The old Bitcoin P2P market Paxful has been suspended for more than two weeks, and its co-founder Ray Youssef has repeatedly stated that he is trying to protect the interests of users. He proposed different solutions, eventually giving up the title of CEO and unfreezing 88% of frozen accounts. Ray Youssef even invested almost all of his company shares in a public trust fund to protect the rights of damaged users.

first level title

The two Lianchuang have different ideas and go to court to fight for the control of the company

On April 4, Paxful abruptly announced the suspension of operations, citing the departure of key employees and regulatory challenges. Paxful was founded in 2015 by Artur Schaback and Mohamad (Ray) Youssef.

thenCointelegraph reported that,Two Paxful co-founders battle in court for control of company, or the real reason for the platform shutdown. The two, at odds over the future and operation of the market, are filing multiple charges against each other, including misappropriating company funds, money laundering and evading U.S. sanctions against Russia, according to court documents.

first level title

88% of frozen accounts unfrozen, Ray Youssef steps down as CEO

In response to the impact of the suspension of the platform, as early as April 6,Ray Youssef tweeted, he is working with the court on a plan that will reimburse users of their funds with his own money. He risked jail time for failing to comply with a court order to return Paxful’s frozen funds, which led him to take such drastic measures.

Because otherwise, users may never get their funds back, Youssef explained. He asked community members to be patient during this time.

To appease creditors, a day before stepping down as Paxful CEO on April 18,Ray Youssef reassured, the platform is supervised by the custodian, he will not "run away" with the money, because he will not do such things that damage his personal reputation.

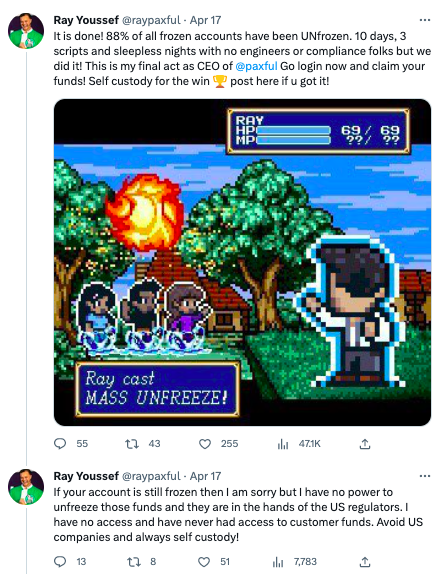

Ray Youssef noted that 88% of frozen accounts had been unfrozen after 10 days of effort. Paxful still has more than $4.4 million in frozen funds, or about 3.3% of all customer funds that cannot be withdrawn.

first level title

Use 99.9% of individual shares to create a public trust fund to protect the interests of users

Stepping down as CEO doesn't mean stopping doing something.Ray Youssef posted on April 22 that, he and the co-founders have agreed that Srinivas Raju of law firm Richards, Layton & Finger (appointed by court order) will serve as Paxful's custodian. Srinivas Raju has complete power and control over the company and its operations and management. Over the next month, Srinivas will attempt to help stabilize Paxful while it prepares to make proposals to the courts on how the business should be conducted. Srinivas is considering all possible proposals for the future of Paxful.

Ray Youssef said that his top priority will still be to solve the problem of user funds being frozen and the reliability of Paxful Wallet. Youssef had previously proposed to another co-founder a deal requiring him to buy all his shares in Paxful for 1 satoshi, provided he did the necessary compliance work to unfreeze the remaining accounts, but the latter rejected the offer .

Now Ray Youssef has come up with a new plan to solve the problem, which will put 99.9% of Paxful's personal shares (more than 45% of the company's shares) into a public trust fund. Funds generated from Ray Youssef's stake will be used to keep every Paxful user safe from loss of funds. Any remaining funds will go directly to the Built With Bitcoin Foundation for the construction of the school.

first level title

Plans to launch Civ Kit, a new platform based on Nostr

Ray Youssef once complained that Paxful spent millions of dollars in compliance, but still faced huge regulatory pressure. In this regard, he advocated self-hosting for crypto users, and even bluntly said, "avoid American companies and always self-host!"

In order to realize the vision of creating a censorship-resistant and permission-free global market, Ray Youssef and others plan to launch the Civilization Kit (Civ Kit), which will be launched onWhitepaper released on April 14th。

According to the white paper, Civ Kit is a peer-to-peer electronic marketplace system that enables censorship-resistant and permissionless transactions between users of the global Bitcoin system.

With the help of the decentralized social protocol Nostr (a protocol supported by former Twitter CEO Jack Dorsey) and the lightning network architecture, Civ Kit uses escrow transactions, decentralized identities, P2P message protocols, Know-Your-Peer (KYP) oracles, etc. Prioritize privacy and security.

According to reports,The transaction process in Civ Kit is as follows:

Sellers list items they want to sell on distributed bulletin boards (Nostr servers associated with Bitcoin Lightning Network onion gateways).

The board publishes the listing to all of its Nostr followers.

Willing buyers check the listing and submit a Hash Time Lock Contract (HTLC) via the Bitcoin Lightning Network, which supports Civ Kit's transaction escrow contract.

A seller delivers a good or service and requests escrow funds. Buyer releases escrow funds.

Civ Kit utilizes Nostr's reputation-based public keys. In Nostr, content creators have a long-lived public key, allowing permissionless migration of friendships across any social media application that supports Nostr public keys. Participants in the Civ Kit marketplace are incentivized to build and maintain a good reputation.

Although I don’t know whether Ray Youssef can succeed in the Bitcoin P2P market again with the help of Civ Kit, at least he has caught up with the wave of Nostr, and at least he is working hard to regain blood in his new business.