1. Project introduction

1.1 Technical solutions and features

The Arbitrum solution was proposed and created by Offchain Labs. It was originally a purely research-based academic project, and then gradually turned into practice after continuous optimization and improvement. This solution is also based on Optimistic Rollup, which maintains security through economically motivated game models and maintains transaction validity through fraud proofs. The main difference lies in the challenge mechanism and implementation form. Optimism only needs the sorter and verifier to perform a fraud proof interaction to determine the result, but Arbitrum believes that an interaction may cause the fraud proof to contain a large number of transactions and exceed the gas limit, and proposes that the fraud proof is caused by an abnormal execution of a single instruction. Not all instructions need to be executed. Therefore, Arbitrum divides the fraud proof into multiple rounds of steps. It only needs to prove that the sorter is abnormal when executing a certain instruction, which can prove that the sorter is evil and save costs.

Arbitrum's scheme is consistent with the main features of Optimism Rollup, so we won't go into details here, and we can focus on the changes brought about by the changes in the fraud proof mechanism.

Multiple rounds of fraud proof interactions. Arbitrum uses multiple rounds of fraud proofs to verify the validity of transactions, reducing the gas consumption required for a single challenge, and there is no need to worry about gas fees exceeding the limit.

Better compatibility with EVM. Although the Optimism team's OVM is compatible with EVM, it is not 100% compatible. Existing projects still need to modify the code when migrating from the first layer. The Arbitrun team's solution is almost 100% compatible.

There may be security issues with multi-step transactions. The verification of the validity of Arbitrum transactions requires multiple rounds of interaction, and the built-in virtual machine needs to support an asynchronous mechanism, which is more complicated, with a larger amount of code, and may have security issues.

2. Current status of Arbitrum

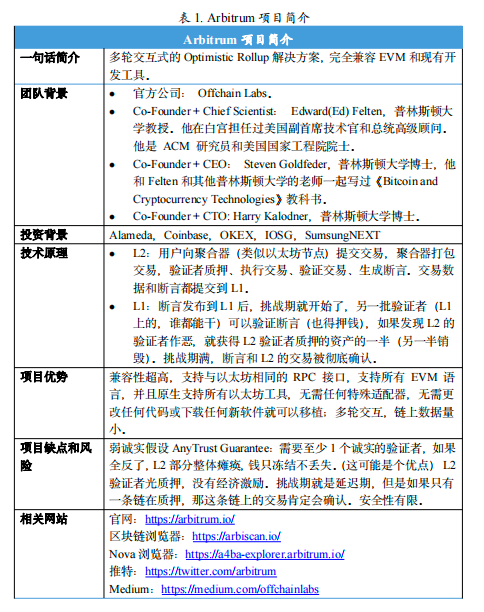

image description

Figure 1. TVL in all chains

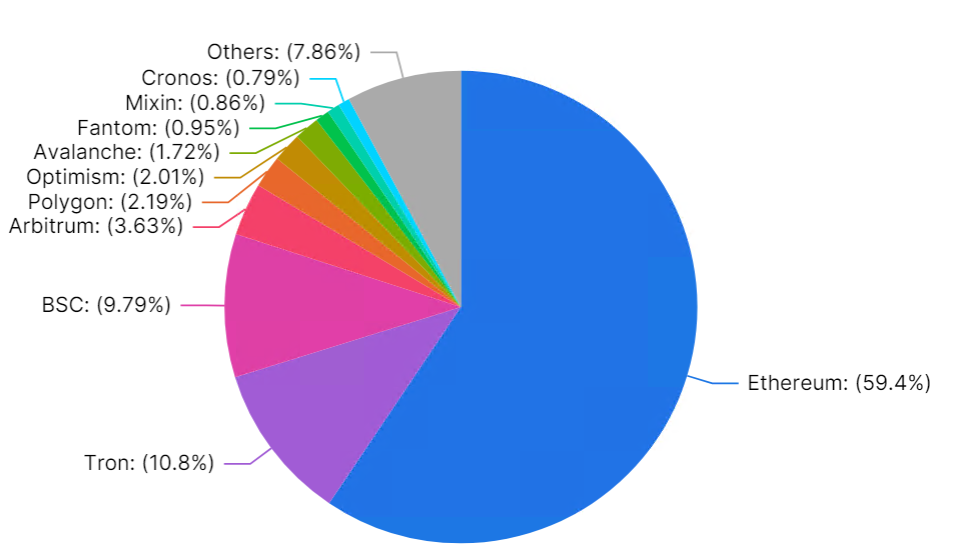

image description

Figure 2. Layer 2 project overview

On March 16, 2023, Arbitrum announced its token $ARB, the DAO governance token for the Arbitrum One and Arbitrum Nova networks. The total initial supply of the Arbitrum token $ARB is 10 billion, with a maximum inflation of 2% per year. In terms of token airdrops, 11.62% of the initial total supply will be airdropped to Arbitrum users, and 1.13% will be airdropped to the DAO treasury that builds applications on Arbitrum. The specific token distribution is as follows:

