Original author: 0xjeremy

Original Compilation: Sissi, Leia

first level title

"Preface"In the last round of cryptocurrency bull market, various projects bloomed like flowers, and new narratives continued to emerge, such as DeFi Summer, X to Earn and so on.The promotion of market enthusiasm makes people pay more attention to token prices and token economics, but often ignores the actual value and sustainability of projects, and easily enters FOMO emotions.But as the market went bearish, the true value of many projects was exposed,Projects that were once glorious, such as Terra/Luna, FTX, etc., lost their value after the crash.

Therefore, we need to calm down, reflect and summarize the reasons behind those successful and sustainable projects.As stated in the article "V God: Beyond Token Economics",A successful sustainable project needs to have multiple elements, not just limited to token economics,Because the encryption market is no longer a competition of a single token economic mechanism,

It has evolved into a comprehensive power game in three aspects of "business & incentives & governance" around positive externalities.

Many projects are exploring the secret of success, and as a leader in the field of Web3.0, Curve's growth path can provide useful experience and inspiration for other projects. This article aims to:1. Taking the Curve protocol as an example,By dividing Curve's evolution into different stages (as shown in the table below), a more comprehensive and systematic understanding of its development trajectory and road to success can be obtained.

(Note: "Curve X.0 stage" refers to the stage of Curve's growth process, such as 1.0 stage; and "Curve VX.0" refers to the functional version of the protocol, such as Curve V1.0)2. Explore the important facts and key initiatives behind Curve's development. These key points, which may be ignored or not mentioned in other articles, are the cornerstones behind Curve's sustainability. pass

Summarize the laws and models that can be used for reference in the success of Web3.0 projects, and provide useful enlightenment and reference for other projects.: The content and viewpoints involved in this article have no publicity purpose for the Curve agreement or other involved agreements. This article is purely for discussion and should not be considered investment advice.

"Curve 1.0 stage": Realize PMF and start the first growth curve 2019.11-2020.7

secondary title

With the continuous development of the encryption market around 2019, especially the rise of DEFI, the types and scale of stablecoins (linked to US dollar assets such as $USDT, $DAI, etc.) and other linked assets (such as $wBTC, $renBTC) will continue to increase expand. Trading needs are growing rapidly. For example, from $24 billion in Q1 2019 to $79 billion in Q3 2019, the transaction volume of stablecoins has increased by 229%. This has led to the creation of entirely new market segments around these assets.

image description

Image credit: Messari

For example, on Uniswap V1 at that time, most of its liquidity pools contained $ETH, and users needed to make two transactions and pay transaction fees twice to trade a pair of stablecoins on the platform. The transaction size of stablecoins tends to be large, and people are more sensitive to transaction costs. So publishers need to find better transaction solutions.

secondary title

2. Business mechanism: the original stable currency AMM solves market pain points

Curve uses an AMM trading mechanism between the constant sum (x+y=const) and constant product (Uniswap xy=const) functions, specifically, the mechanism creates a relatively flat curve near the equilibrium point of the curve , similar to a constant sum function, to keep the price relatively stable, and to make both ends more inclined, similar to a constant product function, so that liquidity can be provided at each point of the curve. The following figure is a schematic diagram of the mechanism:

image description

Image credit: CurveCompared with mainstream constant product AMMs (such as Uniswap),Taking the conversion of $DAI to $USDC as an example at that time, the slippage of Uniswap was about 0.80%, while the slippage of using Curve was only 0.06%.

secondary title

3. The protocol is online but no tokens are issued: Verify Product-Market Fit

Completely different from what many people imagined, Curve did not issue tokens when it went online, and the protocol governance is also centralized. However, it has grown organically through successful partnerships with other protocols.

In the six months from its launch to July 30, 2020, Curve has accumulated more than 8,000 users, and its cumulative transaction volume has reached 1.5 billion US dollars. The total transaction volume in the first half of the year has entered the top four DEXs. This achievement validates Product-Market-Fit and provides a solid foundation for Curve's platform traction and steady revenue growth.

