This afternoon, hosted by MetaStone and Odaily, co-organized by MixMarvel and AWS, and supported by top partners such as CREGIS, Jasmy, HOPE, Souff l3, LD CapitalUS, ArkStream Capital, SevenX, Jubi, zkMe, etc. held in Hong Kong.

Leon LIN, partner of MetaStone Group, attended the event and gave a keynote sharing. He introduced MetaStone's investment logic and the company's AI Trading strategy.

The full text of the speech is as follows, organized by Odaily.

It was great to meet many old friends. As a company standing on the cusp of traditional finance and Web2 and Web3, our core team and I personally have accumulated a lot of traditional finance and Web2, and hope to bring you more new incremental funds and new business models and play.

secondary title

How does MetaStone Group manage over a billion dollars?

MetaStone's quantitative trading algorithm has now entered the form of AI Trading, which has very good market recognition and performance contribution. Quantitative FOF is a quantitative fund of funds. We have contacted almost 80% of the quantitative teams in the industry, and selected 50 of them to enter our FOF investment portfolio. Innovation funds help the development of more cutting-edge technological evolution in the industry, and give the team earlier support and contributions. Recently we released Meta X Combinator, hoping to help talented early entrepreneurial partners to quickly implement technology and products.

We are a comprehensive investment group, from the primary market to the secondary transaction, and to the comprehensive transaction and technology development of the industry in the later stage. We also have relatively good trading tools and investment methods, which can bring better results return and help the industry as a whole advance.

The overall management scale of MetaStone Group exceeds US$1 billion, the overall historical transaction scale exceeds US$1 trillion, and it has more than 200 strategies, including mainstream quantitative trading strategies and artificial intelligence-based algorithms. The firm shared that its core strategy has had a return of over 50% over the past 90 days. After 5-6 years of changes, the type of strategy has undergone a very complete evolution, including trend-based strategies, high-frequency strategies, and arbitrage strategies. Fine-grained strategies already identify market opportunities at the sub-strategy level. We are still very granular in all position control, including the management of strategies.

In the past 6 years, we have not sold a relatively large proportion of mainstream assets. On the contrary, we have made very serious allocations in mainstream assets. Everyone knows that there are not many targets that can be hedged in this industry. We have obtained very good returns in BTC and Ethereum transactions. Behind it is the data system and AI system that can give us a good price position and the overall background. The technical logic allows us to enter the market at the right point.

The relatively big decision in the past few years was to hedge almost 40% -50% of the fund's position from BTC to Ethereum's position two and a half years ago. Making a decision on such a large volume still requires considerable data support. This decision has contributed almost double the currency-based return.

secondary title

What opportunities exist in this round of market conditions?