42.78% (4.278 billion) Arbitrum DAO treasury;

26.94% (2.694 billion pieces) allocated to Offchain Labs team/future team and consultants;

17.53% (1.753 billion pieces) allocated to Offchain Labs investors;

11.62% (1.162 billion) will be allocated to Arbitrum users through airdrops;

1.13% (113 million tokens) allocated to DAOs building applications on Arbitrum (via airdrop).

3. Technology upgrade

In 2022, Arbitrum will take frequent actions. In addition to Odyssey activities, it will also continue to introduce new technology upgrades, including launching the Arbitrum Nova and Arbitrum One dual chains and launching a new programming environment, Stylus. Below we introduce the core technologies and the problems they solve one by one.

(1) Arbitrum Nova – AnyTrust Chain

On July 12, 2022, the Arbitrum network announced the construction of a new chain "Arbitrum Nova". Built on AnyTrust technology, the chain is designed for games, social applications, and more cost-sensitive use cases. AnyTrust technology is based on a minimum trust assumption ensured through data availability committees. This committee will be responsible for managing off-chain transaction data and providing that data to support batches. Therefore, AnyTrust saves the 7-day withdrawal period that users need to wait and improves the user experience. The main technical cores are as follows:

Sign Data Availability Certificates (DACerts) for batch transactions and issue this DACert;

If the committee cannot reach a consensus, the chain will revert to the Arbitrum rollup protocol;

Data execution will be performed on the L2 chain, and after a challenging period, the new aggregated state will be confirmed on Ethereum.

(2 )Nitro

End of August 2022. Arbitrum One successfully upgraded to Nitro version. The Nitro upgrade greatly increases network speed and reduces transaction costs. In general, Nitro has mainly made the following technical upgrades:

Made some modifications to the previous AVM architecture and ArbOS;

The popular WebAssembly (WASM) architecture will replace the older, custom-designed AVM architecture.

Custom EVM emulator replaced by Geth;

ArbOS will be reduced in size and rewritten in Go to provide a more optimized batching and compression system for transactions.

At the heart of Arbitrum Nitro's technology is a new prover that enables Arbitrum's interactive fraud proofs on WASM code. This allows standard languages and tools to be used to build and compile. At the same time, Gethcore is also directly compiled into Arbitrum, making it more compatible with EVM.

(3 )Stylus

Arbitrum development team Offchain Labs announced that it will launch Stylus, the next-generation programming environment for Arbitrum One and Arbitrum Nova. Stylus allows users to deploy applications using their favorite programming languages (including Rust, C, and C++) through the WebAssembly smart contract function to communicate with EVM programs on Arbitrum run together. Stylus is an order of magnitude faster, lowers fees, and is fully interoperable with the Ethereum Virtual Machine (EVM). Offchain Labs calls Stylus EVM+, however, Stylus will not replace EVM.

4. Ecological cooperation

In the past year, Arbitrum's market share has increased significantly. This growth comes from: 1. Layer 2's continued optimism; 2. Arb's currency issuance expectations; 3. The growth of ecological applications, especially the growth of native applications. Since the launch of the mainnet Arbitrum One in September last year, applications such as Uniswap, Sushiswap, and Curve, the top DeFi protocols on the Ethereum Layer 1 mainnet, have been integrated and deployed on Arbitrum One, as well as some well-known cross-chain protocols. Examples include Synapse and Stargate. The influx of these applications also shows that developers are optimistic about Arbitrum's expansion plan.

In June 2022, the organizers of the Odyssey event selected the 14 most active projects on Arbitrum, including cross-chain bridges, DeFi, NFT, and games. The activity time was originally planned to last for 8 weeks, but it was actually suspended after only the first week. The root cause of the suspension of Odyssey was that in the second week, the network was congested, which caused the gas fee to be too high. At that time, it had exceeded the gas fee of the Ethereum mainnet. In fact, this fully demonstrated that the state of Arbitrum at that time could not accommodate so many users.

