Original title: "State Of Ethereum: A Post-Shapella Update》

Original Compilation: Kate, Marsbit

Original Compilation: Kate, Marsbit

secondary title

key points

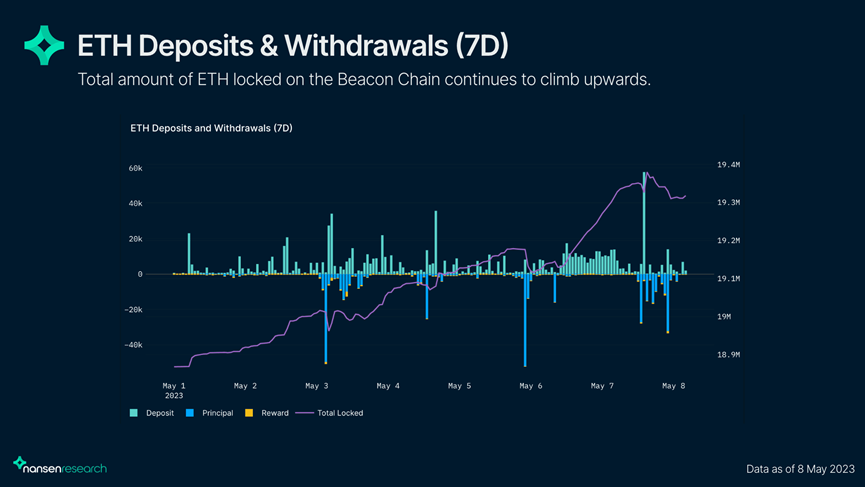

• There are currently 19.3 million ETH (including rewards) on the Beacon Chain, which is equivalent to the amount of ETH on the Beacon Chain during the Shapella upgrade, which means it has had zero impact on the network so far.

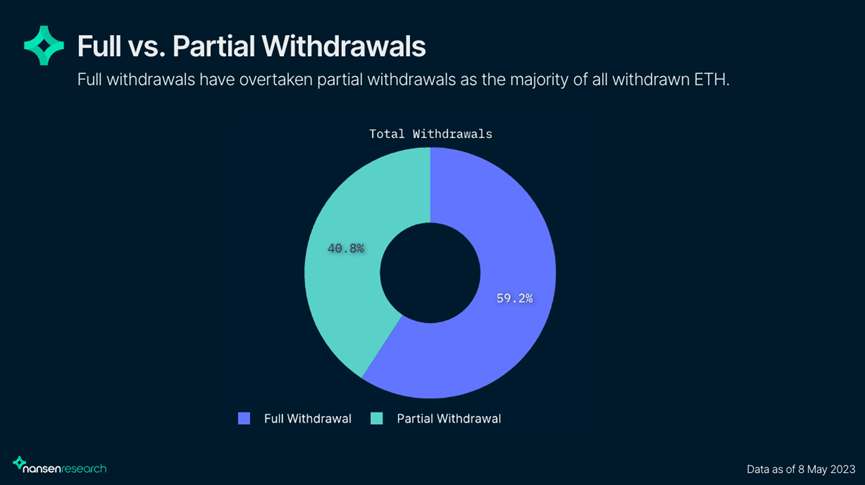

• Full withdrawals have surpassed partial withdrawals and now account for 59.2% of all withdrawn ETH compared to 40.8% for partial withdrawals.

