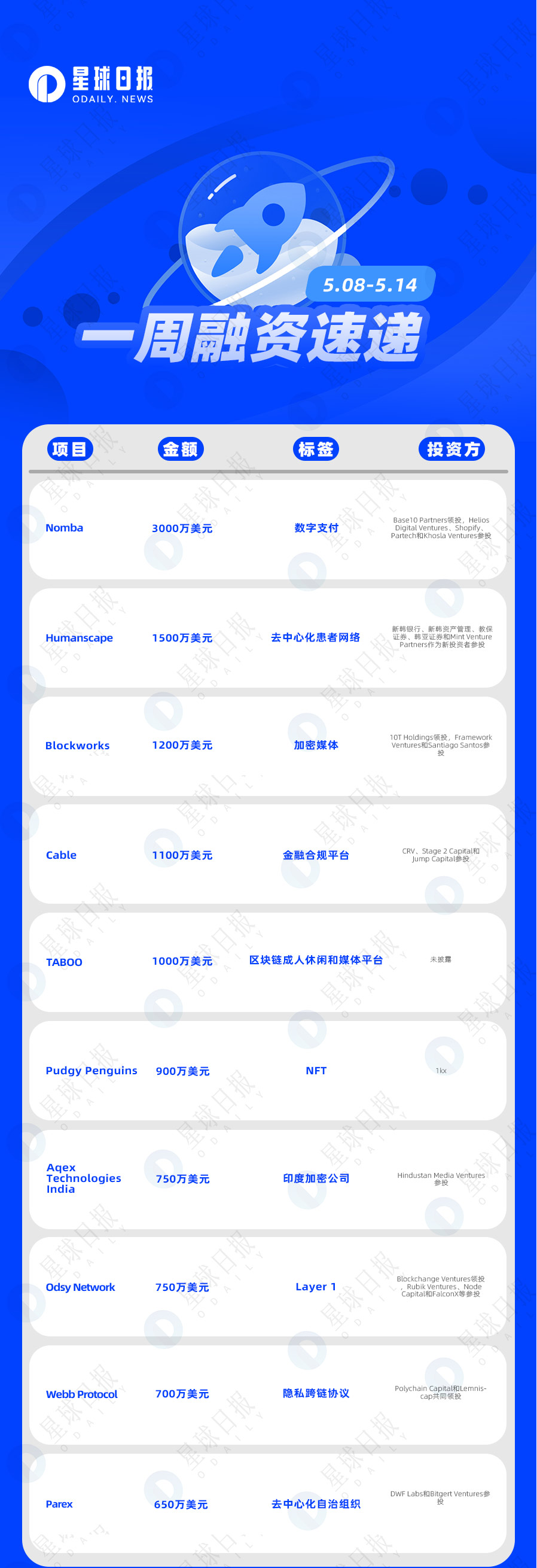

According to Odaily's incomplete statistics, there were 29 domestic and overseas blockchain financing incidents announced from May 8 to May 14, a significant increase from last week's data. There is a significant increase.

Judging from the amount of financing disclosed last week, the more popular projects include digital payment startup Nomba ($30 million), decentralized patient network Humanscape ($15 million), and encrypted media company Blockworks ($12 million). .

The following are specific financing events (Note: 1. Ranked according to the announced amount; 2. Excluding fundraising and mergers and acquisitions; 3. * is a "traditional" company whose business involves blockchain):

Digital payments company Nomba closes $30M Pre-Series B led by Base 10 Partners

On May 6, Nigerian digital payment startup Nomba (formerly known as Kudi) announced the completion of a US$30 million Pre-B round of financing, led by Base 10 Partners, with participation from Helios Digital Ventures, Shopify, Partech and Khosla Ventures.

Nomba's payment solutions, which fill the gaps in the digital payment process, allow businesses to operate more efficiently and provide a "superior customer experience," and currently average about $1 billion in monthly transactions. (Bitcoin.com)

On May 12, Humanscape, a blockchain-based decentralized patient network, completed a 20 billion won (approximately US$15 million) Series C financing, with Shinhan Bank, Shinhan Asset Management, Kyobo Securities, Hana Securities and Mint Venture Partners Participated as a new investor, and existing investors such as GC Green Cross Holdings, Care Labs, and UTC Investment made additional investments. The new funds will be used by the company to further expand its market.

