Last night, Layer 2 scaling solution Arbitrum announced that it will airdrop the governance token ARB to its community members on March 23.

According to the Arbitrum Foundation, the ARB will mark the official transition of Arbitrum to a decentralized autonomous organization (DAO), meaning ARB holders will be able to vote on key decisions governing Arbitrum One and Arbitrum Nova. “The Arbitrum DAO will have the power to control key decisions at the core protocol level, from how the chain’s technology is upgraded to how the chain’s revenue is used to support the ecosystem.”

It is understood that Arbitrum worked with crypto analytics firm Nansen to take a "snapshot" of user activity in February of this year to determine who was eligible for the ARB. Specific airdrop rules have been made by OdailyIntroduction and Explanation。

With the distribution of ARB, how to make a reasonable valuation for ARB has become a topic of most concern to investors.

Different from the popular Zk rollup route nowadays, Arbitrum adopts Optimistic rollup like Optimism, and has become one of the main scaling solutions of Ethereum. Therefore, Optimism provides an extremely valuable reference for Arbitrum's valuation.

secondary title

TVL

According to DeFiLlama data, Arbitrum currently has a TVL of US$1.7 billion. It ranks fourth among all chains, second only to Ethereum, Tron, and BNB Chain. secondary title

secondary title

Number of addresses on the chain

