Originally Posted by Babywhale, Foresight News

Originally Posted by Babywhale, Foresight NewsOn the evening of March 16, Beijing time, Arbitrum, one of the "OR Gemini", officially announced the token airdrop 11 months after Optimism announcedToken Airdrop Program

. Today, ARB tokens are officially open for collection. Similar to Optimism, Arbitrum will also airdrop to ecological projects in addition to airdropping to users, so projects participating in Arbitrum in the future still have the possibility of receiving ARB token rewards.Last April, we conducted aArbitrum Ecological Project Inventory

. L 2B EAT data shows that after nearly a year of development, the TVL on Arbitrum One has not changed much in USD terms, but has increased by 79% in Ethereum terms. In addition, the number of unique addresses also increased from nearly 250,000 to nearly 600,000.

Another difference from a year ago is that, compared to the "copier" of the Ethereum mainnet, Arbitrum has developed innovative projects such as GMX and Y 2 K Finance that are not on Ethereum. Today we reorganized the projects of the Arbitrum ecosystem. In addition to looking for opportunities to obtain potential token rewards, we also explored the next possible Alpha together.

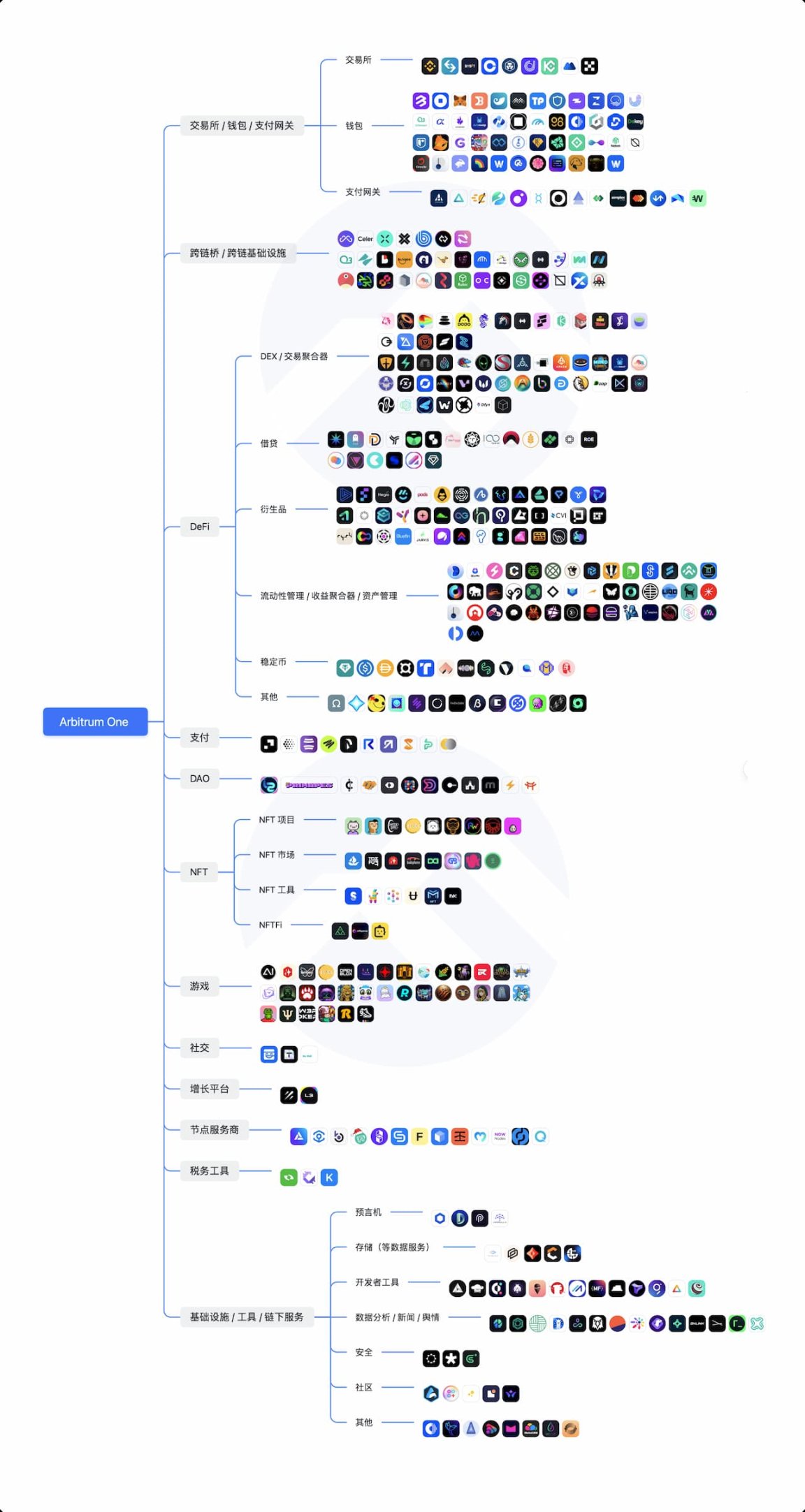

Arbitrum One

The project information comes from the Arbitrum ecological project portal and DefiLlama. The author has selected projects with a certain TVL or user volume. Readers are requested to pay attention to risk control when choosing projects to participate in. If there are any omissions, welcome to add.

