ETH Staking rewards are relatively equal, so what about those high-yield LSD projects? There is a famous saying: If you don't know where the income is coming from, you are the source of the income.

first level title

Protocol asset incentives

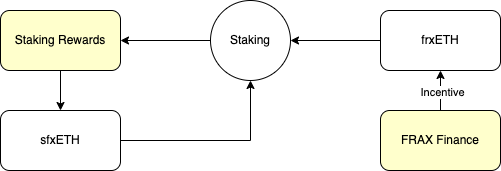

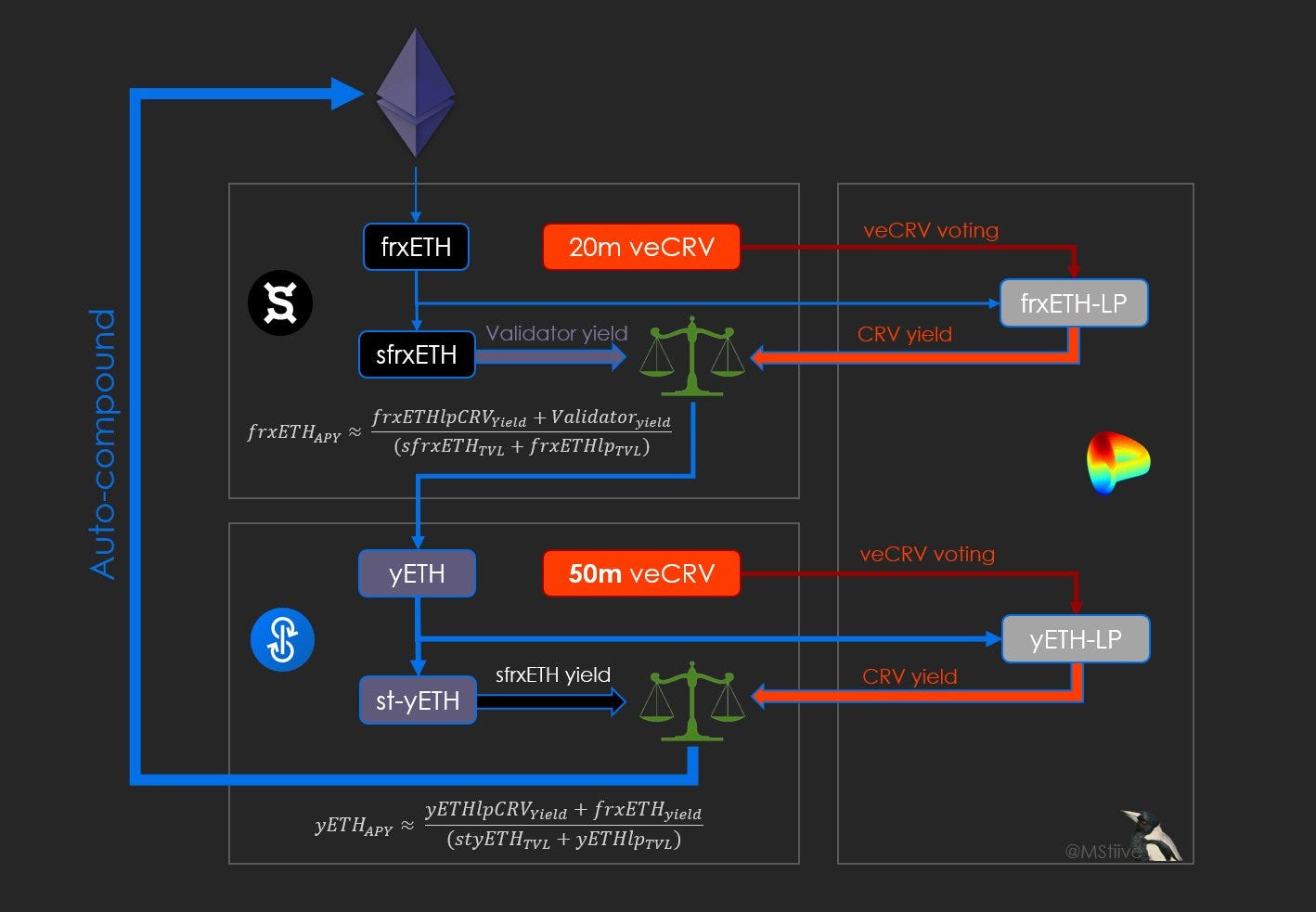

First, we use a picture to analyze the income distribution system of Frax/frxETH, and mark the source of income in yellow:

FXS token incentive means that the rights and interests of Frax Finance are directly incentivized to frxETH Pool

The vlCVX/veCRV voting controlled by Frax indirectly allows CRV/CVX to motivate frxETH Pool

ETH Staking Incentives

1/2 Whether it is direct or indirect, it is essentially an incentive from Frax Finance, nothing more than a different form and packaging. So if we simplify this diagram, it will be very clear. The source and distribution of income are:

Frax Finance protocol assets/protocol income incentivize frxETH

All Staking income of frxETH/sfrxETH is given to sfrxETH

sfrxETH eats "two shares" of Staking income, and the APR is naturally higher

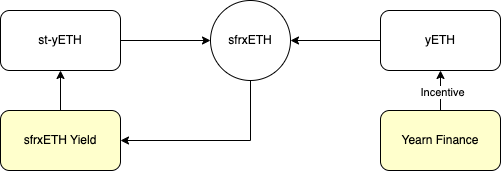

In the same way, let’s analyze the yETH expected to be produced by Yearn in the near future:

Simplify him too, and you can see the source and distribution of income at a glance:

Yearn Finance protocol assets incentivize liquidity and thus indirectly incentivize yETH

yETH/st-yETH Both sfrxETH proceeds are given to st-yETH

However, it should be noted that the so-called "agreement assets" here are not only owned by Yearn's treasury, but may also include the voting rights that Yearn transferred from the yCRV product

Yes, the source of excess income of frxETH/st-yETH is the direct or indirect subsidy of the agreement assets!