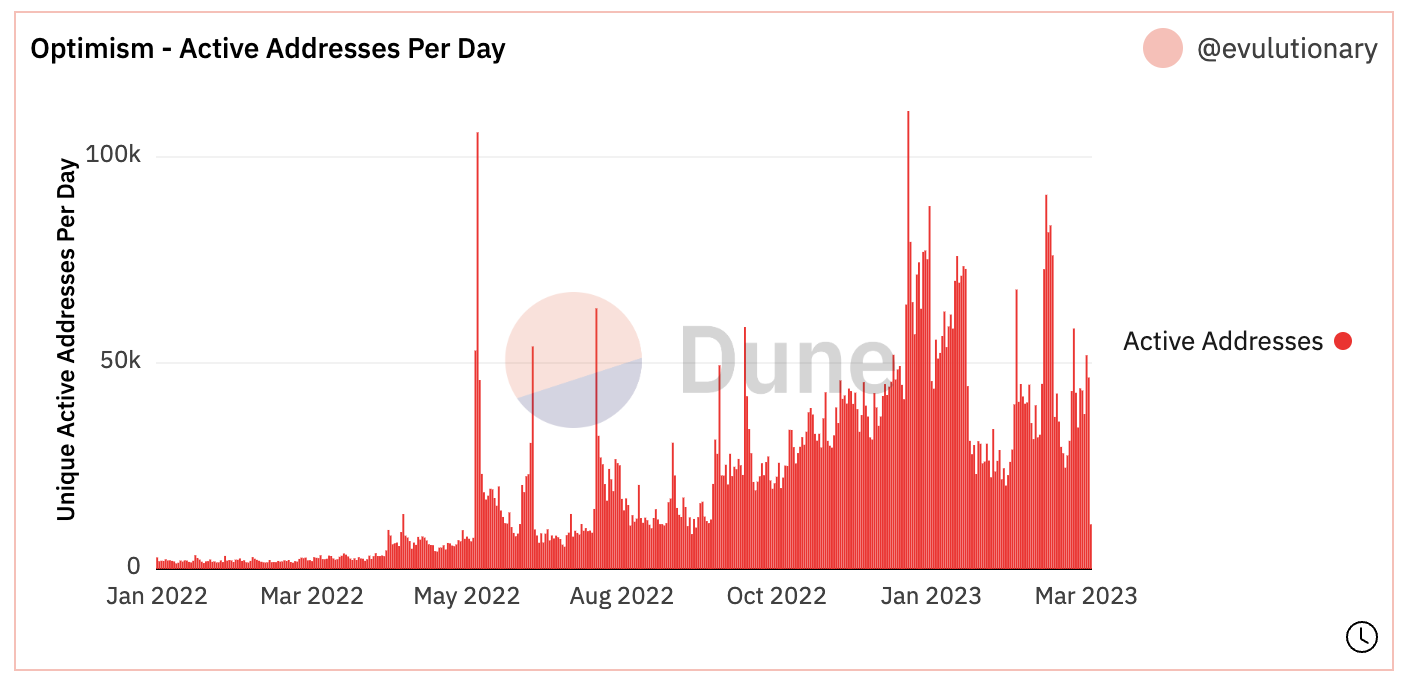

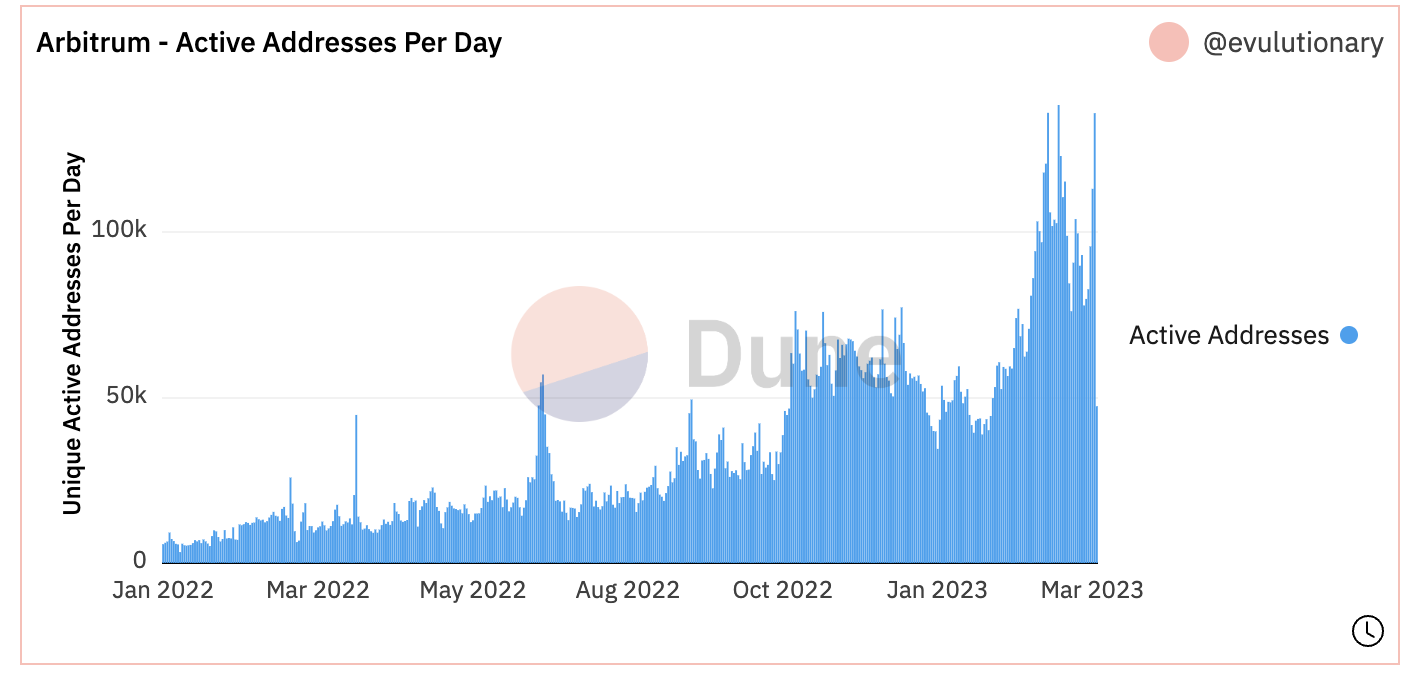

Compared with the number of addresses, the advantage of Arbitrum is more obvious. Since this month, Optimism’s daily active addresses have been in the range of 30,000 to 50,000. The number of active Arbitrum addresses remained around 100,000.

secondary title

Number of transactions

financing

financing

In terms of financing amount, there is not much difference between the two sides. Optimism raised $178 million at a $1.65 billion valuation, while Arbitrum raised $143 million at a $1.2 billion valuation.

first level title

Based on the OP, what is the estimated price of ARB?

Compared with OP, Arbitrum's data are better than Optimism. It seems that the market cap of ARB should be much higher than that of OP, but this is only before the data is "dehydrated".

The previous Odyssey campaign had introduced a large number of users to Arbitrum, including both real active users and professional "hair-pulling" parties with hundreds of accounts. It’s hard to say how much water has been injected into Arbitrum’s on-chain data.

From the perspective of financing, the valuation of the two latest rounds of financing is comparable, and Optimism is slightly higher than Arbitrum.

According to Coingecko data, the current market value of OP is 820 million US dollars, and FDV is as high as 11.2 billion US dollars. Its FDV is about 6.7 times the valuation of the B round financing.