Image source: dune.com

Image credit: Curve

secondary title

4. Comments and Insights of Curve 1.0: PMF is the primary element for the success of Web3.0 protocolToken economic design was once regarded as a panacea, just like Curve's veToken economic model, which has been touted as the secret to Curve's success. But in fact, successful projects like Uniswap and Curve did not issue tokens at all in the early stages of their launch. therefore,

Here I want to tell everyone, don’t be too keen on token economy design, PMF is the primary element for the success of the Web3.0 protocol.While the token economy is an important part of the protocol design, it can indeed attract user participation and incentivize community building. butThe token economy design without PMF support, even if it is perfect, cannot attract sufficient market demand and users, and the project is difficult to succeed.

Jesse Walden, former managing partner of Andreessen Horowitz, also pointed out that in the early stages of building the Web3.0 protocol, the only thing that matters is Product-Market Fit.Issuing tokens prematurely is not only not beneficial, it may have negative effects. (Note: This time we will not discuss protocols that "must have tokens to work", such as Bitcoin, Ethereum, etc.) Research shows that,Issuing tokens prematurely will destroy the intrinsic motivation of users, making them focus on benefits and ignore the value and experience of the product itself.

As V God said: The first law of token economics is: Do not take advice about token economics from people who use the word "token economics".So how can Product-Market Fit be realized?In Web3.0, to achieve Product-Market Fit, you must first find market opportunities or pain points.This means developing a deep understanding of your target audience, their preferences and needs, and the gaps in the market.Then consider business:How to build a product to meet the needs of the market. Pay attention to details to ensure that the product can solve the pain points in the market and meet the real needs of users;Finally to verify the PMF:By focusing on indicators such as user satisfaction, retention rate, and revenue, verify whether the protocol can achieve natural growth, rather than relying on token economic incentives. It should be mentioned that,(Note: "Product" in Product-Market Fit here refers to the protocol in Web3.0).

"Curve 2.0 stage": Promoting decentralization and emerging a prosperous ecology 2020.8-2021.12

secondary title

1. Introduce tokens and create the first veToken mechanism to promote economic decentralization and establish long-term consensusAfter verifying PMF and realizing natural growth, in order to further promote the development of the protocol, Curve launched the token $CRV in August 2020, and introduced the first veToken mechanism. The full name of "veToken" is "Voting Escrow Token" ("Voting Escrow Token"), which is a voting governance mechanism that allows users to lock protocol tokens in a contract called "Voting Lock Contract" ("voting lock contract") to obtain a certain amount of veToken, which is the governance voting right of the agreement.

The veToken mechanism is designed to encourage users to hold tokens for a long time, promote greater incentive alignment among participants, thereby improving the supply and demand of tokens and providing a sustainable governance foundation for the protocol.

|Issuance and distribution of tokens: continuous incentive balance, boosting economic decentralization

The maximum supply of $CRV is 3.03 billion pieces. The distribution method of the initial supply of 1.3 billion pieces (accounting for 43% of the total issuance) includes: 5% for early liquidity providers, 30% for teams and investors, 3% for employees, and 5% for community reserves. The remaining 57% will be gradually released as incentives for future liquidity providers, and there is no linear unlocking time limit until the issuance cap is reached. The release cycle of the token is longer, and only about 75% of the total supply will be released by 2026.Judging from the issuance and distribution of tokens, not only early contributors are considered, but also space is left for future participants, thereby motivating more people to participate and promoting the development of the protocol.

Over time, tokens have a higher degree of decentralization and will not be concentrated in the hands of a few people, avoiding excessive concentration of economic rights, thereby promoting the decentralization of the economy.

In order to ensure that its trading platform has sufficient liquidity, the Curve protocol allocates a total of 62% of the $CRV supply as rewards to liquidity providers (Note: on Curve, liquidity providers can also get 50% transaction fee share). Such an incentive strategy aims to reduce transaction slippage by increasing liquidity, thereby attracting more participants and increasing transaction volume.

|The value capture of tokens for the protocol: build a "long-term consensus" and lay the foundation for the decentralization of governanceThe veToken mechanism introduced in the Curve protocol requires users to lock a certain amount of $CRV tokens to Curve DAO for a period of time in exchange for $veCRV representing governance voting rights.The transaction fees generated by the Curve platform will be distributed proportionally to the holders of $veCRV (see the 3rd subpoint of "The following five benefits" for details), which means that the value of the token will grow with the success of the agreement.

image description

Image credit: Curve

Holders of $veCRV tokens will enjoy the following five benefits:

(1) Governance voting rights on the distribution of $CRV rewards: $veCRV holders can participate in regular voting to determine the weight of the distribution of rewards among the various liquidity pools in Curve, thus affecting how many $CRV emission rewards each liquidity pool gets . This is also the core of the rights.

