According to Odaily’s incomplete statistics, a total of 39 blockchain financing incidents at home and abroad were announced from April 17 to April 23, a certain increase from last week’s data. There is a noticeable increase.

The following are specific financing events (Note: 1. Ranked according to the announced amount; 2. Excluding fundraising and mergers and acquisitions; 3. * is a "traditional" company whose business involves blockchain):

The following are specific financing events (Note: 1. Ranked according to the announced amount; 2. Excluding fundraising and mergers and acquisitions; 3. * is a "traditional" company whose business involves blockchain):

On April 21, cloud service provider and Ethereum mining company CoreWeave announced the completion of a $221 million Series B round of financing, led by Magnetar Capital, with participation from Nvidia, former GitHub CEO Nat Friedman, and former Apple executive Daniel Gross. Magnetar contributed $111 million, with Nvidia, Friedman, and Gross splitting the remainder. An Nvidia spokesperson said the investment represents a "deepening" of its relationship with CoreWeave.

CoreWeave CEO Mike Intrator said that the financing valued CoreWeave at $2 billion pre-money, bringing the company's total financing to $371 million, which will be used to support CoreWeave's data center expansion in the United States. Two data centers will be opened this year. new center. CoreWeave currently operates 5 data centers in North America.

On April 18, Bitcoin financial service provider Unchained announced the completion of a $60 million Series B round of financing, led by Valor Equity Partners, with participation from NYDIG, Trammell Venture Partners, Ecliptic Capital and Highland Capital Partners, and the new funds will be used to expand its impact The scope and suite of services to enable new Bitcoin entrants to adopt Unchained's more secure collaborative custody model across centralized custodians.

It is reported that Unchained Capital will utilize the native multi-signature function of the Bitcoin network to provide customers with shared control over Bitcoin between private keys held by themselves and private keys held by Unchained or other financial services companies.

On April 21, according to official news, Layer 1 public chain Berachain completed a financing of 42 million US dollars, Polychain Capital led the investment, OKX Ventures, Hack VC, Dao 5, Tribe Capital, Shima Capital, Robot Ventures, Goldentree Asset Management, Dragonfly Capital former Partner, Celestia founder Mustafa Al-Bassam, Tendermint co-founder Zaki Manian and 20 other DeFi project founders participated in the investment.

It is reported that Berachain is an EVM-compatible Layer 1 blockchain built on the basis of the Cosmos SDK, and is protected by the Proof of Liquidity consensus mechanism. The Berachain token economy introduces the Bera network of the three-token system for the first time, with the network gas token BERA, the ecological algorithm stable currency HONEY and the non-transferable Bera governance token BGT. The current Berachain project Discord community has more than 50,000 members, and more than 100 teams are building new and existing protocols on the recently released local version of the development network (Devnet). The Berachain ecosystem already has over $250 million in committed total value locked and will launch a public incentivized testnet in the coming weeks.

On April 18, KRAFTON, the developer of the tactical competitive shooting sandbox game "PUBG Mobile", and Naver Z, the metaverse division of South Korean Internet giant Naver, will form a new joint venture in North America. The two companies will contribute to the new North American entity. 48 billion won (approximately US$36.4 million) was invested. KRAFTON will own 85% of the joint venture and NAVER Z will own the remaining 15%.

It is reported that KRAFTON and Naver Z are jointly developing a new metaverse experience called "Migaloo", which has been in development since last year and is planned to be launched by the end of 2023. Migaloo plans to adopt a create-to-earn (C2E) model, allowing creators to develop and sell content as NFTs within the platform.

Metaverse company XRSPACE completes $25 million in financing led by Foxconn

On April 23, XRSPACE, a Taiwan-based metaverse company, announced the completion of a new round of financing of US$25 million, led by Foxconn. The company will use the new funds for research and development of next-generation 3D live streaming and social experiences.

Founded in 2017, XRSPACE mainly provides a social metaverse experience through its platform "XRSPACE MANOVA", aiming to change the way people connect, work and play. Users must wear virtual reality headsets to connect with each other through complementary applications PartyOn and GOXR . (Nftgators)

On April 21, staking provider P2P.org completed $23 million in financing, with Jump Crypto, Bybit and Sygnum participating. P2P.org said it will use the funds to develop blockchain infrastructure to enhance user staking experience as well as research and develop expansion plans. (CoinDesk)

iZUMi Finance Completes $22 Million Financing Through Solv V3, Incuba Alpha Participates

On April 23, iZUMi Finance, a one-stop liquidity-as-a-service (LaaS) DeFi protocol, announced the completion of a round of financing of 22 million US dollars. This round of financing has received Unicode Digital, NextGen Digital Venture, Bella Protocol, Incuba Alpha and other funds and With the support of individual investors, a total of 22 million US dollars worth of ETH, stETH, USDC, USDT, etc. were raised.