However, although the Odyssey was only held for a week, the event still attracted enough attention. Arbitrum combined with NFT in the form of an event week, which stimulated the enthusiasm of users to participate, and also helped users understand Arbitrum's ecology. While increasing the number of users, it also brought traffic to its ecological projects. At the same time, it retains the expectation of issuing coins in the future, instead of issuing coins for airdrops in a hurry.

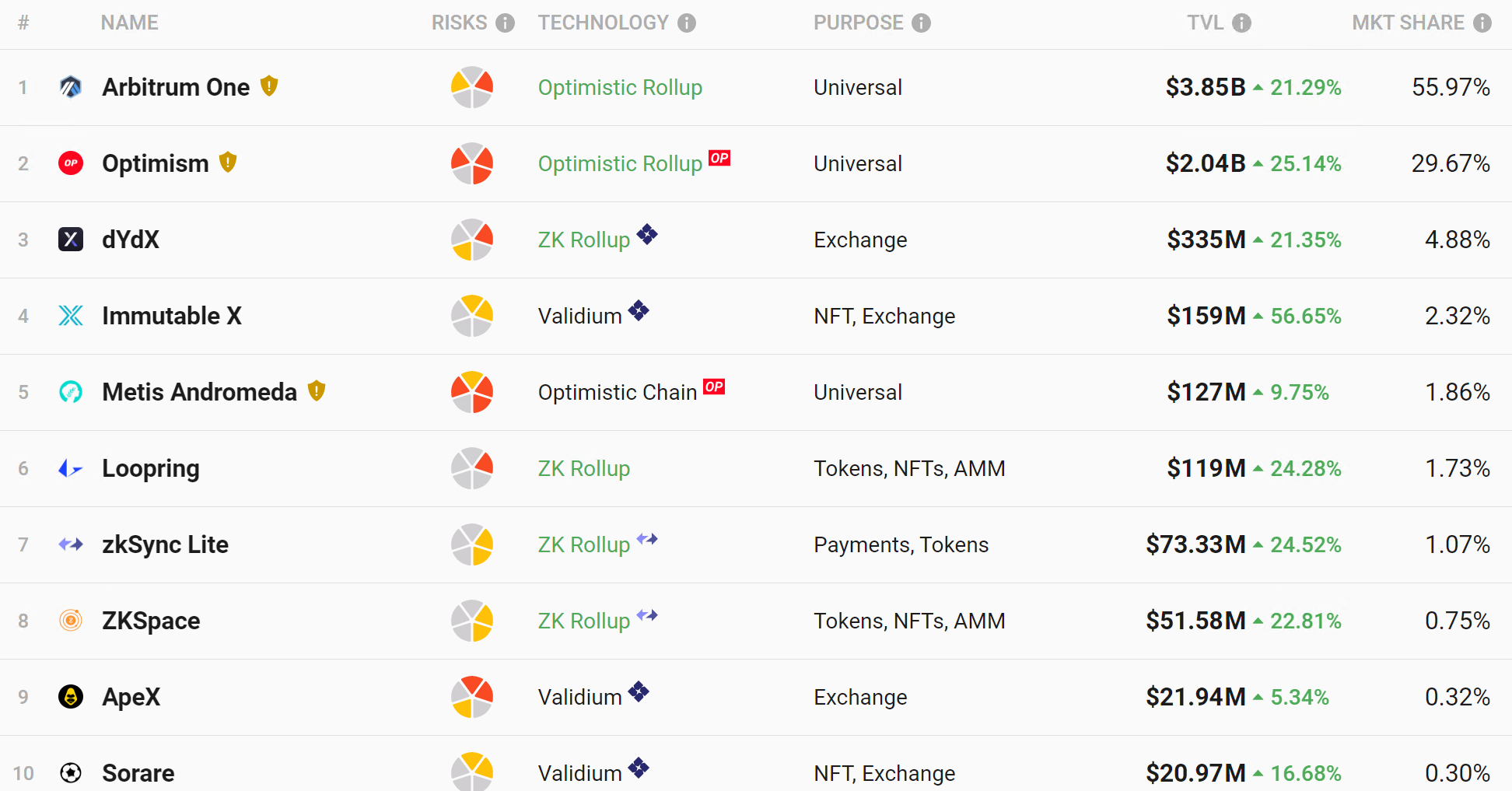

image description

Figure 3. Changes in the number of unique addresses on the Arbitrum chain

image description

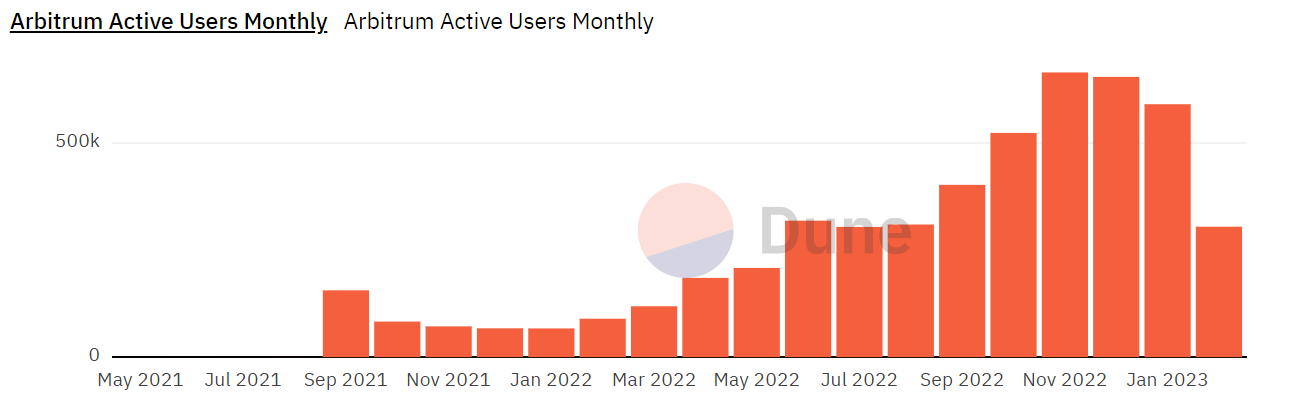

Figure 4. Arbitrum monthly active addresses (dune, @springzhang)

