This afternoon, hosted by MetaStone and Odaily, co-organized by MixMarvel and AWS, and supported by top partners such as CREGIS, Jasmy, HOPE, Souff l3, LD Capital US, ArkStream Capital, SevenX, Jubi, zkMe, etc., "Over the Moon — Zhulang Web3" The summit was held in Hong Kong.

Joy Lou, the co-founder of LD Capital US, attended the event and gave a keynote speech. He talked about the linkage relationship between Crypto and mainstream assets and the law of rotation, and introduced some of LD Capital US's methodologies when analyzing asset value. The full text of the speech is as follows, organized by Odaily.

Hello everyone, I am Joy Lou, co-founder of LD Capital US, and I am very happy to share some views and opinions on the market with you here today. On Twitter, I will often write about my understanding of the macro and the judgment of the market, and I will also publish some research results of the LD Capital US investment research team. If you are interested, you can search my Twitter (@Joylou 1209 ) .

LD Capital US is an institution that manages assets in the secondary market. As of this year, I have issued and are issuing three funds. The first is in Cayman, and the latter two are in Hong Kong. Previously, our main business base was in Singapore. After Hong Kong sent a very clear signal to welcome Web3 practitioners in November last year, we moved our base to Hong Kong. We hope that Hong Kong’s major science and technology parks, cyberports and financial parks will Can give us more policy guidance and support.

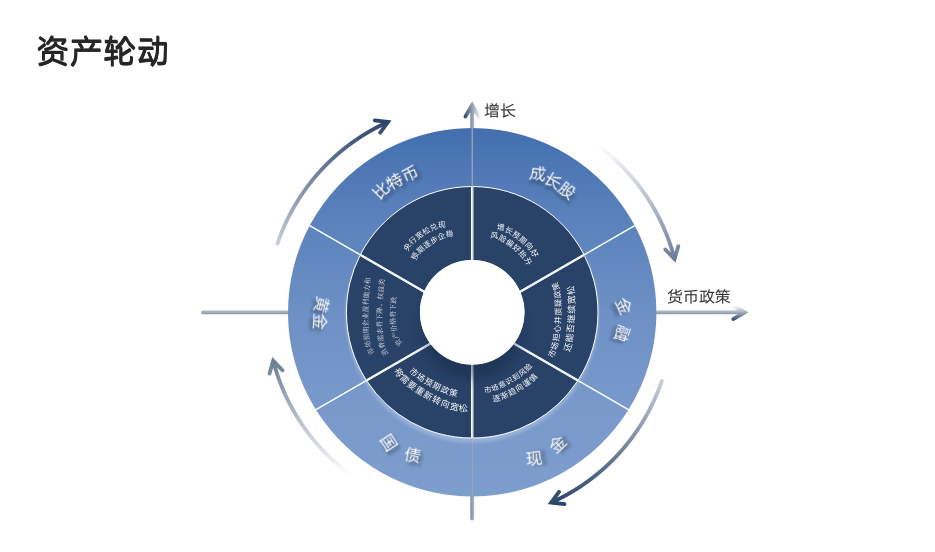

I wrote a theoretical analysis on the value of Crypto assets in January, discussing the linkage relationship between Crypto and other mainstream assets and the law of rotation. At that time, I made such a picture (as shown in the picture below), and put Crypto into the asset rotation table of Merrill Lynch.

My point of view is that when financial risk appetite is relatively low, generally speaking, resource-based commodities will rise first, and funds will prefer cash, followed by treasury bonds, gold, and growth stocks. I put Crypto in the middle of gold and growth stocks. Based on the implied yield characteristics of specific assets, I put BTC close to gold and ETH close to growth stocks.

In November last year, I predicted in the circle of friends and some public exchanges that the CPI would go down more than expected. In the end, the market stumbled to a relative bottom during this period of time as expected. From this time on, due to concerns about recession, the rotating assets slowly shifted from cash and treasury bonds to gold. Why can gold act as a safe-haven asset in a recession? Because it has no implied rate of return. From November to December last year until now, gold has been in the main rising wave, and now it has broken a new high. Growth stocks have also been rising until now, but now they have encountered certain resistance.

Crypto is also doing well. From January 1 this year to the present, BTC has increased by almost 80%, and ETH has increased slightly less. It may be that everyone has certain concerns about the unlocking selling pressure after the Shanghai upgrade. Judging from the structure of open positions, retail investors are more enthusiastic about going long, while large investors and institutions are more worried about the decline. After comprehensively measuring multiple angles, we believe that although the selling pressure of ETH will be a bit large, the price will not experience a deep correction.