In addition, iZUMi's DEX product iZiSwap Pro has landed on the zkSync Era network and launched the "iZiSwap Pool Party" series of activities on the Web3 social platform Galxe.

Web3 karate fighting game Karate Combat raises $18 million led by Bitkraft Ventures

On April 19, Karate Combat, a Web3 karate fighting application, completed $18 million in financing, led by Bitkraft Ventures, with participation from Delphi Digital, The Operating Group, Alpha Wave Global, Hashkey, and RooxieXBT. The new funding will be used to launch the Karate Combat “Up Only Gaming” application and the KARATE token on the Ethereum and Hedera networks on May 10.

Launched in 2018, Karate Combat combines full-contact karate with an immersive computer-generated environment and extended reality (XR) technology using Epic Games' Unreal Engine. The Karate Combat League is sponsored by the HBAR Foundation, which supports the Hedera Ecosystem and the Hedera Hashgraph Network. (Decrypt)

On-chain insurance company Nayms completes $12 million private placement led by UDHC

On April 21, Nayms, a UK-based on-chain insurance company, announced that it had completed a $12 million private placement financing at a valuation of $80 million. UDHC led the investment, and New Form, Tokentus, Keyrock and other long-term investors participated in the investment.

Nayms will use the new funds to expand its global team and accelerate the development of its crypto-native insurance marketplace. Nayms plans to further support its product development, marketing, and accelerate global business expansion. (PRNewswire)

On April 19, Rally, an e-commerce combined checkout platform, announced the completion of a US$12 million Series A financing, led by March Capital, with participation from Felix Capital, Commerce Ventures, Afore Capital, Alumni Ventures and Kraken Ventures.

Rally, the checkout solution that gives merchants the freedom to design and implement a custom checkout that works best for their team, will use the new funding to strengthen its team, penetrate enterprise and international markets, and expand partnerships with e-commerce platforms like Swell and BigCommerce, Salesforce Commerce Cloud and more Integration of e-commerce tools and payment channels like Affirm and AfterPay will also build in Web3 functionality and allow merchants to accept cryptocurrencies at checkout. (FF News)

Galactic Holdings Closes $10M Pre-Series A Funding Led by BAI Capital

On April 17, Galactic Holdings, a leading cryptocurrency company in Latin America, announced the successful completion of a $10 million Pre-Series A funding round. The round was led by BAI Capital, with participation from Animoca Brands, Y 2 Z Ventures, Longling Capital, Head & Shoulders, TKX Digital Group, Perseverance Capital, and Palm Drive Capital. This financing will further promote the development of Galactic Holdings in Latin America.

Galactic Holdings is currently the only large-scale comprehensive platform in Latin America that is compliant and owns the digital currency wallet TruBit, the exchange TruBit Pro, and the Mexican peso-anchored stablecoin MMXN.

Maggie Wu, CEO and co-founder of Galactic Holdings, stated that Galactic is committed to the overall development of the cryptocurrency business in Latin America.

Web3 Data Management Company Fluree Closes $10M Series A Funding Led by SineWave Ventures

On April 20, Fluree, a Web3 data management tool development company, announced the completion of a US$10 million Series A financing, led by SineWave Ventures. So far, the company’s total financing has exceeded US$16 million.

It is reported that Fluree mainly provides a semantic graph database supported by blockchain to help enterprises manage data assets. By combining permissioned blockchain technology, semantic web standards and data security policy control, developers can store data in a decentralized and trusted format. and manage data. (venturebeat)

'Wallet-as-a-Service' Provider Universal Ledger Raises $10M Led by Hard Yaka

On April 19, wallet-as-a-service (wallet-as-a-service) provider Universal Ledger announced the completion of $10 million in financing, led by Hard Yaka. The Universal Ledger ecosystem will run on its native stablecoin which will be backed 1:1 by USD.

