Original source: TechFlow Research

Original Author: 0x min & David

Ordinals and BRC-20 have successfully started the "issuing assets on Bitcoin" trend, but apparently it may not be the last.

If asset issuance on Bitcoin becomes a new narrative, will we have a more feasible and friendly way while minimizing the burden on the Bitcoin mainnet?

Therefore, recently, a protocol that has been silent for many years has once again sparked discussion-"RGB", a protocol that can create and manage digital assets on the Bitcoin network, often appears together with the concept of Bitcoin's second layer such as the Lightning Network.

first level title

Ancient RGB, pay attention to BTC asset issuance

The matter of issuing assets on the Bitcoin network has actually been thought of a long time ago.

The origins of the RGB protocol can be traced back to 2018, when Bitcoin community members such as Giacomo Zucco, Peter Todd, and Alekos Filini began exploring a new method of creating and managing assets on the Bitcoin network. Their goal is to design a protocol that can take advantage of Bitcoin's security and decentralization properties, while supporting more complex functions such as asset issuance and smart contracts.

To achieve this goal, they began to study how to combine asset and state information with Bitcoin's UTXO model, and proposed a new protocol called RGB. Its core idea is to combine asset issuance, ownership and status updates through client-side verification with Bitcoin's UTXO model, rather than relying on full nodes of the Bitcoin network like the current BRC-20.

As for why it is called "RGB", you can easily think of red, green and blue among the three primary colors. In fact, the initial research direction of the RGB protocol is "colored coins", so the concept related to color is used. Although what the current RGB protocol does has little to do with dyed coins, the name has been retained.

As can be seen in its Github directory, RGB's explanation is to provide scalable private smart contracts for Bitcoin and the Lightning Network, creating the possibility of issuing assets in the Bitcoin network.

Only due to the later rise of Ethereum and Bitcoin being more considered as a store of value and a weathervane in the currency circle, the practice of issuing assets and creating contracts on Bitcoin has been in a tepid state.

first level title

Bind asset status with UTXO

The realization of the RGB protocol is actually not difficult to understand. The core lies in the accounting method of Bitcoin itself - UTXO.

Due to limited space, the author does not intend to popularize the concept of UTXO, but only briefly defines it: it does not record the final state of Bitcoin transactions, but only records transaction events and processes.

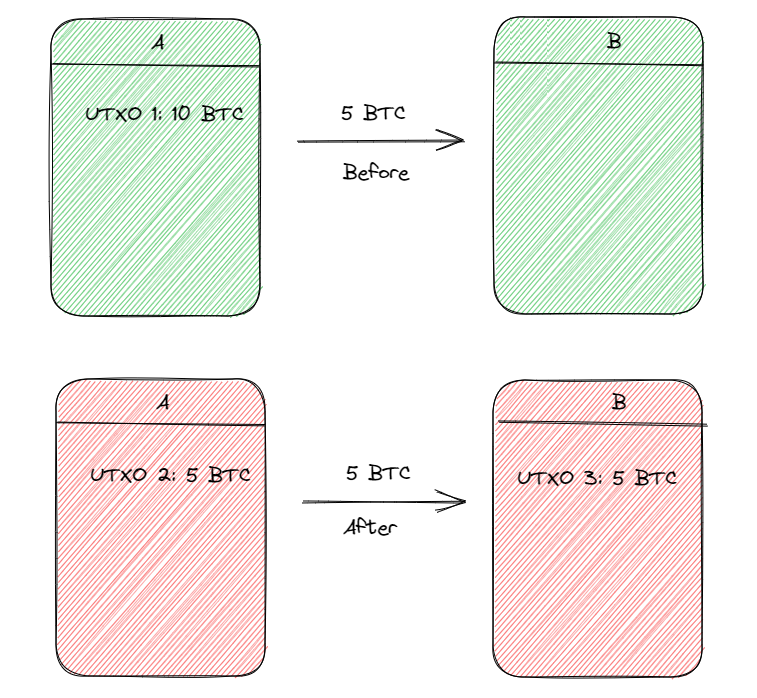

A simple example: A has 10 bitcoins, sent 5 to B, and has 5 left. A simple description with UTXO is as follows:

UTXO 1: A has 10 BTC

UTXO 2: A has 5 BTC left

UTXO 3: B has 5 BTC more

It can be seen that UTXO is recording the transaction status changes on the Bitcoin chain. After the transaction is completed, A has 5 BTC left, which is different from the previous state of 10 BTC. Correspondingly, UTXO 1 is actually split into 2 new states: give yourself 5 change (UTXO 2), and transfer 5 to others (UTXO 3).