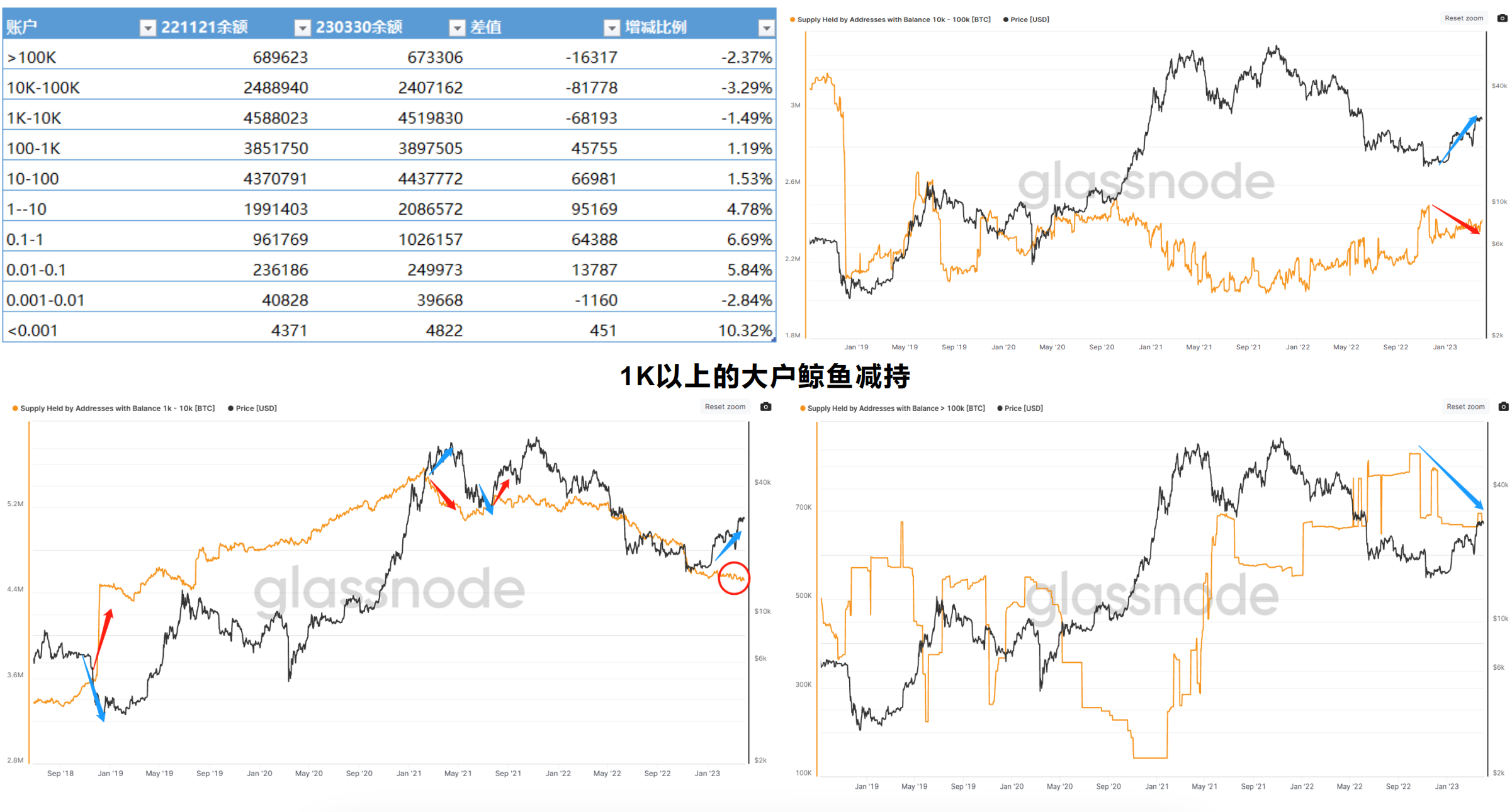

We have also seen a lot of data in this round of the market recently, more of which are short-term and medium-term investment institutions and individuals holding and entering the market for short-term returns. This is equivalent to a rebound in a bear market, and the extreme position is 39,000-40,000. At the same time, the changes in assets also support this conclusion: we have seen that the whales of the big players are reducing their holdings in the past few months. Small and medium investors below 1K, including retail investors, are mostly increasing their holdings. Our judgment on this market will still go up, but the ideal position will not go to a very high point level.

We have seen that many earning users still have a relatively good growth. We think the market will continue for a period of time. The overall idea is to focus on large cycles and mainstream asset allocation, and superimpose some ideas of currency-based income enhancement.

In addition to mainstream asset allocation, we will allocate assets along the technical logic of the industry at the hedge fund level of the entire group. We will find a business segment worth investing in, and at the same time give it a certain weight, and then select projects and assets. . In the link of investment and exit, AI Trading will also participate, giving us better entry and exit points.

In addition to the secondary configuration, there are also ecological opportunities related to Ethereum. Merge, Shanghai Upgrade and Surge in Ethereum will do detailed asset allocation and management strictly according to our position and position.

