secondary title

1. Celestia

Official website: https://celestia.org/

Brief: The first modular consensus and data availability network

Funding: Round: 2, Total Funding: $56.5M

Participating institutions: Bain Capital Crypto, Polychain, Binance Labs, etc.

Project progress: Celestia's incentivized testnet program Blockspace Race is underway, 15 million tokens will be used to reward participants, and the mainnet is expected to be launched in the second quarter of 2023

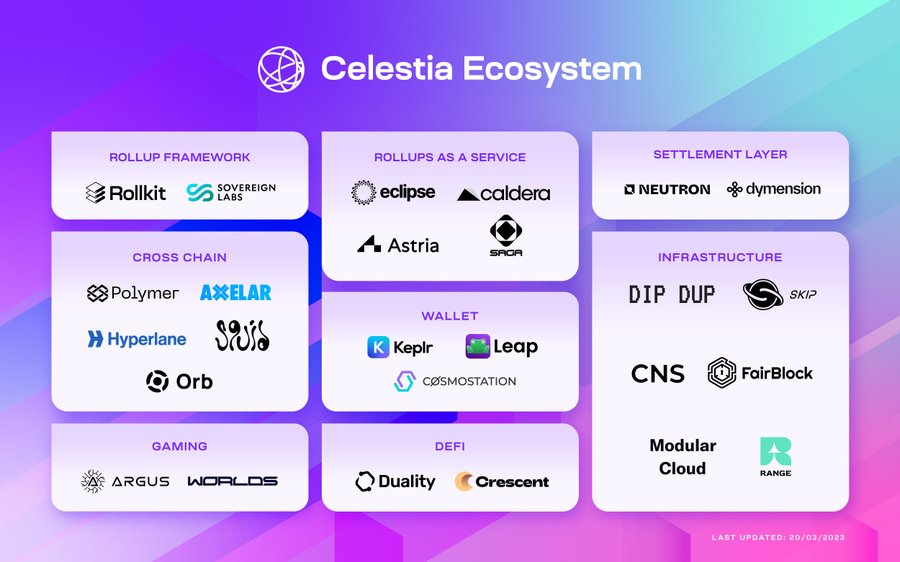

The ecological project is shown in the figure:

secondary title

2. Sei

Official website: https://www.seinetwork.io/

Brief: A layer 1 blockchain with a built-in order book built using the Cosmos SDK and Tendermint core

Financing: Round: 1, Total Funding: $5 million More rounds of financing are waiting to be announced. According to our information, the valuation of the second round of financing is more than ten million U.S. dollars

Participating institutions: Multicoin Capital, Coinbase Ventures

Project progress: The final version of the testnet, Atlantic-2, will be launched soon. Sei Network regards this version as the last milestone of Sei before the mainnet launch. The main network is expected to be launched in the second quarter.

The ecological project is shown in the figure:

secondary title

3. Berachain

Official website: https://berachain.com/

Brief: DeFi-centric EVM L1 compliant built on Cosmos SDK powered by Proof of Liquidity Consensus.

Financing: Not yet announced. According to our communication with the project party, at least ten million dollars of financing has been completed. Participating institutions include polychain, etc.