5. Analysis of popular projects

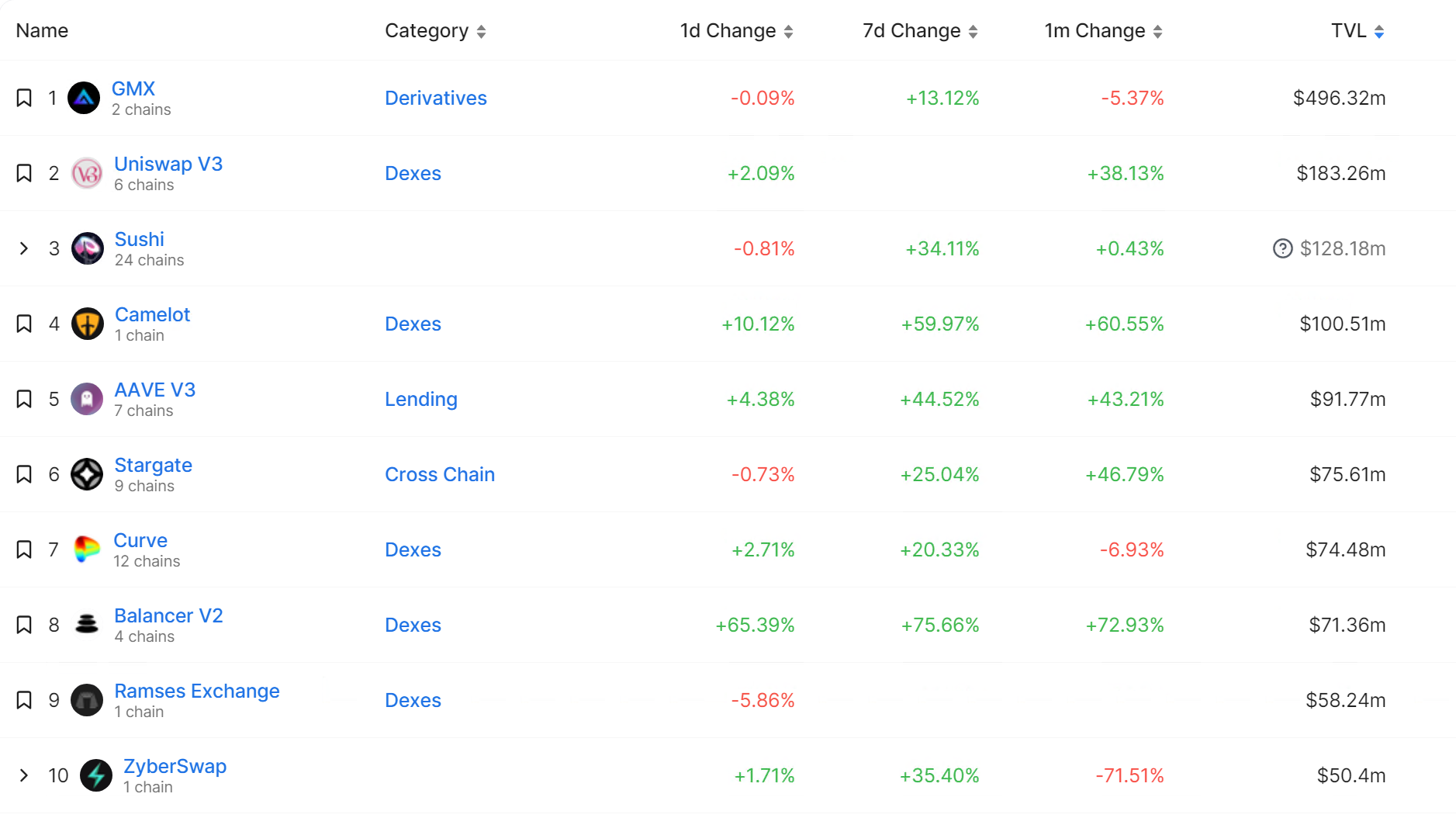

In the past two months, the native ecological projects on Arbitrum have gained the attention of the entire encryption market. Here are some outstanding projects. Compared with other projects of the same type in other public chains, the market