From centralized stablecoins represented by USDT and USDC, to over-collateralized stablecoins dominated by DAI and FRAX, to the rise and fall of UST, the stablecoin market is constantly developing. We hope to use this report to show the status quo of the stablecoin market and look forward to the future development prospects of the stablecoin market.

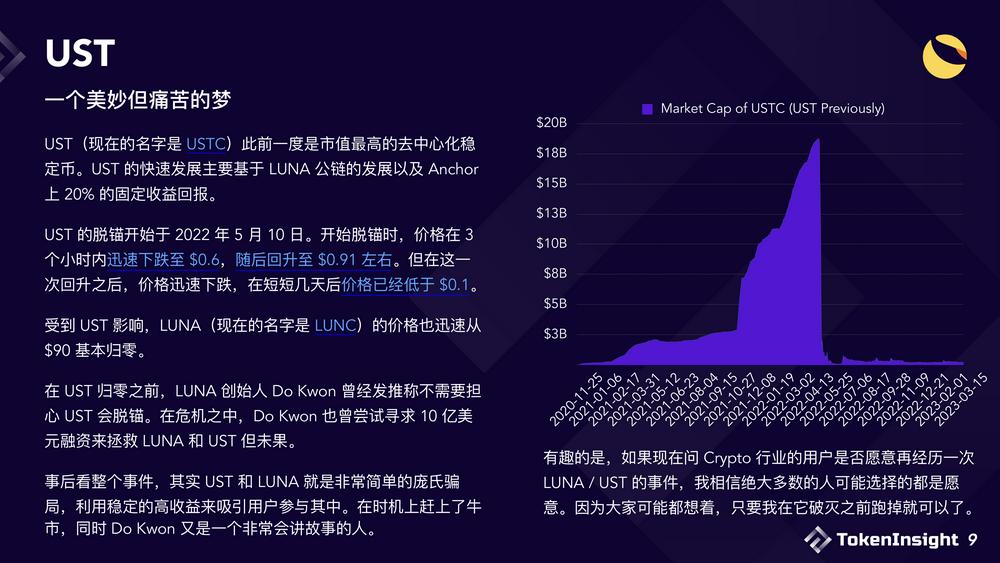

Stablecoins are generally divided into three types, reserve asset endorsement, over-collateralization, and algorithms. Reserve-backed stablecoins are the most common, but they are also the most centralized. Decentralized stablecoins generally adopt an overcollateralization mechanism. Algorithmic stablecoins have petered out after the Terra (LUNA) debacle.