(2) Other governance voting rights: Participating in the governance of Curve DAO, you can submit proposals and vote on proposals, involving new liquidity pools, protocol parameter settings and modifications, etc.

(3) Obtain the transaction fee of the platform: You can obtain the share of the transaction fee of the agreement by virtue of the amount of $veCRV, and the proportion of the share is 50% of the total transaction fee. The share is issued through 3 CRV tokens (3 CRV is the liquidity pool token of the stable currency exchange pool 3 POOL (hereinafter referred to as "LP"), which can be exchanged for other stable currencies at 1: 1, of which 3 POOL is composed of $DAI, $USDC and $USDT three stablecoins).

(4) Increase the market-making income of liquidity providers: After liquidity providers have locked $CRV, they can increase the $CRV rewards they get for staking LPs in the Curve pool (up to a maximum of 2.5 times). The amount of $CRV needed to boost yields depends on the Curve pool the provider is in and the amount of LP. See the link for details.

(5) The longer the $CRV is locked, the greater the amount of $veCRV and the corresponding rights and interests will be. The specific rules are as follows:

ii. As the locked $CRV gradually approaches the expiration time, the corresponding amount of $veCRV will decay linearly. For example, after 4 years of locking 1 $CRV, the initial 1 $veCRV token owned by the user will decay to 0.75 after one year.

image description

Image credit: Curve

iii. The process of obtaining $veCRV by locking is irreversible, which means that users must promise to hold $CRV for a long time. At the same time, $veCRV is also non-transferable, that is, the $veCRV held by the user cannot be transferred to other addresses during the locked period.The veToken mechanism establishes a "consensus" among holders by allowing token holders to hold tokens for a long time to support the success of the protocol. Centralized governance lays the foundation,Because it is based on equal rights and participation among token holders, thereby ensuring a fair and transparent governance process.

The issuance of the protocol token $CRV and the pioneering veToken mechanism have promoted the continuous growth of the protocol TVL and transaction volume. In the half year since the $CRV token was launched, from August 2020 to February 2021, the TVL of the protocol has increased from $136.96 M to $3.8 B, and the cumulative transaction volume has increased from $12.15 B to $129.46 B. Although high incentives for liquidity providers have brought about high inflation of $CRV, which may dilute the rights and interests of token holders, the rapid increase in Curve's business volume has boosted the steady growth of $CRV locked positions, reducing It increases the circulating supply of tokens and helps to stabilize the price of $CRV.

Image source: dune.com

Image source: dune.com

secondary title

2. Economic decentralization breeds a prosperous ecology, and governance tends to be more decentralizedThe continuous growth of Curve TVL and transaction volume, as well as the multiple benefits brought by the veToken mechanism to $veCRV holders, makeStakeholders have gradually realized that holding $veCRV, especially the governance voting rights that enjoy the distribution of $CRV rewards, can bring more liquidity and income to themselves, which plays a huge role in the success of their respective projects.

Therefore, $CRV/$veCRV has become the focus of competition among all parties, and then a battle for Curve governance rights has begun.These projects promote the decentralization of governance by increasing the actual benefits of governance voting rights, encouraging more people to participate in governance and voting. This article will focus on key events and representative projects that occurred during the Curve 2.0 phase. It should be noted that the Curve ecosystem also includes many other projects, but we will not introduce them in detail here. If you want to get more detailed information about the ecology, you can refer to the Curve ecology map and related descriptions produced by Mr. Block in November 2022.

image description

Image credit: twitter@MRBLOCK

|Yearn and Convex start the battle for Curve governance voting rights

Curve has become the main source of income for aggregate yielders such as Yearn and Harvest Finance because of its stable profitability, high capital capacity, and good security. These aggregators help users manage and increase asset returns. By concentrating users' encrypted assets on Curve, they can take advantage of scale to maximize returns. However, having enough $veCRV controls Curve governance voting power, improving reward distribution and yield. In order to provide users with higher returns to expand their business, aggregators have launched a competition for Curve governance voting rights.