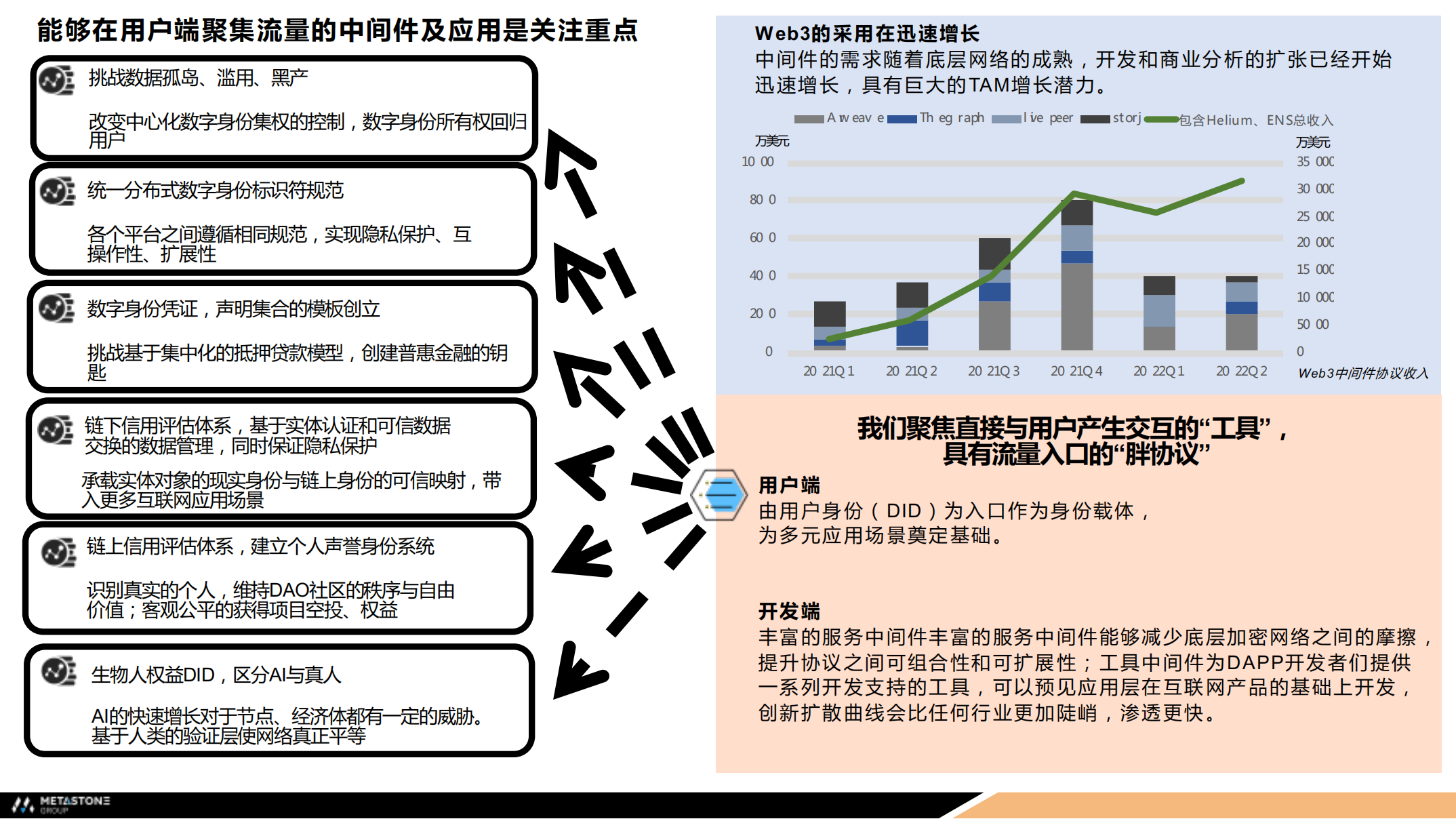

In fact, our secondary investment and primary investment are linked. We are very optimistic about the ecology of Ethereum. When we deploy the ZK sector in the primary market, we will give priority to projects that contribute to and interact with the ecology of Ethereum. For example, Scroll is the most friendly and compatible with the ecology of Ethereum. . At the second level, we think that applications and middleware may perform better in the past three years, and we will make early layouts on entry-level applications (such as Unity).

