first level title

1. Summary of Industry Dynamics

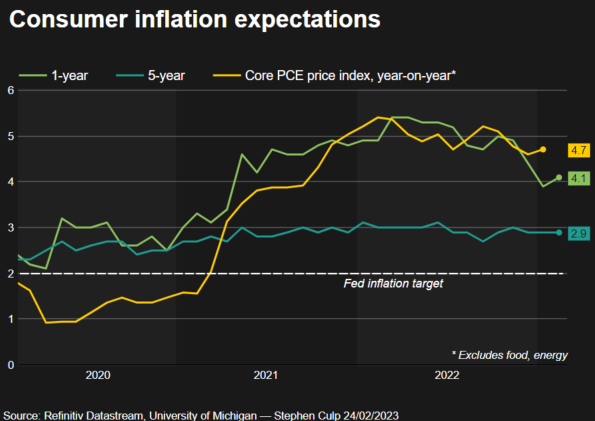

On the other hand, U.S. stocks last week had only four trading days on President’s Day on Monday, and the market also closed four negative lines in a row. The important long-term moving averages and important integer levels were all gained and lost, and there was a short-term pattern. Yinxian, but actually only the first day of decline is more obvious, the remaining days are falling in the morning and rebounding in the afternoon, forming several K-lines with long lower shadow lines, so the probability of rebounding this week is relatively high. The PCE data was released before the market last Friday. Among them, the core PCE rose by 0.6% month-on-month in January, and the expected value was 0.5%, and it rose by 4.7% year-on-year, and the expected value was 4.4%. Caused some panic. In last week's CME's forecast for a rate hike in March, there was a 73% probability of an increase of 25 basis points, and a 27% probability of an increase of 50 basis points. The probability of an increase of 50 basis points has risen significantly (only 2.8 basis points a month ago %), and the market is sure to reprice this expectation as well. Including the peak interest rate increase from the previous 5.5% to 6%. At present, some institutions have begun to take precautions. For example, the head of trading at Citibank proposed that the peak interest rate of the Federal Reserve may be raised to 6%. Risky assets such as stocks may be regulated. further out. In the last week, the net outflow of stock funds was US$7 billion. Michael Harnett, chief strategist of Bank of America, also said that bonds have received net inflows for 8 consecutive weeks, which also shows that institutional investors are still continuing to overweight bonds. Although this week's FOMC meeting minutes basically offset the probability of 50 basis points at the caliber level, the macro data that has been unable to improve is still a sharp knife hanging over the market, and may also influence the decision-making of officials.

secondary title

industry data

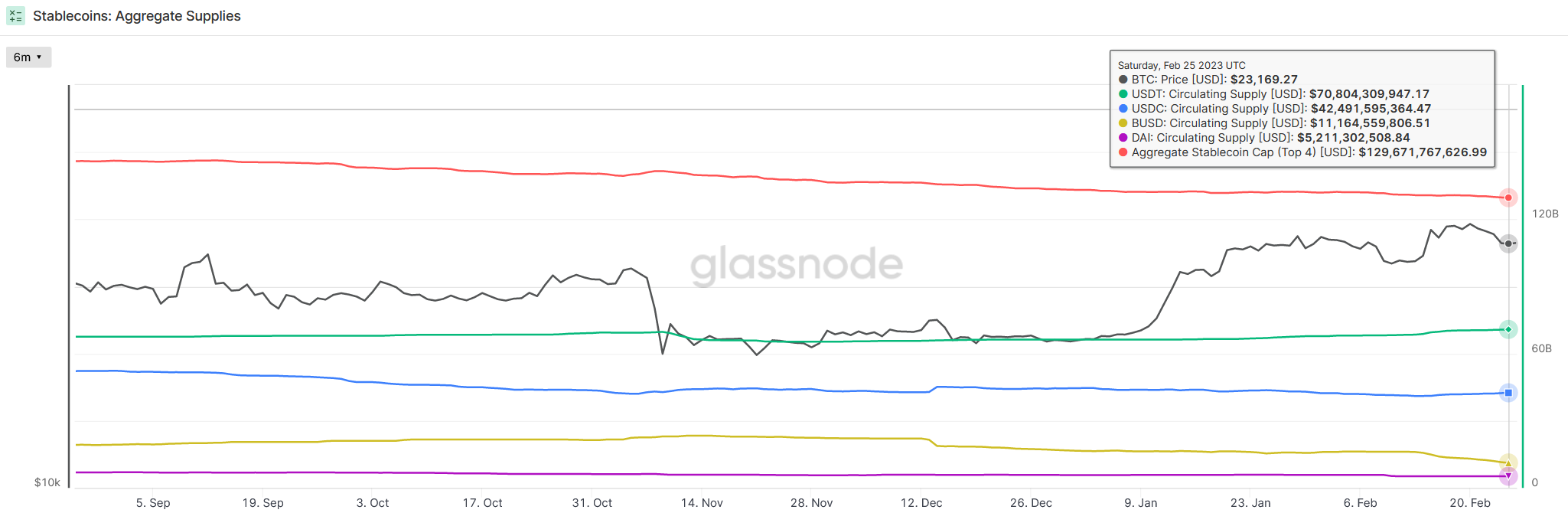

1) Stablecoins

As of February 25, 2023, the total supply of the top four stablecoins (USDT, USDC, BUSD, DAI) is about 129.672 billion, a significant drop from last week, with a decrease of about 1 billion (-0.77%), and the currency market funds are reappearing Large outflow.

Among the three major fiat stablecoins, the supply of USDT and USDC has seen an expected increase. USDT increased by about 420 million (0.6%) this week, and the upward trend continued, with a market share of over 52%. The supply of USDC increased by about 638 million pieces (1.53%) this week, and the downward trend reversed.

Affected by regulation, the supply of BUSD dropped sharply again this week, decreasing by 2.076 billion (-15.68%). Since Paxos has been banned from minting BUSD, the stablecoin market will maintain this trend of ebb and flow for some time to come.

Overall, in this week’s data, the growth of USDT and USDC is difficult to offset the outflow of BUSD, and the currency market funds are still in a net outflow trend, which may be related to the macro uncertainty brought about by the European core CPI data and the US PCE data.

The price rebound in the currency market this year has not attracted off-market funds to enter the market. The rebound height of large-cap currencies may be relatively limited, or will maintain wide fluctuations until incremental funds enter the market.

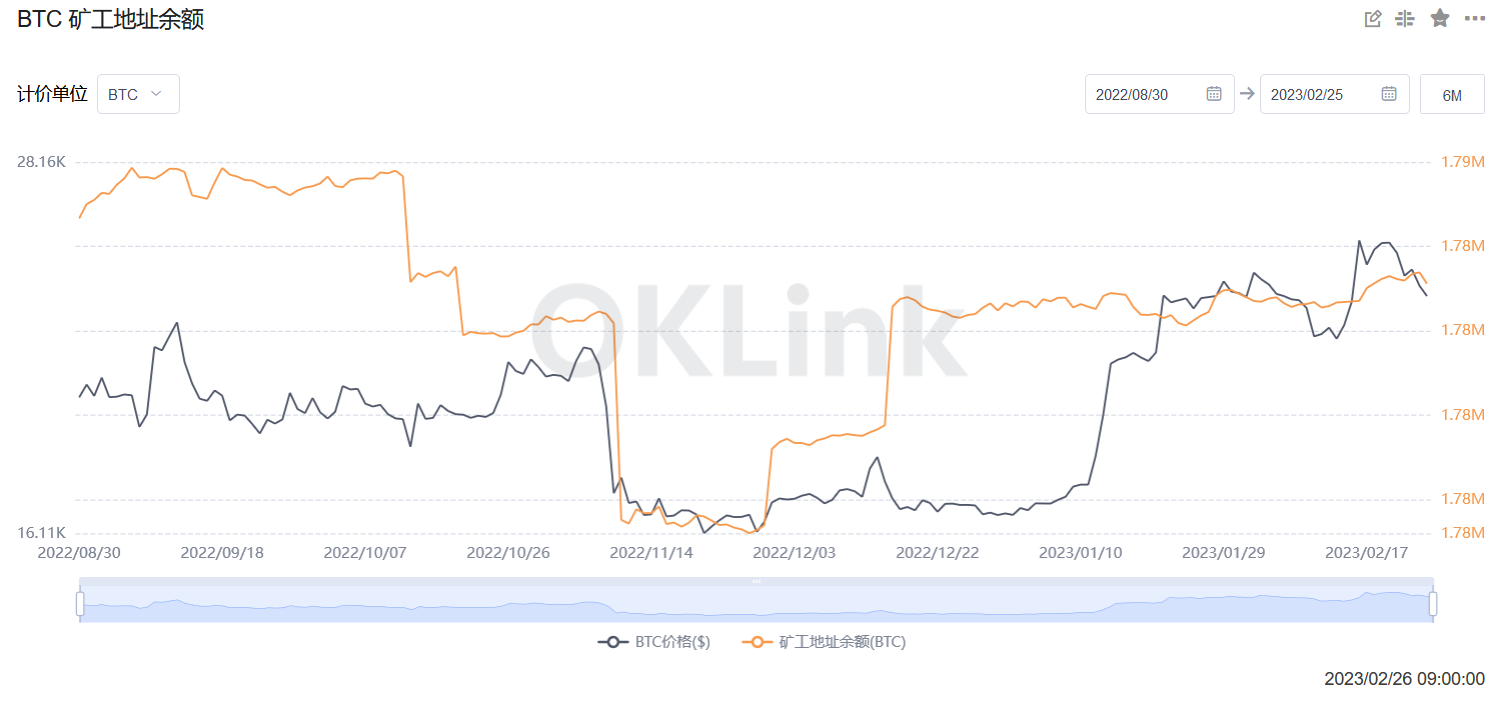

2) BTC miner balance

The BTC miner address balance indicates the total BTC holding balance marked as the miner address on the chain, including Foundry USA, F 2 Pool, AntPool, Poolin, Binance and other addresses.

This data is usually used to judge miners' interest in the current BTC price. When the miner's balance increases, it usually indicates that the chips are in a state of accumulation; when the miner's balance decreases, it indicates that the miners are selling or mortgage their BTC.

According to OKLink data, compared with last week, even if BTC failed to hit the 25,000 mark and turned into a callback shock, the balance of miners remained unchanged.

3) ETH deflation data

Compared with ETH under the POW mechanism, the supply under the POS mechanism has decreased by about 1.88 million pieces, and the selling pressure of this part is about 3 billion U.S. dollars in U.S. dollars.

first level title

2. Macro and technical analysis

The market has entered an adjustment period. We judge that the short-term adjustment trend is difficult to change. It will take a certain amount of time to combine with the macro before the market can further enter an upward trend.