Universal Ledger aims to help users build their own encrypted wallets. Its customers are mainly large financial institutions and administrative institutions. The company has built a hierarchical verification system that provides low-level verification such as phone numbers, emails, and other identification information. High-level verification to ensure transaction security. (Axios)

On April 23, Metaverse infrastructure provider MetaGravity completed a US$9.5 million seed round of financing. Sino Global, Spartan Group LLC, Market One Capital, etc. participated in this round of financing. Funds from this round of financing will be used to expand its projects and products team to develop the infrastructure layers needed to support future large-scale virtual universe experiences. (Tech Funding news)

On April 19, HashPort, a Japanese Web3 start-up company, completed a round C financing of over 1.2 billion yen (US$8.9 million) through a third-party allotment of shares. Investors include Yusaku Maezawa, Shizuoka Capital, Venture Labo Investment, and Tokyu Real Estate Holdings CVC Fund, Sumitomo Mitsui Banking Corporation, etc. HashPort’s total funding so far is approximately 2 billion yen ($14.8 million).

It is reported that HashPort Group has been committed to the research and development of blockchain technology since 2018. Its subsidiaries include HashPort engaged in blockchain-related consulting and system solution business, Hash Palette engaged in NFT-related business, and Hash Bank engaged in financial infrastructure business. .

Decentralized database Tableland raises $8 million led by CoinFund

On April 21, the decentralized database Tableland completed a financing of US$8 million, led by CoinFund, with participation from Multicoin Capital, Blueyard, and A Capital.

Tableeland provides a permissionless relational database that developers can use to build complex relational data models for decentralized games, dapps, and NFTs. Funds raised in this round will help support Tableland’s mainnet launch and release of new developer tools. (coindesk)

On April 21, Singapore-based blockchain verification technology solution Accredify announced the completion of a $7 million Series A financing led by iGlobe Partners and SIG Venture Capital, with participation from Pavilion Capital and Qualgro.

It is reported that Accredify utilizes the underlying use of blockchain technology to ensure the authenticity of shared or received documents, preventing fraud and forgery, such as verifying fake degrees and fake certificates. The company can also help businesses create customer identities, wallets or file storage on blockchains (mainly ethereum for now), ensuring business profiles are verifiable.

Accredify has offices in Singapore and Australia and plans to expand its presence in Australia by hiring more staff. The company is also exploring expanding into Japan through pilot projects with government agencies. (Techcrunch)

On April 18, Fractal, an encrypted financial platform, completed a $6 million financing. Investors include QCP and 6th Man Ventures, prototype, Blizzard, CMT Digital, Golden Tree Asset Management, CoinShares and Spartan Group.

It is reported that Fractal is committed to creating a new platform to facilitate more transparent clearing and settlement of digital assets and eliminate the opacity of transactions caused by leverage.

Through Fractal, customers will be able to monitor counterparty positions in real time to reduce risk, which in theory means that the same collateral cannot be used to trade with multiple counterparties, to avoid the previous opacity of FTX and 3AC that exposed users to violence. The problem of mine loss. (The block)

Market maker protocol Swaap closes $4.5M seed round led by Signature Ventures

On April 19, the market maker agreement Swaap announced the completion of a $4.5 million seed round of financing, led by Signature Ventures, New Form Capital, C² Ventures, Kima Ventures, Pareto Ventures, Entrepreneur First, and angel investors Julien Bouteloup (Stake Capital), Pascal Gauthier (CEO of Ledger), Richard Ma, Meltem Demirors (CSO of Coinshares), Frederic Montagnon (co-founder of Arianee) and Thibaud Elzière (CEO of eFounders) participated.

It is reported that the market maker agreement Swaap aims to build a next-generation market-making agreement, which uses a combination of oracles and dynamic spreads to achieve sustainable returns and reduce transaction costs. Its unique approach aims to provide LPs with a passive and profitable market-making strategy, solving the critical problem of short-lived losses prevalent in DeFi.

Node 40 Closes $4M Funding, Card 1 Ventures Participates

On April 21, Gary Cardone, co-founder and former CEO of Clearwater-based fraud mitigation firm Chargeback 911, invested $4 million in Node 40. With investment from Card 1 Ventures, Node 40 is poised to scale and refine Its existing suite of blockchain infrastructure solutions.

Known for its innovative suite of blockchain tools and services, Node 40 is dedicated to simplifying the deployment and management of blockchain nodes. (Gritdaily)

On April 19th, Web3 notification platform Yoz Labs completed a $3.5 million financing, led by Electric Capital, with participation from Collab+Currency, Coinbase Ventures, Dapper Labs, Form Capital, North Island, and angel investors Mike Krieger and Naval Ravikant.

