If a decentralized contract exchange can log in with a Google account, how much will its audience expand?

If assets are still in the hands of users with a centralized exchange user experience, how much traffic will CEX consume when it encounters FUD?

The so-called "GMX starts fast, dydx has a high ceiling", how about combining the advantages of the two?

secondary title

core mechanism

DYDX-like asset self-custody mode, users can force withdrawal by themselves

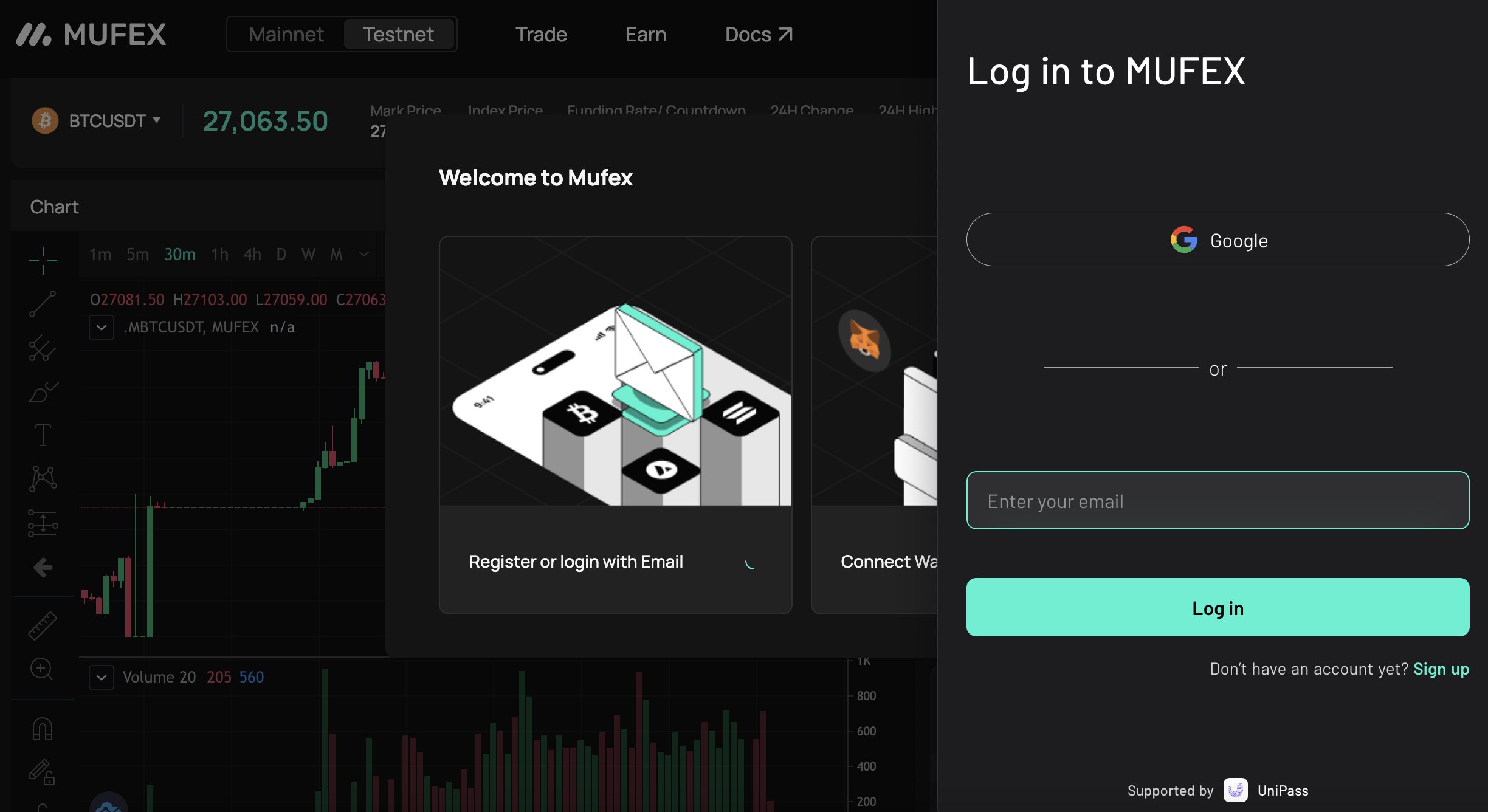

Using the account abstraction (AA) wallet solution, in simple terms, it supports better user experience such as Google login