The two-year U.S. bond rose, and the market no longer expected a rate cut at the end of the year

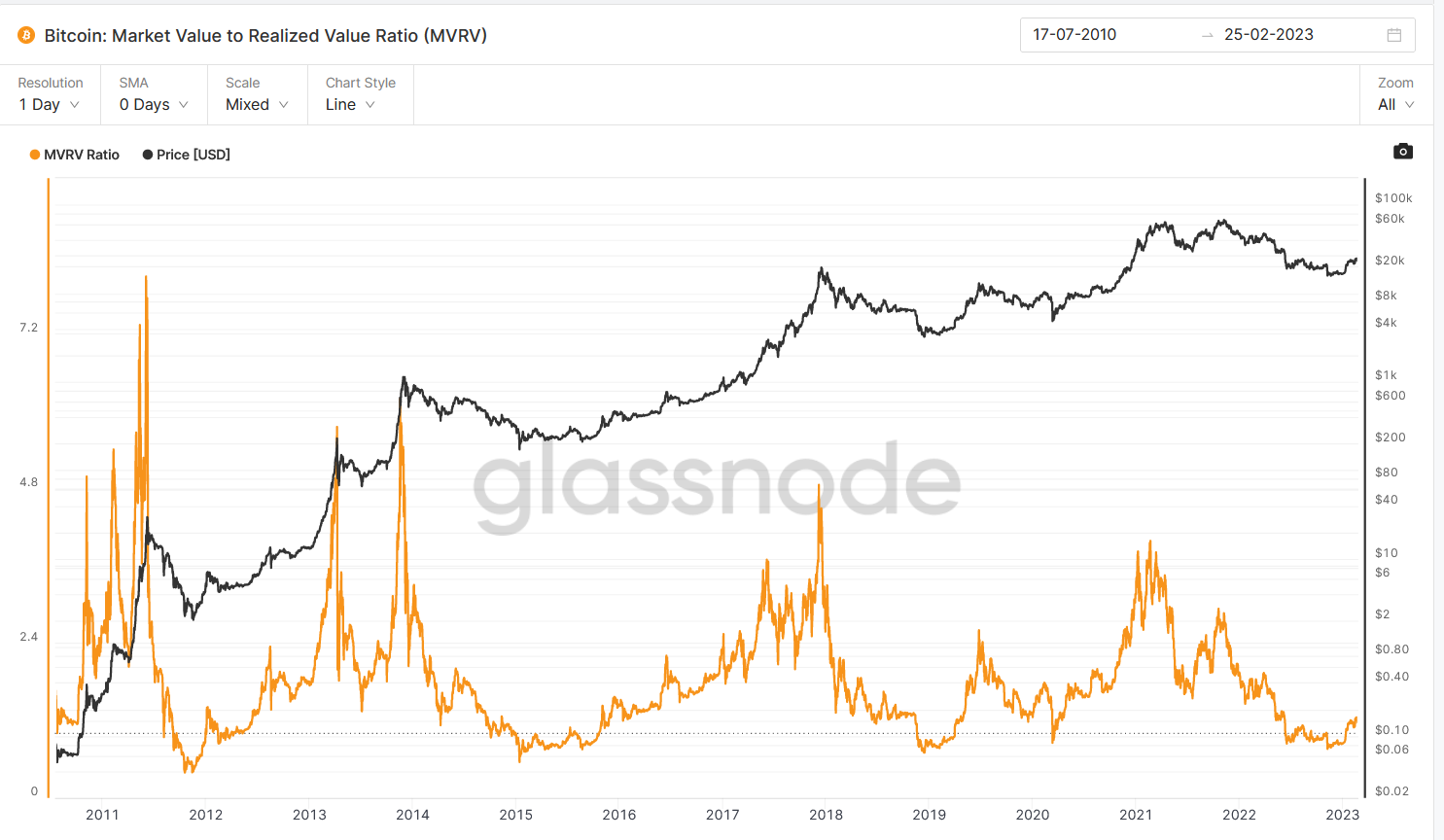

arh 999 : 1.58

Nasdaq enters correction range

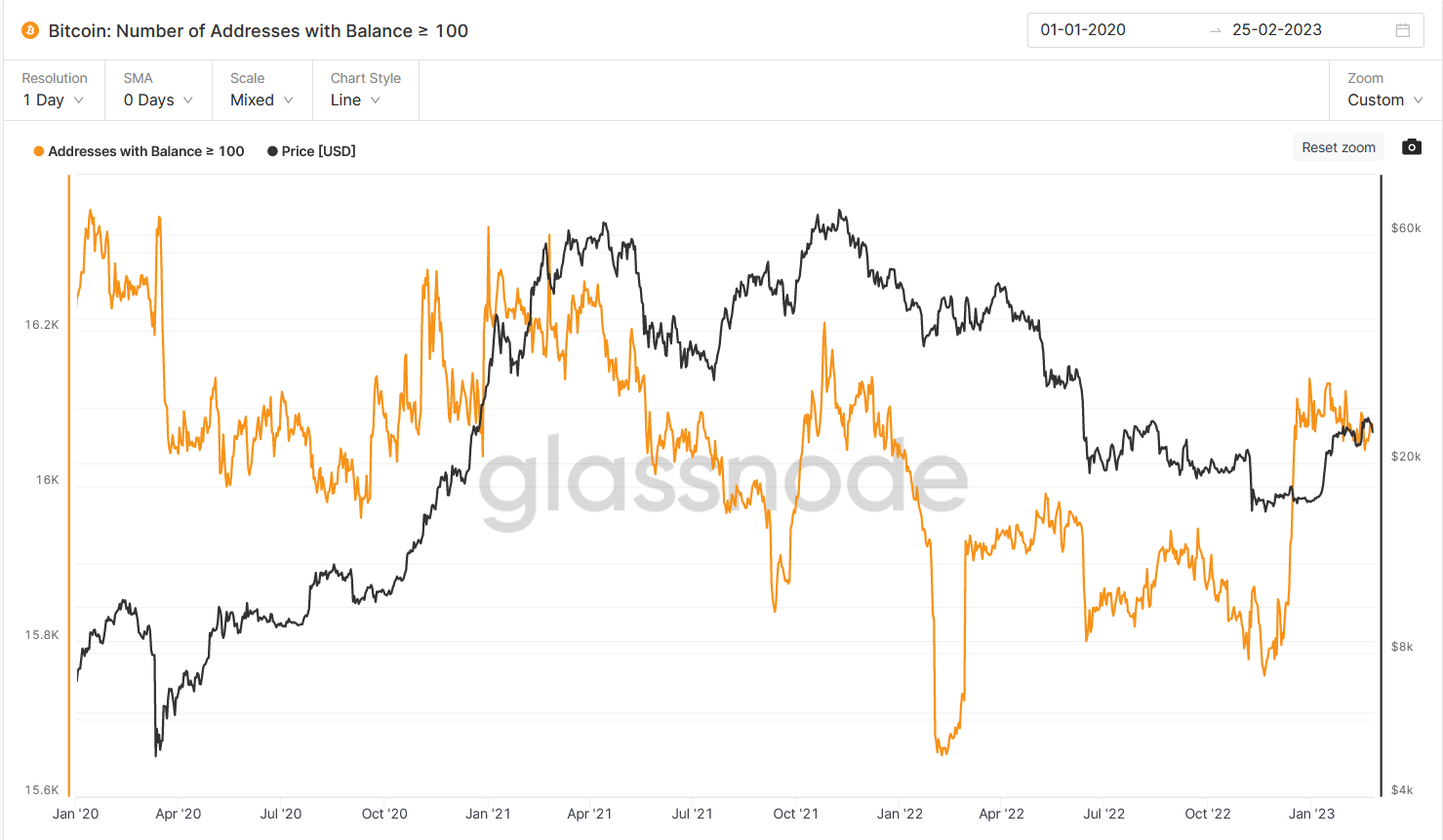

The number of addresses holding more than 100 coins began to decline

3. Summary of investment and financing

secondary title

Investment and financing review

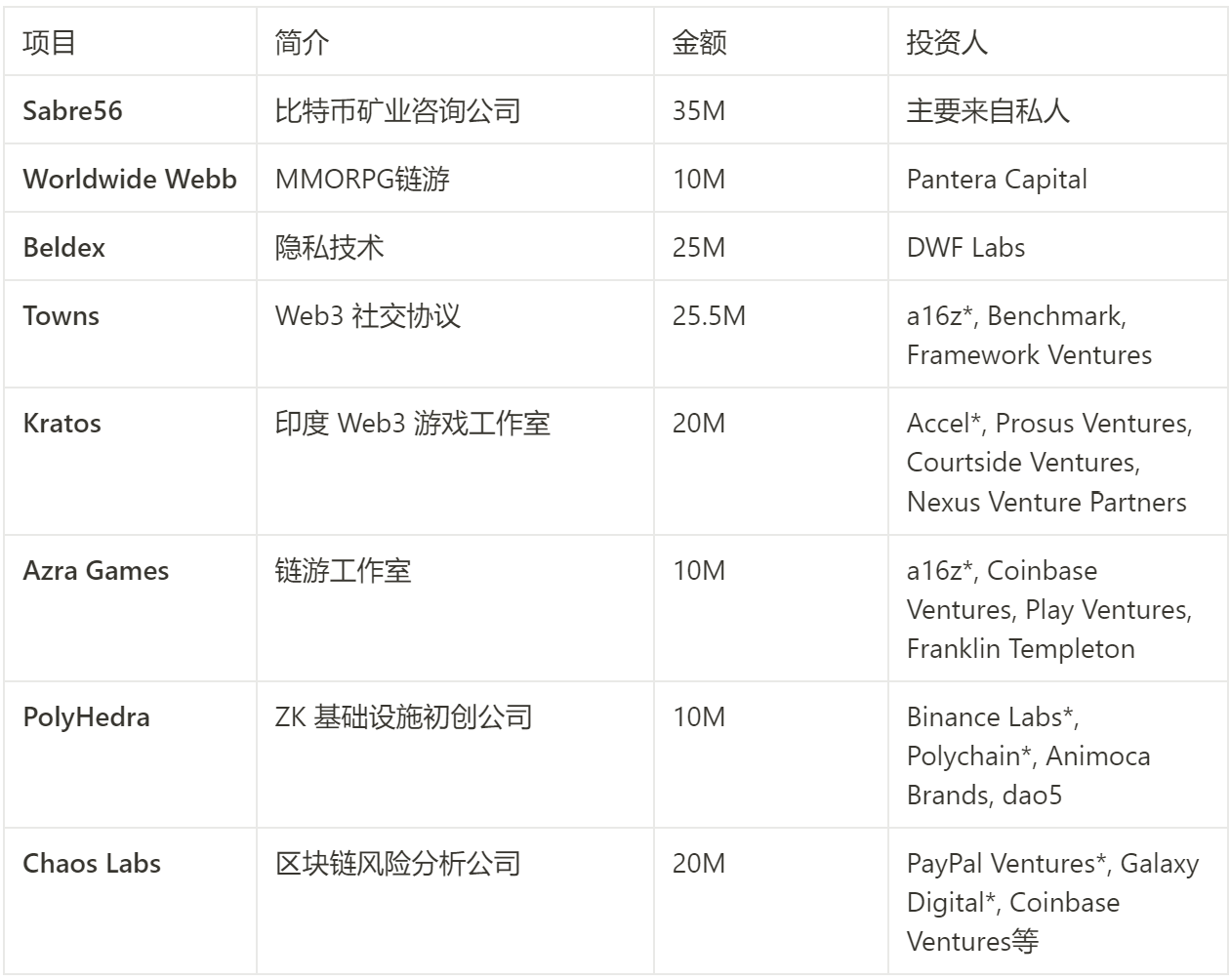

During the reporting period, there were a total of 8 incidents in which the amount of financing exceeded 1,000 w US dollars:

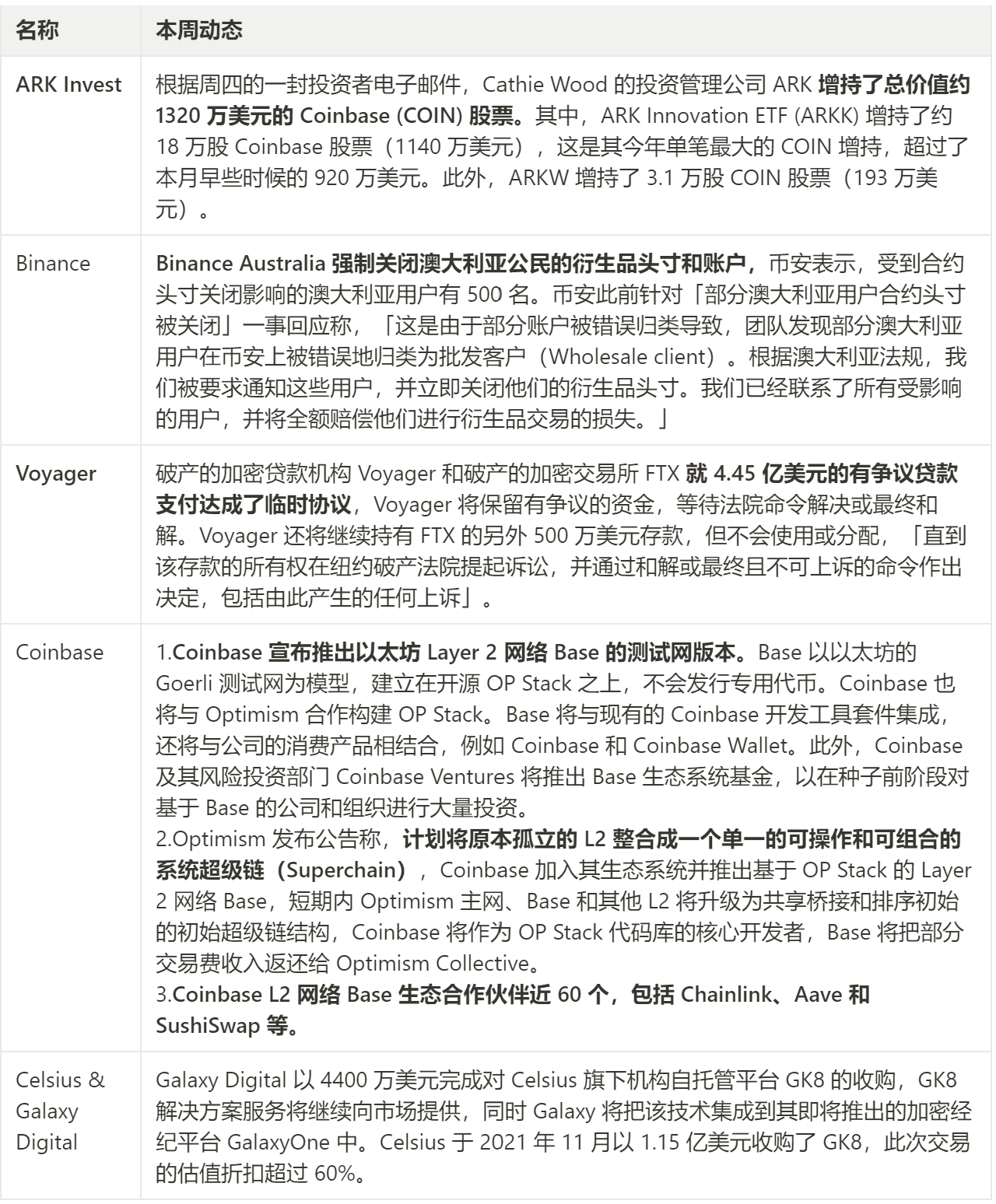

Institutional dynamics

4. Dynamic tracking of non-performing assets

secondary title

1. The latest developments in the FTX digital non-performing asset credit market

FTX debt transaction market dynamics: Currently, non-performing asset acquisition funds can purchase FTX debt at a price of around 20 cents/dollar (20% of face value) in the OTC market.

And because the FTX website is currently in a paralyzed state, it is difficult for creditors to come up with the most complete information to prove their asset certificates on the FTX exchange. Therefore, the quality and proof of the current claims for claims play an important role in the final asset pricing.

secondary title

2. FTX’s Debt Ratio

In the final days before declaring bankruptcy, FTX CEO SBF tried to raise one last round, and the balance sheet he sent to potential investors was revealed by the Financial Times, showing that the exchange had nearly $9 billion in liabilities, And liquid assets are just over $1 billion. In addition to liquid assets, there is another $5.4 billion in assets marked as "illiquid," and many of these "illiquid" assets may already be completely illiquid. Another $3.2 billion was marked as "illiquid."

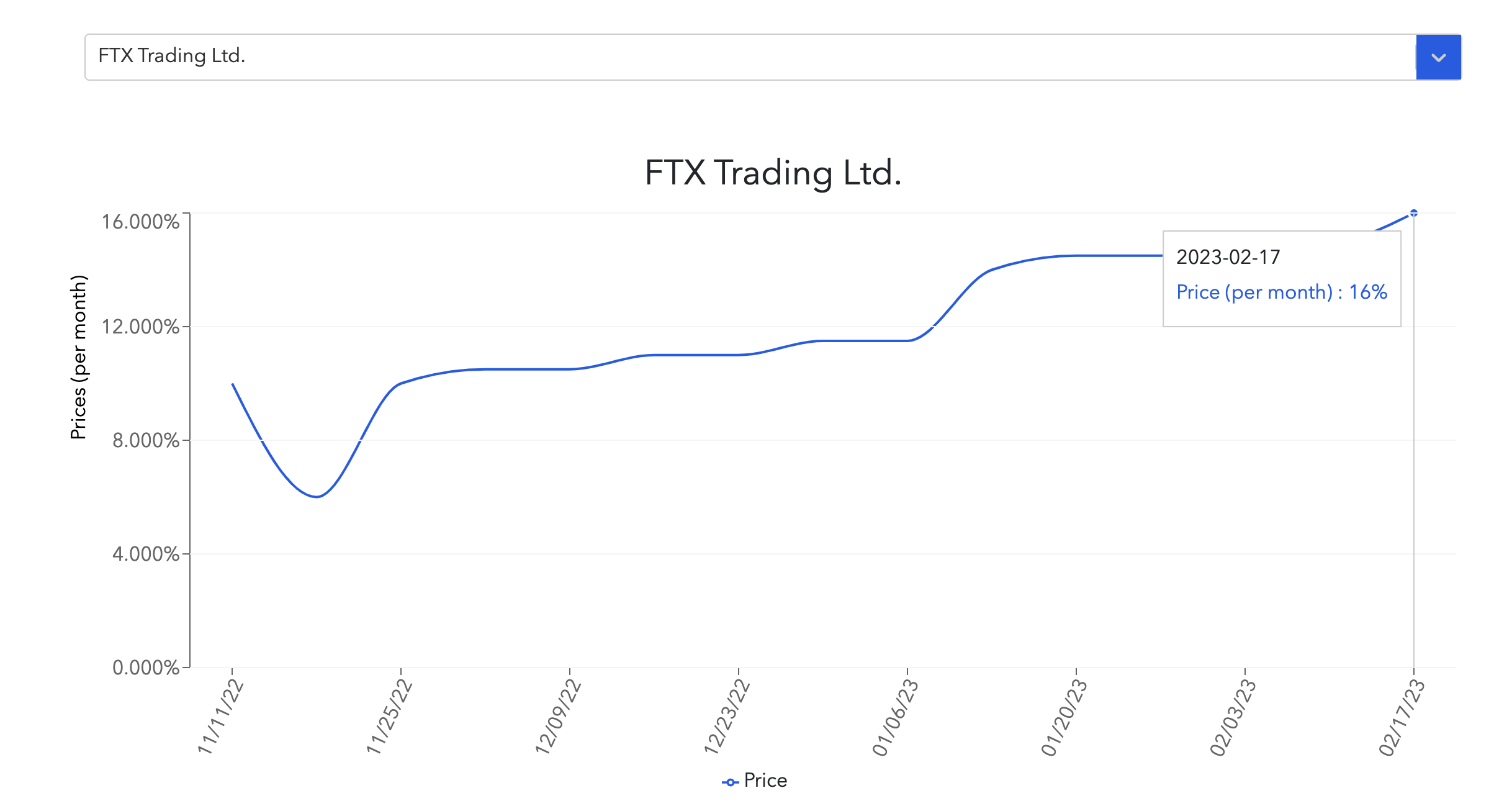

As of 2/17, the current reference price of FTX debt purchase price on the debt trading platform is about 16-20%, and it has also maintained a steady upward trend.

secondary title

3. News

(1) FTX requires parties receiving political donations to return funds by February 28th

Before FTX collapsed last November, SBF provided tens of millions of dollars in campaign contributions to politicians. According to the debtor's estimate, FTX has donated as much as $93 million to multiple congressmen and various political factions in Washington, D.C., and one-third of the current members of the U.S. Congress have received funding from SBF.

With top executives at FTX now facing a slew of criminal charges in connection with an alleged multibillion-dollar fraud, many beneficiaries are trying to offset the scandal by making matching donations to charities. But debtors warned that such practices would not prevent FTX debtors from pursuing recovery.

On February 6, 2023, FTX Group stated on Sunday that it is currently sending confidential letters to politicians, other political beneficiaries of SBF, his deputy and his company, asking them to return the political funds they received from SBF by the end of the month. donate. In a press release, the debtors said they reserved the right to enforce repayment with interest through court proceedings.

(2) New developments in the bankruptcy and reorganization case of Celsius:

The cryptocurrency lender Celsius, which filed for bankruptcy reorganization in July last year, officially announced on February 15 that after reviewing several other bidding institutions, Celsius selected digital asset investment company Novawulf Digital Management to acquire and reorganize Celsius. It also heralds a possible new twist in Celsius' bankruptcy case.