(1) Yearn accumulates a large amount of $CRV to increase income, which poses a threat to the governance of the Curve protocol

In the early days of $CRV, Yearn adopted a variety of strategies to accumulate a large amount of $CRV tokens to increase yield and influence Curve's decision-making power. This includes introducing the Backscratcher machine gun pool, aggregating the assets of liquidity providers and $CRV holders, centralizing deposits in Curve to increase yields, and launching the $yveCRV/$ETH liquidity pool on Sushiswap, allowing $CRV holders While enjoying the benefits of $veCRV, avoid the limitation of $veCRV locking, and increase the liquidity of the $yveCRV/$ETH pool through the partnership with SushiSwap, thereby increasing the demand for $yveCRV.

However, in the early days of token issuance, when the number of tokens in circulation was small and the distribution was not sufficiently dispersed, Yearn held a large amount of $CRV, leading to centralized governance and affecting the development of the Curve protocol.

The emergence of Convex broke Yearn's dominance in the process of accumulating $CRV/$veCRV. As a Curve-based yield aggregator, Convex aims to maximize yield for Curve liquidity providers and $CRV holders. In the early days of the launch, the amount of $CRV accumulated by Convex quickly surpassed other competitors. Not only is it supported by the Curve team and trusted by the community, but it also increases the yield of Curve liquidity providers and $CRV stakers at a lower cost. The key advantage lies in the protocol token $CVX, which has a unique token incentive mechanism and distribution beneficial to the community. The amount of $CVX issued is tied to the amount of $CRV earned by Convex on Curve. The total supply is capped at 100 million pieces. 10% is reserved for the Convex team, 3.3% is allocated to investors, and the remaining 86.7% is used for community rewards. In terms of governance mechanism, Convex adopts the veToken voting mechanism. $CVX holders need to lock the tokens for a period of time (at least 16 weeks) to obtain $vlCVX, which is governance voting rights. Since the Convex protocol has a large number of $veCRV tokens and has entered the Curve governance whitelist, it can participate in the Curve voting process and pass governance voting rights to $vlCVX holders.

Image credit: Convex

image description

Image credit: ConvexThe $CVX token mechanism provides holders with more incentives and protocol governance rights, attracting a large number of Curve liquidity providers and $CRV holders, as well as competitors such as Yearn, Stakedao and other protocols to invest assets on Convex. As of January 2022, Convex has acquired nearly half of $veCRV and can effectively determine the distribution of $CRV rewards. While Convex holds a large amount of $CRV, raising concerns about the centralization of Curve's governance, the fact is that Convex promotes the decentralization of Convex, both economically and governance-wise, by adopting a token economic model. It can be said,Convex's control of voting rights is actually another effective way to promote the decentralization of Curve governance on the basis of ensuring the overall interests of the Curve protocol. Convex, Yearn, etc. compete for governance rights, forming a huge black hole of attention, which aggregates more liquidity for Curve.

In the end, Convex successfully controlled Curve's governance voting rights and promoted the formation of a liquidity ecology around Curve.

Issuers of many stablecoins and other linked assets, such as Frax and Lido, need a large amount of liquidity to support the trading and exchange needs of their issued assets. Around 2021, compared with other centralized exchanges CEX and decentralized exchanges DEX such as Uniswap, Curve's advantage lies in providing a low-slippage, low-fee trading experience, and "purchasing" by rewarding $CRV A large amount of liquidity, as well as advantages such as low barriers to entry, no permission, and composability.

therefore,therefore,Issuers of pegged assets such as stablecoins have chosen to create their own exchange pools on the Curve protocol to gain more liquidity and participants. This has led to a surge in demand for Curve voting rights.

First of all, a considerable number of voting rights must be held in Curve's core liquidity pool, and support is obtained through community voting. As the total circulation of $CRV increases, this threshold will continue to increase. Once successfully entered the pool, issuers need to obtain more voting rights in order to strive for better liquidity depth.