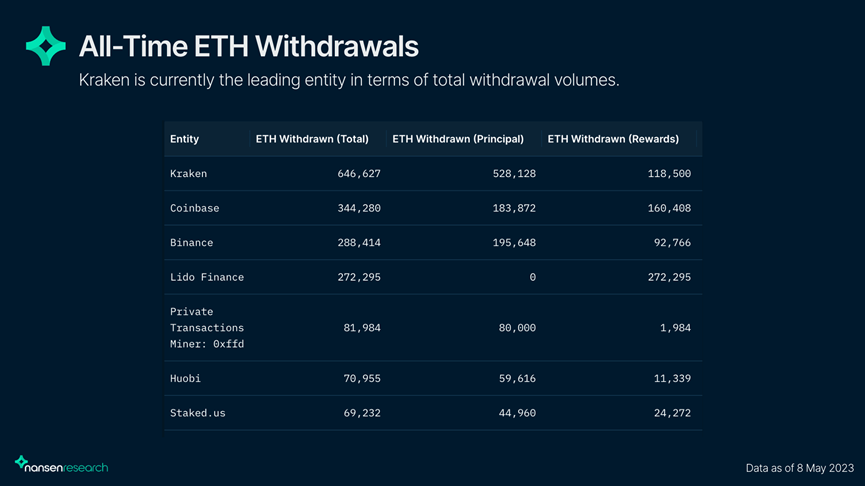

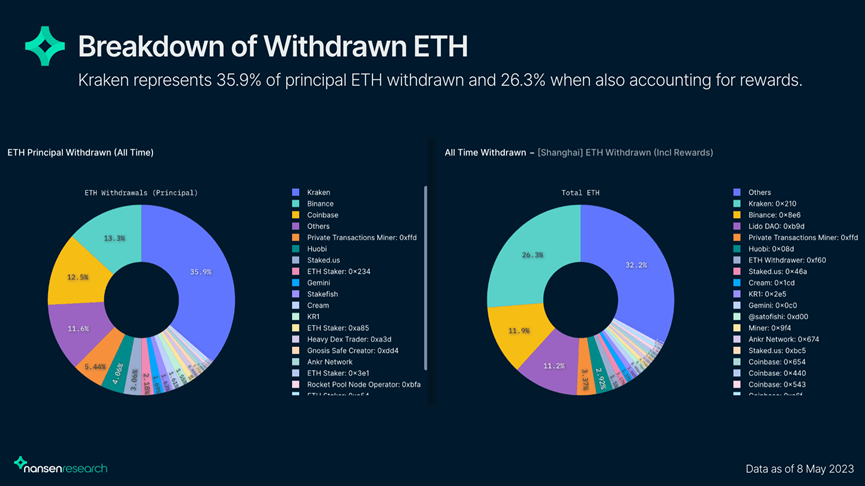

• Kraken had the most withdrawals at 647 k ETH due to the recent regulatory crackdown, accounting for approximately 26.3% of all ETH withdrawals since the upgrade, followed by Coinbase, Binance and Lido.

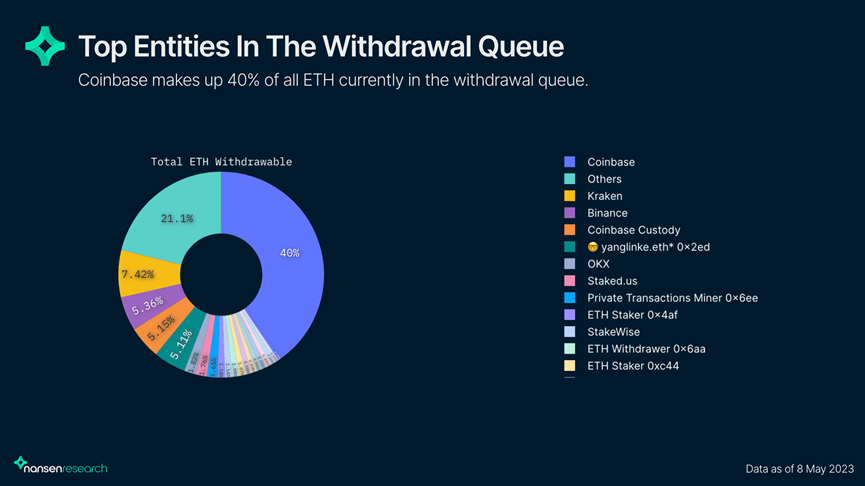

• Around 150 k ETH (0.78%) are scheduled to be withdrawn on the Beacon Chain, while 99.22% of ETH is still staked. Coinbase currently has the most ETH in the withdrawal queue (40% of the total).