The reorganization plan was put forward entirely by the "obligors of Celsius" with the full support of the official Unsecured Creditors Committee (UCC). Under the agreement between the two platforms, NovaWulf will create a newly formed company that will handle debt owed by Celsius. Under Celsius’s proposal, most creditors would receive a one-time payment in crypto. NovaWulf will also provide a cash investment of $45 million to $55 million directly into the new joint venture, and Celsius will likely distribute more new equity to the company's larger creditors as compensation.

The debtors of Celsius also publicly stated that they chose NovaWulf because their plan provided Celsius debtors with the best solution for the liquidity of encrypted assets, while maximizing the value of the debtor’s illiquid assets.

Celsius also gave estimates that more than 85% of customers are expected to be able to recover about 70% of their claims in the form of cryptocurrencies, but this does not include Ethereum stored in the form of pledges.

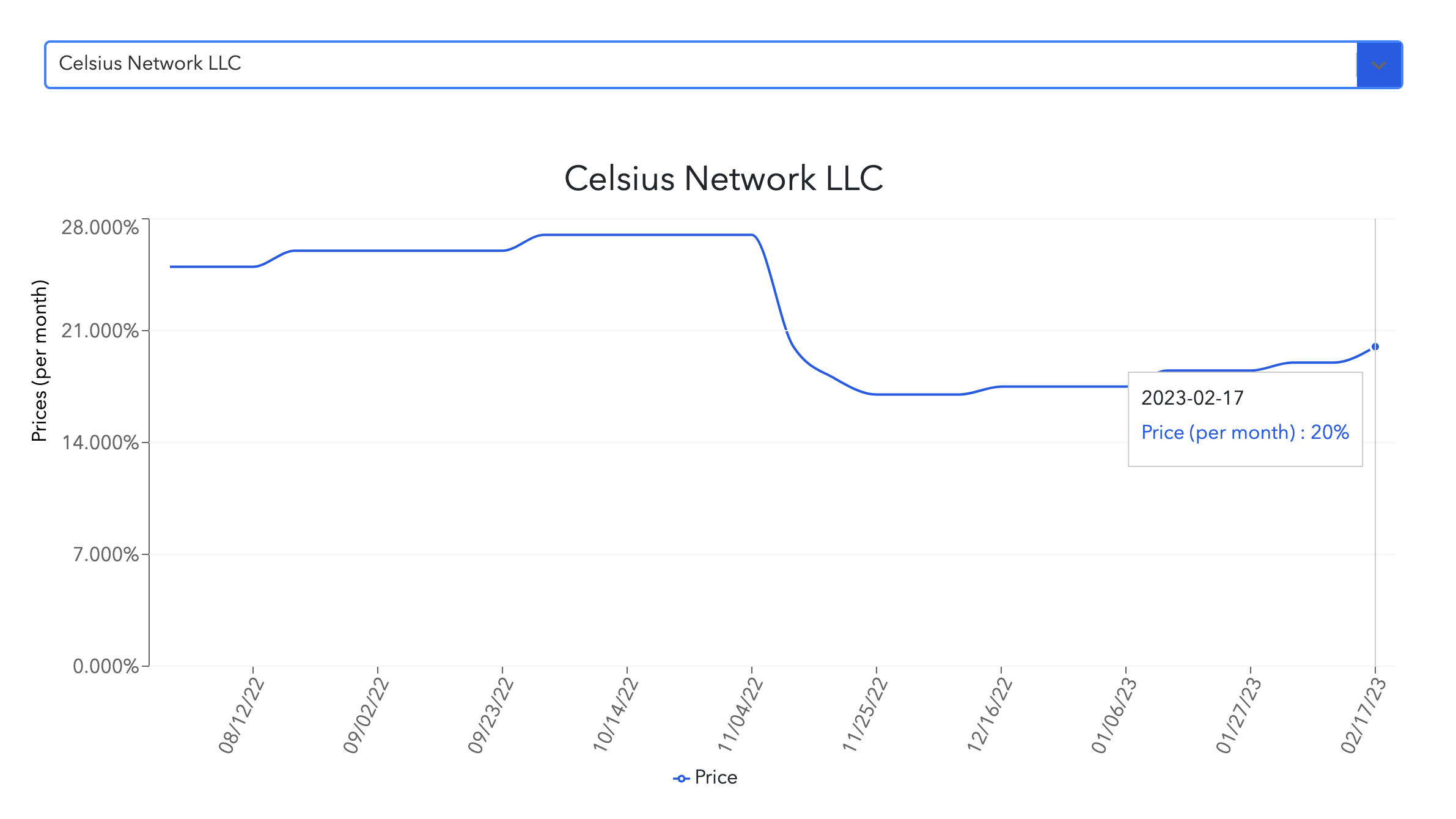

As of 2/17, the current reference price of Celsius debt purchase price on the debt trading platform is about 19-20%. There has not been much change in the past three months. We will also pay close attention to the bankruptcy court for the Southern District of New York in the near future. The adoption status of the bankruptcy reorganization proposal, if accepted, the debt price may have a big increase.

5. Encrypted ecological tracking

secondary title

NFT plate data collation

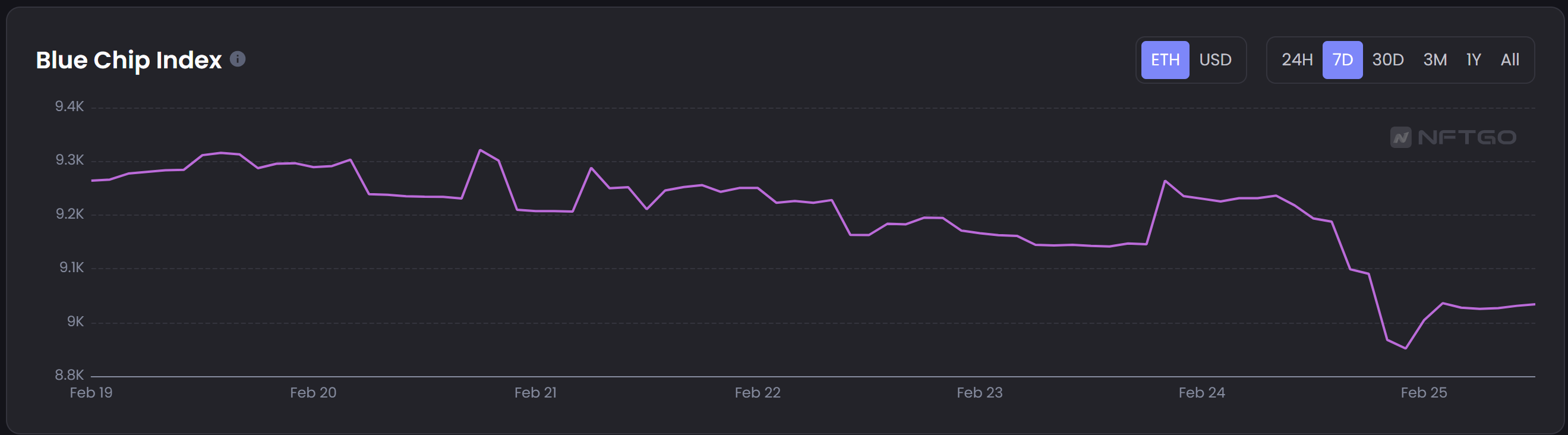

NFT Market of the WeekMarket overview: The performance of the NFT blue-chip index was relatively stable this week. After a slight increase last week, the index has reached a relatively neutral position in the past three months. This week, the blue-chip index is in this position

It fluctuated and fluctuated, and the overall price was relatively stable. On February 24, it suddenly fell.

The main reason here is actually inseparable from Blur and Maggie.

Blur's Bid mechanism (directly use eth as its own bid pool, and the liquidity of a pool can try to bid all nft) + airdrop combination fist is more and more beneficial to NFT liquidity, especially making the floor price of blue-chip nft even more It is stable and will not plummet, and it is even less likely to be liquidated if it is used for borrowing on platforms such as bendao. When blue chips can borrow with low risk and there are more ETHs in the market, the NFT calf will start.

What happened in the market this week confirmed this view from the negative side.

In order to collect blur airdrops, Maji made a BID pool of thousands of ETH, based on which he bid several blue-chip projects

The two seed investors of Yuga labs, Ovie Faruq and Mike Anderson, directly issued 72 BAYCs, almost all of which were picked up by Moji, and then emptied Moji’s liquidity on blur. The basic price is 76-78 ETH

Next, Maji sold 136 BAYC at 58-65 ETH, which directly brought down the price of BAYC

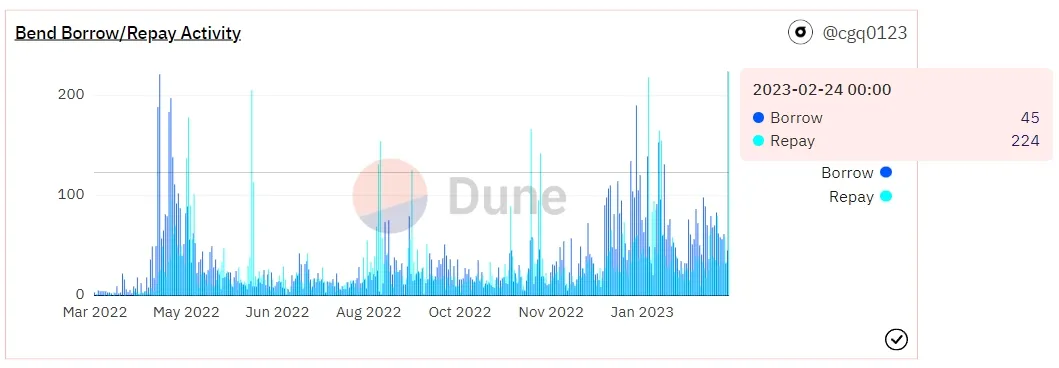

Then it continued to Benddao, 224 repayments were triggered on 2/24, and 10+ BAYCs were on the verge of liquidation

This also further reflects the liquidity problem of the NFT market from the side, making NFT prices easy to be manipulated, especially in Blur, because the depth of bids is much greater than the number of assets actually owned by users, it is easy to face a death spiral, and too many bids to NFT , resulting in a lack of liquidity, selling NFT to replenish liquidity, and the price fell rapidly due to insufficient liquidity.