It is reported that Humanscape can help patients overcome diseases through intellectual and emotional interactions based on community activities. The right to exercise the leading role of PGHD on the health data generated by patients on the platform belongs entirely to the patients. (Seoul Economic Daily)

Blockworks Closes $12M Funding Led by 10 T Holdings

On May 11, the encrypted media company Blockworks completed a financing of US$12 million at a post-money valuation of US$135 million, led by 10 T Holdings, and participated by Framework Ventures and Santiago Santos. The funding will be used to accelerate Blockworks Research, Blockworks’ research and data analytics product, which provides subscription-based research, data and analytics, governance, and real-time news. Blockworks also launched GovHub, a platform for tracking and analyzing crypto protocol proposals, last week. (AXIOS)

On May 11, according to official news, the financial compliance platform Cable announced the completion of an $11 million Series A financing, with participation from CRV, Stage 2 Capital and Jump Capital. The new funding will be used to recruit product, engineering, data and go-to-market teams and accelerate the pace of product development.

It is reported that Cable can detect financial crime regulatory violations in real time, which in turn can help reduce financial crime and provide banks, regulators and consumers with the transparency they want and need. Its customers include fintech and cryptocurrency companies such as Tide and Ramp. The Cable Platform's automated tools enable more efficient development and service of Web3 partners and customers.

Blockchain Adult Leisure and Media Platform TABOO Raises $10M at $250M Valuation

On May 11, blockchain-based adult leisure and media platform TABOO completed a $10 million funding round at a $250 million valuation, led by an unnamed private family office.

The new funds will be used for platform development, product improvements, security enhancements, marketing and promotions, and some acquisitions. It is understood that TABOO aims to expand the creation, management and distribution of adult leisure content by integrating blockchain technology and NFT. In the future, it will introduce new fashion elements and launch a new market with e-commerce functions. (Blockchain Reporter)

NFT project Pudgy Penguins completes $9 million in financing led by 1kx

On May 10, the company behind NFT project Pudgy Penguins raised $9 million in a funding round led by early investor 1kx, which also included the founders of Big Brain Holdings, Kronos Research and LayerZero Labs.

Odsy Network Closes $7.5M Funding Round Led by Blockchange Ventures

On May 11, Layer 1 blockchain Odsy Network completed a financing of US$7.5 million at a valuation of US$250 million. This round of financing was led by Blockchange Ventures, with participation from Rubik Ventures, Node Capital and FalconX.

Odsy decentralized wallets (dWallets) aim to provide access to different Web3 protocols and platforms through a "transferable signature mechanism" on the Odsy network, with the ability to sign transactions on "virtually any other blockchain".

As previously reported, in August last year, network security company DWallet Labs announced the completion of a $5 million seed round of financing, co-led by Node Capital and Digital Currency Group (DCG).

On May 11, Indian encryption company Aqex Technologies India announced the completion of a Pre-A round of financing of approximately US$7.5 million, with participation from Hindustan Media Ventures.

Aqex Technologies India plans to launch Aquarius Exchange, a cryptocurrency trading platform later this year, aiming to bring professional trading services to the South Asian (mainly Indian) virtual digital asset market. The company is also currently in a strategic partnership with transaction technology firm CQG. (Vccircle)

On May 8, the privacy cross-chain protocol Webb Protocol announced the completion of a $7 million seed round of financing, co-led by Polychain Capital and Lemniscap. The new funds will help the team grow and accelerate the development of new privacy-focused tools.

It is reported that Webb Protocol provides cross-chain applications with privacy functions including assets, data and location information in cross-chain through zero-knowledge proof.

Community-driven DAO Parex raises $6.5M with participation from DWF Labs and Bitgert Ventures

On May 14, Parex, a community-driven decentralized autonomous organization, announced the completion of a new round of financing of US$6.5 million. DWF Labs and Bitgert Ventures participated in the investment, of which DWF Labs invested US$3 million and Bitgert Ventures invested US$350. The new financing will be used to accelerate the construction of an environment-friendly DeFi and DAO ecosystem, and part of the funds may be used for mining and assisting Parex mining.

According to reports, Parex is a community-driven DAO ecosystem built by ParexChain, Parex Pockets, RaccoonSwap, Change and other decentralized applications. Parex plans to launch the mainnet after launching the PEP-20 testnet. (Crypto News BTC)

Web3 cloud gaming platform completes USD 5 million seed round financing

On May 11, The Game Company, a Web3 cloud gaming platform, announced the completion of a $5 million seed round of financing at a valuation of $40 million. The investor information has not yet been disclosed. The deal, which was completed in December but was not publicly disclosed until recently, will be used to accelerate the development of the company's game platform and use AI technology to create an interconnected multi-role ecosystem that allows users and digital gamers Profit by participating in this ecosystem.

It is reported that The Game Company is an artificial intelligence-driven cloud gaming platform designed to provide digital gamers around the world with an unparalleled gaming experience. With the powerful Fantasy League engine and Web3 technology, users can participate, play and profit from a huge interconnected multi-role ecosystem.

GameFi Project Mhaya Completes $5M Pre-Series A Funding Led by Firestone Global

On May 14, the GameFi project Mhaya announced the completion of a $5 million Pre-A round of financing, led by Firestone Global. Funds from this round of financing will be used to accelerate the development of the Mhaya ecosystem and support the Mhaya 2023 Grant Game Contest (GGC).