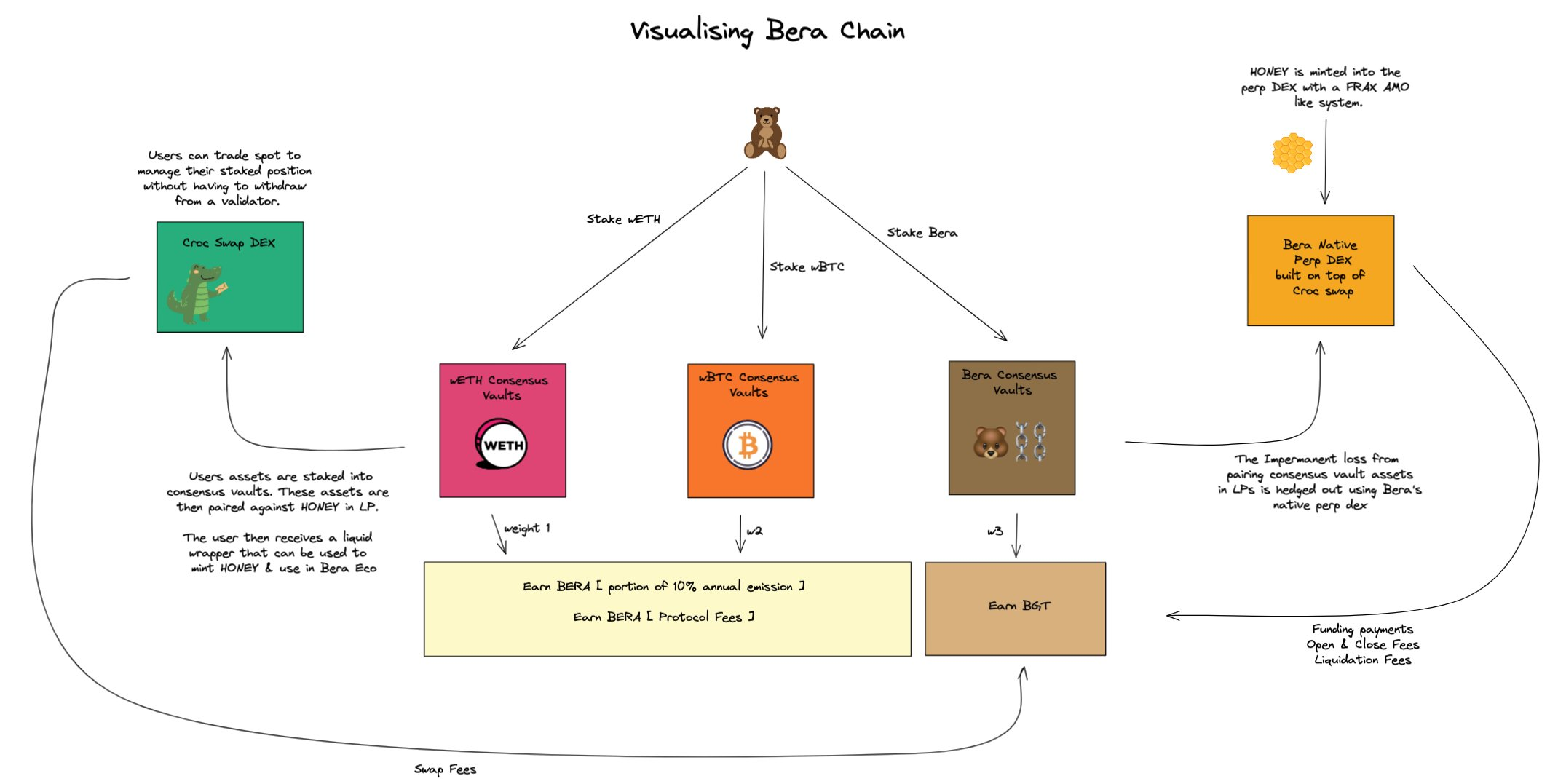

Project progress: Berachain implements a novel "three-token system", testnet launch will be in April

Ecological project:

secondary title

4. Space

Official website: https://www.tryspace.com/

Introduction: SPACE is a business metaverse that allows users to design their own virtual business space for games, art, fashion, music, and experience social commerce in a virtual world.

Funding: Round: 1, total funding: $7 million; currently in the second round of $10 million financing

Institutions: Binance labs, Dapper Labs, CoinFund, DCG, Animoca Brands, etc.,

Project progress: preparations are being made for the network test plan in the spring of 2023, and it is expected to go live in the second or third quarter

secondary title

5. Magpie

Official website: https://www.magpiefi.xyz/

Introduction: A decentralized liquidity aggregation protocol designed to provide the best trades for any asset across top blockchains without directly bridging assets.

Round: 1, Total Funding: $3M

Institutions: Jump Crypto, Sandeep Nailwal (Polygon), Parafi Capital, Republic Capital, etc.