value of these projects still has a certain gap, and they are still undervalued. With the issuance and future development of Arbitrum, there will be a lot of room for improvement.

5.1 DeFi class

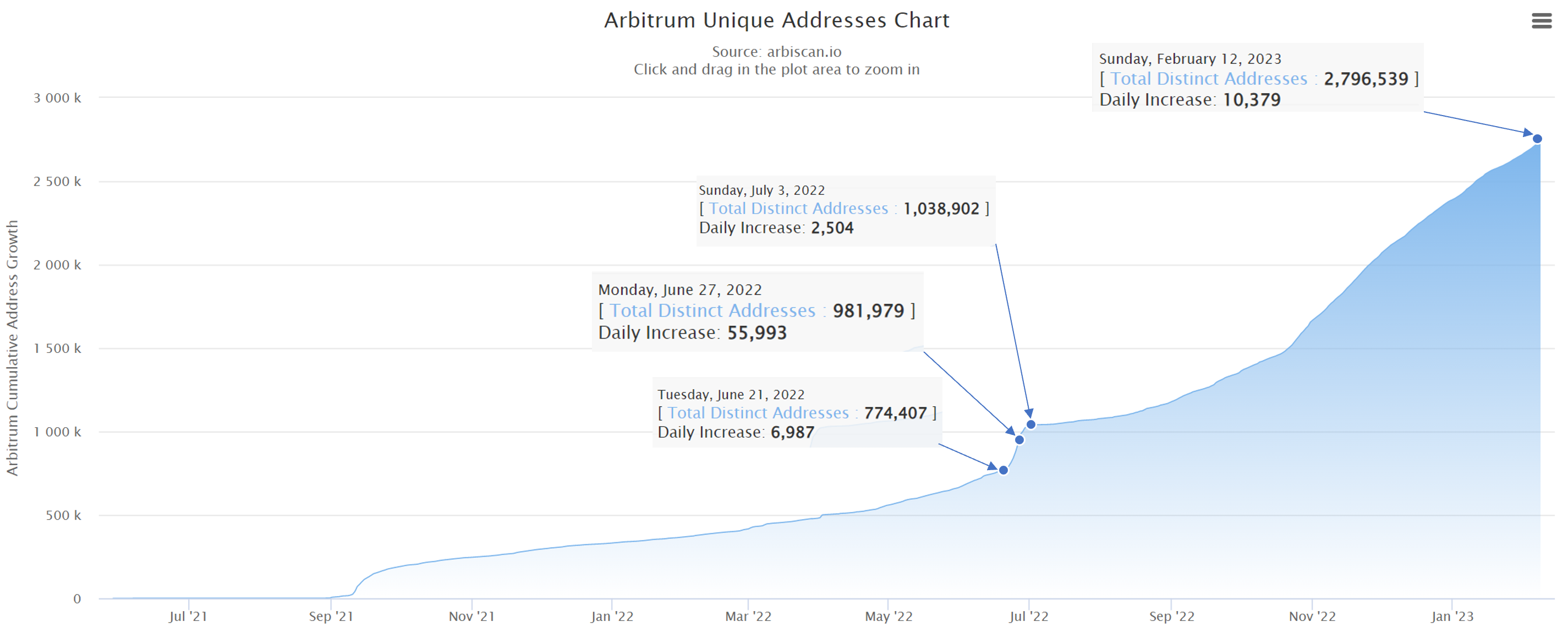

image description

Figure 5. Top ten projects by Arbitrum TVL (Source: Defillama)

