secondary title

1. Overall overview

ETF issuer Direxion has filed an Ethereum ETF application with the US SEC. According to the picture of the prospectus document shared by it, the fund is called "DIREXION ETHER STRATEGY ETF", and it plans to list and trade on the New York Stock Exchange Arca, Inc., and the SEC is currently reviewing the application.

In addition, Valkyrie Investments, an encrypted asset management company, also submitted an application document for the Valkyrie Ethereum Strategy ETF to the US SEC. The Fund, a series of Valkyrie ETF Trust II, seeks to gain exposure to Ethereum futures contracts by investing a portion of its assets in Valkyrie Ethereum Strategy (Cayman) Ltd., a wholly owned subsidiary of the Fund incorporated under the laws of the Cayman Islands . Valkyrie Funds LLC acted as investment advisor to the subsidiary.

Ethereum beacon chain community health advisor superphiz.eth tweeted that Ethereum developers have deployed a fix for Ethereum clients Teku and Prysm to prevent attestation flooding in response to a recent issue affecting Ethereum beacons. chain finality issues and restore network stability. It is reported that the beacon chain failed to stop producing blocks in the early hours of last Friday and Saturday. Additionally, the Ethereum Foundation stated in a blog post that the full cause of the finality issue is still under investigation, but "it appears to be caused by high load on certain consensus layer clients, which in turn is caused by anomalous conditions" .

In terms of the secondary market, the current ETH price may continue to consolidate in the short term, with a support level of $1,800 and a resistance level of $1,860.

Second, the secondary market

According to OKX market data, the price of ETH fell throughout last week, once falling to $1,737, and closed at $1,917-1,818 during the week, a month-on-month decrease of 4.7%.

image description

ETH daily chart via OKX

The daily chart shows that the price is currently consolidating around $1,830 and may continue to test $1,800 in the short term. If the support is valid, it is expected to rebound to $1,860 and $1,900.

Etherscan 2. Network operation

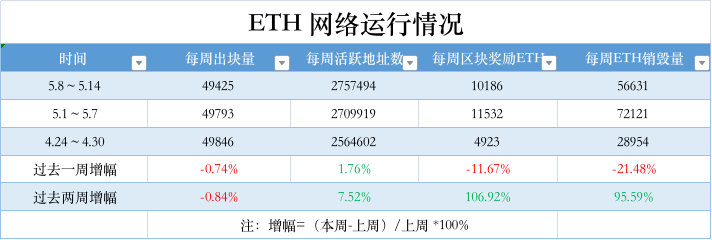

The data shows that in the past week, the number of blocks produced by the Ethereum network was 49,425, a month-on-month decrease of 0.75%; the number of weekly active addresses was 2,757,494, a month-on-month increase of 1.8%; the block reward income was 10,186 ETH, a month-on-month decrease of 11.5%; the weekly ETH The amount burned reached 56,631, a decrease of 22% month-on-month.