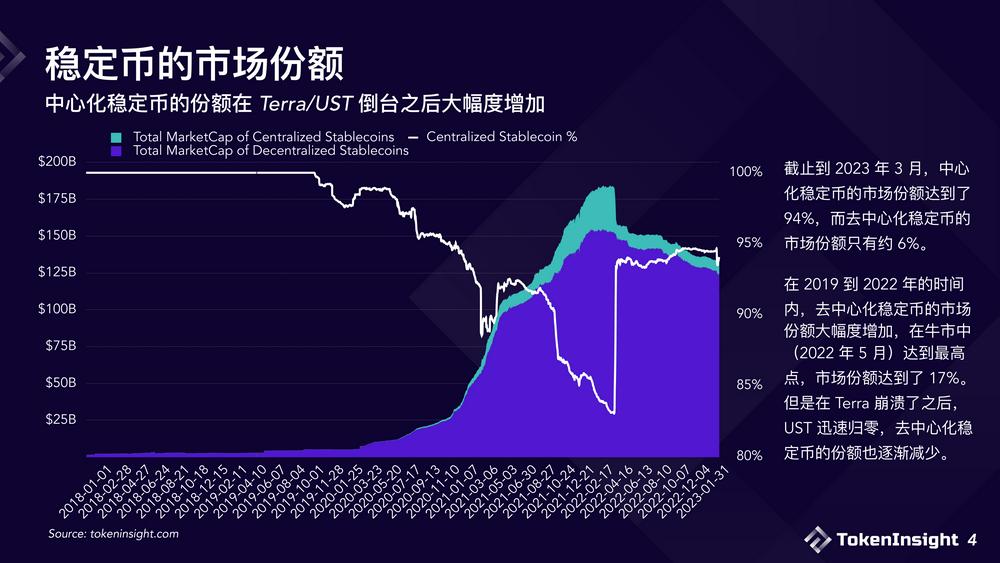

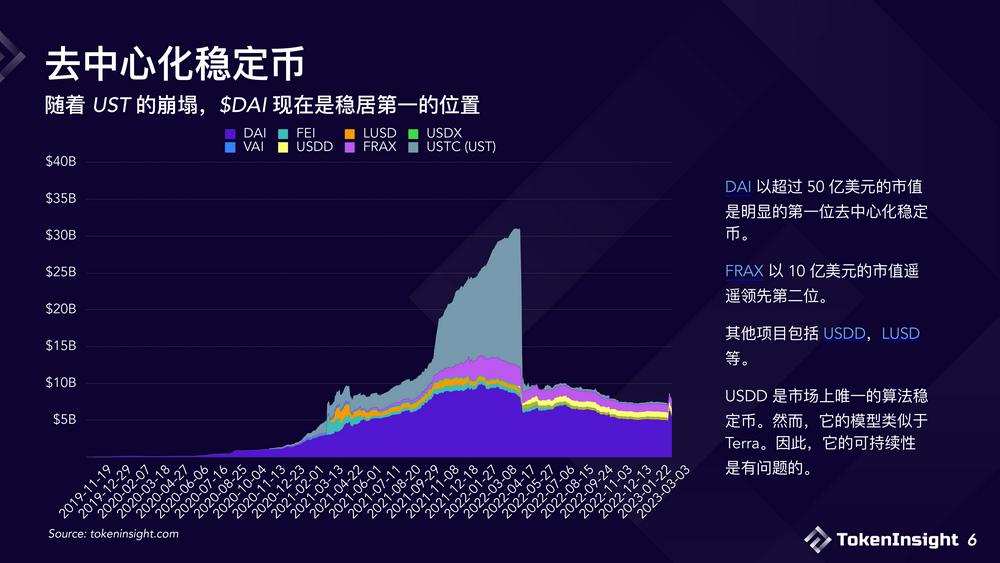

As of March 2023, the market share of centralized stablecoins has reached 94%, while the market share of decentralized stablecoins is only about 6%. During the period from 2019 to 2022, the market share of decentralized stablecoins has increased significantly, reaching the highest point in the bull market (May 2022), with a market share of 17%. But after Terra collapsed, UST quickly returned to zero, and the share of decentralized stablecoins gradually decreased.

