Original title: "TrueFi in the Thunderbolt of CeFi: Risks and Opportunities of Institutional Credit Lending Business"

first level title

secondary title

1. Core investment logic

The crypto credit track is still in its infancy. Credit lending has a large scale in traditional finance, but in the crypto industry, it is still only an inconspicuous segment of the lending track. With the improvement of infrastructure in the future, the credit lending track has the possibility of explosive growth.

Excellent risk control ability, no bad debts yet. TrueFi is currently the leading project on the credit track. After the thunderstorm of DeFi and CeFi in 2022, there have been no problems so far, maintaining a 0 bad debt rate.

secondary title

2. Valuation

secondary title

3. Key risks

In general, TrueFi faces five risks:

first level title

1. Project business scope

1. Project business scope

secondary title

2. Past development and roadmap

The first stage:

The first stage:

second stage:

second stage:

2020.11-2021.02, deploy V2 version, added:

(1) "liquid exit", which is convenient for depositors to exit

(2) Improve the staking model, from staking for a single loan to staking for all loans, staking can also earn TRU and interest income

(3) Governance is all on the chain

The third phase:

2021.03-2021.05, deploy V3 version, added:

(1 )USDC pool

(2) Improved credit model

(3) Allow the transaction of loan token (the deposit certificate obtained by the depositor after depositing the stable currency, similar to Aave's aToken)

The fourth stage:

2021.06-2021.08, deploy V 4 version, add: (1) support any ERC-20 token (2) allow other lending agreements to provide liquidity for TrueFi loans (3) allow other agreements to become credit loan channel providers (4 ) launched the USDT pool (5) set up SAFU (secure asset fund for users) (user security asset fund, which is used to repay investors first when the loan defaults), and injected 500 W TRU

Fifth stage:

2021.09 to now: Deploy version V 5, plan to add:

(1) Deployed on Layer 2, now deployed on optimism

(2) Support "protocol-to-protocol" lending, and now provides credit services for Perpetual Protocol

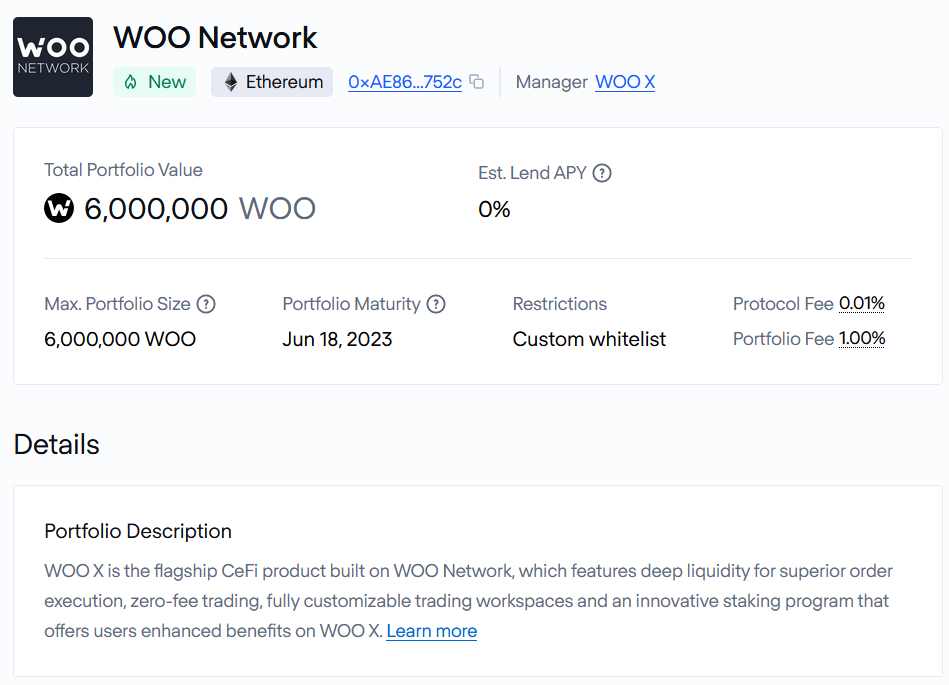

(3) Non-stable currency lending products have reached cooperation with Woo Network

(4) Improve the credit model

secondary title

3.1 Service object

3.1 Service object

TrueFi's customers are divided into deposits and borrowing ends:

On the deposit side, anyone who holds USDC/USDT/TUSD/BUSD can deposit stablecoins, and choose the corresponding lending pool to add liquidity to them, so as to earn income by lending and earning interest.

On the lending side, there are two types of business:

The first type of business is the credit lending business supervised by TrueFi DAO——TrueFi DAO Pools. TrueFi’s early positioning of this business is to serve crypto-native trading investment institutions, and then gradually expand to other protocols. In the future, it plans to further expand to companies and personally. Among the loans that have been disbursed, the main borrowers include: trading investment institutions, trading platforms, market makers, DeFi, high-net-worth individual investors, asset management companies, etc. In terms of the number of loans, they are mainly crypto-native trading investments Mainly institutions and market makers.

The second category is TrueFi Capital Markets, a lending project managed by a third-party independent organization. Borrowers include TrueTrading, Cauris Finance and other institutions.

Recently, TrueFi has reached a cooperation with Woo Network. The depositor is a specific WOO DAO, and the borrower is certain trading customers in Woo Network. In the future, this kind of credit service for a certain type of specific customers will also become one of TrueFi's important business lines.