OKlink dataOKlink data

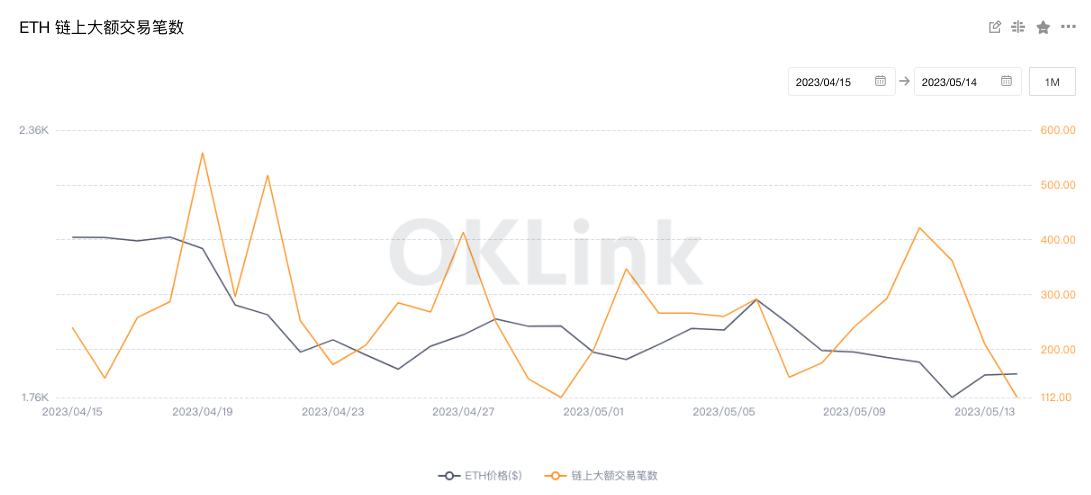

It shows that the number of large-value transactions on the chain reached 1815 last week, an increase of 2% compared to the previous week (1779), and the trading enthusiasm of giant whales has increased slightly.

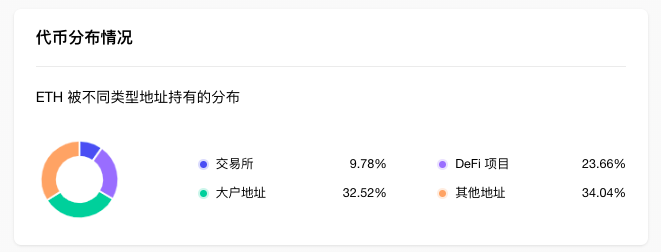

4. Rich list addressOKLink data

token.unlocksIt shows that from the perspective of the distribution of ETH holding addresses, exchanges accounted for 9.78%, a decrease of 0.26% month-on-month; DeFi projects accounted for 23.66%, an increase of 0.76% month-on-month; large addresses (top 1000 addresses excluding exchanges and DeFi projects) Accounted for 32.52%, down 0.3% month-on-month; other addresses accounted for 34.04%, down 0.2% month-on-month.

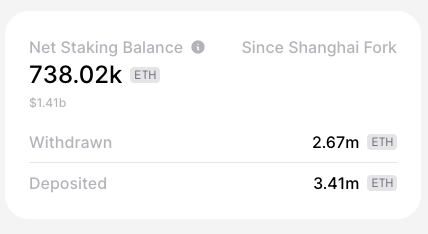

It shows that the total amount of pledged ETH in the entire ETH network is currently 18.28 million ETH, and the pledge rate is 15.07%. 2.67 million, the previous week's data was 2.43 million; the total net pledge increased by 738,000, the previous week's data was 11,000, and the previous week increased by 727,000.

3. Ecology and technology

(1) The latest ACDE meeting of Ethereum: focus on discussing EIP-4844, it is expected that the next one or two meetings can determine the scope of Cancun upgrade

Tim Beiko, the core developer of Ethereum, tweeted to summarize the discussion content of the latest Executive Layer Conference (ACDE). Kun) overall plan.

In terms of EIP-4844, the meeting first discussed some issues with the precompiled input format, they use little-endian, which is not used on EL (but is the default on CL), and the output is big-endian, which is EL the default value for . Andrew Ashikhmin asked if this could be reconciled, ideally using big-endian to match the rest of EL. After some discussion, it was agreed to move forward with the work.

The meeting then discussed whether the EIP-4844 transaction type should use SSZ or RLP. The current EIP-4844 transaction uses SSZ for specification. There are three possible avenues: make some minor modifications to the current SSZ transaction specification, hopefully future-proofing it, do a full SSZ conversion as part of Cancun, or change 4844 to use RLP encoding.

MarioVega.eth raised an issue about the block validity condition, which is implemented implicitly by some clients, but not all. We agree to this as an express condition of validity. Additionally, the Geth team is adding support for c-kzg and go-kzg to allow users to easily switch when encountering errors. The meeting also discussed two EIPs, including EIP-6969 (a proposal to introduce/standardize CSR on Ethereum L2).