Hey, looking at it this way, isn't it infinite nesting dolls? but

Protocol assets have an opportunity cost, such as vlCVX/ veCRV itself can be used to earn bribes

If the agreement is not an air currency, it needs to be empowered, such as income commission. After reaching a certain scale, when the subsidy and commission are close, then the excess income will no longer exist.

Related Reading:

Related Reading:Lido's story: value, growth and moat upgrade in Shanghai, liquid staking track battle is imminent

Are excess returns sustainable? The rise of pledged assets/protocol assets will undoubtedly dilute the excess returns. If the protocol assets are rising relative to ETH due to price and other reasons, then this process will be prolonged, and vice versa. That is to say, this model is obviously reflexive. Therefore, although this model is essentially a subsidy, exquisite and complex packaging is also necessary. Through more exciting narratives, the value of protocol assets can be enhanced, thereby promoting a positive spiral.

Related Reading:

Related Reading:A thread about bestLSD

first level title

spread arbitrage

Related Reading:

Related Reading:first level title

another job

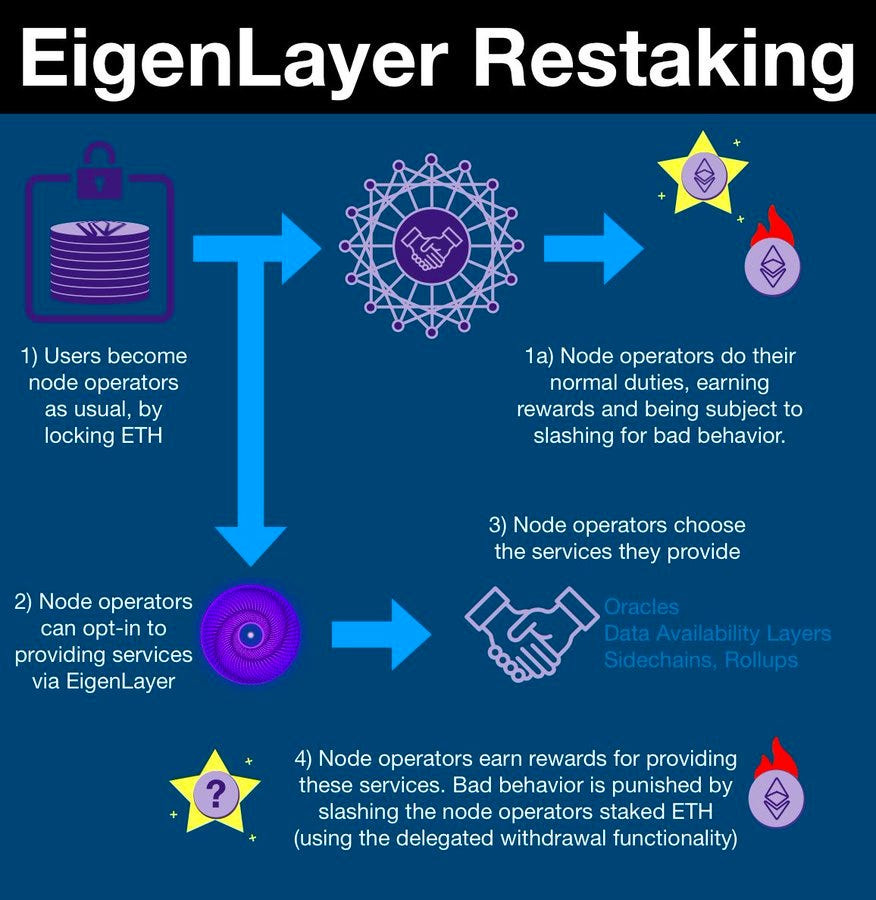

Re-staking, the so-called third party borrowing ETH main network security, unprofessional but simple description is:

The operation of the network and applications requires the security of nodes and the like

Evil actions such as nodes need to pay a price to ensure security

Then let him pay a security deposit first, and he will be fined if he commits crimes

Margin also requires capital efficiency, and ETH Staking is the main way of earning interest, so use related assets to guarantee

The management of the entry and exit of staking assets, fines and confiscations, etc., requires people to implement it. This is re-staking

You work as a node for a third party, and then take another job. The third party will naturally pay you a salary.

To sum up, agreement asset incentives, spread arbitrage and another job are the three sources of excess income. It must be emphasized that complex gameplay will bring more risks, so it is necessary to evaluate whether the excess income can cover The added risk, after all, may end up being a source of income for scientists, regardless of the source of income.

LSD originally involved the interaction with offline entities such as Validators, which is relatively "heavy" work, but the above several high-level gameplays are transformed into relatively "light" work by packaging LSD assets to operate , the threshold here will obviously be lower than that of traditional LSD, and there will naturally be more tricks, it is worth continuing to observe, so pay attention to Miaowaseed@NintendoDoomedThank you meow, continue to analyze LSD meow for you.