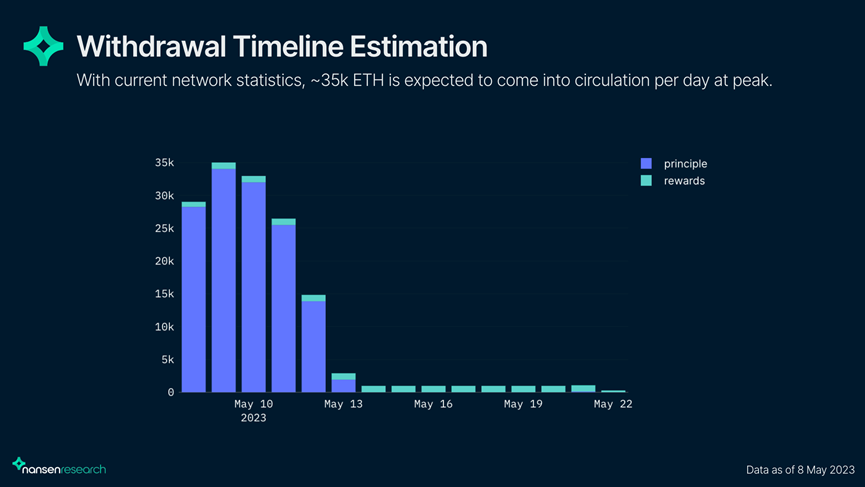

• ETH expected to enter circulation from the Beacon Chain is currently 25k-35k ETH per day.

introduce

Last month’s Shapella implementation was the most anticipated event for Ethereum and its community since the merger, largely because it enabled withdrawals from ETH staked on the Beacon Chain. The incident sparked a debate about whether the ecosystem is bullish or bearish. Bears believe that unstaked ETH entering circulation will lead to continued selling pressure, while bulls believe that the risk of not being able to withdraw is removed, leading to more deposits.asShanghai sales pressure report

As a follow-up to our report on the state of the network before the hard fork, this report aims to provide insight into the current state of the Ethereum network post-Shapella. Specifically, we delve into:

On-chain data and statistics to better understand the flow of withdrawn ETH to deposits,

Which entities have exited?

Where does the withdrawn ETH go?

Breakdown of current withdrawal activity and withdrawal queue

Estimate the time required to withdraw under the current circumstances,

And predict the amount of ETH leaving the beacon chain each day.

Overall, this report provides greater insight into the current state of the Ethereum network and helps gauge potential sell pressure and the dynamics of ETH flows from investors and entities.

Release of pledge status details

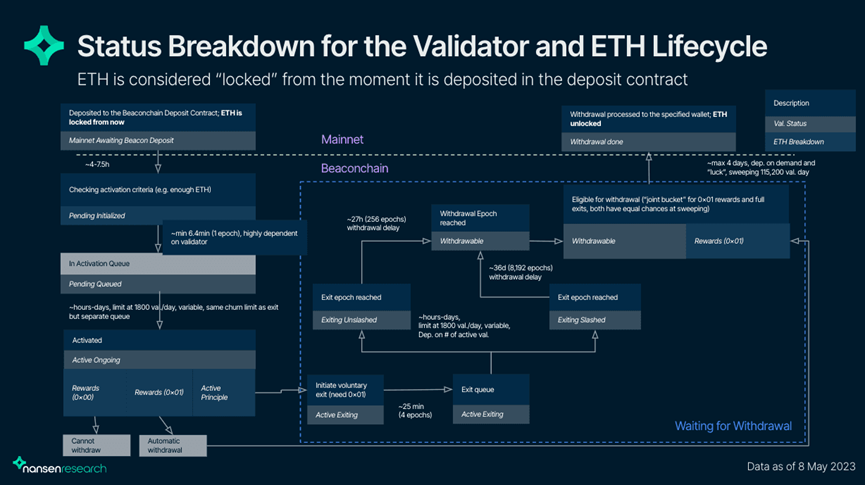

Our definition comes from the deposit and withdrawal process, as shown in the diagram above:

• Total locked ETH: ETH currently on the beacon chain (including rewards and ETH waiting to be withdrawn) + ETH that has been deposited in the main network beacon chain deposit contract but has not yet been credited to the beacon chain.

• ETH Pending/Planned Withdrawal: ETH currently scheduled for withdrawal. this includes

Reward (0x 01): All validators with balance > 32 ETH who have upgraded to 0x 01 withdrawal voucher.

Voluntary Exit: All validators with a validator balance ≤ 32 ETH initiated an exit, but have not yet passed the exit queue and reached the exit period.

Exited unslashed: The balance of all unslashed validators who have passed the exit queue but are still within the 27-hour exit delay and have not yet exited.

Exited slashed: All validator balances of validators who have passed the exit queue but are still within their ~36 day exit delay and have not exited.

Withdrawable: The validator balances of all validators who have passed their withdrawal delay (now withdrawable) and can be included in scans.

Withdrawable: All validator balances of validators that have passed withdrawal delay (now withdrawable) and can be included in the cleanup.