The new funding is planned to further its goal of a scalable messaging track, enabling developers to send instant on-chain notifications directly to users. According to the company’s statement, Yoz Labs describes itself as a Web3 platform that aims to simplify user notifications by providing a “low to no-code interface,” requiring only a single smart contract to start. (CoinDesk)

NFT aggregator Flow completes a $3 million seed round led by Nima Capital

On April 23, NFT aggregator Flow announced the completion of a US$3 million seed round of financing, led by Nima Capital and participated by Shima Capital and others. Flow is a rollup-centric NFT ecosystem built for a modular future, providing a powerful Order matching, execution engine and LLM-based NFT analysis, and will integrate artificial intelligence. The founding team comes from Google and Binance Labs. Flow is currently available on the Goerli testnet and is in beta on the Ethereum mainnet. Tokens are expected to be released on April 30. (cryptonewsland)

Web3 Game Battlegrounds Developer CEBG Game Completes $3 Million Private Equity Funding

On April 19, CEBG Game, the developer of the Web3 multiplayer online tactical arena game Battlegrounds, recently announced on Twitter that it has completed a $3 million private equity round of financing, with participation from Youbi Capital, GSR Ventures, and A&T Capital.

Battlegrounds currently supports iOS and Android systems, and has launched two game modes, PvE and PvP. Players can be motivated by completing game tasks.

On April 23, Sphere 3D, a bitcoin mining company listed on Nasdaq, announced that it had completed a $3 million private placement round of financing by signing a securities purchase agreement, with LDA Capital Limited participating.

According to Sphere 3D CEO Patricia Trompeter, the company will use this latest financing to provide incentives to miners without affecting current cash flow.

According to previous reports, Sphere 3D purchased 60,000 NM 440 mining machines at a price of US$1.7 billion in early 2022. (Newsfile)

On April 21, according to official news, Web3 security company Shield announced the completion of a $2.1 million Pre-Seed round of financing, Kraken Ventures, Eterna Capital, Alchemy, Moonpay, Bessemer Ventures DAO (Steel DAO), Orange DAO, NGC Ventures, Wagmi Ventures , MH Ventures, Coinswitch, 2 Punks Capital, Lecca Ventures, and Very Serious Ventures with Rob Behnke (CEO of crypto security audit firm Halborn), Peter Liebert (former CISO in California), Vijay Maharajan (founder of Bitscrunch), and Angel investors from Coinbase, Google, Microsoft and FireEye participated.

Shield says it has also been funded by a16z’s Crypto Startup School accelerator and is currently participating. Shield aims to help projects adopt comprehensive security measures to prevent cryptographic exploits and increase user trust in the entire ecosystem.

Shield's threat detection software can be integrated directly into any platform via an API, or integrated into Discord as a security bot for online communities.

On April 23, Playbux completed a US$2 million seed round of financing, led by Binance Labs, with participation from Gate.io, Tron, CertiK, Ankr, IMO Ventures, LIF, Math Wallet, and OFR.

Playbux is an e-commerce metaverse platform based on the blockchain network. This project was shortlisted for the fourth season of Binance Labs incubation plan. Its products are designed to be an accessible Shop&Earn metaverse platform. Users can spend and earn cash back at over 20,000 merchants worldwide.

Web3 messaging app Ktalk completes $2 million in funding

On April 23, Web3 instant messaging application Ktalk announced the completion of US$2 million in financing, led by Malaysian sovereign wealth fund and East British East Asia Holdings.

In addition, the Ktalk Beta public beta version will be launched, allowing users to log in to the platform directly using wallets, and providing multi-chain aggregation wallet asset display, on-chain NFT and asset management functions.

On April 23, VEGA, the Web3 entertainment technology platform, announced the completion of a $2 million seed round of financing, led by Arcane Group, with participation from New Wheel Capital and several industry investors.

This round of financing will be used to expand the operation and development team, expand the global market, promote technological innovation, and establish partnerships.

Coinflow Labs Closes $1.45M Seed Funding Round Led by Jump Crypto and Reciprocal Ventures

On April 19, Coinflow Labs, a provider of Web3 cross-chain payment infrastructure solutions, announced the completion of a $1.45 million seed round of financing, led by Jump Crypto and Reciprocal Ventures, CMT Digital, Digital Currency Group, Gumi Cryptos, Builder Capital, Prompt Ventures, Blocktech Venture and a group of angel investors participated in the investment.