(1) Hot project one: GMX

GMX is a decentralized perpetual contract exchange. It allows users to trade ETH, BTC, LINK and UNI perpetual contracts with up to 30 times leverage on a decentralized platform, instead of using leverage to go short or long through centralized exchanges such as Binance or FTX.

In terms of execution, it is more complicated than centralized exchange operations, and requires the use of oracles for price feeding. Therefore, it needs external forces to perform position opening and closing operations. GMX uses Keeper (similar to crowdsourcing) to complete this work.

When a user performs a liquidation operation on GMX, it will be divided into two parts: one is the user sending the transaction, and the other is the execution operation, and the execution operation is completed by GMX Keeper.

Users not only need to pay the gas fee for sending the transaction, but also need to pay the gas fee for the Keeper execution operation in order to ensure the normal execution of the transaction.

GMX TVL reached $496 million, accounting for 27.53% of the TVL of all Arbitrum DeFi protocols (data as of March 20, 2023). The protocol has generated $33.9 million in revenue over the past year, making the GMX token one of the best-performing assets in a volatile 2022, returning 84.0% against USD and 428.5% against ETH.

(2) Hot project two: Camelot

Camelot, as Arbitrum's native DEX, has completed the token sale in December 2022. On the whole, it is still a conventional Uniswap V2+Curve type DEX. On this basis, a Launchpad is added, combined with custom transaction fees, and LP Combined with NFT, it allows the project party to set incentives. Its functions and characteristics are summarized as follows:

The same AMM DEX as Uniswap V2, the liquidity is scattered in the entire range from zero to infinity;

Stablecoin swap pairs similar to Curve;

Support for dynamic directional transaction fees. Camelot allows the project party to set the transaction fee ratio according to the market conditions and the specific circumstances of the agreement;

Offer benefits and incentives through NFTs. Users provide liquidity to obtain spNFT representing pledged positions;

The agreement is permissionless, and project parties can set incentives through the incentive pool Nitro Pools. This is an additional reward pool.

With the Launchpad function, project parties can use it to raise funds and guide liquidity.

The highest TVL of similar projects on OP is Velodrome, with a liquidity of $77.14 million. This figure even exceeds Uniswap V3's $44.87 million, but the FDV is only $9.46 million, and the FDV/TVL is 0.21. Relative to Camelot, Velodrome has a higher TVL but a lower valuation. Camelot's TVL has also recently increased by around 57% to $98.79 million.

(3) Hot project three: RDNT

The lending protocol RDNT on Arbitrum has two innovations: multi-chain lending using LayerZero; revolving lending (temporarily unavailable). It is currently the leader on Arbitrum, and its TVL exceeds the Arb version of aave V3, but in the long run the competition is still very, very big.

Since it is a full-chain lending protocol, users can deposit any major asset on any major chain and borrow various supported assets across chains. The lender deposits assets, borrower can borrow, and 50% of the generated handling fee (platform revenue) is given to the lender, and the remaining 50% is given to the locked RNDT as a reward. Currently the agreement is V1 version, and the V2 version will make the following upgrades:

Will allow full cross-chain lending and borrowing of BTC, ETH, and USDC, followed by more assets voted on by the Radiant DAO.

The agreement fee will be tilted towards LP, thereby improving liquidity and reducing slippage;

Introduce the "Dynamic Liquidity" mechanism to reward long-term investors;

Exiting the liquidity pool will trigger the penalty mechanism.

5.2 Games

Arbitrum has a fast-growing GameFi ecosystem, especially three explosive projects: Treasure DAO, The beacon, Trident DAO. At present, the GameFi ecology on Arbitrum does not have an absolute advantage over other chains like its derivatives track, but it is relatively leading, and everything depends on the follow-up development.

(1 ) Treasure DAO

Treasure wants to build a "decentralized Nintendo", a collection of on-chain games that are connected to each other through the interoperability of in-game assets and Treasure's native token MAGIC as a shared currency. Some of the most popular of these games include strategy game Bridgeworld, role-playing games like The Beacon and Smolverse, and resource management and strategy game Realm.