• Partial/reward withdrawals: All full withdrawals with balances > 32 ETH, have "reached" mainnet.

• Full/Principal Withdrawals: All withdrawals with a balance ≤ 32 ETH have "reached" the mainnet.

• Exit Queue: Time from start of exit to enqueue (~25 minutes) + actual exit queue (variable) + exit delay (27 hours).

Advanced Post-Shapella Data Points

During the upgrade period, including rewards, there were approximately 19.3 million ETH (approximately 19.1% of the circulating supply) on the Beacon Chain. Since then, a total of 2.43 million ETH has been withdrawn, while 2.2 million ETH has been deposited and 102 k ETH has been burned, resulting in approximately 130 k ETH entering circulation. Including unallocated rewards, there are still 19.3 million ETH currently staked on the Beacon Chain, meaning Shapella has had zero net impact on ETH so far.

There are 600,000 active validators securing the network. However, there are currently about 4.5k validators in the exit queue (actively withdrawn), which means they are waiting for their full withdrawal. The upgrade had no impact on the Ethereum network as the number of active validators matched the number of exiting validators, and the total amount of ETH on the beacon chain has remained relatively stable since Shapella.

Extracted ETH details

Partial withdrawals accounted for the majority of all withdrawn ETH in the first two weeks after the Shapella event. This is because partial withdrawals are automatically processed every validator scan (~days), and the only requirement from a validator is to provide a withdrawal address. On the other hand, validators who want to fully withdraw must opt out of the network and wait in an exit queue, which can take up to several weeks (and it is). Full withdrawals have surpassed partial withdrawals and now account for 59.2% of all withdrawn ETH compared to 40.8% for partial withdrawals.

Most Withdrawn Entities

Kraken has been the entity with the most withdrawals so far, totaling over 647k ETH, with principal tokens accounting for the majority. Since the upgrade, Kraken accounted for roughly 26.3% of all ETH withdrawals. This is due to the recent regulatory crackdown on exchanges’ staking services, forcing them to return staked ETH to depositors on their platforms. Kraken has about 1.4 million ETH staked through their service, which means about half of all ETH is still on the beacon chain.

After the latest round of withdrawals, Coinbase is now the second-largest entity with approximately 344,000 ETH withdrawn.

While Lido currently ranks fourth in withdrawals, all withdrawals come from staking rewards, which are automatically processed with every validator scan. However, please note that Lido V2 will support staking withdrawals and permissionless node setup and is scheduled to launch on mainnet in mid-May.

Kraken contributes 26.3% of all ETH withdrawn from the Beacon Chain. However, the percentage is much larger when only the principal amount withdrawn is considered, with transactions accounting for 35.9% of the 1.44 million ETH principal withdrawn to date. Other notable major ETH extractors include Binance, Coinbase, and the private exchange miner: 0x ffd, which accounted for 13.3%, 12.5%, and 5.44% of the major ETH shares withdrawn, respectively.

withdrawal activity

withdrawal queue

The vast majority of ETH staked on the Beacon Chain (99.22%) has no planned withdrawals, while only 150,000 ETH (0.78%) are waiting to be withdrawn from 4,500 different validators. The different categories of ETH withdrawers are composed as follows:

Most of the ETH in the withdrawal queue is from validators fully exiting their stake (active exits, possible exits, and unslashed exits), some of which may be impending selling pressure. On the other hand, ETH withdrawn from exchanges such as Kraken (a significant portion of full withdrawals) may not be sold, as depositors may wish to re-enter via DeFi or other stake-collateralization solutions.

Current withdrawal wait time

Partial withdrawal

Since staking rewards are automatically processed for every validator scan, eligible validators (those with 0x01 credentials) do not have to take any further action.

A validator scan is when a validator plans to propose the next block. Validators are also responsible for building a withdrawal queue of up to 16 withdrawals. Assuming no missed slots, a maximum of 115,200 withdrawals per day can be processed. So, for the ~600,000 validators currently active, each validator scan takes up to 4.3 days, with an average of 2.15 days to complete.

completely quit

On the other hand, validators wishing to fully withdraw from their stake must submit a voluntary withdrawal from the network, which has a delay of 4 epochs (~25 minutes) before they enter the withdrawal queue. The current exit limit is 1800 exits per day, and the exit queue wait period takes about 1.16 days, followed by an exit delay of 256 epochs (~27 hours) before being eligible to exit on the next validator scan. So, based on current web statistics, the average time to withdraw your stake takes about 3.31 days.