3.2 Business Classification

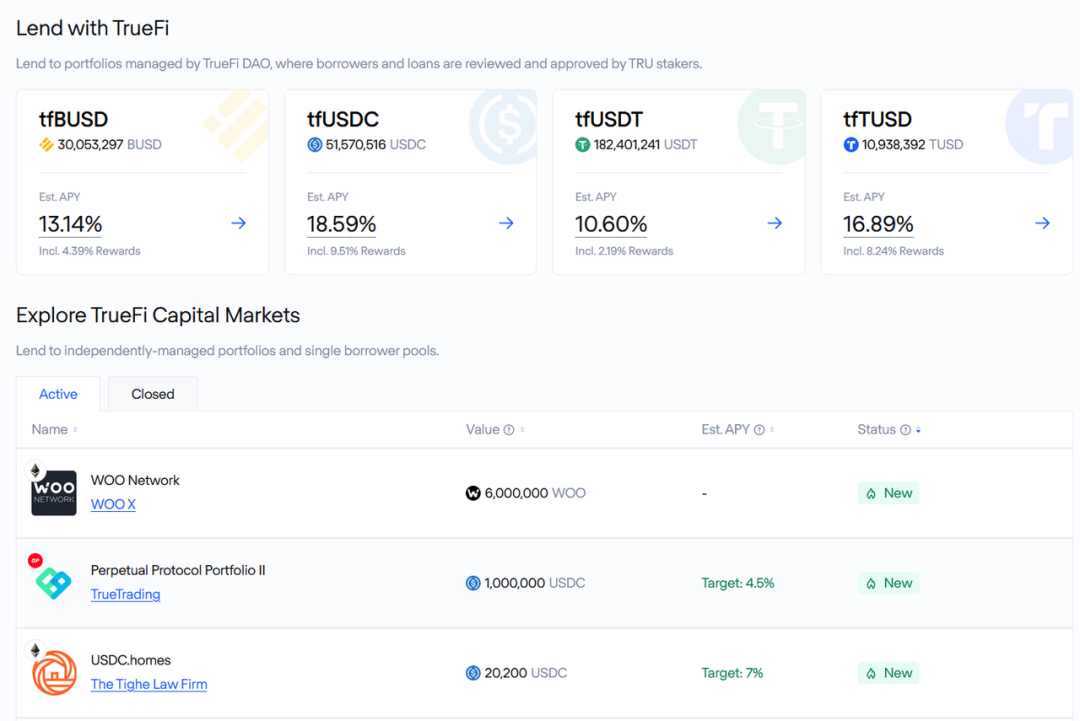

Now TrueFi has two business lines: TrueFi DAO Pools and TrueFi Capital Markets.

image description

3.3 Business Details

3.3 Business Details

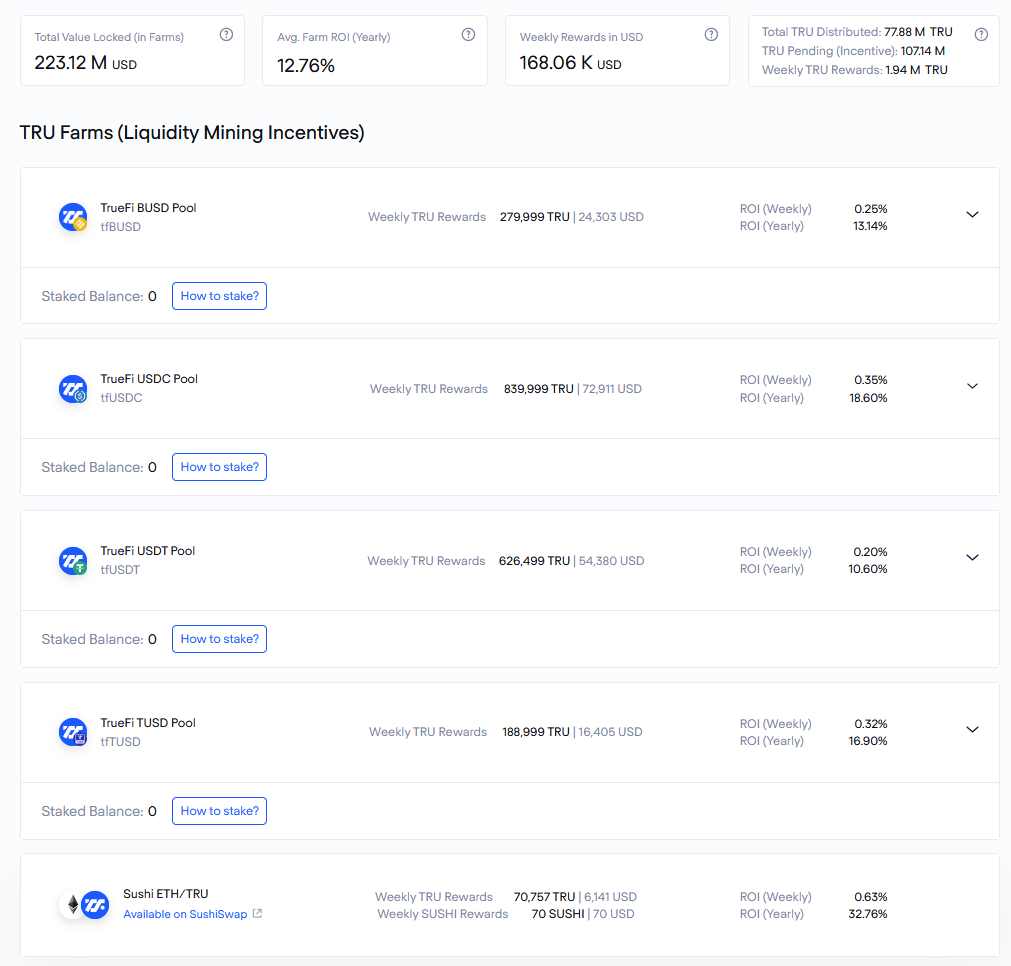

3.3.1 TrueFi DAO Pools

image description

Source: https://truefi.io/

On the deposit side, users can choose from 4 stablecoin pools: BUSD, USDC, USDT and TUSD.

image description

Source: https://app.truefi.io/home

image description

Source: https://app.truefi.io/pools/0x 1 Ed 460 D 149 D 48 FA 7 D 91703 bf 4890 F 97220 C 09437

image description

image description

Source: https://info.uniswap.org/#/pools/0x d 7 c 13 ee 6699833 b 6641 d 3 c 5 a 4 d 842 a 4548030 a 82

Users do not have to wait for the underlying loan to expire, and can redeem assets at any point in time, as long as there is sufficient liquidity in the stablecoin pool.

