March to October 2020, while others made a lot of money by "buying the bottom".

A key point here is the market correction during 2018-2020, when neither Bitcoin nor the Dow was ready for a "bounce". But while the Dow managed to pull out of the doldrums, Bitcoin followed suit 14 days later — in this case, 204 days after Bitcoin’s block reward halving.

Let’s revisit some of the key moments when Bitcoin’s price reached new all-time highs:

2012:

- Day 92 after Bitcoin block reward halving

- 15 days from the Dow breakout high

2016:

- 180 days after Bitcoin block block reward halving

- 57 days after the Dow breakout high

2020:

- Day 204 after Bitcoin block reward halving

- 14 days after Dow breakout high

Following the Bitcoin block reward halving, the time spans we have seen Bitcoin price reach highs are: +92 days, +180 days, then +204 days. And for the multi-year corrected/consolidated Dow Jones, we see the time spans in which the Bitcoin price reached its high: -15 days, +57 days, then +14 days. So, which one seems more relevant?There is a point of view that is not popular in the encryption market, that is:

The record high of Bitcoin price is not due to the halving of the block reward, but relies on the historical high set by the stock market.

Remember the chart mentioned above? Is the trend of the Dow Jones Industrial Average similar to the "double-click to break through the short squeeze and test the V bottom" on Ethereum?

Technically speaking, the intense backtesting phase is actually Wave-4 in the Elliott Wave Theory.

When we look at the Dow Jones Industrial Average next to ethereum... oh my god... the movements are too similar.

secondary title

Summarize

Summarize

The point of this article is that the time span between Bitcoin’s block reward post-halving and hitting a new all-time price high is increasing, compared to the time between Bitcoin’s price high and the Dow’s high Faster and smaller. The reason why I don’t believe in the 4-year bull market cycle of Bitcoin’s halving is because the price trend is actually more closely integrated with the Dow Jones Index, and the halving of the Bitcoin block reward may be just a “lucky timing”.