Exit the top entities in the queue

Coinbase accounts for 40% of all ETH currently in the withdrawal queue, followed by Kraken, Binance, and Coinbase Custody with 7.42%, 5.36%, and 5.15% shares, respectively.

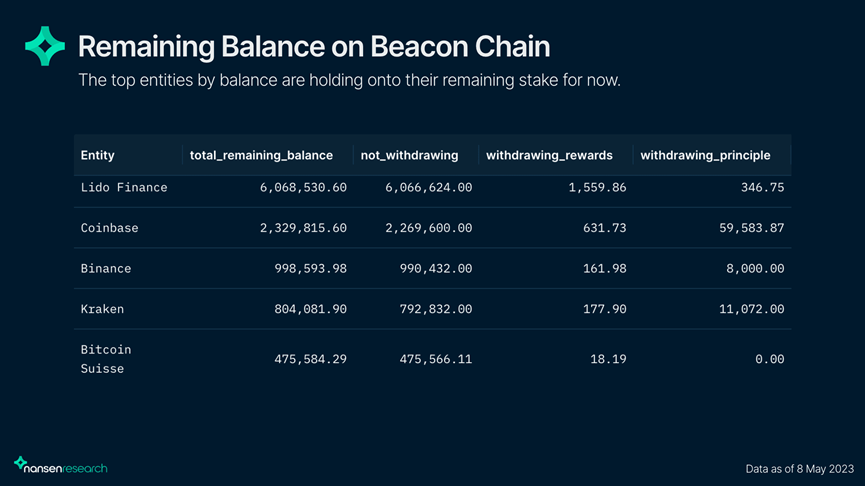

As the table above shows, most entities currently hold their remaining balances. Lido remains the entity with the largest amount of ETH and accounts for almost a third of all staked ETH on the Beacon Chain. Coinbase, the largest entity in the withdrawal queue, is withdrawing about 2.58% of all ETH.

Biggest saver since Shapella

The table above shows the main deposit entities since Shapella. Unsurprisingly, top entities include LSD projects and staking services, with Lido leading the way with nearly 412,000 ETH in deposits. Since Shapella is positive, Lido stakes ETH delta on the beacon chain. At the time of writing, Lido’s lifetime withdrawals are 272,000 ETH, while deposits are 412,000 ETH.

What do withdrawers do with their ETH?

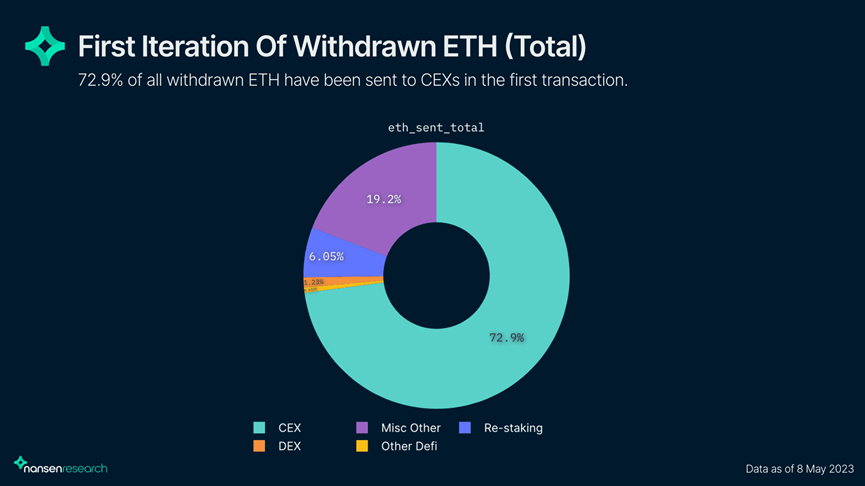

The chart above shows a breakdown of the first iteration of where the withdrawn ETH is being sent, which gives an idea of what withdrawers are doing with their ETH and helps gauge withdrawals immediately or in the short term some selling pressure.