These games can be accessed through Trove. Trove is the hub of the Treasure ecosystem, a marketplace for in-game assets and Treasure NFT collectibles. The most popular of these series are Smol Brains (the basis of the Smolverse) and another NFT series, The Lost Donkeys, which has its own game of the same name.

(2 ) Trident DAO

Arbitrum's previous project "Trident" proposed a "Risk To Earn" sustainable GameFi economic model, which attracted the attention of players and the community, and became the most popular project in Arbitrum's ecology after its Token public sale.

PSI is Trident's official utility token, which will be used in various games in its future versions, and can be used to purchase items, exchange NFT, bets between players, etc., and Trident will charge a fee from each successful bet and then transfer It is permanently destroyed and the supply of PSI will be deflationary once the Risk To Earn integration is complete.

6. Future development of Layer 2

6.1 Bottleneck and Prospect of the Rollup Solution

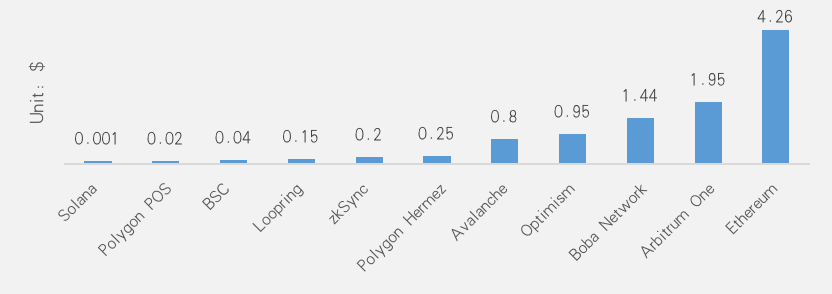

Rollup is a highly anticipated expansion solution, and the gas consumed by its transactions is greatly reduced compared to the Ethereum mainnet. According to actual statistics, the cost of Optimism and Arbitrum is only 10%-30% of the Ethereum mainnet, and the cost of ZK rollups is less than 5% of Ethereum. On the one hand, it reduces the consumption of resources on the chain, and on the other hand, it can maintain the availability of data, that is, the main network of Ethereum can check and ensure that no one can tamper with transactions under the chain. Rollup can inherit the decentralization and security of Ethereum , has become the mainstream technical solution of Layer 2.

At present, there are still some shortcomings in the Rollup technical solution, which prevents it from developing on a large scale. These shortcomings include the following points:

(1) Poor user experience

appears in:

There is a challenge period for OP withdrawals. Currently, the withdrawal waiting period of the official cross-chain bridges of the four major OPs is 7 days;

The interoperability between Rollups is low, and the types of assets supported by some cross-chain bridges are very limited;

OP lacks a fee advantage. According to l2 fees data, OP’s ETH transfer, token transfer and token exchange fees are all higher than 1 $;

image description

Figure 6. Fees for transferring native tokens on mainstream Rollups and public chains (Source: l2 fees, blockchain browsers, Huobi Research Institute)

(2) Low capital efficiency

appears in:

The liquidity fragmentation problem reduces capital efficiency, and different Rollup platforms and applications built on them will further fragment liquidity.

OP's challenging period reduces capital efficiency.

(3) There are potential safety hazards

Both Layer 2 and Rollup are relatively cutting-edge technologies, and many users have doubts about their security, mainly in the following aspects:

There are loopholes in the smart contract of Rollup itself, which leads to the theft of user funds;

The operator of Rollup malfunctions or acts maliciously, resulting in the freezing of user funds;

The cross-chain bridge is attacked or the operator does evil, resulting in the theft of the funds locked by the user.

From the above three aspects, we can look forward to the future development direction of the Rollup solution:

Improving user experience, wider adoption of fast cross-chain bridges and more convenient exchange deposits and withdrawals can reduce the impact of OP's withdrawal waiting period, reduce the amount of uploaded data and improve off-chain processing efficiency to reduce fees.

To improve capital efficiency, capital efficiency can be improved by gathering liquidity.

Improve security and ensure security by promoting the decentralized operation of Rollup and setting up a mandatory withdrawal mechanism.

6.2 Continued explosion of Arbitrum in 2023

The success of Arbitrum indicates that the Layer 2 track will become the starting point of the next bull market. But before that, whether it is the Optimistic Rollup route or the zk Rollup route, there are still some technical problems that need to be resolved. In the future, the Arbitrum project will develop in three aspects:

Continue to upgrade technology;

Continue to support ecological projects;

Attract users to enter the market with the help of currency issuance expectations.