With the continuous emergence of asset-linked projects such as stablecoins, a battle for liquidity in Curve's ecology has begun, which has created a large demand for Curve's governance voting rights.

|The bribery platform enables the rise of retail investors and promotes the decentralization of governance

Since the launch of $CRV, Curve voting rights have played an increasingly important role in the success of various projects, such as stablecoin issuers and revenue aggregators. However, a large number of retail investors who hold voting rights lack the motivation to participate in voting because they cannot directly benefit from voting, while project parties need sufficient voting rights to affect the reward distribution of $CRV. In order to solve this market pain point, Votium and Bribe.crv.finance, a bribery platform based on CRV voting rights, appeared one after another in August 2021.TheseThe platform allows projects to provide incentives to those who hold CRV voting rights to obtain voting rights, so that holders can obtain actual economic benefits and promote their participation in agreement governance voting. This move not only prevents only a small number of large holders from deciding the direction of the agreement and the distribution of rewards, but also contributes to the decentralization of governance.

It also enhances the governance utility of $CRV/$veCRV and promotes demand for tokens. On the other hand, stablecoin project parties can obtain liquidity at a lower cost, making the Curve ecosystem more attractive, but this also intensifies competition among project parties.

The emergence of major bribery platforms has provided project parties with more ways to obtain liquidity, further escalating the liquidity war.

|Redacted further enhances the income of voting and maximizes the decentralization of governance

Although the emergence of bribery platforms has increased participation in Curve governance, there are also issues of unfairness and opacity, which may lead to malicious voting and misconduct. Therefore, it is necessary to weigh the pros and cons when adopting this method to ensure the fairness and transparency of protocol governance. To this end, Redacted emerged in December 2021 as a fork protocol of Olympus DAO, focusing on providing governance services for the Curve ecosystem.

Redacted has attracted many participants through the incentive method of issuing protocol $BTRFLY tokens, and obtained a large number of Curve voting rights. The first product launched by its protocol is a platform called "Hidden Hand", where users delegate the voting rights they own to Hidden Hand, Hidden Hand sells these voting rights to external agreements that need them, and sells the voting rights of these external agreements. Bribe rewards are redistributed to users, protocol treasuries, and $BTRFLY stakers. All voting processes and revenue maximization are handled by Hidden Hand. Redacted has also expanded its business to the management of other ecological governance rights, and has continuously launched new products and upgraded the token economy.Compared with the traditional "bribery platform",Instead, by introducing specific cases, readers can gain a deeper understanding of the practice and application of decentralized governance. When analyzing and evaluating decentralized governance, it can usually be evaluated from five dimensions: governance process and mechanism, degree of decentralization, community participation and governance efficiency, governance transparency and security, innovation and sustainability .

secondary title

3. Comments and insights on Curve 2.0 stage: the decentralization of economy and governance will help the emergence of a rich ecologySince March 2021, Curve's monthly trading volume has exceeded $6 billion. This is partly due to the upward trend of the crypto industry at the time and the repeated record highs in the market capitalization of crypto assets. The Curve 2.0 phase, as a critical moment in the development of the Curve protocol, demonstrates

In the context of Web3.0, how the decentralization of economy and governance can promote ecological self-organization and growth, and promote the generation of Curve network effects.The Curve protocol cleverly integrates the $CRV and veToken mechanisms, closely linking multi-stakeholders such as token holders, liquidity providers, and protocol developers, achieving a more harmonious distribution of benefits and promoting The pace of economic decentralization. By establishing a long-term "consensus", only participants who hold tokens for a long time have governance voting rights, thereby helping to decentralize governance.

This decentralized approach has encouraged many stakeholders to actively join the Curve ecosystem, collaborate and cooperate rationally, injecting strong impetus into the ecological construction. Thanks to the vigorous development of Curve's ecology, liquidity and market trading volume continue to rise. These two elements motivate each other and form a positive feedback loop. This cycle further promotes the efficiency and scale growth of the entire ecology, and the network effect begins to appear.In the Web3.0 era, the importance of the ecosystem to the protocol is self-evident, and it can bring a lot of value to the protocol. First, a thriving ecosystem can attract more users and liquidity, thereby enhancing the market share and competitiveness of the protocol. Second, the development of the ecosystem helps to provide more functions and application scenarios, creating a better user experience for participants and enhancing their loyalty. In addition, it can bring more opportunities for innovation and development, creating more room for growth for the protocol. Finally, the network effect brought by the ecosystem will further strengthen the competitive advantage of the protocol.