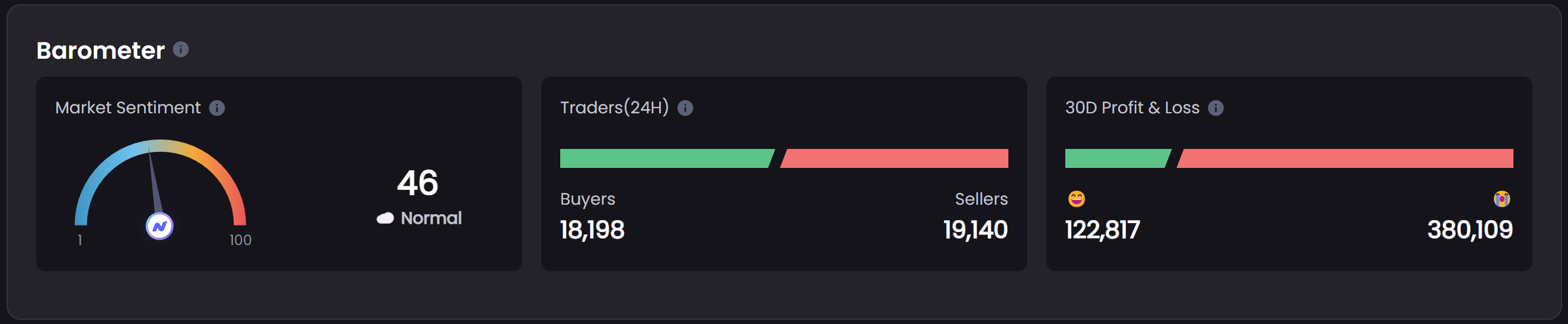

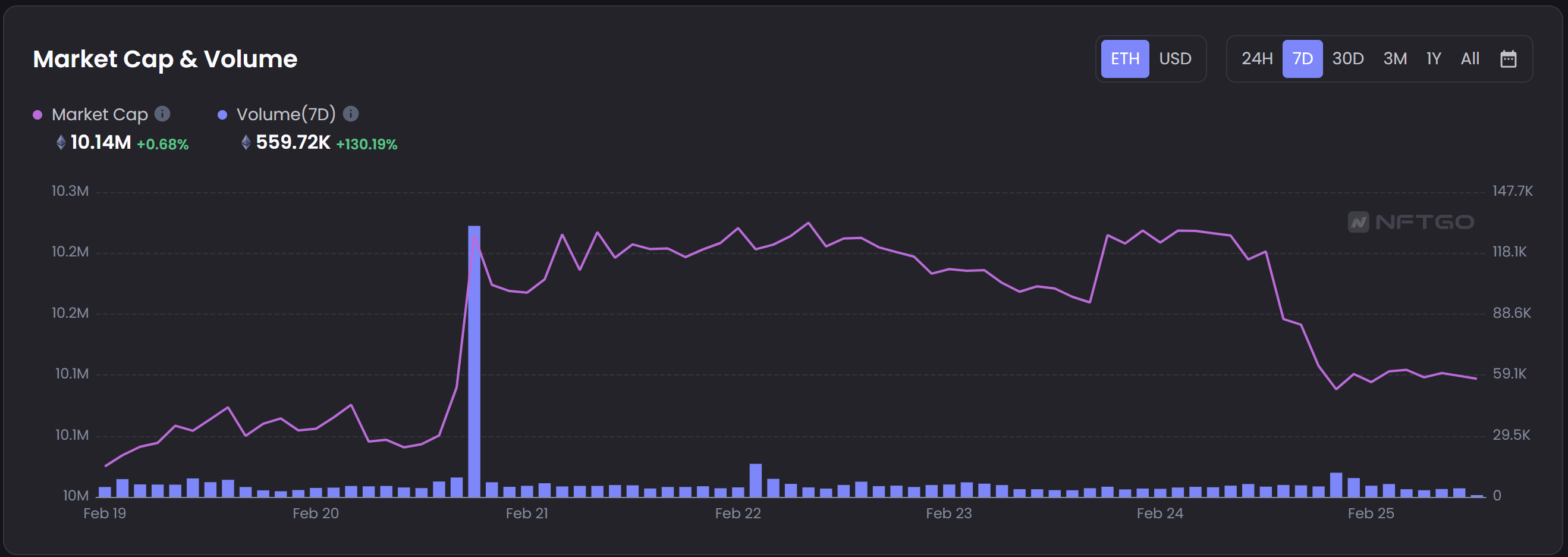

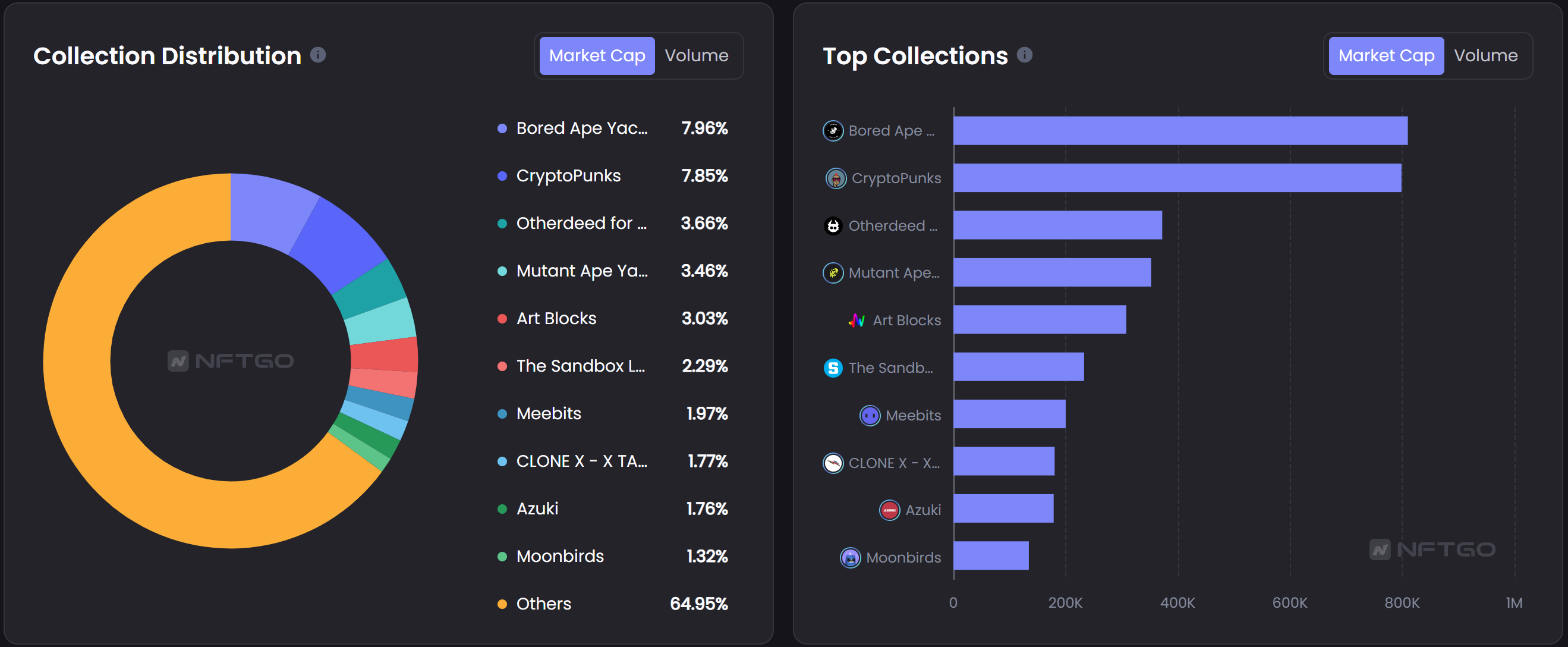

Total market value of NFT: The total market value of NFT increased by 0.68% this week. The total transaction volume continued the strong upward trend last week, with an increase of 130.19% within 7 days. Looking at the total transaction volume within 3 months, it also has a large increase, reaching 120.55%. The NFT market has shown a good recovery trend recently, and its performance this week is in line with our predictions, and it is expected to continue to be hot in the next few weeks.

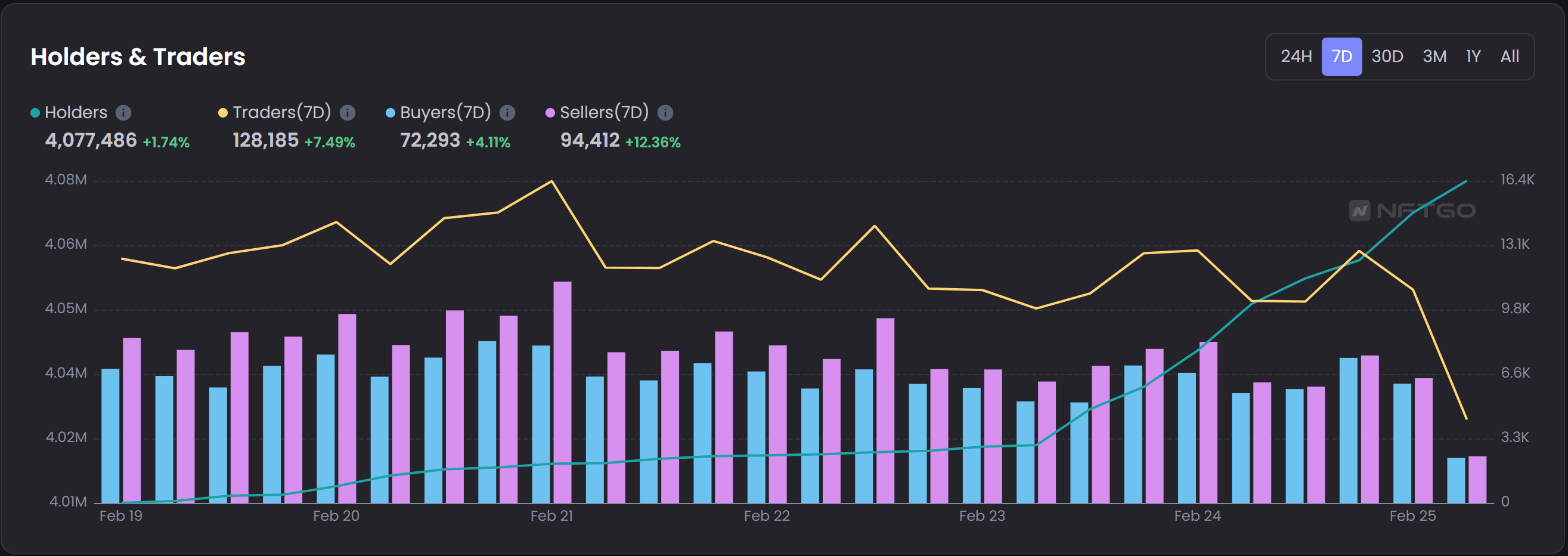

Market activity: The holders of the NFT market have increased slightly this week (+ 1.74%), and the activity of traders has increased significantly compared to last week (+ 7.49%). Buyers have increased by 4.11% year-on-year, and sellers have increased by 12.36% year-on-year % , a larger increase

The top three NFTs in the NFT market trading volume this week are BAYC, CryptoPunks, and Otherdeed. The floor price of BAYC has dropped significantly in the past week, and is currently around 67 ETH.