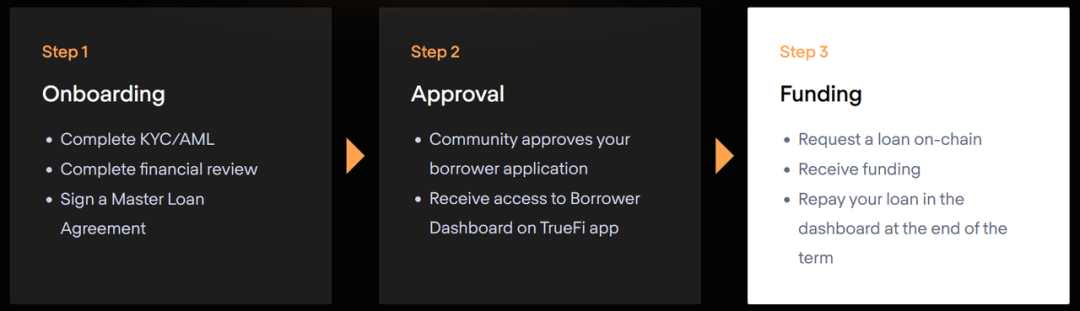

On the borrower side, the source of business comes from borrowers initiating loan applications.

To become a qualified borrower, you need to fill in relevant company basic information and loan basic information.

image description

image description

image description

image description

Source: https://app.trusttoken.com/choose-account-type

In order to assess the credit qualification of the borrower, TruFi launched the "TrueFi creditworthiness score" in the third stage, with a score between 0 and 255. The evaluation of the "TrueFi creditworthiness score" will affect the borrower's credit line and interest rate level. The evaluation system will examine information in the following dimensions:

(1) Company background: including compliance, legal affairs, finance, etc.;

(2) Repayment history: At this stage, it is only the repayment history in TrueFi, and it will be expanded to more data sources in the future;

(3) Operation and transaction history: including transaction data in crypto and traditional financial fields;

(4) AUM: including size, asset type and custodian;

(5) Credit indicators: including leverage ratio, liquidity and risk exposure, etc.

Although this set of credit rating models will continue to integrate data from centralized trading platforms and more on-chain data in the future, it can be seen from the above information that the entire scoring framework is currently more like a traditional bank lending model. Data in the crypto field and the traditional field are collected, and at the same time, the borrowed funds are turned into digital currency.

At present, 33 companies (Amber Group, Alameda Research, etc.) and two large households (0x 819, 0x B 60 ) have become "qualified borrowers".

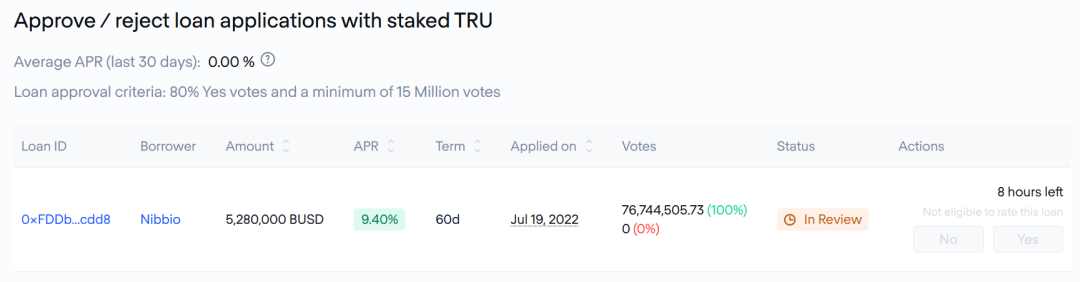

In the loan approval stage, it is divided into (1) TRU stakers Voting and (2) Rating Committee Voting two stages.

TRU holders have the power to vote on every loan after staking. When any loan borrows in this round of voting, it needs to get more than 15 million votes, and at least 80% of them voted for "YES". After the "TRU stakers Voting" is passed, the Rating Committee finally decides whether to issue loans.