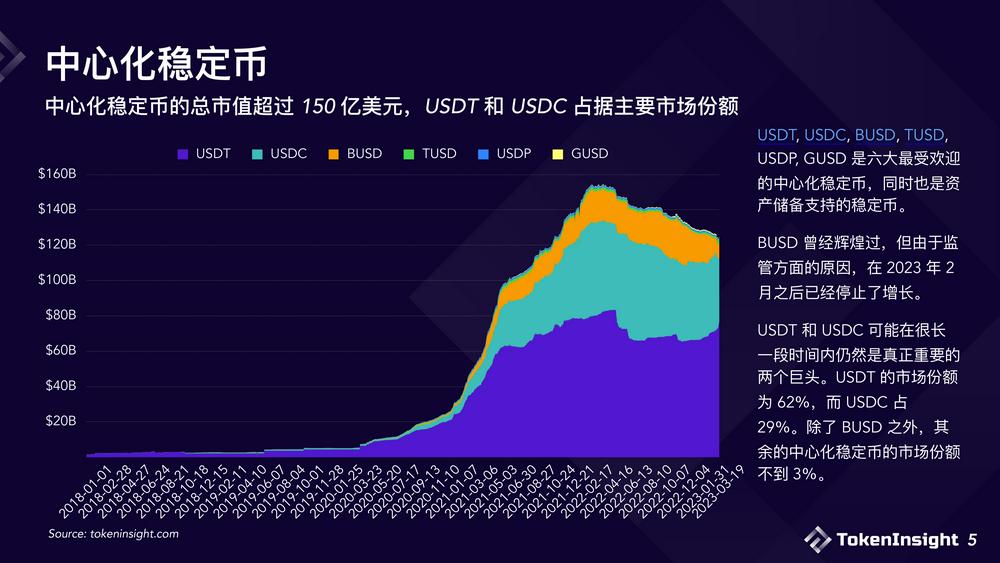

Major centralized stablecoins include USDT, USDC, and BUSD. However, due to regulatory reasons, BUSD will no longer be issued from February 2023, and USDT and USDC are bound to form a two-legged situation. Among the two, USDT currently has a slight lead.

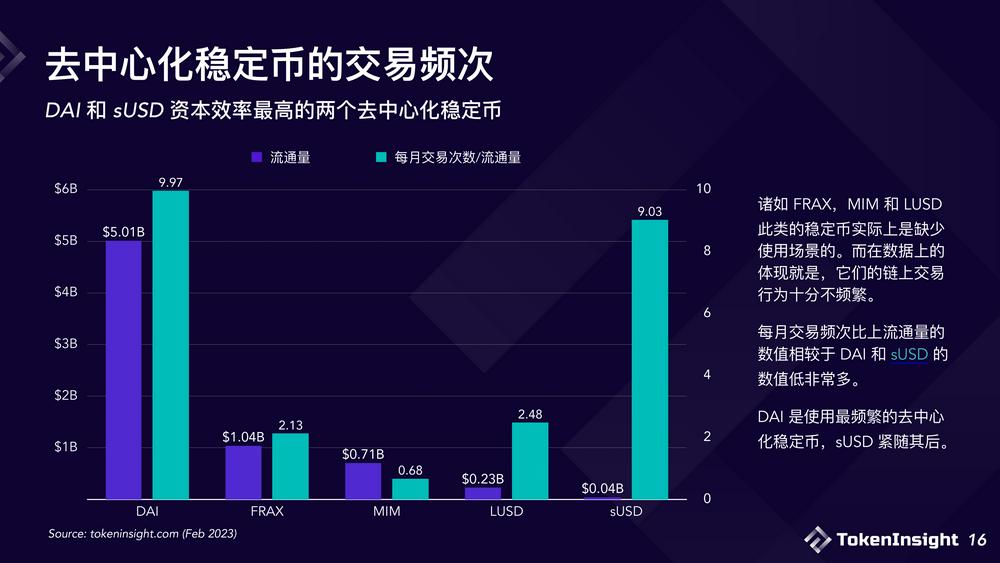

Decentralized stablecoins are also head-to-head, but DAI has a much bigger lead, five times larger than FRAX.

However, these two nominally decentralized stablecoins are more like USDC with a different shell. After Silicon Valley Bank triggered a price drop in USDC, the prices of DAI and FRAX fell simultaneously, because most of the collateral behind these two stablecoins is USDC.