secondary title

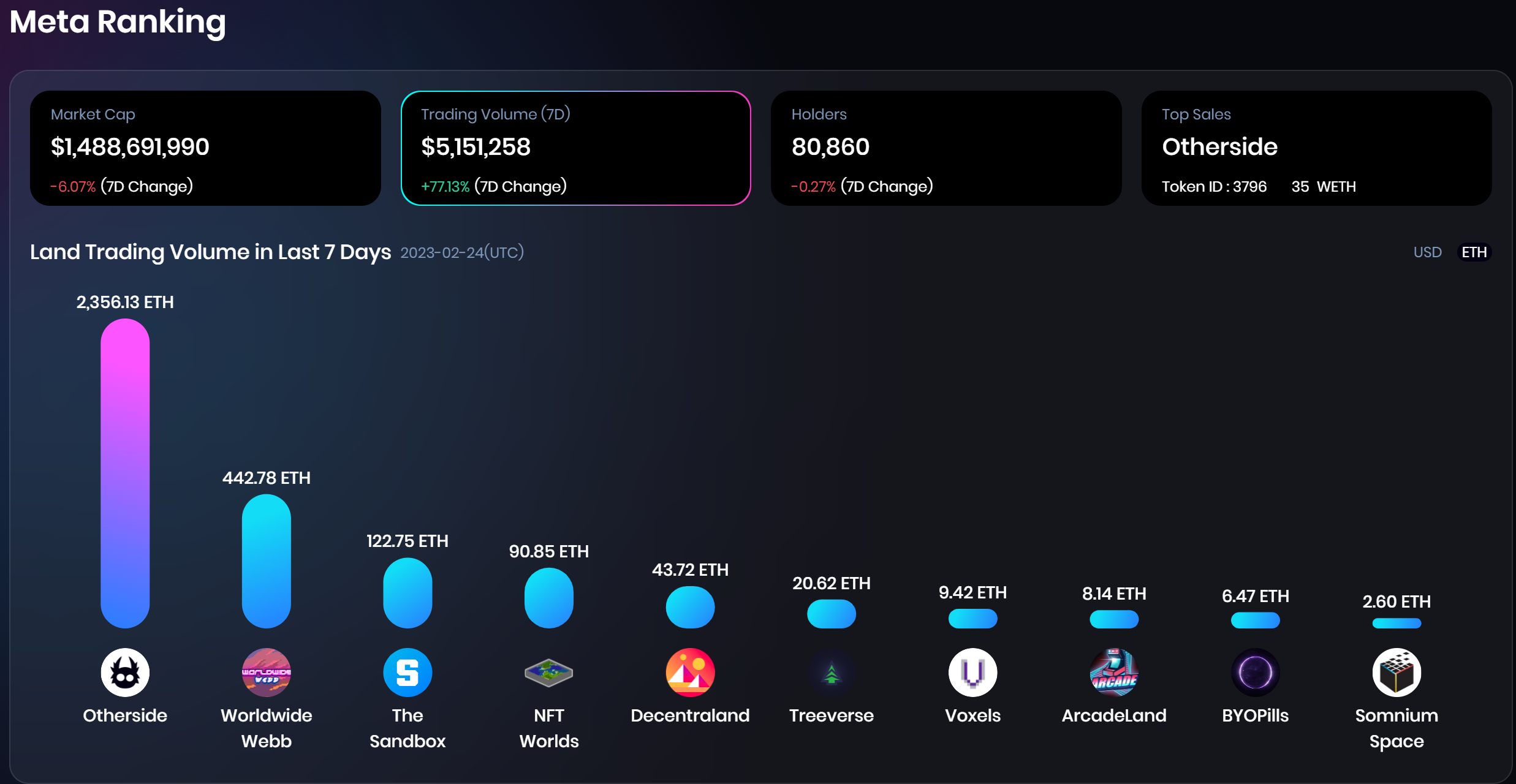

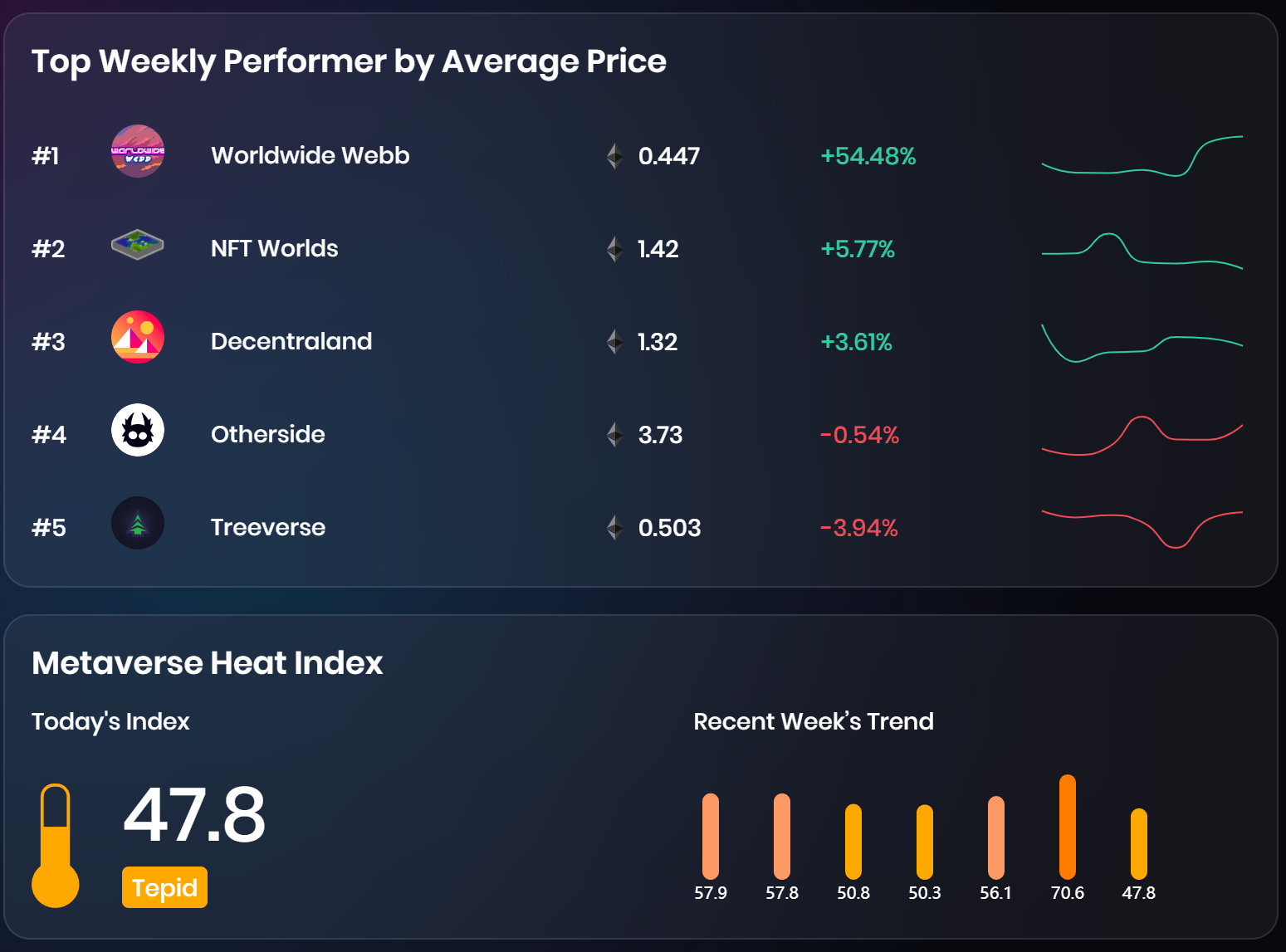

This week's Metaverse project overview

Among them, the Worldwide Webb project is different from the traditional metaverse project. It is essentially a combination of sandbox and beacon. It is a pixel-style gamefi game, which can be followed up in the future.