image description

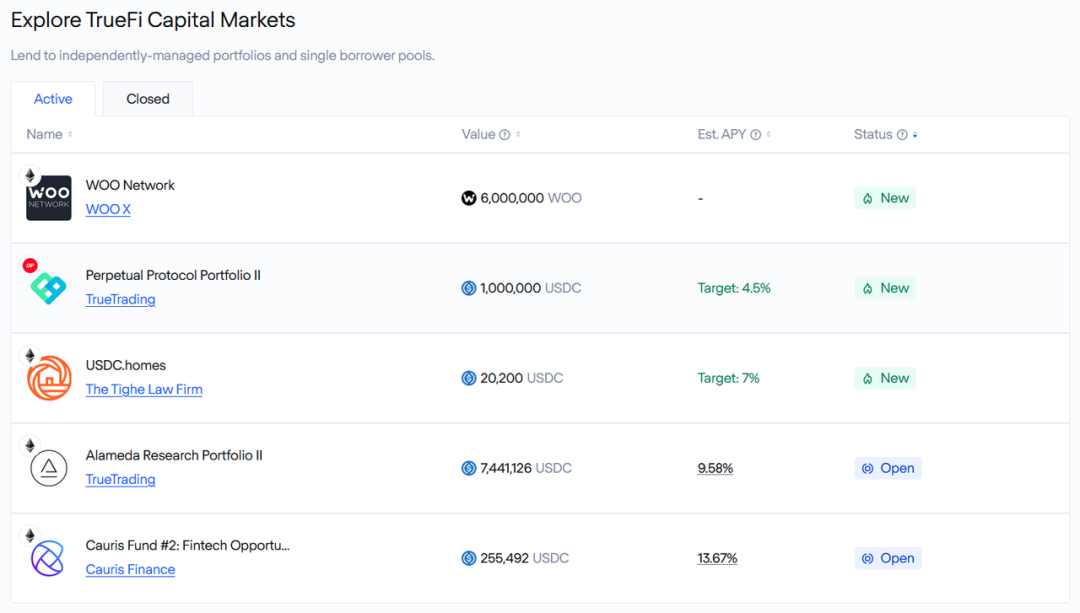

3.3.2 TrueFi Capital Markets

Source: https://app.truefi.io/home

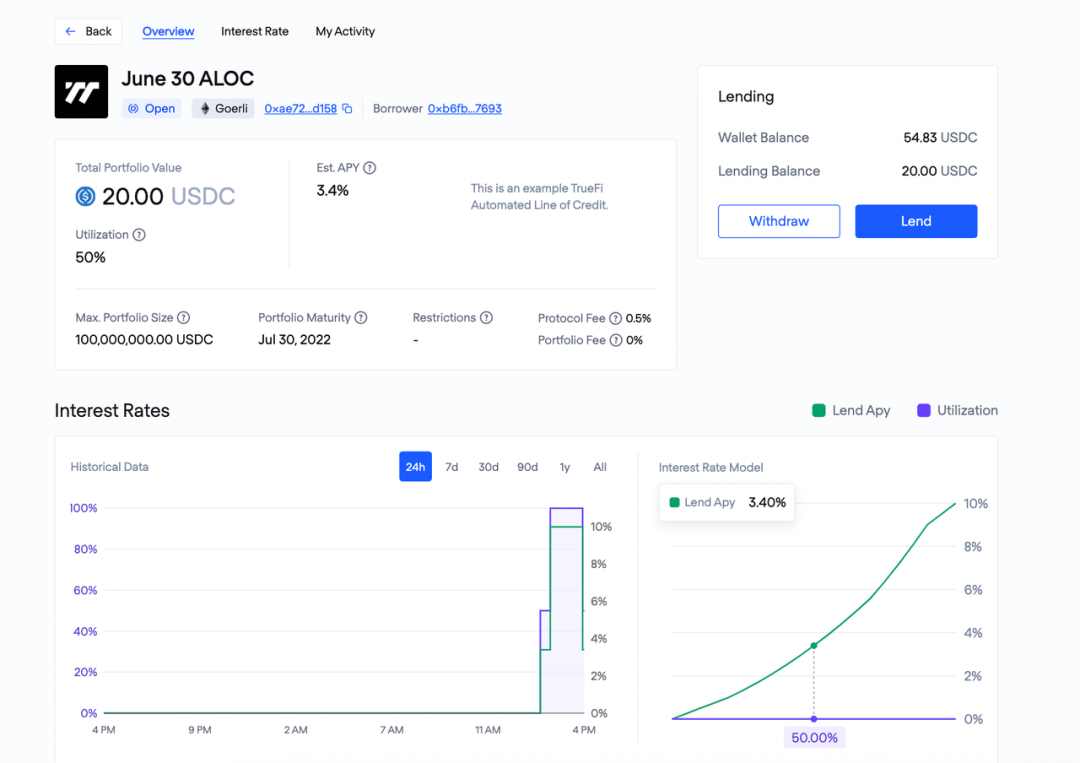

TrueFi Capital Markets is still a credit loan business, and the important difference from TrueFi DAO Pools is the manager. The manager of TrueFi Capital Markets is a third-party institution, which includes two types of pools: Managed Portfolios and Lines of Credit.

For Managed Portfolio, the qualification of "Manager" must be reviewed first. The application process of this step is similar to the process of "qualified borrowers" of TrueFi DAO Pools, but it is also necessary to explain the strategy and requirements of the portfolio to be established, and whether it will apply for TRU incentives and other details. The review of "Manager" is ultimately decided by TrueFi DAO.

After confirming that the "Manager" meets the entry threshold and the "portfolio" requirements are suitable, the sponsor "Manager" can set up special loan products. Like TrueFi DAO Pools, borrowers of special loan products still need to complete the two reviews of "Qualified Borrower" and "Loan Application". Same.

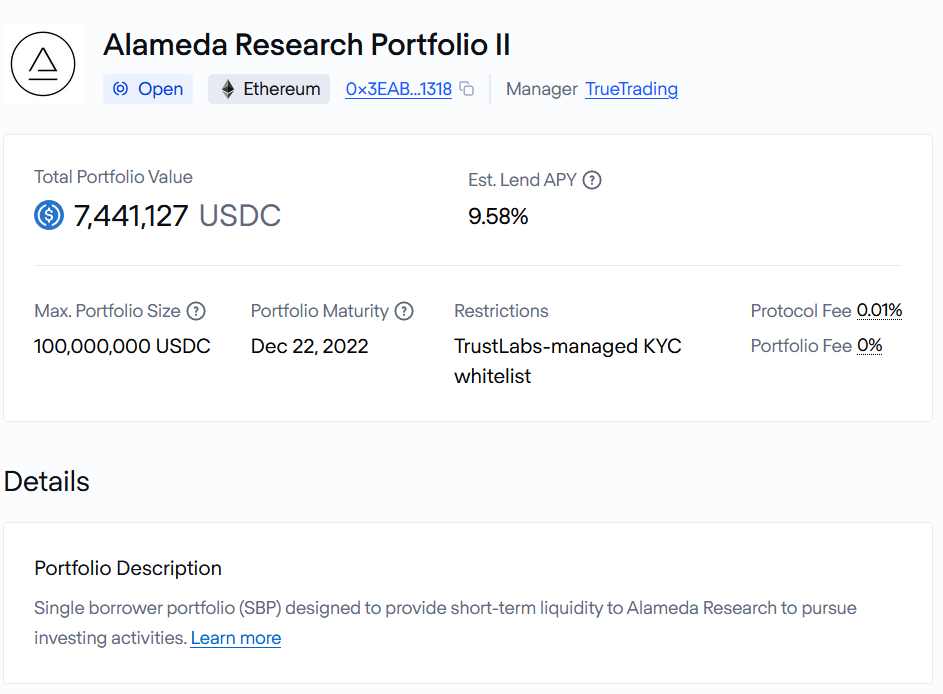

For Managed Portfolio investors, this type of product is like a regular financial product. Assets can only be redeemed when they expire, and the obtained portfolio token cannot be transferred to other addresses. Not only that, each Managed Portfolio also has two fees: (1) Protocol fee, the proportion of this fee is not fixed, and different borrowers will have different rates, which are currently within 0.5%. It will be transferred to TrueFi Protocol Treasury when the product expires; (2) Portfolio fee, the ratio is not fixed, and it is still negotiated on a case-by-case basis. This fee will be transferred to the Manager's wallet address when the product expires. The "Manager" of Managed Portfolio can also design the entry threshold for investors, and such investors need to carry out KYC.