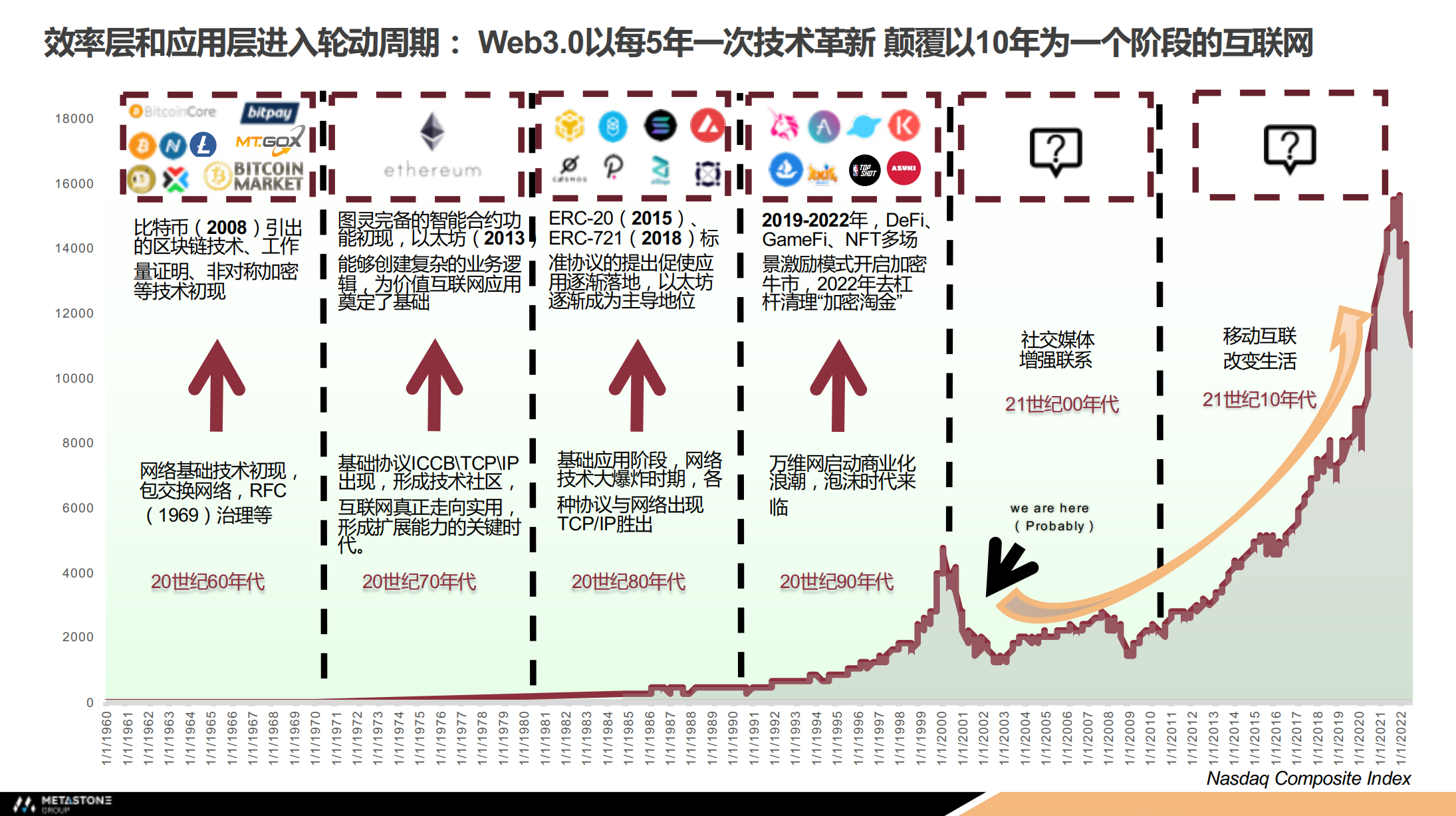

For the development of the Web3.0 industry, it can be compared with the technical logic of the Internet and mobile Internet era. The Internet era is a cycle almost every ten years, and the Web3 standard is iterated and evolved every five years.