After understanding this principle, RGB actually binds the asset issuance under the chain with the UTXO change on the chain:

Since UTXO can confirm the transaction event of Bitcoin at a certain point in time, then we can make the change of this transaction event correspond to the change of the status of some other things;

For example, I issued an asset in another place, corresponding to UTXO 1 on the Bitcoin network. If I transfer this asset to others, then this "transfer" behavior can be mapped to UTXO 2 on the Bitcoin network....

Because UTXO itself is fixed and consensused, as long as I can prove that this binding is reliable, then the change of UTXO on the Bitcoin mainnet should also be recognized by the corresponding changes in the status of other assets.

Furthermore, the RGB protocol is using the security of the Bitcoin mainnet UTXO to endorse the security of asset issuance or contract logic under its chain.

If you find it difficult to understand, take a look at Twitter users@trustmachinescoAn example given:

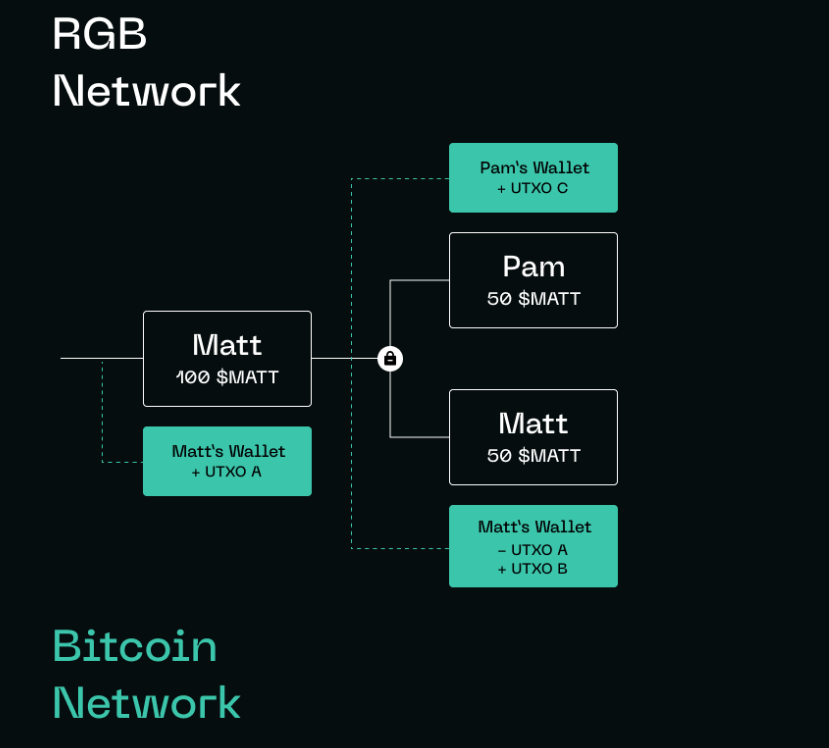

Matt issued 100 $MATT coins to himself on the RGB network;

On the Bitcoin network, Matt’s coin issuance corresponds to the UTXO A of his current Bitcoin holdings;

Matt transfers 50 $MATT coins to Pam;

On the Bitcoin network, Matt’s coin transfer corresponds to a new UTXO B, and UTXO A in step 2 is destroyed;

On the Bitcoin network, Pam’s coin acquisition corresponds to a new UTXO C, which means that Pam currently holds Bitcoin UTXO;

Similarly, when Pam transfers coins, his original UTXO C will also be destroyed to form a new UTXO D...

If this $Matt coin has been transferred in the hands of different people, eventually there will be UTXO corresponding to these transfers on the Bitcoin mainnet for identification, and every transfer that occurs at the moment will cause the original UTXO to be destroyed, resulting in New UTXOs.

first level title

One-Time Stamps and Promises

The above is a very simple technical detail of RGB implementation. In fact, to ensure that the assets issued by RGB under the chain can indeed be matched with the UTXO on the chain, some other technologies are needed to achieve it.