Gamefi secondary title

overall review

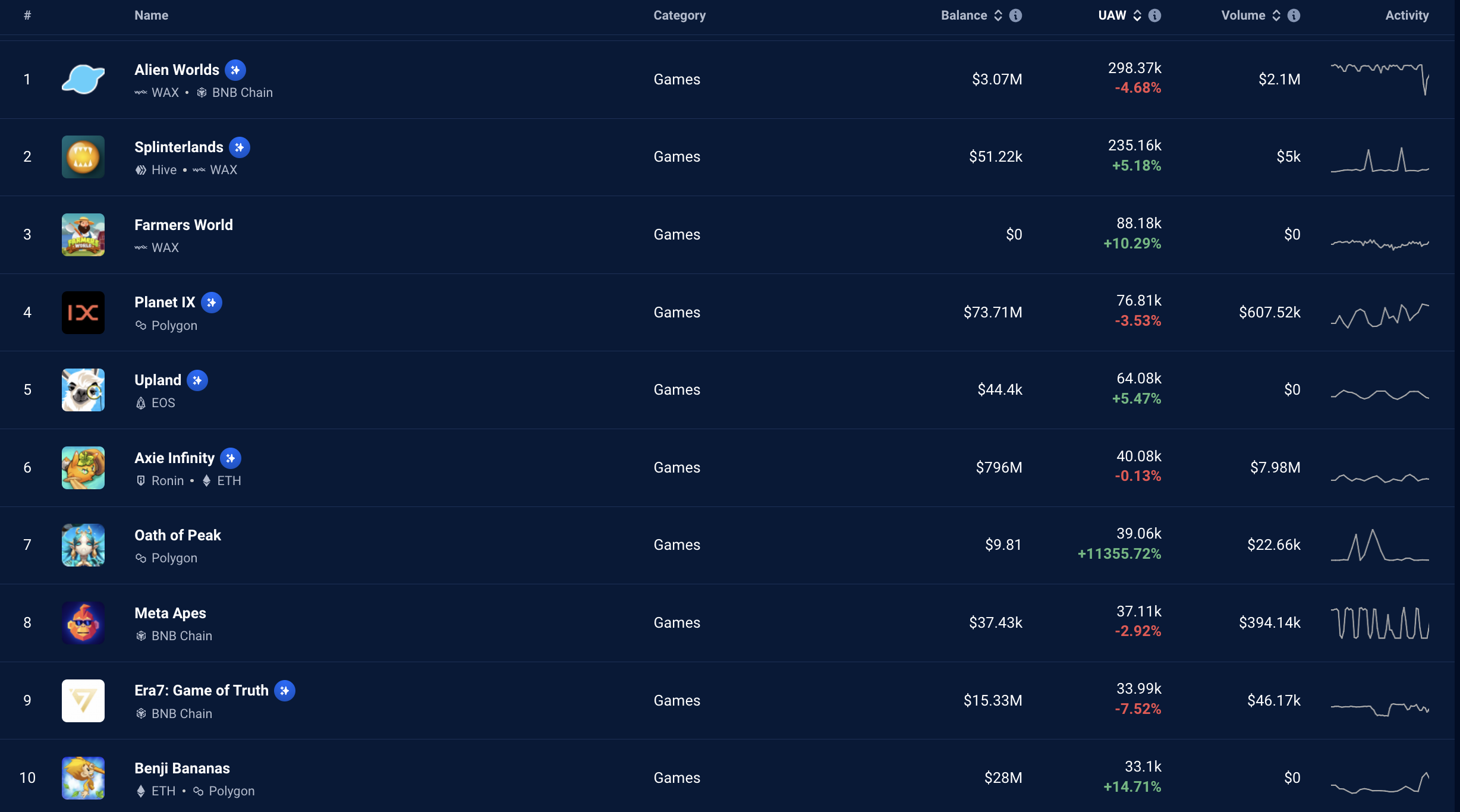

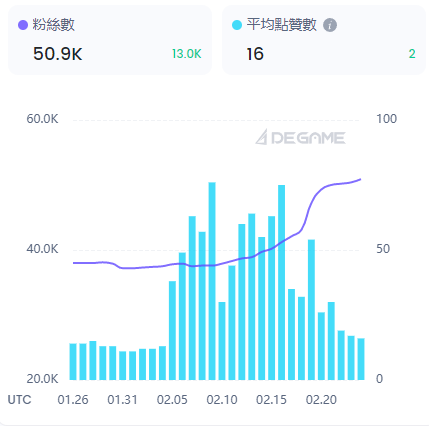

Overall, the Gamefi industry continues to suffer, but there are some small hotspots. From the perspective of Token prices, 40% of the top 10 chain games by market value have risen. This week, WEMIX PLAY continued to lead the rise, rising 29.69% in the past week (WEMIX PLAY continued to disclose a series of benefits such as partners and new exchanges. WEMIX PLAY is A chain game ecosystem including game platforms, data, defi, communities, media, etc.).

Judging by the amount of contract interactions on the chain, among the top ten active chain games, the number of interactive activity rose and fell in the past week was 50-50. Among them, the number of Oath of Peak players has increased significantly (MMORPG game is a relatively new game, the token has not yet been listed, and a lot of marketing and promotion has been done in Brazil, which has brought many new users, which can have actual user growth for this type of game. Stay tuned for chain games).

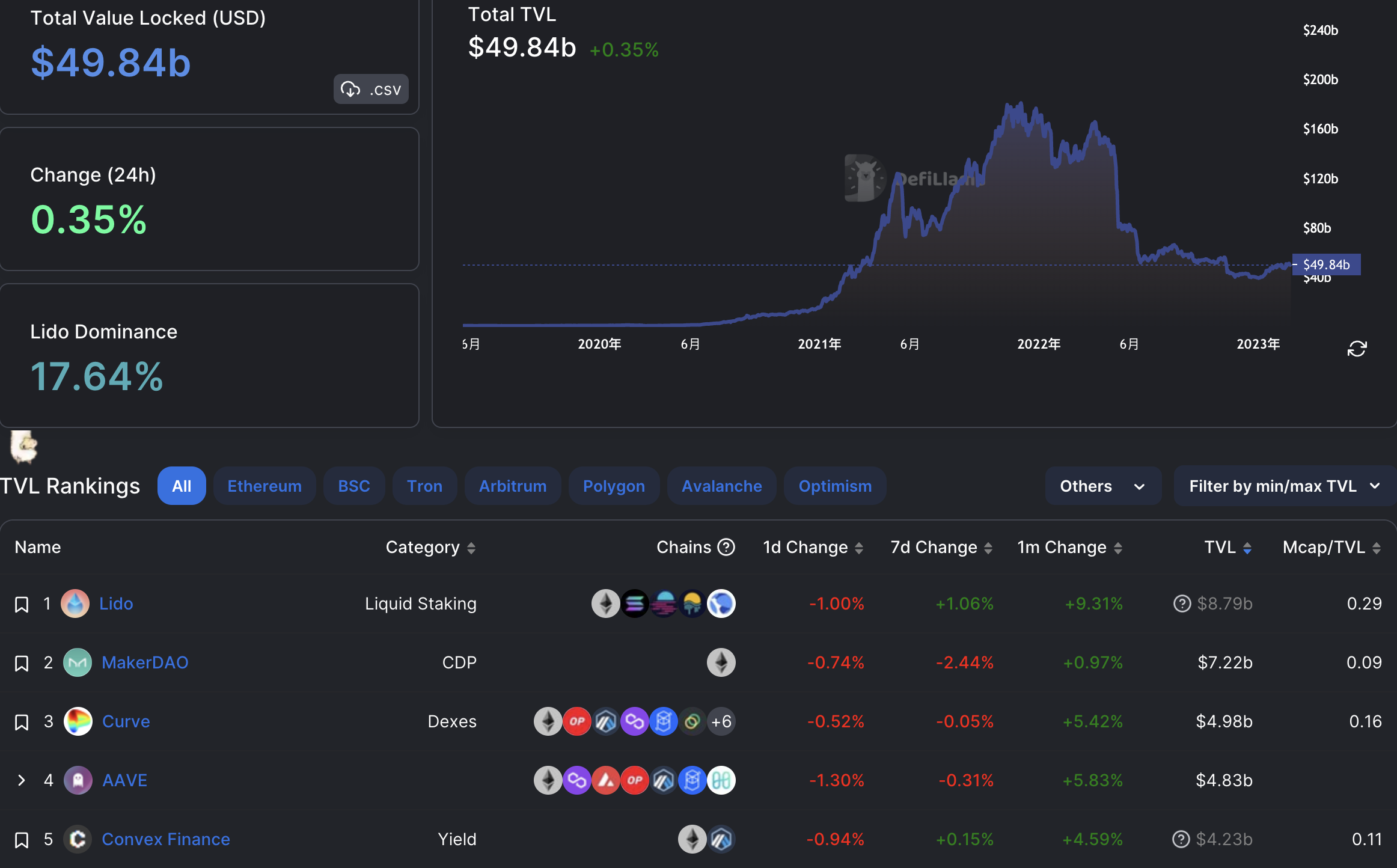

DeFi & public chain track data

From the perspective of the public chain, the top three TVL chains this week are: ETH, Tron and BSC. Arbitrum and Optimism rose 16.93% and 11.16% for the week, ranking fourth and seventh, respectively.

secondary title

( 1)MechMinds

Key Events & Projects of the Week

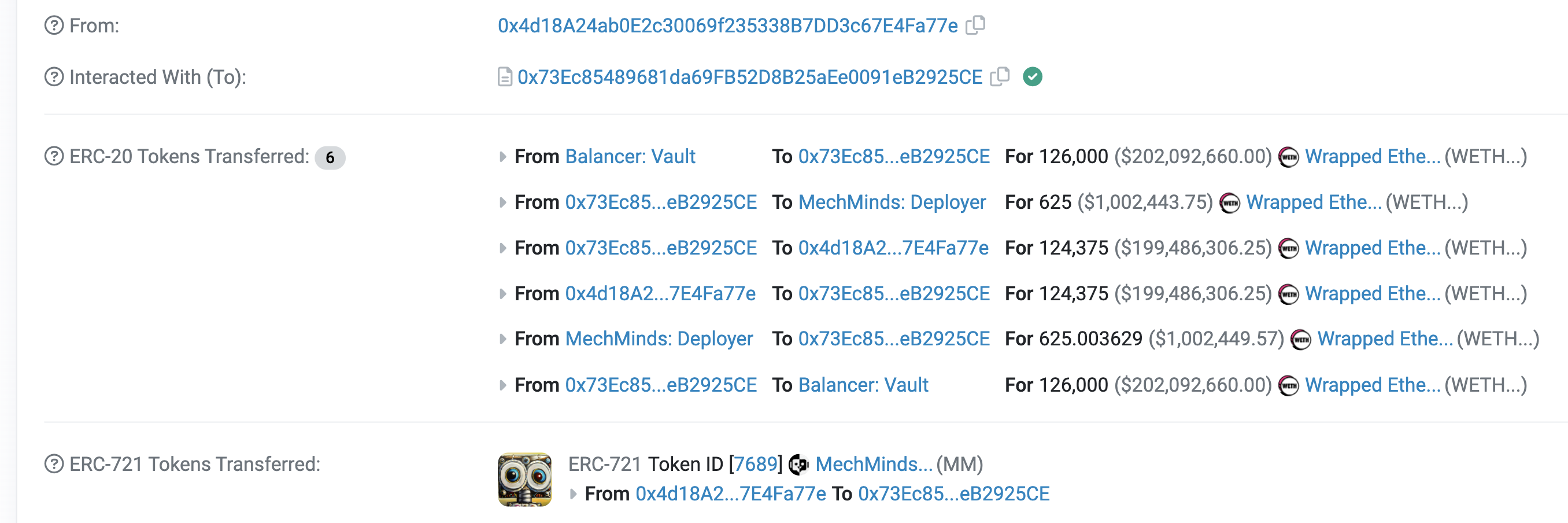

MechMinds used flash loans to facilitate the sale of an NFT for 125,000 ETH

On February 21st, MechMinds tweeted that it helped coordinate the MechMind #7689 NFT transaction for 125,000 ETH, which was the most expensive NFT transaction on the Ethereum chain. The project party did this to attract the attention of users, and this purchase was completed using flash loans.introduce:

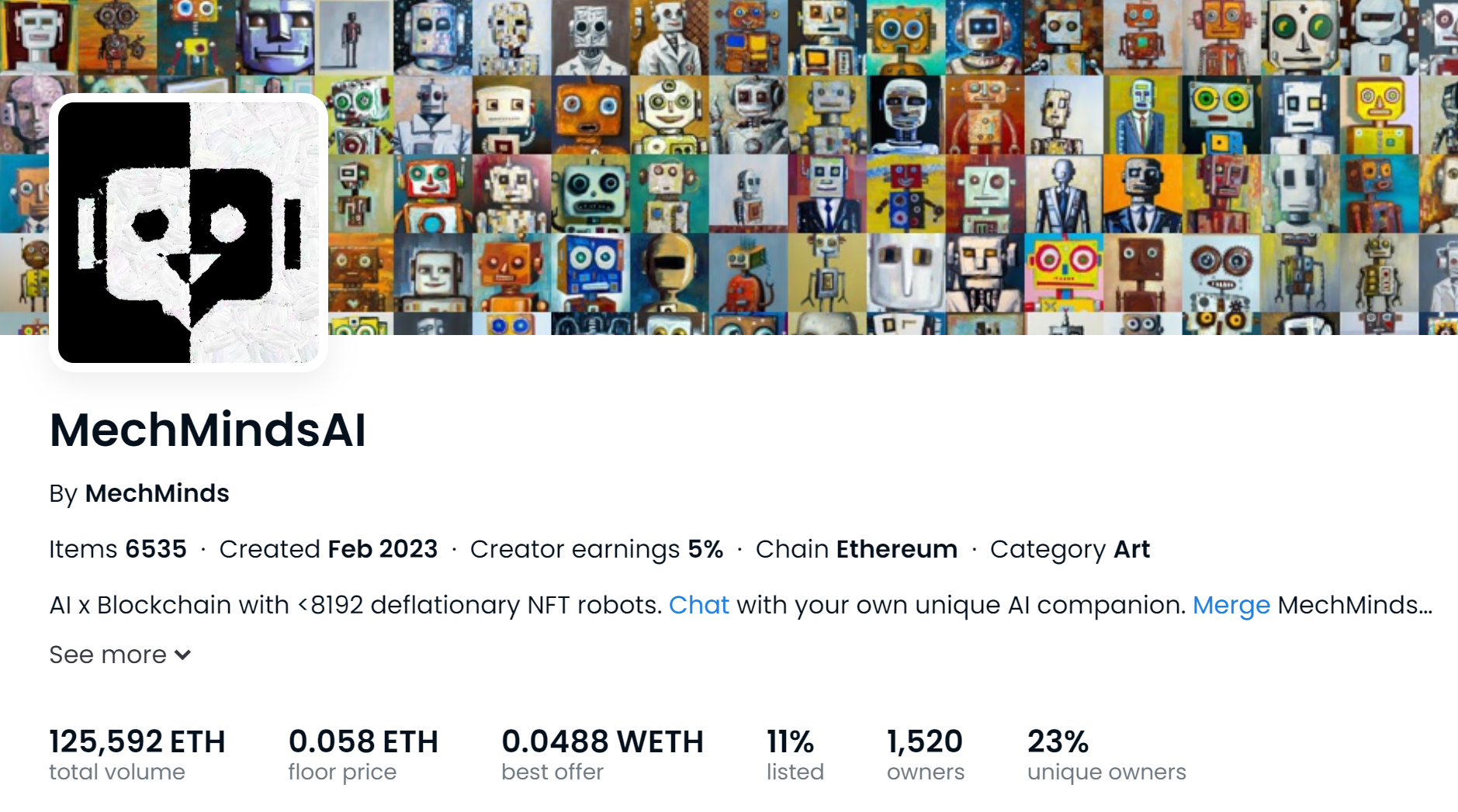

MechMinds is an AI concept NFT project. The project has issued a total of 8,192 NFTs, each of which has a unique personality and wisdom. The project uses OpenAI's ChatGPT model, and the holders can interact with the Robot they own.Personality settings:

MechMinds are defined by five traits: Openness, Conscientiousness, Extraversion, Agreeableness, and Emotional StabilityIQ:

The robot IQ setting range is 0-300, and the IQ level determines the overall intelligence of the robot.artistry:

Each MechMind is an AI-generated oil-painted portrait of a robot that embodies the robot's personality and intelligence.Gameplay and Mechanism:

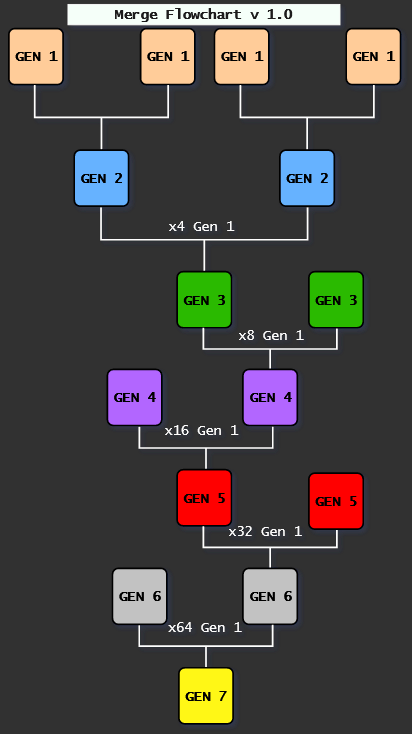

MechMinds is a deflationary model with a total supply of 8192. The initial MechMind robot IQ is between 0-80. Two robots of the same Gen can be merged into a smarter robot of the next generation, while the original NFT will be destroyed. The final supply is merged to 128, 8192 → 4096 → 2048 → 1024 → 512 → 256 → 128transaction

( 2) Go sleep

: MechMinds was launched on February 14, and the trading volume rose rapidly on the 20th, reaching 125,196 ETH on that day. The floor price rose to 0.077 ETH on the 21st, and then the trading volume returned to normal levels. The floor price currently remains at around 0.06 ETH .

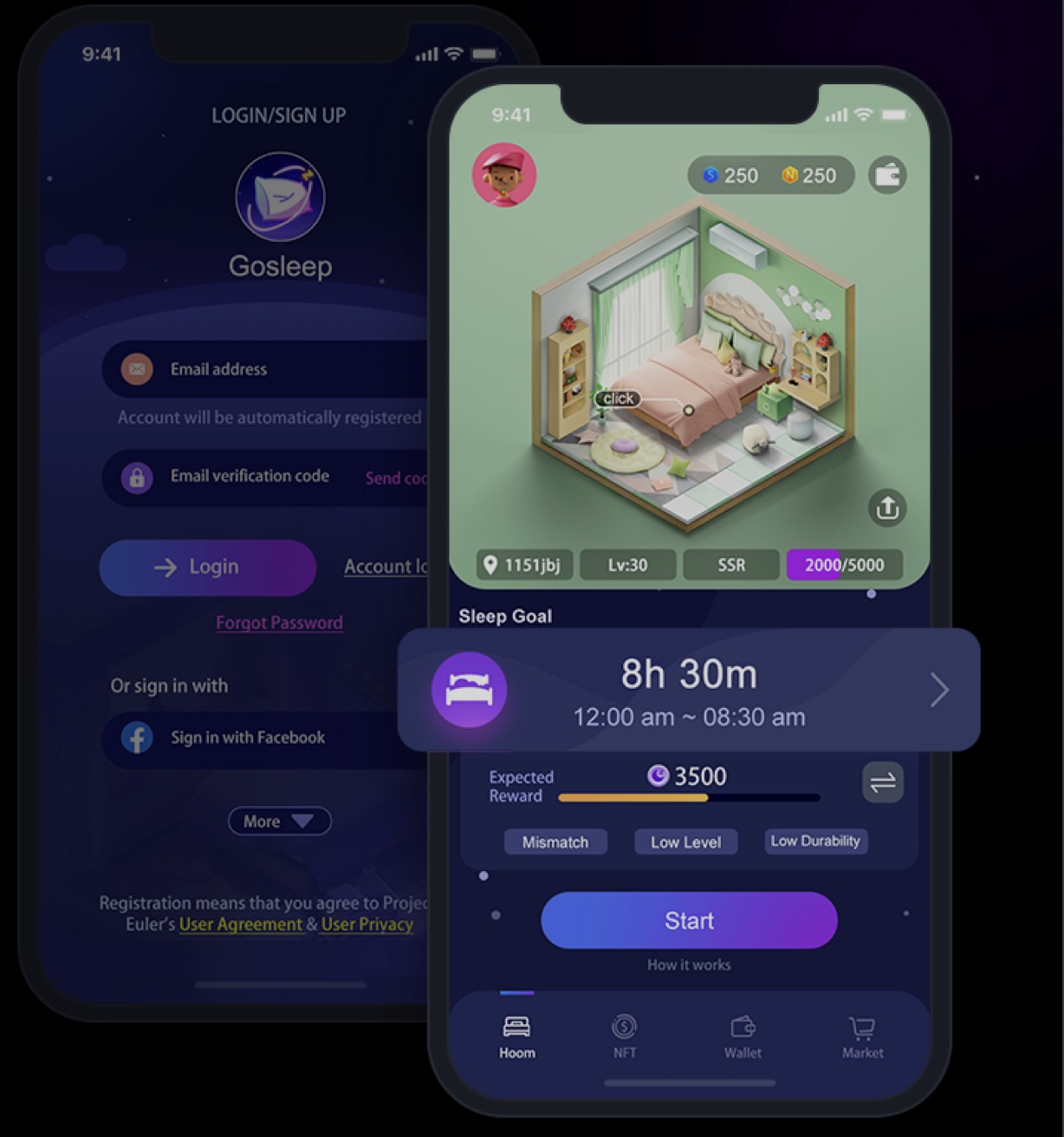

GoSleep is a Web3 lifestyle app with a sleep earning mechanism at its core, combining elements of HealthFi, GameFi and SocialFi. GoSleep aims to revolutionize health by motivating users to prioritize their health.

how to play

(1) Get Gosleep NFT to play:

Players who join Gosleep for the first time will receive a free room NFT. This NFT represents a virtual room in the Gosleep game that players can use to earn tokens.

(2) Set sleep goals:

Players can set sleep goals, such as wake-up and sleep schedules. GoSleep calculates a score based on the quality of their sleep and how close they are to their intended goals.

(3) Performance rewards:

Game token rewards are determined based on the rarity and attributes of the NFTs the player owns and their sleep score.

(4) About GoSleep NFTs:

GoSleep has a variety of NFTs that can be upgraded to higher tiers and rarities. There are 5 different rarities of NFTs: Free, Common, Rare, Epic and Legendary. The higher the rarity, the more tokens are generated. The Gov Token ZZZ can only be generated by high-rare NFTs such as Epic and Legendary. Different types of NFTs can form a new NFT like Lego bricks. For example, a bed NFT plus two pillow NFTs and a comforter NFT creates a brand new fully furnished bed NFT in the virtual room. Players can combine these NFTs to create their own virtual bedrooms.

When the NFT reaches level 30, the sleep bonus is increased and you can choose between generating NGT or ZZZ; until you reach level 30, you can only generate NGT. (Later upgrades need to use ZZZ governance tokens)

(1 )Indream,CEO

team information

(2 )Jonathan,CMO

Former technology entrepreneur, current software architect. Over 10 years of experience in the technology industry, from tech giants like Microsoft and Workday to new start-ups.

(3 )Frank,CTO

Jonathan is a blockchain pioneer and has been the market leader of several blockchain star projects such as Marlin Protocol, Abeatsgame and Realymetaverse. He has rich experience in NFT and blockchain communities, as well as KOL and media resources.

More than 8 years of experience as a senior software engineer in large technology companies such as Microsoft. He has been involved in several web3 projects over the past few years, including social networks, NFTs, and blockchain infrastructure.financing history

: Foresight Ventures (many institutions are listed on the official website, but no investment information can be found except Foresight, and it is speculated that it was incubated by Foresight Ventures)

Impact on Arbitrum: In February 23, Gosleep migrated to Arbitrum, and the popularity of Gosleep increased after the migration

(3) Towns, a Web3 social application, completed a $25.5 million investment led by a16z

Towns, a Web3 social application under Here Not There Labs, completed a financing of US$25.5 million, led by a16z, and participated by Benchmark and Framework Ventures. Towns adopts the concept of town squares, combining community, NFT, and games. The product is built on the Ethereum blockchain.

The team said, “The team’s vision is to create a digital city square where members can define boundaries, make rules, and build the world they want, which can only be achieved through decentralization and web3.

first level title

about Us

about Us