The decentralization of economy and governance is regarded as the foundation and key means to promote the enrichment of ecology and enhance the value of the protocol.It is not enough to rely on the decentralized design of technology, economy and governance to attract ecological participants. Without continuous value creation, the ecology will not be sustainable for a long time.

first level title

By introducing the token and veToken mechanism, Curve has promoted the realization of the network effect of the protocol and achieved staged success. However, in order to achieve the continued development of the protocol, Curve still faces many challenges and doubts.

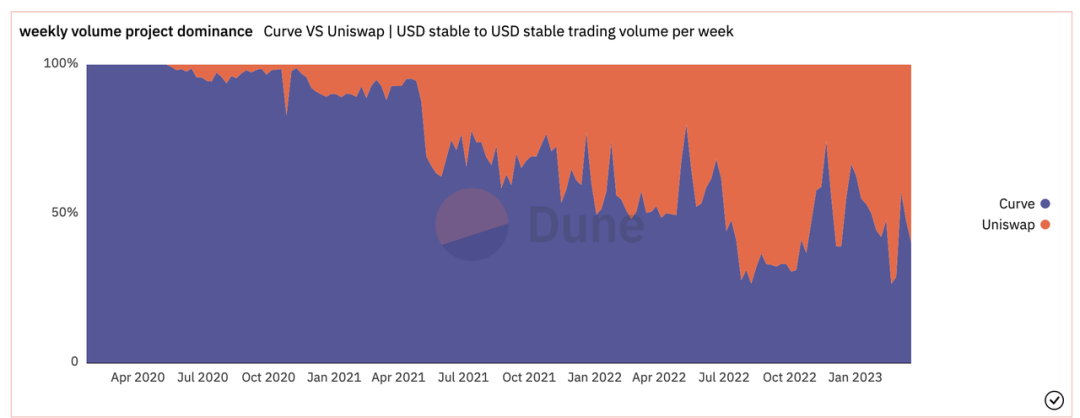

1. DeFi competition is fierce: Curve faces challenges from homogeneous and non-homogeneous competitors

textThe competition in the DEFI field is very fierce, and Curve's business revenue growth has encountered challenges, and there is also a huge risk of business revenue decline.For example, in May 2021, Uniswap launched the V3 version of the protocol, which uses a centralized liquidity algorithm mechanism to improve the capital utilization efficiency of stablecoin market makers and reduce traders' transaction fees and slippage, thus threatening Curve's market share. Share of the stablecoin trading market. According to the comparison of Curve and Uniswap stablecoin trading volume in the figure below, it can be seen that since the launch of Uniswap V3, compared to Curve, Uniswap's market share in stablecoin trading volume has gradually increased.

image description

Image source: dune.comand fromFor example, the lending protocol Aave plans to launch its own native stablecoin, and the stablecoin issuer Frax has launched its own trading and lending platform, aiming to expand DEFI's full-stack business to attract more users' capital inflows. Looking at the TVL trend graph below, we can see that Curve once had a significant advantage, but is now overtaken by Aave. Also, the gap between Curve and Frax is gradually decreasing.

Image source: defillama.com

secondary title

2. The Sustainability Challenge of Curve’s Token Economy: Diminishing Marginal Benefits and Bubble RiskCurve's token economics has indeed brought a lot of liquidity to Curve, thus promoting the prosperity and development of the ecology and the continuous growth of transaction volume. However, whether this model is sustainable has been debated. The data shows that despite increased liquidity through incentives, Curve's capital usage efficiency (transaction volume/total locked value) is low.When the liquidity reaches a certain critical point, the promotion effect on the transaction volume and business income of the agreement begins to weaken significantly, that is, "diminishing marginal benefit".This indicates

High inflation cannot increase transaction volume forever, and we must pay attention to the diminishing marginal benefits.More importantly, after the liquidity reaches the critical point to continueSpecifically, 1) Some participants are overly optimistic about the agreement because of the high liquidity brought about by high inflation, which leads to the overvaluation of token prices. However, high inflation did not bring about a simultaneous increase in transaction volume, leading to bubbles. 2) Consume the future value of the protocol. If the supply of tokens exceeds actual demand too quickly, the token price bubble may burst, causing the value of tokens to fall, which will damage the future value of the agreement. 3) High inflation will increase the entry cost of latecomers to the protocol, and they need to buy more tokens to get the same amount of rewards. This may cause latecomers to lose the opportunity to participate in ecological construction and limit the development potential of the ecology.