image description

Source: https://app.truefi.io/portfolios/mainnet/0x 3 eabf 546 fff 0 a 41 edaaf 5 b 667333 a 84628571318

image description

Source: https://app.truefi.io/portfolios/mainnet/0x ae 86120411 c 450 bc 792 e 7465653 f 99 e 2 fe 4775 2c

image description

3.4 Multi-chain deployment

3.4 Multi-chain deployment

image description

Source: https://app.truefi.io/portfolios/optimism/0x a 8 c 2 f 1571785007 c 9 b 5 ff 039957173 e 82 a 48768 d

Overall, Ethereum is still the main place to do business, with $308 million of the current TVL of $309 million as of August 4th on Ethereum.

3.5 Default response strategies

When a default occurs, TrueFi’s response strategy is to first let SAFU (from the official 5 million TRU) and TRU stakers absorb the loss. If it is still not enough to fill the bad debt, the depositor needs to bear the remaining default loss. The full value of the loan was subsequently written down and proceedings were initiated against the defaulting debtor. If the lawsuit is successful in recovering the loan, the funds of the borrower, the stakers and the SAFU will be restored again.

3.6 Business data

3.6 Business data

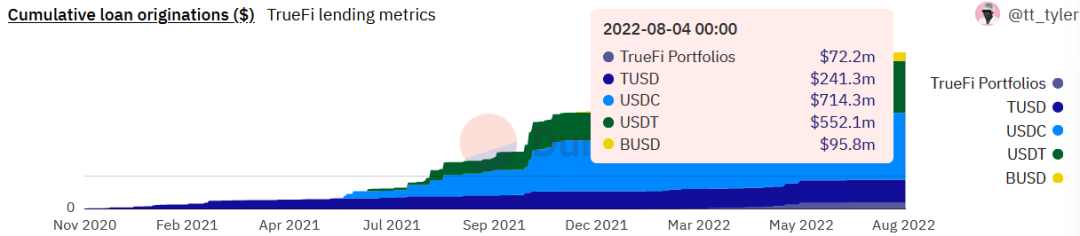

(1) Total issuance of credit loans

image description

Source: https://dune.com/tt_tyler/tru-staking-burns

(2) Loans that have expired

image description

Source: https://app.truefi.io/loans

The TOP 5 borrowers borrowed a total of USD 1.01 billion in loans, accounting for 71.6%, with a high concentration.

(3) Credit loan stock

Currently, there are 14 loans with a value of USD 260 million, an average value of USD 18.81 million, and an average maturity of 126 days. in:

A total of 8 loans will be due in the rest of August, worth 130 million US dollars (for details on the risks of this part of the loan, please refer to 3.2: Project Competitive Advantage and Moat-Risk Assessment Model);

1 deal due in September, worth 10 million US dollars;

image description

Source: https://dune.com/tt_tyler/truefi-loan-stats

(4 )TVL & Utilization Ratio

The current TVL is around $320 million and the ATH is $1.22 billion, which is down 73%.

image description

Source: https://dune.com/tt_tyler/tru-staking-burns

(5) Total income and bad debt ratio

So far, TrueFi has earned $29.85 million in interest income for investors, and has maintained an excellent performance of zero bad debts.

secondary title

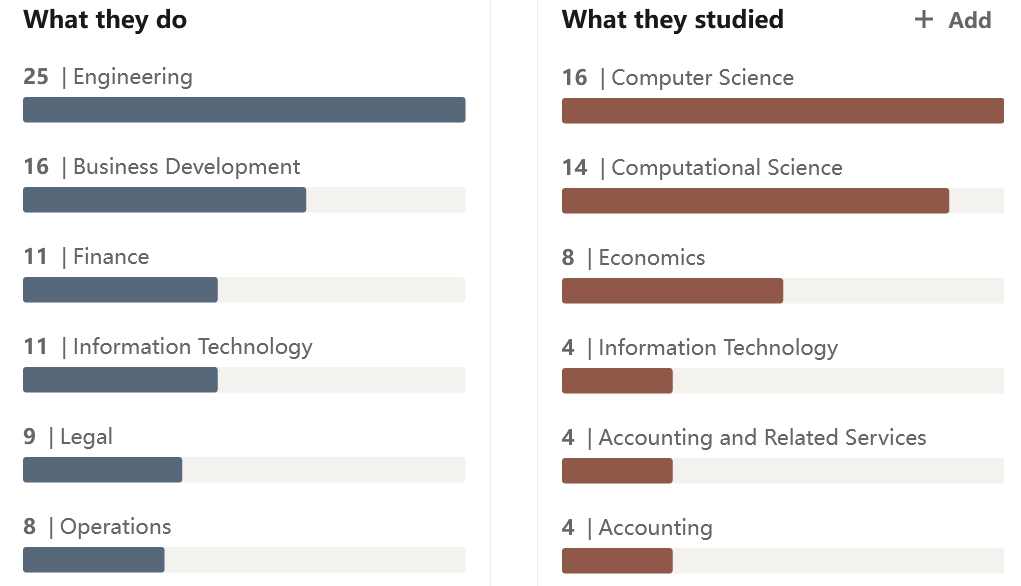

4. Team situation

4.1 Overall situation

image description

text

image description

Source: https://www.linkedin.com/in/rafaelcosman/

text

Members of the main business line have rich and deep backgrounds in related fields.

Members of the main business line have rich and deep backgrounds in related fields.