Coinflow is committed to strengthening the bridge between traditional banking infrastructure and blockchain technology. Its solution can provide Web3 companies with a simpler, safer and more efficient way to accept traditional payment methods such as credit cards. Currently, it supports Solana, Near, Polygon and the Ethereum blockchain. (Business Wire)

On April 23, Super Duper Secret, a blockchain game development company, announced the completion of over $1 million in seed round financing. Round 13 Digital Asset Fund, Merit Circle, Polygon, Solana, Overwolf, Big Brain Holdings, LD Capital, Sebastian Borget, Gabi Dijon and Christian Mane participated in the vote.

Super Duper Secret is developing the "Battle Royale" type chess game "Royale Chess", which will create anonymous escrow wallets for players and store assets accumulated by users over the life of the game on the chain. (cryptosaurus)

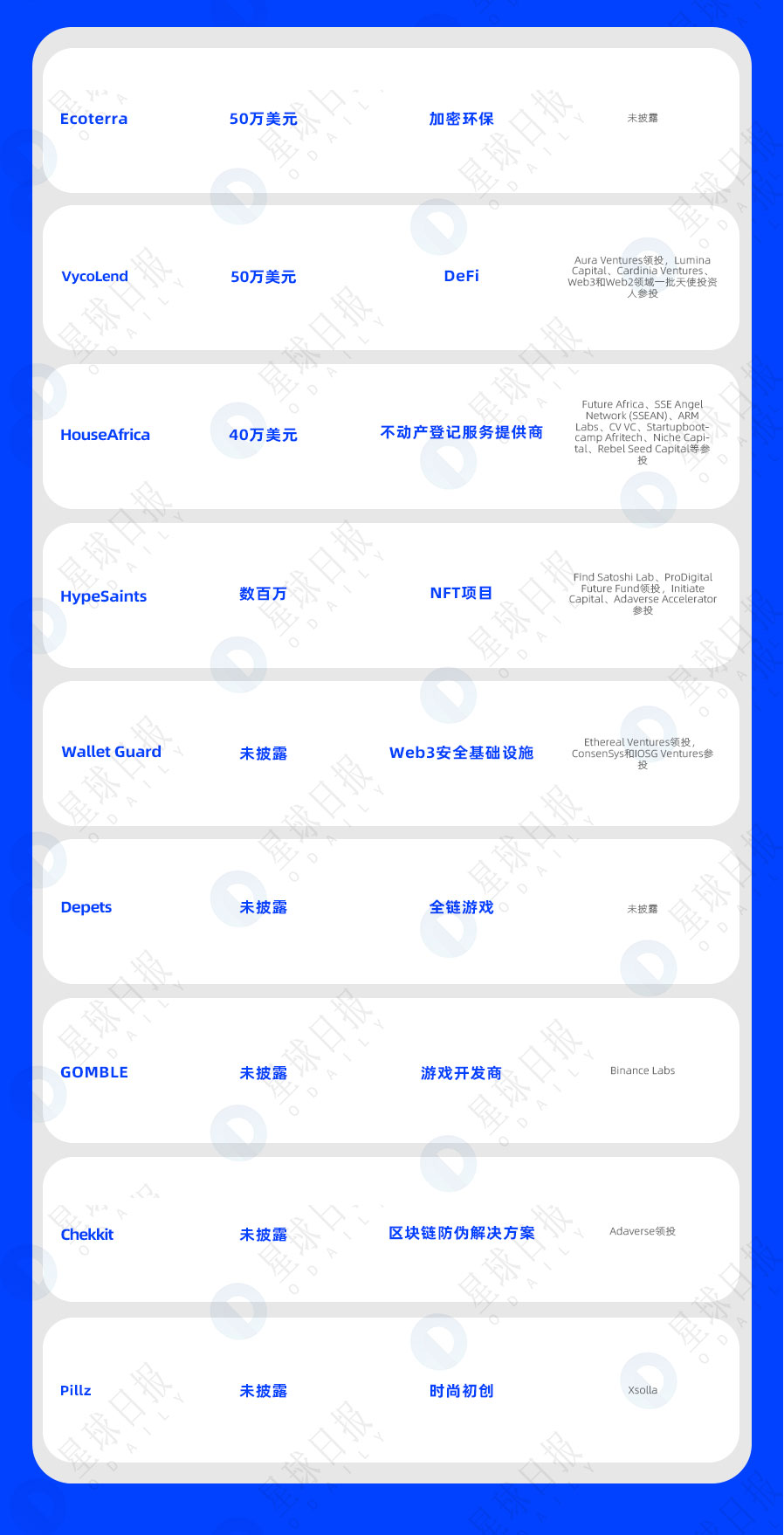

On April 18, Ecoterra, a sustainability-focused crypto-environmental startup, announced that it had completed a pre-sale round of financing of over $500,000.