From 2019 to 2022, the multi-scenario incentive model has achieved relatively good development. We believe that in the next 10 years, Web3 will have new entry-level protocols and applications to improve efficiency. This is also the overall logic of Web3 investment. We will also look at opportunities for Web3 paradigm computing upgrades and structural upgrades, and at the same time see projects with multiple application scenarios where DID is the entry point.

Of course, there are also on-chain investment sectors in the hedge fund sector. We will observe the Layer 1, DeFi and NFT sectors. We have a series of operation modes. Our person in charge will understand the operation logic of the sector in more detail. On-chain investment It is also an important sector for hedge fund investment.

The on-chain investment sector is a relatively new field, and we will do detailed risk control. To give you an example, when the LUNA incident happened that year, we carried out detailed risk control and risk control for LUNA, including market value ratio monitoring and code audit, to ensure that the investment on the chain can be in an ideal security boundary. The price position is around 65-55 and there are two price points where we want to get 50% out and 100% out. At that time, LUNA's position was about 100 million US dollars. Two days before LUNA crashed, according to the risk setting, many smart money also came out in these two days. Many institutions had risk points and value judgments, and we also had relatively good returns on LUNA.

Metastone In addition to hedge funds, AI trading and primary investment, we are very concerned about the cutting-edge technology logic of the industry, especially the protocol and technology fields of decentralized finance (which can bring benefits). We have designed several sub-funds, hoping to see Opportunities for innovative new investments and returns in decentralized finance.