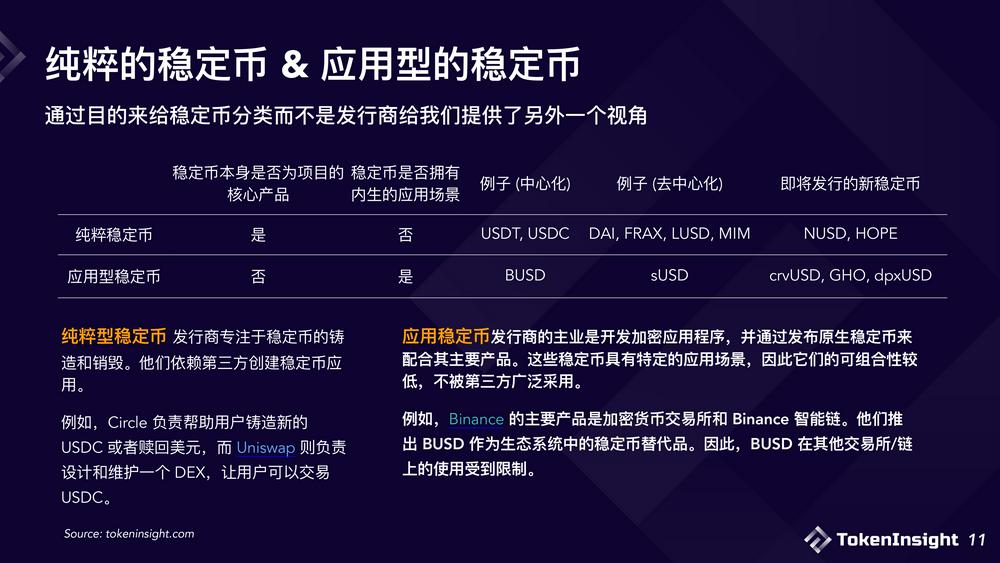

Categorizing stablecoins by purpose rather than issuer gives us another perspective. Pure-play stablecoin issuers focus on the minting and burning of stablecoins. The main business of application stablecoin issuers is to develop encryption protocols and to complement their main products by releasing native stablecoins.

Because there are natural application scenarios, the road to popularization of stablecoins is easier and the growth potential is higher, as evidenced by BUSD and sUSD.

Curve's crvUSD and Aave's GHO are two upcoming application stablecoins that will change the game as they each have billions in TVL ready to be used as collateral.

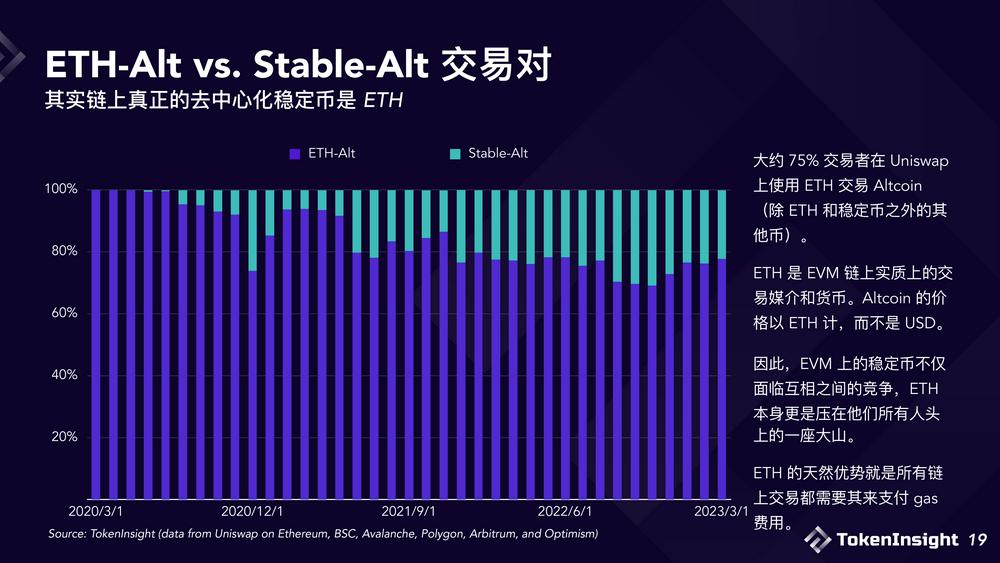

However, if we take ETH into consideration, then ETH may be the currency that Crypto has been trying to create.