Client-side validation (client validation):In the RGB protocol, transaction verification and data storage is done on the client side (such as wallet software), rather than on the blockchain. This keeps transaction data off-chain, improving privacy. Client verification can also reduce on-chain data storage requirements and improve network scalability.

This is also the big difference between RGB and BRC 20 at present. Since the transaction data is on the client side instead of on the chain, it can theoretically greatly reduce the current network congestion and high transaction fees.

Single-Use-Seals:A technology that ensures asset ownership cannot be tampered with. A one-time seal is a cryptographic signature used to lock the state of an asset. When assets are transferred, old seals are destroyed and new ones are created. This way, any attempt to tamper with the ownership of the asset will be detected because the state of the seal does not match.

This also corresponds to the destruction and generation of UTXO described in the previous section. The old seal represents the old UTXO, and the new seal points to the new UTXO.

Commitments:To link assets to the Bitcoin network, the RGB protocol uses a technique called commitments. A commitment is a cryptographic proof that an asset is associated with a specific Bitcoin transaction. Commitments are embedded in Bitcoin transaction outputs (UTXOs), which allow assets to be transferred across the Bitcoin network.

Anchoring:In order to link client-side verification with the Bitcoin network, the RGB protocol uses an anchoring technique. Anchoring is the process of bringing together a one-time stamp and commitment. As assets are transferred, new one-time stamps, commitments, and transaction data are anchored to the Bitcoin network, ensuring the security and consistency of the entire system.

Here, the author gives a RGB protocol workflow that is more in line with the actual situation:

The asset issuer creates a new asset on the client side and generates a one-time stamp and commitment.

Asset issuers anchor new assets to the Bitcoin network by embedding commitments into Bitcoin transaction outputs (UTXOs).

The asset recipient verifies the validity of the asset by viewing the commitment and verifying the one-time stamp.

When assets are transferred, the old one-time stamps are destroyed and new one-time stamps, commitments, and transaction data are anchored to the Bitcoin network.

In this way, the RGB protocol realizes the functions of asset issuance, transfer and verification on the Bitcoin network, while maintaining the characteristics of privacy, scalability and decentralization.

At the same time, RGB can also be well combined with the Lightning Network. In its official documents, RGB describes itself as an L2 or L3; when the Lightning Network exists, RGB can be used as an L3 to quickly exchange Bitcoin and RGB tokens off-chain, thereby achieving more efficient transactions and asset management.

first level title

future

From being silent for a long time to being dug up again, RGB actually relies on the wind of BRC-20 assets.

Instead of making value judgments and meaningful explorations, what we can discover more is that after the first wave of speculation, more opportunities will emerge silently, and push the entire ecology to take another step forward amidst the noise.

Currently we can see that in the recently released V 0.1 version, RGB has also unlocked the last remaining functions required to implement smart contracts. In the context of BRC-20 burdening the network, RGB's paving of the infrastructure layer may give rise to other BTC-based protocols and applications.