Head of BD: Ryan Rodenbaugh, who worked as an investment analyst or consultant in VM Capital, BlueRun Ventures and other investment companies, and became the head of BD of TrustToken in 2018;

CIO (Chief Investment Officer): Bill Wolf, who worked as a partner in traditional financial leading companies such as Goldman Sachs, HSBC, and Credit Suisse, and joined TrustToken as a consultant in 2018;

secondary title

5. Financing

TrueFi is one of TrustToken's business lines, and the past financing situation has been based on TrustToken.

In June 2018, TrustToken received a total of US$20 million in financing from a16z crypto, BlockTower Capital, Danhua Capital, Jump Capital, ZhenFund, Distributed Global and GGV Capital to develop the TrustToken asset tokenization platform, expand its legal, Partners, Product and Engineering Departments.

In August 2018, TrustToken raised $8 million through ColinList;

A total of 26.75% of TRU tokens were sold in the above two rounds.

first level title

secondary title

1. Industry space and potential

1.1 Classification

The track where TrueFi is located is an unsecured loan track. In addition to TrueFi, there are currently Maple Finance, GoldFinch, Clearpool and Atlantis Loans, but the latter projects are not large in scale.

In the traditional field, under the continuous upgrading of many infrastructures such as regulatory laws and regulations, credit ratings, and pricing theories, credit loans have not only become an important tool for enterprises to obtain financing, but also provide convenience for residents' daily consumption. Credit loans have become An important business branch in the traditional financial field.

Now the lending market in the crypto field is almost all mortgage loans. In order to improve the utilization rate of funds, different projects have made many attempts in terms of mortgage rate, interest rate pricing, and collateral. From the perspective of capital utilization, the capital utilization of unsecured loans is undoubtedly the best.

1.2 Market Size

The main customers of credit loans at this stage are market makers and quantitative trading institutions, and their main purposes are arbitrage, execution of market neutral strategies, and market making. Especially in the bull market stage, low-risk arbitrage opportunities emerge in endlessly.

image description

image description

Source: https://www.binance.com/zh-CN/futures/funding-history/quarterly/1

image description

Source: https://www.theblock.co/data/crypto-markets/futures/aggregated-open-interest-of-bitcoin-futures-daily

In addition, the market-making needs of both traditional market makers and Dex's liquidity pool have begun to be gradually replaced by credit loans.

secondary title

2. Token model analysis

2.1 Total amount and distribution of Token

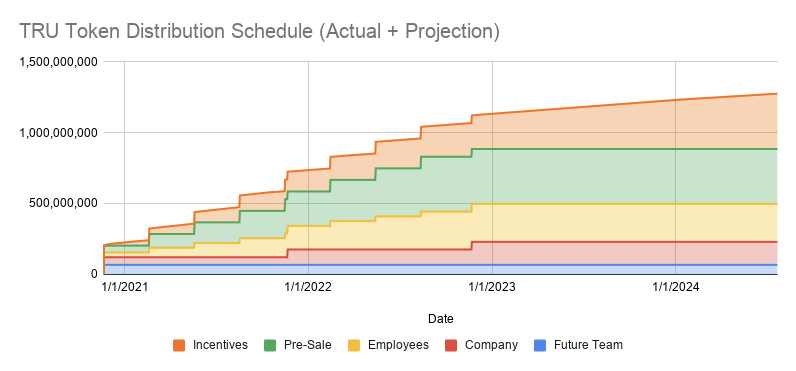

TRU was issued in November 2020, with a total of 1.45 billion. TrustToken, Inc burned a part in February 2021, and now there are still 1.44 billion in total. in:

39% is used for incentives, including TRU Staking, Lending, Sushiswap TRU-WETH Liquidity Providing, etc.;

26.75% are pre-sale;

18.5% belong to the team;

11.25% belong to the company or foundation;

image description

Source: https://blog.trusttoken.com/truefis-tru-token-economics-7facea6651c0

image description

Source: https://app.truefi.io/farm

By the beginning of 2023, there will be only about 350 million tokens in incentives and less than 200,000 tokens belonging to future team members to be released, and all tokens will be released by 2025. Before the release is completed in 2025, the annual inflation rate of circulating disks will be about 20%.

In addition, in order to ensure the stable operation of the project in the future, 5 million tokens originally scheduled to be released to the company in 2021 entered SAFU as insurance funds.

2.2 Token value capture

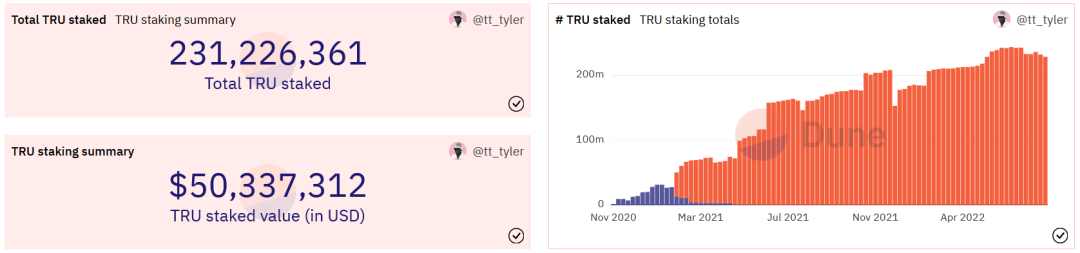

Only the TRU token in staking can get the value capture ability.

image description

Source: https://dune.com/tt_tyler/tru-staking-burns

image description

Source: https://app.truefi.io/stake

In addition, a total of US$3.04 million worth of interest income and protocol fees were issued to TRU Staker.

image description

Source: https://app.truefi.io/stake

2.3 Token core demand side

Investors who are optimistic about the credit lending track and TrueFi for a long time have a layout demand in this round of bear market. The credit track is still in its early stages. At present, it seems that the internal risk control of the track is stable enough, and the only one with a large scale is TrueFi. With the recent launch of the multi-chain strategy and the directional credit loan project, TrueFi’s business scale is likely to grow rapidly after on-chain arbitrage opportunities emerge. So at this stage, whether it is "lending/liquidity providing first and then staking" or "directly buying staking", it is a good strategy.