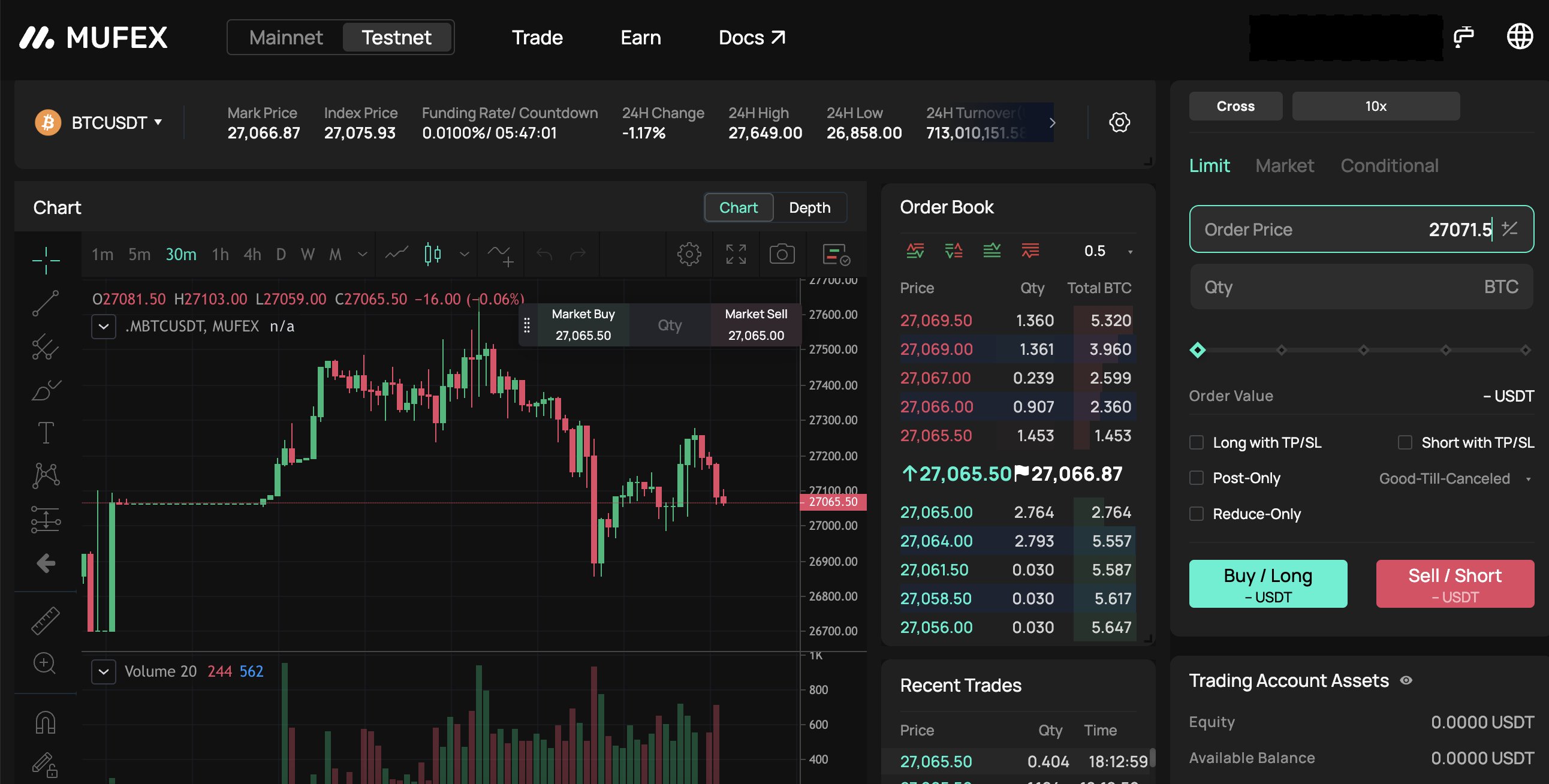

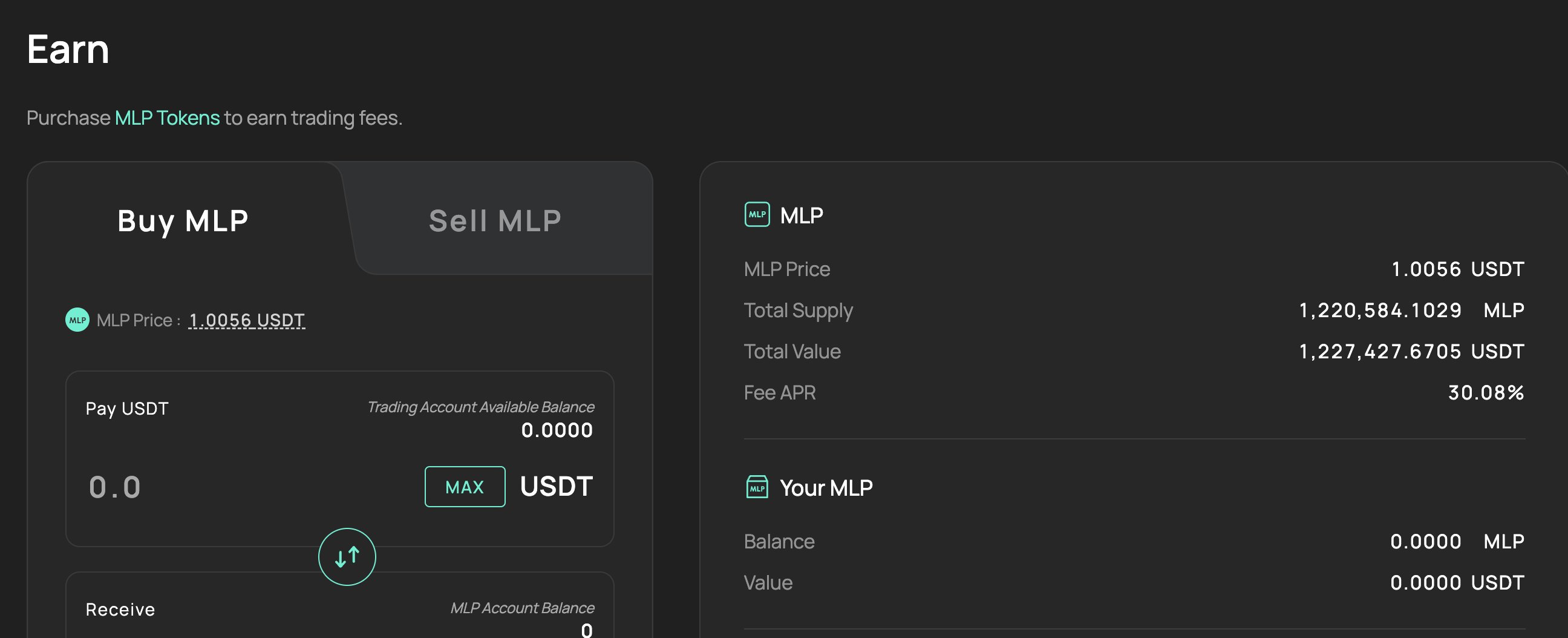

Mixed order book: There are both GMX/GNS passive MLPs and traditional market makers like dydx

