In the past three days, two NFT OGs "Franklin" and "Brother Maji" Huang Licheng have announced their withdrawal from the NFT field. "Franklin" and "Brother Maji" are the first batch of NFT players with a certain transaction scale, and they are also big BAYC players. Their trading frequency, NFT holdings, and selling prices will all have a certain impact on the NFT trading market and the floor price of blue-chip NFTs such as BAYC.

Previously, Blur founder Pacman said that "Franklin" and "Brother Maji" are equivalent to Jump Trading and Jane Street in the NFT field. The entry of new players has made a huge contribution.

Therefore, the withdrawal of the two big brothers has added a touch of uncertainty to the already dull NFT market.

Unlike "Franklin" who exited the NFT market on the grounds of gambling and investment failure, "Brother Maji" did not give a specific reason, and "Franklin" sold a large number of BAYCs after announcing its withdrawal from the NFT field, and almost sold all BAYCs. However, "Brother Maji" has not yet sold a large number of NFTs in his hands, and tweeted on April 10 that he still loves the BAYC community, and canceled the tweet "Exiting the NFT field" from the top, and changed it to BAYC NFT .

This contradictory move has sparked heated discussions in the community, making it even more unpredictable. However, judging from the content of his tweets and the recent NFT transactions, we guess that there are two reasons behind the remarks of "Brother Maji".

Guess 1: Big brother is angry at being blamed for manipulating the NFT market

Since Blur started the second season of airdrop points activity, "Brother Maji" has been occupying the first place in the Blur points list and has frequent transactions. "Brother Maji" owns a large number of BAYC and other blue-chip NFTs. It is a normal performance to obtain transaction points through placing orders and bidding, and at the same time increasing the liquidity of NFTs. But with the recent decline in the NFT market, users who earn points are not as active as before, and traders who hold a bunch of NFTs are also trying to find ways to get them out.

Coincidentally, Blur started the airdrop points activity in the second quarter, and Blur's liquidity created favorable selling conditions for NFT traders. Because Blur's market-making incentive mechanism allows traders to list NFT on Blur at a price close to the floor, further creating a tight bid-ask spread, making Blur's floor price lower than prices in other markets. This approach will continue to create a moat for Blur and increase the depth of bidding.

And "Brother Maji" became a "victim" in this giant whale game. He successively took over 71 BAYCs and 77 CryptoPunks. The loss of funds exceeded 2000 ETH, and then he urgently sold more than 1000 NFTs. The floor price of BAYC The drop reached 25.5% at one point. After that, 991 NFTs were quickly repurchased. According to analysts' speculation, the behavior of "Brother Maji" may be to obtain some profits first, and then conduct "washing transactions" to obtain Blur airdrop points, or "naked market manipulation." Moreover, the behavior of "Brother Maji" was also suspected of creating panic.

However, outsiders cannot be sure whether "Brother Maji" did it intentionally. After all, the act of receiving orders was not caused by "Brother Maji" on its own initiative, and the return of blood to the selling point NFT is also a normal transaction behavior. However, as a "market maker", every move of "Brother Maji" has an important impact on the NFT market. Such a large sell-off is bound to become the focus of public opinion.

"Brother Maji" once posted: "Because of Blur or me, Punks will go to zero?" It seems to be a helpless emotion expressed after being abused by the community.

In addition, some fans of "Brother Maji" said that they should not pay attention to these remarks and continue to do what you do. It is not your problem to let them misunderstand and criticize you. But "Brother Maggie" responded, "I'm not Jesus."

Guess 2: Blur rewards are extended, losses of thousands of ethers, urgent need to calm down

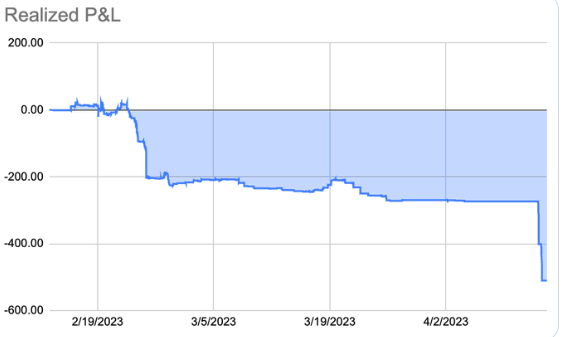

According to NFTstatistics.eth, the research director of Proof, "Brother Moji" lost more than 5,000 ETH in the Blur game.

Although the Blur airdrop in the first season can offset some of the losses, the gap is still there. According to data from CoinGeko, the price of BLUR has continued to decline since its launch, falling from a high of $1.33 to $0.44, and it was temporarily at $0.72 as of press time. And the Blur airdrop activity in the second season is still going on, and it will be extended to May 1st. This may make the value of users who have been desperately swiping points to continue to decrease, and it also means that the loss of "Brother Maji" is likely to double, which also makes "Brother Maji" could no longer justify their losses, and left an angry message: "FUCK".

The double loss made "Brother Maji" more cautious.

In fact, apart from "Franklin" and "Brother Maji" announcing their withdrawal from the NFT field, Jimmy.eth, one of BAYC's OGs, also recently dumped multiple BAYCs and MAYCs. Some users said that these actions from whale OGs damaged the trust of the community. Because their actions are no longer individual trading actions, but affect the entire market. Several recent events have also caused the floor price of BAYC to drop from 60 ETH to 54 ETH, which disturbed the entire NFT market and led to the liquidation of many NFTs on BendDAO.

But what is confusing is that "Brother Maji" still holds 62 BAYCs and has become the sixth largest whale in the project. He did not sell them like "Franklin" announced his withdrawal, and his avatar and Twitter content are also Actively promoting BAYC.

Perhaps, "Brother Maji"'s announcement of "withdrawal" is only a temporary behavior (in the NFT and meme world, there is no speech that can be trusted), and he, who has always been on the "cusp of the storm", also wants to calm down.