For the borrower, holding a larger amount of TRU helps to increase the possibility of passing the loan. Since each loan requires no less than 15 million votes and 80% of the votes are in favor, TRU has an incentive for borrowers to participate in governance. According to the current price of 0.093 US dollars per piece, the cost of obtaining 15 million votes is about 1.4 million US dollars. According to the 15% annualized rate of return of perpetual fund fee arbitrage and the average borrowing cost of 11%, the cost of 15 million TRUs can be fully covered by a borrowing amount of no less than 35 million US dollars.

2.4 Summary of Token Model

Future Token releases will revolve around how to do a good job of incentives. As of July 2022, there are not many remaining non-incentive tokens to be released. The main release amount in the future will come from the incentive mechanism. Through the incentives for Lending and liquidity staking, the deposit side will still have a relatively large amount of tokens in the future. Appeal.

By distributing interest income to match the risk and return of TRU stakers, it is more motivated to review each credit loan. TRU stakers not only take on the pre-loan risk—voting themselves to decide which borrowers to provide credit support to, but also assume the post-loan risk—TRU stakers are also the first wave of people who suffer if they encounter bad debts. In some tokenomics, only staking incentives are provided without distributing profits. TrueFi’s not low profit sharing ratio makes TRU holders more willing to participate in staking and voting, which alleviates the previous situation of simply doing staking “lying to win”.

However, the ratio of the newly released tokens each year in the next two years to the total number of tokens in circulation at the beginning of the year will reach 20%, and the bear market with a lack of arbitrage opportunities will have little demand for credit loans, and the price of TRU will be under considerable pressure in the future.

secondary title

3. Project competition landscape

3.1 Basic Market Structure & Competitors

3.1.1 Competitors at this stage

Credit lending projects in the current market include Maple Finance, Goldfinch, Clearpool, and Atlantis Loans, etc. From the perspective of business model and business volume, the current main competitor is Maple Finance.

In the long run, the core factors of credit loan inspection are: scale, risk control ability and risk pricing ability.

From the perspective of the total distribution scale, the difference between TrueFi and Maple Finance is not obvious, but from the perspective of TVL, Maple Finance's TVL is 500 million US dollars, which is higher than TrueFi's TVL (320 million US dollars), which reflects that the two companies are absorbing deposits Capabilities make a difference. Because the deposits of TrueFi and Maple Finance come from ordinary users, anyone can lend assets, so the ability of the project party at the level of marketing and customer acquisition is an important factor in determining the scale of pro-cyclical credit loans. In this regard, Maple has advantages:

First of all, Maple Finance is more active on social media, carrying out more Twitter Spaces and various activities, which is conducive to promoting the project to absorb more deposits. Especially after the CeFi thunderstorm in June, through Twitter Space, various types of podcasts/interviews and other programs, publicize product positioning, etc., and respond to community issues in a timely manner. This may be one of the important reasons why Maple Finance's Token price quickly rose back to before the incident in this wave of rebound. It can also be seen from the number of tweets that Maple has posted a total of 2,895 tweets since 2019, and TrueFi has posted 4,180 tweets since 2017. In contrast, Maple Finance’s average annual tweets are higher than TrueFi’s Around 25%.

image description

Source: https://dune.com/scottincrypto/Maple-Deposits

image description

Source: https://maple.finance/news/updates-on-celsius/

The problem reflected this time is that there is a problem with Maple's risk control, which may determine the life and death of the project, and TrueFi has an advantage in this regard.

Risk control capabilities are divided into pre-loan risk control, loan risk control and post-loan risk control. In the traditional financial industry, fraudulent loans can generally be divided into three situations:

(1) Using other people's identity information to defraud loans;

(2) Use real personal information, but forge credit data, such as asset certificates and income certificates;

(3) Falsifying the use of funds.

For the first case, with the development of technology, it is now generally possible to achieve a certain degree of evasion through real biological information, such as fingerprints, face recognition and other technologies, which need to be handled in person, and valid identity documents. There are already many solutions in the traditional financial industry.

For the second type of situation, users are generally required to submit asset certificates with official endorsements, income certificates, credit reports, and regular on-site visits by loan officers for risk screening.

The risk management measures for the first and second types of situations belong to pre-lending risk control.

For the third case, it generally stipulates the use of funds. For example, within the scope of its own business system, after the user places an order to purchase goods, the payment method can be changed to a credit loan.

The risk management measures for the third type of situation belong to risk control in lending.

Once a credit default occurs, traditional financial institutions will use methods such as collection, legal proceedings, and selling the asset package to a non-performing asset disposal agency to collect the money. Since the final punishment mechanism falls on specific individuals or companies, this set of models can generally ensure that the default rate of credit loans in the traditional financial system is at a low level, and cover potential defaults through higher interest rates.

The risk management measures for default disposal belong to post-loan risk control.

In the field of credit lending in Crypto, it is still impossible to achieve a complete closed loop of "before-loan-loan-after-loan" on the pure chain, because if there is a default, it can only be handled off-chain. Since the credit demand side is often a crypto native investment institution, there is no regulatory constraint, there is no clear requirement for the use of funds, leverage ratio, etc., and it is more difficult to clarify the "off-balance sheet financing" and the real use, so it is necessary for the lending institution to not only own off-chain The power of prosecution also requires the ability to analyze and collect information on the chain.

TrueFi has not had a thunderstorm so far, while Maple Finance has borrowed from Babel Finance. Maple Finance's credit evaluation system needs to be improved, and this will determine the final fate of the project.

Risk pricing power is related to interest rate spreads. This thunderstorm at least shows that the current spread may still not be enough to cover potential risks, and Maple Finance needs to further revise its pricing model.

3.1.2 Potential Competitors

Credit DID or potential competitors for the future. Vitalik mentioned soulbound tokens (SBT) in the article "Decentralized Society: Finding Web3's Soul". If a credit evaluation system connecting crypto and the real economy can be established through SBT, then this type of project is likely to be another S&P Global Ratings, Sesame Credit or FICO Score, it is easier to enter the credit lending field, which will threaten the realization of TrueFi's long-term vision.