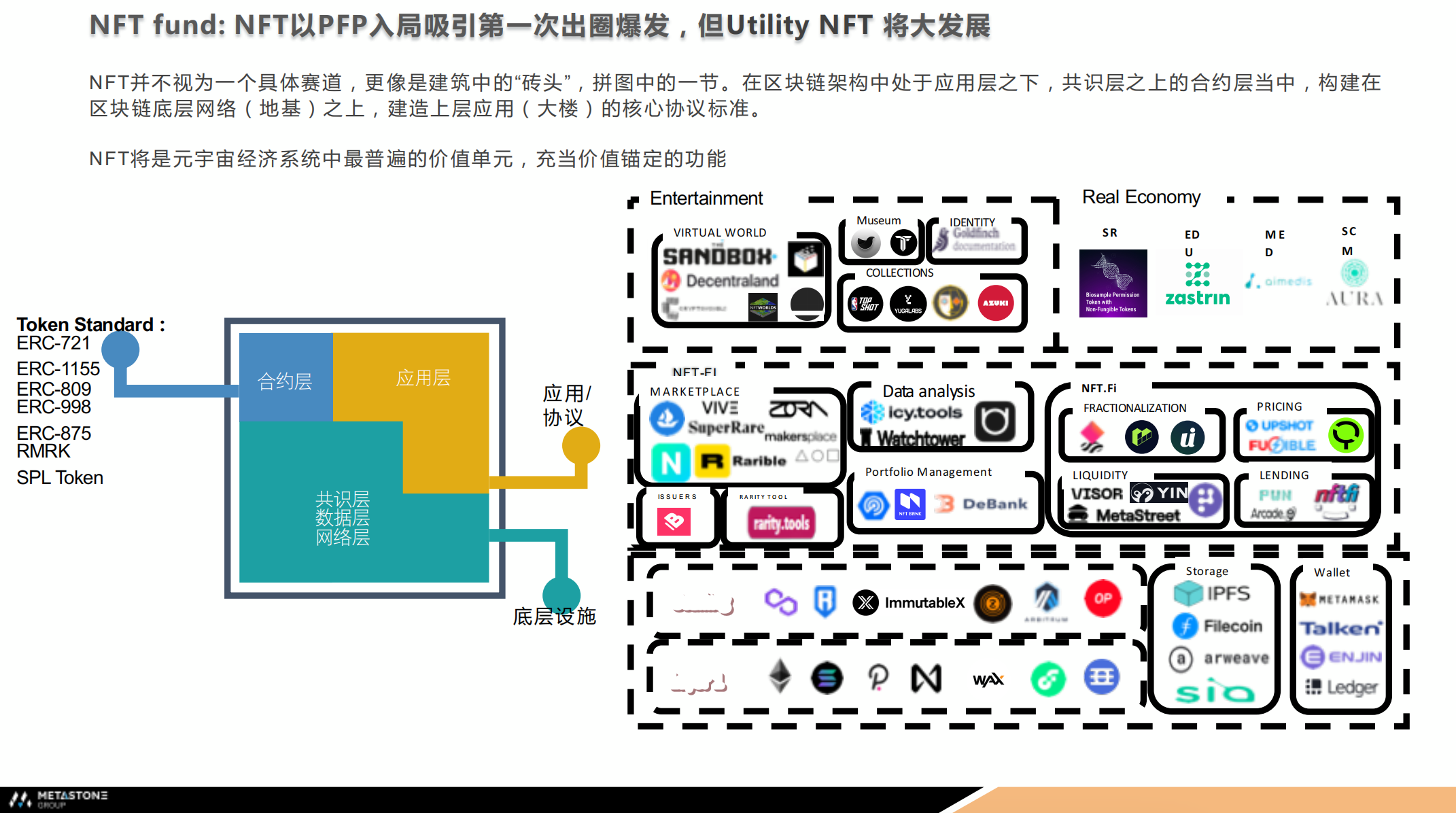

In the NFT sector, we believe that effective NFTs have helped many people outside the circle enter the market, and practical NFTs will better help the entire industry make better progress in digital finance and applications.

We are relatively long-term PFPholding, and we hope to work with you to push forward the PFP matter. We adopt a comprehensive strategy and have relatively rich arsenal resources for the entire industry from primary investment to secondary transactions to innovation on the chain behind.

We believe that investment is actually a counter-cyclical logic, and trading is a pro-cyclical logic. Therefore, investment, including asset allocation, is more of a counter-cyclical thing. Last year, when everyone in the market was not very confident, it was the stage of our large-scale entry and layout, including the allocation of mainstream assets, including projects that we felt had already entered below the baseline of investment and had relatively good value. Will enter the market for a certain proportion of investment and layout.

We follow pro-cyclical multi-polarity in trading, and AI trading is more about short-term and mid-term transaction processing and intelligent transaction processing.

In general, we will earn our own profits in each different market cycle. Basically, the ammunition in the arsenal is relatively sufficient, corresponding to different market cycles.

Finally, let me introduce Meta X Combinator. The project is based on the concept of an incubator, but the incubation will be longer. We didn't care so much about returns in the field of early investment, and we took a step forward on the basis of VC. If you have a good idea and product model that has been verified to a certain extent, and you need funds and resources to quickly occupy the market, we welcome everyone to find us to discuss together. We hope to support earlier entrepreneurs and help you develop faster.

Finally, let me talk about our thinking and Hong Kong. We are an institution standing at the intersection of Web2, Web3 and traditional finance. Personally, I am more accumulated in traditional finance. Hong Kong’s policies this time also let us see the needs and opportunities for traditional funds to enter the market, so we very much hope to do a good job in compliance on the asset side, help more funds flow into this industry, and at the same time give this industry a better contribute.

Many traditional funds are already ready to move, or have already entered the market. We have seen very good opportunities and hope to make good use of this policy dividend in the process. So, let's come to Win Hong Kong, Long China.