So far, 72.9% of the ETH withdrawn from the beacon chain has been sent to CEX. However, most of this was CEXs withdrawing ETH to themselves. This means that most of the ETH sent to CEX is not mainly for sales, but for the internal operation of the exchange. In contrast, the amount of ETH sent from withdrawers to DEXs accounted for only 1.23% of the total. According to Nansen, 19.2% of the withdrawn ETH was classified as "other category", meaning it was sent to all other types of addresses and not labeled as CEX, DEX, Staking or DeFi, about 6.05% of the withdrawn ETH is sent to re-staking.

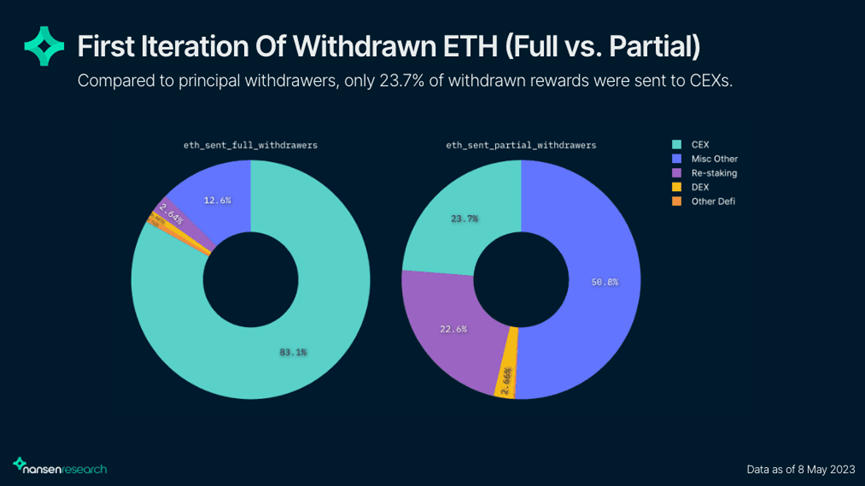

Although splitting withdrawn ETH into full withdrawers (addresses that withdraw principal ETH) and partial withdrawers (addresses that only withdraw staking rewards) paints a very different picture.

The vast majority of ETH (83.1%) from full exports is sent directly to CEXs. While 12.6% of the ETH withdrawn from this queue was sent to other miscellaneous addresses, only 2.64% of the ETH was restaked.

As for partial withdrawers, ETH sent to other addresses accounted for the largest proportion of the allocation, at 50.8%, while CEX and restaking accounted for 23.7% and 22.6%, respectively. This group is less likely to take profits (and overall less bearish) as they are still running validator nodes and staking rewards are handled automatically. So some of the ETH of some exiters will go back to the beacon chain for more yield.

things to consider

While this analysis gives an idea of where the extracted ETH is going, the query only illustrates the "first hop" from the address where the ETH was withdrawn to the receiving address where the ETH was withdrawn, and only traces the label of the receiving address. Therefore, this can lead to overestimation and underestimation of different categories.

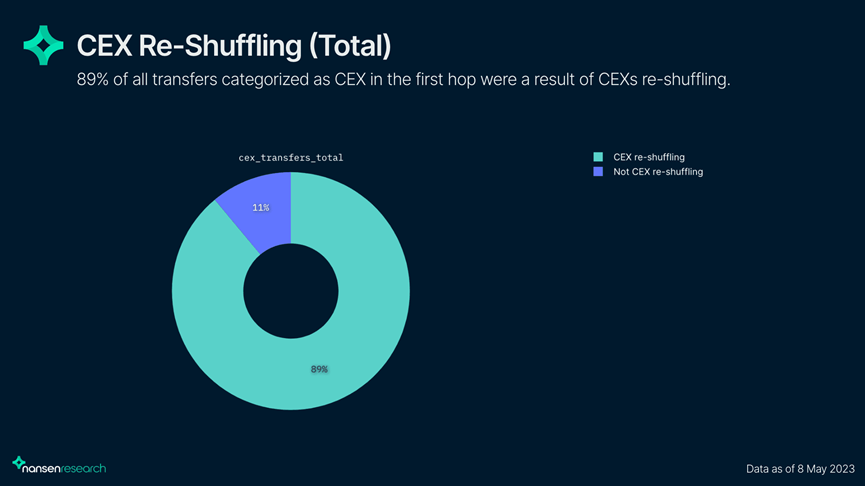

As the chart above shows, 89% of all transactions classified as CEXs were CEXs reshuffled in their wallets, reinforcing the claim that most of the ETH withdrawn was not for sale. Therefore, only 11% of CEX transactions can be considered as potential selling pressure.