Mhaya owns the Free Play to Earn (FP2E) multi-chain game Mhaya 2023, which is inspired by the classic game "Monopoly" and driven by 13 key characters based on NFT. (Coinspeaker)

On May 11, Lavita AI, an AI+Web3 medical technology company, announced the completion of a US$5 million seed round of financing, led by Camford Capital, and a group of angel investors from the blockchain and artificial intelligence fields participated in the investment. The new financing will be used to accelerate the development of Lavita's AI-first platform and applications for patients, healthcare providers and research institutions.

It is reported that Lavita AI is a decentralized health data peer-to-peer market platform based on Theta Network, which aims to enable patients to control their own health with the support of artificial intelligence, blockchain and privacy protection technologies. (Crypto Reporter)

Web3 Startup Blocktorch Closes $4.2M Seed Round Led by IDEO CoLab Ventures

On May 10, Web3 startup Blocktorch completed a $4.2 million seed round of financing, led by IDEO CoLab Ventures, and other investors included Speedinvest, RockawayX, Alchemy Ventures, Remote First Ventures, Bryce Ferguson, Charlie Songhurst, Simon Jones (Voltz Labs chief executive) CEO), Andreas Klinger, Max Stoeckl (CEO of Dogami), Henry Chen (GP WAGMI Ventures), Felix Wolf and Entrepreneur First, among others.

Founded in 2022 by Gerald Pollak and Amine Afia at the Berlin-based Entrepreneur First incubation program, Blocktorch's end-to-end observability platform helps DApps scale by enabling engineers to understand the behavior of DApps and apply technology to deliver scalable functionality. (Tech Funding News)

Crypto-friendly startup Ecoterra raises $3.5 million

On May 14, Ecoterra, an encryption environmental protection start-up company, announced the completion of a new round of financing of US$3.5 million. The investor has not yet disclosed that the new funds will be used to expand the business to increase the user base and develop new technologies that promote environmental sustainability. (bitcoinworld)

As previously reported, in April this year, Ecoterra announced that it had completed a pre-sale round of financing of over US$500,000.

Web3 Company Artifact Labs Closes $3.25M Funding Led by Blue Pool Capital

On May 8, Web3 company Artifact Labs announced the completion of $3.25 million in financing, led by Blue Pool Capital and followed by Animoca Ventures. The new funds will be used to expand the company's business and increase developers.

It is reported that Blue Pool Capital is a fund that mainly invests in the wealth of Alibaba founders Jack Ma and Cai Chongxin. Artifact Labs is a multi-chain NFT ecosystem formed by the South China Morning Post spin-off of its blockchain-based NFT business.

Cloudburst Technologies Closes $3M Funding Round Led by Strategic Cyber Ventures

On May 8, Cloudburst Technologies, a provider of cryptocurrency fraud prevention solutions, announced the completion of a $3 million seed round of financing, led by Strategic Cyber Ventures, with participation from Coinbase Ventures and Bloccelerate.

It is reported that Cloudburst Technologies provides real-time monitoring solutions and cyber threat intelligence tools to help users monitor fraud in the cryptocurrency market in real time.

Chain game Medieval Empires completes $2 million in financing at a valuation of $30 million

On May 12, blockchain game Medieval Empires announced the completion of a new round of financing of US$2 million at a valuation of US$30 million.

Medieval Empires CEO Jan Berkefeld said the new funds will be used to accelerate the development of the game to provide users with a superior gaming experience.

According to previous reports, in April this year, Medieval Empires announced the completion of $ 3 million in financing, led by DWF Labs. According to the project roadmap, the funding will speed up production of the game for its public release by the end of the year.

On May 11, Web3 crowdfunding platform Artizen announced the completion of $2.2 million in financing. This round of financing was led by Consensys Mesh, Animoca Brands and Protocol Labs, as well as Dan Hill of Blank Street Coffee, Matt Condon of PleasrDAO and the founder and founder of Protocol Labs. Individuals, including CEO Juan Benet, participated in the round.

Creators are known to fund their projects on Artizen by selling so-called Artifacts: unique works of art that exist on the Ethereum blockchain and represent the spirit of a project by revealing its potential or showing a small part of its creative process. Artifacts holders can also vote on which projects should appear on Artizen in the future. At the end of a given Artizen "season", the project with the most Artifacts sold will receive a cash prize. The prize money for this season is $23,492.

On May 12, Cookbook, a smart contract registrar, completed $2 million in financing, with participation from MaC Venture Capital, Tagus Capital, Superscrypt, and Alchemy. The company says this will support Cookbook's mission to simplify developers' work building Web3 and reduce development costs for hundreds of companies.