Exchange/Wallet/Payment Gateway

Among the centralized crypto exchanges, in addition to the aforementioned Bitget, Binance, Bybit, Crypto.com, KuCoin, MEXC, and OKX, Coinbase and Juno have already integrated the Arbitrum One mainnet to support the deposit and withdrawal of some tokens on Arbitrum.

In terms of wallets, the number of wallets supporting Arbitrum One has increased from 24 to 47, including BitKeep, Coinbase Wallet, MetaMask, DeBank, imToken, MathWallet, TokenPocket, Trust Wallet, Zapper, Zerion, XDEFI Wallet, UniPass, etc.

In terms of payment gateways, the fiat currency gateways currently supporting Arbitrum include Alchemy Pay, Banxa, CryptoRefills, Fluid Finance, MoonPay, Mt Pelerin, Onmeta, PayTrie, Ramp, Simplex, Swipelux, Transak, TransFi, Wirex, etc.

Cross-chain bridge / cross-chain infrastructure

According to website information, there are as many as 35 cross-chain bridges or infrastructures that support Arbitrum, including Multichain, cBridge, Across Protocol, Axelar Network, BoringDAO, Connext, Hop, etc.

Some of the projects I think deserve your attention, including:

In May 2022, LayerZero was exposed to be launched at a valuation of US$3 billionfinancingfinancing

, and the relevant rights and interests of LayerZero tokens are included in the financing, so there may be related airdrop expectations when using Stargate.

Across: Across announced on November 24, 2022 that it had completed a financing of US$10 million at a valuation of US$2, and officially listed ACX tokens on the 28th. Currently providing liquidity on Across and staking ACX tokens can get token rewards. According to DefiLlama, the current TVL on it is about 48.31 million US dollars.

DeFi

In addition, the portal website did not mention Orbiter Finance, a Layer 2 cross-Rollup bridge. The project announced the completion of the first round of financing in November 2022. Participating parties include Tiger Global, Matrixport, A&T Capital, StarkWare, Cobo Ventures, imToken, Mask Network , Zonff Partners, etc.

DEX / Trading Aggregator

DEX and transaction aggregators currently supporting Arbitrum include Uniswap, SushiSwap, Curve, Balancer, etc.

Among them, Camelot has grown into the leading DEX on Arbitrum. According to DefiLlama, the TVL on Camelot has exceeded 100 million US dollars at the time of writing. Camelot combines the mechanisms of Uniswap V2 and Curve, and is almost the same as most DEXs at the level of liquidity incentives. It can be seen from its Twitter that thanks to the concept of "Arbitrum native", Camelot has a better opportunity to cooperate with Arbitrum ecological projects, and new projects can have more incentive space, which makes Camelot gain a short-term A large amount of liquidity has formed an aggregation effect.

borrow money

borrow money

Currently, lending protocols that support Arbitrum include Radiant Capital, Aave, dForce, Yield Protocol, WePiggy, etc.Among the above lending agreements, the most noteworthy one is Radiant Capital. The author once in October 2022LayerZero ecological key ecological inventory

At present, Radiant has launched the V2 version, and the V2 version will support full-chain lending through LayerZero and launch BNB Chain.

Derivatives

Derivatives

Derivatives protocols currently supporting Arbitrum include Deri Protocol, Volmex, ApeX, GMX, Gains Network, Perennial, Rage Trade, etc.

Among all the derivatives agreements on Arbitrum, the one that attracts the most attention is GMX. GMX uses a unique "peer-to-pool" trading model that allows liquidity providers to act as counterparties to traders and at the same time obtain part of the fees generated by the agreement. After the bankruptcy of FTX, a large number of on-chain trading platforms and on-chain derivatives platforms have gained attention. GMX has benefited from the advantages of transaction costs on the Layer 2 network and the high returns brought by its model to liquidity providers. Currently the DeFi protocol with the highest TVL on Arbitrum. According to DefiLlama data, GMX's current TVL is close to $500 million.