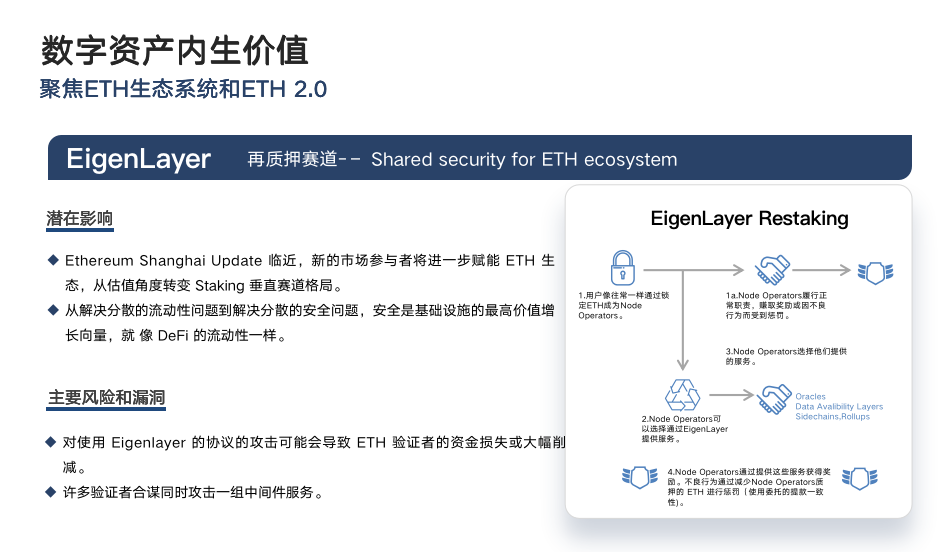

I also discussed the endogenous value of digital assets in that article. At that time, I mentioned a project EigenLayer as an example. At that time, this project was a bit unorthodox, but now you may have heard that they have completed a high-value financing of 50 million U.S. dollars .

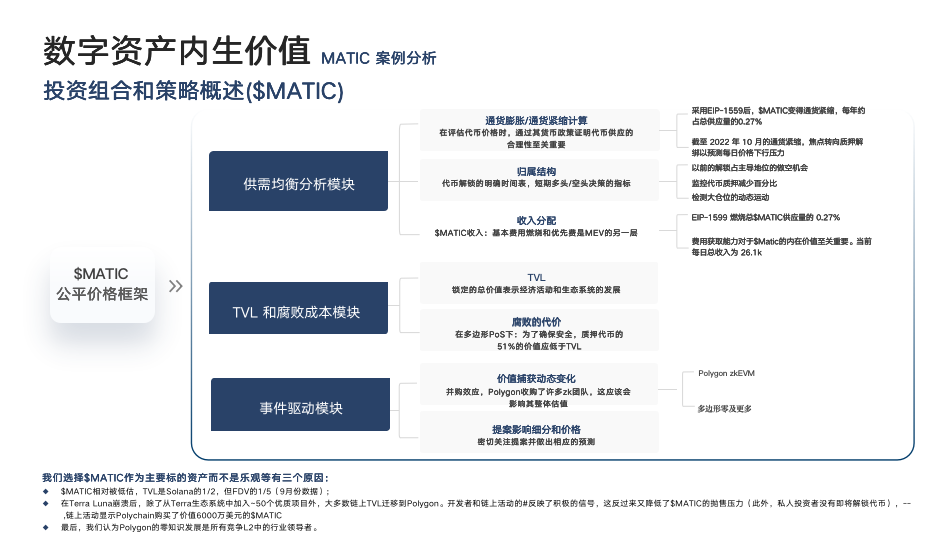

I also took MATIC as an example to explain the "fair price framework" that LD Capital US follows when opening a position. In general, we will judge the entry value and take-profit conditions according to the three modules of supply and demand balance analysis module, TVL and corruption cost module, and event-driven module.

We will also, like some traditional financial institutions, compare a certain target in the horizontal and vertical tracks based on some data to measure the latitude, so as to evaluate whether it is overvalued or undervalued. A typical case in this regard is LDO, which has now grown into the leader of the LSD track, and we have also obtained relatively high profits based on this.

This year we will issue more funds based on market characteristics, and LD Capital US will have more voices in Hong Kong, a compliant market. We are actively seeking authority supervision and applying for a license, and we are also recruiting RO (Note: RO is the business leader of a Hong Kong financial services company, whose main responsibility is to control the risks, professional ethics, and business professionalism in the company's business operations Control), if you have a suitable candidate, you can recommend it to me. Welcome everyone to contact me, thank you!