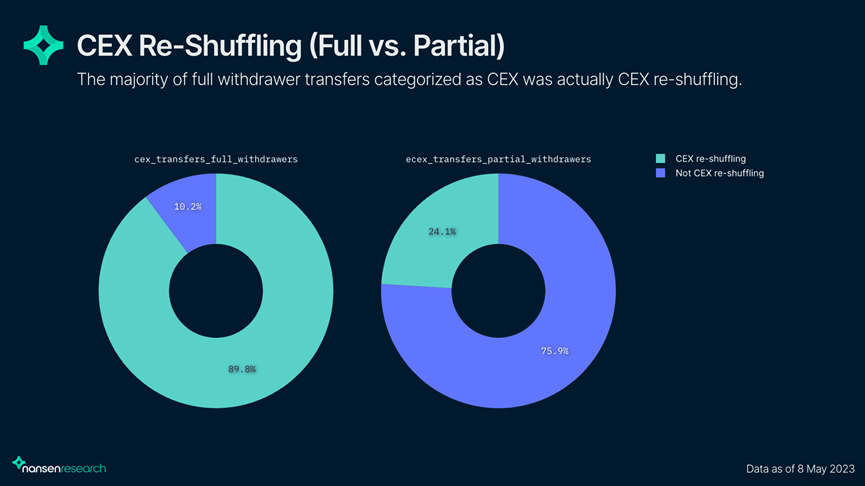

When breaking down CEX transfers into full full withdrawals and partial withdrawals, the percentage of CEX transfers that CEX reshuffles is much larger for full withdrawals than for partial withdrawals. Specifically, 89.8% of the 83.1% of CEX transfers from full withdrawals were actually CEX reshuffles, while only 24.1% of the 23.7% of CEX transfers from partial withdrawals were CEX reshuffles.

Staking, by contrast, may be undervalued. If Coinbase sent some of their ETH to another Coinbase wallet to restake, the first hop would just classify this transaction as a CEX transfer, not a restaking. Also, recipients of Kraken's staking service will not appear here, since they first have to move elsewhere.

Forecast daily withdrawals

To predict selling pressure, our daily estimate is calculated as follows:

• Fully exited validators (validators with Active Exiting, Exited Unslahed, Exited Slashed, or Withdrawal Possible statuses) are either opting out of the network (initiating exit), experiencing a 27-hour exit delay and waiting for the next scan, or somewhere in between among validators.

• The estimated exit timestamp of each fully exited validator is a single exitable epoch timestamp (based on their position in the process, taking into account exit queue time) + a random interval of waiting for the next scan (between 0 and the current maximum between scan times to simulate waiting times)

• This gives an estimated amount of prime ETH expected to be withdrawn per day based on current network statistics.

• Assume a constant amount of staking rewards withdrawn per day. This is calculated by looking at the number of currently outstanding rewards and the time it takes to clear all rewards. We estimate the average reward per epoch and assume this is a constant for reward payouts.

• Combining the estimated amount of prime ETH withdrawn per day and reward payouts gives an approximation of the total ETH expected to leave the beacon chain each day.

Therefore, the distribution of ETH withdrawn per day is shown in the graph above. Based on current network statistics, we can expect ~29 k ETH to enter mainnet from the beacon chain today, peaking at ~35 k ETH on May 9th, and then dropping. This daily estimate can be used as a ceiling for potential selling pressure in the short term. As assessed in the previous section, not all withdrawn ETH is immediately sold to the market.

Note that for the current day, the estimated selling pressure will often be less than the actual volume, since this model shows future withdrawals. For example, if the day was "15 hours ago", less money may be withdrawn for the rest of today than for the entire 24 hours of tomorrow.

The current model only considers validators currently in the process of exiting, rather than predicting how many validators will exit in the future, and bases their evaluation on current on-chain statistics only. Also, the model does not predict the amount of ETH that will be sold on a given day, as withdrawers may not sell immediately, but as an estimate of the amount of ETH withdrawers may sell each day.

in conclusion

in conclusion

Based on current network statistics, we can conclude that the sell pressure on ETH following withdrawals is somewhat non-existent, as deposits nearly match the amount of ETH entering circulation. This means that foreclosure risk has so far offset selling pressure from withdrawals. Also, a significant portion of the withdrawn ETH may not be for sale.