In addition to the above two more attention-grabbing products, Rage Trade and completed a US$12 million investment led by Polychain Capital and Variant in December 2022.financingfinancing

Perennial is also worth noting. For details about the mechanism of the agreement, you can read "Understanding Rage Trade in Three Minutes: Composable Full-Chain Ethereum Perpetual Contract Agreement", "What are the highlights of Perennial, a derivatives agreement that raised $12 million?" ".

Liquidity Management/ Yield Aggregator/ Asset Management

With the gradual improvement of the basic DeFi protocol on Arbitrum, "DeFi Lego" is also slowly being built. GMD Protocol, which focuses on GMX, and PlutusDAO, which has a large number of JONES/WETH LP and DPX and SPA tokens, are important "superstructures" .

stable currency

stable currency

Among them, Fluidity announced at the end of October 2022 that it completed a $1.3 million seed round led by Multicoin Capitalfinancing. Vesta is an over-collateralized stablecoin protocol similar to Liquity. Users can mortgage ETH, WBTC and gOHM to mint the stablecoin VST. Vesta designed the VST "hard peg" mechanism, any user can use VST to redeem $1 worth of collateral when VST is unpegged.

other

other

Among them, Y 2 K Finance, which is similar to stablecoins and packaged asset CDS (credit default swaps), brought huge benefits to risk-insured users when stablecoins were generally unanchored during the previous Circle crisis. For details of the protocol mechanism, please refer to "The DeFi Winner Behind FTX's Defeat: Understanding the Stablecoin Decoupling Risk Pricing Agreement Y 2 K Finance".

to pay

to pay

DAO

Currently, payment protocols that support Arbitrum include privacy payment protocol Umbra, capital flow protocol Superfluid, 0x Splits, Cask Protocol, Holyheld, Raiden Network, Request Finance, Rise, Sablier, etc.

NFT

Currently, the DAO organizations listed on Arbitrum include Layer 2D AO and PrimapesDAO. Layer 2D AO is an investment DAO, focusing on investing in L2 ecological projects; PrimapesDAO is also a DAO aimed at attracting Arbitrum users and investing in projects on Arbitrum. In addition, DAO tools that support Arbitrum include CharmVerse, Collab.Land, Commonwealth, DAOhaus, Dework, Safe, Guild, Multis, Snapshot, Utopia, etc.

NFT items

The NFT projects listed on the official Arbitrum portal include Arbibots, ArbiDudes, Hoodlife Club, Kanpai Pandas, Mithical, Random Walk NFT, yiume, EGGFAM, and more.

NFT market

NFT markets that support Arbitrum include OpenSea, tofuNFT, Trove (the NFT market launched by TreasureDAO), etc.

NFT tools

NFTFi

NFTFi projects on Arbitrum include DeFragDAO, which provides lending services for TreasureDAO ecological NFT, and NFT perpetual contract agreement nftperp, etc.

game

game

When it comes to game projects in the Arbitrum ecosystem, TreasureDAO has to be mentioned. As the game ecological center of Arbitrum, TreasureDAO has entered the field of vision of most people because of the fire of the game The Beacon. The empowerment of MAGIC tokens to ecological games, as well as the launch of the game NFT trading platform Trove and the ecological game token trading platform MagicSwap will continuously improve TreasureDAO's support for games. If Web3 games become a hot spot in the market in the future, TreasureDAO may have a good room for development.

social contact

social contact

Currently, social protocols that support Arbitrum include the Wall and TalenTale, in addition to the Mask Network, which is well known to most people.

growth platform

Currently, growth platforms supporting projects on Arbitrum include Galxe and Layer 3, among others.

Node service provider

Node service providers currently supporting Arbitrum include Alchemy, Ankr, Infura, Pocket Network, etc.

tax tool

Tax tools that currently support transactions on Arbitrum include Binocs, Crypto Tax Calculator, and Koinly.

Infrastructure/ Tools/ Off-Chain Services

Arbitrum Nova

In addition to airdropping to users, Arbitrum's tokens will also be distributed to some projects. In addition to DApps built on Arbitrum, these projects also include some tools. A wide variety of tools support Arbitrum, including repositories, developer tools, repositories, community services, and more. Interested users can learn from the information in the figure.

Offchain Labs officially launched Arbitrum Nova based on AnyTrust in early August 2022. Arbitrum One has always put all transaction data on Ethereum, while Nova utilizes data availability committees for cost savings and only puts data back on-chain when committees fail to do their job, and Nova is fully EVM compliant.At the time of writing, TVL on Arbitrum Nova is approaching $10.5 million, according to L 2B EAT data. At present, there are few ecological projects on Arbitrum Nova and most of them are games. I won’t expand too much here. You can useArbitrum Nova Ecological Portal