The company encourages users to engage in environmental protection by issuing native tokens ECOTERRA. Users can get token incentives every time they recycle plastic bottles, containers and other reusable materials. The Web3 application it develops allows users to scan the items they want to recycle. The barcode of the material. The app contains a library of packaging materials from major companies and calculates rewards for each item. (Finbold)

DeFi Startup VycoLend Closes $500K Seed Round Led by Aura Ventures

On April 17, DeFi startup VycoLend announced the completion of a US$500,000 seed round of financing, led by Aura Ventures, and a group of angel investors from Lumina Capital, Cardinia Ventures, Web3 and Web2 participated in the investment. The new funding will be used to accelerate product development, expand the team and scale operations.

It is reported that VycoLend, a decentralized non-custodial lending agreement, is specially built for Layer 2 networks, aiming to establish a high-speed market for more traditional encrypted asset lending services, in which users can participate in independent lending pools as lenders or borrowers. (Zycrypto)

On April 20, HouseAfrica, a blockchain real estate registration service provider, announced the completion of $400,000 in financing, with participation from Future Africa, SSE Angel Network (SSEAN), ARM Labs, CV VC, Startupbootcamp Afritech, Niche Capital, and Rebel Seed Capital. The company utilizes proprietary blockchain and mapping technologies to create real estate registries and digitize real estate project site maps to help users authenticate land transactions in real time. (aimgroup)

Wallet Guard Closes Pre-seed Funding Round Led by Ethereal Ventures

Odaily news Web3 security infrastructure Wallet Guard announced the completion of the pre-seed round of financing, led by Ethereal Ventures, ConsenSys and IOSG Ventures participated in the investment, in addition, Ben Chan from Chainlink and Dave Pazdan from Phantom and other famous angel investors in the Web3 field also Participated in this round of investment.

On April 21, according to official news, the full-chain game Depets completed a community round of financing of 80 Ethereum, and will soon issue tokens and airdrop them to the community.

It is reported that Depets is a full-chain free-to-play game. Blue-chip users such as Azuki, BAYC, Cryptopunk, and Nouns can all receive an NFT pet for on-chain battle games, and invite friends to participate together.

South Korean chain game developer GOMBLE receives Binance Labs seed round financing

On April 21, according to Binance’s announcement, Binance Labs has committed to invest in GOMBLE’s seed round of financing, with an undisclosed amount of funding. It is reported that GOMBLE is a blockchain-based game developer and an affiliate of 111 Percent, a Korean casual mobile game publisher.

GOMBLE aims to allow casual gamers around the world to experience blockchain games with a sustainable reward mechanism. Another focus is advancing NFT interoperability through the development of mobile-based blockchains.

GOMBLE will use the funds to develop and publish its first mobile game, RumbyStars, and continue to expand its gaming platform using the Games-as-a-Service (GaaS) model.

On April 19, Chekkit, a blockchain anti-counterfeiting solution provider, announced the completion of a new round of financing. The Cardano ecological accelerator Adaverse led the investment, and RTA, HoaQ, Launch Africa and Blockchain Founders Fund participated in the investment. The company did not disclose the specific financing amount. But it is said to be in the "seven-figure" millions of dollars. Chekkit mainly provides DAG blockchain anti-counterfeiting solutions for food and pharmaceutical supply chain tracking, which can provide manufacturers with product serialization and traceability services that meet global standards. (techbuild)

Web3 Fashion Startup Pillz Closes New Funding Round, Xsolla Participates

On April 18, Pillz, a Web3 "phygital" fashion start-up, announced the completion of a new round of financing, with game payment platform Xsolla participating.

Pillz is an extension of digital identity, making devices that make NFT collections and NFT games tangible, allowing users to interact with NFTs in reality, and building their own systems based on Linux. The new funding will help Pillz accelerate the launch and mass production of its products, including necklaces, bracelets, key chains, and fashion and jewelry brands, which are expected to hit stores this May. (Venture Beat)

HypeSaints Closes $1 Million Seed Round Led by Find Satoshi Lab and ProDigital Future Fund

On April 23, the NFT project HypeSaints has completed a million-dollar seed round financing, led by Find Satoshi Lab and ProDigital Future Fund, and participated by Initiate Capital and Adaverse Accelerator.

HypeSaints will enter Phase 2 in May, with plans to release a second series of HypeSaints NFTs mid-year.