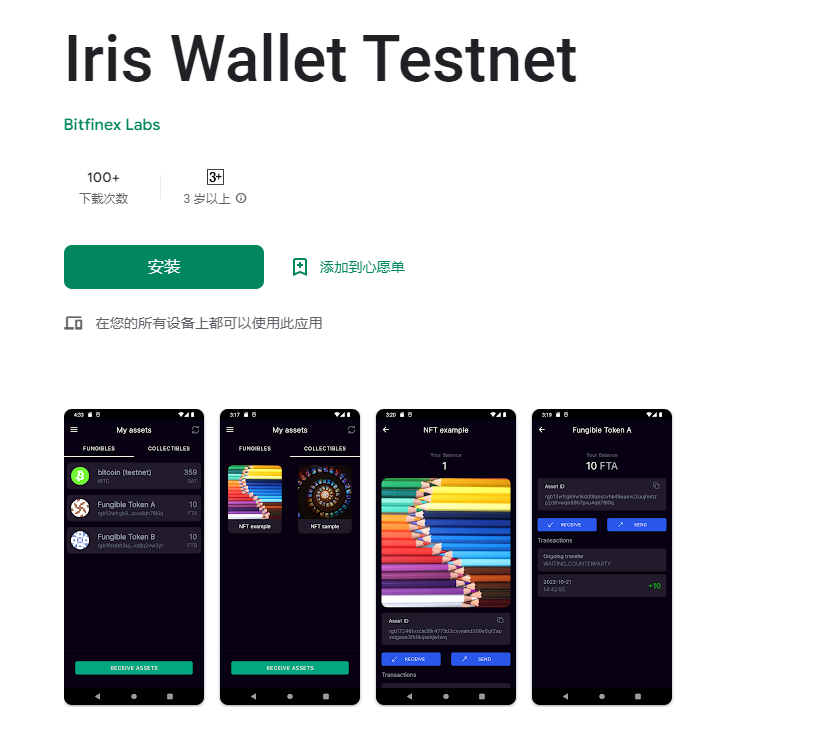

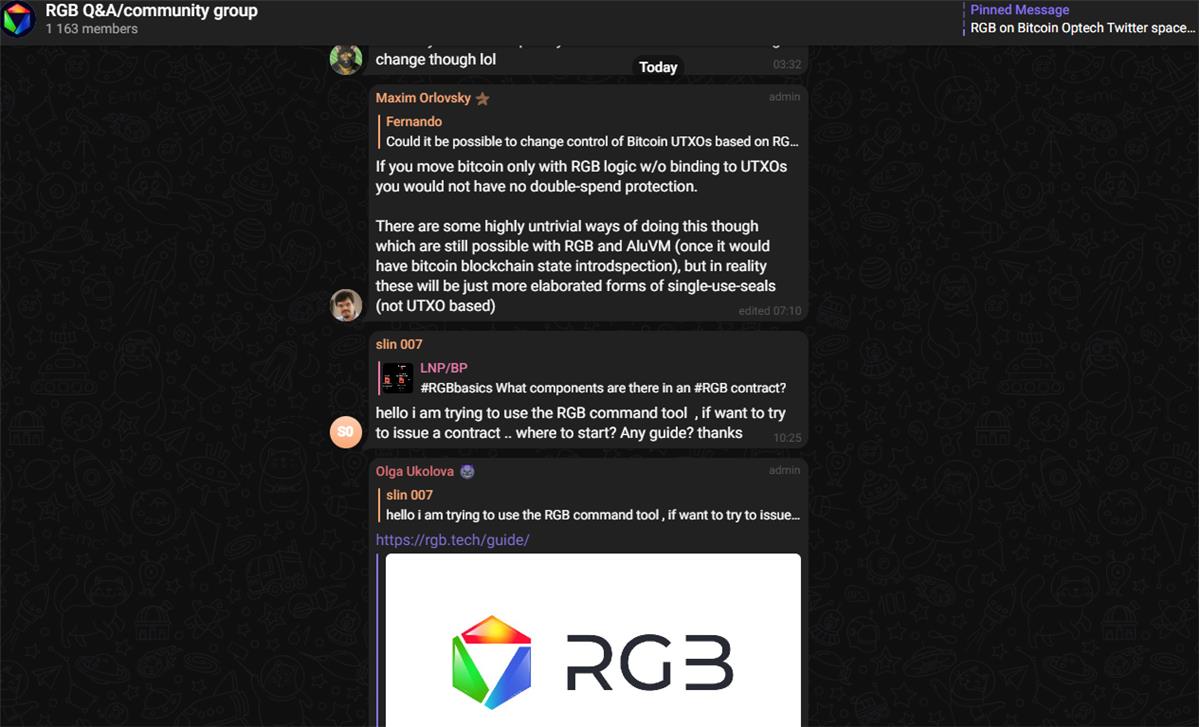

At the same time, RGB has actually launched a wallet that can send and receive BTC-based network assets, and supports NFT-related functions. In the process of the author's research, I found that RGB-related telegram discussion groups are still active, and developers are keen to discuss and answer technology-related questions.

Leading the BTC revival narrative, the BRC-20 may be the first, but it's unlikely to be the last.

Some people benefit from the hype and bring new technical problems; solving these problems often also generate new narratives, awakening ancient protocols like RGB, which may cause the next wave of hype.