therefore,therefore,In the face of competitive pressure, bubbles and Ponzi doubts, Curve may have realized the importance of transaction volume and value creation, and opened the second growth curve. The new business directions it explores include 1) expanding the "volatile asset" trading business; 2) launching the protocol's own stable currency.

secondary title

In the ever-evolving DeFi world, innovation and adaptation are key to staying competitive. With the release of Uniswap V3 in May 2021, Curve also launched the V2 version of the protocol in June of the same year. Through technological innovation, Curve has upgraded the market maker model so that it can support the trading of "volatile assets". This move marks Curve's entry into the trading market beyond stablecoins and other pegged assets, further enriching its business areas. The curve of Curve V2 (orange line) is located between the constant product curve (dashed line) and Curve V1 curve (blue line), and the end of the curve gradually converges to the constant product curve. This improvement makes V2 not only retain the advantages of low slippage and high liquidity in the smooth area of the V1 curve, but also overcome the problems of insufficient liquidity at the tail end and lagging response to price changes. In addition, V2 also created an internal oracle machine EMA mechanism to prevent external risks, improve liquidity aggregation and reduce uncompensated losses. At the same time, the dynamic properties of the V2 curve have further improved Curve's capital efficiency.

image description

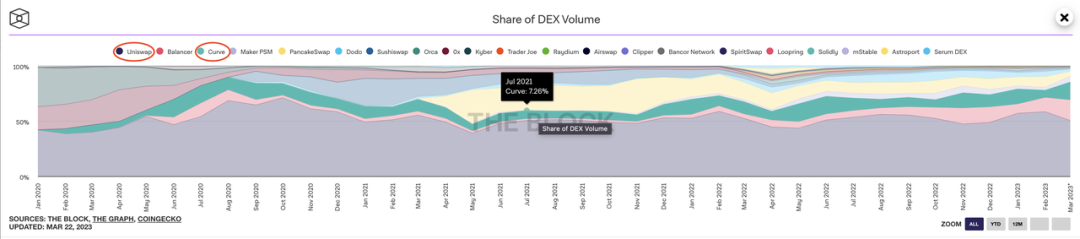

Although Uniswap V3 grabbed some stablecoin trading volume after its launch, Curve V2 also began attracting trading volume in volatile assets to expand its user base. Currently on Ethereum, tricrypto 2 ($USDT/$WBTC/$ETH) is currently the largest liquidity pool for Curve V2, and the latest daily transaction volume has reached $66 million. Judging from the proportion of trading volume of various decentralized exchanges in the market, since the launch of Uniswap V3 and Curve V2, the gap between them has not changed significantly. You can refer to the chart below.

Image source: THE BLOCK

secondary title

4. Curve launches its stablecoin offering program, aims to expand revenue streams

In May 2022, Terra/Luna's stablecoin $UST suddenly collapsed, causing market shocks and many similar assets were affected. Among them, Curve's stable currency trading business has also been affected. In response to this challenge, Curve first disclosed its plan to release Curve's over-collateralized stablecoin in June of the same year, and released a related white paper in November. The goal of this initiative is to create new revenue streams for the Curve protocol, attract more liquidity, and boost the price of $CRV.

To achieve this goal, Curve proposed an innovative Lending-Liquidating AMM Algorithm ("LLAMMA" for short) and PegKeeper in the white paper. LLAMMA is a new liquidation mechanism created by Curve, which realizes continuous liquidation and de-liquidation through the AMM algorithm, reducing the risk of bad debts and user losses. PegKeeper is used to maintain the anchor value of the protocol stable currency.Although the price of $CRV has fallen sharply before, the release of the white paper has made the market full of confidence and expectations for Curve's future new business expansion. At present, Curve has not officially issued a stable currency, and the specific performance needs to observe the market reaction after its launch.

secondary title

5. Comments and insights on Curve 3.0 stage: continuous value creation is the core goal of the Web3.0 protocolThe Web3.0 field is still in the early stage of development, and the external environment is changing rapidly. Especially in the DEX field, the competition is extremely fierce. While network effects also play an important role, Web3.0 differs from Web2.0 in its monopoly features,