First of all, technically, Optimistic Rollup technology is still criticized by slightly centralized sorters. Arbitrum currently has a centralized sorter and whitelist proof verification, as well as an upgradable contract. Although these have not caused security problems at present, they are sufficient to protect user assets. But still increases the risk of censorship and loss of user funds. So, decentralized sorters and permissionless proof verification are the way to go. Offchain labs also gave corresponding technical routes on these issues:

decentralized

decentralized

Decentralize management and authorized software upgrades

Decentralization of validators

sequencer decentralization

In terms of ecology, currently Defi, cross-chain and games are the main applications of Arbitrum. But in the future, with the continuous growth of developers and users, more new applications will be deployed on the platform, and the most anticipated are social and NFT projects. At the same time, given the success of Treasure and the growth potential of Arbitrum Nova, the Arbitrum Nova chain will actually be used, putting Arbitrum in a favorable position in the gaming field.

In terms of the economic model, this is actually the most anticipated part. The token launch is critical to Arbitrum's long-term success, including:

Token distribution plan;

Airdrop and incentive ecological schemes;

Governance program.

A good economic model will allow Arbitrum to develop in a more positive direction, attracting users and developers. Token distribution will also play an important role in determining L2's governance and the long-term concentration of power within the ecosystem. Additionally, tokens can be used to decentralize key network functions such as the collator — the entity that sorts, batches, and submits transactions to L1.

Huobi Blockchain Application Research Institute (referred to as "Huobi Research Institute") was established in April 2016. Since March 2018, it has been committed to comprehensively expanding research and exploration in various fields of blockchain, with a view to pan-blockchain As a research object, the research objectives are to accelerate the research and development of blockchain technology, promote the implementation of blockchain industry applications, and promote the ecological optimization of the blockchain industry. The main research contents include industry trends, technical paths, application innovations, Pattern Exploration, etc. In line with the principles of public welfare, rigor, and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms, and build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical foundation and trend judgment to promote the healthy and sustainable development of the entire blockchain industry.

references

1. https://candydao.notion.site/Arbitrum-Odyssey-17634 b 06 aa 084 a 3 a 8407 d 212927 e 5 f 16

2. https://www.bitance.net/category/jingzhengbizixun/18081.html

4. https://newsletter.banklesshq.com/p/arbitrum-is-mooning

5. https://www.panewslab.com/zh/articledetails/764 o 364 a.html

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as "Huobi Research Institute") was established in April 2016. Since March 2018, it has been committed to comprehensively expanding research and exploration in various fields of blockchain, with a view to pan-blockchain As a research object, the research objectives are to accelerate the research and development of blockchain technology, promote the implementation of blockchain industry applications, and promote the ecological optimization of the blockchain industry. The main research contents include industry trends, technical paths, application innovations, Pattern Exploration, etc. In line with the principles of public welfare, rigor, and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms, and build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical foundation and trend judgment to promote the healthy and sustainable development of the entire blockchain industry.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you want to quote the content of this report, please indicate the source. Please let me know in advance if you need to quote a lot, and use it within the scope of permission. Under no circumstances shall any quotation, abridgement and modification contrary to the original intention be made to this report.

https://research.huobi.com/

disclaimer

1. Huobi Blockchain Research Institute does not have any relationship with the projects or other third parties involved in this report that affect the objectivity, independence, and impartiality of the report.

2. The materials and data cited in this report come from compliant channels, and the sources of the materials and data are considered reliable by Huobi Blockchain Research Institute, and necessary verifications have been carried out for their authenticity, accuracy and completeness , but Huobi Blockchain Research Institute does not make any guarantees about its authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the conclusions and opinions in the report do not constitute any investment advice on relevant digital assets. Huobi Blockchain Research Institute is not responsible for any losses caused by the use of the content of this report, unless it is clearly stipulated by laws and regulations. Readers should not make investment decisions solely based on this report, nor should they lose the ability to make independent judgments based on this report.

4. The information, opinions and speculations contained in this report only reflect the judgment of researchers on the date of finalizing this report. In the future, based on industry changes and updates of data information, there is a possibility of updating opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you want to quote the content of this report, please indicate the source. Please let me know in advance if you need to quote a lot, and use it within the scope of permission. Under no circumstances shall any quotation, abridgement and modification contrary to the original intention be made to this report.