However, TrueFi’s credit evaluation system also includes on-chain data to form a more comprehensive evaluation plan. With the enrichment of on-chain data dimensions in the future, TrueFi may not lose the competition with DID represented by SBT.

3.2 Project Competitive Advantages and Moat

TrueFi now has two core strengths:

risk management measures. Both TrueFi DAO Pools and TrueFi Capital Markets adopt a two-tier evaluation structure: first evaluate the borrower, and then evaluate a single loan, which draws on the risk control process of the traditional financial system. The approval and evaluation of credit loans before lending can only be judged based on the data and information at the time of approval. The evaluation model cannot include the tail risk after lending. Risk management measures are very important. Since we have no way of knowing the specific risk management model and parameters of TrueFi, judging from TrueFi’s lending to Three Arrows Capital in May, there may be problems with its pre-loan risk control, but this loan should have expired in August this year The credit loan was repaid in advance in June, which also shows that TrueFi has an advantage in post-loan risk management capabilities. TrueFi has been helped in the selection of borrowers and loan conditions in order to maintain a zero bad debt rate. The intensive maturity of loans in August this year may test TrueFi's risk control capabilities again. In general, among all outstanding loans, Alameda Research still needs to repay 35.04 million US dollars, accounting for about 13%, Amber Group still needs to repay about 65.86 million US dollars, accounting for about 1/4, and Wintermute also needs to repay. About $92 million needs to be repaid, accounting for about 35%. In addition, the debtors also include Bastion Trading, Folkvang, etc. However, the above-mentioned debtors have not disclosed that there is a risk of bankruptcy or default for the time being, and now it seems that the probability of the remaining debt storm is not high.

secondary title

4. Risk

Competition from other projects in the credit loan track. Clearpool, which has the same subdivision track, has been running steadily so far, and may survive and grow stronger in this round of bear market. There are also differences in the business model of the credit lending track. For example, Goldfinch absorbs on-chain deposits and lends to off-chain merchants, and can enter the credit market of small and medium-sized institutions by adapting its own risk control model.

The gradual maturity of credit DID can also become the technical cornerstone of credit lending, breaking the exclusivity of the current risk control model. TrueFi’s current risk control methods are somewhat exclusive. If DID is now more mature and incorporates more data dimensions, then there is a possibility of cutting into credit loans, which may form a new risk control paradigm superior to TrueFi.

first level title

secondary title

1. Core issues

(1) Market space

Even if the total market value of digital currencies stays at the current level, perpetual contract fund arbitrage based on TOP 5 non-stable currency currencies will have an annualized capacity of about 100 billion, which does not include centralized trading platforms and AMM market making need. If the "digital gold" narrative of Bitcoin can finally be realized to a certain extent in the future, and functional public chains such as Ethereum further mature, the demand for arbitrage and market-making in the entire market will further expand. At this stage, the credit demand of trading investment institutions and asset management companies as the main customer groups will also increase accordingly.

(2) The periodicity of downstream demand

Credit demand is a pro-cyclical demand. Now crypto credit loans are mainly used in financial activities such as market making and arbitrage, especially arbitrage is a relatively lagging demand, so the outbreak period of credit loan demand may be even more lagging. Then a project like TrueFi may be a strong cyclical target.

image description

Source: https://app.truefi.io/stake

(3) Replacement of TrueFi credit evaluation model after maturity such as SBT

secondary title

2. Valuation level

In view of the strong cyclicality of TrueFi's business, traditional valuation indicators such as PS and PE are likely to soar due to the cooling of business in the future. At the same time, TrueFi has not experienced a complete bull-bear cycle, and the time dimension of past historical indicators that can be referred to is not enough.

The investment in TrueFi may still have to make vague judgments from the big cycle and the gradual recovery of business volume. The following indicators help us make a decision:

(1) Demand forward-looking indicators: perpetual contract funding rate, term spread, Gas Fee and other indicators that can represent market enthusiasm;

(2) Scale indicators: TVL, Total Loans Outstanding;

(3) Risk control indicators: bad debt rate;

(4) Profit indicator: Fees paid to stkTRU;

(5) Liquidity indicator: TRU pledge rate.

secondary title

3. Summary of Preliminary Valuation

Even judging from the current downstream demand for arbitrage and market making, credit lending is one of the tracks with great potential in the future in DeFi. With the maturity of other infrastructure such as DID, the application scenarios and demand scale of credit lending will become more abundant.

TrueFi has become a very competitive project in this track, no matter from the perspective of scale indicators such as TVL and loans issued, or from the perspective of safely surviving the CeFi/DeFi thunderstorm this time. Its main competitive advantage comes from risk management Measures and scalability of future business.

The TrueFi team has senior experience in the traditional financial field, and can transplant past knowledge and experience of risk management into the project. Especially at the current stage when infrastructure such as credit DID and other on-chain risk management measures are relatively lacking, this experience and ability can help TrueFi deal with risky events with greater impact. The recent cooperation with Woo Network also shows that TrueFi does not stick to its own business scope, and is willing to innovate products to meet new needs of customers under the premise of risk control.

first level title

secondary title

secondary title

https://truefi.io/

secondary title

https://dune.com/tt_tyler/tru-staking-burns

Dune:

https://dune.com/queries/636881/1186840

Linkin:

https://www.linkedin.com/company/trusttoken/people/

Uniswap:https://info.uniswap.org/#/pools/ 0 x d 7 c 13 ee 6699833 b 6641 d 3 c 5 a 4 d 842 a 4548030 a 82

Original link

Dune:

https://dune.com/scottincrypto/Maple-Deposits

Binance:

https://www.binance.com/zh-CN/futures/funding-history/quarterly/1

Cryptoquant:

https://cryptoquant.com/asset/btc/chart/derivatives/funding-rates? exchange=all_exchange&window=DAY&sma= 0&ema= 0&priceScale=log&metricScale=linear&chartStyle=column

The Block:

https://www.theblock.co/data/crypto-markets/futures/aggregated-open-interest-of-bitcoin-futures-daily