(2) Ethereum developers have released a patch for the block failure that occurred in the beacon chain this week

Ethereum beacon chain community health advisor superphiz.eth tweeted that Ethereum developers have deployed a fix for Ethereum clients Teku and Prysm to prevent attestation flooding in response to a recent issue affecting Ethereum beacons. chain finality issues and restore network stability. It is reported that the beacon chain failed to stop producing blocks in the early hours of last Friday and Saturday. Additionally, the Ethereum Foundation stated in a blog post that the full cause of the finality issue is still under investigation, but "it appears to be caused by high load on certain consensus layer clients, which in turn is caused by anomalous conditions" .

Interlay founders propose creation of BRC-42 standard aimed at bridging BRC-20 tokens to external networks like Ethereum

Interlay founder Alexei Zamyatin tweeted to propose the creation of the BRC-42 standard, aiming to bridge BRC-20 tokens to external smart contract chains such as Ethereum, Solana, Polkadot, Interlay, etc. in a fully decentralized manner, thereby unlocking BRC-20 DeFi use cases of tokens, such as flash exchange, lending, etc.

Previously, Alexei also proposed to create the BRC-21 standard, which aims to bridge the tokens of external blockchains such as Ethereum and Solana to the Bitcoin chain in a decentralized manner. Both BRC-42 and BRC-21 function In the cross-chain field, but in the opposite direction.

(1) Immutable launched the payment solution "Immutable Checkout"

(2) Privacy project Railgun DAO cooperates with Chainway to add "not guilty proof" function to meet anti-money laundering and sanctions compliance

(3) The Uniswap community initiated a new proposal, proposing to "implement charges on liquidity pools"

The governance page shows that GFX Labs initiated a proposal in the Uniswap community to "implement fees for liquidity pools", proposing to implement an agreement fee equal to 20% of the pool fee in all Uniswap V3 pools, and open the fee switch for Uniswap V2. The proposal covers implementing fees on Uniswap liquidity pools, deploying a system to collect fees, and selling UNI community-designated assets in a trustless manner to earn fees. In subsequent proposals, the UNI community can decide how to manage, distribute or otherwise use assets that should be credited to the treasury.

With the support of the community, the launch of Polygon on Uniswap V3 will serve as an initial measure to deploy the system. Following a successful deployment, follow-up proposals will be made for the Ethereum deployment as well as other recommendations deemed necessary by the governance. The proposal states that all liquidity pools with regular trading volume will generate more than $10,000 in annualized revenue for the protocol.

(4) DEX aggregator Cashmere testnet has been deployed to ConsenSys L2 solution Linea

(5) Uniswap trading volume exceeds Coinbase for four consecutive months

(6) MetaMask supports US users to purchase Ethereum through PayPal

(7) Lido has officially launched the V2 version upgrade voting

Lido officially announced that it has launched a vote on the V2 version upgrade of its Ethereum mainnet application on Aragon. Once the vote is passed, Lido V2 will go live on May 15.

DeFiLlama4. Borrowing

The data shows that the value of locked collateral on the chain fell from $28.1 billion to $27.23 billion last week, a month-on-month decrease of 3%. Specifically, the number of ETH mortgages rose from 14.82 million to 15.13 million last week, an increase of 2%. From the perspective of individual projects, the top three lock-up values are: Lido $12.25 billion; MakerDAO $7.01 billion; Aave $4.41 billion.

(1) ETF issuer Direxion submits an Ethereum ETF application to the US SEC

(2) Valkyrie submits the application documents for the Ethereum strategy ETF to the US SEC

(3) Report: ETH pledge rate may double to 20% -35% in the next 18 months

According to a new report from Kraken subsidiary Staked, the rate of ETH staked could double in the next 18 months. In the week ending May 2, total ETH deposits were four times the amount added in the week before the Shapella upgrade. “Based on increased staking demand, we expect the ETH staking rate to increase from around 15% today to a range of 20-35% over the next 12-18 months, with average daily deposits currently 6.5 times what they were in April,” Staked said.