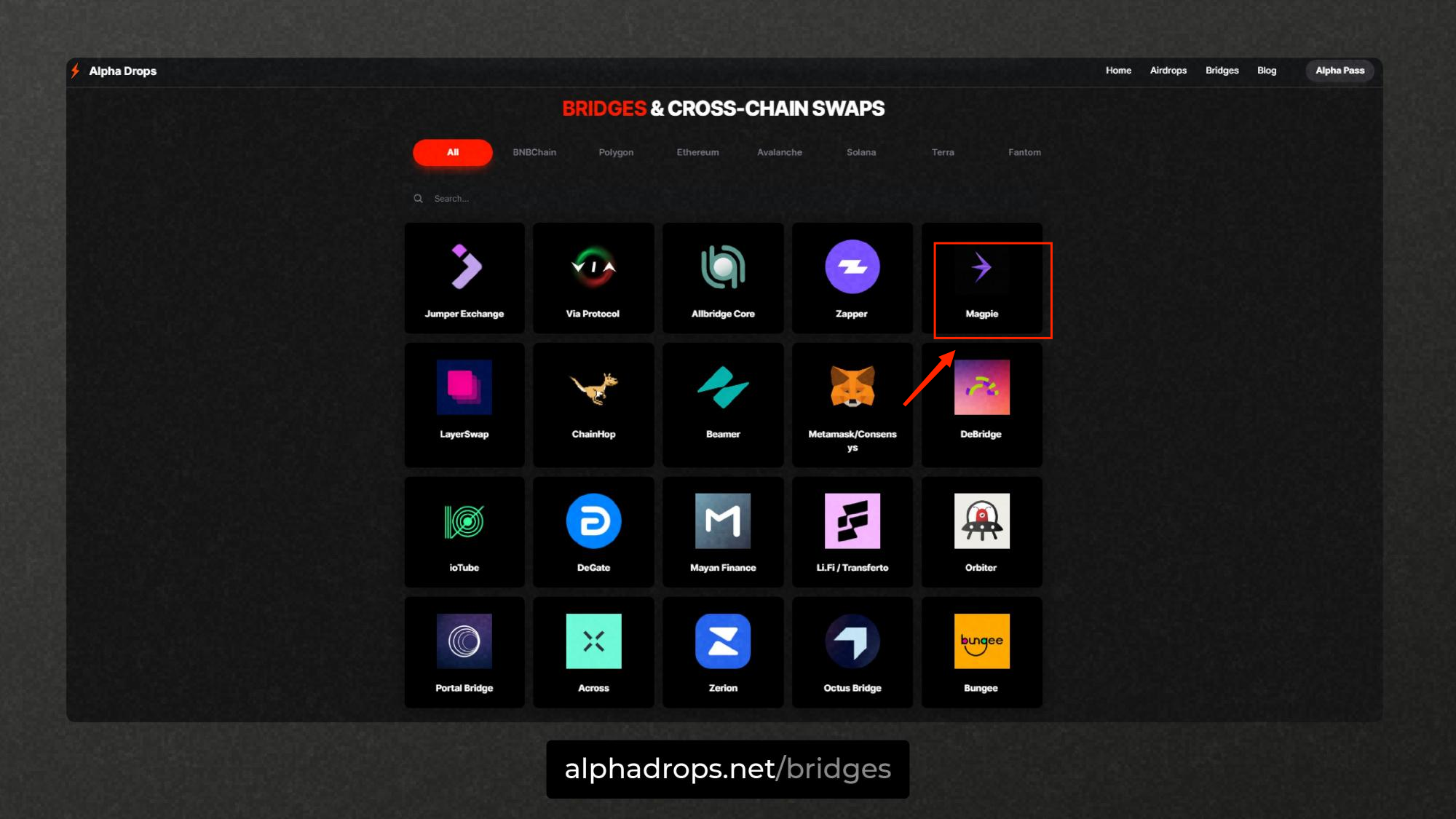

Project progress: It has been deployed on the four chains of Ethereum, BNB Chain, Polygon, and Avalanche. The public Alpha test is about to end, and it is expected to go online in the second quarter

secondary title

6. Taker

Official website: https://www.taker.org/

Introduction: NFT liquidity protocol, which allows users to liquidate and lease a variety of novel encrypted assets, including encrypted collectibles, metaverse assets, financial instruments, synthetic assets, etc.

Funding: Round: 1, Total Funding: $3M

Institutions: Electric Capital, Dragonfly, Spartan Group, etc.

Project progress: Launched the Taker NFT empowerment plan, and will launch Polygon and ZkSync

secondary title

7. Fluidity

Official website: https://app.fluidity.money/

What it is: A yield generating protocol that rewards people for spending their cryptocurrency, where holders are rewarded with a random payout when they spend their cryptocurrency.

Funding: Round: 1, Total Funding: $1.3M

Institutions: Multicoin Capital, Circle Ventures, etc.

Project Progress: Launched on Arbitrum, when you wrap your DAI for fDAI on the Fluidity WebApp, it will automatically be lent out on Aave and start generating yield.

The following is a screenshot of the income

secondary title

8. Mohash

Introduction: DeFi of emerging market debt can provide investors with sustainable, scalable and stable high returns backed by real-world debt assets.

Funding: Round: 1, Total Funding: $6M

Institutions: Sequoia Capital, Jump Crypto, Coinbase Ventures, two polygon joint ventures and well-known angel investor Balaji Srinivasan, etc.

Project progress: The financing completed in June 22, the project operation is not in place, and the social media has not been updated for a long time

Reasons for SixthDaoVC’s attention: Because the project is in the early stage and has a strong lineup of investment institutions. Sequoia is a well-known investment institution in the web2 field, similar to a16z. The resources obtained by this project are quite good, and the early valuation is not high, and it is still an RWA competition Road project, this track may explode in the future, you can observe and pay attention to it, and wait for the project update.

The above are the eight first-level projects we have brought to you. We have been deeply involved in the first-level investment field for three years. The projects we invested in the past had losses, and there were also ten-fold or even hundred-fold returns. The charm of the primary market is that you can understand And access to the core resources and information of the project will not be a headless transaction like a secondary market.