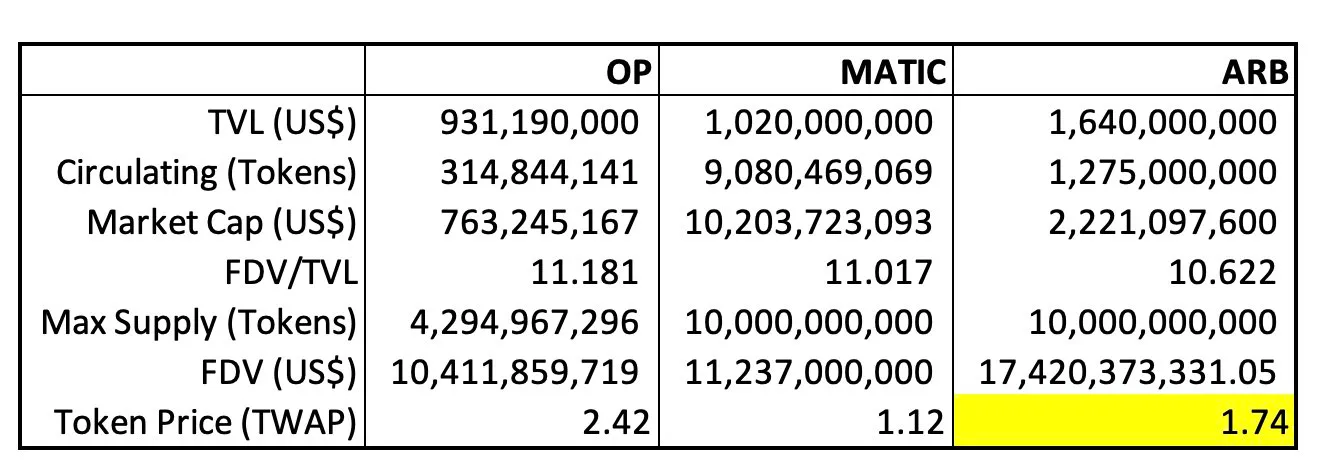

If the price of Optimism is used as the benchmark, the FDV of ARB may surpass that of OP, with a scale of over 10 billion, that is, a single coin or more than 1.1 US dollars.

But considering the circulation, there are other variables.

It is understood that the total circulation of ARB will reach 10 billion. The Arbitrum community will receive 56% - the airdrop will give 11.62% of the total supply to eligible Arbitrum users, 1.1% to DAOs operating within the Arbitrum ecosystem, and the remaining community tokens will go to be controlled by the new Arbitrum DAO treasury, which will allow ARB holders to vote on how to allocate funds.

Another 44% of ARB’s circulating supply will go to the team at Offchain Labs, the development company that built Arbitrum, as well as investors, a slightly higher percentage than its competitor Optimism(Odaily note: Optimism allocates 36% of its tokens to investors and core contributors). CEO Goldfeder stated that the tokens held by the team will be locked.

This also means that at the beginning of the coin issuance, only about 11.62% of the supply (airdropped tokens) will enter the market circulation, that is, about 1.1 billion.

first level title

Taking the governance scenario as the value benchmark, what is the valuation of ARB?

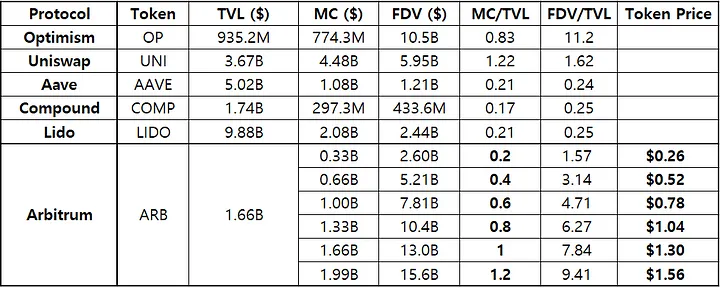

Twitter user 100 y.eth suggested another approach to share prices. He believes that ARB, as a Layer 2 token, cannot be consumed as a gas fee.

Therefore, the valuation of this token should refer to governance tokens of other protocols. According to this standard, 100 y.eth compares ARB’s valuation with Optimism, Uniswap, Aave, Compound, Lido.

The conclusion is that, based on the ratio of circulating market capitalization to TVL, 100 y.eth believes that,first level title

What do other analysts think?

Twitter user Miles Deutscher compared ARB to OP and MATIC. He believes that ARB's allocation of investors and core teams is too high (nearly 44%), which is a potential hidden danger. In the end, he gave two target prices:A reasonable range is between US$0.7 and US$2。

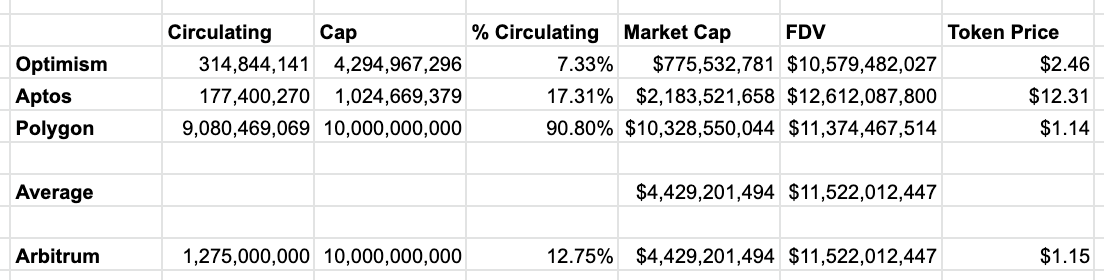

Anders values ARB by comparing it to other chains.

The analyst averaged the FDV of the three currencies OP, APT, and MATIC to obtainARB fair price should be $1.15。

From the data point of view, Arbitrum's data on each chain is better than Optimism. When forecasting, analysts all gave ARB higher market value expectations than OP. However, whether this expectation can be implemented in the market depends on the official opening of ARB for trading.