Web3.0 has the characteristics of decentralization, openness and interoperability, as well as the promotion of token incentives, community drive and innovative technology, making it easier for users to quickly migrate between different protocols and Dapps, resulting in more brutal competition.In such fierce competition,The core goal of the Web3.0 protocol should be to continuously create value, not just to pursue token price increases,Only in this way can the sustainable development of the agreement be ensured. The agreement should adopt a reliable mechanism to avoid damage to the agreement caused by short-sighted behavior. also,

As pointed out by CTO Eddy Lazzarin of a16z crypto, token design should be called protocol design, which is a very early field. Because "token design" is only a part of "protocol design", it is one of the auxiliary means for the protocol to create value. The real value comes from "protocol design", including but not limited to business construction logic, token incentive mechanism, community governance way etc.Taking Curve as an example, the protocol has made many efforts in product iteration, token design, and ecological construction, hoping to achieve sustainable development in the process of continuous innovation. However, in this process, it is necessary to prevent bubbles caused by excessive incentives, and even cause "Ponzi" to question, thus affecting the stable development of the agreement.

Only when the incentive mechanism is properly designed and used can it really promote business growth, otherwise it may be just a bluff and sell the future without generating real value.Design needs to be guided by token dynamics and token engineering perspectives to ensure the sustainability of the protocol. At the same time, in order to assist the optimization of the design, Agent-Based simulation technology can be used to understand and optimize the protocol design more deeply and enhance the core competitiveness of the protocol.

first level title

"at last"

This article mainly summarizes the laws and experiences applicable to the success of the Web3.0 protocol by combing and analyzing the evolution process of the Curve protocol.The core goal of the Web3.0 protocol is "continuously creating value". To achieve this goal, the protocol needs to implement PMF at the initial stage.Only the realization of PMF can attract more participants and promote the rapid development of the protocol.Token economic design should be reasonable, and tokens can be used to raise start-up capital and motivate users to actively participate.The project party needs to ensure that the token economy provides strong support for the long-term and stable development of the protocol, rather than becoming an obstacle on the road to success.

in addition,in addition,In the Web3.0 ecology, the transition from a centralized team to a decentralized community is a key link.In this process, the protocol requiresFirst of all, ensure that the technology of the protocol itself is decentralized,Avoid the emergence of centralized nodes or institutions. At the same time, the distribution of token issuance also needs to avoid excessive concentration.To achieve economic decentralization.Delegate as much as possibleDecentralized governance

, allowing the community to participate in the governance process of the protocol.However, in the field of Web3.0, the cryptocurrency market fluctuates violently, and bulls and bears alternate quickly. At the same time, Web3.0 is still in its infancy, users are prone to loss, and market competition is becoming increasingly fierce. Therefore, the agreement needs to pursue sustainable success, not one-time success.

For the Web3.0 protocol, sustainable success is a brand-new proposition that requires continuous exploration.

For example, in the process of pursuing sustainable success, should project governance choose complete decentralization, or properly retain the role and influence of the core team on the basis of decentralization? And is it reasonable and necessary to pursue the perfection of decentralized governance? These issues need to be further explored.How can we overcome the challenges when dealing with the high degree of internal and external "uncertainty" faced by the agreement?While uncertainty cannot be eliminated, we can use tools to iteratively optimize the protocol.There is currently no one on the marketTools that are easy to operate, intuitive to visualize, and at the same time have scalability and flexibility for complex systems can assist protocol design.

cadCAD is highly customizable and extensible, but not easy-to-use and intuitive; Machination is not Agent-Based Modeling, so it cannot handle complex situations. It is reported that the new entrepreneurial project HoloBit is the first code-free, visual, Agent-Based modeling and simulation platform aimed at the design and optimization of the protocol, which seems to have the advantages of both. The platform has not yet been officially launched, and it is worth looking forward to.

To sum up, the key to the success of the Web3.0 protocol lies in the realization of PMF, the establishment of a suitable incentive mechanism, the shift to decentralization, etc., and the ability to adapt to internal and external changes. Although there is currently no general method applicable to all Web3.0 projects, I hope that the laws and experiences summarized in this article can provide useful ideas and suggestions for the construction of Web3.0 projects, and help build a healthier and more sustainable protocol.

Original link: https://medium.com/@protocolneering/curves-evolution-insights-into-sustainable-protocol-design-beyond-token-design-2780dfc1ccda