The new financing will also be used for the platform's plan to work with the developer community to create free educational content for Web3 builders. This educational initiative will complement Cookbook’s existing offerings, including its platform, which provides developers with the tools to sift through thousands of open-source smart contract templates and access documentation on how to operate those contracts.

The tools allow developers to secure "battle-tested" code to support the projects they're building, Leon Mirochnik, general partner at Tagus Capital, said in a release.

Cookbook is said to have served more than 1,500 developers who have accessed more than 3,000 smart contracts through the platform. (CoinDesk)

DeFi derivatives protocol Smilee completes $2 million seed round led by Dialectic

On May 12, DeFi derivatives agreement Smilee Finance announced the completion of a $2 million seed round of financing, led by Dialectic, Synergis Capital, Concave, Owl Ventures, Yunt Capital, Dewhales Capital, Outlier Ventures, New Order, Multisig Ventures, GTS Ventures and Marc Zeller, 0x Sami, Barry Fried, Darren Camas, Slappjakke and other angel investors participated in the investment.

Smilee's mission is to build on-chain derivatives, enable large-scale volatility trading, become the de facto liquidity layer, and the most capital-efficient primitive for DeFi options and structured products.

On May 8, Siphon Lab, a Sui ecological DeFi encryption startup, announced the completion of a $1.2 million seed round of financing, led by Kima Ventures, Waveline Capital, BT Growth Capital, Uno Ventures, Quidnet Ventures, Mava Ventures, and a number of Web3 and Web2 fields Angel investors in the company participated in the investment, and the new funds will be used to expand its business scale, cultivate personnel and accelerate its development.

It is reported that Siphon Lab is currently building the "Siphon Universe" on the Sui network. Its products include liquid staking agreements such as Tradeify and Liquidify, aiming to maximize the capital efficiency of SUI in the entire ecosystem.

Token auditing and crypto risk management firm Nomiks raises €1 million

On May 10, Nomiks, a token audit and encryption risk management company, completed a financing of 1 million euros (about 1.09 million U.S. dollars). Outlier Ventures and Cygni Capital, as well as several anonymous angel investors, participated in the investment.

Headquartered in Geneva, Nomiks helps clients implement token-based business systems (token economics), maximizing commercial, financial and technological opportunities in Web3 while mitigating risks. The new funding will be used to invest in research and development, advance product development and form partnerships. (Royals Blue)

On May 10, MetaZ Holding, an American Web3 sneaker resale platform, announced the completion of a $1 million financing round, with participation from Pinewood Capital. MetaZ.inc, a Korean subsidiary of MetaZ, currently operates an NFT-based sneaker marketplace, Meta[Z], which enables NFT owners to trade NFT-based collectible sneakers.

On May 11, NFT subscription platform MintStars announced the completion of a $600,000 Pre-Seed round of financing, led by Polygon Labs and SpankChain. The MintStars platform is built on the Polygon blockchain. Creators can monetize their content through subscriptions and market sales. Fans can also profit by promoting content or collecting exclusive content and reselling it to the MintStars marketplace. Membership will be returned to the original creator.

On May 11, as part of the latest seed round of financing, Web3 and blockchain company HyperGlade announced that it has completed $350,000 in financing, and Draper Associates, a venture capital arm of Tim Draper, participated in the investment.

HyperGlade mainly provides innovative Web3 migration solutions for Web2 companies, helping enterprises transition from Web2 architecture to decentralized Web3 infrastructure. The new funds will be used by the company to accelerate platform development and scale its team. (Cryptosaurus)

On May 11, Triple Labs, a Web3 distributed infrastructure platform, announced the completion of its seed round of financing, with participation from CBI Holding and StepVC. The specific amount and valuation information of this round of financing has not yet been disclosed.

It is reported that Triple Lab aims to provide a one-stop development platform for enterprises and developers, lower the entry threshold for Web3 developers, to easily build and deploy decentralized applications (DApp) on the blockchain and build a developer-oriented and an ecosystem of Web3 infrastructure services for end users. (Globenewswire)

On May 13, the encrypted payment infrastructure Meso announced the completion of a round of financing. The specific amount was not disclosed. Solana Ventures, Ribbit Capital, 6th ManVentures, Phantom, etc. participated in the investment.

Meso, co-founded by Ben Mills, former head of product at mobile payment service Venmo, and Ali Aghareza, former head of engineering at mobile payment company Braintree, is building a fast, secure, and reliable way to transfer funds on-chain and off-chain, designed to allow users to One-click access to the bank from its integrated DApp or wallet, enabling them to deposit and withdraw funds quickly.

On May 12, Polynomial Protocol, a DeFi derivatives agreement, announced the completion of a seed round of financing. The specific financing amount was not disclosed. Block research summary Eden Au, Lyra Lianchuang Mike, The Graph engineer Pranav and other individual investors participated in the investment.