secondary title

Asset self-custody

secondary title

Using account abstraction wallet scheme

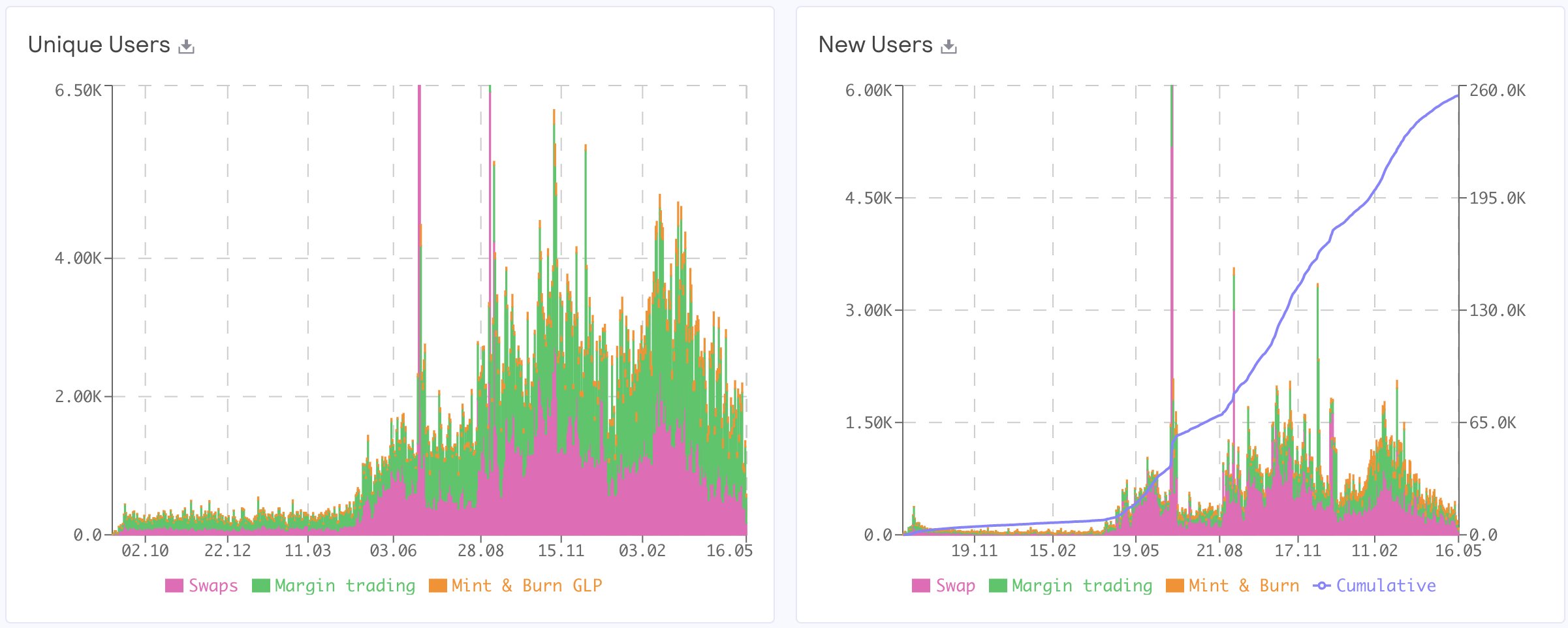

After a year of strong growth, the number of GMX users has also reached a bottleneck period, with an average daily number of users of 2 k, of which the number of contract trading users is 1 k. But in all fairness, considering that the number of real users on the chain is only tens of thousands per day according to rumors, GMX has done quite well.

So how to go further? This has to further lower the threshold of use. There is no doubt that private key wallets such as Metamask have very high user education costs, and the current increasingly mature account abstraction (Account Abstraction, AA) wallet has become a breakthrough direction. This is also the solution adopted by MUFEX. In the case of security Scalability is increased below. The benefit of intuition is to make the user experience better and simpler. For example, you can log in through email, Google account, etc., which is similar to the experience of web2 products.

secondary title

Mixed Order Book

We mentioned in the previous analysis of GNS that the dynamic slippage Spread of its transactions is calculated based on the depth of CEX transactions. To some extent, it can be said that GNS actually vaguely maps the Orderbook of CEX.

Zero slippage = buy one sell one order directly at the spot price with the remaining transaction upper limit

Dynamic slippage = placing orders at different prices above and below the spot price

MUFEX is also based on this principle. Although it has made an Orderbook, it is essentially a dynamic slippage model of GNS for MLP, and allocates liquidity through external spot data such as CEX depth. In addition to the liquidity provided by MLP, since MUFEX uses the mode of self-custody of assets on the chain and matching of transactions under the chain, it supports market makers to place orders through API. What are the benefits of this?

Because no matter what rules MLP follows to place orders, as a passive type of LP, its principles must be conservative, and large-scale losses must be avoided. In this way, it is difficult to have an advantage in slippage and fees compared with CEX, and the upper limit of scale is also very small. It will be relatively low (the upper limit of GNS BTC OI in the figure below is 10 M), which will inevitably limit the ceiling.

secondary title

Summarize

Judging from the design of MUFEX, it should aim to combine the following advantages:

Asset Security of DEX

CEX user experience

Low slippage for GMX/GNS

Composability of GLP

Orderbook's Scale Ceiling

As for the degree of completion and whether there will be a good effect, it is not yet possible to jump to conclusions. After all, there is still a big difference between this and the current DeFi, which requires strong operational capabilities. The operational capabilities of the project party can only be reflected through market practice. MUFEX is being tested, if you are interested, you canpractical experience。

CapitalismLab sharp review

DeFi has also begun to affect the user experience. The perpetual contract was invented by Bitmex. The small and sophisticated team is very similar to the current DeFi. However, Binance/OKX/Bybit and other exchanges that have done better in terms of operation and user experience, although there is no innovation in the underlying mechanism, still grabbed most of the market share.

Contract trading users operate more frequently, and user experience is the top priority. Most DeFi tracks do not make money, and it is not worth investing a lot of resources in user experience, but this does not include derivatives. MUFEX has just started, and we can look forward to the performance of the various forces that will appear on the stage next